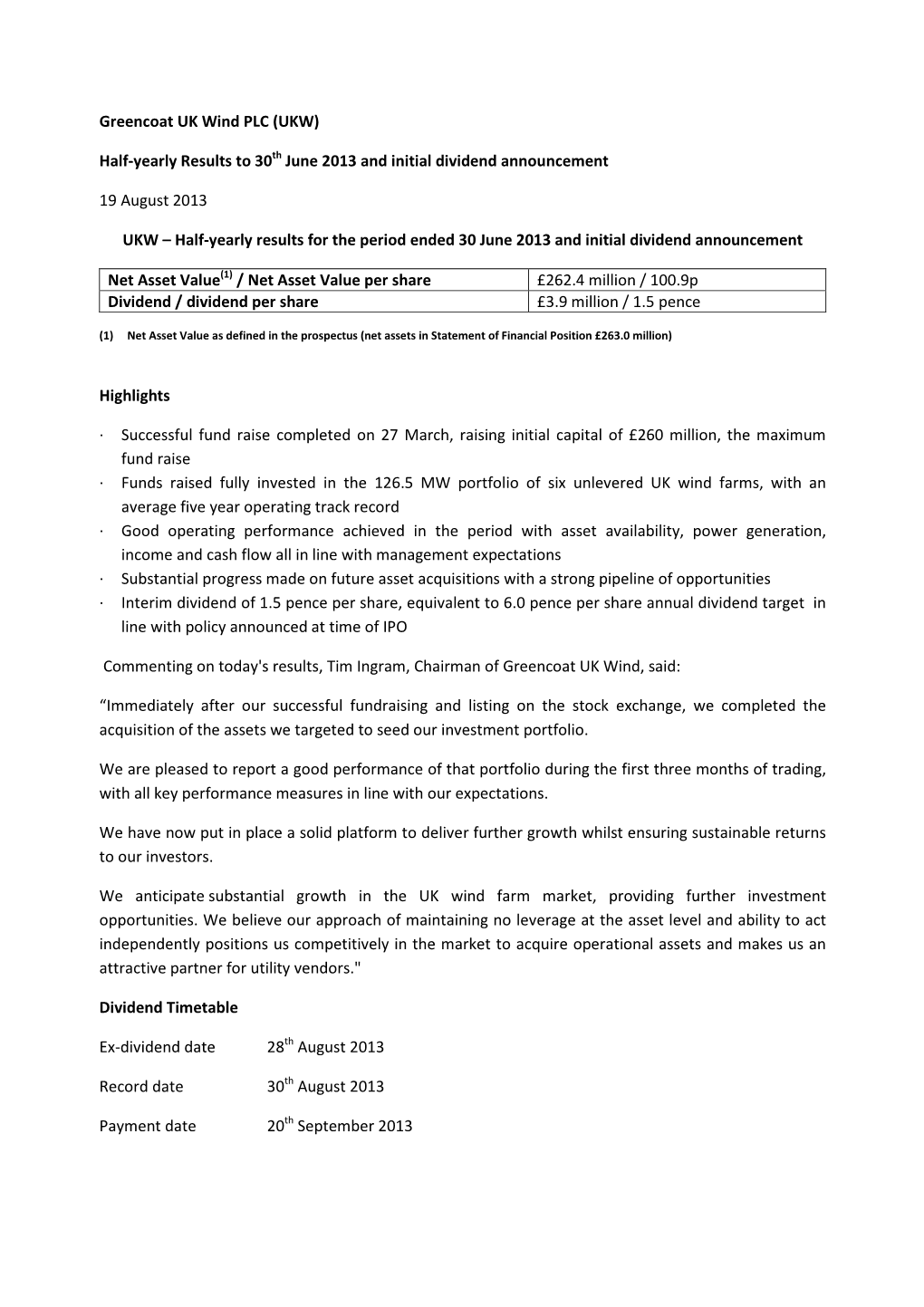

Greencoat UK Wind PLC (UKW)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Digest of United Kingdom Energy Statistics 2017

DIGEST OF UNITED KINGDOM ENERGY STATISTICS 2017 July 2017 This document is available in large print, audio and braille on request. Please email [email protected] with the version you require. Digest of United Kingdom Energy Statistics Enquiries about statistics in this publication should be made to the contact named at the end of the relevant chapter. Brief extracts from this publication may be reproduced provided that the source is fully acknowledged. General enquiries about the publication, and proposals for reproduction of larger extracts, should be addressed to BEIS, at the address given in paragraph XXVIII of the Introduction. The Department for Business, Energy and Industrial Strategy (BEIS) reserves the right to revise or discontinue the text or any table contained in this Digest without prior notice This is a National Statistics publication The United Kingdom Statistics Authority has designated these statistics as National Statistics, in accordance with the Statistics and Registration Service Act 2007 and signifying compliance with the UK Statistics Authority: Code of Practice for Official Statistics. Designation can be broadly interpreted to mean that the statistics: ñ meet identified user needs ONCEñ are well explained and STATISTICSreadily accessible HAVE ñ are produced according to sound methods, and BEENñ are managed impartially DESIGNATEDand objectively in the public interest AS Once statistics have been designated as National Statistics it is a statutory NATIONALrequirement that the Code of Practice S TATISTICSshall continue to be observed IT IS © A Crown copyright 2017 STATUTORY You may re-use this information (not including logos) free of charge in any format or medium, under the terms of the Open Government Licence. -

Greencoat UK Wind PLC Prospectus April 2016

GREENCOAT UKWIND Greencoat UK Wind PLC Prospectus April 2016 c111997CCL_COVER.pdf 1 15/04/2016 23:52:04 SUMMARY Summaries are made up of disclosure requirements known as ‘Elements’. These elements are numbered in Sections A – E (A.1 – E.7). This summary contains all the Elements required to be included in a summary for this type of security and issuer. Because some Elements are not required to be addressed there may be gaps in the numbering sequence of the Elements. Even though an Element may be required to be inserted into the summary because of the type of security and issuer, it is possible that no relevant information can be given regarding the Element. In this case a short description of the Element is included in the summary with the mention of ‘not applicable’. Section A – Introduction and warnings Element Disclosure Disclosure requirement A.1 Warning This summary should be read as an introduction to the Securities Note and Registration Document (together with this summary, the Prospectus). Any decision to invest in the securities should be based on consideration of the Prospectus as a whole by the investor. Where a claim relating to the information contained in a prospectus is brought before a court, the plaintiff investor might, under the national legislation of the Member States, have to bear the costs of translating such prospectus before the legal proceedings are initiated. Civil liability attaches only to those persons who have tabled the summary including any transaction thereof, but only if the summary is misleading, inaccurate or inconsistent when read together with the other parts of the prospectus or it does not provide, when read together with the other parts of the prospectus, key information in order to aid investors when considering whether to invest in such securities. -

International Passenger Survey, 2008

UK Data Archive Study Number 5993 - International Passenger Survey, 2008 Airline code Airline name Code 2L 2L Helvetic Airways 26099 2M 2M Moldavian Airlines (Dump 31999 2R 2R Star Airlines (Dump) 07099 2T 2T Canada 3000 Airln (Dump) 80099 3D 3D Denim Air (Dump) 11099 3M 3M Gulf Stream Interntnal (Dump) 81099 3W 3W Euro Manx 01699 4L 4L Air Astana 31599 4P 4P Polonia 30699 4R 4R Hamburg International 08099 4U 4U German Wings 08011 5A 5A Air Atlanta 01099 5D 5D Vbird 11099 5E 5E Base Airlines (Dump) 11099 5G 5G Skyservice Airlines 80099 5P 5P SkyEurope Airlines Hungary 30599 5Q 5Q EuroCeltic Airways 01099 5R 5R Karthago Airlines 35499 5W 5W Astraeus 01062 6B 6B Britannia Airways 20099 6H 6H Israir (Airlines and Tourism ltd) 57099 6N 6N Trans Travel Airlines (Dump) 11099 6Q 6Q Slovak Airlines 30499 6U 6U Air Ukraine 32201 7B 7B Kras Air (Dump) 30999 7G 7G MK Airlines (Dump) 01099 7L 7L Sun d'Or International 57099 7W 7W Air Sask 80099 7Y 7Y EAE European Air Express 08099 8A 8A Atlas Blue 35299 8F 8F Fischer Air 30399 8L 8L Newair (Dump) 12099 8Q 8Q Onur Air (Dump) 16099 8U 8U Afriqiyah Airways 35199 9C 9C Gill Aviation (Dump) 01099 9G 9G Galaxy Airways (Dump) 22099 9L 9L Colgan Air (Dump) 81099 9P 9P Pelangi Air (Dump) 60599 9R 9R Phuket Airlines 66499 9S 9S Blue Panorama Airlines 10099 9U 9U Air Moldova (Dump) 31999 9W 9W Jet Airways (Dump) 61099 9Y 9Y Air Kazakstan (Dump) 31599 A3 A3 Aegean Airlines 22099 A7 A7 Air Plus Comet 25099 AA AA American Airlines 81028 AAA1 AAA Ansett Air Australia (Dump) 50099 AAA2 AAA Ansett New Zealand (Dump) -

The Economic Impacts of Wind Farms on Scottish Tourism

The economic impacts of wind farms on Scottish tourism A report for the Scottish Government March 2008 The economic impact of Wind farms on Scottish tourism 2 Executive summary 1. Background and Approach Over the last two decades Energy Policy has seen a marked shift towards renewables as part of the UK commitment to reduce green house gas emissions by 20% between 2000 and 2010. The policy was reinforced in November 2007 with a new target of 50 per cent of Scotland's electricity from renewables by 2020, and an interim milestone of 31 per cent by 2011. The 2011 target implies around 5,000 Megawatts of installed capacity almost double current levels. Given current technology and the time needed to plan and develop large projects such as storage hydro or offshore wind farms, the policy suggests a very significant increase in on-shore wind farms with associated impacts on Scotland’s landscape. Scottish tourism depends heavily on the country's landscape, with 92% of visitors stating that scenery was important in their choice of Scotland as a holiday destination, the natural environment being important to 89% of visitors (Tourism Attitudes Survey 2005). As part of the general policy to create a more successful country, with increasing sustainable economic growth, the Tourism sector has agreed a target of 50% revenue growth in the ten years to 2015 The potential problem is that many people find that man made structures such as pylons and wind turbines reduce the attractiveness of a landscape. It is logical to assume that reduced quality of an important feature could reduce demand to some degree which in turn may result in either reduced prices for tourism services or reduced numbers of tourists or both. -

Adroddiad Report

Adroddiad Report Ymchwiliad a agorwyd ar 15/10/13 Inquiry opened on 15/10/13 Ymweliadau safle a wnaed ar 24/10/13 & Site visits made on 24/10/13 & 8/11/13 8/11/13 gan Emyr Jones BSc(Hons) CEng by Emyr Jones BSc(Hons) CEng MICE MICE MCMI MCMI Arolygydd a benodir gan Weinidogion Cymru an Inspector appointed by the Welsh Ministers Dyddiad: 16/01/2014 Date: 16/01/2014 TOWN AND COUNTRY PLANNING ACT 1990 SECTIONS 78 & 79 APPEAL BY RES UK & IRELAND LTD. LAND SURROUNDING BRYN LLYWELYN, LLANLLWNI, PENCADER SA39 9ED COMMONS ACT 2006 SECTIONS 16 & 38 APPLICATIONS BY THE CROWN ESTATE AND RES UK & IRELAND LTD. LAND AT MYNYDD LLANLLWNI AND MYNYDD LLANFIHANGEL RHOS-Y-CORN COMMONS Cyf ffeiliau/File refs: APP/M6825/A/12/2189697, APP/M6825/X/13/515763 & APP/M6825/X/13/515764 www.planningportal.gov.uk/planninginspectorate Report APP/M6825/A/12/2189697, APP/M6825/X/13/515763 & APP/M6825/X/13/515764 Contents Page List of abbreviations 4 Case details 6 Preamble 6 Procedural and background matters 7 The site and surroundings 9 Planning policy 10 The proposals 11 Other agreed matters 12 The case for RES UK & Ireland Ltd. 13 The case for Carmarthenshire County Council 60 The case for the Save Mynydd Llanllwni Group 86 The case for Cllr L Davies Evans 99 The case for Llanllwni Community Council 100 The case for Grŵp Blaengwen 101 The case for the Teifi Valley Tourism Association 104 The case for the Llanfihangel Rhos-y-Corn and Llanllwni Mountain 105 Grazing Association The case for the Brechfa Forest Energy Action Group 106 The case for the Brechfa Forest and -

SSE Annual Report 2009

Scottish and Southern Energy plc Annual Report 2009 Producing energy in a more sustainable way with new developments like the Glendoe hydro electric scheme. Helping make electricity and gas more affordable by offering a ‘better plan’ and installing insulation. Ensuring electricity supply is reliable through investing in networks in England and Scotland. Providing more capacity for the UK to maintain dependable supplies of gas through development at Aldbrough. SSE’s core purpose is to provide the energy people need in a reliable and sustainable way. Our Values Safety, service, efficiency, sustainability, excellence, teamwork – the SSE SET. Our Strategy To deliver sustained real growth in the dividend payable to shareholders through the efficient operation of, and investment in, a balanced range of regulated and non-regulated energy-related businesses. Our Team More than 18,500 people, working from power stations, depots, customer service centres, offices and shops. * Unless otherwise stated, this Annual Report describes adjusted operating profit before exceptional items, the impact of IAS 32 and IAS 39 and after the removal of taxation and interest on profits from jointly-controlled entities and associates. In addition, it describes adjusted profit before tax before exceptional items, the impact of IAS 32 and IAS 39 and after the removal of taxation on profits from jointly-controlled entities and associates. It also describes adjusted earnings and earnings per share before exceptional items, the impact of IAS 32 and IAS 39 and deferred -

Greencoat Uk Wind

GREENCOAT UK WIND Greencoat UK Wind PLC Share Issuance Programme 3 September 2020 SUMMARY Section A – Introduction and Warnings This Summary should be read as an introduction to the Securities Note and Registration Document (together with this Summary, the “Prospectus”). Any decision to invest in the securities should be based on consideration of the Prospectus as a whole by the investor. The investor could lose all or part of the invested capital. Where a claim relating to the information contained in a prospectus is brought before a court, the plaintiff investor might, under the national legislation of any sovereign state which is a member of the European Union, have to bear the costs of translating such prospectus before the legal proceedings are initiated. Civil liability attaches only to those persons who have tabled the summary including any translation thereof, but only if the summary is misleading, inaccurate or inconsistent when read together with the othe9r parts of the Prospectus or it does not provide, when read together with the other parts of the Prospectus, key information in order to aid investors when considering whether to invest in such securities. You are about to purchase a product that is not simple and may be difficult to understand. Name and ISIN of the Ordinary shares of one pence each in the capital of the Company securities: (the “Ordinary Shares”). The ISIN of the New Shares is GB00B8SC6K54 and the SEDOL is B8SC6K5. Identity of issuer: Greencoat UK Wind PLC (the “Company”), a public limited company incorporated in England and Wales with company registration number 08318092 and whose registered address is at 27-28 Eastcastle Street, London W1W 8DH. -

Greencoat Uk Wind

GREENCOAT UK WIND Greencoat UK Wind PLC Half Year Report For the six months ended 30 June 2021 GREENCOAT UK WIND Contents Summary 1 Chairman’s Statement 2 Investment Manager’s Report 4 Statement of Directors’ Responsibilities 14 Unaudited Condensed Consolidated Financial Statements 15 Notes to the Unaudited Condensed Consolidated Financial Statements 19 Company Information 29 Defined Terms 30 Alternative Performance Measures 32 Cautionary Statement 33 All capitalised terms are defined in the list of defined terms on pages 30 to 31 unless separately defined. GREENCOAT UK WIND Summary Greencoat UK Wind PLC is the leading listed renewable infrastructure fund, invested in UK wind farms. The Company’s aim is to provide investors with an annual dividend that increases in line with RPI inflation while preserving the capital value of its investment portfolio in the long term on a real basis through reinvestment of excess cashflow and the prudent use of gearing. The Company provides investors with the opportunity to participate directly in the ownership of UK wind farms, so increasing the resources and capital dedicated to the deployment of renewable energy and the reduction of greenhouse gas emissions. Highlights • The Group’s investments generated 1,476GWh of zero carbon electricity. • Net cash generation (Group and wind farm SPVs) was £103.6 million. • Acquisition of the remaining 50 per cent interest in Braes of Doune wind farm increased net generating capacity to 1,209MW as at 30 June 2021. • Issuance of further shares raising £198 million. • The Company declared total dividends of 3.59 pence per share with respect to the period. -

User Company Register Number Registered Office Category of Use Date Signed 3R Enenrgy Solution Limited SC354680 , the Mechanics

User Company Register Number Registered Office Category of Use Date Signed 3R Enenrgy Solution Limited SC354680 , The Mechanics Workshop, New Lanark, Lanark, Lanarkshire ML-11 9DB Directly Connected Power Station Aberarder Wind Farm 00398487 Beaufort Court,Egg Farm Lane,Kings Langley,Hertfordshire,WD4 8LR Directly Connected Power Station Aberdeen Offshore Wind Farm Limited SC278869 Johnstone House, 52-54 Rose Street, Aberdeen, AB10 1HA Directly Connected Power Station Abergelli Power Limited 08190497 33 Cavendish Square, London, WIG OPW Directly Connected Power Station Abernedd Power Company Limited 06383166 6th Floor, Riverside Building, County Hall, London SE1 7BF Directly Connected Power Station ABO WIND UK LIMITED SC314110 1 Houstoun Interchange Business Park, Livingston, West Lothian, EH54 5DW Directly Connected Power Station A'Chruach Wind Farm Limited 06572505 First Floor , 500 Pavillion Drive , Northampton Business Park ,Northampton ,NN4 7YL Directly Connected Power Station Addito Supply Limited 8053202 1 America Square, Crosswall, London, EC3N 2SG Interconnector User AES Energy Limited 3896738 37 Kew Foot Road, Richmond, Surrey, TW9 2SS Supplier Aikengall Community Wind Company Limited SC313596 Edinburgh Quay, 133 Fountain Bridge, Edinburgh, EH3 9AG Embedded Exemptable Large Power Station Airies Wind Farm Limited SC407954 Suite F3 Clyde View, Riverside Business Park, 22 Pottery Street, Greenock, Inverclyde, PA15 2UZ Directly Connected Power Station Airtricity Developments (Scotland) Limited SC212524 Inveralmond House, 200 Dunkfield -

User Registered Company Number Registered Company Address

Registered Company User Number Registered Company Address Category of Use 3R Energy Solution Limited SC354680 The Mechanics Workshop, New Lanark, Lanark, Lanarkshire ML11 9DB Directly Connected Power Station Aberarder Wind Farm 00398487 Beaufort Court,Egg Farm Lane,Kings Langley,Hertfordshire,WD4 8LR Directly Connected Power Station Aberdeen Offshore Wind Farm Limited SC278869 Johnstone House, 52-54 Rose Street, Aberdeen, AB10 1HA Directly Connected Power Station Abergelli Power Limited 08190497 Drax Power Station, Selby, North Yorkshire, YO88PH Directly Connected Power Station Abernedd Power Company Limited 06383166 6th Floor, Riverside Building, County Hall, London SE1 7BF Directly Connected Power Station ABO WIND UK LIMITED SC314110 1 Houstoun Interchange Business Park, Livingston, West Lothian, EH54 5DW Directly Connected Power Station First Floor , 500 Pavillion Drive , Northampton Business Park ,Northampton A'Chruach Wind Farm Limited 06572505 ,NN4 7YL Directly Connected Power Station Addito Supply Limited 8053202 1 America Square, Crosswall, London, EC3N 2SG Interconnector User AES Energy Limited 3896738 37 Kew Foot Road, Richmond, Surrey, TW9 2SS Supplier Unit 7 Riverside Business Centre, Brighton Road, Shoreham-By-Sea, West Affect Energy 9263368 Sussex, England, BN43 6RE Supplier Embedded Exemptable Large Power Aikengall Community Wind Company Limited SC313596 Edinburgh Quay, 133 Fountain Bridge, Edinburgh, EH3 9AG Station Suite F3 Clyde View, Riverside Business Park, 22 Pottery Street, Greenock, Airies Wind Farm Limited SC407954 -

Craigton and Spittalhill Wind Farm Environmental Statement

Craigton and Spittalhill Wind Farm Environmental Statement Volume I: Main Text and Figures November 2013 ! ! ! ! ! ! ! Reproduced from Ordnance Survey digital map data © Crown copyright 2013. All rights reserved. Licence number 100047514 Craigton and Spittalhill Wind Farm Environmental Statement Prepared by LUC on behalf of Force 9 Energy November 2013 Preface This Environmental Statement (ES) has been prepared in support of an application for planning permission to construct and operate the seven turbine Craigton and Spittalhill Wind Farm. The Development is located approximately 12km south-west of Stirling and 7.5km to the east of Balfron, and lies wholly within the Stirling Council area. The ES comprises the following documents: Volume I: Main Text and Figures Volume II: Appendices The ES has been prepared by LUC and supporting sub-consultants. In addition, the ES is accompanied by a Non- Technical Summary, Planning Statement, Design and Access Statement and Pre-Application Consultation (PAC) Report. Copies of the full ES and accompanying documents, or further information on the Development may be obtained from: Force 9 Energy LLP and EDF Energy ER c/o 272 Bath Street Glasgow G2 4JR The Non-Technical Summary is available free of charge. A hard copy of the ES and accompanying documents costs £250. In addition, all documents are available in an electronic format (as PDFs for screen viewing only) on CD/DVD for £2. The ES and accompanying documents are available for viewing by the public during normal opening hours at the following locations: Fintry Sports and Recreation Club Planning and Building Standards Howietown Fishery Kippen Road Stirling Council Stirling Fintry Municipal Buildings FK7 9QH Glasgow 8-10 Corn Exchange Road G63 OYA Stirling FK8 2HU The documents will also be made available on-line at http://pabs.stirling.gov.uk/online-applications/ Comments in relation to the Planning Application should be forwarded to the Stirling Council Planning Environment Services department at the address above. -

The Economics of Renewable Energy

HOUSE OF LORDS Select Committee on Economic Affairs 4th Report of Session 2007–08 The Economics of Renewable Energy Volume II: Evidence Ordered to be printed 12 November 2008 and published 25 November 2008 Published by the Authority of the House of Lords London : The Stationery Office Limited £price HL Paper 195–II CONTENTS Page Oral Evidence Professor Paul Ekins and Dr Neil Strachan, King’s College London Oral Evidence, 6 May 2008 1 Professor AbuBakr Bahaj, Southampton University, Professor Tony Bridgwater, Aston University and Dr Simon Watson, Loughborough University Oral Evidence, 6 May 2008 8 Mr Benet Northcote, Chief Policy Adviser, Greenpeace, Dr Tim Jenkins, Economics Campaigner, Mr Dave Timms, and Ms Robin Webster, Senior Energy and Climate Campaigner, Friends of the Earth Oral Evidence, 13 May 2008 17 Mr Malcolm Keay, Senior Research Fellow, Oxford Institute for Energy Studies Oral Evidence, 13 May 2008 26 Mr Campbell Dunford, Chief Executive and Dr John Constable, Policy and Research Director, Renewable Energy Foundation Oral Evidence, 3 June 2008 36 Supplementary Written Evidence 45 Mr Philip Wolfe, Chief Executive, Renewable Energy Association; Ms Maria McCaffery, Chief Executive, British Wind Energy Association; and Mr William Heller, Chief Executive, Falck Renewables Limited Written Evidence (British Wind Energy Association) 55 Oral Evidence, 10 June 2008 63 Professor David Newbery, Cambridge University, and Professor Dieter Helm, Oxford University Written Evidence (Professor David Newbery) 71 Oral Evidence, 10 June 2008