Novartis Turns to Beigene for a PD-1 Blocker

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mirati's Clinical Programs

NASDAQ: MRTX Targeting the genetic and immunological drivers of cancer Corporate Presentation August 2019 1 Safe Harbor Statement Certain statements contained in this presentation, other than statements of fact that are independently verifiable at the date hereof, are "forward-looking" statements, within the meaning of the Private Securities Litigation Reform Act of 1955, that involve significant risks and uncertainties. Forward looking statements can be identified by the use of forward looking words such as “believes,” “expects,” “hopes,” “may,” “will,” “plan,” “intends,” “estimates,” “could,” “should,” “would,” “continue,” “seeks,” “pro forma,” or “anticipates,” or other similar words (including their use in the negative), or by discussions of future matters such as the development of current or future product candidates, timing of potential development activities and milestones, business plans and strategies, possible changes in legislation and other statements that are not historical. Forward-looking statements are based on current expectations of management and on what management believes to be reasonable assumptions based on information currently available to them, and are subject to risks and uncertainties. Such risks and uncertainties may cause actual results to differ materially from those anticipated in the forward-looking statements. Such risks and uncertainties include without limitation potential delays in development timelines, negative clinical trial results, reliance on third parties for development efforts, changes in the competitive landscape, changes in the standard of care, as well as other risks detailed in Mirati's recent filings on Forms 10-K and 10-Q with the U.S. Securities and Exchange Commission. Except as required by law, Mirati undertakes no obligation to update any forward-looking statements to reflect new information, events or circumstances, or to reflect the occurrence of unanticipated events. -

Beigene, Ltd. 百濟神州有限公司 (Incorporated in the Cayman Islands with Limited Liability) (Stock Code: 06160)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. BeiGene, Ltd. 百濟神州有限公司 (incorporated in the Cayman Islands with limited liability) (Stock Code: 06160) INSIDE INFORMATION CHINA NMPA APPROVES BRUKINSA® (ZANUBRUTINIB) FOR THE TREATMENT OF PATIENTS WITH RELAPSED OR REFRACTORY WALDENSTRÖM’S MACROGLOBULINEMIA This announcement is issued pursuant to Rule 13.09 of the Rules Governing the Listing of the Securities on The Stock Exchange of Hong Kong Limited and under Part XIVA of the Securities and Futures Ordinance (Cap. 571). On June 18, 2021 (U.S. Eastern Time), BeiGene, Ltd. (“BeiGene” or the “Company”) announced that BRUKINSA® (zanubrutinib) has received conditional approval from the China National Medical Products Administration (NMPA) for the treatment of adult patients with Waldenström’s macroglobulinemia (WM) who have received at least one prior therapy. The supplemental new drug application was previously granted priority review by the Center for Drug Evaluation (CDE) of the NMPA in October 2020. Attached hereto as Schedule 1 is the full text of the press release issued by the Company on June 18, 2021 (U.S. Eastern Time) announcing the above-described business updates. 1 Forward-Looking Statements This announcement contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws, including statements regarding the potential clinical benefits and advantages of BRUKINSA compared to other BTK inhibitors; BeiGene’s plans for the advancement, and anticipated clinical development, regulatory milestones and commercialization of BRUKINSA; and BeiGene’s plans, commitments, aspirations, and goals under the headings “BeiGene Oncology” and “About BeiGene”. -

Hon55 2630.Pdf

ABSTRACT 245 ifosfamide in 2 pts (12%) and other regimens in 3 pts (18%). Pts kinases in biochemical assays and shown favorable PK/PD properties treated with ibrutinib received 560 mg p.o. daily. Intratechal CT was in preclinical studies. In phase 1 testing, high plasma concentrations added in 5 pts (31%) and 7 pts (47%) in standard and ibrutinib cohort. were achieved, resulting in complete and sustained 24-hour BTK inhi- Radiotherapy was delivered to 3 pts, all in the standard cohort, in one bition in blood and lymph nodes in patients (pts) treated at 160 mg case as consolidation and in 2 cases as salvage. With a median follow- twice daily (bid; Tam. Blood 2016;128:642). Here, we present updated up of 10.4 months, the 1-year PFS and OS of the entire study popula- safety and efficacy data from pts with MCL. tion are 24% and 46%. A statistically significant difference in 1-year Methods: This is a global, phase 1 study investigating zanubrutinib in PFS was observed in favor of ibrutinib versus standard CT (49% vs pts with B-cell malignancies with indication-specific expansion cohorts. In the expansion phase, enrolled pts received zanubrutinib 6%, p = 0.044). The difference in 1-year OS in favor of ibrutinib versus 320 mg daily or 160 mg bid (the RP2D). Treatment emergent adverse standard CT did not reach statistical significance (57% vs 37%, events (TEAEs) were summarized according to NCI CTCAE v4.03 and p = 0.097). In the standard cohort only one pt is alive after allogeneic responses were assessed by CT scans as per Lugano Classification transplantation. -

Abstract EP783 MARGINAL ZONE LYMPHOMA (MAGNOLIA STUDY)

PHASE 2 STUDY OF ZANUBRUTINIB IN PATIENTS WITH RELAPSED/REFRACTORY Abstract EP783 MARGINAL ZONE LYMPHOMA (MAGNOLIA STUDY) Stephen Opat,1,2 Alessandra Tedeschi,3 Kim Linton,4 Pamela McKay,5 Bei Hu,6 Henry Chan,7 Jie Jin,8 Magdalena Sobieraj-Teague,9 Pier Luigi Zinzani,10 Morton Coleman,11 Peter Browett,12 Xiaoyan Ke,13 Mingyuan Sun,14 Robert Marcus,15 Craig Portell,16 Catherine Thieblemont,17 Kirit Ardeshna,18,19 Fontanet Bijou,20 Patricia Walker,21 Eliza Hawkes,22-24 Sally Mapp,25 Shir-Jing Ho,26 Melannie Co,27 Xiaotong Li,27 Wenxiao Zhou,27 Massimo Cappellini,27 Chris Tankersley,27 Jane Huang,27 and Judith Trotman28 1Monash Health, Clayton, Victoria, Australia; 2Clinical Haematology Unit Monash University, Clayton, Victoria, Australia; 3ASST Grande Ospedale Metropolitano Niguarda, Milan, Italy; 4The Christie, Manchester, UK; 5Beatson West of Scotland Cancer Centre, Glasgow, UK; 6Levine Cancer Institute/Atrium Health, Charlotte, NC, USA; 7North Shore Hospital, Auckland, New Zealand; 8The First Affiliated Hospital, Zhejiang University, Hangzhou, China; 9Flinders Medical Centre, Bedford Park, Australia; 10Institute of Hematology “Seràgnoli” University of Bologna, Bologna, Italy; 11Clinical Research Alliance, Lake Success, NY, USA; 12Auckland City Hospital, Grafton, New Zealand; 13Peking University Third Hospital, Beijing, China; 14Institute of Hematology & Blood Diseases Hospital, Chinese Academy of Medical Sciences and Peking Union Medical College, Tianjin, China; 15Sarah Cannon Research Institute UK, London, UK; 16University of Virginia -

Beigene, Ltd. (Incorporated in the Cayman Islands with Limited Liability and Trading As “百濟神州”Or“百濟神州有限公司”) (Stock Code: 06160)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. BeiGene, Ltd. (incorporated in the Cayman Islands with limited liability and trading as “百濟神州”or“百濟神州有限公司”) (Stock Code: 06160) BUSINESS UPDATE BEIGENE INITIATES GLOBAL HEAD-TO-HEAD PHASE 3 CLINICAL TRIAL OF ZANUBRUTINIB IN PATIENTS WITH RELAPSED/REFRACTORY CHRONIC LYMPHOCYTIC LEUKEMIA OR SMALL LYMPHOCYTIC LYMPHOMA On November 7, 2018, BeiGene, Ltd. (“BeiGene” or the “Company”), a commercial-stage biopharmaceutical company focused on developing and commercializing innovative molecularly-targeted and immuno-oncology drugs for the treatment of cancer, announced that the first patient was dosed in a global Phase 3 clinical trial of its investigational BTK inhibitor zanubrutinib compared with ibrutinib in patients with relapsed/refractory chronic lymphocytic leukemia (CLL) or small lymphocytic lymphoma (SLL). “We continue to be encouraged by data on zanubrutinib in various B-cell malignancies and are excited to further expand the development program for zanubrutinib in CLL and SLL with this Phase 3 trial, which represents the second Phase 3 study directly comparing zanubrutinib to ibrutinib,” said Jane Huang, M.D., Chief Medical Officer, Hematology, at BeiGene. The global Phase 3 open-label trial is expected to enroll approximately 400 patients with relapsed/refractory CLL or SLL across approximately 150 study centers in the U.S., China, Europe, Australia and New Zealand. -

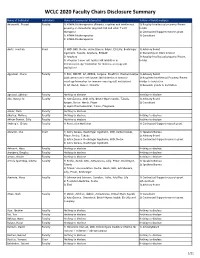

WCLC 2020 Faculty Chairs Disclosure Summary

WCLC 2020 Faculty Chairs Disclosure Summary Name of Individual Individual's Name of Commercial Interest(s) Nature of Relationship(s) Adusumilli, Prasad FacultyRole(s) in Activity 1) ATARA Biotherapeutics (Patents, royalties and intellectual 1) Royalty/Intellectual property/Patent property on mesothelin-targeted CAR and other T-cell holder therapies) 2) Contracted/Support research grant 2) ATARA Biotherapeutics 3) Consultant 3) ATARA Biotherapeutics Aerts, Joachim Chair 1) MSD, BMS, Roche, Astra-Zeneca, BAyer, Eli-Lilly, Boehringer 1) Advisory Board Ingelheim, Takeda, Amphera, BIOCAD 2) Ownership or Stock interest 2) Amphera 3) Royalty/Intellectual property/Patent 3) allogenic tumor cell lysate/JAK inhibition in holder immunooncology/ biomarker for immuno-oncology (all institution) Aggarwal, Charu Faculty 1) BMS, ROCHE, AZ, MERCK, Celgene, BluePrint, Diachaii Sankyo 1) Advisory Board 2)Allogenic tumor cell lysate/JAK inhibition in immuno- 2) Royalties/Intellectual Property/Patent oncology/biomarker for immuno-oncology (all institution) Holder to institution 3) AZ, Merck, Xencor, Novartis 3) Research grants to institution Agrawal, Abhinav Faculty Nothing to disclose Nothing to disclose Ahn, Myung-Ju Faculty 1) AstraZeneca, MSD, Lilly, Bristol-Myers Squibb, Takeda, 1) Advisory Board Amgen, Roche, Merck, Pfizer 2) Consultant 2) Alpha Pharmaceutical, Yuhan, Progenere Aisner, Dara Faculty Nothing to disclose Akerley, Wallace Faculty Nothing to disclose Nothing to disclose Akhtar-Danesh, Gilly Faculty Nothing to disclose Nothing to disclose -

Beigene, Ltd. 百濟神州有限公司 (Incorporated in the Cayman Islands with Limited Liability) (Stock Code: 06160)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. BeiGene, Ltd. 百濟神州有限公司 (incorporated in the Cayman Islands with limited liability) (Stock Code: 06160) INSIDE INFORMATION UNAUDITED RESULTS FOR THE THREE MONTHS ENDED MARCH 31, 2021 OF BEIGENE, LTD. AND BUSINESS UPDATES This announcement is issued pursuant to Rule 13.09 of the Rules Governing the Listing of the Securities on The Stock Exchange of Hong Kong Limited and under Part XIVA of the Securities and Futures Ordinance (Cap. 571). BeiGene, Ltd. (the “Company” or “BeiGene”) is pleased to announce its unaudited condensed consolidated financial results for the three months ended March 31, 2021 and business updates. The Company is pleased to announce the unaudited condensed consolidated results of the Company and its subsidiaries for the three months ended March 31, 2021 (the “Q1 Results”) published in accordance with applicable rules of the U.S. Securities and Exchange Commission and business highlights for the first quarter of 2021 and expected milestones for the remainder of 2021 and 2022 (the “Business Updates”). The Q1 Results have been prepared in accordance with U.S. Generally Accepted Accounting Principles, which are different from the International Financial Reporting Standards. Attached hereto as Schedule 1 is the full text of the press release issued by the Company on May 6, 2021 (U.S. -

Sustainability at Beigene 2020 Environmental, Social, and Governance (ESG) Report Beigene 2020 ESG Report

Sustainability at BeiGene 2020 Environmental, Social, and Governance (ESG) Report BeiGene 2020 ESG Report Letter from the CEO BeiGene was founded just over a decade ago, with a vision that high-quality, affordable medicines should be accessible to all. Dr. Xiaodong Wang and I launched BeiGene to create a truly transformative, global biotechnology company with the capabilities to accelerate the discovery and commercialization of new therapies, more affordably, to reach billions more people worldwide. We knew then that changing the system would require breaking with convention. That’s why, even a decade later, BeiGene remains a very different kind of company: purposefully global, always challenging the status quo, and ultimately pioneering an innovative model for developing medicines. By leveraging a unique opportunity to build cost This year, we began defining a set of ESG goals that will reflect and time efficiencies into clinical development, we are this commitment. Our strategy will include providing boundless working to fundamentally change how medicines are opportunities for our employees, giving back to our developed for global affordability and accessibility. communities, and continuing to uphold our values by operating our business responsibly, ethically, and with integrity. We will We know cancer doesn’t recognize geographical borders, and share the results in our next annual ESG report. neither do we. We recruit exceptional talent wherever they might be located. Today with colleagues working across five continents, Last year, we saw unprecedented suffering but also rarely seen I can proudly say that we are disrupting the traditional model of levels of collaboration between regulators, industry, and the biopharma—advancing 11 internally discovered molecules into broader healthcare community as everyone grappled with clinical trials in just 10 years, with two of our medicines, COVID-19. -

Clinigen Launches Managed Access Program with Beigene for Zanubrutinib

8 April 2021 Clinigen launches Managed Access Program with BeiGene for zanubrutinib Clinigen Group plc (AIM: CLIN, ‘Clinigen’), the global pharmaceutical Products and Services company, has launched a Managed Access Program (MAP) for BeiGene, Ltd. , a commercial-stage biotechnology company focused on developing and commercializing innovative medicines worldwide. A MAP, also being referred to as a Pre-Reimbursement Access Program by BeiGene, is a program which gives patients early access to a medicine that has either not yet been approved for use in the patient’s country, or is approved but not yet reimbursed by health insurers and therefore not yet commercially available. These programs are key to bridging the gap for patients between approval and reimbursement. The MAP will provide zanubrutinib initially to prescribed patients with Waldenström macroglobulinemia (WM) in specific European countries. Under the terms of the agreement Clinigen will manage all elements of the program including HCP enquiry management, regulatory oversight, logistics and access management. Pete Belden, Executive Vice President Services Division, Clinigen said: “We are pleased to be partnering with BeiGene to make zanubrutinib available for patients with this rare and serious condition. This aligns with our mission to ensure the right patient gets the right medicine at the right time.” Healthcare professionals can obtain details about the zanubrutinib Pre-Reimbursement Access Program by calling the customer service team at +44 1932 824001 or emailing [email protected]. Patients seeking medical information should contact their physician. - Ends - Contact details Clinigen plc +44 (0) 1283 495010 Pete Belden, EVP Services Division Instinctif Partners +44 (0) 20 7457 2020 Melanie Toyne-Sewell / Phillip Marriage / Nathan Billis [email protected] Notes to Editors About zanubrutinib Zanubrutinib is a small molecule inhibitor of Bruton’s tyrosine kinase, or BTK. -

Puretech Announces Clinical Trial and Supply Agreement with Beigene to Evaluate LYT-200 and Tislelizumab in Patients with Difficult-To-Treat Solid Tumors

PureTech Announces Clinical Trial and Supply Agreement with BeiGene to Evaluate LYT-200 and Tislelizumab in Patients with Difficult-to-Treat Solid Tumors July 7, 2021 RNS Number : 3709E PureTech Health PLC 07 July 2021 7 July 2021 PureTech Health plc PureTech Announces Clinical Trial and Supply Agreement with BeiGene to Evaluate LYT-200 and Tislelizumab in Paents with Difficult-to-Treat Solid Tumors Study will invesgate potenal acvity of a novel immunotherapeuc (LYT-200) with checkpoint inhibion as a new treatment modality Topline Phase 1 results with single-agent LYT-200 expected in the fourth quarter of 2021 PureTech Health plc (Nasdaq: PRTC, LSE: PRTC) ("PureTech" or the "Company"), a clinical-stage biotherapeucs company dedicated to discovering, developing and commercializing highly differenated medicines for devastang diseases, today announced a clinical trial and supply agreement with an affiliate of BeiGene, Ltd. (Nasdaq: BGNE; HKEX: 06160) to evaluate BeiGene's slelizumab, an an-PD-1 immune checkpoint inhibitor, in combinaon with PureTech's LYT-200, an invesgaonal monoclonal anbody targeng galecn-9, for the potenal treatment of difficult- to-treat solid tumor indicaons that are associated with poor survival rates. Galecn-9 is a pivotal immune modulator widely expressed in mulple difficult-to-treat tumor types and involved in the regulaon of tumor promong inflammatory and immunosuppressive pathways. Inhibion of galecn-9 with targeted anbodies leads to upregulaon of immunosmulatory cytokines and an-tumor acvity in preclinical cancer models. LYT-200 is currently being evaluated as a single agent in the first phase of an adapve Phase 1/2 clinical trial, which, based upon the trial protocol, will be followed by the poron of the trial intended to invesgate LYT-200 in combinaon with slelizumab. -

Summary Introduction Study Objectives Methods Results

Zanubrutinib for the Treatment of Patients With Waldenström Macroglobulinemia: Abstract EP1168 Three Years of Follow‑Up Stephen Opat, FRACP, FRCPA, MBBS1,2; Constantine S. Tam, MBBS, MD, FRACP, FRCPA3‑6; Paula Marlton, MBBS (Hons), FRACP, FRCPA7,8; David Gottlieb, MBBS, MD, FRACP, FRCPA9; David Simpson, MBChB, FRACP, FRCPA10,11; Gavin Cull, MB, BS, FRACP, FRCPA12,13; David Ritchie, MD, PhD3,5,6; Emma Verner, MBBS, BMedSci, FRCPA, FRACP14,15; Javier Munoz, MD, MS, FACP16; Alessandra Tedeschi, MD17; Jane Huang, MD11; William Novotny, MD11; Ziwen Tan18; Eric Holmgren, PhD11; Siminder K. Atwal, PhD11; John F. Seymour, MBBS, FRACP, PhD3,5,6; Andrew W. Roberts, MBBS, PhD, FRACP, FRCP3,5,6; and Judith Trotman, MBChB, FRACP, FRCPA14,15 1Monash Health, Clayton, Victoria, Australia; 2Monash University, Clayton, Victoria, Australia; 3Peter MacCallum Cancer Centre, Melbourne, Victoria, Australia; 4St Vincent’s Hospital, Fitzroy, Victoria, Australia; 5University of Melbourne, Parkville, Victoria, Australia; 6Royal Melbourne Hospital, Parkville, Victoria, Australia; 7Princess Alexandra Hospital, Brisbane, Queensland, Australia; 8University of Queensland, Brisbane, Queensland, Australia; 9Faculty of Medicine and Health, University of Sydney, Westmead Hospital, Sydney, NSW, Australia; 10North Shore Hospital, Auckland, New Zealand; 11BeiGene USA, Inc., San Mateo, CA, USA; 12Sir Charles Gairdner Hospital, Perth, WA, Australia; 13University of Western Australia Perth, WA, Australia; 14Concord Repatriation General Hospital, Concord, NSW, Australia; 15University of Sydney, Concord, NSW, Australia; 16Banner MD Anderson Cancer Center, Gilbert, AZ, USA; 17ASST Grande Ospedale Metropolitano Niguarda, Milan, Italy; 18BeiGene (Beijing) Co., Ltd., Beijing, China. INTRODUCTION RESULTS • Bruton tyrosine kinase (BTK) is an integral component of the B‑cell receptor Figure 2. Disposition of Patients With WM Figure 3. -

Beigene Corporate Presentation

BeiGene’s Internal Pipeline Global Three late-stage, and eight early-stage clinical assets China DOSE ESC. DOSE EXPANSION PIVOTAL ASSETS PROGRAMS FILED MARKET PH1a PH1b PH2* PH2** PH3 R/R MCL (approved in multiple geographies) WM† (filings accepted in multiple geographies) R/R MCL, R/R CLL/SLL (conditionally approved by NMPA in China 06.03.20) R/R WM (approved in China 06.18.21) monotherapy 1L CLL/SLL, R/R CLL/SLL zanubrutinib R/R MZL (BTK) lupus nephritis Previously treated CLL/SLL (ibrutinib acalbrutinib intolerant) +rituximab 1L MCL combination +obinutuzumab R/R FL +lenalidomide +/- ritux. R/R DLBCL MSI-H or dMMR solid tumors 2L ESCC R/R cHL (approved 12.26.19), 2L+ UC (approved 04.10.20) monotherapy 2L/3L HCC (conditionally approved in China 06.23.21) 2L/3L NSCLC 1L HCC, R/R cHL tislelizumab R/R NK/T-cell lymphoma (PD-1) 1L Sq. NSCLC (approved 01.13.21) 1L non-Sq. NSCLC (approved in China 06.23.21) + chemo 1L NPC, 1L SCLC, Stage II/IIIA NSCLC, Localized ESCC 1L GC, 1L ESCC + pamiparib (PARP) Solid tumors + zanubrutinib (BTK) B-cell malignancies 3L gBRCA+ OC (conditionally approved in China 05.07.21) 2L platinum-sensitive OC maintenance monotherapy 1L platinum-sensitive GC maintenance pamiparib HER2- BRCA mutated breast cancer (PARP) Solid tumors + TMZ (chemo) Solid tumors + RT/TMZ (RT/chemo) Glioblastoma 1L NSCLC ociperlimab (BGB-A1217, TIGIT) + tislelizumab R/M Cervical Cancer, R/M ESCC^ Solid tumors lifirafenib (RAF Dimer) + mirdametinib B-Raf- or K-RAS/N-RAS-mutated solid tumors BGB-A333 (PD-L1) monotherapy & + tislelizumab Solid tumors BGB-A425 (TIM-3) monotherapy & + tislelizumab Solid tumors BGB-A445 (OX40) + tislelizumab Solid tumors BGB-11417 (BCL-2) monotherapy & + zanubrutinib B-cell malignancies BGB-10188 (PI3-Kδ) mono; + tislelizumab; + zanubrutinib B-cell malignancies; Solid tumors BGB-15025 (HPK1) monotherapy & + tislelizumab Advanced solid tumors *Some indications will not require a non-pivotal Ph2 clinical trial prior to beginning pivotal Ph2 or Ph3 clinical trials.