Delancey-Brochure.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Strategy Issue 5 V2.Qxd

LOPSG Strategy London Older People’s Strategies Group Issue 5 May 2004 Welcome to Strategy New resource for London Pensioners elcome to Strategy, which we hope will Wappear on a regular basis. It continues and replaces The Link. The editor is David Jones and the editorial committee is Joe Harris, Graeme Matthews and Les Evans. David is an experienced editor, who did a first rate job on the Greater London Pensioner. The articles must come from you, and should be readable and to the point. We hope to include photos, and would like to include cartoons. We are sure that among the many thousands of older Londoners represented on LOPSG there are those who are handy with the pen. Project officers Charlotte and Anna The Link was put together by the representative of Age Concern London, who The Mayor has provided a valuable new kindly offered their facilities. But when she resource for London’s older people. left to work at another charity we were Charlotte Smith opens the door on page 2 unable to find a replacement. For more information on the facility contact Now with a new editor and the new Resource Facility we are starting again. We Anna Roberts or Charlotte Smith expect to distribute 2000 copies of each edition, and would hope that our London Older People's Resource Facility participants will photocopy any additional c/o London Pension Fund Authority copies that may be needed. We also Dexter House decided to give the newsletter a more 2 Royal Mint Court snappy title, which we hope will meet with London EC3N 4LP your approval. -

Block Adjacent to Tower Bridge

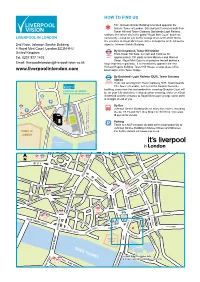

HOW TO FIND US The Johnson Smirke Building is located opposite the historic Tower of London. Situated just 5 minutes walk from Tower Hill and Tower Gateway Docklands Light Railway stations, the venue sits in the gated “Royal Mint Court” business LIVERPOOL IN LONDON community – keep an eye out for a large stone arch which forms the entrance to Royal Mint Court. Once through the arch, follow the 2nd Floor, Johnson Smirke Building signs to Johnson Smirke Building. 4 Royal Mint Court, London EC3N 4HJ By Underground, Tower Hill Station United Kingdom From Tower Hill Tube, turn left and continue for Tel: 0207 977 1433 approximately 100 yards across Minories and Mansell Street. Royal Mint Court is situated on the left behind a Email: [email protected] large impressive gateway. It is immediately opposite the new Richard Rogers building, Tower Hill House, a large glass office www.liverpoolinlondon.com block adjacent to Tower Bridge. By Docklands Light Railway (DLR), Tower Gateway Station If you are arriving from Tower Gateway DLR, head towards The Tower of London, turn left at the Societe Generale building, cross over the next pedestrian crossing (Sceptre Court will LIVERPOOL IN LONDON www.liverpoolinlondon.com be on your left) and at the next pedestrian crossing, cross over East Smithfield and the entrance to Royal Mint Court (a large stone arch) is straight ahead of you. MI N O R I E S By Bus Johnson Smirke Building sits on many bus routes, including C A R the 42, 78,15 and RV1. Bus Stop TE/TN/TH/TA. -

(By Email) Our Ref: MGLA120221-5818 24 March 2021

(By email) Our Ref: MGLA120221-5818 24 March 2021 Dear Thank you for your request for information which the GLA received on 11 February 2021. Your request has been dealt with under the Environmental Information Regulations (EIR) 2004. You asked for; 1. a copy of all correspondence in relation to the relocation of the new Chinese Embassy at Royal Mint Court from 1st January 2018 to date, between: • Edward Lister • CBRE • The Chinese Embassy • The FCO • Delancey • And the GLA planning department. 2. Please provide any documents retained from the Deputy Mayoralty of Edward Lister related to the relocation of the new Chinese Embassy, which may include meeting minutes, official correspondence, or reports into adequate sites. Our response to your request is as follows: Please find attached the information that the GLA holds within scope of your request. Please note that some names of non-senior members of staff are exempt from disclosure under Regulation 13 (Personal information) of the EIR. Information that identifies specific employees constitutes as personal data which is defined by Article 4(1) of the General Data Protection Regulation (GDPR) to mean any information relating to an identified or identifiable living individual. It is considered that disclosure of this information would contravene the first data protection principle under Article 5(1) of GDPR which states that Personal data must be processed lawfully, fairly and in a transparent manner in relation to the data subject. Please note that all accounts belonging to the former Mayoral team have now been deleted. If you have any further questions relating to this matter, please contact me, quoting the reference at the top of this letter. -

Preferred Office Location Boundary Review (2017)

London Borough of Tower Hamlets Preferred Office Locations Boundary review Peter Brett Associates Final July 2017 Office Address: 16 Brewhouse Yard, Clerkenwell, London EC1V 4LJ T: +44 (0)207 566 8600 E: [email protected] Project Ref 40408 Name Position Signature Date Prepared by Andrew Lynch Associate AL 19th May ‘17 Reviewed by Richard Pestell Director RP 23rd May ‘17 Approved by Richard Pestell Director RP 24th July ‘17 For and on behalf of Peter Brett Associates LLP Revision Date Description Prepared Reviewed Approved 23rd May 1 draft AL RP RP ‘17 24th July 2 Final AL RP RP ‘17 Peter Brett Associates LLP disclaims any responsibility to the client and others in respect of any matters outside the scope of this report. This report has been prepared with reasonable skill, care and diligence within the terms of the contract with the client and taking account of the manpower, resources, investigations and testing devoted to it by agreement with the client. This report has been prepared for the client and Peter Brett Associates LLP accepts no responsibility of whatsoever nature to third parties to whom this report or any part thereof is made known. Any such party relies upon the report at their own risk. © Peter Brett Associates LLP 2017 THIS REPORT IS FORMATTED FOR DOUBLE-SIDED PRINTING. ii London Borough of Tower Hamlets - Preferred Office Locations Boundary review CONTENTS 1 INTRODUCTION .......................................................................................................... 1 2 OVERVIEW OF THE BOROUGH-WIDE OFFICE FLOORSPACE DEMAND SUPPLY BALANCE ............................................................................................................................. 4 3 METHOD FOR BOUNDARY ASSESSMENTS ............................................................ 6 4 NORTH OF THE ISLE OF DOGS (CANARY WHARF) - BOUNDARY ASSESSMENT 7 The potential for intensification .................................................................................... -

Measuring the Strategic Value of Ir

IR SOCIETY NEWS AND EVENTS | CHAIRMAN’S LETTER | PERSONAL VIEW | NEW MEMBERS INFORMED THE VOICE OF INVESTOR RELATIONS IN THE UK ISSUE 80 AUTUMN 2013 MEASURING THE STRATEGIC VALUE OF IR A special feature which looks at the growing contribution of IR to corporate success THE IR BEST PRACTICE AWARDS AND ANNUAL DINNER 2013 See the shortlist of potential winners and further information on the 19 November event. Book your places now! PLUS Letter from Asia IR in Middle East markets Service providers directory The IR Society Best Practice Awards 2013 19 November 2013 The IR Society Best Practice Awards recognise and reward excellence in investor relations. Join us for the premier event in the IR calendar – book your table now! www.irs.org.uk The Pavilion, at the Tower of London, EC3N 4AB 6.30pm For more information please contact: Dipty Patel on [email protected] or call +44 (0)20 7379 1763 Promoting excellence in investor relations PLATINUM SPONSOR GOLD SPONSOR SILVER SPONSOR MEDIA PARTNER SUPPORTER INFORMED AUTUMN 2013 CONTENTS 4 CHAIRMAN’S LETTER Surprising on the upside 12 IR: THE STRATEGIC VALUE John Dawson, IR Society chairman 13 TAKE IT FROM THE TOP... THE 5 NEWS FROM THE SOCIETY CHAIRMAN AND THE IRO Krishnan Guru-Murthy to host IR awards dinner Gillian Karran-Cumberlege, Fidelio Partners Best practice awards – shortlist announced for self-entry and voted categories (page 6) 16 PUTTING IR INTO PERSPECTIVE How to contribute to our ‘white paper’ emails (page 9) Craig Marks, Halfords New IR Society members (page 9) 18 FOLLOWING A SOCIAL MEDIA ROADMAP FOR IROs 8 A PERSONAL VIEW Jim Delaney, Marketwired After the long, hot summer.. -

Our History Is Long but Our Mission Never Changes

OUR HISTORY IS LONG BUT OUR MISSION NEVER CHANGES. ANNUAL REPORT AND ACCOUNTS 2017/18 1850s The hospital circa 1850. 2017 The hospital in the present day. 1936 Princess Tsahai as a nurse at Great Ormond Street Hospital (GOSH). 2018 GOSH patient Angel, age 3. 1948 Nana entertaining a patient at a Christmas performance at GOSH. 2018 Play worker Lauren plays cards with a patient. NAVEEN, 7 This is Naveen, he comes to GOSH regularly for treatment. OUR MISSION Our mission at Great Ormond Street Hospital Children’s Charity (GOSH charity) is to enhance Great Ormond Street Hospital’s (GOSH) ability to transform the health and wellbeing of children and young people, giving them the best chance to fulfil their potential. THEN Back in the 1980s, we kick-started decades of fundraising to give seriously ill children the chance of a better future. Thousands of people from across the UK united to support GOSH’s Wishing Well Appeal, which became the largest ever appeal of its kind. NOW We’re celebrating 30 years of incredible support. Over the years, people like you have helped to fund wards and medical facilities, state-of-the-art medical equipment, ground breaking research and support services such as parent accommodation. On average 619 children and young people from across the UK arrive at GOSH every day. Many of our young patients have life-limiting or life-threatening conditions. Every day, doctors and nurses battle the most complex illnesses, and the brightest minds come together to achieve pioneering medical breakthroughs. ALWAYS We continue to be committed to providing the patients and their families treated at our extraordinary hospital with the very best facilities. -

Saffron Wharf

DEVELOPMENT GUIDE SAFFRON WHARF DISCOVER Computer generated image. Indicative only. LONDON DOCK SAFFRON WHARF WELCOME TO SAFFRON WHARF AT LONDON DOCK 04 05 The latest release of new homes at London Dock, Saffron Wharf, offers a choice of contemporary Manhattan, one, two and three bedroom apartments. With its private and tranquil open spaces and easy access to exciting new squares and boulevards, you’ll find yourself right at home in the heart of a thriving new London neighbourhood. Computer generated image. Indicative only. LONDON DOCK SAFFRON WHARF KEY FACTS LOCATION ARCHITECT DEVELOPER LOCAL AUTHORITY TENURE PARKING WARRANTY EST COMPLETION London Dock Show Apartments Patel Taylor ST GEORGE CITY LTD London Borough of 999 years leasehold Right to park available for 10-year NHBC warranty From Q1 2024 - Q4 2025 and Marketing Suite, 9 Arrival St George House, Tower Hamlets from July 1989 2 and 3 bedroom apartments 2-year St George Square, London, E1W 2AA 9 Pennington Street, London, E1W 2BD only at a cost of £50,000 product warranty Tel: +44 (0)20 360 0790 06 07 Computer generated image. Indicative only. LONDON DOCK SAFFRON WHARF SERVICE CHARGE Anticipated to be c. £5.49 psf* Right to park £650 p.a GROUND RENTS Manhattan / 1 Bed £400 p.a. 2 Bed £550 p.a. 3 Bed £750 p.a. COUNCIL TAX London Borough of Tower Hamlets Council Tax Bands April 2021 – March 2022 A £984.61 E £1,805.12 B £1,148.72 F £2,133.33 C £1,312.82 G £2,461.53 D £1,476.92 H £2,953.84 TERMS OF PAYMENT 1. -

Public Document Pack

Public Document Pack AUDIT COMMITTEE Contact: Pauline Bagley Committee Secretary Thursday, 29 June 2006 at 7.30 pm Direct : 020-8379- 5119 Conference Room, Civic Centre, Silver Street, Enfield Tel: 020-8379-1000 EN1 3XA Ext: 5119 Fax: 020-8379-3177 (DST) E-mail: [email protected] Council website: www.enfield.gov.uk Councillors : Andreas Constantinides, Don Delman, Jonas Hall (Chairman), Dino Lemonides, Henry Pipe, Jeff Rodin and Edward Smith (Vice-Chairman) LEAD OFFICER : Bill Somerville/Assistant Director, Finance and Corporate Resources COMMITTEE SECRETARY: Pauline Bagley/Democratic Services Team AGENDA – PART 1 1. WELCOME AND APOLOGIES FOR ABSENCE (IF ANY) 2. DECLARATIONS OF INTEREST (Pages 1 - 2) 3. MINUTES OF THE LAST MEETING (Pages 3 - 8) To receive the Minutes of the meeting that took place on 5 April 06. 4. MATTERS ARISING FROM THE MINUTES To consider any matters arising from the Minutes. 5. 2005/06 ANNUAL STATEMENT OF ACCOUNTS (REPORT NO. 27) (Pages 9 - 104) To receive the report of the Director of Finance and Corporate Resources presenting the unaudited Annual Statement of Accounts for the 2005/06 financial year for the consideration and approval of the Committee. (NOTE: A copy of the full Statement of Accounts has been provided only for members of the Committee. In addition, a copy has been placed in the Members’ Library and in both Group Offices (for reference). Further copies are available on request from the Committee Administrator, details as above). 6. STATEMENT OF INTERNAL CONTROL (REPORT NO. 28) (Pages 105 - 124) To receive the report of the Director of Finance and Corporate Resources. -

Ebiquity Plc Annual Report and Accounts for the Year Ended 30 April 2013

EBIQUITY PLC ANNUAL REPORT AND ACCOUNTS AND ACCOUNTS REPORT ANNUAL EBIQUITY PLC EBIQUITY PLC ANNUAL REPORT AND ACCOUNTS FOR THE YEAR ENDED 30 APRIL 2013 Stock code: EBQ FOR THE YEAR ENDED 30 APRIL 2013 YEAR THE FOR Ebiquity Plc, The Registry, Royal Mint Court, London, EC3N 4QN +44 (0) 20 7650 9600 www.ebiquity.com ebiquityopinion.com @ebiquityglobal Enabling clients across the world to improve their brand and business performance Ebiquity is an independent marketing performance specialist. We help brands optimise the efficiency and effectiveness of their paid, earned and owned marketing communications worldwide. We collect, aggregate and analyse vast amounts of online and offline marketing data to provide brands with a better understanding of what is going on in their market, how they are performing, and what they can do to improve. Our consultancy and software services are built upon this data, our industry expertise, and our independence from the media transaction process. For over 1,100 clients we enhance capabilities, instil greater accountability and assist their pursuit of transparency with their agency partners. 91 of the world’s top 100 advertisers are amongst our clients. We answer client questions such as: • What’s driving our business performance and how can I demonstrate a greater ROI? • What result is our digital activity really achieving? • How can we best evaluate agency performance? • What effect is our paid and earned activity having on our reputation? • What can we learn from our competitors’ communication strategies? Ebiquity employs over 750 people across the world with wide-ranging skills and experience from their agency, client and consultancy backgrounds. -

Appendix 4 Aldgate and Tower Key Area of Change

Appendix 4 Aldgate and Tower Key Area of Change Context This area contains a mix of uses, including offices, Sir John Cass Primary School, Mansell and Middlesex Street housing estates, part of Petticoat Lane market, hotels and tourist activity associate with the Tower of London. There have been considerable improvements to the area in recent years, with the Aldgate Gyratory being removed and replaced with a large public square created stimulating further change. Major hotel and office development is under construction on Minories, an application has been submitted for redevelopment of the Mansell Street Estate and several large office sites currently have development potential. These proposals and opportunities will impact the use and environment of the area. The Chinese Embassy will be moving to Royal Mint Court just outside of the City boundary and this may lead to further diplomatic and commercial interest in this area. Spatial Extent This area is positioned in the east of the City between the City's eastern cluster of tall buildings and Tower Hamlets. The southern edge of the area is adjacent to the Tower of London and on the northern edge is the Middlesex Street estate. Vision The area will be promoted and protected as a mixed use area which balances the competing needs and requirements of residents, students, workers and visitors. Diplomatic use and associated commercial activity will be encouraged. The needs of residents, particularly those on Middlesex Street and Mansell Street Estates will be addressed, maximising employment, health, education, recreation, retail facilities and opportunities. Provision will be made to meet the needs of visitors to the area, particularly around Aldgate Square and the Tower of London, , and appropriate hotel provision provided. -

White- Chapel

Scales 0 100 200 300 1 2 B C U r metres o E T R L sb T F Y A y S X ALDGATE S q A M E H A L S H M 0 100 200 300 R Y ST G E R R D I A EE M H D T G A yards M ITRE A E N MA I T N . T N U R SQ T E E M S T S S T E 0 1 2 3 T A RE RE G E T E LD I IE S S T N L A L A T LE minutes ADENHAL T S B L STREE T L O I WHITE- E London R L M L Guildhall A I R E I S L T University W E E CHAPEL Lloyds I ST T R E ES T of London ST . S L IA D R M L IN V T T S Entrance 2 O A IN R T Y E R E D E Key E K E N ' E S S T T S C L A ÚÊ T T T T E P V N S R DO U HAY R L E H FENCHURCH L S U E M C T Places of interest M T ST S T S STREET EN R K T A TSO T T EE Û FRIARS POR O TR R U Entrance 1 S C K L E to S H SSWAL R CH FEN C CRO P SHADWELL PARK RD Road R L FENCHU E D C Amirica A E N O Square N H YA A TC O D M A N S R E U O D L R Pitcher O ST DLR Park Rd Pedestrians only C P G MBER to Dock Street to and Piano E HA G C and Cable Street MONUMENT Minister ST Public House R The Minories N T S ' I AR S Public House Canal Way Court H E C E R Tower Footpath T T T T E E O E N STR Gateway E I St Olave YS H EP R P S G W DLR Station ST R Church I Nov M otel T EA ANE N MIN L Cycle racks T G AL C T London The Liberty L OY O ÚØ R A W Underwriters L Bounds A L E ARE R R Centre Post Office N Public House QU E T W E S Embassy ST S R TY EE I ÚÖ R B T N Merchant Navy N I I G MARK R War Memorial A H Hotel T ÚÙ Ú× T D TOWER M A R S T S W HILL T À to London Bridge and All Hallows Church and Royal Mint Court Lettered bus stop Y L Tower Gardens London Dungeon B Brass Rubbing Centre L I H to News International, H Safeways and Theatre Tickets Office C Û National Rail R Tobacco Dock and Bureau De Change E A E Custom House LO W O A W O R S Public toilet ER The Tiger Tavern T T L D C T P E ustom House HA S F I Walk Public House Y M P M H E A I T S S CE Public toilet, disabled access T A C PLA Su W O AR g Y ar Q Tower of London MM ST u 'S ay W O A ALK E alk E D ITY U SUN W Taxi rank IN G Q R D A I H Theatre Tower of London Park R T A B . -

Retail and Leisure Opportunity Alie Street

Retail and Leisure Opportunity Alie Street Main Plaza Leman Street Computer Generated Image of Northwest Block Main Piazza Retail and Leisure Opportunity. Goodman’s Fields, E1. Goodman’s Fields is a world-class Contents mixed-use scheme, representing a Location 04–07 fantastic commercial opportunity The Proposed Scheme 08–09 Public Realm 10–11 within walking distance of the Phase One – Availability 12–14 City of London. Contact 15 Appendix – Aldgate Area 17 Existing Local Occupiers 18–19 Development Pipeline 20–21 Residential Schemes: Completed Developments 22 Residential Development Pipeline 23 3 Location Local area map Goodman’s Fields is located A truly unique environment Shopping Nightlife Transport in Aldgate which is currently with over two acres of public 1 One New Change 26 Shoreditch House 49 Liverpool Street Station undergoing a significant realm will draw office workers, 2 Westfield Stratford City 27 Callooh Callay 50 St Pancras International transformation. Forthcoming residents, students and artists 3 Spitalfields Market 28 Nightjar 51 City Airport developments will provide a into the scheme. Goodman’s 4 Leadenhall Market 29 Lounge Bohemia 52 Aldgate East Station mixture of uses from offices, Fields will set the benchmark 5 Mawi 30 The Golden Bee 53 Crossrail – Liverpool Street retail, residential, student for developments within the 6 Boxpark 31 The Golden Heart 54 Crossrail – Whitechapel accommodation, hotels and area and become a retail 7 Start 32 Old Truman Brewery 55 Fenchurch Street Station new public realm. With its and leisure destination in its 8 Labour and Wait excellent communication links own right. 9 SCP East Culture & Entertainment Berkeley Developments the area is set to emerge as a 10 Maltby Street Market 33 Tate Modern 56 One Tower Bridge gateway between the City, The three surrounding streets 11 Columbia Rd 34 The Barbican Centre 57 Wapping Village East End and East of London.