Saj Food Products Pvt. Ltd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Trade Marks Journal No: 1897 , 15/04/2019 Class 30 1954573 22

Trade Marks Journal No: 1897 , 15/04/2019 Class 30 1954573 22/04/2010 AROMSA BESIN AROMA VE KATKI MADDELERI SANAYI VE TICARET ANONIM SIRKETI trading as ;AROMSA BESIN AROMA VE KATKI MADDELERI SANAYI VE TICARET ANONIM SIRKETI GEBZE ORGANIZE SANAYI BOLGESI, IHSAN DEDE CADDESI, PK-18 GEBZE- KOCAELI TURKEY MANUFACTURERS AND MERCHANTS A COMPANY REGISTERED UNDER THE LAWS OF TURKEY Address for service in India/Agents address: SELVAM & SELVAM 9/1-VALLIAMMAL STREET, KILPAUK, CHENNAI 600 010 Proposed to be Used CHENNAI COFFEE, TEA, COCOA, SUGAR, RICE, TAPIOCA, SAGO, ARTIFICIAL COFFEE; FLOUR AND PREPARATIONS MADE FROM CEREALS, BREAD, PASTRY AND CONFECTIONERY, ICES; HONEY, TREACLE; YEAST, BAKING-POWDER; SALT, MUSTARD; VINEGAR, SAUCES (CONDIMENTS); SPICES; ICE. 3188 Trade Marks Journal No: 1897 , 15/04/2019 Class 30 REPARE 2409984 11/10/2012 MANKIND PHARMA LIMITED 208, Okhla Industrial Estate, Phase-III, New Delhi – 110020, INDIA MERCHANT AND MANUFACTURER A COMPANY DULY ORGANIZED AND EXISTING UNDER THE INDIAN COMPANIES ACT, 1956 Address for service in India/Attorney address: DASWANI & DASWANI Daswani House, Green Acres 23B, Ahiripukur 1st Lane, Kolkata - 700019 Used Since :01/03/2001 DELHI NUTRITIONAL ADDITIVES, NOT FOR MEDICAL PURPOSES, NJADE-"LROM COFFEE, TEA, COCOA, SUGAR, RICE, TAPIOCA, SAGO, PASTA, CEREALS, FLAVOURINGS (OTHEF^^THAN ESSENTIAL OILS); NON-MEDICATED FOOD IN THE FORM OF BARS, TABLETS AND POWDERS USED AS NUTRITIONAL SUPPLEMENTS, FOOD SUPPLEMENTS, VITAMINS SUPPLEMENTS AND MINERAL SUPPLEMENTS. 3189 Trade Marks Journal No: 1897 , 15/04/2019 Class 30 CRYSTAL CLEAR 2457596 09/01/2013 SOCIETE DES PRODUITS NESTLE S. A. 1800 VEVEY, SWITZERLAND. MERCHANTS & MANUFACTURERS A COMPANY INCORPORATED UNDER THE LAWS OF SWITZERLAND Address for service in India/Agents address: INTTL ADVOCARE. -

Competitive Strategy and Its Impact on ITC Portfolio 1Durga Prasad Bhuyan, 2Dr

ISSN : 2249-5762 (Online) | ISSN : 2249-5770 (Print) IJRMET VOL . 5, ISSU E 1, SPL - 1 NO vem B er 2014 - AP ri L 2015 Competitive Strategy and Its Impact on ITC Portfolio 1Durga Prasad Bhuyan, 2Dr. Sushanta Tripathy 1Ravenshaw Business School, Ravenshaw University, Cuttack, Odisha, India 2School of Mechanical Engineering, KIIT University, Bhubaneswar, Odisha, India Abstract Technology business. The objective of the study is to find out the competition strategy ITC get them involved in the food business in the year of 2001, adopted by ITC.ltd (biscuit divison) and the impact of it on ITC with the introduction of Kitchen of India, then in the year 2002 portfolio and to find out the problem related to the sales and service ITC entered the confectionery and staples segments with the activity of ITC and the ways to overcome it. Through this survey launch of the brands mint-o and Candyman confectionery and in market the market position of ITC is determined and what Aashirvaad atta (wheat flour). The company in 2003 entered to effect does it have on the sales activity. The steps to overcome the biscuit segment by the name of Sunfeast. In 2007 they entered into problem are determined through this survey and how to develop the snacks category Bingoo. In 2010 ITC launched SunfeastYipee! the sales and distribution are also suggested through this paper. and thereby they were into noodles segment. In 2002 the company was into incense sticks and safety matches Keywords business. Competitive Strategy, Sales and Service, ITC Portfolio In the year 2002 ITC came over with educational and Stationary business. -

Vishal Mega Mart History Vishal Retail Ltd

vishal mega mart history Vishal Retail Ltd. (Figure-1) has a strong presence in manufacturing and retailing of readymade garments (apparels);retailing of non-apparels and a large variety of FMCG products. The jewel in Vishal Group’s crown is its flagship company Vishal Retail Ltd., a company engaged in Hyper market stores with an average area of 25,000 to 30,000 sq. ft.through an impressive chain of 172 fully integrated stores in spread over the area of more than 24,00,000 sq. ft. in around 129 cities across India in 24 states. The turnover of the company for 09-10 was 1105 Crore. Maintaining the highest standards in quality and design, these stores have come to offer the finest fashion garments at down-to-earth price structure. It also has 29 warehouses located in 9 key cities in India covering over 1,053,066 sq. ft area. It started as a retailer of ready-made apparels in Kolkata in 2001. At the time of incorporation, the registered office of the Company was situated at 4, R. N. Mukharjee Road, Kolkata 700 001. In 2003, it acquired the manufacturing facilities From Vishal Fashions Private Limited and M/s Vishal Apparels. It follows the concept of value retail in India. In other words, their business approach is to sell quality goods at reasonable prices by either manufacturing them self or directly procuring from manufacturers (primarily from small and medium size vendors and manufacturers). It facilitates one-stop-shop convenience for their customers and to cater to the needs of the entire family. -

Applications Received During 1 to 31 August, 2018

Applications received during 1 to 31 August, 2018 The publication is a list of applications received during 1 to 31 August, 2018. The said publication may be treated as a notice to every person who claims or has any interest in the subject matter of Copyright or disputes the rights of the applicant to it under Rule 70 (9) of Copyright Rules, 2013. Objections, if any, may be made in writing to copyright office by post or e-mail within 30 days of the publication. Even after issue of this notice, if no work/documents are received within 30 days, it would be assumed that the applicant has no work / document to submit and as such, the application would be treated as abandoned, without further notice, with a liberty to apply afresh. S.No. Diary No. Date Title of Work Category Applicant 1 10996/2018-CO/L 01/08/2018 Master Plan & Layman’s Guide HUMAN Literary/ Dramatic SHUBHAM A.AGARWAL, KISHOR KUMAR BISEN ELEPHANT CONFLICT MITIGATION Surguja Forest Circle 2 10997/2018-CO/A 01/08/2018 unique anticlockwise watch design. Artistic Ajinkya Ravindra Kottawar 3 10998/2018-CO/L 01/08/2018 Cost Efficient Catalytic Converter Literary/ Dramatic Udhayakumar N 4 10999/2018-CO/SW 01/08/2018 Transaction adminstrattion system Computer Software Tejas Jagdish Chaudhari, Rushikesh sanjay phalke, Shubham laxman chavan, Sopan Rajendra Bembde 5 11000/2018-CO/L 01/08/2018 Living Biological Specimens - Biological Living Literary/ Dramatic Abhijeet Madhukar Deshpande Automated Information & Data Computing, Analysis, Processing & Communication System 6 11001/2018-CO/L 01/08/2018 WRITE GRACEFULLY Literary/ Dramatic SMITA THORAT 7 11002/2018-CO/A 01/08/2018 GEOFAST Artistic GEOFAST CARRIERS PVT. -

Placement Brochure 2020-22

P L A C E M E N T BROCHURE 2 0 2 0 - 2 2 Shri Dharmasthala Manjunatheshwara Institute for Management Development Dharmasthala Sri Kshetra Dharmasthala is the encompassing force sustaining all SDM institutions, social initiatives and organisations. The temple town of Dharmasthala that fosters multiple faiths under the watchful eye of Lord Manjunatha is a pilgrimage, an attraction and a spiritual healing centre, keeping intact the values and ideals of institutions functioning under the guidance of the Dharmadhikari Dr. D. Veerendra Heggade P L A C E M E N T BROCHURE 2 0 2 0 - 2 2 Inside Message from Deputy Director 02 An Invite... 03 Vision & Mission 04 Governing Board 06 Faculty 07 The Institute 08 Post Graduate Diploma in Management 10 PGDM Courses 12 Accreditation & Rankings 14 International Linkages 16 Learning Beyond Classroom 18 Why hire an SDMite? 20 Placements@SDMIMD 22 Profile of PGDM 2020-22 23 Placement Process 24 Recruiting Partners 25 Student Profile Index 26 Students with Work Experience 28 Freshers 34 Contacts 44 Message from Deputy Director Dear Recruiter, India is now on the cusp of recovering from the second wave of the Covid onslaught, the primary issue facing the Nation in the past one year. In spite of the overwhelming environment of gloom and doom as felt by the general public, specifically the students, academic and business fraternity, India has done fairly well in terms of the market indices, the business sentiments as well as on the export and trade front. Except for the hospitality, leisure, entertainment and fitness industries, all other business sectors have either bounced back or are hopeful of a strong growth trajectory in the coming months. -

E-Register: July, 2017

E-Register: July, 2017 S.No. RoC No. Date Diary No. Title of Work Category Applicant RUKMANI ENTERPRISES PROPRIETOR RAJESH 1 A-117997/2017 03/07/2017 13329/2016-CO/A KASOTI Artistic KUMAR RAWAT 2 A-117998/2017 03/07/2017 13317/2016-CO/A SILGO Artistic NITIN JAIN CONCISE TEXTBOOK OF Literary/ 3 L-66654/2017 03/07/2017 10836/2016-CO/L PHARMACOLOGY Dramatic Dr. ABHISHEK JAIN PRANAMI BUILDERS 4 A-117999/2017 03/07/2017 13058/2016-CO/A PRANAMI Artistic PRIVATE LIMITED SOLUTION TO AIR Literary/ 5 L-66655/2017 03/07/2017 13127/2016-CO/L POLLUTION - PART II Dramatic MS. PRACHIE SHARMA SOLUTION TO AIR Literary/ DR BHUPINDER SINGH 6 L-66655/2017 03/07/2017 13127/2016-CO/L POLLUTION - PART II Dramatic GILL SOLUTION TO AIR Literary/ 7 L-66655/2017 03/07/2017 13127/2016-CO/L POLLUTION - PART II Dramatic MR. AMIT KUMAR SINGH SIDDHA REAL ESTATE DEVELOPMENT PRIVATE 8 A-118000/2017 03/07/2017 13062/2016-CO/A LAKEVILLE Artistic LIMITED Literary/ 9 L-66656/2017 03/07/2017 13190/2016-CO/L Chanakkyam Dramatic Lakshminarayan.C.M. Literary/ 10 L-66657/2017 03/07/2017 13275/2016-CO/L CREATIVE WRITINGS Dramatic KETAN R AGARWAL Handbook on Internal Literary/ Mr. Parag Vijaykant 11 L-66658/2017 03/07/2017 13266/2016-CO/L Audit Dramatic Kulkarni Literary/ 12 L-66659/2017 03/07/2017 13078/2016-CO/L Khamoshiyaan Dramatic Shivani Tibrewala PERIODIC TABLE AT Literary/ 13 L-66660/2017 04/07/2017 13032/2016-CO/L YOUR FINGERTIPS Dramatic Rajan Gupta 14 SR-12015/2017 04/07/2017 12999/2016-CO/SR Apnaoge Kabhi? Sound Recording Vibhu Trehan TUMI AMAR Literary/ 15 L-66661/2017 04/07/2017 13065/2016-CO/L NAYANMONI Dramatic MOU PIYA DEB Literary/ 16 L-66662/2017 04/07/2017 8333/2016-CO/L Kill Me, Again Dramatic Bala Sekhar Kadiyala The Nutrient Buffer Power Concept for Literary/ 17 L-66663/2017 04/07/2017 8282/2016-CO/L Sustainable Agriculture Dramatic KP Prabhakaran Nair JAYA INDUSTRIES PVT. -

Iem) in the Month of September 2019

STATEMENT ON DETAILED BREAK-UP FOR INDUSTRIAL ENTREPRENUERS MEMORANDUM (IEM) IN THE MONTH OF SEPTEMBER 2019 (Investment in Rs Crore) Sl. Company Name Item of District Capacity IEM No and Address Manufacture State Unit No and Date 1 OSTRO AP WIND PVT LTD WIND POWER ANANTAP 0 1612 UNIT NO. G-0, PLANT PUR MW 04 GROUND FLOOR,MIRA ANDHRA Sept CORPORATE SUITE, 1 AND 2 PRADESH emb ISHWAR INDUSTRIAL ESTATE er MATHURA RD, NEW DELHI-65 2019 Place(Tehsil) : WIND POWER PLANT, VILLAGE VEPAKUNTA, MANDAL KANAGANAPALI,(ANANTAPUR) 2 HYUNDAI STEEL ANANTAPUR PVT LTD BLANKING ANANTAP 191000 1599 D.NO.1-635/A SLITTING PUR MT 03 GROUND FLOOR, SHEARING ANDHRA Sept OPP. TO DSP OFFICE PRADESH emb NH-7, PENUKONDA,ANANTAPUR er ANDHRA PRADESH-51510 2019 Place(Tehsil) : 349-1,370-1A & 2,371 PARTS, KIA INDUSTRIAL PARK, ERRAMANCHI,(ANANTAPUR) 3 RENEW VAYU URJA PVT LTD., WIND POWER ANANTAP 0 1627 138 ANSALS CHAMBERS II PLANT PUR MW 06 BHIKAJI CAMA PLACE, ANDHRA Sept SOUTH DELHI PRADESH emb DELHI - 110066 er 2019 Place(Tehsil) : WIND POWER PLANT(ANANATPUR) 4 HYUNDAI MATERIALS INDIA PRIVATE LIMITED. SCRAP ANANTAP 65000 1704 28-6-606,NEW HOUSING COLLECTION PUR METRIC 18 BOARD COLONY,ANANTAPUR, AND TRADING ANDHRA TONNES Sept ANDHRA PRADESH-515001. PRADESH emb er 2019 Place(Tehsil) : PLOT NO.14C, APIIC INDUSTRIAL PARK, SITE A(PENUKONDA MANDAL) 5 SUNGWOO HITECH AP PRIVATE LIMITED., BODY PARTS ANANTAP 300000 1757 PLOT NO.14A, INDUSTRIAL OF PUR NOS 25 PARK,,AMMAVARIPALLI, AUTOMOBILE ANDHRA Sept PENUKONDA, ERRAMANCHI, COMPONENT PRADESH emb ANANTAPPUR, S er ANDHRA PRADESH-515164. -

Activities of Training and Placement Cell

Activities of Training and placement Cell • Vocational Training: The Training & Placement Cell organizes vocational training for all pre final year students at different industries and corporate. This enhances the first exposure of students to the corporate world. Major companies those who provide summer training opportunities to our students are IOCL, HDC, HPL, Exide, TATA Steel, TATA Power, TATA Chemicals, TATA Motors, UPL, MCCPTI, ESCL, IOPL, Adani Group, Aegis Logistics, Praxair, Petro Carbon, Burn Standard, GPT, Dee Power, SAIL, NTPC,WBPDCL, BSNL, DCPL, HCL, DPL, Chittaranjan Locomotive, PWD, GPTetc • Soft Skill Development: The cell invites different soft skill experts to conduct soft skill development courses for the students of the institute to improve their employability skills. The cell also conducts special grooming and preparatory classes directly through workshops, aptitude tests, mocks interviews, group discussions. • Industry-students interaction: The Training and Placement Cell initiates different seminar conducted by industry- eminent personnel. Through this interactive session students are being benefited by new up-coming ideas in industry. • Placement: The cell has excellent track records for providing opportunities to the students for employments. The Cell also maintains liaison with various industries and corporate establishments for placements of the students. Every year new industries are always appended to the list. Feedbacks are obtained from the employers on regular basis which helps the present students to enhance their strike rate during interview process. • Industry Visits: The Training and Placement Cell also taken care of direct industry oriented experience of the students by arranging Industry Visits in different industries like TATA Power, Haldia Energy Ltd, United Phosphorus Ltd. -

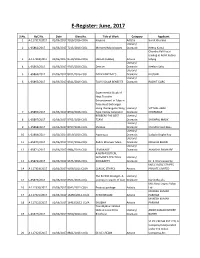

E-Register: June, 2017

E-Register: June, 2017 S.No. RoC No. Date Diary No. Title of Work Category Applicant 1 A-117317/2017 01/06/2017 9010/2016-CO/A Kayesse Artistic Sumit Khurana Literary/ 2 L-65862/2017 01/06/2017 7215/2016-CO/L Mirrored Monologues Dramatic Neena Kamal Chandra Pal Khatri trading as Rohit Kuteer 3 A-117318/2017 01/06/2017 8510/2016-CO/A LAKLAK (LABEL) Artistic Udyog Literary/ 4 L-65863/2017 01/06/2017 9583/2016-CO/L Demise Dramatic Neelam Sahu Literary/ 5 L-65864/2017 01/06/2017 8201/2016-CO/L DAVV KANTAAL'S Dramatic KAUSHIK Literary/ 6 L-65865/2017 01/06/2017 8344/2016-CO/L TAU’S SOLAR BENEFITS Dramatic RACHIT GARG Experimental Study of Heat Transfer Enhancement in Tube in Tube Heat Exchanger Using Rectangular Wing Literary/ VITTHAL ABAJI 7 L-65866/2017 01/06/2017 8559/2016-CO/L Type Vortex Generator Dramatic CHORMALE ROBBERS-THE BEST Literary/ 8 L-65867/2017 01/06/2017 9761/2016-CO/L TEAM Dramatic SHISHPAL MALIK Literary/ 9 L-65868/2017 01/06/2017 8797/2016-CO/L Shadow Dramatic Chandramouli Basu Literary/ 10 L-65869/2017 01/06/2017 8359/2016-CO/L Paparazzo Dramatic Sudipta Singha Roy Literary/ 11 L-65870/2017 01/06/2017 9917/2016-CO/L Aadmi Bhanwar Mein Dramatic KRISHNA BIHARI Literary/ 12 L-65871/2017 01/06/2017 9684/2016-CO/L LEMONADE Dramatic AKANSHA SHIVHARE A NON-POLITICAL WOMAN'S POLITICAL Literary/ 13 L-65872/2017 01/06/2017 9675/2016-CO/L BIOGRAPHY Dramatic Dr. -

Can Biscuits Act As Meal Replacements?

Can Biscuits act as meal replacements? 37 Are biscuits really healthy snacks? Can Biscuits act as meal replacements? TV commercials talk about high • Biscuit is a hygienically packaged fiber, diabetic friendly multigrain snack food available at very biscuits and some biscuits claim to be competitive prices and in different providing the much needed nutrition tastes. at work. All these claims make you • According to a National Council believe that biscuits are healthy foods. of Applied Economic Research Are they really healthy and can they (NCAER) Study, biscuit is replace your meals? predominantly consumed by people from the lower strata of Haven’t you heard some frequent society, particularly children in travellers say “ I can manage a few both rural and urban areas. days of my travel with biscuits and fruits” finding an easy solution The different varieties of biscuits can for their food requirements in the be broadly classifiedas per the BIS absence of hygienic food? (Bureau of Indian Standards), on the basis of sensory attributes Biscuits have today become part Type I Sweet of our lives more out of habit and because of the sentiments attached Type II Semi-Sweet to certain meals like tea time etc. Type III Crackers You should really look at biscuits as Type IV Cookies they are- that is high in calories and Type V Speciality Biscuits with little nutrition, and look beyond Biscuit industry in India in the the advertisements as being better organized sector produces around options for snacks. 65% of the total production, the This study helped us understand all balance 35% being contributed by the about biscuits! And the truth behind unorganized bakeries. -

Saj Food Products Pvt. Ltd.: Ratings Reaffirmed

February 27, 2020 Saj Food Products Pvt. Ltd.: Ratings reaffirmed Summary of rating action Previous Rated Amount Current Rated Amount Instrument* Rating Action (Rs. crore) (Rs. crore) Fund Based – Term Loan 40.00 35.00 [ICRA]A (Stable); Reaffirmed Fund based – Cash Credit 50.00 50.00 [ICRA]A (Stable); Reaffirmed Non-fund Based – Bank 5.00 10.00 [ICRA]A1; Reaffirmed Guarantee/ Letter of Credit Total 95.00 95.00 *Instrument details are provided in Annexure-1 Rationale The reaffirmation of the ratings considers the established track record of Saj Food Products Pvt. Ltd. (SFPPL) in the biscuit- manufacturing business, strong market position of the company’s brand (Bisk Farm), particularly in eastern and north- eastern India, which is backed by the Group’s experience of around four decades in the distribution of FMCG and pharmaceutical products, and a favourable demand outlook of the biscuit industry. The ratings continue to draw comfort from the steady increase in SFPPL’s scale of operations in the recent years, which is likely to continue in the near to medium term, driven by its ongoing capacity expansion and increasing distribution network. ICRA also notes SFPPL’s conservative capital structure, comfortable debt coverage metrics and low working capital intensity of operations. A significant deterioration in the company’s profitability in FY2019 adversely impacted its ROCE, though the same is expected to improve in the current fiscal. The ratings, however, take into consideration the high sensitivity of the profitability of biscuit manufacturers, including SFPPL, to fluctuations in input costs (raw material prices, packaging materials, fuel, etc.) and intense competition from the unorganised players as well as other established peers, which are likely to keep its margins under check. -

Saj Food Products Pvt. Ltd.: Ratings Reaffirmed and Outlook on Long-Term Rating Revised to Positive

April 05, 2021 Saj Food Products Pvt. Ltd.: Ratings reaffirmed and outlook on long-term rating revised to Positive Summary of rating action Previous Rated Amount Current Rated Amount Instrument* Rating Action (Rs. crore) (Rs. crore) [ICRA]A; Reaffirmed and outlook Fund Based – Term Loan 35.00 65.00 revised to Positive from Stable [ICRA]A; Reaffirmed and outlook Fund based – Cash Credit 50.00 20.00 revised to Positive from Stable Non-fund Based – Bank 10.00 10.00 [ICRA]A1; Reaffirmed Guarantee/ Letter of Credit Total 95.00 95.00 *Instrument details are provided in Annexure-1 Rationale The revision in the outlook on the long-term rating to Positive from Stable considers a consistent growth in the scale of operations demonstrated by Saj Food Products Pvt. Ltd. (SFPPL) in the recent years and its improving geographical diversification, as reflected by a significant increase in revenue from Maharashtra, post commissioning of the Nagpur plant and an improvement in share of revenues from some other states. The ratings continue to draw comfort from the company’s established track record in the biscuit manufacturing business, strong market position of its brand (Bisk Farm), particularly in eastern and north-eastern India, which is backed by the Group’s experience of around four decades in the distribution of FMCG and pharmaceutical products, and a favourable demand outlook of the biscuit industry. ICRA also notes SFPPL’s conservative capital structure, strong debt coverage metrics and low working capital intensity of operations. The company’s profitability improved in FY2020 and is likely to increase further in FY2021, aided by a significant decline in managerial remuneration and low advertisement and business promotion expenses amid a strong demand for packaged foods due to the Covid-19 pandemic, particularly in H1 FY2021.