2020 Trends Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Billboard.Com “Finesse” Hits a New High After Cardi B Hopped on the Track’S Remix, Which Arrived on Jan

GRAMMYS 2018 ‘You don’t get to un-have this moment’ LORDE on a historic Grammys race, her album of the year nod and the #MeToo movement PLUS Rapsody’s underground takeover and critics’ predictions for the Big Four categories January 20, 2018 | billboard.com “Finesse” hits a new high after Cardi B hopped on the track’s remix, which arrived on Jan. 4. COURTESY OF ATLANTIC RECORDS ATLANTIC OF COURTESY Bruno Mars And Cardi B Title CERTIFICATION Artist osition 2 Weeks Ago Peak P ‘Finesse’ Last Week This Week PRODUCER (SONGWRITER) IMPRINT/PROMOTION LABEL Weeks On Chart #1 111 6 WK S Perfect 2 Ed Sheeran 120 Their Way Up W.HICKS,E.SHEERAN (E.C.SHEERAN) ATLANTIC sic, sales data as compiled by Nielsen Music and streaming activity data by online music sources tracked by Nielsen Music. tracked sic, activity data by online music sources sales data as compiled by Nielsen Music and streaming Havana 2 Camila Cabello Feat. Young Thug the first time. See Charts Legend on billboard.com/biz for complete rules and explanations. © 2018, Prometheus Global Media, LLC and Nielsen Music, Inc. Global Media, LLC All rights reserved. © 2018, Prometheus for complete rules and explanations. the first time. See Charts on billboard.com/biz Legend 3 2 2 222 FRANK DUKES (K.C.CABELLO,J.L.WILLIAMS,A.FEENY,B.T.HAZZARD,A.TAMPOSI, The Hot 100 B.LEE,A.WOTMAN,P.L.WILLIAMS,L.BELL,R.L.AYALA RODRIGUEZ,K.GUNESBERK) SYCO/EPIC DG AG SG Finesse Bruno Mars & Cardi B - 35 3 32 RUNO MARS AND CARDI B achieve the career-opening feat, SHAMPOO PRESS & CURL,STEREOTYPES (BRUNO MARS,P.M.LAWRENCE II, C.B.BROWN,J.E.FAUNTLEROY II,J.YIP,R.ROMULUS,J.REEVES,R.C.MCCULLOUGH II) ATLANTIC bring new jack swing and the second male; Lionel Richie back to the top 10 of the landed at least three from each of his 2 3 4 Rockstar 2 Post Malone Feat. -

Sheila Simmenes.Pdf (1.637Mb)

Distant Music An autoethnographic study of global songwriting in the digital age. SHEILA SIMMENES SUPERVISOR Michael Rauhut University of Agder, 2020 Faculty of Fine Arts Department of Popular music 2 Abstract This thesis aims to explore the path to music creation and shed a light on how we may maneuver songwriting and music production in the digital age. As a songwriter in 2020, my work varies from being in the same physical room using digital communication with collaborators from different cultures and sometimes even without ever meeting face to face with the person I'm making music with. In this thesis I explore some of the opportunities and challenges of this process and shine a light on tendencies and trends in the field. As an autoethnographic research project, this thesis offers an insight into the songwriting process and continuous development of techniques by myself as a songwriter in the digital age, working both commercially and artistically with international partners across the world. The thesis will aim to supplement knowledge on current working methods in songwriting and will hopefully shine a light on how one may improve as a songwriter and topliner in the international market. We will explore the tools and possibilities available to us, while also reflecting upon what challenges and complications one may encounter as a songwriter in the digital age. 3 4 Acknowledgements I wish to express my gratitude to my supervisor Michael Rauhut for his insight, expertise and continued support during this work; associate professor Per Elias Drabløs for his kind advice and feedback; and to my artistic supervisor Bjørn Ole Rasch for his enthusiasm and knowledge in the field of world music and international collaborations. -

Sarbanes-Oxley, Kermit the Frog, and Competition Regarding Audit Quality Matthew .J Barrett Notre Dame Law School, [email protected]

Notre Dame Law School NDLScholarship Journal Articles Publications 2008 Sarbanes-Oxley, Kermit the Frog, and Competition Regarding Audit Quality Matthew .J Barrett Notre Dame Law School, [email protected] Follow this and additional works at: https://scholarship.law.nd.edu/law_faculty_scholarship Part of the Business Organizations Law Commons Recommended Citation Matthew J. Barrett, Sarbanes-Oxley, Kermit the Frog, and Competition Regarding Audit Quality, 3 J. Bus. & Tech. L. 207 (2008). Available at: https://scholarship.law.nd.edu/law_faculty_scholarship/638 This Article is brought to you for free and open access by the Publications at NDLScholarship. It has been accepted for inclusion in Journal Articles by an authorized administrator of NDLScholarship. For more information, please contact [email protected]. Journal of Business & Technology Law Volume 3 | Issue 2 Article 2 1-1-2008 Sarbanes-Oxley, Kermit the Frog, and Competition Regarding Audit Quality Matthew .J Barrett Follow this and additional works at: http://digitalcommons.law.umaryland.edu/jbtl Part of the Accounting Law Commons, and the Corporation and Enterprise Law Commons Recommended Citation Matthew J. Barrett, Sarbanes-Oxley, Kermit the Frog, and Competition Regarding Audit Quality, 3 J. Bus. & Tech. L. 207 (2008) Available at: http://digitalcommons.law.umaryland.edu/jbtl/vol3/iss2/2 This Article is brought to you for free and open access by the Academic Journals at DigitalCommons@UM Carey Law. It has been accepted for inclusion in Journal of Business & Technology Law by an authorized administrator of DigitalCommons@UM Carey Law. For more information, please contact [email protected]. MATTHEW J. BARRETT* Sarbanes-Oxley, Kermit the Frog, and Competition Regarding Audit Quality It's not easy bein' green. -

'Boxing Clever

NOVEMBER 05 2018 sandboxMUSIC MARKETING FOR THE DIGITAL ERA ISSUE 215 ’BOXING CLEVER SANDBOX SUMMIT SPECIAL ISSUE Event photography: Vitalij Sidorovic Music Ally would like to thank all of the Sandbox Summit sponsors in association with Official lanyard sponsor Support sponsor Networking/drinks provided by #MarketMusicBetter ast Wednesday (31st October), Music Ally held our latest Sandbox Summit conference in London. While we were Ltweeting from the event, you may have wondered why we hadn’t published any reports from the sessions on our site and ’BOXING CLEVER in our bulletin. Why not? Because we were trying something different: Music Ally’s Sandbox Summit conference in London, IN preparing our writeups for this special-edition sandbox report. From the YouTube Music keynote to panels about manager/ ASSOCIATION WITH LINKFIRE, explored music marketing label relations, new technology and in-house ad-buying, taking in Fortnite and esports, Ed Sheeran, Snapchat campaigns and topics, as well as some related areas, with a lineup marketing to older fans along the way, we’ve broken down the key views, stats and debates from our one-day event. We hope drawn from the sharp end of these trends. you enjoy the results. :) 6 | sandbox | ISSUE 215 | 05.11.2018 TALES OF THE ’TUBE Community tabs, premieres and curation channels cited as key tools for artists on YouTube in 2018 ensions between YouTube and the music industry remain at raised Tlevels following the recent European Parliament vote to approve Article 13 of the proposed new Copyright Directive, with YouTube’s CEO Susan Wojcicki and (the day after Sandbox Summit) music chief Lyor Cohen both publicly criticising the legislation. -

Lionsgate® Selected to Distribute Hit Entertainment’S Premiere Family Entertainment Library in North America

LIONSGATE® SELECTED TO DISTRIBUTE HIT ENTERTAINMENT’S PREMIERE FAMILY ENTERTAINMENT LIBRARY IN NORTH AMERICA Agreement Catapults Lionsgate Into Top Three In North American Non-Theatrical Family Home Entertainment Marketplace With Distribution Rights To Thomas & Friends™, Bob the Builder™, Barney™, Angelina Ballerina™ And More SANTA MONICA, CA, VANCOUVER, BC, and LONDON, UK– March 24, 2008 – Reflecting the continued growth of its home entertainment business, Lionsgate (NYSE: LGF), the premier independent filmed entertainment studio, has acquired the home entertainment distribution rights to worldwide family entertainment leader HIT Entertainment’s extensive portfolio of award-winning children’s programming in the US and Canada. The announcement was made today by Lionsgate President and Co-Chief Operating Officer Steve Beeks and HIT Entertainment Chief Financial Officer Jim Weight. Under the terms of the agreement, Lionsgate obtains the exclusive marketing, sales and distribution rights to HIT’s iconic franchises including Thomas & Friends™, Bob the Builder™, Barney™, Angelina Ballerina™and Fireman Sam™ newly acquired brands such as Fifi & the Flowertots™ and Roary the Racing Car™ from Chapman Entertainment, Aardman Animations’ award-winning Wallace & Gromit™ which includes four TV half hour episodes, and Shaun the Sheep™, as well as The Jim Henson Company’s Fraggle Rock™ and additional family titles from the Henson library. Lionsgate is scheduled to begin distributing HIT’s full slate of home entertainment releases in May 2008. Thomas and the Great Discovery, the brand’s first feature length direct to DVD movie since 2005, featuring Pierce Brosnan as the narrator, will be one of the first titles released in September 2008. “The HIT library will be one of the most treasured jewels in our family entertainment crown,” said Lionsgate President and Co-Chief Operating Officer Steve Beeks. -

2011 Annual Report

Mattel Annual Report 2011 Click to play! Please visit: www.Mattel.com/AnnualReport The imagination of children inspires our innovation. Annual Report 2011 80706_MTL_AR11_Cover.indd 1 3/7/12 5:34 PM Each and every year, Mattel’s product line-up encompasses some of the most original and creative toy ideas in the world. These ideas have been winning the hearts of children, the trust of parents and the recognition of peers for more than 65 years. 80706_MTL_AR11_Text.indd 2 3/7/12 8:44 PPMM To Our Shareholders: am excited to be Mattel’s sixth environment. The year proved Chief Executive Offi cer in 67 to be a transition period for years, and honored to continue Fisher-Price with the expiration the legacy of such visionaries of the Sesame Street license as Mattel founders Ruth and and our strategic re-positioning Elliot Handler; Herman Fisher of the brand. and Irving Price, the name- sakes of Fisher-Price; Pleasant We managed our business Rowland, founder of American accordingly as these challenges Girl; and Reverend W. V. Awdry, played out during the year. We creator of Thomas & Friends®. maintained momentum in our core brands, such as Barbie®, First and foremost, I would like Hot Wheels®, American Girl® to acknowledge and thank and our new brand franchise, Bob Eckert for his tremendous Monster High®, as well as with contributions to the company key entertainment properties, during the last decade. Bob is such as Disney Princess® and a great business partner, friend CARS 2®. As a result, 2011 and mentor, and I am fortunate marks our third consecutive to still be working closely with year of solid performance: him as he remains Chairman revenues and operating of the Board. -

The Paley Center for Media Board of Trustees

THE PALEY CENTER FOR MEDIA BOARD OF TRUSTEES CHAIRMAN Anne del Castillo New York City Mayor’s Office of Media and Entertainment Frank A. Bennack, Jr. (ex officio member) Hearst Nancy Dubuc PRESIDENT & CEO Vice Media Maureen J. Reidy Tami Erwin Verizon VICE CHAIR David Eun Mel Karmazin Cristiana Falcone JMCMRJ Foundation TRUSTEES Mike Fries Liberty Global Alfonso de Angoitia Grupo Televisa Dexter Goei Altice USA Brandon Beck Riot Games Brian Goldner Hasbro, Inc. Gary B. Bettman National Hockey League Roger Goodell National Football League Adam Bird McKinsey & Company Gérard Guillemot Ubisoft Andy Bird, CBE Pearson Judy Hart Angelo Aryeh B. Bourkoff Alberto Ibargüen LionTree LLC John S. & James L. Knight Foundation Adriana Cisneros Robert A. Iger Cisneros The Walt Disney Company Cesar Conde John H. Josephson NBCUniversal SESAC Steve Cooper Jeffrey Katzenberg Warner Music Group WndrCo Eddy Cue David Kenny Apple, Inc. Nielsen Wade Davis Jason Kilar Univision Communications Inc. WarnerMedia Steve King Mark Read Publicis Groupe WPP Henry A. Kissinger Shari Redstone Kissinger Associates, Inc. ViacomCBS Mark Lazarus Alex Rodriguez NBCUniversal Television and A-Rod Corp. Streaming Michael I. Roth Debra Lee Interpublic Group Leading Women Defined, Inc. Faiza J. Saeed Robert D. Manfred, Jr. Cravath, Swaine & Moore LLP Major League Baseball Ricardo B. Salinas Roberto Marinho Neto Groupo Salinas Globo Ventures Josh Sapan Crystal McCrary AMC Networks Producer, Director, and Author Robert B. Schumer Jonathan Miller Paul, Weiss, Rifkind, Wharton Integrated Media Company & Garrison LLP Daniel L. Mosley Ryan Seacrest William S. Paley Foundation Ryan Seacrest Enterprises James Murdoch Stanley S. Shuman LUPA Systems LLC Allen & Company LLC Lachlan Murdoch Edward Skyler FOX Citi Katherine Oliver Phil Spencer Bloomberg Associates Microsoft Dawn Ostroff Evan Spiegel Spotify Snap Inc. -

VIRAL ART Exhibition Guide

VIRAL ART Exhibition Guide VIRAL ART is an exhibition focusing on this last year and the universal pandemic (COVID-19) which has affected many different aspects of life, one of which is evident in the artistic world. COVID-19 has forced many artists to open up to new avenues of expression in many different disciplines; visual art, music, performing arts, photography, fashion, and literature. Some of the main goals for our exhibition are to bring light to how the pandemic has affected all corners of life, especially in regard to artistic capability/expression, and further, illustrate how certain artists captured the essence and experience of COVID-19. Introduction by Taylor Weaver I wanted to start by saying how grateful I am to have been able to lead this exhibition project with the help of Mirea Suarez. I am so proud of each and every one of the girls and hope you can see how hard they have all worked to make this possible. So welcome to our exhibition which we have titled Viral Art! I would like to note that some of the pieces, such as music are slightly more interactive, for example one of the music pieces is a live DJ set and is an hour and a half in total in the event you are interested in watching more – we will only briefly show certain pieces We would like to preface this exhibition by giving a small dedication to those whose lives have been affected by COVID-19. We thought it would be most appropriate to say a few words to front line workers such as those in the healthcare industry who have dedicated their lives to fighting this virus, essential workers such as those in the food (and or) agriculture industry who prepared meals for those in need during these stressful times, Research Methods Fall 2020 Taylor Weaver, Mirea Suarez, Cristina Ponce de Leon, Sophie Schaesberg, Sydney Levno, Annamaria Borvice, Marta Belogolova VIRAL ART Exhibition Guide volunteers, and of course, to all who lost their lives to COVID-19 or people who have lost family members. -

Spotlight and Hot Topic Sessions Poster Sessions Continuing

Sessions and Events Day Thursday, January 21 (Sessions 1001 - 1025, 1467) Friday, January 22 (Sessions 1026 - 1049) Monday, January 25 (Sessions 1050 - 1061, 1063 - 1141) Wednesday, January 27 (Sessions 1062, 1171, 1255 - 1339) Tuesday, January 26 (Sessions 1142 - 1170, 1172 - 1254) Thursday, January 28 (Sessions 1340 - 1419) Friday, January 29 (Sessions 1420 - 1466) Spotlight and Hot Topic Sessions More than 50 sessions and workshops will focus on the spotlight theme for the 2019 Annual Meeting: Transportation for a Smart, Sustainable, and Equitable Future . In addition, more than 170 sessions and workshops will look at one or more of the following hot topics identified by the TRB Executive Committee: Transformational Technologies: New technologies that have the potential to transform transportation as we know it. Resilience and Sustainability: How transportation agencies operate and manage systems that are economically stable, equitable to all users, and operated safely and securely during daily and disruptive events. Transportation and Public Health: Effects that transportation can have on public health by reducing transportation related casualties, providing easy access to healthcare services, mitigating environmental impacts, and reducing the transmission of communicable diseases. To find sessions on these topics, look for the Spotlight icon and the Hot Topic icon i n the “Sessions, Events, and Meetings” section beginning on page 37. Poster Sessions Convention Center, Lower Level, Hall A (new location this year) Poster Sessions provide an opportunity to interact with authors in a more personal setting than the conventional lecture. The papers presented in these sessions meet the same review criteria as lectern session presentations. For a complete list of poster sessions, see the “Sessions, Events, and Meetings” section, beginning on page 37. -

Popular Music and Society Artists As Entrepreneurs, Fans As Workers

This article was downloaded by: [James Madison University] On: 03 November 2014, At: 16:54 Publisher: Routledge Informa Ltd Registered in England and Wales Registered Number: 1072954 Registered office: Mortimer House, 37-41 Mortimer Street, London W1T 3JH, UK Popular Music and Society Publication details, including instructions for authors and subscription information: http://www.tandfonline.com/loi/rpms20 Artists as Entrepreneurs, Fans as Workers Jeremy Wade Morris Published online: 15 May 2013. To cite this article: Jeremy Wade Morris (2014) Artists as Entrepreneurs, Fans as Workers, Popular Music and Society, 37:3, 273-290, DOI: 10.1080/03007766.2013.778534 To link to this article: http://dx.doi.org/10.1080/03007766.2013.778534 PLEASE SCROLL DOWN FOR ARTICLE Taylor & Francis makes every effort to ensure the accuracy of all the information (the “Content”) contained in the publications on our platform. However, Taylor & Francis, our agents, and our licensors make no representations or warranties whatsoever as to the accuracy, completeness, or suitability for any purpose of the Content. Any opinions and views expressed in this publication are the opinions and views of the authors, and are not the views of or endorsed by Taylor & Francis. The accuracy of the Content should not be relied upon and should be independently verified with primary sources of information. Taylor and Francis shall not be liable for any losses, actions, claims, proceedings, demands, costs, expenses, damages, and other liabilities whatsoever or howsoever caused arising directly or indirectly in connection with, in relation to or arising out of the use of the Content. This article may be used for research, teaching, and private study purposes. -

Perspectives for Music Education in Schools After COVID-19: the Potential of Digital Media

Min-Ad: Israel Studies in Musicology Online, Vol. 18, 2021 Benno Spieker, Morel Koren – Perspectives for Music Education in Schools after COVID-19: The Potential of Digital Media Perspectives for Music Education in Schools after COVID-19: The Potential of Digital Media BENNO SPIEKER, MOREL KOREN Abstract: Innovations in research fields related to computer music and the advancement of the music industry have also influenced the digital sector for music education. Although many kinds of educational, edutainment, and entertainment music software appeared before the pandemic and are still in use, with the COVID-19 crisis and restrictions, it seems that music education in the primary classes has not systematically and thoroughly benefited from the innovations and advances reported by science and the music industries. However, the current need to teach music online could have an effect on the use of digital media after the pandemic. We present examples from the Netherlands, Romania, and Israel that lead to observations and suggestions about the potential of digital media after COVID-19. Keywords: music education, online music learning, singing, solfege, music literacy, primary education, voice synthesis, artificial intelligence. Introduction More than sixty years after humankind successfully programmed a computer to generate sounds from a digital composition, and almost forty years after the invention of a standard for sharing musical information digitally – MIDI (Musical Instrument Digital Interface), and the invention of the Internet, it can be said that digital media brought significant changes in almost all fields of music. Writing, composing, performing, recording, storing, disseminating with or without video are encompassing producing and consuming computerized music and digital media. -

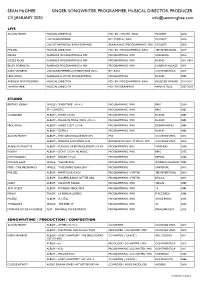

CV JANUARY 2020 [email protected]

SEAN McGHEE SINGER, SONGWRITER, PROGRAMMER, MUSICAL DIRECTOR, PRODUCER. CV JANUARY 2020 [email protected] LIVE ALISON MOYET MUSICAL DIRECTOR MD / BV / SYNTHS / BASS MODEST! 2018- LIVE BAND MEMBER BV / SYNTHS / BASS MODEST! 2013- LIVE SET ARRANGER & PROGRAMMER ARRANGING / PROGRAMMING / MIX MODEST! 2013- PHILDEL MUSICAL DIRECTOR MD / BV / PROGRAMMING / BASS YEE INVENTIONS 2019 KIESZA PLAYBACK PROGRAMMING & MIX PROGRAMMING / MIX UNIVERSAL 2014 RIZZLE KICKS PLAYBACK PROGRAMMING & MIX PROGRAMMING / MIX ISLAND 2011-2014 BLUEY ROBINSON PLAYBACK PROGRAMMING & MIX PROGRAMMING / MIX LONDON VILLAGE 2013 KATE HAVNEVIK LIVE BAND MEMBER (CHINESE TOUR 2015) BV / BASS CONTINENTICA 2015 FROU FROU PLAYBACK & SYNTH PROGRAMMING PROGRAMMING ISLAND 2003 ANDREW MONTGOMERY MUSICAL DIRECTOR MD / BV / PROGRAMMING / BASS RULED BY DREAMS 2014-2015 TEMPOSHARK MUSICAL DIRECTOR MD / PROGRAMMING PAPER & GLUE 2007-2010 STUDIO BRITNEY SPEARS SINGLE – “EVERYTIME” (UK #1) PROGRAMMING / MIX BMG 2004 EP – CHAOTIC PROGRAMMING / MIX BMG 2005 SUGABABES ALBUM – THREE (UK #3) PROGRAMMING / MIX ISLAND 2003 ALBUM – TALLER IN MORE WAYS (UK #1) PROGRAMMING / MIX ISLAND 2005 FROU FROU ALBUM – SHREK 2 OST (US #8) PROGRAMMING / MIX DREAMWORKS 2004 ALBUM – DETAILS PROGRAMMING / MIX ISLAND 2002 ALISON MOYET ALBUM – THE TURN: DELUXE EDITION MIX COOKING VINYL 2015 ALBUM – MINUTES & SECONDS LIVE BACKING VOCALS / SYNTHS / MIX COOKING VINYL 2014 ALANIS MORISSETTE ALBUM – FLAVORS OF ENTANGLEMENT (US #8) PROGRAMMING / BVs WARNERS 2008 ROBYN ALBUM – DON’T STOP THE MUSIC PROGRAMMING / MIX BMG