Ecommerce Market Review

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ANNUAL REPORT 2016 French Connection Group PLC French Connection Group PLC FRENCH CONNECTION • GREAT PLAINS • TOAST • YMC

ANNUAL REPORT 2016 French Connection Group PLC French Connection Group PLC FRENCH CONNECTION • GREAT PLAINS • TOAST • YMC The French Connection Group designs, produces and distributes branded fashion clothing for men and women to more than 50 countries around the world CONTENTS STRATEGIC REPORT FINANCIAL STATEMENTS Chairman’s Statement _______________________ 2 Consolidated Statement of Comprehensive Income __________________ 30 Our Business ______________________________ 3 Consolidated Statement of Financial Position __ 31 Corporate Social Responsibility _______________ 7 Consolidated Statement of Changes in Equity __ 32 Financial Review ____________________________ 9 Consolidated Statement of Cash Flows _______ 33 GOVERNANCE Notes to the Group Accounts ________________ 34 Board of Directors _________________________ 11 Company Balance Sheet ____________________ 52 Directors’ Report __________________________ 12 Statement of Changes in Equity ______________ 53 Corporate Governance Statement ____________ 15 Notes to the Company Accounts _____________ 54 Audit Committee Report ____________________ 17 SHAREHOLDER INFORMATION Directors’ Remuneration Report ______________ 20 Five Year Record __________________________ 59 Statement of Directors’ Responsibilities _______ 27 Advisers __________________________________ 60 Independent Auditor’s Report ________________ 28 Financial Calendar _________________________ 60 Notice of Meeting __________________________ 61 ChairmaN’S STatement Dear Shareholders As reported in September, we went through -

NEWCASTLE Cushman & Wakefield Global Cities Retail Guide

NEWCASTLE Cushman & Wakefield Global Cities Retail Guide 0 A city once at the heart of the Industrial Revolution, Newcastle has now repositioned itself as a thriving and vibrant capital of the North East. The city offers a blend of culture and heritage, superb shopping, sporting activity and nightlife with the countryside and the coastline at its doorstep. The city is located on the north bank of the River Tyne with an impressive seven bridges along the riverscape. The Gateshead Millennium Bridge is the newest bridge to the city, completed in 2001 - the world’s first and only titling bridge. Newcastle benefits from excellent fast rail links to London with journey times in under three hours. Newcastle Airport is a top ten UK airport and the fastest growing regional airport in the UK, with over 5 million passengers travelling through the airport annually. This is expected to reach 8.5 million by 2030. NEWCASTLE OVERVIEW 1 Cushman & Wakefield | Newcastle | 2019 NEWCASTLE KEY RETAIL STREETS & AREAS NORTHUMBERLAND ST GRAINGER ST & CENTRAL EXCHANGE Newcastle’s traditional prime retail street. Running Grainger Street is located between Newcastle Station and between Haymarket Metro Station to the north and Newcastle’s main retail core. It not only plays host to the Blackett St to the south. It is fully pedestrianised and a key historic Central Exchange Building and Central Arcade footfall route. Home to big brands including H&M, Primark, within, but also Newcastle’s famous Grainger Market. Marks & Spencer, Fenwick among other national multiple Grainger Street is one of Newcastle’s most picturesque retail brands. -

Ockleston Bailey

UNIT 2, 58-62 JAMESON STREET, HULL HU1 3LS ockleston bailey PRIME FREEHOLD RETAIL INVESTMENT retail leisure investment LET TO ANN SUMMERS LIMITED Location Hull is located in the North East on the northern banks of the Humber Estuary. The City is located 60 miles (96km) east of Leeds, 40 miles (64 km) southeast of York, 45 miles (72km) east of Doncaster, 66 miles (106km) east of Sheffield and187 Investment Summary miles (301 km) north of London. n Prime trading location on the pedestrianised Jameson Street. Hull benefits from excellent road communications being strategically located on the A63 which provides direct access to the M62 motorway which in turns runs n In close proximity to the £130 million Albion Square west to Manchester and connects with the M1 motorway. The M180 is situated redevelopment of the former BHS/Co-op and Edwin Davis 15 miles (24km) south and is accessed via both the A63 and A15. Buildings (King Edward, Jameson and Waltham Streets) to The City benefits from an excellent rail service with regular services from Hull create 182,000 sq ft of retail space, with 279 residential units, Paragon Interchange running to London Kings Cross with a fastest journey time of more than 600 car parking spaces and a new Ice Arena. approximately 2hrs 45mins. In addition there are regular services to Leeds, York and Manchester and onwards to the rest of the UK. n The property is let to Ann Summers Limited (Company No.01034349) by way of a 10 year FR&I lease from 29 October Humberside Airport is located within a 30 minute drive time south of Hull and 2018, subject to an upward only rent review in 5th year, at a serves in excess of 500,000 passengers a year. -

Annual Report & Accounts 2019

ANNUAL REPORT & ACCOUNTS 2019 SPORTS DIRECT INTERNATIONAL PLC AT A GLANCE Founded as a single store in 1982, Sports Direct International plc (Sports Direct, the Group, the Business or the Company) is today the UK’s largest sporting goods retailer by revenue. The Group operates a diversified portfolio of sports, fitness, fashion and lifestyle fascias in over 20 countries. We have approx. 29,400 staff across six business segments: UK Sports Retail, Premium Lifestyle, House of Fraser Retail, European Sports Retail, Rest of World Retail and Wholesale & Licensing. Our business strategy is to invest in our people, our business, and our key third party brand partners, in order to elevate our retail proposition across all our channels to attain new levels of excellence. The Group aspires to be an international leader in sports, lifestyle, and luxury apparel retail, by offering our customers a dynamic range of iconic brands. We value our people, our customers, our shareholders and our third-party brand partners - and we strive to adopt good practices in all our corporate dealings. We are committed to treating all people with dignity and respect. We endeavour to offer customers an innovative and unrivalled retail experience. We aim to deliver shareholder value over the medium to long-term, whilst adopting accounting principles that are conservative, consistent and simple. MISSION STATEMENT ‘TO BECOME EUROPE’S LEADING ELEVATED SPORTING GOODS RETAILER.’ CONTENTS 1 HIGHLIGHTS AND OVERVIEW 002 2 STRATEGIC REPORT Chair’s Statement ��������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� -

Specialist Retail Unit F41 Metrocentre

Upon the instructions of intu properties plc. TO LET – SPECIALIST RETAIL UNIT F41 METROCENTRE GATESHEAD NE11 9YG TENURE The unit is available by way of a new 5 year effectively Full Repairing and Insuring Lease for a term certain of 12 months, subject to a monthly mutual rolling option to break the lease thereafter. The lease will be contracted out of the security of tenure provisions provided by the Landlord and Tenant Act 1954. Rent Reviews will be on an annual basis in line with the Retail Price Index (RPI). RATES With effect from 1 April 2010 the property is assessed for rating purposes as follows:- Rateable Value £40,750 UBR 2012/2013 45.8p Interested parties should verify the accuracy of this information and the rates payable with Gateshead Metropolitan Borough Council (Tel: 0191 433 3000). LOCATION LEGAL COSTS The Metrocentre is the principal regional shopping centre in The ingoing tenant is to be responsible for the Landlord’s legal the North of England and the largest covered shopping and costs incurred in connection with any transaction. Further leisure complex in Europe, providing in excess of 1.8M sq ft details upon application. of retail and leisure accommodation with over 9,250 free car parking spaces. The centre is anchored by Marks & CODE OF PRACTICE Spencer, Debenhams, House of Fraser and Odeon The landlord accepts the principles and will be flexible in Cinema, with other retailers including Primark, Zara, Apple considering alternative terms offered in accordance with the and Next. Commercial Lease Code of Practice. SITUATION ENERGY PERFORMANCE CERTIFICATE The unit is situated on the upper level of Metrocentre in The The Energy Performance Asset Rating is Band B (46). -

A Spacious, Two Bedroom Apartment

A spacious, two bedroom apartment Apartment 3, Milsom Apartments, 13 Milsom Street, Bath, BA1 1DE Leasehold Entrance Hall • Living Room • Kitchen/Breakfast Room • Utility Cupboard • Two Double Bedrooms • Bathroom • Shower Room Description Apartment 3 is located on the History second floor of this fine Milsom Street was first built in development on Milsom Street 1762 and gets its name from and provides spacious Daniel Milsom a school master accommodation over one floor. and member of the The apartment is entered into Corporation who leased this an excellent size hallway with a last strip of untouched land spacious living room with between the old town and the kitchen/breakfast room new architecture on the hill. adjacent. There are two double During this early period until bedrooms with fitted 1830 Bath was the place to be wardrobes, along with a for out-of-London social shower room and bathroom. activity. At this time Milsom Milsom Apartments is a Street was seen as a very unique residential development fashionable Georgian of 14 apartments within a thoroughfare and is mentioned Grade II listed building and several times in the works of combines a traditional Jane Austen. James Jolly, the Georgian exterior with original owner of the business contemporary internal Jolly’s, first took occupation of elegance. This exceptional 12 Milsom Street in 1823 and development by Bath-based over the next 100 years the developer Longacre is perfect business would go on to for those who desire acquire numbers 9, 10, 11, 13 convenient city living in an and 14 to create an impressive iconic Bath location. -

ANNUAL REPORT 2017 FRENCH CONNECTION GROUP PLC French Connection Group PLC

ANNUAL REPORT REPORT ANNUAL 2017 ANNUAL REPORT 2017 French Connection Group PLC FRENCH CONNECTION GROUP PLC French Connection Group PLC FRENCH CONNECTION • GREAT PLAINS • TOAST • YMC The French Connection Group designs, produces and distributes branded fashion clothing for men and women to more than 50 countries around the world CONTENTS STRATEGIC REPORT FINANCIAL STATEMENTS Chairman’s Statement _________________________ 2 Consolidated Statement of Comprehensive Income _____________________ 34 Our Business _________________________________ 4 Consolidated Statement of Financial Position____ 35 Corporate Social Responsibility _________________ 8 Consolidated Statement of Changes in Equity ___ 36 Financial Review _____________________________ 10 Consolidated Statement of Cash Flows _________ 37 GOVERNANCE Notes to the Group Accounts __________________ 38 Board of Directors ____________________________ 13 Company Balance Sheet ______________________ 56 Directors’ Report _____________________________ 14 Statement of Changes in Equity _______________ 57 Corporate Governance Statement ______________ 17 Notes to the Company Accounts _______________ 58 Audit Committee Report ______________________ 20 SHAREHOLDER INFORMATION Directors’ Remuneration Report _______________ 23 Five Year Record _____________________________ 63 Statement of Directors’ Responsibilities ________ 30 Advisers _____________________________________ 64 Independent Auditor’s Report _________________ 31 Financial Calendar ____________________________ 64 Notice of Meeting ____________________________ -

House of Fraser Announces New Toy Collection by Hamleys Submitted By: Pr-Sending-Enterprises Tuesday, 14 December 2010

House of Fraser announces new toy collection by Hamleys Submitted by: pr-sending-enterprises Tuesday, 14 December 2010 House of Fraser, the premium department store is has introduced a toy collection from Hamleys online at houseoffraser.co.uk. The world's most famous toys store now offers a jam-packed collection that is full of specially selected toys made up of Hamleys own-brand and other favourite toy brands of popular toys and games for customers to purchase from the House of Fraser website. Founded by William Hamley in 1760, Hamleys (http://www.houseoffraser.co.uk/on/demandware.store/Sites-hof-Site/default/Search-ShowBrand?brand=Hamleys&fromBrand=Hamleys) currently operates out of its famous flagship store in London's Regent Street, airport stores, online at hamleys.com and a few concession stores in Denmark. The expansion is part of the Hamleys strategy to build a strong presence outside London, both in the UK and internationally. Hamleys has quickly developed an international reputation for choice, quality and innovation. Almost two and a half centuries later, Hamleys is proud to continue that tradition with toys (http://www.houseoffraser.co.uk/Toys/427,default,sc.html) that provide magic, entertainment and educational value. True to form, the retailer renowned for its magic, theatre and entertainment will offer an extensive range of toys online at houseoffraser.co.uk. Parents have the opportunity to buy children's Christmas gifts along with thousands of other items which include fashion and homeware. Among the toys on offer from Hamleys are colour magic pens, jitter ball, easy rider and tube train, a mini basketball set, binoculars and a draughts board game for juniors. -

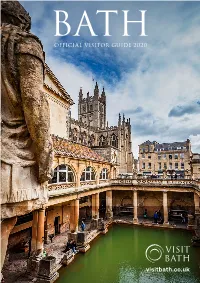

Official Bath Visitor Guide 2020.Pdf

OFFICIAL VISITOR GUIDE 2020 visitbath.co.uk WELCOME TO BATH Built for pleasure include the iconic Royal Crescent and relaxation, Bath and the majestic Circus. There’s Follow Us plenty to see beyond the city, has been a wellbeing @visitbath too, with stunning countryside destination since to explore, as well as attractions @visitbath including Stonehenge, Avebury the Roman times. @visitbath The waters are still a and Longleat Safari Park. big draw, both at the With so much to discover, you'll want to stay – choose from ancient Roman Baths Cover Photo luxury hotels and grand Georgian Climb the rigging, clamber and the thoroughly guesthouses, or cosy country The Roman Baths through the cabins and dive modern Thermae cottages and chic central by Kim Stone. under the glass sea to marvel apartments. Don’t wait for Bath Spa. Kim is a semi-pro the weekend – there are great at the ship from below. photographer and Bath’s visitor-friendly centre midweek breaks on offer, often influencer with a passion Located in the heart of is overflowing with places to with special rates. for seascapes, landscapes Bristol’s harbour, just a eat and drink, plus some of the Whether you’re looking to and event photography. short trip from Bath. finest independent shops in celebrate a special occasion, Kim has over 17,000 Britain, making it the ideal city immerse yourself in culture, relax followers on Instagram, Make the most of your break. Lose yourself in Bath’s and unwind in a spa, embark on and is the creative and visit and book online: remarkable museums and an outdoor adventure or treat social media maverick galleries, and enjoy festivals, your taste buds to a foodie feast, at Love for Somerset. -

ANNUAL REPORT 2019 FRENCH CONNECTION GROUP PLC French Connection Group PLC

ANNUAL REPORT REPORT ANNUAL 2019 ANNUAL REPORT 2019 French Connection Group PLC FRENCH CONNECTION GROUP PLC French Connection Group PLC FRENCH CONNECTION • GREAT PLAINS • YMC The French Connection Group designs, produces and distributes branded fashion clothing for men and women to more than 50 countries around the world CONTENTS STRATEGIC REPORT FINANCIAL STATEMENTS Chairman’s Statement _________________________ 2 Consolidated Statement Our Business _________________________________ 4 of Comprehensive Income _____________________ 42 Corporate Social Responsibility _________________ 9 Consolidated Statement of Financial Position____ 44 Financial Review _____________________________ 11 Consolidated Statement of Changes in Equity ___ 45 GOVERNANCE Consolidated Statement of Cash Flows _________ 46 Board of Directors ____________________________ 14 Notes to the Group Accounts __________________ 47 Directors’ Report _____________________________ 15 Company Balance Sheet ______________________ 70 Corporate Governance Statement ______________ 18 Statement of Changes in Equity _______________ 71 Audit Committee Report ______________________ 23 Notes to the Company Accounts _______________ 72 Directors’ Remuneration Report _______________ 26 SHAREHOLDER INFORMATION Statement of Directors’ Responsibilities ________ 33 Five Year Record _____________________________ 76 Independent Auditor’s Report to the members Advisers _____________________________________ 77 of French Connection Group PLC ______________ 34 Financial Calendar ____________________________ 77 Notice of Meeting ____________________________ 78 ChairmaN’s STatement Dear Shareholders our New York operation and removing our office in Toronto, thereby reducing the cost base going forward but maintaining I am pleased to report that we have achieved our target of the majority of the revenue. returning the Group to underlying1 profitability this financial year which represents a significant achievement given the results Gross margins at 32.5% were 0.4% up on last year driven by over recent years. -

ANNUAL REPORT 2014 French Connection Group PLC French Connection Group PLC FRENCH CONNECTION • GREAT PLAINS • TOAST • YMC

ANNUAL REPORT 2014 French Connection Group PLC French Connection Group PLC FRENCH CONNECTION • GREAT PLAINS • TOAST • YMC The French Connection Group designs, produces and distributes branded fashion clothing for men and women to more than 60 countries around the world CONTENTS STRATEGIC REPORT Consolidated Statement Chairman’s Statement 2 of Financial Position 32 Our Business 3 Consolidated Statement Corporate Social Responsibilty 7 of Changes in Equity 33 Financial Review 9 Consolidated Statement GOVERNANCE of Cash Flows 34 Board of Directors 11 Notes to the Group Accounts 35 Directors’ Report 12 Company Balance Sheet 54 Corporate Governance Statement 14 Audit Committee Report 16 Notes to the Company Accounts 55 Directors’ Remuneration Report 19 SHAREHOLDER INFORMATION Statement of Directors’ Responsibilities 27 Five Year Record 60 Independent Auditor’s Report 28 Advisers 61 FINANCIAL STATEMENTS Financial Calendar 61 Consolidated Statement of Comprehensive Income 30 Notice of Meeting 62 CHAIRMAN’S STATEMENT Dear Shareholders, In the Annual Report last year I set out the initiatives we put Toast performed well during the year and continues in place to drive a turnaround in our trading performance. to leverage on its primarily online business model, I am pleased that the initiatives have delivered improved complemented by a small retail portfolio. results during the year and that they are continuing to gain In International markets, in our Joint Ventures in China traction as our business performance further strengthens. and Hong Kong, additional stores were opened and After delivering a reduction in losses in H1, the Group reports with positive LFL’s, the share of profit from joint ventures an underlying operating profit in H2 of £1.7m (2013: H2 loss increased. -

House of Fraser in the United Kingdom Location Map House Of

House of Fraser in the United Kingdom This GPS POI file is available here: https://www.gps-data-team.com/poi/united_kingdom/store_locator/HoF-UK.html Location Map House of Fraser Altrincham Map House of Fraser Aylesbury Map House of Fraser Bath Map House of Fraser Belfast Map House of Fraser Birkenhead Map House of Fraser Birmingham Map House of Fraser Bluewater Map House of Fraser Bournemouth Map House of Fraser Bristol Map House of Fraser Camberley Map House of Fraser Cardiff Map House of Fraser Carlisle Map House of Fraser Cheltenham Map House of Fraser Chichester Map House of Fraser Cirencester Map House of Fraser City Map House of Fraser Croydon Map House of Fraser Cwmbran Map House of Fraser Darlington Map House of Fraser Dundrum Map House of Fraser Edinburgh Map House of Fraser Epsom Map House of Fraser Exeter Map House of Fraser Glasgow Map House of Fraser Grimsby Map House of Fraser Guildford Map House of Fraser High Wycombe Map House of Fraser Huddersfield Map House of Fraser Hull Map House of Fraser Lakeside Map House of Fraser Leamington S Map House of Fraser Leeds Map House of Fraser Lincoln Map House of Fraser Loch Lomond Map House of Fraser London Map House of Fraser London Victo Map House of Fraser Maidstone Map House of Fraser Manchester Map House of Fraser Meadowhall Map House of Fraser Metro Centre Map Page 1 Location Map House of Fraser Middlesbroug Map House of Fraser Milton Keyne Map House of Fraser Norwich Map House of Fraser Nottingham Map House of Fraser Outlet Donca Map House of Fraser Outlet Leice Map House of Fraser Outlet Swind Map House of Fraser Plymouth Map House of Fraser Reading Map House of Fraser Richmond Map House of Fraser Shrewsbury Map House of Fraser Skipton Map House of Fraser Solihull Map House of Fraser Sutton Coldf Map House of Fraser Telford Map House of Fraser Westfield Map House of Fraser Wolverhampto Map House of Fraser Worcester Map Page 2.