Taxationguide Eng.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Pdf/Rosen Eng.Pdf Rice fields) Connnecting Otsuki to Mt.Fuji and Kawaguchiko

Iizaka Onsen Yonesaka Line Yonesaka Yamagata Shinkansen TOKYO & AROUND TOKYO Ōu Line Iizakaonsen Local area sightseeing recommendations 1 Awashima Port Sado Gold Mine Iyoboya Salmon Fukushima Ryotsu Port Museum Transportation Welcome to Fukushima Niigata Tochigi Akadomari Port Abukuma Express ❶ ❷ ❸ Murakami Takayu Onsen JAPAN Tarai-bune (tub boat) Experience Fukushima Ogi Port Iwafune Port Mt.Azumakofuji Hanamiyama Sakamachi Tuchiyu Onsen Fukushima City Fruit picking Gran Deco Snow Resort Bandai-Azuma TTOOKKYYOO information Niigata Port Skyline Itoigawa UNESCO Global Geopark Oiran Dochu Courtesan Procession Urabandai Teradomari Port Goshiki-numa Ponds Dake Onsen Marine Dream Nou Yahiko Niigata & Kitakata ramen Kasumigajo & Furumachi Geigi Airport Urabandai Highland Ibaraki Gunma ❹ ❺ Airport Limousine Bus Kitakata Park Naoetsu Port Echigo Line Hakushin Line Bandai Bunsui Yoshida Shibata Aizu-Wakamatsu Inawashiro Yahiko Line Niigata Atami Ban-etsu- Onsen Nishi-Wakamatsu West Line Nagaoka Railway Aizu Nō Naoetsu Saigata Kashiwazaki Tsukioka Lake Itoigawa Sanjo Firework Show Uetsu Line Onsen Inawashiro AARROOUUNNDD Shoun Sanso Garden Tsubamesanjō Blacksmith Niitsu Takada Takada Park Nishikigoi no sato Jōetsu Higashiyama Kamou Terraced Rice Paddies Shinkansen Dojo Ashinomaki-Onsen Takashiba Ouchi-juku Onsen Tōhoku Line Myoko Kogen Hokuhoku Line Shin-etsu Line Nagaoka Higashi- Sanjō Ban-etsu-West Line Deko Residence Tsuruga-jo Jōetsumyōkō Onsen Village Shin-etsu Yunokami-Onsen Railway Echigo TOKImeki Line Hokkaid T Kōriyama Funehiki Hokuriku -

Chiba Universitychiba

CHIBA UNIVERSITY CHIBA 2019 2020 2019 CHIBA UNIVERSITY 2019 2019-2020 Contents 01 Introduction 01-1 A Message from the President ................................................................................................. 3 01-2 Chiba University Charter ........................................................................................................... 4 01-3 Chiba University Vision ............................................................................................................... 6 01-4 Chiba University Facts at a Glance .......................................................................................... 8 02 Topic 02-1 Institute for Global Prominent Research ............................................................................... 11 02-2 Chiba Iodine Resource Innovation Center (CIRIC) ............................................................. 12 02-3 Enhanced Network for Global Innovative Education —ENGINE— ................................. 13 02-4 Top Global University Project .................................................................................................. 14 02-5 Inter-University Exchange Project .......................................................................................... 15 02-6 Frontier Science Program Early Enrollment ........................................................................ 16 02-7 Honey Bee Project ....................................................................................................................... 18 02-8 Inohana Campus High -

'A Grand Stage for Kōsen Rufu in the Future': Sōka Gakkai in Austria

1 ‘A Grand Stage for kōsen rufu in the Future’: Sōka Gakkai in Austria, 1961–1981 Lukas Pokorny 1. Introduction A flag bearer of global Engaged Buddhism, Sōka Gakkai (Value Creation Society) is Japan’s single largest religious organisation with affiliations ‘in 192 countries and territories worldwide’.1 Today this international Buddhist network—operating since 1975 under the name of Soka Gakkai Interna- tional (SGI)—reports a membership of twelve million people,2 of which 8.27 million ‘households’ (setai) belong to the Japanese branch.3 Though Acknowledgments: This research benefited considerably from the support given by members of SGI Austria. I am also indebted to Johannes Sinabell of the Department for Questions about World Views of the Catholic Archdiocese of Vienna (Referat für Welt- anschauungsfragen der Erzdiözese Wien) and Sarah-Allegra Schönberger of the Depart- ment for the Study of Religions at the University of Vienna. I would also like to thank SGI Austria and Japan for their permission to reproduce pictures contained in the appen- dix. Notes on Romanisation and Style: Japanese terms and names are romanised using the Modified Hepburn system. The romanisation of Chinese is in accordance with the Hànyǔ Pīnyīn system including tonal marks. The transliteration of Sanskrit follows the IAST. Japanese names are written according to East Asian custom: family name precedes per- sonal name. 1 See http://www.sgi.org/about-us/history-of-sgi/history-of-sgi.html (accessed: April 12, 2014). 2 See http://www.sgi.org/about-us/what-is-sgi.html (accessed: February 6, 2014). 3 Traditionally, Sōka Gakkai counts its Japanese membership in households, which does not mean that all members of a family are indeed followers, but that at least one person in the respective household appears as such. -

Summary of Family Membership and Gender by Club MBR0018 As of June, 2009

Summary of Family Membership and Gender by Club MBR0018 as of June, 2009 Club Fam. Unit Fam. Unit Club Ttl. Club Ttl. District Number Club Name HH's 1/2 Dues Females Male TOTAL District 333 C 25243 ABIKO 5 5 6 7 13 District 333 C 25249 ASAHI 0 0 2 75 77 District 333 C 25254 BOSHUASAI L C 0 0 3 11 14 District 333 C 25257 CHIBA 9 8 9 51 60 District 333 C 25258 CHIBA CHUO 3 3 4 21 25 District 333 C 25259 CHIBA ECHO 0 0 2 24 26 District 333 C 25260 CHIBA KEIYO 0 0 1 19 20 District 333 C 25261 CHOSHI 2 2 1 45 46 District 333 C 25266 FUNABASHI 4 4 5 27 32 District 333 C 25267 FUNABASHI CHUO 5 5 8 56 64 District 333 C 25268 FUNABASHI HIGASHI 0 0 0 23 23 District 333 C 25269 FUTTSU 1 0 1 21 22 District 333 C 25276 ICHIKAWA 0 0 2 36 38 District 333 C 25277 ICHIHARA MINAMI 1 1 0 33 33 District 333 C 25278 ICHIKAWA HIGASHI 0 0 2 14 16 District 333 C 25279 IIOKA 0 0 0 36 36 District 333 C 25282 ICHIHARA 9 9 7 26 33 District 333 C 25292 KAMAGAYA 12 12 13 31 44 District 333 C 25297 KAMOGAWA 0 0 0 37 37 District 333 C 25299 KASHIWA 0 0 4 41 45 District 333 C 25302 BOSO KATSUURA L C 0 0 3 54 57 District 333 C 25303 KOZAKI 0 0 2 25 27 District 333 C 25307 KAZUSA 0 0 1 45 46 District 333 C 25308 KAZUSA ICHINOMIYA L C 0 0 1 26 27 District 333 C 25309 KIMITSU CHUO 0 0 1 18 19 District 333 C 25310 KIMITSU 5 5 14 42 56 District 333 C 25311 KISARAZU CHUO 1 1 5 14 19 District 333 C 25314 KISARAZU 0 0 1 14 15 District 333 C 25316 KISARAZU KINREI 3 3 5 11 16 District 333 C 25330 MATSUDO 0 0 0 27 27 District 333 C 25331 SOBU CHUO L C 0 0 0 39 39 District 333 C -

Tokyo Metoropolitan Area Railway and Subway Route

NikkNikkō Line NikkNikkō Kuroiso Iwaki Tōbu-nikbu-nikkkō Niigata Area Shimo-imaichi ★ ★ Tōbu-utsunomiya Shin-fujiwara Shibata Shin-tochigi Utsunomiya Line Nasushiobara Mito Uetsu Line Network Map Hōshakuji Utsunomiya Line SAITAMA Tōhoku Shinkansen Utsunomiya Tomobe Ban-etsu- Hakushin Line Hakushin Line Niitsu WestW Line ■Areas where Suica・PASMO can be used RAILWAY Tochigi Oyama Shimodate Mito Line Niigata est Line Shinkansen Moriya Tsukuba Jōmō- Jōetsu Minakami Jōetsu Akagi Kuzū Kōgen ★ Shibukawa Line Shim-Maebashi Ryōmō Line Isesaki Sano Ryōmō Line Hokuriku Kurihashi Minami- ban Line Takasaki Kuragano Nagareyama Gosen Shinkansen(via Nagano) Takasaki Line Minami- Musashino Line NagareyamaNagareyama-- ō KukiKuki J Ōta Tōbu- TOBU Koshigaya ōōtakanomoritakanomori Line Echigo Jōetsu ShinkansenShinkansen Shin-etsu Line Line Annakaharuna Shin-etsu Line Nishi-koizumi Tatebayashi dōbutsu-kōen Kasukabe Shin-etsu Line Yokokawa Kumagaya Higashi-kHigashi-koizumioizumi Tsubamesanjō Higashi- Ogawamachi Sakado Shin- Daishimae Nishiarai Sanuki SanjSanjōō Urawa-Misono koshigaya Kashiwa Abiko Yahiko Minumadai- Line Uchijuku Ōmiya Akabane- Nippori-toneri Liner Ryūgasaki Nagaoka Kawagoeshi Hon-Kawagoe Higashi- iwabuchi Kumanomae shinsuikoen Toride Yorii Ogose Kawaguchi Machiya Kita-ayase TSUKUBA Yahiko Yoshida HachikHachikō Line Kawagoe Line Kawagoe ★ ★ NEW SHUTTLE Komagawa Keihin-Tōhoku Line Ōji Minami-Senju EXPRESS Shim- Shinkansen Ayase Kanamachi Matsudo ★ Seibu- Minami- Sendai Area Higashi-HanHigashi-Hannnō Nishi- Musashino Line Musashi-Urawa Akabane -

Chiba Travel

ChibaMeguri_sideB Leisure Shopping Nature History&Festival Tobu Noda Line Travel All Around Chiba ChibaExpressway Joban Travel Map MAP-H MAP-H Noda City Tateyama Family Park Narita Dream Farm MITSUI OUTLET PARK KISARAZU SHISUI PREMIUM OUTLET® MAP-15 MAP-24 Express Tsukuba Isumi Railway Naritasan Shinshoji Temple Noda-shi 18 MAP-1 MAP-2 Kashiwa IC 7 M22 Just within a stone’s throw from Tokyo by the Aqua Line, Nagareyama City Kozaki IC M24 Sawara Nagareyama IC Narita Line 25 Abiko Kozaki Town why don’t you visit and enjoy Chiba. Kashiwa 26 Sawara-katori IC Nagareyama M1 Abiko City Shimosa IC Whether it is for having fun, soak in our rich hot springs, RyutetsuNagareyamaline H 13 Kashiwa City Sakae Town Tobu Noda Line Minami Nagareyama Joban Line satiate your taste bud with superior products from the seas 6 F Narita City Taiei IC Tobu Toll Road Katori City Narita Line Shin-Matsudo Inzai City Taiei JCT Shiroi City Tonosho Town and mountains, Chiba New Town M20 Shin-Yahashira Tokyo Outer Ring Road Higashikanto Expressway Hokuso Line Shibayama Railway Matsudo City Inba-Nichi-idai Narita Sky Access Shin-Kamagaya 24 you can enjoy all in Chiba. Narita Narita Airport Tako Town Tone Kamome Ohashi Toll Road 28 34 Narita IC Musashino Line I Shibayama-Chiyoda Activities such as milking cows or making KamagayaShin Keisei City Line M2 All these conveniences can only be found in Chiba. Naritasan Shinshoji Temple is the main temple Narita International Airport Asahi City butter can be experienced on a daily basis. Narita Line Tomisato IC Ichikawa City Yachiyo City of the Shingon Sect of Chizan-ha Buddhism, Funabashi City Keisei-Sakura Shisui IC You can enjoy gathering poppy , gerbera, Additionally, there are various amusement DATA 398, Nakajima, Kisarazu-City DATA 689 Iizumi, Shisui-Town Sobu LineKeisei-Yawata Shibayama Town M21 Choshi City Isumi and Kominato railroad lines consecutively run across Boso Peninsula, through a historical Choshi 32 and antirrhinum all the year round in the TEL:0438-38-6100 TEL:043-481-6160 which was established in 940. -

Hours: (Varies Depending on Seasons)

Symbolic mascot “Donchan・Gurichan” of Forest and Park for the 21st Century Hours: (varies depending on seasons) 9:00 am~5:00pm (9:00 am to 6:30 pm between July 21 and August 20 9:00 am to 4:30 pm between November 1 and end of February) *Closed on: December 30 to January 1 You are requested to return this guidebook at the gate when leaving the park. —Foreword— Thank you for your coming to Forest and Park for the 21st Century. This park was opened on April 29, 1993 as a “Respect Nature Style Urban Park”. As the word “Respect nature” indicates, we operate the park based on the keynote that we will protect and grow the valuable nature that still exists in the Matsudo Sendabori district. As one of the ways to protect the nature from harm, we have to ask the visitors to kindly take their litter home with them. We would appreciate your further understanding and cooperation to the following requests. —Requests— There are some rules for visitors’ safe and comfortable use of the park as below. The following are forbidden: Playing golf, baseball and soccer, dangerous play like radio-controlled toys, bringing in of dangerous goods, using of fire (excluding barbecue site), using of bicycles (including kickboards), bringing in of pets, setting up of tents, fishing (fishing of crayfish by kite strings is allowed, but not by nylon fishing guts). Picking the plants and catching the animals are prohibited (excluding crayfish), and feeding the birds, fish and other living creatures are also prohibited. -

Japan Typhoon 19 Hagibis Humanity Road Situation Report

Activation: Japan Typhoon 19 / Typhoon Hagibis Situation Report 1 – period covered: October 12-14, 2019 Prepared by: Humanity Road / Animals in Disaster Situation Overview Typhoon 19 (Hagibis) made landfall on October 10, 2019 just before 1900 local time at Izu Peninsula in Shizuoka Prefecture. In advance of the typhoon, millions of people across Japan were asked to evacuate due to the risk of landslides and flooding. Humanity Road activated it’s disaster desk on October 12, 2019 as Typhoon 19 began impacting multiple prefectures. As of 0100 October 14, an estimated 15 prefectures have been impacted by historic rainfall, flooding, and landslides, 31 people have died, 186 people were injured, and 14 people are missing. An estimated 59,100 households are without power. A total of 142 rivers overflowed and there were breakdown of river banks in 21 rivers at 24 locations. This situation report number one provides useful official disaster resources and situational information based on early indications in social media. Twitter Handles Facebook Pages @humanityroad Humanity Road @disasteranimals Disaster Animals @DAFNready @jAIDdog About Humanity Road: Founded in 2010 as a 501(c)3 non-profit corporation, Humanity Road is a leader in the field of online disaster response. Through skilled and self-directed work teams, Humanity Road and its network of global volunteers aim to provide the public and disaster responders worldwide with timely and accurate aid information. Providing such information helps individuals survive, sustain, and reunite with loved ones. [email protected] www.humanityroad.org Support our work Page 1 of 8 SIGNIFICANT UPDATES (MOST RECENT FIRST) 14 Oct ● NHK reported that as of October 14, at 1:00am, 31 people have been killed, 14 people are missing, and 186 people have been injured across 28 prefectures. -

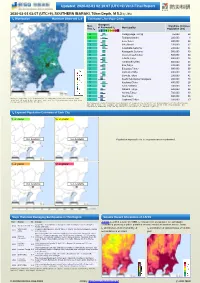

Ver.6 Final Report 2020-02-01 02:07 (UTC+9), SOUTHERN IBARAKI, 70Km Depth, M 5.3 By

Updated: 2020-02-01 02:19:07 (UTC+9) Ver.6 Final Report 2020-02-01 02:07 (UTC+9), SOUTHERN IBARAKI, 70km Depth, M 5.3 by JMA Is Distribution Maximum Observed Is:4 Estimated Is for Major Cities Histogram Max. Nighttime Distance of Estimated Is Municipality Obs. Is Population [km] 1 2 3 4 5-5+6-6+7 4 Motegi,Haga,Tochigi 15,000 59 4 Tsukuba,Ibaraki 210,000 4 3 Koto,Tokyo 460,000 44 3 Mito,Ibaraki 270,000 52 3 Kasukabe,Saitama 240,000 31 3 Kawaguchi,Saitama 560,000 40 3 Utsunomiya,Tochigi 510,000 64 3 Adachi,Tokyo 680,000 36 3 Funabashi,Chiba 610,000 35 3 Kita,Tokyo 340,000 42 3 Edogawa,Tokyo 680,000 38 3 Matsudo,Chiba 480,000 29 3 Sumida,Tokyo 250,000 41 3 Asahi,Yokohama,Kanagawa 250,000 76 3 Kashiwa,Chiba 400,000 18 3 Soka,Saitama 240,000 32 3 Itabashi,Tokyo 540,000 44 3 Nerima,Tokyo 710,000 49 3 Ota,Tokyo 690,000 59 S eism ic In ten sity (Is) d istrib u tio n is estim ated f ro m th e o b served d ata (c irc les) o f N IED K-N ET, KiK-n et, JM A, an d lo c al g o vern m en ts th at h ad b een 3 Suginami,Tokyo 550,000 53 c o llec ted b y 20 20 /0 2/0 1 0 2:18 :13. Th e h isto g ram sh o ws f req u en c y d istrib u tio n o f estim ated Is d erived f ro m in terp o latio n o f th e o b servatio n with 250 -m m esh . -

Guidance to Enter the International House

Pre-entry Guidance to the International House (Becoming a Resident) Tokyo University of the Arts (Tokyo Geijutsu Daigaku) Version: 2016/11 Preface All Intended Residents for the International House of Tokyo Geijutsu Daigaku are required to carefully read the written Rules and Regulations in this guidance, which refers to qualification/Requirements for Being a Resident, Procedures for Entrance and Withdrawal from the House and cost and expenses to be borne by the residents. All residents are asked to cooperate to help create a peaceful and comfortable living environment by strictly abiding by the written rules and regulations. Contents 1. Outline of the International House (Here after called the House) 1 Objective of the House 2 Management and Administration 3 Name, Location and Telephone Number 4 Access and Transportation 5 Facilities and Equipment 6 The House Administration Room II. Criteria and Procedures for Entrance and Withdrawal 1. Qualification for Entrance 2. Application for Residence 3. Selection of Residents and Admission for Residence 4. Procedures for Residence 5. Term of Residence 6. Procedures for Withdrawal III. Charges/Expenses to be borne by Residents 1. Boarding Charge 2. Utility Charges IV. All the Resident must Observe 1. Keys for Residence 2. Leased Items in Resident Rooms 3. Inspection of Facilities and Equipment 4. Items to be Purchased by Residents 1 5. Use of Common Facilities and Warnings 6. Warning about Leased Item Usage 7. Hygiene Control 8. Health and Medical Treatment 9. Gathering and Event Report 10. Telephone 11. Handling of Mail 12. Notices to the Residents 13. Guide Board 14. Meeting/Interview with Visitors 15. -

Discover Chiba Prefecture Mascot “CHI-BA+KUN”

ENGLISH Discover Chiba Prefecture Mascot “CHI-BA+KUN” Chiba Sawara Saitama Attractions Narita Colorful Chiba Prefecture Awaits Your Visit Narita Tokyo Sakura Airport Choshi Urayasu Chiba Haneda Kujukuri Airport Yokohama Kisarazu Mt.Fuji Tokaido Shinkansen Chiba Tateyama Chiba Official Tourism Website http://japan-chiba-guide.com/en/ is located within the “Chiba” Tokyo metropolitan area Nikko and has mild climate and many sightseeing spots. Surrounded by sea and rivers on all four sides, Chiba is blessed with the nature full of water and greenery. Under the influence of the warm current (Kuroshio Current) that flows offshore, the land is seldom frosted even in winter. The precipitation is heavy in summer and light in winter. Its eastern part faces the Pacific Ocean and western part faces Tokyo Bay. Besides, its northwest- ern part borders on Tokyo and Saitama Prefecture, and northern part borders on Ibaraki Prefecture. With a total area of 5,156.64 sq km, Chiba is composed of Boso Kyuryo (hills) with a series of 200 to 300-meter-high mountains, comparatively flat Shimosa Plateau, a far-reaching Tone River basin, and the coast of Kujukuri. The total length of coast- line of Chiba Prefecture is about 530.5km, showing various sceneries. Hokkaido Map Saitama of Sawara Japan Kashiwa Narita Tokyo Osaka Sakura Narita Airport Tokyo Choshi Kyushu Chiba Urayasu Chiba Kujukuri Haneda Airport Okinawa Yokohama Kisarazu Mt.Fuji Chiba Tokaido Shinkansen Tateyama 02 Nikko Contents 04 Chiba Drive Map 05 Chiba Train Map 06 Bay Area, Tokatsu Area 08 Chiba -

Matsudo City Funabashi City Kamagaya City Urayasu City

Matsudo City Matsuhidai Sta. Omachi Sta. Outdoor Recreation and Adventure Course Higashi-Matsudo Sta. Bamboo Grove at Takenouchi Omachi Nashi Omachi Residence Omachi Nature Observation Garden Kaido Highway Omachi Nature Observation Garden View of Nashi Fields and Fireflies Akiyama Sta. Hokuso Line Growers at Work Botanical and Zoological Park Doshokubutsuen Stop Kita-KokubunKitakokubun Sta. Station Neighborhood Ginkgo Trees Road inside Konodai Tsujikiri Komagata Daijinja Ichikawa Reien Cemetery Junsai-Ike Pond Park (Traditional Apotropaic Ceremony) Ginkgo History Museum Great Shrine Trees at Hakubutsukan View of Nashi Fields and Atago Shrine Horinouchi Kaizuka (Shell Mound) Park Iriguchi Stop Growers at Work Komagata Daijinja Shiei Reien Stop Kokubun-ji temple I Great Shrine Stop Kamagaya Yagiri Sta. Kozukayama Koen Park ch ik Omachi Farming Garden aw -a O n View of Sloping Forest and City o S Paddy Fields in Ono-machi District Kokubun Koinobori Carp Streamer Festival t.a Konodai Sloping Green Space Wayo Women's University Man'yo Botanical Garden Ichikawa-Kita Koko Stop Kokubun r Junsai-Ike Pond Park e v Soshajo Stop i Konodai Tsujikiri R (Traditional Apotropaic a w Junsai Ike Stop i Ceremony) h s a View of Tokyo and Edogawa River from Satomi Koen Park g Cherry Blossom Road in front of O Satomi Kokuritsu Byoin Stop Koen Park Soya Elementary School Wayo-Joshidai-Mae Stop Keyaki (Japanese Zelkova) Soya Kozato Koen Park Trees on Campus of Tsukuba Kokubun Stop Kominkan Soya Kaizuka Shell Mound Konodai Sports Center Stop University School for Deaf Ogashiwa Kozato Koen Park Omachi Farming Garden Satomi Koen Park Wayo Women's University Kokubun-ji temple Soya Stop Shutchojo Stop Konodai Sloping Green Space Mamasan Hills View from Mamasan Guho-ji Temple Mamasan Shita Stop Guho-ji Yoshizawa Garden Gallery Kiuchi Gallery Temple EdogawaTsugihashi Sta.