STRONG FOUNDATION, RESILIENT FUTURE Mapletree Commercial Trust Annual Report 2015/16 CONTENTS

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Review of the Singapore Office Market

September 2018 Singapore | Hong Kong The Office A review of the Singapore office market Demand / Supply / Rentals / Forecast P2 Four Best Premium Leasing Options P3 Common Myths You Need to Know P3 Six Best Value For Money Opportunities P4 Eight Most Competitive Leasing Options P5 Summary of New Developments 2018 P6 Frequently Asked Questions P6 Complete Rental Table (Islandwide) P7 Four Most Expensive Office Buildings P8 Future Developments P8 Finding Office Space For You, With You Corporate Locations (S) Pte Ltd License No. L3010044A Marina One T +65 6320 8355 / [email protected] / www.corporatelocations.com.sg Demand Rentals A healthy take-up of space in 2018 Top premium asking rates are now around $14.00+ per sq ft The office leasing market has continued its momentum from 2017 and The top premium asking rates are now around $14.00+ per sq ft, with there has indeed been a healthy take-up of space in 2018. Many of the less room to negotiate than before but effective rates are still averaging preferred locations have been busy, whilst some other locations not around $11.50 - $12.00 per sq ft for prime space. As in any strong so active. Last year the talk of the town was all about the new tenants leasing market, the gap between the upper end and lower end tends to relocating to the brand new schemes such as Marina One and UIC stretch, which is exactly what is happening right now. Building. The story this year so far, has been all the new tenants that have committed to Frasers Tower and Duo Tower. -

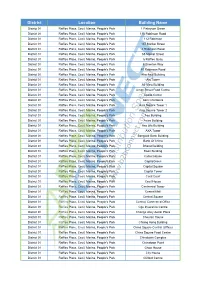

District Location Building Name

District Location Building Name District 01 Raffles Place, Cecil, Marina, People's Park 1 Finlayson Green District 01 Raffles Place, Cecil, Marina, People's Park 110 Robinson Road District 01 Raffles Place, Cecil, Marina, People's Park 112 Robinson District 01 Raffles Place, Cecil, Marina, People's Park 137 Market Street District 01 Raffles Place, Cecil, Marina, People's Park 4 Robinson Road District 01 Raffles Place, Cecil, Marina, People's Park 55 Market Street District 01 Raffles Place, Cecil, Marina, People's Park 6 Raffles Quay District 01 Raffles Place, Cecil, Marina, People's Park 6 Shenton Way District 01 Raffles Place, Cecil, Marina, People's Park 80 Robinson Road District 01 Raffles Place, Cecil, Marina, People's Park Afro-Asia Building District 01 Raffles Place, Cecil, Marina, People's Park Aia Tower District 01 Raffles Place, Cecil, Marina, People's Park Air View Building District 01 Raffles Place, Cecil, Marina, People's Park Amoy Street Food Centre District 01 Raffles Place, Cecil, Marina, People's Park Apollo Center District 01 Raffles Place, Cecil, Marina, People's Park Asia Chambers District 01 Raffles Place, Cecil, Marina, People's Park Asia Square Tower 1 District 01 Raffles Place, Cecil, Marina, People's Park Asia Square Tower 2 District 01 Raffles Place, Cecil, Marina, People's Park Aso Building District 01 Raffles Place, Cecil, Marina, People's Park Aviva Building District 01 Raffles Place, Cecil, Marina, People's Park Axa Life Building District 01 Raffles Place, Cecil, Marina, People's Park AXA Tower District 01 -

Singapore Office Market Review

Q2 2021 Published 8 April 2021 Singapore Office Market Review DEMAND Pg 3 SUPPLY Pg 4 Special Feature: Guoco Midtown Pg 6 New Developments: B1/2 Category Pg 7 Rentals Forecasts Top prime rates for premium Grade A buildings have softened from a • Market still dominated by tech firms and the financial services high of $14.00 per sq ft a year ago, to around $11.50 - $12.00 per sq ft. / investment sector, as well as displaced tenants looking for new Average prime rates in the Raffles Place area are in the region of office premises. $9.50 per sq ft. Office rates in theRobinson Road / Shenton Way area are in the $7.00 - $8.50 per sq ft bracket. • Demand for co-working space to continue with hybrid solutions proving popular. There is not much difference in the rental costs for Tanjong Pagar, which averages around $7.50 per sq ft. City Hall ranges from $7.00 to • Ample choice of supply at the moment and the amount of shadow $9.00 per sq ft and Beach Road averages around $7.25 per sq ft. space is increasing, due to companies rightsizing. There has been little movement on Orchard Road, and as such this • Supply will begin to tighten later in the year. location still enjoys a relatively high occupancy rate. Rents range from $7.50 to $9.50 per sq ft in this district. • Only two sizeable office developments due for completion this year in the CBD (CapitaSpring and Afro-Asia iMark). Edge of CBD like Novena, River Valley Road and decentralized locations like Harbourfront Centre and Paya Lebar Square range from • Rates to soften by 7% across the board, but rate of decline will $6.00 to $7.00 per sq ft. -

Property Portfolio As at 30 June 2019 Integrated Development

CapitaLand Property Portfolio as at 30 June 2019 Integrated Development Values Country City Property Holding Entity/ Fund/ REIT Note Effective Stake (%) Status Tenure Tenure Expiry Lease Type Currency Valuation as at 31 Dec 2018 (million) Valuation as at 30 Jun 2019 (million) GFA (sqm) (Years) China Beijing Raffles City Beijing Raffles City China Income Ventures Limited 1 55.0 Leasehold 2046 Retail RMB 5,932 6,167 110,997 2056 Integrated Use - Chengdu CapitaMall Tianfu CapitaLand Mall China Development Fund III 50.0 Leasehold 2048 Commercial RMB 2,896 2,908 193,851 CapitaMall Tianfu* 2078 Residential - Raffles City Chengdu Raffles City China Income Ventures Limited 1 55.0 Leasehold 2046 RMB 4,378 4,549 237,310 Chongqing Raffles City Chongqing 2 100.0 A Leasehold 2057 Commercial RMB 7,554 8,108 816,105 2087 Residential - Hangzhou Raffles City Hangzhou Raffles City China Income Ventures Limited 1 55.0 Leasehold 2049 RMB 5,675 5,793 296,886 Ningbo Raffles City Ningbo Raffles City China Income Ventures Limited 1 55.0 Leasehold 2047 RMB 2,116 2,168 101,405 Y-Town 100.0 A Leasehold 2057 RMB 80 114 23,662 Shanghai Capital Square 70.0 Leasehold 2052 Retail RMB 2,946 3,002 75,117 2062 Office - CapitaMall Hongkou CapitaLand and CapitaLand Mall China Income Fund I 72.5 Leasehold 2057 RMB 9,090 9,398 205,119 CapitaMall LuOne CapitaLand Mall China Development Fund III 33.0 A Leasehold 2056 RMB 5,202 5,301 131,303 CapitaMall Minhang CapitaLand and CapitaLand Mall China Income Fund II 65.0 Leasehold 2053 RMB 4,750 4,896 146,843 Raffles City · The Bund -

A Review of the Singapore Office Market

November 2014 Singapore | Hong Kong The Office A review of the Singapore office market Demand still healthy Supply tightening Rents firming Index Page 02 Super Savers: $3.00 - $5.00 psf Demand 03 Premium Office Space: $10.00 - $14.00 psf 04 Economy Range: $5.00 - $6.00 psf Rentals 05 Lower Mid-Range: $6.00 - $7.00+ psf Rental History 06 Mid-Range: $7.50 - $8.00 psf Supply / Market Forecast Centennial Tower 07 Upper Mid-Range: $8.00 - $9.00 psf Useful Contacts 08 Rental Guide - Summary of Asking Rates Senior Rentals Team Corporate Locations (S) Pte Ltd License No. L3010044A T +65 6320 8355 / [email protected] / www.corporatelocations.com.sg SUPER SAVERS: Business / Commercial Space $3.00 - $5.00 psf 02 *All rents quoted are estimated target effective rates subject to negotiations and are not the landlords quoted figure Qualification for Business Space East up to $4.00 psf Important Note: to qualify for business space, tenants must be involved with software development, research and development, datacenter management, design functions or customer support services. For industrial space a 60:40 ruling applies where 60% of the space must be used for industrial purposes and 40% can be used for offices. If in doubt checks should be made through the URA providing detailed information of $3.50 - $3.70 psf* $4.00 psf* $3.20 psf* $3.00 psf* your specific operations and use of Units from 1,584 – 27,943 sq ft Units from 2,357 – 8,908 sq ft Units from 1,130 – 52,743 sq ft Units from 1,807 – 12,165 sq ft the premises. -

Getting Here ASIA SQUARE TOWER 1 8 Marina View, Singapore 018960 ASIA SQUARE TOWER 2 12 Marina View Singapore 018961 GENERAL

MARINA COASTAL EXPRESSWAY E N U V E A GARDENS BY THE BAY E S R E A S H BAYFRONT STATION SHEARES LINK Getting Here BAYFRONT AVENUE Y A W S S E R ASIA SQUARE TOWER 1 P X MARINA BOULEVARD E Y 8 Marina View, Singapore 018960A W K R A SINGAPORE FLYER P T ASIA SQUARE TOWERS 2 A O C LINK BAYFRONT 12 Marina View Singapore 018961 T S A E MARINA BAY STATION GENERAL ENQUIRIES: MARINA WAY [email protected] BAYFRONT AVENUE +65 6499 1888 MARINA BAY RESIDENCES MBFC TOWER 3 Taxi and Car MARINA ONE MARINA BAY MBFC TOWER 1 ENTRY VIA COMMERCE STREET MBFC drop o point via Marina View TOWER 2 THE FLOAT @ MARINA STRAITS VIEW THE MRT Stations BAY RITZ- MARINA THE PROMONTORY DOWNTOWN CENTRAL BOULEVARD CARLTON SITTING CENTRAL LINEAR PARK RAFFLESGALLERY PLACEBAY @ MARINA BAY STATION MILLENIA RAFFLES AVENUE SINGAPORE6 minutes walk via Exit I or J MARINA VIEW MARINA BOULEVARD K N THE SAIL I ASIA ASIA MARINA BAY L SHENTON @ MARINA SQUARE CUSTOMS HOUSE SQUARE WAY BAY W TOWER 1 TOWER 2 MILLENIA 4 minutes walk via Exit B E I WALK V MARINA M A R I N A BAY SHENTON LANE MAXWELL ROAD SUITES MANDARIN DOWNTOWN CLIFFORD PIER FULLERTONHOTEL BAY ORIENTAL ONE SINGAPORE ONE RAFFLES STREET COMMERCE V ON SHENTON CONFERENCE PAN SINGAPORE OUE MARINA 2 minutes walk via Exit E BOULEVARD QUAY ONE SHENTON SHENTON HOUSE HALL PACIFIC BAYFRONT SINGAPORE RAFFLES QUAY SHENTON WAY SHENTON WAY MARINA ASCOTT 6 SGX CENTRE RAFFLES RAFFLES OUE DOWNTOWN SQUARE MAS PLACE QUAY HONG CHANGE ALLEY BUILDING ONE FULLERTON LEONG LAU PA SAT AXA TOWER R BOON TAT LINK MAXWELL LINK THE ARCADE LUCRUM -

Proposed Acquisition of the Office Components of OUE Downtown and Rights Issue

Proposed Acquisition of the Office Components of OUE Downtown and Rights Issue 10 September 2018 Page Title: 22 pt; Arial Important Notice 255 255 255 This presentation should be read in conjunction with the announcement released by OUE Commercial REIT (“OUE C-REIT”) on 10 September Placeholder Heading 2018 (in relation to its proposed Acquisition of the Office Components of OUE Downtown (the “Acquisition”), the proposed fully underwritten and Font color – 52/62/72 renounceable Rights Issue and the proposed payment of the sub-underwriting commission. Fill Color – 255/255/255 Line: 182/136/44 This presentation is for information purposes only and does not constitute an invitation, offer or solicitation of any offer to acquire, purchase or subscribe for units in OUE C-REIT (“Units”). The value of Units and the income from them, if any, may fall or rise. The Units are not obligations of, deposits in, or guaranteed by, OUE Commercial REIT Management Pte. Ltd. (the “Manager”), DBS Trustee Limited (as trustee of OUE C-REIT) or Charts/Objects Color Scheme any of its affiliates. An investment in the Units is subject to investment risks, including the possible loss of the principal amount invested. The past 224 192 127 performance of OUE C-REIT is not necessarily indicative of the future performance of OUE C-REIT. 61 82 97 This presentation may contain forward-looking statements that involve risks and uncertainties. Actual future performance, outcomes and results may differ materially from those expressed in forward-looking statements as a result of a number of risks, uncertainties and assumptions. -

Top Micro-Markets in Singapore

COLLIERS RADAR OFFICE | RESEARCH | SINGAPORE | 21 JUNE 2019 Shirley Wong Associate Director | Research | Singapore +65 6531 8567 [email protected] Tricia Song Director and Head | Research | Singapore +65 6531 8536 [email protected] TOP MICRO-MARKETS IN SINGAPORE Identifying the most attractive CBD micro-markets in Singapore for different occupiers, and implications for landlords and investors COLLIERS RADAR OFFICE | RESEARCH | SINGAPORE | 21 JUNE 2019 Summary & Recommendations Raffles Place/ Colliers earlier identified the top locations in Asia for technology, finance and law occupiers, and Singapore is the only city to rank top three across all three sectors. This report provides New Downtown the top occupier sectors deeper insights into the best micro-market locations within Singapore based on existing clusters, availability of office stock, accessibility and rents. Raffles Place/New Downtown (Premium) is #1 ➢ Financial Services is the top occupier sector in the CBD Grade A office market with a 42% for Financial services companies, while Raffles share, and should locate in Raffles Place/New Downtown (Premium) for its strong Place (Grade A) is #1 for Professional Services. industry cluster and premium specifications; This precinct remains the key financial district in Singapore (> 48% financial services ➢ TMT (technology, media and telecommunications) and flexible workspace operators exposure), with the most premium buildings. have emerged as fast-growing sectors in recent years, and we recommend Shenton Way/Tanjong Pagar micro-market for its modern new builds, and high accessibility; ➢ Professional Services, comprising legal, real estate, consultancy services occupiers should Shenton Way/ locate in Raffles Place/New Downtown (Grade A), balancing rents and accessibility; ➢ Resources, energy and commodities should stay in City Hall given a stronger cluster; Tanjong Pagar ➢ Consumer is recommended to locate in Orchard for its proximity to distribution channels. -

Circular Dated 27 September 2019

CIRCULAR DATED 27 SEPTEMBER 2019 MAPLETREE COMMERCIAL TRUST THIS CIRCULAR IS IMPORTANT AND REQUIRES Acquisition of Mapletree Business City (Phase 2) (Constituted in the Republic of Singapore pursuant to YOUR IMMEDIATE ATTENTION. and the Common Premises a Trust Deed dated 25 August 2005 (as amended)) The Property Mapletree Business City (Phase 2) located at 40, 50, 60, 70, 80 Pasir Panjang Road including the common property (carpark, landscape areas, driveways and walkways) Common Premises comprising the common carpark, multi-purpose hall, retail area and common property (including the landscape areas, driveways and walkways) located at 10, 20, 30 Pasir Panjang Road Year of Completion 2016 (the Common Premises were completed in 2010) Agreed Property Value S$1,550 million Valuation Savills: S$1,552 million CBRE: S$1,560 million – Business Park: S$1,520 million – Business Park: S$1,530 million – Retail: S$32 million – Retail: S$30 million Land Tenure 99 years leasehold commencing 1 October 1997 Net Lettable Area (“NLA”) 1,184,704 sq ft – Business Park: 1,167,106 sq ft – Retail: 17,598 sq ft Average Passing Rent S$6.15 psf per month(1) Committed Occupancy 99.4%(1) Weighted Average Lease 2.9 years(2) Expiry (“WALE”) Singapore Exchange Securities Trading Limited (the “SGX-ST”) takes no CIRCULAR TO UNITHOLDERS IN RELATION TO: responsibility for the accuracy of any statements or opinions made, or reports contained, in this Circular. If you are in any doubt as to the action (1) THE PROPOSED ACQUISITION OF THE PROPERTY you should take, you should consult your stockbroker, bank manager, (COMPRISING MAPLETREE BUSINESS CITY (PHASE 2) AND solicitor, accountant or other professional adviser immediately. -

Rental List 2016.Xlsx

Rental Guide - Summary of Asking Rates Raffles Place / Marina Bay Tanjong Pagar 6 Battery Road $9.50 - $15.00 Finexis Building Full 78 Shenton Way $7.80 20 Collyer Quay $12.00 - $14.00 GB Building $7.00 79 Anson Road $8.00 55 Market Street $8.50 Grace Global Raffles Full ABI Plaza Full Asia Square Tower 1 $16.00 Great Eastern Centre $10.00 Amara Corporate Tower TBC Asia Square Tower 2 $16.00 Hong Leong Building $9.50 Anson Centre Full Bank of China Building Full Keck Seng Tower $7.00 - $7.50 Anson House $9.50 Bharat Building $8.00 PIL Building $8.00 AXA Tower $9.50 Bank of Singapore Centre $10.50 PWC Building $9.50 Fuji Xerox Towers $7.50 - $8.50 Chevron House $9.50 Prudential Tower $10.50 Hub Synergy Point Full Clifford Centre $8.50 Robinson 77 $8.50 International Plaza $6.50 - $7.50 Income@Raffles Full Robinson 112 $7.50 Jit Poh Building $6.50 Maybank Tower Full Robinson Centre $8.50 Keppel Towers $7.00 MBFC Tower 1, 2 & 3 TBC Robinson Point Full Mapletree Anson $9.00 OCBC Centre $9.50+ Samsung Hub $10.00 MAS Building Full OCBC Centre East $9.80 SGX Centre $9.00 St. Andrew's Centre Full Ocean Financial Centre $15.00 SIF Building Full Southpoint Full One Finlayson Green Full Shenton House $5.00 - $6.00 Springleaf Tower $8.00 - $8.50 One George Street $12.00 The Globe Full Tower Fifteen $7.50 One Marina Boulevard Full The Octagon $6.00 - $6.50 Twenty Anson $9.00 One Raffles Place Tower 1 $11.00 - $13.50 Tokio Marine Centre $8.50 One Raffles Place Tower 2 $10.50 - $13.50 Tong Eng Building Full One Raffles Quay North Tower $15.00 City Hall -

Property Portfolio As at 31 Dec 2019 Integrated Development

CapitaLand Property Portfolio as at 31 Dec 2019 Integrated Development Values Country City Property Holding Entity/ Fund/ REIT Note Effective Stake (%) Status Tenure Tenure Expiry Lease Type Currency Valuation as at 30 Jun 2019 Valuation as at 31 Dec 2019 GFA (sqm) (Years) (million) (million) China Beijing Raffles City Beijing Raffles City China Income Ventures Limited 1 55.0 Leasehold 2046 Retail RMB 6,167 6,186 110,996 2056 Integrated Use - Chengdu CapitaMall Tianfu CapitaLand Mall China Development Fund III 50.0 Leasehold 2048 Commercial RMB 2,908 2,925 194,114 CapitaMall Tianfu* 2078 Residential Raffles City Chengdu Raffles City China Income Ventures Limited 1 55.0 Leasehold 2046 RMB 4,549 4,552 242,086 Chongqing Raffles City Chongqing 2 100.0 A Leasehold 2057 Commercial RMB 8,108 10,278 758,169 2087 Residential - - Hangzhou Raffles City Hangzhou Raffles City China Income Ventures Limited 1 55.0 Leasehold 2049 RMB 5,793 5,859 282,177 Ningbo Raffles City Ningbo Raffles City China Income Ventures Limited 1 55.0 Leasehold 2047 RMB 2,168 2,191 101,405 Y-Town 100.0 Leasehold 2057 RMB 114 130 24,173 Shanghai Capital Square 70.0 Leasehold 2052 Retail RMB 3,002 3,015 70,206 2062 Office - CapitaMall Hongkou CapitaLand and CapitaLand Mall China Income Fund I 72.5 Leasehold 2057 RMB 9,398 9,449 202,145 CapitaMall LuOne CapitaLand Mall China Development Fund III 33.0 A Leasehold 2056 RMB 5,301 5,429 130,085 CapitaMall Minhang CapitaLand and CapitaLand Mall China Income Fund II 65.0 Leasehold 2053 RMB 4,896 4,971 144,915 Raffles City · The Bund -

Capitaland Commercial Trust Singapore’S First Commercial REIT

CapitaLand Commercial Trust Singapore’s First Commercial REIT Third Quarter 2016 Financial Results Wednesday, 19 October 2016 1 Important Notice This presentation shall be read in conjunction with CCT’s 3Q 2016 Unaudited Financial Statement Announcement. The past performance of CCT is not indicative of the future performance of CCT. Similarly, the past performance of CapitaLand Commercial Trust Management Limited, the manager of CCT is not indicative of the future performance of the Manager. The value of units in CCT (CCT Units) and the income derived from them may fall as well as rise. The CCT Units are not obligations of, deposits in, or guaranteed by, the CCT Manager. An investment in the CCT Units is subject to investment risks, including the possible loss of the principal amount invested. Investors have no right to request that the CCT Manager redeem or purchase their CCT Units while the CCT Units are listed. It is intended that holders of the CCT Units may only deal in their CCT Units through trading on Singapore Exchange Securities Trading Limited (SGX-ST). Listing of the CCT Units on the SGX-ST does not guarantee a liquid market for the CCT Units. This presentation may contain forward-looking statements that involve assumptions, risks and uncertainties. Actual future performance, outcomes and results may differ materially from those expressed in forward- looking statements as a result of a number of risks, uncertainties and assumptions. Representative examples of these factors include (without limitation) general industry and economic conditions, interest rate trends, cost of capital and capital availability, competition from other developments or companies, shifts in expected levels of occupancy rate, property rental income, charge out collections, changes in operating expenses (including employee wages, benefits and training costs), governmental and public policy changes and the continued availability of financing in the amounts and the terms necessary to support future business.