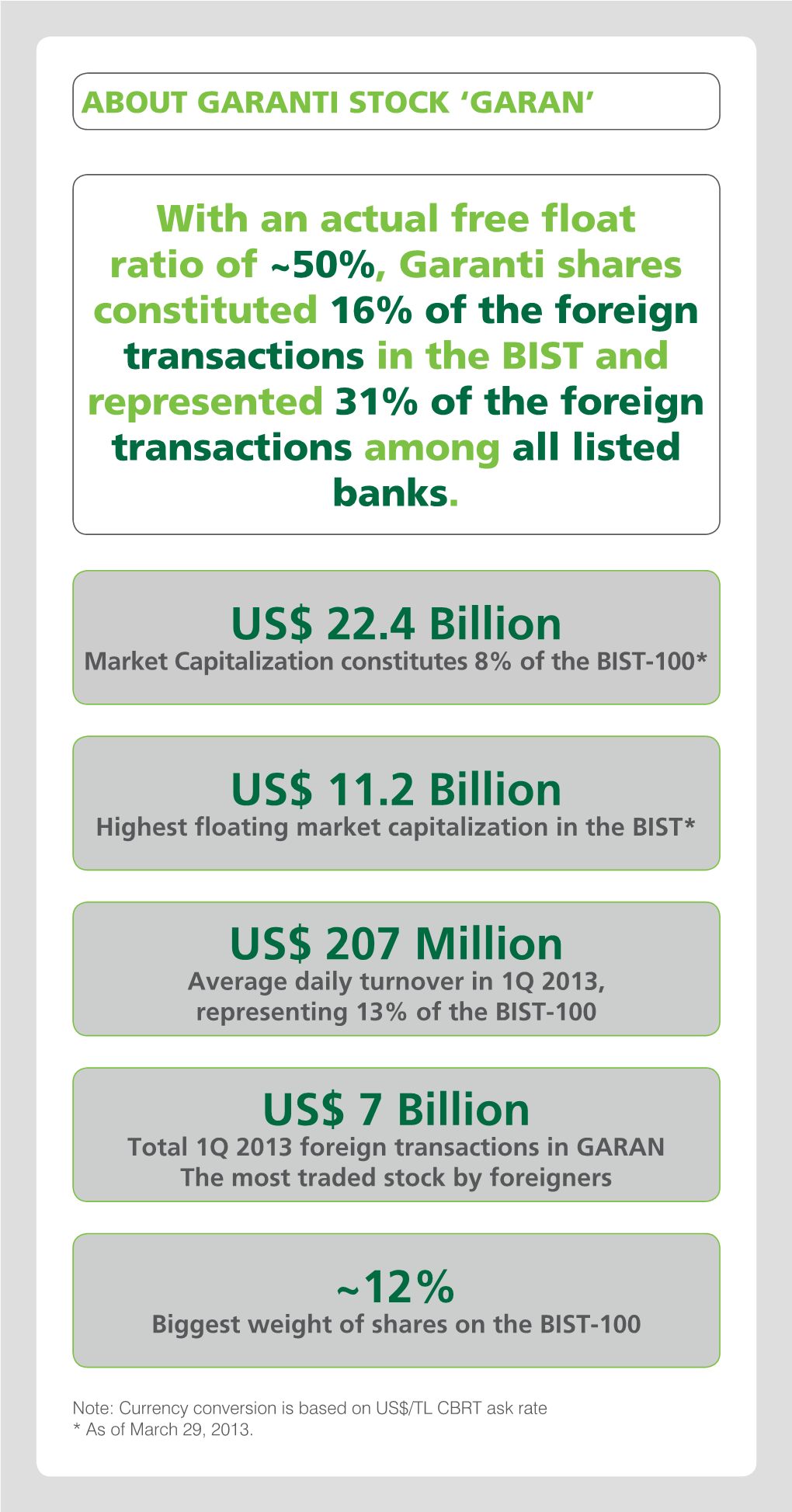

US$ 22.4 Billion US$ 11.2 Billion US

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Financial Health

About Our Value Our 2020 Material Financial Reaching Operational Data and The Best and Most Corporate Financial Reports Introduction Sustainability 100 Garanti BBVA Creation Issue: COVID-19 Health More Customers Excellence Technology Engaged Team Governance and Appendix 101 2020 PERFORMANCE IN STRATEGIC PRIORITIES AND OUTLOOK BURAK ALİ GÖÇER CEO - Garanti BBVA Pension FINANCIAL ELİF GÜVENEN Director - Corporate Brand Management HEALTH and Marketing Communication HÜLYA TÜRKMEN Director - Customer Experience and Satisfaction ZEYNEP ÖZER YILDIRIM Istanbul, Kozyatağı Commercial Branch Manager MAHMUT KAYA CEO - Garanti BBVA Asset Management Scan the QR code to watch the video. TRUST PIONEER SUSTAINABILITY RESPONSIBILTY EXPERIENCE TRANSPARENCY SUCCESS AGILITY EMPATHY DIGITALIZATION Garanti BBVA | Integrated Annual Report 2020 Garanti BBVA | Integrated Annual Report 2020 About Our Value Our 2020 Material Financial Introduction Sustainability 102 Garanti BBVA Creation Issue: COVID-19 Health Financial 7,307 37 min 12 customer Health Related Material Value Drivers Indicators 2019 2020 Topics OFFER OUR CUSTOMERS New and updated products, services and channels SOLUTIONS AND SUGGESTIONS that aim to support the customers in terms of 5 5 THAT CATER TO THEIR NEEDS SO managing their financials AS TO HELP THEM ATTAIN THEIR Customers informed about their financial positions 85% 92% GOALS Disabled-friendly Garanti BBVA ATMs 5,214 5,276 FINANCIAL ADVISORY TO OUR Customers that started using saving products 943,541 898,212 #3 BUSINESS CUSTOMERS TO HELP THEM -

The Cause of Misfire in Counter-Terrorist Financing Regulation

UNIVERSITY OF CALIFORNIA RIVERSIDE Making a Killing: The Cause of Misfire in Counter-Terrorist Financing Regulation A Dissertation submitted in partial satisfaction of the requirements for the degree of Doctor of Philosophy in Political Science by Ian Oxnevad June 2019 Dissertation Committee: Dr. John Cioffi, Chairperson Dr. Marissa Brookes Dr. Fariba Zarinebaf Copyright by Ian Oxnevad 2019 The Dissertation of Ian Oxnevad is approved: ________________________________________________ ________________________________________________ ________________________________________________ Committee Chairperson University of California, Riverside ABSTRACT OF THE DISSERTATION Making a Killing: The Cause of Misfire in Counter-Terrorist Financing Regulation by Ian Oxnevad Doctor of Philosophy, Graduate Program in Political Science University of California, Riverside, June 2019 Dr. John Cioffi, Chairperson Financial regulations designed to counter the financing of terrorism have spread internationally over past several decades, but little is known about their effectiveness or why certain banks get penalized for financing terrorism while others do not. This research addresses this question and tests for the effects of institutional linkages between banks and states on the enforcement of these regulations. It is hypothesized here that a bank’s institutional link to its home state is necessary to block attempted enforcement. This research utilizes comparative studies of cases in which enforcement and penalization were attempted, and examines the role of institutional links between the bank and state in these outcomes. The case comparisons include five cases in all, with three comprising positive cases in which enforcement was blocked, and two in which penalty occurred. Combined, these cases control for rival variables such as rule of law, state capacity, iv authoritarianism, and membership of a country in a regulatory body while also testing for the impact of institutional linkage between a bank and its state in the country’s national political economy. -

Yös -2020 Hatali Iban Bilgisi Olan Öğrenci Listesi

YÖS -2020 HATALI IBAN BİLGİSİ OLAN ÖĞRENCİ LİSTESİ Öğrencinin Dikkatine:İade işlemleri yapılmış ancak IBAN numarası ile iade edilecek kişi adı/soyadı uyuşmazlığı veya ıban numarasının hatalı girilmesi nedeniyle iadeler ödeme biriminden geri gelmiştir. Dikkat edilmesi gereken hususlar: • İadelerin yapılabilmesi için mutlaka IBAN numarası verilmelidir. • İade edilecek kişinin ad/soyad bilgileri ve bu kişiye ait IBAN numarasının uyuşması gerekmektedir. • Yapılacak iade Türk Lirası ise verilen IBAN numarasının TR dahil 26 hane olması gerekmektedir. • Yapılacak iade tutarının para cinsine göre (Örnek:TL.-USD-AVRO) banka IBAN numarası verilmesi gerekmektedir. YÖS-2020 HATALI IBAN BİLGİSİ OLAN ÖĞRENCİ LİSTESİ ADAY KREDİ KARTI S.N. NO NO ÖĞRENCİ ADI/SOYADI HESAP SAHİBİ ADI/SOYADI İBAN NO BANKA ADI BIC/SWIFT NO 1 758874 387204 Sarkhan Mammadzada ELVIRA MAMMADOVA AZ03AIIB45810019442100005121 KAPİTAL BANK AIIBAZ2X 2 761418 389292 DAIANA HAMMADI MUHAMMED YUSUF TR6600015001580073083707310 VAKIF BANKASI 3 758245 386790 Karina Panayeva KARİNA PANAYEVA KZ76722C000033463013 KASPİ.KZ 273 4 757255 386232 meryem bircan MERYEM BİRCAN TR730001000749836073465001 ZİRAAT BANKASI SPARKASSE HAMELN- 5 757807 386579 DAMLA CAKA DAMLA CAKA DE86 2545 0110 0160 1387 15 WESERBERGLAND NOLADE21SWB 6 758957 387265 AYSAN FAHIMI AYSAN FAHİMİ IR6037701491151079 KESHAVARZİ 7 750454 391789 GÜNAY SÜRMELİOĞLU GÜNAY SÜRMELİOĞLU TR410001001690867468685004 ZİRAAT BANKASI 8 758411 387868 ALMINA CHAISMAILOVA AYŞE ALİSOY TR10006701000000073994618 YAPIKREDİ GHAZALEH 9 757560 386421 ILIA -

Premailer Middle East 2021

Bonds, Loans Shangri-La Bosphorus, Istanbul & Sukuk Turkey 2021 Turkey’s largest capital markets event www.bondsloansturkey.com 93% 50+ 20% 250+ DIRECTOR LEVEL OR ABOVE REGIONAL & INTERNATIONAL SOVEREIGN, CORPORATE & INDUSTRY EXPERT SPEAKERS BANKS ATTENDED FI BORROWERS Bonds, Loans & Sukuk Turkey has become the meeting point of all important players in finance through the correct mix of its participants, and its reliability with continuity of successful organisations in the last consecutive years Selahattin BİLGEN, IGA Airport PLATINUM SPONSOR GOLD SPONSOR BRONZE SPONSORS WELCOME TO THE ANNUAL MEETING PLACE FOR TURKEY’S FINANCE PROFESSIONALS Bonds, Loans & Sukuk Turkey is the country’s largest capital markets event. It is the only event to combine discussions across the Bond, Loans and Sukuk markets, making it a “must attend” event for the country’s leading CEOs, CFOs and Treasurers. With over 65% of the audience representing issuers and borrowers and over 93% being director level or above, it is the place where live deals are discussed and mandates are won each year. As a speaker, I had a dynamic discussion which was a great experience. Overall, the organisation was great and attracted an invaluable list of attendees. Orhan Kaya, ICBC Turkey SAVE YOURSELF SHOWCASE YOUR INCREASE TIME AND MONEY EXPERTISE IN THE REGION AWARENESS get the attendee list 2 weeks by presenting a case study by taking an exhibition space before the event so you can to a room full of potential and demonstrating your pre-arrange meetings. clients. products and services. WIN MORE INCREASE YOUR BUSINESS BRANDS PRESENCE packages include a number through the numerous of staff passes so you can branding opportunities cover more clients. -

Turkey RISK & COMPLIANCE REPORT DATE: March 2018

Turkey RISK & COMPLIANCE REPORT DATE: March 2018 KNOWYOURCOUNTRY Executive Summary - Turkey Sanctions: None FAFT list of AML No Deficient Countries US Dept of State Money Laundering assessment Higher Risk Areas: Not on EU White list equivalent jurisdictions Failed States Index (Political)(Average score) Weakness in Government Legislation to combat Money Laundering Medium Risk Areas: Corruption Index (Transparency International & W.G.I.)) World Governance Indicators (Average score) Compliance of OECD Global Forum’s information exchange standard Major Investment Areas: Agriculture - products: tobacco, cotton, grain, olives, sugar beets, hazelnuts, pulses, citrus; livestock Industries: textiles, food processing, autos, electronics, mining (coal, chromate, copper, boron), steel, petroleum, construction, lumber, paper Exports - commodities: apparel, foodstuffs, textiles, metal manufactures, transport equipment Exports - partners: Germany 10.3%, Iraq 6.2%, UK 6%, Italy 5.8%, France 5%, Russia 4.4% (2011) Imports - commodities: machinery, chemicals, semi-finished goods, fuels, transport equipment Imports - partners: Russia 9.9%, Germany 9.5%, China 9%, US 6.7%, Italy 5.6%, Iran 5.2% (2011) 2 Investment Restrictions: The Government of Turkey (GOT) has developed specific strategies for 24 industrial sectors, including eight priority sectors. It has also established specific plans for physical infrastructure upgrades, as well as a major expansion of Turkey’s health, information technology, and education sectors, all of which are geared to make the Turkish workforce and companies more competitive. GOT recognizes that the domestic economy alone will not be sufficient to reach these goals and that Turkey will need to attract significant new foreign direct investment (FDI). Foreign-owned interests in the petroleum, mining, broadcasting, maritime transportation, and aviation sectors are subject to special regulatory requirements. -

2019 Annual Report

2019 ANNUAL REPORT “A VEHICLE SUITS EVERYONE IS AVAILABLE AT GARANTI BBVA FLEET.” ABOUT GARANTI BBVA FLEET CONTENTS 4 Independent Auditor Report on 48 RISKS AND ASSESSMENTS OF THE BOARD OF DIRECTORS Annual Activity Report by Board of Directors 50 Sectoral Risks 50 Risks from Products and Services 6 ABOUT GARANTI BBVA FLEET 51 Risks Related to the Determination of Used Car Price (RV) 8 Our Vision - Our Mission - Our Strategy 51 Risks Related to the Second Hand Vehicle Sales 9 Our Values 52 Risks Arising from External Factors 10 Corporate Profile 52 Financial Risks 11 Accounting Period 54 Committees 11 Approval of Annual Report 56 Meetings of the Board of Directors 11 Statement of Responsibility 56 Administrative Sanctions and Penalties 11 Shareholder Structure 56 Assessment of Financial Situation, Profitability and Solvency of Indemnity 12 Organizational Structure 56 Grants and Donations 14 Board of Directors 56 The Suits Filed Against the Company and Their Possible Results 18 Senior Management 56 Remarks on the Private Auditing and Public Auditing 20 Message from the Chairman 57 Amendments on Articles of Association 22 Message from the General Manager 57 Significant Events Occurring Up to the Date of the General Assembly Meeting, in which the Relevant Financial Statements Shall Be Discussed, from the Closure of the 24 HUMAN RESOURCES AND TRAINING Accounting Period 26 Human Resources 57 General Assemblies held yearly 3 27 Training Types Training Made During the Year 57 Significant Purchase/Sales of Assets 27 Training Made During the Year -

Vulnerability Analysis of Turkish Banks Using Stress Testing and Internal Credit Rating Approach

Journal of Economics, Finance and Accounting – JEFA (2020), Vol.7(2),p.103-119 Ghazavi, Bayraktar Tur VULNERABILITY ANALYSIS OF TURKISH BANKS USING STRESS TESTING AND INTERNAL CREDIT RATING APPROACH DOI: 10.17261/Pressacademia.2020.1207 JEFA- V.7-ISS.2-2020(4)-p.103-119 Masoud Ghazavi1, Sema Bayraktar Tur2 1Financial Specialist, Bank Mellat Headquarters, Tehran, Iran. [email protected] , ORCID: 0000-0002-3973-1076 2Istanbul Bilgi University, Department of Banking and Finance Istanbul, Turkey. [email protected], ORCID: 0000-0002-7564-4148 Date Received: April 2, 2020 Date Accepted: June 15, 2020 To cite this document Ghazavi, M., Tur, S.B,, (2020). Vulnerability analysis of Turkish banks using stress testing and internal credit rating approach. Journal of Economics, Finance and Accounting (JEFA), V.7(2), p.103-119. Permanent link to this document: http://doi.org/10.17261/Pressacademia.2020.1207 Copyright: Published by PressAcademia and limited licensed re-use rights only. ABSTRACT Purpose- This study examines the performance and financial vulnerability of twelve Turkish banks for 2019. Methodology - Stress testing identifies the impact of extreme expected and unexpected shocks to a bank’s capital, provides an assessment of its financial strength to withstand shocks and helps to spot emerging risk(s) and uncover weak spots in the financial institution. It enables banks in identifying their vulnerabilities at an early stage. In addition to stress testing, as for Internal Credit Rating (ICR), some financial ratios have been selected to assess the performance of each bank within banking industry. Findings- All banks in 2019 are within the standard classification of ICR rating except for Şekerbank. -

Monthly Equity Strategy

Equity Strategy June 05, 2012 Monthly Equity Strategy Selling pressure rose in May… Research Team HOLD +90 (212) 334 33 33 [email protected] Following the strong first quarter fuelled by increased risk appetite in developed markets, sentiment has Facts & Figures Close MoM again turned negative over the past two months. The ISE - 100, TRY 55,099 -8.18 mood in the market went south in April on news from ISE - 100, USD 29,939 -12.75 the U.S., while sales accelerated in May on increased Total Volume, TRY mn 43,471 -69.14 uncertainty following the elections in France and Greece. In addition to this, the inability to establish a MSCI EM Turkey 413,199 -13.0% government in Athens, and the emergent likelihood of MSCI EM 906 -11.7% its exit from the euro increased selling pressure in the Benchmark Bond 9.45% -13 bps stock market in May. The ISE-100 index, remaining relatively strong compared to international peers in USD/TL 1.8404 5.23% April, was also buffeted by international sell-off winds EUR/TL 2.2840 -1.26% in the last month. The ISE-100 index, which started the P/E Current month of May at 60,000 levels, has, aside from negative developments in foreign markets, been affected by ISE - 100 10.2 S&P’s downgrading of the country outlook from positive Banking 7.9 to ‘stable’, and Fitch’s statement that the period Industrial 13.2 leading to Turkey’s uptick to investment grade would Steel 8.4 be longer than expected, and retreated to 54,000 levels. -

Turkey's Largest Capital Markets Event

Book your place before 5th September to SAVE £200 enter code DM1 at www.BondsLoansTurkey.com Turkey’s largest capital markets event Platinum Sponsors Gold Sponsors Lunch Sponsor Silver Sponsor Bronze Sponsors WELCOME TO Bonds, Loans & Sukuk Turkey 2018 REASONS TO ATTEND 1 Hear global investors’ analysis of the opportunities in the market from: BlueBay, Barings, Manulife 2 Gain an economist’s assessment of Turkey’s macroeconomic fundamentals: Find out which external factors are likely to impact Turkey over the next 2 years 520+ 3 Discover how issuers are hedging against FX volatility, attendees and what companies are doing with existing hard 95% currency debt Director level 4 Uncover which markets offer borrowers and issuers or above the best options, hear from: Medical Park, Vakıf Emeklilik, Bank ABC, HSBC and Emirates NBD 5 Network with 520+ senior stakeholders from the Turkish Capital Markets: 95% are Director level or above 63% Corporate & Bonds, Loans & Sukuk Turkey is a fantastic event where I can see many financial institutions and colleagues from all over the world. It also FI Issuers and provides a useful market update, covering the latest developments in the Borrowers, Turkish Capital Markets. 70+ Muzaffer Aksoy, Bank ABC Investors and speakers 2 Government Senior Level Speakers include Semih Ergür, Naz Masraff, Timothy Ash, Murat Ucer, Chief Executive Officer, Director of Europe, Senior EM Sovereign Strategist, Economist, IC Holding Eurasia Group BlueBay Asset Management GlobalSource Partners Burcu Ozturk, Burcu Geris Richard -

2Q19 Earnings Preview

July 22, 2019 2Q19 Earnings Preview Flat spreads with no major asset quality problem TL mn 2Q19E 1Q19 2Q18 Chg. QoQ Chg. YoY Banks will begin announcing their 2Q19 earnings on July 25, spearheaded by Akbank. The deadline for the BRSA AKBNK 1,201 1413 1602 -15% -25% results is August 19. We estimate a total net profit of TL4.1bn for the banks HALKB 315 305 1113 3% -72% under our coverage in 2Q19, implying a 23% qoq and 39% yoy decline. ISCTR 934 1458 1528 -36% -39% The main highlights of 2Q19 are: i) flattish core lending spread qoq, ii) almost zero loan growth iii) drop in COR, despite a 30bps rise in NPL ratio VAKBN 400 651 1074 -39% -63% Akbank and Yapi Kredi have distinguished themselves YKBNK 1,020 1241 1227 -18% -17% from their peers on the back of relatively solid spreads supported by declining deposit costs. TSKB 191 185 166 3% 15% Main highlights of the quarter: FX-adjusted loan growth is almost zero in 2Q19, vs. 3.9% Total 4,060 5,254 6,710 -23% -39% in 1Q19, in which the decline in SME loans is partially compensated for by retail loan growth. Looking at the stock values, TL lending spreads are P/E (x) P/BV (x) ROE % almost stable, despite the rise in deposit rates. That said, the FX lending spread is also supportive due to the currency impact. 19-June- 2019E 2020E 2019E 2020E 2019E 2020E 19 The sector’s swap average volumes increased from USD37bn in 1Q19 to USD46bn in 2Q19, mainly due to the heavy swap usage of state banks. -

Fitch Affirms 4 Large Privately-Owned Turkish Banks

FITCH AFFIRMS 4 LARGE PRIVATELY-OWNED TURKISH BANKS Fitch Ratings-London-10 June 2016: Fitch Ratings has affirmed the IDRs, Viability Ratings (VRs) and Support Ratings of Turkiye Is Bankasi (Isbank), Akbank T.A.S. (Akbank), Yapi ve Kredi Bankasi (YKB) and Turkiye Garanti Bankasi (Garanti). The Outlook on YKB's Long-Term IDRs is Negative. The Outlooks on Akbank's, Isbank's and Garanti's Long-Term IDRs are Stable. A full list of rating actions is at the end of this rating action commentary. Isbank and Akbank's 'BBB-' Long-term IDRs are driven by their standalone creditworthiness, as reflected by their 'bbb-' VRs. Garanti's and YKB's 'BBB' Long-term IDRs are driven by potential support from their controlling shareholders, Banco Bilbao Vizcaya Argentaria (A-/Stable) and Unicredit (BBB+/Negative), respectively. YKB's ratings are sensitive not just to Unicredit's ratings, but also to any decision by Unicredit to reduce or sell its stake in the bank. The ratings of all four banks' subsidiaries are equalised with those of their parent institutions. Consequently, the Long-term IDRs of the subsidiaries of Isbank, Akbank and Garanti have been affirmed with Stable Outlooks, while the Outlooks on YKB's subsidiaries are Negative. KEY RATING DRIVERS: IDRS, NATIONAL RATINGS AND DEBT RATINGS OF ISBANK AND AKBANK; VRS OF ALL FOUR BANKS The 'bbb-' VRs of all four banks continue to reflect their still reasonable financial metrics in terms of performance and capitalisation, notwithstanding some weakening in 2015. They also consider the banks' strong franchises, which mean that any moderate deterioration in the operating environment should be manageable, in Fitch's view. -

As Defined in Regulation S) Outside of the U.S

IMPORTANT NOTICE OFFERINGS UNDER THE PROGRAMME ARE AVAILABLE ONLY TO INVESTORS WHO ARE PERSONS OTHER THAN U.S. PERSONS (AS DEFINED IN REGULATION S) OUTSIDE OF THE U.S. IMPORTANT: You must read the following before continuing. The following applies to the Base Prospectus following this page, and you are therefore advised to read this carefully before reading, accessing or making any other use of the Base Prospectus. In accessing the Base Prospectus, you agree to be bound by the following terms and conditions, including any modifications to them any time you receive any information from the Bank as a result of such access. NOTHING IN THIS ELECTRONIC TRANSMISSION CONSTITUTES AN OFFER OF SECURITIES FOR SALE IN THE UNITED STATES OR ANY JURISDICTION WHERE IT IS UNLAWFUL TO DO SO. SECURITIES OFFERED UNDER THE PROGRAMME HAVE NOT BEEN, AND WILL NOT BE, REGISTERED UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR THE SECURITIES LAWS OF ANY STATE OF THE U.S. OR OTHER JURISDICTION AND THE SECURITIES MAY NOT BE OFFERED OR SOLD WITHIN THE U.S. OR TO, OR FOR THE ACCOUNT OR BENEFIT OF, U.S. PERSONS (AS DEFINED IN REGULATION S (“REGULATION S”) UNDER THE SECURITIES ACT), EXCEPT PURSUANT TO AN EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND APPLICABLE STATE OR LOCAL SECURITIES LAWS. THE FOLLOWING BASE PROSPECTUS MAY NOT BE FORWARDED OR DISTRIBUTED TO ANY OTHER PERSON AND MAY NOT BE REPRODUCED IN ANY MANNER WHATSOEVER AND IN PARTICULAR MAY NOT BE FORWARDED TO ANY U.S.