2020 Leap Year Highlights

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Mathematics of the Chinese, Indian, Islamic and Gregorian Calendars

Heavenly Mathematics: The Mathematics of the Chinese, Indian, Islamic and Gregorian Calendars Helmer Aslaksen Department of Mathematics National University of Singapore [email protected] www.math.nus.edu.sg/aslaksen/ www.chinesecalendar.net 1 Public Holidays There are 11 public holidays in Singapore. Three of them are secular. 1. New Year’s Day 2. Labour Day 3. National Day The remaining eight cultural, racial or reli- gious holidays consist of two Chinese, two Muslim, two Indian and two Christian. 2 Cultural, Racial or Religious Holidays 1. Chinese New Year and day after 2. Good Friday 3. Vesak Day 4. Deepavali 5. Christmas Day 6. Hari Raya Puasa 7. Hari Raya Haji Listed in order, except for the Muslim hol- idays, which can occur anytime during the year. Christmas Day falls on a fixed date, but all the others move. 3 A Quick Course in Astronomy The Earth revolves counterclockwise around the Sun in an elliptical orbit. The Earth ro- tates counterclockwise around an axis that is tilted 23.5 degrees. March equinox June December solstice solstice September equinox E E N S N S W W June equi Dec June equi Dec sol sol sol sol Beijing Singapore In the northern hemisphere, the day will be longest at the June solstice and shortest at the December solstice. At the two equinoxes day and night will be equally long. The equi- noxes and solstices are called the seasonal markers. 4 The Year The tropical year (or solar year) is the time from one March equinox to the next. The mean value is 365.2422 days. -

Islamic Calendar from Wikipedia, the Free Encyclopedia

Islamic calendar From Wikipedia, the free encyclopedia -at اﻟﺘﻘﻮﻳﻢ اﻟﻬﺠﺮي :The Islamic, Muslim, or Hijri calendar (Arabic taqwīm al-hijrī) is a lunar calendar consisting of 12 months in a year of 354 or 355 days. It is used (often alongside the Gregorian calendar) to date events in many Muslim countries. It is also used by Muslims to determine the proper days of Islamic holidays and rituals, such as the annual period of fasting and the proper time for the pilgrimage to Mecca. The Islamic calendar employs the Hijri era whose epoch was Islamic Calendar stamp issued at King retrospectively established as the Islamic New Year of AD 622. During Khaled airport (10 Rajab 1428 / 24 July that year, Muhammad and his followers migrated from Mecca to 2007) Yathrib (now Medina) and established the first Muslim community (ummah), an event commemorated as the Hijra. In the West, dates in this era are usually denoted AH (Latin: Anno Hegirae, "in the year of the Hijra") in parallel with the Christian (AD) and Jewish eras (AM). In Muslim countries, it is also sometimes denoted as H[1] from its Arabic form ( [In English, years prior to the Hijra are reckoned as BH ("Before the Hijra").[2 .(ﻫـ abbreviated , َﺳﻨﺔ ﻫِ ْﺠﺮﻳّﺔ The current Islamic year is 1438 AH. In the Gregorian calendar, 1438 AH runs from approximately 3 October 2016 to 21 September 2017.[3] Contents 1 Months 1.1 Length of months 2 Days of the week 3 History 3.1 Pre-Islamic calendar 3.2 Prohibiting Nasī’ 4 Year numbering 5 Astronomical considerations 6 Theological considerations 7 Astronomical -

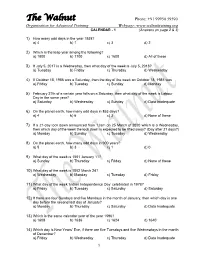

CALENDAR - 1 (Answers on Page 2 & 3)

The Walnut Phone: +91 99950 59590 Organisation for Advanced Training Webpage: www.walnuttraining.org CALENDAR - 1 (Answers on page 2 & 3) 1) How many odd days in the year 1938? a) 4 b) 1 c) 3 d) 2 2) Which is the leap year among the following? a) 1800 b) 1100 c) 1600 d) All of these 3) If July 5, 2017 is a Wednesday, then what day of the week is July 5, 2018? a) Tuesday b) Friday c) Thursday d) Wednesday 4) If October 18, 1986 was a Saturday, then the day of the week on October 18, 1985 was a) Friday b) Tuesday c) Sunday d) Monday 5) February 27th of a certain year falls on a Saturday, then what day of the week is Labour Day in the same year? a) Saturday b) Wednesday c) Sunday d) Data Inadequate 6) On the planet earth, how many odd days in 853 days? a) 4 b) 6 c) 3 d) None of these 7) If a 21-day lock down announced from 12am on 25 March of 2020 which is a Wednesday, then which day of the week the lock down is expected to be lifted away? (Day after 21 days?) a) Monday b) Sunday c) Tuesday d) Wednesday 8) On the planet earth, how many odd days in 900 years? a) 5 b) 3 c) 1 d) 0 9) What day of the week is 1501 January 11? a) Sunday b) Thursday c) Friday d) None of these 10) What day of the week is 1802 March 24? a) Wednesday b) Monday c) Tuesday d) Friday 11) What day of the week ‘Indian Independence Day’ celebrated in 1978? a) Friday b) Tuesday c) Saturday d) Saturday 12) If there are four Sundays and five Mondays in the month of January, then which day is one day before the second last day of January? a) Monday b) Thursday c) Saturday d) Data Inadequate 13) Which is the same calendar year of the year 1596? a) 1608 b) 1636 c) 1624 d) 1640 14) Which day is New Years’ Eve, if there are five Tuesdays and five Wednesdays in the month of December? a) Friday b) Wednesday c) Thursday d) Data Inadequate 1 The Walnut Phone: +91 99950 59590 Organisation for Advanced Training Webpage: www.walnuttraining.org Basic facts of calendars (Answers next page): 1) Odd Days Number of days more than the complete weeks, are called odd days in a given period. -

How Long Is a Year.Pdf

How Long Is A Year? Dr. Bryan Mendez Space Sciences Laboratory UC Berkeley Keeping Time The basic unit of time is a Day. Different starting points: • Sunrise, • Noon, • Sunset, • Midnight tied to the Sun’s motion. Universal Time uses midnight as the starting point of a day. Length: sunrise to sunrise, sunset to sunset? Day Noon to noon – The seasonal motion of the Sun changes its rise and set times, so sunrise to sunrise would be a variable measure. Noon to noon is far more constant. Noon: time of the Sun’s transit of the meridian Stellarium View and measure a day Day Aday is caused by Earth’s motion: spinning on an axis and orbiting around the Sun. Earth’s spin is very regular (daily variations on the order of a few milliseconds, due to internal rearrangement of Earth’s mass and external gravitational forces primarily from the Moon and Sun). Synodic Day Noon to noon = synodic or solar day (point 1 to 3). This is not the time for one complete spin of Earth (1 to 2). Because Earth also orbits at the same time as it is spinning, it takes a little extra time for the Sun to come back to noon after one complete spin. Because the orbit is elliptical, when Earth is closest to the Sun it is moving faster, and it takes longer to bring the Sun back around to noon. When Earth is farther it moves slower and it takes less time to rotate the Sun back to noon. Mean Solar Day is an average of the amount time it takes to go from noon to noon throughout an orbit = 24 Hours Real solar day varies by up to 30 seconds depending on the time of year. -

Package 'Lubridate'

Package ‘lubridate’ February 26, 2021 Type Package Title Make Dealing with Dates a Little Easier Version 1.7.10 Maintainer Vitalie Spinu <[email protected]> Description Functions to work with date-times and time-spans: fast and user friendly parsing of date-time data, extraction and updating of components of a date-time (years, months, days, hours, minutes, and seconds), algebraic manipulation on date-time and time-span objects. The 'lubridate' package has a consistent and memorable syntax that makes working with dates easy and fun. Parts of the 'CCTZ' source code, released under the Apache 2.0 License, are included in this package. See <https://github.com/google/cctz> for more details. License GPL (>= 2) URL https://lubridate.tidyverse.org, https://github.com/tidyverse/lubridate BugReports https://github.com/tidyverse/lubridate/issues Depends methods, R (>= 3.2) Imports generics, Rcpp (>= 0.12.13) Suggests covr, knitr, testthat (>= 2.1.0), vctrs (>= 0.3.0), rmarkdown Enhances chron, timeDate, tis, zoo LinkingTo Rcpp VignetteBuilder knitr Encoding UTF-8 LazyData true RoxygenNote 7.1.1 SystemRequirements A system with zoneinfo data (e.g. /usr/share/zoneinfo) as well as a recent-enough C++11 compiler (such as g++-4.8 or later). On Windows the zoneinfo included with R is used. 1 2 R topics documented: Collate 'Dates.r' 'POSIXt.r' 'RcppExports.R' 'util.r' 'parse.r' 'timespans.r' 'intervals.r' 'difftimes.r' 'durations.r' 'periods.r' 'accessors-date.R' 'accessors-day.r' 'accessors-dst.r' 'accessors-hour.r' 'accessors-minute.r' 'accessors-month.r' -

In Interdisciplinary Studies of Climate and History

PERSPECTIVE Theimportanceof“year zero” in interdisciplinary studies of climate and history PERSPECTIVE Ulf Büntgena,b,c,d,1,2 and Clive Oppenheimera,e,1,2 Edited by Jean Jouzel, Laboratoire des Sciences du Climat et de L’Environ, Orme des Merisiers, France, and approved October 21, 2020 (received for review August 28, 2020) The mathematical aberration of the Gregorian chronology’s missing “year zero” retains enduring potential to sow confusion in studies of paleoclimatology and environmental ancient history. The possibility of dating error is especially high when pre-Common Era proxy evidence from tree rings, ice cores, radiocar- bon dates, and documentary sources is integrated. This calls for renewed vigilance, with systematic ref- erence to astronomical time (including year zero) or, at the very least, clarification of the dating scheme(s) employed in individual studies. paleoclimate | year zero | climate reconstructions | dating precision | geoscience The harmonization of astronomical and civil calendars have still not collectively agreed on a calendrical in the depths of human history likely emerged from convention, nor, more generally, is there standardi- the significance of the seasonal cycle for hunting and zation of epochs within and between communities and gathering, agriculture, and navigation. But difficulties disciplines. Ice core specialists and astronomers use arose from the noninteger number of days it takes 2000 CE, while, in dendrochronology, some labora- Earth to complete an orbit of the Sun. In revising their tories develop multimillennial-long tree-ring chronol- 360-d calendar by adding 5 d, the ancient Egyptians ogies with year zero but others do not. Further were able to slow, but not halt, the divergence of confusion emerges from phasing of the extratropical civil and seasonal calendars (1). -

Gauss' Calendar Formula for the Day of the Week

GAUSS’ CALENDAR FORMULA FOR THE DAY OF THE WEEK BERNDT E. SCHWERDTFEGER In memory of my father Martin Walter (1910–1977) ABSTRACT. This paper describes a formula of C. F. GAUSS for calculating the day of the week from the calendar date and gives a conceptual proof. A formula for the Julian day number is derived. My implementation of the formula in REXX and C is included. PREFACE GAUSS’ formula calculates the day of the week, Monday, . , Sunday, from the calendar date year-month-day. I learned about it in 1962 when reading the Mathematical Recreations [2] by MAURICE KRAITCHIK (1882–1957). It is stated there without proof, together with an application to a perpetual calendar. This article explains the formula and its mathematical background, including a proof and the concepts behind the algorithms implemented in the program gauss.c. GAUSS never published his formula; it appeared only in 1927 in his Werke [1, [XI, 1.]. For the convenience of the reader I have included this notice in appendix A.1 Berlin, 11 May 2009 © 2001–2018 Berndt E. Schwerdtfeger v1.4a, 14 November 2018 1. GAUSS’ FORMULAEXPLAINED 1.1. The Gauss formula. Given are d day, m month, y year. We split the year into Æ Æ Æ the century part and the two digit year inside the century. For m 3 it is done for the ¸ year y 100 c g, i.e. c [y/100], g y 100 c, such that 0 g 99. For m 1,2 it is Æ ¢ Å Æ Æ ¡ ¢ · · Æ done for the year y 1 100 c g. -

Calendars from Around the World

Calendars from around the world Written by Alan Longstaff © National Maritime Museum 2005 - Contents - Introduction The astronomical basis of calendars Day Months Years Types of calendar Solar Lunar Luni-solar Sidereal Calendars in history Egypt Megalith culture Mesopotamia Ancient China Republican Rome Julian calendar Medieval Christian calendar Gregorian calendar Calendars today Gregorian Hebrew Islamic Indian Chinese Appendices Appendix 1 - Mean solar day Appendix 2 - Why the sidereal year is not the same length as the tropical year Appendix 3 - Factors affecting the visibility of the new crescent Moon Appendix 4 - Standstills Appendix 5 - Mean solar year - Introduction - All human societies have developed ways to determine the length of the year, when the year should begin, and how to divide the year into manageable units of time, such as months, weeks and days. Many systems for doing this – calendars – have been adopted throughout history. About 40 remain in use today. We cannot know when our ancestors first noted the cyclical events in the heavens that govern our sense of passing time. We have proof that Palaeolithic people thought about and recorded the astronomical cycles that give us our modern calendars. For example, a 30,000 year-old animal bone with gouged symbols resembling the phases of the Moon was discovered in France. It is difficult for many of us to imagine how much more important the cycles of the days, months and seasons must have been for people in the past than today. Most of us never experience the true darkness of night, notice the phases of the Moon or feel the full impact of the seasons. -

How Many Days Are in a Year?

Document ID: 04_21_97_1 Date Received: 1997-04-21 Date Revised: 11/21/97 Date Accepted: 09/05/97 Curriculum Topic Benchmarks: S17.4.1, S17.4.2, S17.4.3, M3.4.2 Grade Level: [9-12] High School Subject Keywords: leap year, year, calendar, error analysis, successive approximations, fractions Rating: moderate How Many Days Are in a Year? By: Evan M Manning, MS 233-305 Jet Propulsion Lab, 4800 Oak Grove Drive, Pasadena CA 91109 e-mail: [email protected] From: The PUMAS Collection http://pumas.jpl.nasa.gov ©1997, California Institute of Technology. ALL RIGHTS RESERVED. Based on U.S. Gov't sponsored research. Calendar design is a classic use of fractions, and is a good application of successive approximations and basic error analysis. Background: The true length of a year on Earth is 365.2422 days, or about 365.25 days. We keep our calendar in sync with the seasons by having most years 365 days long but making just under 1/4 of all years 366-day "leap" years. Exercise: Design a reasonable calendar for an imaginary planet. Your calendar will consist of a pattern of 366-day "leap" years and 365-day regular years that approximates your planet's average number of days per year. Presentation: Give each student a different fractional number of days per year, perhaps using dice. You can also give each planet a whimsical name like "George-world" or "Planet Sue". Some sample year lengths might be 365.1234 days, 365.1119 days, 365.8712 days. Then present the history of the Gregorian Calendar as a story, drawing upon material from the other sections as appropriate. -

The Use of the Eight-Year Cycle in the Early Malay Calendar

International Journal of Academic Research in Business and Social Sciences Vol. 10, No. 11, 2020, E-ISSN: 2222-6990 © 2020 HRMARS The Use of the Eight-Year Cycle in the Early Malay Calendar Baharrudin Zainal, Zurita Mohd Yusoff, Jamalluddin Hashim, Wan Ismail Wan Abdullah To Link this Article: http://dx.doi.org/10.6007/IJARBSS/v10-i11/8200 DOI:10.6007/IJARBSS/v10-i11/8200 Received: 10 September 2020, Revised: 12 October 2020, Accepted: 16 November 2020 Published Online: 29 November 2020 In-Text Citation: (Zainal et al., 2020) To Cite this Article:Zainal, B., Yusoff, Z. M., Hashim, J., & Abdullah, W. I. W. (2020). The use of the Eight-Year Cycle in the Early Malay Calendar. International Journal of Academic Research in Business and Social Sciences, 10(11), 1232–1239. Copyright: © 2020 The Author(s) Published by Human Resource Management Academic Research Society (www.hrmars.com) This article is published under the Creative Commons Attribution (CC BY 4.0) license. Anyone may reproduce, distribute, translate and create derivative works of this article (for both commercial and non-commercial purposes), subject to full attribution to the original publication and authors. The full terms of this license may be seen at: http://creativecommons.org/licences/by/4.0/legalcode Vol. 10, No. 11, 2020, Pg. 1232 - 1239 http://hrmars.com/index.php/pages/detail/IJARBSS JOURNAL HOMEPAGE Full Terms & Conditions of access and use can be found at http://hrmars.com/index.php/pages/detail/publication-ethics 1232 International Journal of Academic Research in Business and Social Sciences Vol. 10, No. -

Calendar Algorithms Given a Date in History, What Day of the Week Was It? First, Some Terminology

2-16-2019 Calendar Algorithms Given a date in history, what day of the week was it? First, some terminology. A sidereal year is the time is takes for the Earth to make 1 revolution around the sun relative to the fixed stars. It is approximately 365.25636 days. The tropical year is the time it takes for the mean tropical longitude of the Sun to increase by 360 degrees. (Due to the increase in the Earth’s precessional rate, the length of the tropical year decreases over time. A tropical year is approximately 365.24220 days. The discrepancy between the sidereal year and the tropical year results from the precession of the Earth’s axis of rotation: The Earth “wobbles” as it rotates. If no allowances were made for this, the seasons would occur at a slightly different time every year. The Egyptian calendar had 365 days in a year. In 45 B.C., the Julian calendar was introduced. It had 365.25 days in a year, the year began in January (there being 12 months instead of the previous 10), and there was a leap year every 4-th year. This calendar loses approximately 1 day every 128 years. By 1582, the calendar was nearly 11 days behind the calendar of 325 A.D. (Nicea). The vernal equinox, which now occurs around March 21, is the instant during spring when the sun “crosses” the Earth’s equatorial plane. The vernal equinox had occurred around March 21 in the year 325; by the year 1582, it was occurring around March 11. -

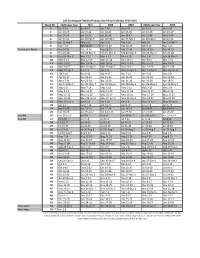

Week No. 2020 Leap Year 2021 2022 2023 2024 Leap Year 2025 1 Jan 3

Old Greenwood Flexible/Primary Use Period Calendar 2020-2025 Week No. 2020 Leap Year 2021 2022 2023 2024 Leap Year 2025 1 Jan 3-10 Jan 8-15 Jan 7-14 Jan 6-13 Jan 5-12 Jan 3-10 2 Jan 10-17 Jan 15-22 Jan 14-21 Jan 13-20 Jan 12-19 Jan 10-17 3 Jan 17-24 Jan 22-29 Jan 21-28 Jan 20-27 Jan 19-26 Jan 17-24 4 Jan 24-31 Jan 29-Feb 5 Jan 28-Feb 4 Jan 27-Feb 3 Jan 26-Feb 2 Jan 24-31 5 Jan 31-Feb 7 Feb 5-12 Feb 4-11 Feb 3-10 Feb 2-9 Jan 31-Feb 7 6 Feb 7-14 Feb 12-19 Feb 11-18 Feb 10-17 Feb 9-16 Feb 7-14 President's Week 7 Feb 14-21 Feb 19-26 Feb 18-25 Feb 17-24 Feb 16-23 Feb 14-21 8 Feb 21-28 Feb 26-Mar 5 Feb 25-Mar 4 Feb 24-Mar 3 Feb 23-Mar 1 Feb 21-28 9 Feb 28-Mar 6 Mar 5-12 Mar 4-11 Mar 3-10 Mar 1-8 Feb 28-Mar 7 10 Mar 6-13 Mar 12-19 Mar 11-18 Mar 10-17 Mar 8-15 Mar 7-14 11 Mar 13-20 Mar 19-26 Mar 18-25 Mar 17-24 Mar 15-22 Mar 14-21 12 Mar 20-27 Mar 26-Apr 2 Mar 25-Apr 1 Mar 24-31 Mar 22-29 Mar 21-28 13 Mar 27-Apr 3 Apr 2-9 Apr 1-8 Mar 31-Apr 7 Mar 29-Apr 5 Mar 28-Apr 4 14 Apr 3-10 Apr 9-16 Apr 8-15 Apr 7-14 Apr 5-12 Apr 4-11 15 Apr 10-17 Apr 16-23 Apr 15-22 Apr 14-21 Apr 12-19 Apr 11-18 16 Apr 17-24 Apr 23-30 Apr 22-29 Apr 21-28 Apr 19-26 Apr 18-25 17 Apr 24-May 1 Apr 30-May 7 Apr 29-May 6 Apr 28-May 5 Apr 26-May 3 Apr 25-May 2 18 May 1-8 May 7-14 May 6-13 May 5-12 May 3-10 May 2-9 19 May 8-15 May 14-21 May 13-20 May 12-19 May 10-17 May 9-16 20 May 15-22 May 21-28 May 20-27 May 19-26 May 17-24 May 16-23 21 May 22-29 May 28-Jun 4 May 27-Jun 3 May 26-Jun 2 May 24-31 May 23-30 22 May 29-Jun 5 Jun 4-11 Jun 3-10 Jun 2-9 May 31-Jun 7 May 30-Jun 6 23