2018 Q3 Management Discussion & Analysis

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Prix Écrans Canadiens : Lauréats Du Gala CTV Honorant Des Productions En Fiction Par Ordre De Présentation Des Catégories

Prix Écrans canadiens : Lauréats du gala CTV honorant des productions en fiction par ordre de présentation des catégories Best Supporting Actor, Drama Anne with an E CBC (CBC) (Northwood Entertainment) R.H. Thomson Best Supporting Actress, Drama Anne with an E CBC (CBC) (Northwood Entertainment) Geraldine James Best Guest Performance, Drama Series Mary Kills People - The Means Global (Corus Entertainment) (Cameron Pictures) Karen Robinson Best Pre-School Program or Series Sponsor | WOW! Unlimited Media Dino Dana TVOKids (TVO) (Sinking Ship Entertainment) J.J. Johnson, Blair Powers, Christin Simms, Matthew J.R. Bishop, Eric Beldowski Best Animated Program or Series Sponsor | WOW! Unlimited Media PAW Patrol TVOKids (TVO) (Spin Master Paw Productions 5 Inc.) Jennifer Dodge, Laura Clunie, Ronnen Harary, Keith Chapman, Scott Kraft, Ursula Ziegler- Sullivan, Toni Stevens, Jonah Stroh, Jason McKenzie, Christina Sang - St. Catherine, David Sharples, Damian Temporale Best Children's or Youth Fiction Program or Series Sponsor | WOW! Unlimited Media Odd Squad TVOKids (TVO) (Sinking Ship Entertainment) J.J. Johnson, Tim McKeon, Blair Powers, Paul Siefken, Matthew J.R. Bishop, Adam Peltzman, Mark De Angelis, Stephen J. Turnbull Best Performance, Children's or Youth Sponsor | WOW! Unlimited Media Odd Squad TVOKids (TVO) (Sinking Ship Entertainment) Anna Cathcart Best Performance, Animation Sponsor | WOW! Unlimited Media The Cat in the Hat Knows A Lot About That! Treehouse TV (Corus Entertainment) (Portfolio Entertainment Inc.) Martin Short Best Photography, -

2025 West Broadway Vancouver, British Columbia V6J 1Z6 NOTICE

WOW UNLIMITED MEDIA INC. 200 – 2025 West Broadway Vancouver, British Columbia V6J 1Z6 NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF THE SHAREHOLDERS OF WOW UNLIMITED MEDIA INC. NOTICE IS HEREBY GIVEN that an annual general and special meeting (the "Meeting") of the holders (the "Shareholders") of: (i) common voting shares (the "Common Voting Shares"); and (ii) variable voting shares (the "Variable Voting Shares" and, together with the Common Voting Shares, the "Shares") in the capital of WOW Unlimited Media Inc. (the "Corporation") will be held by way of a live teleconference, instead of in person at: 877-407-2991 on Thursday, June 17 2021, at 11:00 a.m. (Toronto time) for the following purposes: 1. to receive the audited financial statements of the Corporation for the years ended December 31, 2020 and 2019, together with the auditors' report thereon; 2. to set the number of directors at seven (7) for the ensuing period; 3. to elect directors of the Corporation for the ensuing period; 4. to appoint KPMG LLP, Chartered Professional Accountants, as the auditors of the Corporation for the ensuing year and to authorize the board of directors of the Corporation to fix their remuneration; 5. to consider and, if thought advisable, to pass an ordinary resolution in the form set out in the accompanying management information circular dated May 13, 2021 (the "Information Circular") approving the renewal of the ten percent (10%) rolling stock option plan of the Corporation; and 6. to transact such further or other business as may properly come before the Meeting or any postponements or adjournments thereof. -

A Stock That Makes You Go WOW!

A stock that makes you go WOW! WOW! Unlimited Media Inc. (TSXV: WOW.A | TSXV: WOW.B) is a Canadian-American animation and media holding company. It was formed as a result of the merger betweenRainmaker Studios, Frederator Networks and Ezrin Hirsh Entertainment (EHE). WOW! are focused on the kids and youth market, but let’s face everyone loves kids shows. Rainmaker Studios Rainmaker Studios is a multi-faceted animation studio and one of Canada’s largest producers of computer graphics (‘CG’) animation. Originally established as Mainframe Entertainment, the Company produced the first-ever CG animated series, ReBoot, and over the course of its 15+ years of innovative history, Rainmaker Studios has continued to break new ground in animation. In addition, Rainmaker has produced with partners and clients including Mattel, The Weinstein Company, Hasbro, Lionsgate and Sony. These are some of the big names in the industry. Rainmaker Studios also develops proprietary projects. WOW!’s ReBoot CG series Frederator Networks Inc. Frederator Networks Inc. is a small media company that produces and distributes cartoons, often on Channel Frederator, and through its in-house animation studio Frederator Studios. The studio focuses primarily on artists who write their own shorts, series, and movies. Their slogan is “Original Cartoons since 1998.” It is one of the most successful independent cartoon production companies of the past 20 years with hits on Cartoon Network and Nickelodeon. It is the largest distributor of independent animation online. The studio has locations in New York City, where Federator Digital is based, and Burbank, California. Ezrin Hirsh Entertainment Inc. -

Participating Companies at Mip Junior - 06/12/2019

PARTICIPATING COMPANIES AT MIP JUNIOR - 06/12/2019 ARGENTINA BELGIUM EL REINO INFANTIL / LEADER ENTERTAINMENT MACKY INSTITUTO NACIONAL DE CINE Y ARTES AUDIOVISUALES RTBF RADIO TELEVISION BELGE COMMUNAUTE FRANCAISE THE WALT DISNEY COMPANY VRT VIS (VIACOM INTERNATIONAL STUDIOS) BOSNIA AND HERZEGOVINA AUSTRALIA AEON ABC COMMERCIAL BOTSWANA AUSTRALIAN BROADCASTING CORPORATION CAMP BOTSWANA AUSTRALIAN CHILDRENS TELEVISION FOUNDATION TOP POWER PICTURES CASTLEMAN BRAZIL ESCAPADE MEDIA PTY LTD 2DLAB HIPSTER WHALE PTY LTD BOUTIQUE FILMES E PRODUES LTDA IMAGINE IF... BRAZILIAN CONTENT KOMIXX ENTERTAINMENT PTY LTD BROMELIA PRODUCOES LTDA MOOSE TOYS CABONG STUDIOS OZPIX ENTERTAINMENT PTY LTD CHATRONE LATIN AMERICA POP FAMILY ENTERTAINMENT COPA STUDIO PRODUTORA AUDIOVISUAL LTDA. SCREEN AUSTRALIA DRUZINA CONTENT (SUPER8PROD) THE MORFS GLAZ ENTRETENIMENTO SA. WINDMILL PICTURES GLOBOSAT BANGLADESH GLOBOSAT PROGRAMADORA LTDA ROBI AXIATA LIMITED LIGHTSTAR STUDIOS BELARUS MARISOL SA TELEVISION AND RADIO COMPANY VITEBSK MOVILE / PLAY KIDS BELGIUM PAULA TABORDA AGENCE BRUXELLOISE POUR L'ACCOMPAGNEMENT DE PETIT FABRIK L'ENTREPRISE PUSHSTART CONTENTINUUM RIO2C CREATIVE CONSPIRACY N.V. SPIRIT ENTRETENIMENTO LTDA EPP DPG MEDIA SPLIT STUDIO ER PRODUCTIONS STORY PRODUCTIONS BRAZIL FABRIQUE FANTASTIQUE TELECINE PROGRAMACAO DE FILMES LTDA. FLANDERS AUDIOVISUAL FUND - VAF TV PINGUIM IMPS TV SBT CANAL 4 DE SAO PAULO S/A KIWIWIHO PRODUCTIONS BULGARIA LUMIERE PUBLISHING ASSOCIATION OF COPYRIGHT CONTENT CREATORS BULGARIA CANADA CHASE A CLOUD HG DISTRIBUTION FOX NETWORKS GROUP BULGARIA EOOD HOUSE OF COOL CANADA IMAGE-ICC 108 MEDIA JERRYCO ANIMATION 10TH AVE PRODUCTIONS JUST FOR LAUGHS DISTRIBUTION 9 STORY MEDIA GROUP K6 MEDIA GROUP ALLIANCE DES PRODUCTEURS FRANCOPHONES DU CANADA KNOWLEDGE NETWORK KOTV ANTHEM ENTERTAINMENT LP L'ATELIER ANIMATION APARTMENT 11 PRODUCTIONS INC. LANDSLIDE ENTERTAINMENT ARCADIA CONTENT MAINFRAME STUDIOS ATOMIC CARTOONS MOLOT ANIMATION INC. -

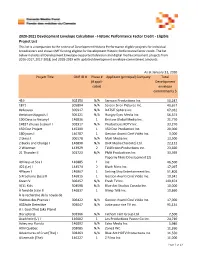

CMF 2020-2021 Development Historic Performance Project List.Xlsx

2020‐2021 Development Envelope Calculation ‐ Historic Performance Factor Credit ‐ Eligible Project List This list is a companion to the review of Development Historic Performance eligible projects for individual broadcasters and shows CMF funding eligible for Development Historic Performance factor credit. The list below includes all Development Envelope‐supported television and digital media component projects from 2016‐2017, 2017‐2018, and 2018‐2019 with updated development envelope commitment amounts. As at January 31, 2020 Project Title CMF ID # Phase # Applicant (principal) Company Total (if appli‐ Development cable) envelope commitments $ 419 302150 N/A Sarrazin Productions Inc. 50,247 1871 305894 N/A Screen Siren Pictures Inc. 40,657 #elleaussi 305917 N/A DATSIT Sphère inc. 67,032 #relationshipgoals I 305121 N/A Hungry Eyes Media Inc. 56,374 100 Days to Victory I 146836 1 Bristow Global Media Inc. 21,770 14837 choses à savoir I 302917 N/A Productions KOTV Inc. 33,270 150 Doc Project 145309 1 150 Doc Production Inc. 20,000 180 jours I 146787 1 Gestion Avanti Ciné Vidéo Inc. 3,000 2 bleus I 306578 N/A Maki Media inc 13,500 2 Bucks and Change I 146890 N/A DHX Media (Toronto) Ltd. 22,112 2 Wiseman 143929 2 Téléfiction Productions inc. 23,660 21 Thunder II 301723 N/A PMA Productions Inc. 33,369 Paperny Films Development (2) 40 Days at Sea I 146885 1 Inc. 46,500 422 (Le) I 144574 2 Blach Films Inc. 17,097 4Player I 146867 1 Sinking Ship Entertainment Inc. 51,806 5 Prochains (Les) III 146815 1 Gestion Avanti Ciné Vidéo Inc. -

CMPA (Formerly CFTPA) Signatory Producers 2015 to 2017 (Extended to June 30, 2019) Live Action up to April 9, 2019

CMPA (formerly CFTPA) Signatory Producers 2015 to 2017 (extended to June 30, 2019) Live Action up to April 9, 2019 #REF! Production Ltd. 0744770 B.C. Ltd. 0897624 B.C. Ltd. 0897624 B.C. Ltd. For ""Prison MD"" 0978603 B.C. Ltd for ""Year of the Rat"" 101117088 Saskatchewan Ltd 10237981 Pelee Entertainment 10283690 Canada Inc. for ""Trump's Left Behind America"" 10564141 Canada Inc. 1106126 BC Ltd. for ""Angel's Flight"" 1162831 B.C. Ltd. 1181106 Alberta Inc (o/a) Draw Your Cat 1259534 Alberta Inc. 1380099 Ont. Inc. Heroic Films Co. for ""Ladies Killing Circle"" 1380099 Ont. Inc.as Heroic Film Cpy for ""First Things First"" 1380099 Ontario Inc. o/a Heroic Film Company 1514373 Ontario Inc. 1555135 Alberta Inc 16 Lighthouse Road Productions, Ltd. for "Cedar Cove" - TV Series - Season 1 1664121 Ontario Ltd for ""Ganesh Boy Wonder"" 1743722 Ontario, Inc. 1746020 Ontario, Inc. 1760451 Ontario, Inc. 1900333 Ontario Limited for ""Asset"" 1921391 Ontario Inc 1972 Productions Inc. 1972 Productions Inc. 1st Person Media Inc. for ""My Wife's Affair is Kind of A Funny Story"" 2005519 Ontario Limited 2006376 Ontario Inc. 2033162 Ontario Inc c.o.b.a Floating Island Entertainment for ""Untitled AI Television Series"" 2051657 Alberta Ltd. 2075382 Ontario Limited 2104023 Ontario Inc. 2108602 Ontario Ltd 22 Minutes (Nye) IV Incorporated 22 Minutes XI Incorporated 22 Minutes XIV Limited 2215190 Ontario, Inc. 2215190 Ontario, Inc. for "The Backpackers" 2218373 Ontario Inc for ""Splashings"" 2218373 Ontario Inc for ""Upstaged"" 2223702 Ontario, Inc. 2255478 Ont. Ltd. 2282131 Ontario Inc for ""Hardy Boys"" 2289543 Ontario Ltd 229543 Ontario, Inc for "URL" 2296613 Ontario Inc. -

WOW! Unlimited Media Announces Financial Results for the Second Quarter of 2019

Source : WOW! Unlimited Media Inc. 28 août 2019 18h45 HE WOW! Unlimited Media Announces Financial Results for the Second Quarter of 2019 VANCOUVER, British Columbia, Aug. 28, 2019 (GLOBE NEWSWIRE) -- WOW! Unlimited Media Inc. (“WOW!” or the “Company”) (TSX-V: WOW; OTCQX: WOWMF) announced its results for the three and six months ended June 30, 2019. The Company completed the second quarter of 2019 with revenue of $26.6 million, as compared to $16.3 million for the second quarter of 2018. Q2 2019 HIGHLIGHTS Studio production During the quarter, WOW! commenced production on a major animated series for a leading US studio with a committed 2+ year production and delivery schedule Strong production pipeline As of June 30, 2019, WOW!’s animation production backlog was $71.9 million; Animation Production segment revenue was $6.9 million for the three months ended June 30, 2019 Networks & Platforms On August 30, 2019, WOW! will officially own the Category B Canadian specialty service license acquired under an agreement with its strategic investor, Bell Media. Management is exploring strategic partnerships to structure a financially attractive business plan for a potential WOW!-branded linear channel On June 8, 2019, the Company announced that a key channel affiliate, ADME (CY), Ltd. (“ADME”), would repatriate certain of its YouTube channels from Frederator; Frederator would continue to distribute and manage certain other ADME channels and it will have the opportunity to distribute and manage certain new ADME YouTube channels as they are developed. As of June 30, 2019, ADME channels represented approximately 85% of overall viewership on the Channel Frederator Network. -

Wow Unlimited Media Inc

MANAGEMENT’S DISCUSSION & ANALYSIS Wow Unlimited Media Inc. December 31, 2018 MANAGEMENT’S DISCUSSION AND ANALYSIS This Management’s Discussion and Analysis (“MD&A”) is dated April 25, 2019, and is intended to assist in understanding the results of operations and financial condition of Wow Unlimited Media Inc. (the “Company” or “Wow Unlimited”) as at and for the three and twelve months ended December 31, 2018, and should be read in conjunction with the audited consolidated financial statements and accompanying notes for the year ended December 31, 2018 and other public disclosure documents of Wow Unlimited. Past performance may not be indicative of future performance. Unless otherwise noted, all amounts are reported in Canadian dollars, the Company’s functional currency, and have been prepared in accordance with International Financial Reporting Standards (“IFRS”). Throughout the MD&A reference to “Wow Unlimited” or the “Company” refers to Wow Unlimited Media Inc. and its subsidiary entities. Additional information, including the Company’s annual information form (the “AIF”) and other publicly filed documents relating to the Company are available through the internet on the Canadian Securities Administrators’ System for Electronic Document Analysis and Retrieval (“SEDAR”), which can be accessed at www.sedar.com. FORWARD LOOKING STATEMENTS Certain statements contained in this MD&A, and in certain documents incorporated by reference in this MD&A, constitute “forward looking information” within the meaning of applicable Canadian securities laws. The words “anticipate", "achieve", "could", "believe", "plan", "intend", "continuous", "ongoing", "estimate", “outlook", "expect", "may", "will", "project", "should”, and similar expressions are often used to identify forward looking statements. -

E-Catalogue Cartoon Connection on Your Tablet/Smartphone/Computer Using Adobe Acrobat Reader

Cartoon connection 2017 2-4 October 2017, Québec City - Canada Illustrator: Francis Desharnais Francis Illustrator: e-catalogue INDEX OFFICIALS PROGRAMME PROFILES ATTENDEES PRACTICAL DIGITALMAP & VENUES EXPERTS SOCIALSPEAKERS EVENTS CHAIRSBLURBS HOW TO NAVIGATE? HOW TO NAVIGATE? IT’S EASY! You have uploaded and saved the e-Catalogue Cartoon Connection on your tablet/smartphone/computer using Adobe Acrobat Reader. This enhanced digital version will allow you to take notes, make quick searches, and contact other participants with a simple “click”. HOW TO ACCESS THE DIFFERENT PAGES? THE PROGRAMME THE PARTICIPANTS To reach the programme’s pages, just click on the Click on “Attendees” in the main Index or in the tabs button “Programme” in the main Index or in the tabs above. They are all listed by alphabetical order. above. This will redirect you to the programme’s Index. Click on the email next to their photo to contact Click on the day you wish to view. You can also use the them directly. You can also use the search tool and search tool and bookmarks (see below). bookmarks (see below). The navigation stays the same to access other information in the e-Catalogue. Do not forget: the easiest way to access everything is by using the tabs at the top of the pages. HOW TO USE THE MAIN FUNCTIONS AVAILABLE IN ADOBE ACROBAT READER? VIEW MODES GO TO PAGES These modes allow you to read/turn Don’t want to scroll all the pages? It’s easy: the pages in different ways: TAP on the page number; you can then enter Continuous: scroll vertically. -

CMPA (Formerly CFTPA) Signatory Producers 2015 to 2017 Live Action up to January 30, 2019

CMPA (formerly CFTPA) Signatory Producers 2015 to 2017 Live Action up to January 30, 2019 Production Company #REF! Production Ltd. 0744770 B.C. Ltd. 0897624 B.C. Ltd. 0897624 B.C. Ltd. For ""Prison MD"" 0978603 B.C. Ltd for ""Year of the Rat"" 101117088 Saskatchewan Ltd 10237981 Pelee Entertainment 10283690 Canada Inc. for ""Trump's Left Behind America"" 10564141 Canada Inc. 1106126 BC Ltd. for ""Angel's Flight"" 1181106 Alberta Inc (o/a) Draw Your Cat 1259534 Alberta Inc. 1380099 Ont. Inc. Heroic Films Co. for ""Ladies Killing Circle"" 1380099 Ont. Inc.as Heroic Film Cpy for ""First Things First"" 1380099 Ontario Inc. o/a Heroic Film Company 1514373 Ontario Inc. 1555135 Alberta Inc 16 Lighthouse Road Productions, Ltd. for "Cedar Cove" - TV Series - Season 1 1664121 Ontario Ltd for ""Ganesh Boy Wonder"" 1743722 Ontario, Inc. 1746020 Ontario, Inc. 1760451 Ontario, Inc. 1900333 Ontario Limited for ""Asset"" 1921391 Ontario Inc 1972 Productions Inc. 1972 Productions Inc. 1st Person Media Inc. for ""My Wife's Affair is Kind of A Funny Story"" 2005519 Ontario Limited 2006376 Ontario Inc. 2033162 Ontario Inc c.o.b.a Floating Island Entertainment for ""Untitled AI Television Series"" 2051657 Alberta Ltd. 2075382 Ontario Limited 2104023 Ontario Inc. 2108602 Ontario Ltd 22 Minutes (Nye) IV Incorporated 22 Minutes XI Incorporated 22 Minutes XIV Limited 2215190 Ontario, Inc. 2215190 Ontario, Inc. for "The Backpackers" 2218373 Ontario Inc for ""Splashings"" 2218373 Ontario Inc for ""Upstaged"" 2223702 Ontario, Inc. 2255478 Ont. Ltd. 2282131 Ontario Inc for ""Hardy Boys"" 2289543 Ontario Ltd 229543 Ontario, Inc for "URL" 2296613 Ontario Inc. -

Wow Unlimited Media Inc

MANAGEMENT’S DISCUSSION & ANALYSIS Wow Unlimited Media Inc. December 31, 2019 MANAGEMENT’S DISCUSSION AND ANALYSIS This Management’s Discussion and Analysis (“MD&A”) is dated April 28, 2020, and is intended to assist in understanding the results of operations and financial condition of Wow Unlimited Media Inc. (the “Company” or “Wow Unlimited”) as at and for the three and twelve months ended December 31, 2019, and should be read in conjunction with the audited consolidated financial statements and accompanying notes for the year ended December 31, 2019 and other public disclosure documents of Wow Unlimited. Past performance may not be indicative of future performance. Unless otherwise noted, all amounts are reported in Canadian dollars, the Company’s functional currency, and have been prepared in accordance with International Financial Reporting Standards (“IFRS”). Throughout the MD&A reference to “Wow Unlimited” or the “Company” refers to Wow Unlimited Media Inc. and its subsidiary entities. Additional information, including the Company’s annual information form (the “AIF”) and other publicly filed documents relating to the Company are available through the internet on the Canadian Securities Administrators’ System for Electronic Document Analysis and Retrieval (“SEDAR”), which can be accessed at www.sedar.com. FORWARD LOOKING STATEMENTS Certain statements contained in this MD&A, and in certain documents incorporated by reference in this MD&A, constitute “forward looking information” within the meaning of applicable Canadian securities laws. The words “anticipate", "achieve", "could", "believe", "plan", "intend", "continuous", "ongoing", "estimate", “outlook", "expect", "may", "will", "project", "should”, and similar expressions are often used to identify forward looking statements. -

Liste Des Finalistes En Télévision

LISTE DES FINALISTES EN TÉLÉVISION Best Drama Series Anne with an E CBC (CBC) (Northwood Entertainment) Miranda de Pencier, Moira Walley-Beckett Bad Blood City (Rogers Media) (New Metric Media, Sphere Media Plus Inc.) Mark Montefiore, Josée Vallée, Michael Konyves, Kim Coates, Paula J. Smith Blood and Water OMNI (Rogers Media) (Breakthrough Entertainment) Diane Boehme, Al Kratina, Ira Levy, Peter Williamson, Nat Abraham, Michael McGuigan, Steph Song, Ben Lu, Paula J. Smith Frankie Drake Mysteries CBC (CBC) (Shaftesbury) Christina Jennings, Scott Garvie, Cal Coons, Carol Hay, Michelle Ricci, Greg Phillips, Sarolo McGregor, Jonathan Hackett Vikings History (Corus Entertainment) (Take 5 Productions Inc.) Sheila Hockin, John Weber, Michael Hirst, Morgan O'Sullivan, James Flynn, Alan Gasmer, Sherry Marsh, Bill Goddard Best Comedy Series Letterkenny Crave (Bell Media) (New Metric Media) Mark Montefiore, Jared Keeso, Jacob Tierney, Kara Haflidson Mr. D CBC (CBC) (Mr. D S7 Productions Limited) Michael Volpe, Gerry Dee, Jessie Gabe Schitt's Creek CBC (CBC) (Not A Real Company Productions, Inc.) Eugene Levy, Daniel Levy, Andrew Barnsley, Fred Levy, Ben Feigin Second Jen OMNI (Rogers Media) (Don Ferguson Productions) Don Ferguson, Amanda Joy, Lucy Stewart, Samantha Wan, Kevin Wallis, Nataline Rodrigues Workin' Moms CBC (CBC) (Wolf + Rabbit Entertainment) Catherine Reitman, Philip Sternberg, Tina Horwitz, Joe Sorge, Jonathan A. Walker Best Reality/Competition Program or Series Big Brother Canada Global (Corus Entertainment) (Insight Productions Ltd.)