Financial Information As of March 31, 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Note: This English Translation Is for Reference Purposes Only. in The

Note: This English translation is for reference purposes only. In the event of any discrepancy between the Japanese original and this English translation, the Japanese original shall prevail. We assume no responsibility for this translation or for direct, indirect or any other forms of damage arising from the translation. (Securities code: 7211) June 3, 2019 To our shareholders 3-1-21, Shibaura, Minato-ku, Tokyo MITSUBISHI MOTORS CORPORATION Chairman of the Board, CEO Osamu Masuko NOTICE OF THE 50TH ORDINARY GENERAL MEETING OF SHAREHOLDERS You are cordially invited to attend the 50th Ordinary General Meeting of Shareholders of Mitsubishi Motors Corporation (“MMC”) to be held as described as below. If you are unable to attend, as described in the “Notice on Exercising Voting Rights” (P. 3 and P. 4), you may exercise your voting right(s) in writing or via the Internet. To do so, please review the “Reference Materials” for the Ordinary General Meeting of Shareholders contained in this notice, and exercise your voting right(s) either by posting your voting form so that it arrives before 5:45 p.m. on Thursday, June 20, 2019 or inputting your vote on the website for exercising voting right(s) before the aforementioned date and time. 1. Date and time Friday, June 21, 2019 at 10:00 a.m. (Japan time) 2. Place 3-3-1 Shibakoen, Minato-ku, Tokyo Ho-O-No-Ma, 2F, Tokyo Prince Hotel (Please note that the place for this Ordinary General Meeting of Shareholders differs from the one for the previous meeting.) 3. Purposes Matters to report 1. -

Integrated Report 2020

INTEGRATED REPORT 2020 For the year ended March 31, 2020 Contents Message from the CEO . 2 Contribution to Local Economy Message from the CFO . 4 through Business Activities . 31 New Mid-Term Business Plan. 6 Business and Financial Condition . 32 Introducing Our New Models . 10 Overview of Operations by Region . 32 Mitsubishi Motors’ History . 12 Consolidated Financial Summary . 36 Major Successive Models . 14 Operational Review . 37 Sales and Production Data . 16 Business-related risks . 38 Sustainability Management . 18 Consolidated Financial Statements . 42 Corporate Governance . 20 Consolidated Subsidiaries and Affiliates . 48 Management . 24 Principal Production Facilities . 50 The New Environmental Plan Package . 27 Investor Information . 51 Safety and Quality . 30 System for Disclosing Information Extremely high Extremely This z Integrated Report Report • Financial and non-financial information with a direct connection to the Company’s management strategy ・Focus on information that is integral and concise Stakeholders’ Concern Stakeholders’ z Sustainability Report • Sustainability (ESG) information • Focus on information that is comprehensive and continuous y Sustainability Report High https://www.mitsubishi-motors.com/en/sustainability/report/ High Impact on Management Extremely high y Global Website: “Investors” https://www.mitsubishi-motors.com/en/investors/ Forward-looking Statements Mitsubishi Motors Corporation’s current plans, strategies, beliefs, performance outlook and other statements in this annual report that are not historical facts are forward-looking statements. These forward-looking statements are based on management’s beliefs and assumptions drawn from current expectations, estimates, forecasts and projections. These expectations, estimates, forecasts and projections are subject to a number of risks, uncertainties and assumptions that may cause actual results to differ materially from those indicated in any forward-looking statement. -

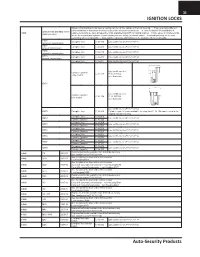

IGNITION LOCKS Auto-Security Products

31 IGNITION LOCKS Nissan / Infi niti ignition locks have a casting number on the outside of the lock housing. There are many different minor variations in this range of locks, mostly in the electrical connections. In order to simplify the availability of Ignition locks identifi ed by the Infi niti replacement parts we have grouped the locks available from ASP by casting number. Future sales of complete locks casting number will be the housing and cylinder of each casting number without electrical switch. Electrical switches will be sold separately whenever possible. Also cylinder repair kits will continue to be available whenever possible. AS51 Complete lock C-16-410 Use tumbler series P-16-181/184 automatic transmission AS51 Complete lock C-16-409 Use tumbler series P-16-181/184 manual transmission AS55 Complete lock C-16-412 Use tumbler series P-16-181/184 automatic transmission AS55 Complete lock C-16-411 Use tumbler series P-16-181/184 manual transmission Complete lock C-16-401 Use tumbler series P-16-161/164 Use tumbler series Cylinder repair kit C-16-127 P-16-161/164 early models see illustration KV71 Use tumbler series Cylinder repair kit C-16-134 P-16-161/164 late models see illustration Use tumbler series P-16-161/164 KV75 Complete lock C-16-402 Cylinder repair kit is not available, the plug from C-16-134 can be used in the original cylinder housing. Complete lock C-16-403 SK53 Use tumbler series P-16-161/164 Cylinder repair kit C-16-126 Complete lock C-16-404 SK61 Use tumbler series P-16-161/164 Cylinder repair kit C-16-129 Complete lock C-16-405 SK63 Use tumbler series P-16-161/164 Cylinder repair kit C-16-129 Complete lock C-16-406 SK66 Use tumbler series P-16-161/164 Cylinder repair kit C-16-133 Complete lock C-16-407 SK67 Use tumbler series P-16-161/164 Cylinder repair kit C-16-133 Complete lock C-16-408 SK69 Use tumbler series P-16-161/164 Cylinder repair kit C-16-133 Replacement locks available from Infi niti dealers only. -

![Mission [P3] 801Kb](https://docslib.b-cdn.net/cover/5774/mission-p3-801kb-725774.webp)

Mission [P3] 801Kb

NISSAN MOTOR COMPANY ANNuAl RePORT 2013 03 contents corporate face time MANAGEMENT MESSAGES nissan power 88 performance corporate governance 1935 Datsun 14 1969 Datsun Z S30 1989 Infiniti Q45 G50 In April 1935, less than two years after Nissan's establishment, the The S30 was the first-generation Z car. It was created by transforming a light open-top In autumn 1989 Nissan launched its new Infiniti brand in the United States with the Q45 first small “Datsun 14” passenger car rolled off the assembly line at sports car into a Grand Touring (GT) car with a closed body, reflecting the changing as its flagship model. Presented as a “Japan original,” this large, luxurious sedan was an the Yokohama Plant. The plant had just been newly built as Japan's trends of the times. The graceful styling of the S30 with its lower, longer and wider expression of Japan’s unique aesthetics and detailed attention to passenger comfort. first mass production facility for automobiles. dimensions captivated car fans the world over. The Q45 attracted considerable attention in the target U.S. market, as well as in its home country of Japan. 1982 March/Micra K10 The March embodied a variety of concepts unprecedented in Japanese cars. For example, a model life of approximately ten years 1957 Datsun 1000 Sedan 210 was envisioned from the outset. Outstanding levels of basic Datsun 1000 Sedan (210) was released in 1957. The following year performance were attained though extensive weight savings. And the it was entered in the 1958 Australian Rally, an exceptionally grueling styling was intended to have timeless appeal. -

The Renault-Nissan Alliance 014 the Renault-Nissan Alliance

The Renault-Nissan Alliance 014 The Renault-Nissan Alliance Nissan has greatly increased its global footprint and achieved dramatic economies of scale through the Renault-Nissan Alliance, a unique and highly scalable strategic partnership founded in 1999. In 2011, 8.03 million cars* were sold by the Renault-Nissan Alliance, amounting to a 10.7% global share. We are marketing vehicles under the brands of Nissan, Infiniti, Renault, Renault Samsung Motors and Dacia. * This figure includes Lada sales (AvtoVAZ of Russia). The Alliance’s Vision Although it was initially considered a unique arrangement in the late 1990s, the Alliance quickly became a model for similar partnerships in the auto industry. The Alliance itself has entered cooperative relationships with Germany’s Daimler, China’s Dongfeng Motor Corp., Russia’s AvtoVAZ and others, and it continues to prove itself as the industry’s most enduring and successful partnership. The Alliance is based on the rationale that substantial cross-shareholding investments compel each company to act in the financial interest of the other, while maintaining individual brand identities and independent corporate cultures. Renault currently has a 43.4% stake in Nissan, and Nissan holds a 15.0% stake in Renault. The cross-shareholding arrangement requires mutual trust and respect, as well as a transparent management system focused on speed, accountability and performance. > Please see our website for more information on the Renault-Nissan Alliance. http://www.nissan-global.com/EN/COMPANY/PROFILE/ALLIANCE/RENAULT01/index.html Alliance Objectives The Alliance pursues a strategy of profitable growth with three objectives: 1. To be recognized by customers as being among the best three automotive groups in the quality and value of its products and services in each region and market segment 2. -

Environmental Report 2020

SUSTAINABILITY REPORT 2020 Commitment of Top Management Sustainability Management Environment Social Governance ESG Data CONTENTS Corporate Overview �����������������������������������������������������������������������������������������������������������������������������������������������������������������3 Governance ���������������������������������������������������������������������������������������������������������������������������������������������������������������������������������80 Commitment of Top Management ��������������������������������������������������������������������������������������������������������������������������������5 Corporate Governance ��������������������������������������������������������������������������������������������������������������������������������������������������81 Sustainability Management Internal Control ������������������������������������������������������������������������������������������������������������������������������������������������������������������84 Corporate Philosophy and Policy�������������������������������������������������������������������������������������������������������������������������������7 Risk Management ������������������������������������������������������������������������������������������������������������������������������������������������������������85 Sustainability Management ������������������������������������������������������������������������������������������������������������������������������������������8 Compliance ���������������������������������������������������������������������������������������������������������������������������������������������������������������������������86 -

Nissan – Mitsubishi Increase Annual Synergies to €5.7 Billion

PRESS RELEASE – Paris/Yokohama/Tokyo, June 13, 2018 RENAULT – NISSAN – MITSUBISHI INCREASE ANNUAL SYNERGIES TO €5.7 BILLION Annual synergies rise 14%, from €5 billion in 2016 to €5.7 billion in 2017 Mitsubishi Motors reports first full year of synergies as Alliance member Further convergence underway in Aftersales, Quality & Total Customer Satisfaction and Business Development The Alliance reaffirms synergy target of more than €10 billion by the end of 2022 Renault – Nissan – Mitsubishi today reported a 14% increase in annualized synergies to €5.7 billion, up from €5 billion in 2016, as members of the world’s largest automotive alliance benefited from growing cost savings, incremental revenues and cost avoidance. The latest synergies reflect the economies of scale realized by the Alliance members, which reported total sales of more than 10.6 million vehicles for 2017 – becoming the world’s largest automotive group in terms of sales of passenger cars and light commercial vehicles (LCVs). “The Alliance has a direct, positive impact on the growth and profit of each member company,” said Carlos Ghosn, Chairman and CEO of Renault-Nissan-Mitsubishi. “In 2017, the Alliance turbo-charged the performance of all three companies including Mitsubishi Motors which saw its first full-year of synergy gains.” “We expect to generate growing synergies in coming years as the Alliance accelerates convergence through increased utilization of joint plants, common vehicle platforms, technology-sharing and our combined presence in mature and emerging markets. We reaffirm our synergy goal of more than €10 billion by the end of 2022.” Under the Alliance 2022 mid-term plan, the member companies forecast to sell more than 14 million vehicles by the end of the plan, of which 9 million will be built on four common platforms including electric and B segment vehicles, and extending the use of common powertrains from one third to 75% of the total. -

DATSUN GO NOW IT’S YOUR TURN the Time to Reach for Your Dream Has Arrived

Break Through DATSUN GO NOW IT’S YOUR TURN The time to reach for your dream has arrived. It’s time to break through. To set your own boundaries and push the boundaries of others. The open road is calling, with every turn promising a new adventure. Where you go is up to you. How will you get there? Meet the Datsun GO. 1 3 SO STYLISH, IT WILL MAKE HEADS TURN The Datsun GO is here to stay. With a robust body, strong and dynamic shoulder line, distinctive headlamps and impressive arches, it’s a bold design that reflects its character. Its D-cut grille with chrome lining shows Datsun GO’s strong characteristics. From the athletic rear shoulders, to its cosy cabin space, the Datsun GO is a style statement to mark your breakthrough to tomorrow. 1. Headlamp design Just like the eyes, headlamps can say so much. The signature, elongated 3-D shaped headlamps feature a multifaceted design, framed by a metallic 2 accent to provide a premium and stylish look. 2. Athletic shoulders Its robust, wide body with deeply curving shoulders suggest substance and strength that sets it apart from anything else in its segment. 3. Sculpted front fenders 4 Flowing smoothly into the front end, these bold, curvy fenders add a touch of class. And with its 3-D silhouette, it has a modern character that’s a class apart. 4. Bold, characteristic D-cut grille TOMORROW’S THERE FOR THE TAKING A face you can love. The contours of the car draw attention to the honeycomb-style grille, and feature You know who you are. -

Misguided Teaching in the DCX-MMC Strategic Alliance (Part I)

論 説 When NOT to Learn: Misguided Teaching in the DCX-MMC Strategic Alliance (Part I) Daniel A. Heller Keywords: DaimlerChrysler Corporation (DCX), Mitsubishi Motors Corporation (MMC), equity alliance, learning alliance, inter-firm learning, organizational capabilities, case study Special Introductory Note: At the time of the writing of this paper, MMC was dealing with its third major corporate scandal in fifteen years. The first two scandals happened in 2000 and 2004 and involved systematic cover-ups of quality issues of MMC vehicles that should have been recalled but were not. The second scandal immediately preceded the effective end of the DCX-MMC alliance, forced the company to undertake a series of major reform initiatives. Yet, in April 2016 MMC admitted again to decades of falsifying results of government-mandated fuel economy measurement tests in Japan. While it certainly does not excuse lying to the government and overstating by a reported 5-10% the listed fuel economy of some of its vehicles sold in Japan, it is important to note that the government- mandated tests themselves are rather misleading from the point of view of the consumer. In Japan, the listed fuel economy of all vehicles has generally been greatly inflated over what an actual user will experience in real-world driving conditions.1 The data in this paper’s Appendix show the fuel economy discrepancies between the posted and actual performance of MMC vehicles does not seem to have been markedly different from that of other Japanese automakers.2 Nevertheless, many have called the most recent MMC scandal an existential crisis. -

Nissan Motor Co., Ltd

Financial Information as of March 31, 2012 (The English translation of the “Yukashoken-Houkokusho” for the year ended March 31, 2012) Nissan Motor Co., Ltd. Table of Contents Page Cover...........................................................................................................................................................................1 Part I Information on the Company...........................................................................................................2 1. Overview of the Company .........................................................................................................................2 1. Key financial data and trends........................................................................................................................2 2. History ..........................................................................................................................................................4 3. Description of business .................................................................................................................................6 4. Information on subsidiaries and affiliates .....................................................................................................7 5. Employees...................................................................................................................................................13 2. Business Overview ......................................................................................................................................14 -

MITSUBISHI Pickup Truck the 40-Year History of Pickup Trucks (Timeline)

PRESS INFORMATION 40th Anniversary MITSUBISHI Pickup Truck The 40-Year History of Pickup Trucks (Timeline) Mitsubishi Motors’ first 1-ton pickup truck – the FORTE - was launched in 1978 and exported with names including L200 . Since then, approximately 4.7 million trucks have been sold worldwide. It’s a pickup truck that can handle all types of road, anywhere on the planet. It has been developed with a design brief - to meet the desire of customers for a pickup with outstanding reliability, durability and payload performance; with levels of drivability, utility, comfort and ride that are on a par with a passenger sedan. Mitsubishi Motors leveraged its experience in manufacturing Jeeps to carry out independent development of a model for off-road. Consequently, 4WD was added to its lineup in 1980 which became the foundation for all Mitsubishi 4WD vehicles and led directly to the PAJERO/MONTERO and DELICA 4WD. The first and second generation pickups were mainly produced at Mitsubishi Motors Ohe Plant in Japan. Since the third-generation model in 1995, production has been concentrated in the Laem Chabang Plant in Thailand, from where they are exported worldwide. The model and factory serve an important role in global strategic plan of Mitsubishi Motors. 1st Generation September 1978 ・FORTE , a 1-ton pickup truck was introduced in Japan and exported with names including the MITSUBISHI TRUCK and L200 . Exports to North America started the following October. ・The only body option is a single cab. Power is from a 2.0-litre petrol, with a 2.6-litre option for North America and 1.6-litre engine for Japan and for other regions. -

21MY Pajero Sport Brochure.Pdf

TOUGHNESS, REFINED Pajero Sport is a striking fusion of contemporary design, cutting-edge technology and genuine four wheel drive capability, with an enviable off-road heritage. A luxury 4WD that is as comfortable off road as it is prowling the urban jungle, Pajero Sport embodies style and substance in one sleek, purposeful package. Cover & Page 2 Exceed model shown with optional accessory rear spoiler. Pajero Sport, built for the time of your life. Since 1917 Mitsubishi Motors has been at the forefront of technological innovation, having launched the innovative Super-Select 4WD system and the world’s first Plug-in hybrid electric SUV, our vehicles have been tested and triumphed in some of the most gruelling and toughest terrains on earth including Dakar rally. These engineering milestones and our commitment to reliability and ingenuity set us apart from the competition. As we continue to move forward, pushing the boundaries of innovation, you can rest assured 2 your Mitsubishi has been built for the time of your life. ASX Eclipse Cross Outlander Pajero Sport Pajero Triton Achieve adventure every day. Pajero Sport’s striking design combines sophisticated aesthetics with a muscular stance that makes Pajero Sport’s roof rails are functional in more ways than one – not only do they allow for carrying it clear it is a potent performer on any road. With sleek lines from its distinctive front to its dramatic extra cargo on the roof, their aerodynamic design provides directional stability at high speeds tail, Pajero Sport has an unmistakable presence that exudes confidence and capability. while reducing wind noise and fuel consumption.