1 Dr Ilias Basioudis, Aston University Business School – Written Evidence

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Here's for Making Things Happen

2020 Postgraduate Prospectus THINGS HAPPEN MAKING HERE’S FOR HERE’S ASTON UNIVERSITY BIRMINGHAM UK POSTGRADUATE PROSPECTUS 2020 HERE IS Welcome to Aston University THE ASTON A stimulating and enjoyable place to study. We pride ourselves on providing a modern, supportive and MASTERS multicultural environment and we are committed to giving you the opportunity to achieve your full potential. We are known as an enterprising university and our students work with real life projects, create start-up businesses and undertake placements and internships in industry, the professions or the public sector. This is a great springboard for successful careers in an international world of work. Professor Alec Cameron Vice-Chancellor and Chief Executive Any questions? +44 (0)121 204 4910 [email protected] 3 HERE IS ASTON CONTENTS 06 A university for enterprise 08 Our reputation 10 Our UK location 12 Discover Birmingham 14 Our campus 16 Accommodation 18 Your career 20 Welcoming international students 24 Entry requirements 25 Programme contents 26 Aston Business School 44 School of Engineering & Applied Science 54 School of Life & Health Sciences 66 School of Languages & Social Sciences 74 How to apply As a postgraduate student at Aston University you will be part of a multicultural, international campus community where you A UNIVERSITY benefit from high quality teaching and work with researchers SINCE 1966 who are making a real impact on society. 4 5 A UNIVERSITY FOR ENTERPRISE Our students develop an entrepreneurial mind-set, enabling them to start their own companies, join fast growing SMEs and innovate within multinational organisations. Our graduates are highly sought after, because of their practical skills and ability to apply knowledge. -

Alliance Manchester Business School Undergraduate Study – 2017 Entry

1889 JOHN DALTON Alliance Manchester Business School Undergraduate Study – 2017 Entry Alliance MBS Undergraduate Study – 2017 Entry www.alliancembs.manchester.ac.uk/undergraduate 02 — 03 MANCHESTER... Contents Written by Tony Walsh (a.k.a Longfella) Find us P04 A world-changing University and Alliance Manchester Business School on Facebook P06 Our building project and campus masterplan www.facebook.com/ P08 AMBSincoming The City of Manchester undergraduates P10 Student life To some it means our architecture, P12 BSc (Hons) Management / Management (Specialism) poems made of stone Follow us P20 BSc (Hons) International Management on Twitter P20 BSc (Hons) International Management with American Business Studies The new, the old, the cool, the bold, @AMBSUGAdmission P28 BSc (Hons) International Business, Finance and Economics the city stands alone... P34 BSc (Hons) IT Management for Business / IT Management for Business (Specialism) Watch us on YouTube P40 BSc (Hons) Accounting www.youtube.com/ P46 Other business-related courses manchestermbs To some it means a sporting city, P48 Employability second place to none P50 Student support Join us P51 Find out more For thrills and spills and skills on LinkedIn P52 Entry requirements and scholarships we’re still the global number one... uk.linkedin.com/edu/ manchester-business- school-12712 Virtual open day If you can’t make it to one of our on-campus events, our virtual open day is the next best thing: www.alliancembs.manchester.ac.uk/virtualopenday Follow us To some it means our music scene on Google+ that keeps the city pounding plus.google.com/ +manchester Student blogs An A-list playlist, some might say businessschool The best way to find out what studying at Alliance MBS is really like – read our student blogs. -

Education in the Asia-Pacific Region: Issues, Concerns and Prospects

Education in the Asia-Pacific Region: Issues, Concerns and Prospects Volume 50 Series Editors-in-Chief Professor Rupert Maclean, RMIT University, Melbourne, Australia Dr Lorraine Pe Symaco, Zhejiang University, Hangzhou, China Editorial Board Professor Bob Adamson, The Education University of Hong Kong, China Dr Robyn Baker, New Zealand Council for Educational Research, Wellington, New Zealand Professor Michael Crossley, University of Bristol, United Kingdom Ms Shanti Jagannathan, Asian Development Bank, Manila, Philippines Dr Yuto Kitamura, University of Tokyo, Japan Professor Colin Power, Graduate School of Education, University of Queensland, Brisbane, Australia Professor Konai Helu Thaman, University of the South Pacific, Suva, Fiji Advisory Board Professor Mark Bray, UNESCO Chair, Comparative Education Research Centre, The University of Hong Kong, China; Professor Yin Cheong Cheng, The Education University of Hong Kong, China; Professor John Fien, Swinburne University, Melbourne, Australia; Dr Pham Lan Huong, International Educational Research Centre, Ho Chi Minh City, Vietnam; Dr Chong-Jae Lee, Korean Educational, Development Institute (KEDI), Seoul, Republic of Korea; Ms Naing Yee Mar, GIZ, Yangon, Myanmar; Professor Geoff Masters, Australian Council for Educational Research, Melbourne, Australia; Margarita Pavlova, The Education University of Hong Kong, China; Dr Max Walsh, Secondary Education Project, Manila, Philippines; Dr Uchita de Zoysa, Global Sustainability Solutions (GLOSS), Colombo, Sri Lanka More information about this series at http://www.springer.com/series/5888 Nhai Thi Nguyen • Ly Thi Tran Editors Reforming Vietnamese Higher Education Global Forces and Local Demands Editors Nhai Thi Nguyen Ly Thi Tran Monash College Deakin University Clayton, VIC, Australia Burwood, VIC, Australia ISSN 1573-5397 ISSN 2214-9791 (electronic) Education in the Asia-Pacific Region: Issues, Concerns and Prospects ISBN 978-981-13-8917-7 ISBN 978-981-13-8918-4 (eBook) https://doi.org/10.1007/978-981-13-8918-4 © Springer Nature Singapore Pte Ltd. -

Professor Christopher Julian Hewitt Freng 1969–2019

Biotechnol Lett https://doi.org/10.1007/s10529-019-02717-y (0123456789().,-volV)( 0123456789().,-volV) OBITUARY Professor Christopher Julian Hewitt FREng 1969–2019 Ó Springer Nature B.V. 2019 It is with deep sadness that we announce the death of as microbial fermentation, bio-remediation, bio-trans- Professor Chris Hewitt FREng, an Executive Editor of formation, brewing and cell culture. He was also the Biotechnology Letters since 2007 and Editor in Chief co-founder of the Centre for Biological Engineering at since last year, who died in the early hours of 25th July Loughborough University, where he developed a 2019, at the age of 50. He had suffered a short illness world-leading team in regenerative medicine biopro- but his passing was very unexpected. cessing. In particular, his team made a significant Chris graduated with a first class honours degree in contribution to the literature on the culture and Microbiology from Royal Holloway College, Univer- recovery of fully functional human mesenchymal sity of London in 1990 and then went to the University stem cells in stirred bioreactors based on sound of Birmingham to read for a Ph.D. in Biochemical biochemical engineering and fluid dynamic consider- Engineering in the School of Chemical Engineering ations essential to scale-up for commercialisation. (1993). After a short break, mainly in industry, he In recognition of his achievements, he was awarded a returned to the School in 1996 as a post-doc at the end DSc in Biochemical Engineering from Loughborough of which in 1999 he was appointed Lecturer, then University (2013) and the Donald Medal by the Institu- Senior Lecturer in Biochemical Engineering. -

Aston Business School Aston University Aston Triangle Birmingham B4 7ET United Kingdom Website Erasmus Institution Code UK BIRMING 01

Information for Partner Institutions Incoming Postgraduate Exchange Students 2019- 2020 Address Aston Business School Aston University Aston Triangle Birmingham B4 7ET United Kingdom Website www.abs.aston.ac.uk Erasmus Institution Code UK BIRMING 01 KEY CONTACTS: Saskia Hansen Institutional Erasmus Coordinator Pro-Vice Chancellor International Tel: ++44 (0)121 204 4664 Email: [email protected] Aston Business School Professor George Feiger Executive Dean Email Rebecca Okey Email: [email protected] Associate Dean Dr Geoff Parkes International Email: [email protected] International Relations Selena Teeling Manager Email: [email protected] Incoming and Outgoing International and Student Exchange Students Development Office Tel: ++44 (0) 121 204 3279 Email: [email protected] Postgraduate Student Elsa Zenatti-Daniels Development Lead Tel: ++44 (0)121 204 3279 Email: [email protected] International and Student Ellie Crean Development Coordinator Tel: ++44 (0)121 204 3255 Email: [email protected] Contents Academic Information Important Dates 2 Entry Requirements 4 Application Procedures: 1 or 2 Term Exchange 5 Application Procedures: Double Degree Students 7 Credits and Course Layout 8 Study Methods and Grading System 9 MSc Module Selection: 1 or 2 Term Exchange 10 Course Selection: Double Degrees 11 The Aston Edge (MSc Double Degree) 12 Induction and Erasmus Form Details 13 Conditions for Eligibility 14 Practical Information Visas and Health Insurance 16 Accommodation 17 Support Facilities 20 Student Life at Aston 21 Employments and Careers Services 22 Health and Well Being at Aston 23 Academic Information Important Dates APPLICATION DEADLINES The nomination deadline for the fall term will be 1 June 2019 and the application deadline will be 20 June 2019 for double degree and Term 1 exchange students. -

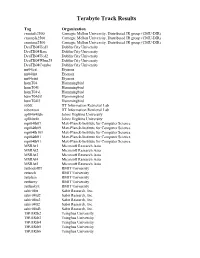

Terabyte Track Results

Terabyte Track Results Tag Organization cmutufs2500 Carnegie Mellon University, Distributed IR group (CMU-DIR) cmuapfs2500 Carnegie Mellon University, Distributed IR group (CMU-DIR) cmutuns2500 Carnegie Mellon University, Distributed IR group (CMU-DIR) DcuTB04Ucd1 Dublin City University DcuTB04Base Dublin City University DcuTB04Ucd2 Dublin City University DcuTB04Wbm25 Dublin City University DcuTB04Combo Dublin City University nn04test Etymon nn04tint Etymon nn04eint Etymon humT04 Hummingbird humT04l Hummingbird humT04vl Hummingbird humT04dvl Hummingbird humT04l3 Hummingbird iit00t IIT Information Retrieval Lab robertson IIT Information Retrieval Lab apl04w4tdn Johns Hopkins University apl04w4t Johns Hopkins University mpi04tb07 Max-Planck-Institute for Computer Science mpi04tb09 Max-Planck-Institute for Computer Science mpi04tb101 Max-Planck-Institute for Computer Science mpi04tb81 Max-Planck-Institute for Computer Science mpi04tb91 Max-Planck-Institute for Computer Science MSRAt1 Microsoft Research Asia MSRAt2 Microsoft Research Asia MSRAt3 Microsoft Research Asia MSRAt4 Microsoft Research Asia MSRAt5 Microsoft Research Asia zetbodoffff RMIT University zetanch RMIT University zetplain RMIT University zetfuzzy RMIT University zetfunkyz RMIT University sabir04tt Sabir Research, Inc. sabir04td2 Sabir Research, Inc. sabir04ta2 Sabir Research, Inc. sabir04tt2 Sabir Research, Inc. sabir04td3 Sabir Research, Inc. THUIRtb2 Tsinghua University THUIRtb3 Tsinghua University THUIRtb4 Tsinghua University THUIRtb5 Tsinghua University THUIRtb6 Tsinghua -

Curriculum Vitae Dr GUILLERMO ARANDA-MENA PART A

Curriculum Vitae Dr GUILLERMO ARANDA-MENA PART A Personal Details Full name: Guillermo Aranda-Mena Title: Dr. Current position: Associate Professor - Tenured College/School College of Design and Social Context School of Property, Construction a Project Management Correspondence address: GPO Box 2476V, Melbourne VIC 3001 Email address: [email protected] Academic Qualifications Formal qualifications Year Qualification University 2008 – Professional Certificate in Virtual Design Stanford University, California, 2010 and Construction. Department of Civil and Environmental Project: Australian National Guideline for Digital Engineering. Modelling in Architecture, Engineering and Construction Supervisor: Professor Martin Fischer 1997 – PhD in Construction Management and The University of Reading, 2003 Engineering United Kingdom Thesis title: Mapping Workers’ Cognitive School of Construction Management Structures of Construction Site Hazards. and Engineering. Supervisor: Professor Edward Finch 1996 – MSc in European Construction Engineering Loughborough University of 1997 European Inter-University Programme Technology, United Kingdom Thesis title: Investigating the impact of Department of Civil and Building Hoftede’s Cultural Dimensions in Managing Engineering. Construction Partnerships. Supervisor: Professor John Baker 1996 Postgraduate Diploma Fellowship in Universidad de Sevilla, Spain Architecture and Planning Escuela Tecnica Superior de Master en Arquitectura y Patrimonio Arquitectura Historico. (School of Architecture). -

From the Careers Centre

CAREER NEWS Friday 23 March Dear Students and Parents, Over the course of the year, I will be meeting with all year 10 -12 students to discuss their future career and education pathways. Enclosed is some information collated about opportunities and career options that may be of interest. All students are encouraged to drop into my office to explore the career and education possibilities or to gain assistance with anything related to their future career pathway. Parents are also welcome to contact me by email or call me. Year 10 Careers Program All year 10 students at Mordialloc College are exploring their career options through a program delivered in fortnightly classes. As a valuable activity, they will all be taking part in compulsory work experience at some stage throughout the year. During 7th to 11th May, 50 of our students will be taking part in a week of work experience. Some students have been unable to source an employer for their placements. If you are able to assist any of our students with work experience during 7th to 11th May or at some other time during the year, please contact me ASAP. Jane Jamieson Careers & Pathways Coordinator - Mordialloc College [email protected] Direct Ph. 8587 0521. Useful Links Job Guide – a good resource for exploring possible careers http://wwhttp://www.jobguide.thegoodguides.com.au/Your-guide-to-Job-Guide TAFES / Colleges – scroll down to get to the Victorian TAFE’s. http://www.australian- universities.com/colleges/list.php Chisholm TAFE http://www.chisholm.edu.au/ Holmesglen TAFE http://www.holmesglen.edu.au/ Melbourne Universities http://www.australian-universities.com/directory/melbourne-universities/ Victorian Curriculum and Assessment Authority (VCAA) has published much useful information on their website. -

Curriculum Vitae Dr Raj

Curriculum Vitae Dr Raj Das Faculty Member, Department of Mechanical Engineering Principal Investigator, Centre for Advanced Composite Materials University of Auckland 20 Symonds Street Auckland 1010 New Zealand Tel: +64 9 923 5094 Fax: + 64 9 373 7479 E-mail: [email protected] Citizenship: Australian Biography Dr Raj Das is a faculty member of the Mechanical Engineering Department of the University of Auckland, New Zealand. He is also a member of the Centre for Advanced Composite Materials. His current areas of interest include impact response and failure of composite materials, numerical modelling using finite element and mesh-less methods, dynamic fracture and fatigue, structural optimisation, and severe plastic deformation processes. Dr Das has a PhD in the field of failure analysis and structural optimisation from Monash University, Australia, and a Bachelor degree (1st class Hons) in Mechanical Engineering from Jadavpur University, India. He developed a range of damage tolerance based optimisation tools, which have been adopted by aerospace industries for optimum designs of fracture strength and fatigue life. Dr Das subsequently worked as a Research Associate in the University of Manchester, UK. Here he was involved in the investigation of structural responses and collapse of joints in steel- framed structures in fire. On his return to Australia, Dr Das joined the Commonwealth Scientific and Industrial Research Organisation (CSIRO) as a Senior Research Scientist, where he contributed to the development and applications of mesh-less SPH method for a range of industrial applications. In the early stage of his career, Dr Das worked in Gas Turbine Research Establishment (GTRE), a national research laboratory under the Ministry of Defence in Bangalore, India. -

AACSB Accredited Overseas Partners

AACSB Accredited Overseas Partners AUSTRALIA Bond University Accreditation(s): Accredited Australian university by the Tertiary Education Quality and Standards Agency (TEQSA) and EQUIS. Transcript: Bond University Academic Highlight: Our Semester on the Gold Coast program is located at Bond University. Founded in 1915, Bond is AACSB-accredited and accredited by the Tertiary Education Quality and Standards Agency (TEQSA) . Macquarie University Accreditation(s): Accredited by The Department of Education and Training of Australia Transcript: Macquarie University Academic Highlight: Our Semester in Sydney program is located at Macquarie University. Founded in 1964, Macquarie is accredited by the Department of Education and the Employment and Workplace Relations of Australia. Its graduate school is AACSB-accredited. Macquarie is ranked in the top 2% of universities in the world by Shanghai Jiao Tong Academic Ranking of World Universities. University of Adelaide Accreditation(s): Accredited by the Department of Education and Training, Australia; CPA Australia; Institute of Chartered Accountants in Australia (ICAA); Australian Computer Society (ACS); Engineers Australia Transcript: University of Adelaide Academic Highlight: Our Summer at University of Adelaide program is located at the University of Adelaide. Founded in 1874, Adelaide is AACSB-accredited and is a full member of EFMD, the Global Management Development Network. The University of Adelaide is ranked in the top 2% of universities in the world by Shanghai Jiao Tong Academic Ranking of World Universities and top 150 by Times Higher Education. Furthermore, it is one of Australia's leading Group of Eight research-intensive universities. University of Melbourne Accreditation(s): Accredited by the Department of Education and Training, Australia. -

Your Passport to University in the Uk

YOUR PASSPORT TO UNIVERSITY IN THE UK kaplanpathways.partners/aston YOU’LL ENJOY: YOUR ROUTE TO A • Complete preparation for your degree • Guaranteed entry to LIFE-CHANGING DEGREE Aston University* If you don’t quite qualify for a degree at Aston University, you can still gain • Access to university facilities in London entry with a pathway course at Kaplan International College (KIC) London. • Dedicated support services It’s your very own passport to university. • High-quality accommodation FOR STUDENTS WHO HAVE COMPLETED HIGH SCHOOL WITH GOOD GRADES PROGRESS TO 1 OF 30+ DEGREES AT ASTON Graduate International Bachelor’s Bachelor’s Subject areas include: Year One degree year 2 degree year 3 with a degree from Aston • Accounting at KIC London at university at university University • Business Analytics • Design Engineering • Electronic Engineering FOR STUDENTS WITH A BACHELOR’S DEGREE OR EQUIVALENT • Finance • Human Resources • Investment Analysis Master’s Graduate • Management Pre-Master’s degree with a degree • Marketing at KIC London 1 year at from Aston • Mechanical Engineering university University • Strategic Marketing • Supply Chain Management + many more * When you pass your KIC London pathway course at the required level and with good attendance WHY STUDY AT ASTON UNIVERSITY? Top 20 in the UK for student experienceT1 2nd in the UK for teaching effectivenessT2 Globally elite Business School, with triple accreditation Top 20 in the UK for graduate prospectsC Excellent location in Birmingham city centre Business Top 20 in the UKT1 MASUD FROM BANGLADESH MASTER’S IN HUMAN Marketing RESOURCE MANAGEMENT AND BUSINESS 12th in the UKC “Aston University is an excellent place to study, with great resources. -

International Partner Universities Australia Griffith University, Gold Coast Monash University, Melbourne University of Newcastl

International Partner Universities Hong Kong Sweden City University of Hong Kong, Kowloon Jönkoping University, Jönkoping Australia Luleå University of Technology, Luleå Griffith University, Gold Coast Hungary Monash University, Melbourne ESSCA School of Management, Budapest Taiwan University of Newcastle, Newcastle National Taiwan Ocean University, Taiwan University of Technology Sydney (UTS), Sydney India RMIT University, Melbourne Indian Institute of Technology Madras (IITM), Uruguay Queensland University of Technology(QUT), Brisbane Chennai** University of Montevideo, Montevideo Western Sydney University, Rydalmere Ireland Vietnam Austria National University of Ireland, Galway RMIT University, Ho Chi Minh City Upper Austria University of Applied Sciences, Steyr and Wels Italy *Study only University of Bologna, Bologna** **Research only Canada Sant'Anna Institute, Sorrento* Laval University, Quebec City Politecnico di Torino, Turin** Sapienza University, Rome** China ESSCA School of Management, Shanghai Japan Ocean University of China, Qingdao** Kyushu Institute of Technology, Fukuoka** Shanghai University of Electric Power, Shanghai** Tsinghua University School of Materials Science and Mexico Engineering, Beijing** University of Monterrey, Monterrey Tecnologico de Monterrey, Mexico City Croatia University of Rijeka, Rijeka Netherlands Delft University of Technology, Delft Denmark Technical University of Denmark (DTU), Lyngby New Zealand AUT University, Auckland England Northumbria University, Newcastle-Upon-Tyne Romania University