India- Mumbai- Office- Q1 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sr. No. Ward Name of Socities Addresses of Societies Daily Waste

Bulk Generator Addresses-Eastern Suburbs Daily Waste Sr. Generation by Ward Name of Socities Addresses of Societies No. Bulk Generators (in Kgs) L & T, Gate No.5, Sakivihar Road, Kulra (W), L & T, Gate No.5, Sakivihar Road, 1 460 Mumbai – 400072 Kulra (W), Mumbai – 400072 (0.46) Light Hall, Sakivihar Road, Kulra (W), Light Hall, Sakivihar Road, Kulra (W), 2 740 Mumbai – 400072 Mumbai – 400072 (0.74) Ashok Tower, Marva Road, Kulra (W), Ashok Tower, Marva Road, Kulra 3 290 Mumbai – 400072 (W), Mumbai – 400072 (0.29) Satair Lake side CHS, Mountain Satair Lake side CHS, Mountain Bridge CHS Bridge CHS (New Mhada Colony), 4 (New Mhada Colony), Powai, JVL Road, 630 Powai, JVL Road, Kulra (W), Mumbai Kulra (W), Mumbai – 400072 – 400072 (0.632) Manav Sthal Heights, Marva Road, Kurla (w), Manav Sthal Heights, Marva Road, 5 265 Mumbai-400072 Kurla (w), Mumbai-400072 (0.267) N.G. Complex, Marva road, Kurla (w), N.G. Complex, Marva road, Kurla 6 225 Mumbai-400072 (w), Mumbai-400072 (0.225) Ashok Vihar CHS, Marva Road, Kurla (W), Ashok Vihar CHS, Marva Road, Kurla 7 160 Mumbai – 400072. (W), Mumbai – 400072.(0.160) Udyan Society, Marwa Road, Kurla (W), Udyan Society, Marwa Road, Kurla 8 140 Mumbai-400072 (W), Mumbai-400072 (0.139) Om Shanti complex Bhudhaji wadi Om Shanti complex Bhudhaji wadi lane, 9 lane, Sakivihar road, Kurla (w), 195 Sakivihar road, Kurla (w), Mumbai-400072 Mumbai-400072 (0.196) Harshvardhan Soc, Sakivihar Road, Kurla Harshvardhan Soc, Sakivihar Road, 10 125 (W), Mumbai-400072 Kurla (W), Mumbai-400072 (0.127) Adityavardhan Soc, (Aristocrat Lane), Kurla Adityavardhan Soc, (Aristocrat Lane), 11 140 (W), Mumbai-400072 Kurla (W), Mumbai-400072 (0.138) Tata Symphany CHS, Nahar Amrut Tata Symphany CHS, Nahar Amrut Shakti 12 Shakti Road, Kurla (W), Mumbai – 175 Road, Kurla (W), Mumbai – 400072. -

Powai Report.Cdr

® Powai, Mumbai From a tiny hamlet in the peripheries to being a densely populated residential market Micro Market Overview Report August 2018 About Powai THE CONSTRUCTION ACTIVITY IN POWAI PICKED UP IN THE LATE 90’S AND THERE HAS BEEN NO LOOKING BACK SINCE THEN FOR THE MICRO MARKET. Decades ago, Powai was an unfamiliar hamlet in There are numerous educational institutions the north eastern suburbs of Mumbai on the banks namely Hiranandani Foundation School, Bombay of Powai Lake, catering to the drinking water Scottish School, Podar International School and supply needs of the city. In 1958, the establishment Kendriya Vidyalaya. Dr. L H Hiranandani Hospital, of the technology and research institution – Indian Nahar Medical Centre and Powai Hospital are a few Institute of Technology, Bombay brought the prominent healthcare facilities. micro market into limelight. The construction activity in Powai picked up in the late 90’s and Convenience stores such as D Mart and shopping there has been no looking back since then for the complexes like Galleria and R City Mall (located micro market. less than 4 km from Powai) are also available for the shopping needs of residents. Apart from Powai is surrounded by hills of Vikhroli Parksite in residential developments, there are corporate the south east, Sanjay Gandhi National Park in the offices such as Crisil, Bayer, L&T, Nomura, Colgate- north and L.B.S. Road in the north eastern Palmolive, Deloitte and Cognizant. Additionally, direction. Powai is equipped with excellent social the micro market also provides a scenic view of the infrastructure. Powai Hills and the Sanjay Gandhi National Park. -

NAME ADDRESS CONTACT DETAILS MUMBAI DELHI Four

NAME ADDRESS CONTACT DETAILS MUMBAI Four Fountains De- 1st Floor – Cypress, Next to Reliance World, T: 022-65144044 T: 022-65130022 Stress Spa Hiranandani Gardens, Powai, Mumbai 400076, Open 7 days a week, 7 am to 10 pm Powai Four Fountains De- 1st Floor – Landmark Building, Below Golds T: 022-6453 6677 T: 022-6453 5599 Stress Spa Gym, Above HDFC Bank,Pali Naka, Open 7 days a week, 7 am to 10 pm Bandra(West) Bandra (West), Mumbai 400050, Four Fountains De- Next to Kaya Skin Clinic, Opp. Greens T:022-6529 4449 T:022-6529 5551 Stress Spa – Restaurant, Link Road, Malad (West), Open 7 days a week, 7 am to 10 pm Malad(West) Mumbai 400064 Four Fountains De- Ground Floor, Rajanigandha Shopping Centre, T:022-4003 1360 T:022-2842 5657 Stress Spa – Behind Indian Bank, Opp. Gokuldham Temple, Open 7 days a week, 7 am to 10 pm Goregaon(East) Gokuldham, Goregaon (East), Mumbai – 400063. Four Fountains De- 1st floor, Kohli Villa-130, SV Road, T:022-4006 6615 T:022-4006 6616 Stress Spa – Near Shoppers Stop, Next to Open 7 days a week, 9 am to 10 pm Andheri (West) KFC (Andheri West), Mumbai 400058 Four Fountains De- 102, E-Square, Above State Bank of India, T: 022-6535 9777 T: 022-6535 8777 Stress Spa – Vile Near Garware Industries, Subhash Road, Open 7 days a week, 7 am to 10 pm Parle(East) Vile Parle (East), Mumbai – 400057 DELHI Four Fountains De- E-18, 2nd Floor, NDSE Market, South T: 011-4165 0016 T: 011-4165 0017 Stress Spa – South Extension Part 2, New Delhi – 110049 Open 7 days a week, 9 am to 10 pm Delhi B-15, Ground Floor,Next to ICICI Bank, -

Sample Best Use Study and Design Brief for a Plot In

XYZ developers, December, 201X Forward Liases Foras was approached by XYZ developer to conduct Best Use Analysis and Design Brief development which helps them to take decision on future development plan for their ABC location located in Kandivali- East, Mumbai Maharashtra. The project is framed and developed under the head of MAHADA Redevelopment Policy. Following are the key statistical details of the project. The site is approximately XXX acres of the continuous land parcel. Cumulative development potential of the subject site is XXX sq.ft. of BUA (Built up area) as mentioned by XYZ developers. After the rehabilitation, built up area available for sale is 38,08,271 sq.ft. While, there are many ways to arrive at the recommendations related to product, price and phasing, we have considered rationales, which according to urban economics are most crucial for success of any location. All the recommendations and suggestions mentioned in the report are directly or indirectly governed by scientifically laid down theories and methodologies of Urban Economics. We hope the report will be helpful to XYZ developersto envisage the project and its future market outlook. Disclaimer The information provided in this report is based on the data collected by Liases Foras. Liases Foras has taken due care in the collection of the data. However, Liases Foras does not warranty the correctness of the information provided in this report. The report is available only on "as is" basis and without any warranties express or implied. Liases Foras disclaims all warranties including the implied warranty of merchantability and fitness for any purpose. -

'AM Naik Tower' at Powai

L&T inaugurates ‘A.M. Naik Tower’ at Powai Mumbai, December 21, 2020: Larsen & Toubro, India's leading engineering, procurement and construction projects, manufacturing, defence and services conglomerate, inaugurated ‘A.M. Naik Tower’, the corporate office tower located at its Powai campus. A smart, digitally advanced, green corporate office tower dedicated on the occasion of completing 55 years of service to the company by L&T Group Chairman Mr. A.M. Naik. The corporate office tower is one of the most advanced, digitally smart and green building in India that provides choicest modern amenities for its employees and visitors. With a total built-up area of 1.03 million sqft, it will be hosting 4,500 group employees availing modern amenities such as 300-seater hi-tech multipurpose hall, 800-seater food court, well-equipped gymnasium, digital library, immersive training rooms and a special lounge. On this momentous occasion, Mr. S.N. Subrahmanyan, CEO & MD, Larsen & Toubro, said: “It is our fortune to have the visionary leadership of Mr. A.M. Naik, who have guided the company and its people to always achieve the unachievable. This newly inaugurated ‘A.M. Naik Tower’ is a befitting acknowledgement of his stupendous 55 years of service and contributions to the group.” “The tower will pave the way to bring in further synergies across businesses, group companies and corporate functions by hosting multiple group offices at one location,” added Mr. Subrahmanyan. Located at the junction of Saki Vihar road and Jogeshwari Vikhroli Link Road (JVLR) in the central part of Mumbai, the A.M. -

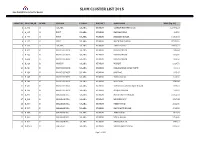

List of Slum Cluster 2015

SLUM CLUSTER LIST 2015 Slum Rehabilitation Authority, Mumbai OBJECTID CLUSTER_ID WARD VILLAGE TALUKA DISTRICT SLUM NAME AREA (Sq. M.) 1 A_001 A COLABA COLABA MUMBAI GANESH MURTHI NAGAR 120771.23 2 A_005 A FORT COLABA MUMBAI BANGALIPURA 318.50 3 A_006 A FORT COLABA MUMBAI NARIMAN NAGAR 14315.98 4 A_007 A FORT COLABA MUMBAI MACHIMAR NAGAR 37181.09 5 A_009 A COLABA COLABA MUMBAI GEETA NAGAR 26501.21 6 B_021 B PRINCESS DOCK COLABA MUMBAI DANA BANDAR 939.53 7 B_022 B PRINCESS DOCK COLABA MUMBAI DANA BANDAR 1292.90 8 B_023 B PRINCESS DOCK COLABA MUMBAI DANA BANDAR 318.67 9 B_029 B MANDVI COLABA MUMBAI MANDVI 1324.71 10 B_034 B PRINCESS DOCK COLABA MUMBAI NALABANDAR JOPAD PATTI 600.14 11 B_039 B PRINCESS DOCK COLABA MUMBAI JHOPDAS 908.47 12 B_045 B PRINCESS DOCK COLABA MUMBAI INDRA NAGAR 1026.09 13 B_046 B PRINCESS DOCK COLABA MUMBAI MAZGAON 1541.46 14 B_047 B PRINCESS DOCK COLABA MUMBAI SUBHASHCHANDRA BOSE NAGAR 848.16 15 B_049 B PRINCESS DOCK COLABA MUMBAI MASJID BANDAR 277.27 16 D_001 D MALABAR HILL COLABA MUMBAI MATA PARVATI NAGAR 21352.02 17 D_003 D MALABAR HILL COLABA MUMBAI BRANHDHARY 1597.88 18 D_006 D MALABAR HILL COLABA MUMBAI PREM NAGAR 3211.09 19 D_007 D MALABAR HILL COLABA MUMBAI NAVSHANTI NAGAR 4013.82 20 D_008 D MALABAR HILL COLABA MUMBAI ASHA NAGAR 1899.04 21 D_009 D MALABAR HILL COLABA MUMBAI SIMLA NAGAR 9706.69 22 D_010 D MALABAR HILL COLABA MUMBAI SHIVAJI NAGAR 1841.12 23 D_015A D GIRGAUM COLABA MUMBAI SIDHDHARTH NAGAR 2189.50 Page 1 of 101 SLUM CLUSTER LIST 2015 Slum Rehabilitation Authority, Mumbai OBJECTID CLUSTER_ID WARD VILLAGE TALUKA DISTRICT SLUM NAME AREA (Sq. -

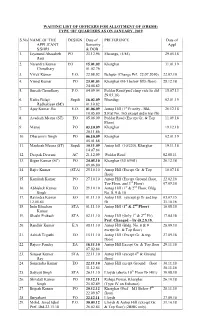

Waiting List of Officers for Allotment of (Fresh) Type 'Iii'

WAITING LIST OF OFFICERS FOR ALLOTMENT OF (FRESH) TYPE ‘III’ QUARTERS AS ON JANUARY, 2019 S.No NAME OF THE DESIGN Date of PREFERENCE Date of . APPLICANT . Seniority Appl S/SHRI & DOB 1. Jayanand Abasaheb PO 23.12.96 Matunga, (5/85) 29.05.18 Raut 2. Narendra Kumar EO 15.01.02 Kharghar 31.01.19 Choudhary 01.02.76 3. Vivek Kumar E.O. 22.08.02 Belapur (Change Prf. 22.07.2010) 22.07.10 4. Vinod Kumar PO 23.01.03 Kharghar (M-1 below fifth floor) 28.12.18 24.08.82 5. Suresh Choudhary P.O. 04.09.04 Peddar Road(pref chng vide ltr dtd 15.07.13 29.03.16) 6. Katke Balaji Supdt 16.02.09 Bhandup 02.01.19 Radhakisan (SC) 01.10.82 7. Ajay Kumar Jha E.O. 01.06.09 Antop Hill (1st Priority - Bld- 26.12.18 10.05.80 8,Flat No. 165 except grd n top flr) 8. Avadesh Meena (ST) EO 05.06.09 Peddar Road (Except Gr. & Top 11.09.18 Floor) 9. Manoj PO 03.10.09 Kharghar 19.12.18 20.11.86 10. Dharamvir Singh PO 06.10.09 Kharghar 02.01.19 05.01.88 11. Mankesh Meena (ST) Supdt 30.11.09 Antop hill (10/220), Kharghar 19.11.18 14.07.84 12. Deepak Devrani AC 21.12.09 Peddar Road 02.08.11 13. Bigan Kumar (SC) PO 24.05.10 Kharghar (M16/901) 26.12.18 09.06.80 14. Rajiv Kumar (STA) 25.10.10 Antop Hill (Except Gr. -

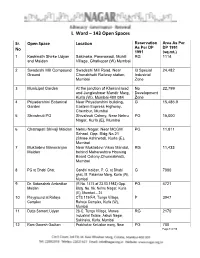

L Ward – 143 Open Spaces

L Ward – 143 Open Spaces Sr. Open Space Location Reservation Area As Per No As Per DP DP 1991 1991 (sq.mt.) 1 Kashinath Shirke Udyan Sakinaka, Parerawadi, Mohili RG 1114 and Maidan Village, Ghatkopar (W) Mumbai 2 Swadeshi Mill Compound Swadeshi Mill Road, Near I3 Special 24,482 Ground Chunabhatti Railway station, Industrial Mumbai Zone 3 Municipal Garden At the junction of Kherani road No 22,799 and Jangleshwar Mandir Marg, Development Kurla (W), Mumbai 400 084 Zone 4 Priyadarshini Botanical Near Priyadarshini building, G 15,486.9 Garden Eastern Express Highway, Chembur, Mumbai 5 Shivshruti PG Shivshruti Colony, Near Nehru PG 15,000 Nagar, Kurla (E), Mumbai 6 Chatrapati Shivaji Maidan Nehru Nagar, Near MCGM PG 11,811 School, Opp. Bldg No.21 (Shree Ashirwad), Kurla (E), Mumbai 7 Muktadevi Manoranjan Near Muktadevi Vikas Mandal, RG 11,433 Maidan behind Maharashtra Housing Board Colony,Chunnabhatti, Mumbai 8 PG at Dhobi Ghat Gandhi maidan, P. G. at Dhobi G 7000 ghat, M. Patankar Marg, Kurla (W), Mumbai 9 Dr. Babasaheb Ambedkar (R.No. 1474 of 23.03.1983) Opp. PG 4721 Maidan Bldg. No. 96, Nehru Nagar, Kurla (E), Mumbai – 24 10 Playground at Raheja CTS 119/F/4, Tunga Village, P 3947 Complex Raheja Complex, Kurla (W), Mumbai 11 Dutta Samant Udyan 28-C, Tunga Village, Marwa RG 2170 Industrial Estate, Ashok Nagar, Sakinaka, Kurla, Mumbai 12 Ram Ganesh Gadkari Prabhakar Keluskar marg, Near PG 700 Page 1 of 10 Reservation Area As Per Sr. Open Space Location As Per DP DP 1991 No 1991 (sq.mt.) Maidan Bharat cinema, Opp. -

359 LTD Bus Time Schedule & Line Route

359 LTD bus time schedule & line map 359 LTD Malvani Depot (Gaikwad Nagar) - Hiranandani View In Website Mode Powai Bus Station The 359 LTD bus line (Malvani Depot (Gaikwad Nagar) - Hiranandani Powai Bus Station) has 2 routes. For regular weekdays, their operation hours are: (1) Hiranandani Powai Bus Station / िहरानंदानी पोवई बस थानक: 6:05 AM - 9:05 PM (2) Malvani Depot (Gaikwad Nagar) / मालवणी आगार (गायकवाड नगर): 7:15 AM - 10:40 PM Use the Moovit App to ƒnd the closest 359 LTD bus station near you and ƒnd out when is the next 359 LTD bus arriving. Direction: Hiranandani Powai Bus Station / 359 LTD bus Time Schedule िहरानंदानी पोवई बस थानक Hiranandani Powai Bus Station / िहरानंदानी पोवई बस 73 stops थानक Route Timetable: VIEW LINE SCHEDULE Sunday 6:05 AM - 9:05 PM Monday 6:05 AM - 9:05 PM Malvani Depot (Gaikwad Nagar) / मालवणी आगार (गायकवाड नगर) Tuesday 6:05 AM - 9:05 PM Malvani Block No 7 Wednesday 6:05 AM - 9:05 PM Thursday 6:05 AM - 9:05 PM Malvani Block No 6 Friday 6:05 AM - 9:05 PM Malvani Block No.5 Police Station Saturday 6:05 AM - 9:05 PM Fire Brigade/Kharodi Colony Township Municipal School 359 LTD bus Info Asmita Jyoti Direction: Hiranandani Powai Bus Station / िहरानंदानी Giridhar Park पोवई बस थानक Stops: 73 Malad Marve Road, Mumbai Trip Duration: 67 min Line Summary: Malvani Depot (Gaikwad Nagar) / Mith Chowky Malad मालवणी आगार (गायकवाड नगर), Malvani Block No 7, Malvani Block No 6, Malvani Block No.5 Police Evershine Nagar Station, Fire Brigade/Kharodi Colony, Township Municipal School, Asmita Jyoti, Giridhar Park, Mith Kach -

Flooding Mumbai

Draft Report Identification of flood risk on urban road network using Hydrodynamic Model Case study of Mumbai floods Author Mr. Prasoon Singh Ms Ayushi Vijhani Reviewer(s) Dr Vinay S P Sinha Ms Neha Pahuja Ms Suruchi Bhadwal Dr M S Madhusoodanan Identification of flood risk on urban road network using Hydrodynamic Model Case study of Mumbai floods © The Energy and Resources Institute 2016 Suggested format for citation T E R I. 2016 Identification of flood risk on urban road network using Hydrodynamic Model Case study of Mumbai floods New Delhi: The Energy and Resources Institute. 105 pp. [Project Report No. ________________] For more information Project Monitoring Cell T E R I Tel. 2468 2100 or 2468 2111 Darbari Seth Block E-mail [email protected] IHC Complex, Lodhi Road Fax 2468 2144 or 2468 2145 New Delhi – 110 003 Web www.teriin.org India India +91 • Delhi (0)11 ii 4 Table of Contents Introduction ............................................................................................................................................. 8 Objectives ............................................................................................................................................... 9 Literature Review .................................................................................................................................. 10 Mumbai District Profile ........................................................................................................................ 11 Geography ........................................................................................................................................ -

India- Mumbai- Residential Q4 2020

M A R K E T B E AT MUMBAI Residential Q4 2020 FESTIVE SEASON AND POLICY SUPPORT PROVIDES FURTHER IMPETUS TO LAUNCHES IN Q4 Mumbai’s residential sector rode on the policy support of lower stamp duty, developer incentives, low interest rates to record robust growth in quarterly launches in Y-O-Y DROP IN NEW LAUNCHES Q4, which also coincided with the festive season which has traditionally seen strong buyer and developer activity. Better sales momentum also allowed developers 46% IN 2020 the confidence to launch new projects, in H2 2020. A total of 11,492 units were launched during the quarter, which is nearly 2.4 times higher on a q-o-q basis. With 32,457 units launched in 2020, annual launches were down by 46% compared to 2019. Thane sub-market witnessed the highest launches in the quarter with a SHARE OF MID SEGMENTIN share of 26% followed by the sub-markets of Eastern Suburbs and Navi Mumbai with 22% and 16% share, respectively. Interestingly, Extended Eastern and 58% 2020 LAUNCHES Western Suburbs witnessed reduced launches during the quarter with elevated levels of unsold inventory being a major concern for developers in these sub- markets. Prominent developers like Dosti Realty, Runwal Group, Godrej Properties, Paradigm Realty, Raymond Realty and Marathon Realty were the most active during the quarter and contributed nearly 56% of the cumulative launches. Construction activity also gained some momentum during the quarter as developers 22% THANE’s SHARE IN LAUNCHES across sub-markets focused on completion of on-going projects. However, we expect delay in possession of new homes by nearly 3-6 months. -

Hiranandani Gardens

https://www.propertywala.com/hiranandani-gardens-mumbai Hiranandani Gardens - Powai, Mumbai classical residential township Hiranandani Gardens, Powai is strategically located where International Airport is just 5km away and Domestic Airport is just 12km away. A world class multi – specialty hospital in the township More than eight five star hotels in the vicinity Project ID : J119091451 Builder: Hiranandani Group Properties: Apartments / Flats, Independent Houses, Shops, Office Spaces, Commercial Plots / Lands Location: Hiranadani Gardens, Powai, Mumbai (Maharashtra) Completion Date: Oct, 2007 Status: Completed Description Hiranandani Group-Ever since its inception in 1978, Hiranandani group has believed that its success comes from its people. Wherever there are people there is an opportunity to serve. Every activity, be it in real estate, education, healthcare, hospitality, leisure or entertainment has steadily focused on creating a better experience in every aspect of life. While corporate has gone from strength to strength , the Group is primarily synonymous with quality, commitment towards customers, reliability, and excellence in architecture. Hiranandani Gardens is a neo classical architectural marvel nestled amidst the verdant Powai hill, strategically located opposite the serene Powai Lake, A place where more than 4000 families stay. Sprawled majestically over 250 acres, Hiranandani Gardens is Mumbai’s finest residential township that has redefined the standards of elegant living. Intelligently planned, crafted with precision and embellished with care, it fulfills the delicate dreams of many, giving rise to a new perception of life and life style.Created from Barren land, this luxuriantly green and grand township is a tangible expression of a vision to create better communities. The product of a grand master plan, Hiranandani Gardens provides for every lifestyle need – real and imagined.