PG&E Corporation 2021 First Quarter Earnings

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

September 30, 2020

Valley air about to get worse as wildfire smoke has nowhere to go By Corin Hoggard and Dale Yurong Tuesday, September 29, 2020 FRESNO, Calif. (KFSN) -- Air quality is about to take a turn for the worse as a changing weather pattern will combine with wildfires to fill the Central Valley with smoke again. The last few months have produced a stretch of the worst air quality on record, according to the Air Pollution Control District. Satellite images show smoke gently blowing from several California fires out to the Pacific Ocean, a weather pattern keeping the Valley's air relatively clean for several days now. "Right now we're seeing the smoke aloft," said Maricela Velasquez of the San Joaquin Valley Air Pollution Control District. "It's above us. But as the week goes through, we'll continue to see that smoke come onto the Valley floor." Here's how: When you have a fire in the Central Valley -- which is essentially just a bowl -- the smoke can usually get out and air quality won't be bad everywhere. But when a high pressure system comes in, it essentially puts a lid on the bowl and the smoke has nowhere to go so it just collects on the Valley floor. "The blocking high, basically, once it sits over a certain spot it likes to stay there for quite a while," said meteorologist Carlos Molina of the National Weather Service in Hanford. Forecasters at the NWS say the lid will sit on our bowl for at least a week. Air Quality Science Director Jon Klassen of the Valley Air District said, "We're expecting that to continue in the coming days." By that time, our air will have collected smoke from the Creek Fire, the SQF Complex Fire, and even more recent fires to our west, like the Glass Fire in the Bay Area. -

Superior Court of California

1 INTRODUCTION 2 1. This Complaint arises from a fire caused by PG&E’s powerlines in Shasta County on 3 September 27, 2020, a wildfire now called the “Zogg Fire.” 4 5 6 7 8 9 10 11 12 13 14 15 16 17 Flames of Zogg Fire – Photo by Ethan Swope of Associated Press via Los Angeles Times 18 2. The Zogg Fire started when electrical equipment owned, operated and/or maintained by 19 PG&E utility infrastructure contacted, or caused sparks to contact, surrounding vegetation. This 20 occurred because: (1) PG&E’s utility infrastructure was intended, designed, and constructed to pass 21 electricity through exposed powerlines in vegetated areas; (2) PG&E negligently, recklessly, and 22 willfully failed to properly, safely, and prudently inspect, repair, maintain and operate the electrical 23 equipment in its utility infrastructure; and/or (3) PG&E negligently, recklessly, and willfully failed to 24 maintain an appropriate clearance area between the electrical equipment in its utility infrastructure and 25 surrounding vegetation. 26 3. The California Department of Forestry and Fire Protection (Cal Fire), which is the 27 primary investigating agency in this case, has concluded that the Zogg Fire was caused by a pine tree 28 2 ZOGG FIRE COMPLAINT 1 contacting electrical transmission lines owned and operated by Pacific Gas and Electric (PG&E) 2 located north of the community of Igo. 3 4. The Zogg Fire burned more than 56,000 acres, destroyed over 200 structures, resulted in 4 multiple injuries and fatalities, and catastrophically impacted the local community. 5 5. -

Response to Order Requesting Information Re. Zogg Fire and Order

Case 3:14-cr-00175-WHA Document 1250 Filed 10/26/20 Page 1 of 16 1 JENNER & BLOCK LLP Reid J. Schar (pro hac vice) 2 [email protected] 353 N. Clark Street 3 Chicago, IL 60654-3456 4 Telephone: +1 312 222 9350 Facsimile: +1 312 527 0484 5 CLARENCE DYER & COHEN LLP 6 Kate Dyer (Bar No. 171891) [email protected] 7 899 Ellis Street 8 San Francisco, CA 94109-7807 Telephone: +1 415 749 1800 9 Facsimile: +1 415 749 1694 10 CRAVATH, SWAINE & MOORE LLP Kevin J. Orsini (pro hac vice) 11 [email protected] 12 825 Eighth Avenue New York, NY 10019 13 Telephone: +1 212 474 1000 Facsimile: +1 212 474 3700 14 Attorneys for Defendant PACIFIC GAS AND ELECTRIC 15 COMPANY 16 UNITED STATES DISTRICT COURT 17 NORTHERN DISTRICT OF CALIFORNIA SAN FRANCISCO DIVISION 18 19 UNITED STATES OF AMERICA, Case No. 14-CR-00175-WHA 20 Plaintiff, RESPONSE TO ORDER 21 REQUESTING INFORMATION RE 22 ZOGG FIRE AND ORDER FOR v. FURTHER INFORMATION RE 23 ZOGG FIRE PACIFIC GAS AND ELECTRIC COMPANY, 24 Judge: Hon. William Alsup Defendant. 25 26 27 28 RESPONSE TO ORDER REQUESTING INFORMATION RE ZOGG FIRE AND ORDER FOR FURTHER INFORMATION RE ZOGG FIRE Case No. 14-CR-00175-WHA Case 3:14-cr-00175-WHA Document 1250 Filed 10/26/20 Page 2 of 16 1 Defendant Pacific Gas and Electric Company (“PG&E”) respectfully submits this 2 response to the Court’s October 12 and October 21, 2020 orders requesting information 3 regarding the Zogg Fire. -

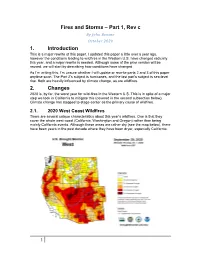

1 Fires and Storms

Fires and Storms – Part 1, Rev c By John Benson October 2020 1. Introduction This is a major rewrite of this paper. I updated this paper a little over a year ago, however the conditions leading to wildfires in the Western U.S. have changed radically this year, and a major rewrite is needed. Although some of the prior version will be reused, we will start by describing how conditions have changed. As I’m writing this, I’m unsure whether I will update or rewrite parts 2 and 3 of this paper anytime soon. The Part 2’s subject is hurricanes, and the last part’s subject is sea-level rise. Both are heavily influenced by climate change, as are wildfires. 2. Changes 2020 is, by far, the worst year for wild-fires in the Western U.S. This is in spite of a major step we took in California to mitigate this (covered in the second subsection below). Climate change has stepped to stage-center as the primary cause of wildfires. 2.1. 2020 West Coast Wildfires There are several unique characteristics about this year’s wildfires. One is that they cover the whole west coast (California, Washington and Oregon) rather than being mainly California events. Although these areas are rather dry (see the map below), there have been years in the past decade where they have been dryer, especially California. 1 Another factor is the number and severity of the wildfires in the west coast states. See the chart below.1 The following CAL FIRE Chart from September 10 shows the severity of this year’s fires in California. -

Shasta Trinity Unit Headquarters / Northern Operations

STATE OF CALIFORNIA Capital Outlay Budget Change Proposal (COBCP) - Cover Sheet DF-151 (REV 07/20) Fiscal Year Business Unit Department Priority No. 2021-2022 3540 Department of Forestry Click or tap here to enter text. and Fire Protection Budget Request Name Capital Outlay Program ID Capital Outlay Project ID 3540-135-COBCP-MR 2485 0000971 Project Title Shasta Trinity Unit Headquarters / Northern Operations: Relocate Facility Project Status and Type Status: ☐ New ☒ Continuing Type: ☒Major ☐ Minor Project Category (Select one) ☐CRI ☐WSD ☐ECP ☐SM (Critical Infrastructure) (Workload Space Deficiencies) (Enrollment Caseload Population) (Seismic) ☒FLS ☐FM ☐PAR ☐RC (Fire Life Safety) (Facility Modernization) (Public Access Recreation) (Resource Conservation) Total Request (in thousands) Phase(s) to be Funded Total Project Cost (in thousands) $ 360 Preliminary plans $ 109,759 Budget Request Summary The Department of Forestry and Fire Protection (CAL FIRE) requests an additional $360,000 General Fund for the preliminary plans phase of the Shasta Trinity Unit Headquarters / Northern Operations: Relocate Facility project. CAL FIRE submitted a proposal for the preliminary plans phase of this project in the 2021-22 Governor’s Budget. This request amends the previous proposal to address scope and cost changes to the project. The total estimated project costs are now $109,759,000. Requires Legislation Code Section(s) to be Added/Amended/Repealed CCCI Click or tap here to enter text. ☐ Yes ☒ No Click or tap here to enter text. Requires Provisional Language Budget Package Status ☐ Yes ☒ No ☐ Needed ☐ Not Needed ☒ Existing Impact on Support Budget One-Time Costs ☒ Yes ☐ No Swing Space Needed ☐ Yes ☐ No Future Savings ☒ Yes ☐ No Generate Surplus Property ☐ Yes ☐ No Future Costs ☐ Yes ☒ No If proposal affects another department, does other department concur with proposal? ☒ Yes ☐ No Attach comments of affected department, signed and dated by the department director or designee. -

10.1.20 Statewide Fires Report

Current Wildland Fires a as of October O1 2020 - 0800 Hours Slater- FRA Devil - FRA Start 9/8/2020 Start: 9/9/2020 48 % Containment 20% Containment 154,145 Acres 8,410 Acres Butte/Tehama/Glenn Complex - SRA FM: 5361 Start: 8/23/2020 97% Containment 19,609Acres North Complex - FRA Start: 8/17/2020 31 % Containment 79% Containment 124,464 Acres 314 ,949 Acres FM: 5363 Fork - FRA Start: 9/8/2020 70% Containment 1,667 Acres Zogg - SRA Slink - FRA Start 9/27/2020 Start: 8/30/2020 26% Containment 86% Containment 55,303 Acres 26 ,759 Acres FM: 5377 Wolf-FRA Start: 8/11 /2020 August Complex - FRA 35% Containment Start: 8/17/2020 I __J,...----• 1,087 Acres 51 % Containment 955,513 Acres 50 % Containment Creek - FRA LNU Lightning Complex - SRA 4,488 Acres Start: 9/5/2020 Start 8/17/2020 44% Containment 98% Containment 309,033 Acres 363,220 Acres FM: 5348 FM: 5331 Bullfrog - FRA Start: 9/8/2020 50% Containment 1,185 Acres 5% Containment 56,781 Acres Moraine - FRA FM: 5376 Start: 8/21 /2020 70 % Containment 668 Acres Woodward - FRA Start 8/18/2020 98% Containment 4,929Acres SCU Lightning Complex - SRA Rattlesnake - FRA Start: 8/16/2020 Start: 8/16/2020 98% Containment 0% Containment 396,624 Acres 4,070 Acres FM : 5338 ar-,.~\5---------.:~~:-------' SQFStart: Complex 8/24/2020 - FRA 61 % Containment 151,436Acres FM: 5373 El Dorado - SRA Dolan -SRA Start 9/5/2020 Start: 8/19/2020 93 % Containment 87 % Containment 22 ,744 Acres 124 ,924 Acres FM: 5350 Bobcat- FRA Start 9/6/2020 71 % Containment 114,829 Acres Snow -SRA FM: 5374 Start: 9/1 7/2020 95% -

Pleading Form with 28 Lines

1 KENNETH ZOOK, individually and as ) 2 trustee of the Zook Kenneth B Rev Liv ) Trust; ) 3 MIKE and CLARE MULLIN; ) 4 IRENE RUSS, individually and as trustee ) of the Irene S. Russ Trust of 2012; ) 5 GARY A. and SANDRA L. ) 6 SCHLUETER; ) MARJORIE M. LEWIS individually and ) 7 as trustee of the Lewis Marjorie M. 2003 ) 8 Revocable Trust; ) PRAXEDIS SANCHEZ and DANIELA ) 9 GARIBO; ) SUSAN L COOK, individually and as ) 10 trustee of the Wayne A. Cook and Susan L. ) 11 Cook Trust; ) TREVOR A. and AMBER M. ) 12 FLETCHER, individually and as guardian ) 13 for L.B.F & R.M.F; ) PAMELA HOWELL; ) 14 TAMMY HOWELL; ) 15 DANNY O. COLBY; ) JEFFREY and MIRANDA OWENS; ) 16 JOHN P. and TAMMY MOORE; ) 17 GREGORY ATKINS; ) ARIANNA L. MULHOLLAND; ) 18 JEFFREY MASON; ) 19 ROBERT D. SCHERTZ; ) CLINT SCHLUETER and MAITE ) 20 CABRERA; ) 21 DAMON L. and CAROL BRAZELL; ) AUSTIN BRAZELL; ) 22 MICHAEL J. CHALLENDER and ) 23 KIRSTEN EBERT; ) CHRISTOPHER H. CHOUINARD; ) 24 GEOFFREY BRYAN THEODORE ) 25 MCCOY; ) DAVID and GAYLE MARTIN; ) 26 ANNETTE VOWELL, individually and as ) 27 trustee of the Vowell Family Revocable ) Trust of 2006; ) 28 ) COMPLAINT FOR DAMAGES - 2 1 MARY JAN POWERS-NIGHTINGALE, ) 2 individually and as trustee of the Powers ) Nightingale Mary Jan 2016 Trust; ) 3 BILL BUSHNELL; ) 4 KENT LOWE, individually and as trustee ) of the Lowe Family Living Trust; ) 5 JEANNE LOWE; ) 6 BRIAN D. MILLER and TABITHA ) HENDRICKS; ) 7 REBECCA F. PERRY; ) 8 CANDACE STEELE; ) KYLE GARRETT; ) 9 RAY DALE and JANICE KATHLEEN ) PEDERSEN; ) 10 CHANTELL STEELE; ) 11 PERRY REYES; ) BERNITA MORRISON; ) 12 RANDY and BRENDA SANDIFER; ) 13 BAILEY SANDIFER; ) JANET MARTINEZ; ) 14 FELIX MARTINEZ; ) 15 TYLER REYES; ) KIMBERLY LAWSON; ) 16 PHOUNGEUN KHANTHAVONG; ) 17 DEVONG PAMOUANSITH, individually ) and as guardian for K.K; ) 18 HELEN M. -

August 10, 2021

Fueled by winds, Dixie Fire grows by nearly 6,000 acres overnight By Omar Shaikh Rashad San Francisco Chronicle, Tuesday, Aug. 10, 2021 Fanned by gusting winds and low humidity, the Dixie Fire — now the second largest wildfire in California’s history — grew by nearly 6,000 acres overnight Monday. By Tuesday morning, the blaze was reported at 487,764 acres and was 25% contained. The Dixie Fire’s growth Monday was a significant uptick compared to a day earlier, when more favorable conditions prevented the fire’s growth overnight Sunday, according to Cal Fire measurements. Cal Fire reported that thick smoke reduced visibility considerably on the eastern and western sides of the blaze, making firefighting conditions more difficult. The prospect of warming temperatures could aid the fire’s growth in the coming days. So far, the Dixie Fire has destroyed 893 structures and damaged 61 others. More than 16,000 structures remain threatened by the blaze. The fire has no fatalities or injuries among civilians but it has injured three firefighters. Progress made but hot weather could spur California wildfire By Christopher Weber and Jonathan J. Cooper, Associated Press Bakersfield Californian, Tuesday, Aug. 10, 2021 California's largest single wildfire in recorded history kept pushing through forestlands as fire crews tried to protect rural communities from flames that have destroyed hundreds of homes. Thick smoke cleared for several hours along one edge of the Dixie Fire on Monday, allowing aircraft to join nearly 6,000 firefighters in the attack. Many were battling to protect more than a dozen small mountain and rural communities in the northern Sierra Nevada. -

Office of the Governor

OFFICE OF THE GOVERNOR September 28, 2020 The Honorable Donald J. Trump President of the United States The White House 1600 Pennsylvania Avenue, NW Washington, D.C. 20500 Through: Mr. Robert J. Fenton, Jr. Regional Administrator Federal Emergency Management Agency, Region IX U.S.Department of Homeland Security 1111 Broadway, Suite 1200 Oakland, California 94607-4052 Mr. President, First, let me extend my sincere gratitude for the federal government's support throughout this unprecedented global pandemic, for the wildfires currently impacting California, and for your recent visit to McClellan Air Force Base on September 14, 2020. I sincerely appreciate the Presidential Emergency Declaration for both the Coronavirus Disease 2019 (FEMA-4482-DR-CA) and the August 2020 Northern California Wildfires GOVERNOR GAVIN NEWSOM • SACRAMENTO, CA 95814 • (916) 445-2841 ~64 (FEMA-4558-DR-CA). Unfortunately, as you witnessed during your visit, California is experiencing another siege of fires from early September, which continue to devastate communities throughout the State. In addition, at least two additional significant fires - the Glass Fire and the Zogg Fire- began burning yesterday and have rapidly spread and caused significant destruction. California is very much still engaged in a firefight with respect to those fires and will assess that damage as soon as possible. Under the provisions of Section 401 of the Robert T. Stafford Disaster Relief and Emergency Assistance Act, 42 U.S.C. §§ 5121-5207 (Stafford Act), and implemented by 44 CFR § 206.36, I request that you declare a major disaster in Fresno, Los Angeles, Madera, Mendocino, San Bernardino, San Diego, and Siskiyou counties, as a result of wildfires that began in early September 2020, and are continuing. -

Safeguard Properties Western Wildfire Reference Guide

Western U.S. Wildfire Reference Guide | 10/26/2020 | Disaster Alert Center Click image for enhanced view Recent events reportedly responsible for structural damage (approximate): California August Complex Fire (1,032,648 acres; 93% containment) August 16 – Present Mendocino, Humboldt, Trinity, Tehama, Lake, Glenn and Colusa Counties 54 structures destroyed; 6 structures damaged Approximate locations at least partially contained in event perimeter: Alder Springs (Glenn County, 95939) Bredehoft Place (Mendocino County, 95428) Chrome (Glenn County, 95963) Covelo (Mendocino County, 95428) Crabtree Place (Trinity County, 95595) Forest Glen (Trinity County, 95552) Hardy Place (Mendocino County, 95428) Houghton Place (Tehama County, 96074) Kettenpom (Trinity County, 95595) Mad River (Trinity County, 95526, 95552) Red Bluff (Tehama County, 96080) Ruth (Trinity County, 95526) Shannon Place (Trinity County, 95595) Zenia (Trinity County, 95595) Media: https://www.theguardian.com/us-news/2020/oct/06/california-wildfires-gigafire-first P a g e 1 | 15 Western U.S. Wildfire Reference Guide | 10/26/2020 | Disaster Alert Center Bobcat Fire (115,796 acres; 92% containment) September 6 – Present Los Angeles County *Northeast of Cogswell Reservoir, San Gabriel Canyon 163 structures destroyed; 47 structures damaged Approximate locations at least partially contained in event perimeter: Big Rock Springs (Los Angeles County, 93544) Hidden Springs (Los Angeles County, 93550) Juniper Hills (Los Angeles County, 93543, 93553)) Littlerock -

2020 Annual Progress Report

Please Start Here General Information Jurisdiction Name Shasta County - Unincorporated Optional: Click here to import last year's data. This is best used 2020 Reporting Calendar Year when the workbook is new and empty. You will be prompted to Contact Information pick an old workbook to import from. Project and program data will be copied exactly how it was entered in last year's form and First Name David must be updated. Last Name Schlegel Title Senior Planner Email [email protected] Phone 5302456473 Mailing Address Street Address 1855 Placer Street, Suite 103 City Redding Zipcode 96001 v 3_8_21 Annual Progress Report January 2020 Optional: This runs a macro which checks to ensure all required fields are filled out. The macro will create two files saved in the same directory this APR file is saved in. One file will be a copy of the APR with highlighted cells which require information. The other file will be list of the problematic cells, along with a description of the nature of the error. Submittal Instructions Optional: Save before running. This copies data on Table A2, and creates another workbook with the table split across 4 tabs, each of which can fit onto a single page for easier printing. Running this macro will remove the comments on the column headers, which contain the instructions. Do not save the APR file after running in order Please save your file as Jurisdictionname2020 (no spaces). Example: the city of to preserve comments once it is reopened. San Luis Obispo would save their file as SanLuisObispo2020 Housing Element Annual Progress Reports (APRs) forms and tables must be Optional: This macro identifies dates entered that occurred outside of the reporting year. -

2020 FULL YEAR and FOURTH QUARTER EARNINGS February 25, 2021 ® Forward-Looking Statements

2020 FULL YEAR AND FOURTH QUARTER EARNINGS February 25, 2021 ® Forward-Looking Statements This presentation contains statements regarding management’s expectations and objectives for future periods (including key factors affecting 2020 non-GAAP core earnings) as well as forecasts and estimates regarding PG&E Corporation’s and Pacific Gas and Electric Company’s (the “Utility”) 2020-2022 Wildfire Mitigation Plan (WMP), rate base projections, capital expenditure forecasts and regulatory developments. These statements and other statements that are not purely historical constitute forward-looking statements that are necessarily subject to various risks and uncertainties. Actual results may differ materially from those described in forward-looking statements. PG&E Corporation and the Utility are not able to predict all the factors that may affect future results. Factors that could cause actual results to differ materially include, but are not limited to risks and uncertainties associated with: • historical financial information not being indicative of future financial performance as a result of the Chapter 11 Cases and the financial and other recent restructuring in connection with their emergence from Chapter 11; • wildfires, including the extent of the Utility’s liability in connection with the 2019 Kincade fire and the 2020 Zogg fire, the Utility’s ability to recover related costs, and the timing of insurance recoveries; and with any other wildfires that have occurred in the Utility’s service territory for which the cause has yet to be determined;