GK Tornado for NIACL AO Mains 2018-19 Exam

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

THE NEW E-MAIL ID of UNION of INDIA IS “[email protected]”

09.09.2021 THE NEW E-MAIL ID OF UNION OF INDIA IS “[email protected]” AND TELEPHONE NUMBER IS 011- 23384193 FOR SERVICE OF MATTER/S FOR UNION OF INDIA IN THE DELHI HIGH COURT WITH EFFECT FROM 13th SEPTEMBER, 2021. THEREAFTER, NO SERVICE OF THE MATTER/S SHALL BE ENTERTAINED ON THE EXISTING MAIL ID I.E. “[email protected]” AND MOB. NO. 9999864964. DELHI HIGH COURT LEGAL SERVICES COMMITTEE NOTICE A LIST OF CANDIDATES SHORTLISTED FOR INTERVIEW FOR VARIOUS PANELS OF DELHI HIGH COURT LEGAL SERVICES COMMITTEE IS AVAILABLE ON THE WEBSITE OF DHCLSC(www.dhclsc.org) AS WELL AS ON THE NOTICE BOARD. THE INTERVIEW SCHEDULE WILL BE COMMUNICATED IN DUE COURSE. HIGH COURT OF DELHI AT NEW DELHI No.289/RG/DHC/2021 Dated: 23-04-2021 O FFICE ORD ER In continuation of this Court's Office Order No.4/RG/DHC/2021 dated 23.4.2021, it is further directed that in view of the prevailing circumstances, wherever so required, the concerned Counsel or party-in-person may,at the time of filing any petition, etc., submit an application seeking exemption from filing sworn/affirmed affidavit(s). Sd/- (MANOJ JAIN) REGISTRAR GENERAL As approved by Hon'ble Chairman, DHCLSC, National Lok Adalat is to be held on 11.09.2021(SECOND SATURDAY) at High Court of Delhi for pending cases under following category:- 1. Criminal Compoundable Offence 2. NI Act cases under Section 138; 3. Bank Recovery cases; 4. MACT cases; 5. Labour disputes cases; 6. Electricity and Water Bills[excluding non-compoundable] 7. -

Parliamentary Bulletin

RAJYA SABHA Parliamentary Bulletin PART-II Nos.55433-55442] TUESDAY, MAY 3, 2016 No.55433 Table Office MEMBERS OF RAJYA SABHA (DISQUALIFICATION ON GROUND OF DEFECTION) RULES, 1985 Under Rule 4(2) of the Members of Rajya Sabha (Disqualification on Ground of Defection) Rules, 1985, every member is required to furnish to the Secretary-General, inter-alia, a statement of particulars giving details of his/her party affiliation and declaration as in Form III set out for the purpose in the Rules. Rule 4(3) of the said Rules further provides that a summary of information furnished by the members under sub-rule (2) of this Rule is required to be published in Bulletin-Part II. The requisite information as furnished by the following members elected in the biennial elections to the Rajya Sabha from the States of Assam, Himachal Pradesh, Kerala, Nagaland, Tripura and Punjab and nominated to the Rajya Sabha during the month of April, 2016 are detailed below:— Sl. Name of the Member Name of the Political No. Party / Legislature Party 1 2 3 ASSAM 1. Shrimati Ranee Narah Indian National Congress 2. Shri Ripun Bora Indian National Congress HIMACHAL PRADESH 3. Shri Anand Sharma Indian National Congress KERALA 4. Shri A.K. Antony Indian National Congress 2 Sl. Name of the Member Name of the Political No. Party / Legislature Party 1 2 3 5. Shri M.P. Veerendra Kumar Janata Dal (United) 6. Shri K. Somaprasad Communist Party of India (Marxist) NAGALAND 7. Shri K.G. Kenye Naga People's Front TRIPURA 8. Shrimati Jharna Das Baidya. -

Years Because of a #Metoo Scandal

1 CHAPTERS 1 AWARDS & HONOURS 2 FAMOUS BOOKS 3 APPOINTMENTS 4 INDIAN ECONOMY 5 BUSINESS & CORPORATE WORLD 6 BRAND AMBASSADORS 7 AGREEMENTS & MoU 8 SUMMITS 9 INDEX, RANKINGS & DISTINCTIONS 10 SPORTS 11 SCIENCE & TECHNOLOGY 11 YOJANAS & SCHEMES 12 MISCELLANEOUS 2 AWARDS & HONOURS 2018 Nobel Laureates 2018 2018 Nobel Prize were announced in 5 different fields viz. Physiology or Medicine, Physics, Chemistry, Peace, & Economic Sciences. This is for the first time that Nobel Prize for Literature was not given in 70 years because of a #MeToo scandal. Field Winners Key Points “for their discovery of cancer James P Allison (USA) therapy by inhibition of negative Physiology or Medicine & Tasaku Honjo(Japan) immune regulation” Arthur Ashkin (USA), Gerard Mourou (France) and Donna Strickland "for groundbreaking inventions Physics (Canada) in the field of laser physics" (a) one half to Frances H. Arnold (USA) (a) "for the directed evolution of (b) Other half jointly to George P. enzymes" Chemistry Smith (USA) & Sir Gregory P. (b) "for the phage display of peptides & antibodies" Winter (UK) “for their efforts to end the use of Denis Mukwege (Congo) & sexual violence as a weapon of war Peace Nadia Murad (Iraq) & armed conflict” (a) “for integrating climate change into long-run macroeconomic analysis” (a) William D.Nordhaus (USA) Economic Sciences (b) “for integratingtechnological (b) Paul M. Romer (USA) innovations into long-run macroeconomic analysis.” 3 Ramon Magsaysay Award Winners 2018 Ramon Magsaysay Award is an annual award established to perpetuate former Philippine President Ramon Magsaysay's example of integrity in governance, courageous service to the people, & pragmatic idealism within a democratic society. -

Tamil Nadu 1

000000000000000000000000000000000000000000000000000 000000000000000000000000000000000000000000000000000 ENGLISH 00000000000000000000000TM0000000000000000000000000000 0000000000000000000000000JANUARY000000 - 0JULY00 020190000000000000000 000000000The0 Best0 IAS0 Academy000 In South00 India0 SINCE00 200400000Compilation000000 0for0 Group0000 IV0 0000000000000 Examination 000000000000000000000000000000000000000000000000000 000000000000000000000000000000000000000000000000000 000000000000000000000000000000000000000000000000000 000000000000TNPSC000000000000000000000000000000000000000 000000000000000000000000000000000000000000000000000 000000000000000000000000000000000000000000000000000 00000000000000ZERO0000000000000000000000000000000000000 000000000000000000000000000000000000000000000000000 000000000000000000000000000000000000000000000000000 00000000CURRENT0000000000000000000000000000000000000000000 000000000000000000000000000000000000000000000000000 000000000000000000000000000000000000000000000000000 0000000000AFFAIRS00000000000000000000000000000000000000000 000000000000000000000000000000000000000000000000000 000000000000000000000000000000000000000000000000000 000000000PRELIMS000000000000000000000000000000000000000000 000000000000000000000000000000000000000000000000000 000000000000000000000000000000000000000000000000000 0000000000000%000000000 100%000000000000000000000000000000 00000000000 0Effort0000000000Results00000000000000000000000000000 000000000000000000000000000000000000000000000000000 000000000000000000000000000000000000000000000000000 -

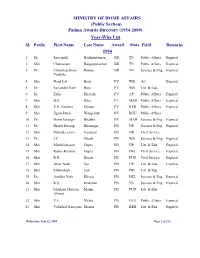

(Public Section) Padma Awards Directory (1954-2009) Year-Wise List Sl

MINISTRY OF HOME AFFAIRS (Public Section) Padma Awards Directory (1954-2009) Year-Wise List Sl. Prefix First Name Last Name Award State Field Remarks 1954 1 Dr. Sarvapalli Radhakrishnan BR TN Public Affairs Expired 2 Shri Chakravarti Rajagopalachari BR TN Public Affairs Expired 3 Dr. Chandrasekhara Raman BR TN Science & Eng. Expired Venkata 4 Shri Nand Lal Bose PV WB Art Expired 5 Dr. Satyendra Nath Bose PV WB Litt. & Edu. 6 Dr. Zakir Hussain PV AP Public Affairs Expired 7 Shri B.G. Kher PV MAH Public Affairs Expired 8 Shri V.K. Krishna Menon PV KER Public Affairs Expired 9 Shri Jigme Dorji Wangchuk PV BHU Public Affairs 10 Dr. Homi Jehangir Bhabha PB MAH Science & Eng. Expired 11 Dr. Shanti Swarup Bhatnagar PB UP Science & Eng. Expired 12 Shri Mahadeva Iyer Ganapati PB OR Civil Service 13 Dr. J.C. Ghosh PB WB Science & Eng. Expired 14 Shri Maithilisharan Gupta PB UP Litt. & Edu. Expired 15 Shri Radha Krishan Gupta PB DEL Civil Service Expired 16 Shri R.R. Handa PB PUN Civil Service Expired 17 Shri Amar Nath Jha PB UP Litt. & Edu. Expired 18 Shri Malihabadi Josh PB DEL Litt. & Edu. 19 Dr. Ajudhia Nath Khosla PB DEL Science & Eng. Expired 20 Shri K.S. Krishnan PB TN Science & Eng. Expired 21 Shri Moulana Hussain Madni PB PUN Litt. & Edu. Ahmed 22 Shri V.L. Mehta PB GUJ Public Affairs Expired 23 Shri Vallathol Narayana Menon PB KER Litt. & Edu. Expired Wednesday, July 22, 2009 Page 1 of 133 Sl. Prefix First Name Last Name Award State Field Remarks 24 Dr. -

Agriculture Marketing and Role of Weekly Gramin Haats"

STANDING COMMITTEE ON AGRICULTURE (2018-2019) 62 SIXTEENTH LOK SABHA MINISTRY OF AGRICULTURE AND FARMERS WELFARE (DEPARTMENT OF AGRICULTURE, COOPERATION AND FARMERS WELFARE) SIXTY SECOND REPORT "AGRICULTURE MARKETING AND ROLE OF WEEKLY GRAMIN HAATS" LOK SABHA SECRETARIAT NEW DELHI January, 2019/Pausha, 1940 (Saka) Page 1 of 81 SIXTY SECOND REPORT STANDING COMMITTEE ON AGRICULTURE (2018-2019) (SIXTEENTH LOK SABHA) MINISTRY OF AGRICULTURE AND FARMERS WELFARE (DEPARTMENT OF AGRICULTURE, COOPERATION AND FARMERS WELFARE) "Agriculture Marketing and Role of Weekly Gramin Haats" Presented to Lok Sabha on 03.01.2019 Laid on the Table of Rajya Sabha on 03.01.2019 LOK SABHA SECRETARIAT NEW DELHI January, 2019/Pausha, 1940 (Saka) Page 2 of 81 COA No. 392 Price : Rs. © 2018 By Lok Sabha Secretariat Published under Rule 382 of the Rules of Procedure and Conduct of Business in Lok Sabha (Fourteenth Edition) and Printed by Page 3 of 81 <CONTENTS> PAGE No. COMPOSITION OF THE COMMITTEE (2016-17)………………………… (iii) COMPOSITION OF THE COMMITTEE (2017-18)………………………… (iv) COMPOSITION OF THE COMMITTEE (2018-19)………………………… (v) INTRODUCTION…………………………………………………………… (vi) REPORT PART- I Chapter - I Introduction A Procurement vis a vis Production of Agriculture Produce B Marketing Platform for Agriculture Produce C Functioning of Agriculture Produce Marketing Committee (APMCs) D Reform in Agriculture Produce Marketing sector E Relevance of Gramin Haat as Platform for Agriculture Marketing F Implementation of GrAM Scheme G Implementation of e-NAM scheme PART-II RECOMMENDATIONS AND OBSERVATIONS OF THE COMMITTEE ANNEXURES I. Status of Adoption of Marketing Reforms as on 18.06.2018 II. Major Recommendations of the Committee. APPENDICES I. -

Current Affairs Q&A

Current Affairs Q&A PDF Explanation: On October 1, 2018, SBI halved the withdrawal limit from Rs. 40,000 to Rs. 20,000 per day. This was targeted for debit cards of the ‘Classic’ and ‘Maestro’ platfroms. The main objective in doing so was to reduce the number of fraudulent transactions and promote cashless transactions. This move would be effective form October 31, 2018 as according to Banking Codes & Standards Board of India (BCSBI) guidelines, at least 30 days’ notice has to be given to customers for any change in terms and conditions or charges. 3)Which stock exchange has launched 2 dynamic asset allocation indices namely Nifty 50 & short duration debt –Dynamic P/E index and Nifty 50 & short duration debt – Dynamic P/B index? 1) National Stock Exchange (NSE) 2) Bombay Stock Exchange (BSE) 3) Calcutta Stock Exchange (CSE) 4) Indian Stock Exchange (ISE) 5) None of these Answer – 1) National Stock Exchange (NSE) Explanation: On October 1, 2018, National Stock Exchange (NSE) launched 2 dynamic asset allocation indices designed to combine equity and debt. These indices are: • Nifty 50 & short duration debt –Dynamic P/E index and • Nifty 50 & short duration debt – Dynamic P/B index. The indices compare the current price-earnings ratio (P/E) or price-book ratio (P/B) with historical P/E or P/B ratio of Nifty 50 in the previous seven years. In these indices, the maximum allocation to equity is 80 per cent and minimum allocation is 65 per cent. This will help fill the gap due to the absence of a relevant benchmark for performance comparison of the popular dynamic asset allocation category offered by mutual funds in the country. -

Chief Minister

!"!#$#%&'() ! #$ % $ &'(&)*+ /0!& ! ## "# "$ $) ( ' > 1<=/ $ !$"#!$ # a gap of nine years. It will further from the SPF is less than market increase in coming years as the borrowing. he Rajendra College here ! $: State Government is forced to go The National Small Savings Twould be soon upgraded for more loans from market. At Fund (NSSF) is another source ( (@ /<2 to a university, announced ( '@' 1? / least 75 per cent of loan is raised for the State Government to raise Chief Minister Naveen from open markets by the State loans, but these loans are high hief Minister Naveen Patnaik while addressing a ith grants and loans from Government. cost loans. So, the State CPatnaik on Thursday laid conclave of Biju Yuva Vahini Wthe Union Government Loans from the Centre are Government has opted out of ( '@' 1? / second draft beneficiary list will foundation-stone for a cancer at the college ground here on getting squeezed continuously, hardly less than Rs 8,000 crore, NSSF as high cost borrowing is be released at all panchayat care hospital here besides Thursday. the State Government is forced while market borrowing is four not good for fiscal health of the total of 12,45,490 benefi- offices from January 25 to launching a slew of projects Patnaik said “The State to depend more on open market times of the debt from the State. Now, the NSSF loan is Aciaries of the KALIA December 3 (this year),” said worth 618.66 crore in the dis- Government is seriously con- borrowings. An analysis of the Centre. Reduction in Central about Rs 10,000 crore; and slow- scheme would get monetary the Cooperation Secretary. -

Weekly One Liner (15-21 Oct 2018)

WEEKLY ONE LINER (15-21 OCT 2018) NATIONAL To honour the police and paramilitary personnel, involved in disaster response operations, The Prime Minister announced an award in the name of - Netaji Subash Chandra Bose. In the honour of Atal Bihari Vajpayee this many Himalayan peaks have been named after him – Four (Atal-1, 2, 3 and 4). India’s only aircraft carrier is set to sail after undergoing a five-month refit at a cost of ₹705 crore - INS Vikarmaditya. India has imposed anti-dumping duties of up to 185.51 US dollars per tonne for five years on certain varieties of steel products from - China. According to the Ministry of Rural Development, the country’s best developed village - Kuligod, Karnataka. The AI chatbot of Indian Railway Catering and Tourism Corporation (IRCTC) to help its users answer various queries - Ask Disha. According to new guidelines by NITI Aayog, PPP Units will set up in district hospitals for - Non Communicable Diseases. CSIR-IITR, Lucknow has developed an innovative technology for drinking water disinfection system with trade name - OneerTM. The famous Shahi litchi has got the Geographical Indication (GI) tag, which is cultivated in the state of - Bihar. This state is now set to become the first smoke-free State in the country with 100% LPG usage - Kerala. According to new decision, Survivors of child sexual abuse can file a police complaint after they become adults under - Protection of Children from Sexual Offences Act (POCSO), 2012. The Uttar Pradesh Cabinet cleared the proposal to rename Allahabad as - Prayagraj. Government has announced 100 crore rupee award for states that would complete the household electrification early under - Saubhagaya scheme. -

True Or Pure” Republic the Window Is Still Open for Registration for the Eligible Educators Upto What Does It Mean to Be a 30Th November 2017

ISSN 2347-162X Happy Uttarayan RNI No. GUJENG/2002/23382 | Postal Registration No. GAMC-1732 | 2016-18 Issued by SSP Ahd-9, Posted at P.S.O. 10th Every Month Ahmedabad-2, Valid up to 31-12-2018 AHMEDABAD, FRIDAY, JANUARY 5, 2018 VOL.16, ISSUE-9 www.theopenpage.co.in facebook.com/theopenpage (12 + 4) TOTAL PAGE -16 INVITATION PRICE: `30/- From, The Open Page, 4th Floor Vishwa Arcade, Opp. Kum-Kum Party Plot, Nr. Akhbarnagar, Nava Wadaj, Ahmedabad - 380013 | Ph : 079-27621385/86 4th EDUCATOR’S AWARD We are honoured to NEED OF EVERY NATION – tO FORM announce the program date of the 4th Educator’s award 11th January 2018 at VADODARA “trUE OR PURE” REPUBLIC The window is still open for registration for the eligible educators upto WHAT DOes IT MEAN TO BE A 30th November 2017. REPUBLIC? "The roots of education are bitter, but Of course the Republic is a government fruits are sweet!" formed by people elected by the popula- tion in the democratic way. The constitu- tion of India is the supreme law of India. We find frame work defining fundamen- tal political principle, establishes the structure, procedure, power and duties of government institutions and sets out fundamental right, directive principle and duty of citizens. India implemented its own plan on Janu- ary 26, 1950, since then every year January 26 is celebrated as a Republic Day. What really means to be republic? What is to be done in the Republic Day celebration ? When any nation is released from oth- er foreign nationals, it becomes an inde- clarity for 2 years, 11 months and 17 days is a gift to the people of India's pendent public. -

Current Affairs Q&A PDF 2019

Current Affairs Q&A PDF 2019 Current Affairs Q&A PDF 2019 Contents Current Affairs Q&A – January 2019 ..................................................................................................................... 2 INDIAN AFFAIRS ............................................................................................................................................. 2 INTERNATIONAL AFFAIRS ......................................................................................................................... 94 BANKING & FINANCE ................................................................................................................................ 109 BUSINESS & ECONOMY ............................................................................................................................ 128 AWARDS & RECOGNITIONS..................................................................................................................... 149 APPOINTMENTS & RESIGNS .................................................................................................................... 177 ACQUISITIONS & MERGERS .................................................................................................................... 200 SCIENCE & TECHNOLOGY ....................................................................................................................... 202 ENVIRONMENT ........................................................................................................................................... 215 SPORTS -

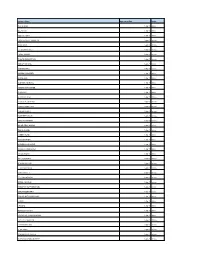

Producer Name Agreement Date Status PRATIK NAIK 1-Apr-15

producer Name Agreement Date Status PRATIK NAIK 1-Apr-15 Inforce BELA SHAH 1-Apr-15 Inforce YOGESH JOSHI 1-Apr-15 Inforce SAMIR KISHORE GANATRA 1-Apr-15 Inforce ANANDAN D 1-Apr-15 Inforce P.V. MOHAN BABU 1-Apr-15 Inforce J UDAY KUMAR 1-Apr-15 Inforce SUBODH KHANDELWAL 1-Apr-15 Inforce SANJAY SINGHAL 1-Apr-15 Inforce JAISHANKAR G 1-Apr-15 Inforce NIMESH CURUMSEY 1-Apr-15 Inforce MANAS KAR 1-Apr-15 Inforce MADHURI AGARWAL 1-Apr-15 Inforce ASHOKE MUKHERJEE 1-Apr-15 Inforce DEB MITRA 1-Apr-15 Inforce G RAMANA RAO 1-Apr-15 Inforce ERUKULLA SATHYAM 1-Apr-15 Inforce VINOD KUMAR PAIDI 1-Apr-15 Inforce RANJAN KUMAR 1-Apr-15 Inforce HARPREET SINGH 1-Apr-15 Inforce BABU H V RAMESH 1-Apr-15 Inforce MAJOR FELIX MORAS 1-Apr-15 Inforce PEONA GHOSH 1-Apr-15 Inforce NARESH KOHLI 1-Apr-15 Inforce PIOUS MATHEW 1-Apr-15 Inforce BASUDEO M GAGGAR 1-Apr-15 Inforce DHIREN CHANDARANA 1-Apr-15 Inforce TARUN ARORA 1-Apr-15 Inforce AMIT AGGARWAL 1-Apr-15 Inforce APARNA KAPOOR 1-Apr-15 Inforce R RAGHAVENDRA 1-Apr-15 Inforce VINAY SHAPETI 1-Apr-15 Inforce T. V. RAJGOPALAN 1-Apr-15 Inforce SEEMA CHANDAK 1-Apr-15 Inforce SSBSSPVV SATYNARAYANA 1-Apr-15 Inforce SANGAMESHWAR T 1-Apr-15 Inforce KALLURI SATYANARAYANA 1-Apr-15 Inforce V. RAVI 1-Apr-15 Inforce A RAGHU 1-Apr-15 Inforce MURALIDHARA C V 1-Apr-15 Inforce VIDYADHAR JHUNJHUNWALA 1-Apr-15 Inforce D PETER JESUDHAS 1-Apr-15 Inforce S SWAMINATHAN 1-Apr-15 Inforce HEMA SHAH 1-Apr-15 Inforce PRABHAKARA RAO A H 1-Apr-15 Inforce SURYANARAYANA MURTHY 1-Apr-15 Inforce LINUS MARIO DLIMA 1-Apr-15 Inforce B MURALIDHARAN 1-Apr-15