[D1] HKCD Chinaamc Return Securities Investment Fund ENG

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 1 Corporate Overview

ai161915073836_Yida AR20 Cover_21.5mm_output.pdf 1 23/4/2021 下午12:05 C M Y CM MY CY CMY K Contents Corporate Overview 2 Corporate Information 3 Financial Summary 5 Chairman’s Statement 7 Management Discussion and Analysis 11 Environmental, Social and Governance Report 39 Profile of Directors and Senior Management 60 Directors’ Report 65 Corporate Governance Report 80 Independent Auditor’s Report 90 Consolidated Financial Statements • Consolidated Statement of Profit or Loss 97 • Consolidated Statement of Comprehensive Income 98 • Consolidated Statement of Financial Position 99 • Consolidated Statement of Changes in Equity 101 • Consolidated Statement of Cash Flows 103 • Notes to the Consolidated Financial Statements 105 Yida China Holdings Limited 2020 Annual Report 1 Corporate Overview Yida China Holdings Limited (the “Company”), together with its industrial upgrading strategies, fully integrated internal and external subsidiaries (collectively referred to as the “Group”), founded in resources, further developed and operated Dalian Ascendas IT Park, 1988, headquartered in Shanghai, is China’s largest business park Tianjin Binhai Service Outsourcing Industrial Park, Suzhou High- developer and leading business park operator. The main business tech Software Park, Wuhan Guanggu Software Park, Dalian Tiandi, involves business park development and operation, residential Dalian BEST City, Wuhan Software New Town, Yida Information properties within and outside business parks and office properties Software Park and many other software parks and technology sales, business park entrusted operation and management and parks. It helped the Group achieve its preliminary strategic goals of construction, decoration and landscaping services. On 27 June “National Expansion, Business Model Exploration and Diversified 2014, the Company was successfully listed (the “Listing”) on the Cooperation”. -

Annual Report, and They Severally and Jointly Accept Legal Responsibility for the Truthfulness, Accuracy and Completeness of Its Contents

(A joint stock limited company incorporated in the People's Republic of China with limited liability) Stock Code: 1618 * For identification purpose only IMPORTANT NOTICE I. The Board and the Supervisory Committee of the Company and its Directors, Supervisors and senior management warrant that there are no false representations, misleading statements contained in or material omissions from the information set out in this annual report, and they severally and jointly accept legal responsibility for the truthfulness, accuracy and completeness of its contents. II. The Company convened the 14th meeting of the third session of the Board on 31 March 2020. All Directors of the Company attended the meeting. III. Deloitte Touche Tohmatsu CPA LLP issued an unqualified audit report to the Company. IV. Guo Wenqing, the Chairman and legal representative of the Company, Zou Hongying, the Vice President and the Chief Accountant of the Company, and Fan Wanzhu, the Deputy Chief Accountant and the Head of the Financial Planning Department, have declared that they warrant the truthfulness, accuracy and completeness of the financial report contained in this annual report. V. The proposal for profit distribution or transfer of capital reserve to share capital for the Reporting Period was considered by the Board The net profit attributable to Shareholders of the Company in the audited consolidated statement of MCC in 2019 amounted to RMB6,599,712 thousand and the undistributed profit of MCC headquarters amounted to RMB1,920,906 thousand. Based on the total share capital of 20,723.62 million shares, the Company proposed to distribute to all Shareholders a cash dividend of RMB0.72 (tax inclusive) for every 10 shares and the total cash dividend is RMB1,492,101 thousand, the remaining undistributed profit of RMB428,805 thousand will be used for the operation and development of the Company and rolled over to the coming year for distribution. -

Printmgr File

BUSINESS OVERVIEW We were the largest provider of private education from kindergarten to university in China by student enrolments in the 2015/2016 school year, according to the Frost & Sullivan Report. We had 48,220 students enrolled at our schools for the 2015/2016 school year, giving us a market share of approximately 0.11% in the fragmented PRC private education industry according to the Frost & Sullivan Report. Our University, Zhengzhou Technology and Business University, had 25,063 students enrolled in the 2015/2016 school year, while our 24 “YuHua” branded private schools for K-12 on 16 campuses had an aggregate of 23,157 students enrolled in the same school year. With our significant scale and extensive experience in the private education industry, we believe we are well- placed to benefit from growth and consolidation within the fragmented private education industry. All of our schools are located in Henan Province, a province that has the largest registered population and generated the fifth largest GDP of RMB3.7 trillion among all provinces in China in 2015, according to the Frost & Sullivan Report. The favourable demographics of Henan Province have facilitated the growth of our school network from our inception in 2001 with a single high school to one University and 24 K-12 schools across nine cities with 48,220 students in the 2015/2016 school year. We intend to continue to strengthen our leading position in Henan Province as well as to selectively expand to the surrounding regions of Henan Province. We believe our advanced and established management system has supported our previous business expansion and, together with the growing recognition of our “YuHua” brand, will continue to help us successfully replicate our operating model in new markets. -

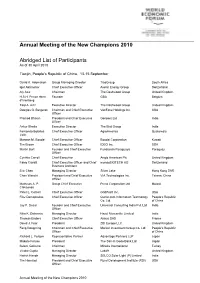

Annual Meeting of the New Champions 2010 Abridged List Of

Annual Meeting of the New Champions 2010 Abridged List of Participants As of 30 April 2010 Tianjin, People's Republic of China, 13-15 September David K. Adomakoh Group Managing Director TisoGroup South Africa Igor Akhmerov Chief Executive Officer Avelar Energy Group Switzerland Aly Aziz Chairman The Dashwood Group United Kingdom H.S.H. Prince Henri Founder GBA Belgium d'Arenberg Taqi A. Aziz Executive Director The Dashwood Group United Kingdom Douglas G. Bergeron Chairman and Chief Executive VeriFone Holdings Inc. USA Officer Pramod Bhasin President and Chief Executive Genpact Ltd India Officer Ankur Bhatia Executive Director The Bird Group India Fernando Bolaños Chief Executive Officer AgroAmerica Guatemala Valle Marwan M. Boodai Chief Executive Officer Boodai Corporation Kuwait Tim Brown Chief Executive Officer IDEO Inc. USA Martin Burt Founder and Chief Executive Fundación Paraguaya Paraguay Officer Cynthia Carroll Chief Executive Anglo American Plc United Kingdom Fabio Cavalli Chief Executive Officer and Chief mondoBIOTECH AG Switzerland Business Architect Eric Chen Managing Director Silver Lake Hong Kong SAR Chen Wenchi President and Chief Executive VIA Technologies Inc. Taiwan, China Officer Mathews A. P. Group Chief Executive Press Corporation Ltd Malawi Chikaonda Peter L. Corsell Chief Executive Officer GridPoint Inc. USA Fritz Demopoulos Chief Executive Officer Qunar.com Information Technology People's Republic Co. Ltd. of China Jay P. Desai Founder and Chief Executive Universal Consulting India Pvt. Ltd India Officer Nitin K. Didwania Managing Director Hazel Mercantile Limited India Thomas Enders Chief Executive Officer Airbus SAS France David J. Fear President ZBI Europe LLC United Kingdom Feng Dongming Chairman and Chief Executive Markor Investment Group Co. -

Netizens, Nationalism, and the New Media by Jackson S. Woods BA

Online Foreign Policy Discourse in Contemporary China: Netizens, Nationalism, and the New Media by Jackson S. Woods B.A. in Asian Studies and Political Science, May 2008, University of Michigan M.A. in Political Science, May 2013, The George Washington University A Dissertation submitted to The Faculty of The Columbian College of Arts and Sciences of The George Washington University in partial fulfillment of the requirements for the degree of Doctor of Philosophy January 31, 2017 Bruce J. Dickson Professor of Political Science and International Affairs The Columbian College of Arts and Sciences of The George Washington University certifies that Jackson S. Woods has passed the Final Examination for the degree of Doctor of Philosophy as of September 6, 2016. This is the final and approved form of the dissertation. Online Foreign Policy Discourse in Contemporary China: Netizens, Nationalism, and the New Media Jackson S. Woods Dissertation Research Committee: Bruce J. Dickson, Professor of Political Science and International Affairs, Dissertation Director Henry J. Farrell, Associate Professor of Political Science and International Affairs, Committee Member Charles L. Glaser, Professor of Political Science and International Affairs, Committee Member David L. Shambaugh, Professor of Political Science and International Affairs, Committee Member ii © Copyright 2017 by Jackson S. Woods All rights reserved iii Acknowledgments The author wishes to acknowledge the many individuals and organizations that have made this research possible. At George Washington University, I have been very fortunate to receive guidance from a committee of exceptional scholars and mentors. As committee chair, Bruce Dickson steered me through the multi-year process of designing, funding, researching, and writing a dissertation manuscript. -

Mizuho China Business Express Economic Journal (No

October 27, 2017 Mizuho Bank (China), Ltd. Advisory Division ―The macroeconomy― Mizuho China Business Express Economic Journal (No. 72) Summary Though China’s real GDP growth rate slowed slightly to +6.8% y-o-y in July–September, it remained above the 2017 government’s target of ‘around +6.5%.’ Xi Jinping unveiled his ‘Thought on Socialism with Chinese Characteristics for a New Era’ at the 19th National Congress of the Communist Party of China. In his report, Xi Jinping said that after the Party had finished building a moderately prosperous society in all respects by 2020, a two-step approach should be taken (the first step from 2020 to 2035 and the second step from 2035 onwards) to build China into a ‘great modern socialist country that is prosperous, strong, democratic, culturally advanced, harmonious, and beautiful’ by the middle of the century. 1. September’s economic indicators improved on the previous month ・ Growth slowed to +6.8% over July–September ・ Production, investment and consumption all accelerated ・ The floor space of residential buildings sold grew at a slower y-o-y pace for the first time since March 2015 ・ Imports and exports both improved ・ CPI growth slowed while PPI growth accelerated ・ Net new loans and total social financing both increased 2. Topics: The economic policy position revealed at the National Congress ・ A change in the ‘principal contradiction facing Chinese society’ ・ Building a ‘great modern socialist country’ by the middle of the century - 1 - 1. September’s economic indicators improved on the previous month ・Growth slowed to +6.8% over July–September On October 19, the National Bureau of Statistics (NBS) announced that China’s real GDP growth rate had hit +6.8% in July–September, down from the +6.9% recorded in April–June (from here on, all figures refer to ‘same- period previous-year’ growth unless otherwise specified). -

Issuance Overpricing of China's Corporate Debt Securities

Internet Appendix for “Issuance Overpricing of China’s Corporate Debt Securities” Yi Ding Wei Xiong Jinfan Zhang In this Internet Appendix, we report the following figures, tables, and additional analyses omitted from the main paper. Fig. A1 depicts debt security issuance across the interbank market and the exchange market from 2009 to 2019. In Table A1, we list the 68 licensed underwriters in the interbank market at the end of 2019. Information on underwriters is obtained from NAFMII. In Table A2, we summarize overpricing for CP and MTNs separately for both before and after the rebate ban period. Although the magnitude declined after the ban for both CP and MTNs, overpricing remains statistically significantly. Taken together, we find significant overpricing in all these issuance categories. In Table A3, we report summary statistics of issuance overpricing by using excess returns of the first secondary-market trading day as the overpricing measure. The table shows that the overpricing is robust across time, debt securities, and issuers with different characteristics, consistent with Table 3 in the main paper. In Tables A4 and A5, we conduct difference-in-difference analyses to examine how the underwriter rebate ban affects the excess return across different issuers and across different underwriters. Consistent with results in Tables 5 and 6 of the main paper from using the yield-spread measure, these tables show that after the ban, the drop in overpricing is significantly greater for securities issued by central SOEs than for those issued by other firms, and the drop in overpricing is significantly smaller for issuances underwritten by the Big Four banks. -

2020 Annual Report Contents

2020 Annual Report Contents ABOUT US CORPORATE GOVERNANCE i Five-Year Summary 116 Corporate Governance Report 1 Introduction 131 Changes in the Share Capital and ’ 2 Business Performance at a Glance Shareholders Profile Directors, Supervisors, Senior Management 4 Chairman’s Statement 134 and Employees 152 Report of the Board of Directors and MANAGEMENT DISCUSSION AND ANALYSIS Significant Events 170 Report of the Supervisory Committee 8 Customer Development 14 Technology-Powered Business Transformation FINANCIAL STATEMENTS 20 Business Analysis 20 Performance Overview 172 Independent Auditor’s Report 23 Life and Health Insurance Business 179 Consolidated Income Statement 32 Property and Casualty Insurance Business 180 Consolidated Statement of Comprehensive 38 Investment Portfolio of Insurance Funds Income 181 Consolidated Statement of Financial Position 44 Banking Business 183 Consolidated Statement of Changes In Equity 54 Asset Management Business 184 Consolidated Statement of Cash Flows 60 Technology Business 185 Notes to Consolidated Financial Statements 68 Analysis of Embedded Value 79 Liquidity and Capital Resources 85 Risk Management OTHER INFORMATION 100 Sustainability 327 Ping An Milestones 113 Prospects of Future Development 328 Honors and Awards 329 Glossary 332 Corporate Information Cautionary Statements Regarding Forward-Looking Statements To the extent any statements made in this Report contain information that is not historical, these statements are essentially forward- looking. These forward-looking statements include but are not limited to projections, targets, estimates and business plans that the Company expects or anticipates may or may not occur in the future. Words such as “potential”, “estimates”, “expects”, “anticipates”, “objective”, “intends”, “plans”, “believes”, “will”, “may”, “should”, variations of these words and similar expressions are intended to identify forward-looking statements. -

Central China Securities Co., Ltd

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. Central China Securities Co., Ltd. (a joint stock company incorporated in 2002 in Henan Province, the People’s Republic of China with limited liability under the Chinese corporate name “中原證券股份有限公司” and carrying on business in Hong Kong as “中州證券”) (Stock Code: 01375) ANNUAL RESULTS ANNOUNCEMENT FOR THE YEAR ENDED 31 DECEMBER 2017 The board (the “Board”) of directors (the “Directors”) of Central China Securities Co., Ltd. (the “Company”) hereby announces the audited annual results of the Company and its subsidiaries for the year ended 31 December 2017. This annual results announcement, containing the full text of the 2017 annual report of the Company, complies with the relevant requirements of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited in relation to information to accompany preliminary announcements of annual results and have been reviewed by the audit committee of the Company. The printed version of the Company’s 2017 annual report will be dispatched to the shareholders of the Company and available for viewing on the website of Hong Kong Exchanges and Clearing Limited at www.hkexnews.hk, the website of the Shanghai Stock Exchange at www.sse.com.cn and the website of the Company at www.ccnew.com around mid-April 2018. -

Annual Report

2018 Annual Report Annual Report HUA XIA BANK CO., LIMITED 2018 HUA XIA BANK CO., LIMITED HUA XIA BANK CO., Address: Hua Xia Bank Mansion, 22 Jianguomennei Street, Dongcheng District, Beijing Postal code: 100005 Tel: 010-85238570 010-85239938 Fax: 010-85239605 Website: www.hxb.com.cn CONTENTS 3 Message from Chairman for the Annual Report 2018 5 Message from President for the Annual Report 2018 6 Important Notice 7 Section I Definitions 8 Section II Company Profile and Major Financial Indicators 13 Section III Business Overview 16 Section IV Discussion and Analysis of Operations 53 Section V Significant Events 64 Section VI Details of Changes in Ordinary Shares and Shareholders 74 Section VII Preference Shares 78 Section VIII Basic Information on Directors, Supervisors, Senior Management Members and Employees 89 Section IX Corporate Governance 94 Section X Financial Statements 95 Section XI List of Documents for Inspection 96 Written Confirmation of the Annual Report 2018 by Directors and Senior Management Members of Hua Xia Bank Co., Limited 98 Auditor’s Report 2018 Annual Report Hua Xia Bank Co., Limited Chairman of the Board: Li Minji 2 Message from Chairman for the Annual Report 2018 MESSAGE FROM CHAIRMAN FOR THE ANNUAL REPORT 2018 In 2018, China started to act on the guiding principles Hereby, I would like to extend my sincere gratitude to of the 19th CPC National Congress and celebrated the the public, shareholders, senior management and entire staff 40th anniversary of reform and opening-up, while Hua Xia on behalf of our Party Committee and the Board of Directors. -

Income Diversification of Chinese Banks

Durham E-Theses Income Diversication of Chinese Banks: Performance, Risk and Eciency QU, ZHIXIAN How to cite: QU, ZHIXIAN (2018) Income Diversication of Chinese Banks: Performance, Risk and Eciency, Durham theses, Durham University. Available at Durham E-Theses Online: http://etheses.dur.ac.uk/12164/ Use policy The full-text may be used and/or reproduced, and given to third parties in any format or medium, without prior permission or charge, for personal research or study, educational, or not-for-prot purposes provided that: • a full bibliographic reference is made to the original source • a link is made to the metadata record in Durham E-Theses • the full-text is not changed in any way The full-text must not be sold in any format or medium without the formal permission of the copyright holders. Please consult the full Durham E-Theses policy for further details. Academic Support Oce, Durham University, University Oce, Old Elvet, Durham DH1 3HP e-mail: [email protected] Tel: +44 0191 334 6107 http://etheses.dur.ac.uk Income Diversification of Chinese Banks: Performance, Risk and Efficiency Zhixian Qu A thesis submitted in partial fulfilment of the requirements for the degree of Doctor of Philosophy in Economics Department of Economics and Finance Durham University Business School University of Durham June 2018 To My Parents ACKNOWLEDGEMENTS In writing this acknowledgement as the final task to complete my dissertation, my thoughts turn to the many days I have spent with respected supervisors and teachers, and beloved family and friends. This thesis could not have been written without the instruction, inspiration, guidance and encouragement these people offered me. -

Chinese Bankers Survey 2016

www.pwchk.com Chinese Bankers Survey 2016 Executive summary February 2017 Preface We are pleased to present the Chinese Bankers Most bankers in the survey believe that the top Survey 2016 report, prepared jointly by the China priority in addressing risk is "to improve cash Banking Association (CBA) and PwC. Now in its collection, accelerate write-offs and disposal of eighth year, the report keeps track of developments collaterals". While increasing NPL disposal efforts in China’s banking sector from the perspective of a through conventional means such as write-offs, group of bankers. collections and transfers, Chinese banks are also actively exploring a diversified range of alternatives, This year’s survey dug deep into the core issues including NPL securitisation, cooperating with the while maintaining a broad scope. Dr. BA Shusong, big four asset management companies (AMCs), and the project leader, together with the project team, transfer of income beneficial rights. There is a interviewed 15 senior bankers to get their insights section in this report summarising bankers’ views into the sector. Seven of the 15 bankers are at C- on the major challenges regarding disposal of NPLs. suite level (director, vice president or above). These interviews complemented the online survey With China’s economic structural reform at a critical covering 31 provinces in mainland China (excluding juncture, Chinese banks are expected to play a more Hong Kong, Macau and Taiwan). With a total of active role in fulfilling social responsibilities by 1,794 valid responses collected, the survey sampling serving the real economy. With regard to economic process has taken into account participants’ restructuring, most bankers believe that “upgrading geographical regions, grades, types of financial and transforming manufacturing sector, and institution, and if the institution is listed on stock exploration of new markets" brings many exchange(s) or privately held.