Japanese Fiscal Year 2013 Subsidy Program for Projects Promoting Asian Site Location in Japan

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sakura, Chiba

Coordinates: 35°43′N 140°13′E Sakura, Chiba 佐 倉 市 Sakura ( Sakura-shi) is a city located in Sakura Chiba Prefecture, Japan. 佐倉市 As of December 2014, the city has an estimated City population of 17 7 ,601, and a population density of 17 14 persons per km². The total area is 103.59 km². Contents Geography Neighboring municipalities History Economy Yuukarigaoka district of Sakura Education Transportation Railway Highway Local attractions Flag Noted people from Sakura Seal References External links Geography Sakura is located in northeastern Chiba Prefecture on the Shimōsa Plateau.[1] It is situated 40 kilometers northeast of the Tokyo and 15 kilometers from Narita International Airport. Chiba City, the prefectural capital, lies 15 kilometers southwest of Sakura. Lake Inba and the Inba Marsh form the northern city limits.[2][3] Neighboring municipalities Chiba, Chiba Location of Sakura in Chiba Prefecture Narita, Chiba Yotsukaido, Chiba Yachiyo, Chiba Inzai, Chiba Yachimata, Chiba Shisui, Chiba History The area around Sakura has been inhabited since prehistory, and archaeologists have found numerous Kofun period burial tumuli in the area, along with the remains of a Hakuho period Buddhist temple. During the Kamakura and Muromachi Sakura periods, the area was controlled by the Chiba clan. During the Sengoku period, the Chiba clan fought the Satomi clan to the south, and the Later Hōjō clan to the west. After the defeat of the Chiba clan, the area came within the control of Tokugawa Ieyasu, who assigned one of his chief generals, Doi Coordinates: 35°43′N 140°13′E Toshikatsu to rebuild Chiba Castle and to rule over Country Japan Sakura Domain as a daimyō.[2] Doi rebuilt the area Region Kantō as a jōkamachi, or castle town, which became the Prefecture Chiba Prefecture largest castle town in the Bōsō region.[1][3] Under Government the Tokugawa shogunate, Sakura Domain came to • Mayor Kazuo Warabi be ruled for most of the Edo period under the Hotta Area clan. -

Chiba University Overview Brochure (PDF)

CHIBA UNIVERSITY 2020 2021 21 0 2 - 20 0 2 20 0 2 Contents 01 Introduction 01-1 A Message from the President ................................................................................................. 3 01-2 Chiba University Charter ........................................................................................................... 4 01-3 Chiba University Vision ............................................................................................................... 6 01-4 Chiba University Facts at a Glance .......................................................................................... 8 01-5 Organization Chart ....................................................................................................................... 10 02 Topic 02-1 Enhanced Network for Global Innovative Education —ENGINE— ................................. 12 02-2 Academic Research & Innovation Management Organization (IMO) .......................... 14 02-3 WISE Program (Doctoral Program for World-leading Innovative & Smart Education) ........................................................................................................................ 15 02-4 Creating Innovation through Collaboration with Companies ......................................... 16 02-5 Institute for Global Prominent Research .............................................................................. 17 02-6 Inter-University Exchange Project .......................................................................................... 18 02-7 Frontier -

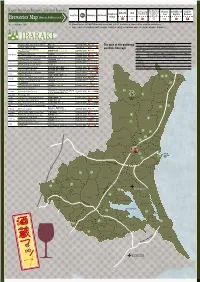

Ibaraki (PDF/6429KB)

Tax Free Shop Kanto-Shinetsu Regional Taxation Bureau Tax Free Shop Brewery available for English website shop consumption tax telephone consumption tax tour English Brochure Location No. Breweries Mainbrand & liquor tax (Wineries,Distilleries,et al.) number As of December, 2017 ※ Please refer to SAKE Brewery when you visit it, because a reservation may be necessary. ※ A product of type besides the main brand is being sometimes also produced at each brewery. ❶ Domaine MITO Corp. Izumi-cho Winery MITO Wine 029-210-2076 Shochu (C) Shochu (Continuous Distillation) Mito The type of the mainbrand ❷ MEIRI SHURUI CO.,LTD MANYUKI Shochu (S) 029-247-6111 alcoholic beverage Shochu (S) Shochu (Simple system Distillation) Isakashuzouten Limited Shochu (S) Sweet sake ❸ Partnership KAMENOTOSHI 0294-82-2006 Beer Beer, Sparkling liquor New genre(Beer-like liqueur) Hitachiota ❹ Okabe Goumeigaisha YOKAPPE Shochu (S) 0294-74-2171 ❺ Gouretsutominagashuzouten Limited Partnership Kanasagou Shochu (S) 0294-76-2007 Wine Wine, Fruit wine, Sweet fruit wine ❻ Hiyamashuzou Corporation SHOKOUSHI Wine 0294-78-0611 Whisky ❼ Asakawashuzou Corporation KURABIRAKI Shochu (S) 0295-52-0151 Liqueurs Hitachiomiya ❽ Nemotoshuzou Corporation Shochu (S) Doburoku ❾ Kiuchi Kounosu Brewery HITACHINO NEST BEER Beer 029-298-0105 Naka Other brewed liquors ❿ Kiuchi Nukata Brewery HITACHINO NEST BEER Beer 029-212-5111 ⓫ Kakuchohonten Corporation KAKUSEN Shochu (S) 0295-72-0076 Daigo ⓬ Daigo Brewery YAMIZO MORINO BEER Beer 0295-72-8888 ⓭ Kowa Inc. Hitachi Sake Brewery KOUSAI Shochu (S) -

Social Contribution Activities

Commitment of Top Management Sustainability Management Environment Social Governance ESG Data Social Contribution Activities FY2019 Materiality Targets and Results : As planned : Delayed Self- Details of Main Initiatives FY2019 Target Indicator FY2019 Results Evaluation Undertake activities in cooperation with local Social contribution expenditure: 1�0% of ordinary income*1 Social contribution expenditure as a percentage 3�28% communities, NGOs, and other organizations *1 Ordinary income for MMC on a non-consolidated basis of ordinary income Breakdown of Social Contribution Expenditures*2 Social Contribution Activities Policy Social Contribution Activities Policy (¥ million) To address diversifying social issues, MITSUBISHI FY2017 FY2018 FY2019 In April 2020, we formulated a wider-ranging social MOTORS carries out its STEP social contribution activ- Society 132 116 118 contribution activities policy to help address increas- ities, focused on four main themes, standing for the Traffic safety 10 8 21 first letters of Society, Traffic safety, Environment and Environment 135 37 32 ingly diverse global social issues� In addition to con- People 206 225 169 People� Based on this policy, we will continue to con- tinuing with ongoing efforts, the policy calls for us to Support for tribute to society by utilizing each and every employ- step up activities through alliances in key markets� disaster-strick- 25 62 60 ee's skills and know-how as well as our technologies en areas To make more people aware of these activities, we and products, aiming -

Chiba Universitychiba

CHIBA UNIVERSITY CHIBA 2019 2020 2019 CHIBA UNIVERSITY 2019 2019-2020 Contents 01 Introduction 01-1 A Message from the President ................................................................................................. 3 01-2 Chiba University Charter ........................................................................................................... 4 01-3 Chiba University Vision ............................................................................................................... 6 01-4 Chiba University Facts at a Glance .......................................................................................... 8 02 Topic 02-1 Institute for Global Prominent Research ............................................................................... 11 02-2 Chiba Iodine Resource Innovation Center (CIRIC) ............................................................. 12 02-3 Enhanced Network for Global Innovative Education —ENGINE— ................................. 13 02-4 Top Global University Project .................................................................................................. 14 02-5 Inter-University Exchange Project .......................................................................................... 15 02-6 Frontier Science Program Early Enrollment ........................................................................ 16 02-7 Honey Bee Project ....................................................................................................................... 18 02-8 Inohana Campus High -

Lions Club Name District Recognition

LIONS CLUB NAME DISTRICT RECOGNITION AGEO District 330 C Model Club AICHI EMERALD District 334 A Model Club AICHI GRACE District 334 A Model Club AICHI HIMAWARI District 334 A Model Club AICHI SAKURA District 334 A Model Club AIZU SHIOKAWA YUGAWA District 332 D Model Club AIZU WAKAMATSU KAKUJO District 332 D Model Club AIZUBANGE District 332 D Model Club ANDONG District 356 E Model Club ANDONG SONGJUK District 356 E Model Club ANJYO District 334 A Model Club ANSAN JOONGANG District 354 B Model Club ANSUNG NUNGKOOL District 354 B Model Club ANYANG INDUK District 354 B Model Club AOMORI CHUO District 332 A Model Club AOMORI HAKKO District 332 A Model Club AOMORI JOMON District 332 A Model Club AOMORI MAHOROBA District 332 A Model Club AOMORI NEBUTA District 332 A Model Club ARAO District 337 E Model Club ASAHIKAWA District 331 B Model Club ASAHIKAWA HIGASHI District 331 B Model Club ASAHIKAWA NANAKAMADO District 331 B Model Club ASAHIKAWA TAISETSU District 331 B Model Club ASAKA District 330 C Model Club ASAKURA District 337 A Model Club ASHIKAGA District 333 B Model Club ASHIKAGA MINAMI District 333 B Model Club ASHIKAGA NISHI District 333 B Model Club ASHIRO District 332 B Model Club ASHIYA District 335 A Model Club ASHIYA HARMONY District 335 A Model Club ASO District 337 E Model Club ATSUGI MULBERRY District 330 B Model Club AYASE District 330 B Model Club BAIK SONG District 354 H Model Club BANGKOK PRAMAHANAKORN 2018 District 310 C Model Club BAYAN BARU District 308 B2 Model Club BIZEN District 336 B Model Club BUCHEON BOKSAGOL District -

Chiba Prefecture!

Tokyo Narita Airport Makuhari Shintoshin Haneda Airport NNearbyearby ! Tokyo Bay CHIBA Aqualine Chiba GUIDE Digest Edition English Welcome to Chiba Prefecture! Chiba Prefecture is home to Narita Aiport making it the gateway to Japan. It neighbors Tokyo and is easily accessed from Haneda Airport as well. Visitors can experience Japanese culture and enjoy uniquely Japanese scenery. Welcome to Chiba Prefecture! Chiba Prefecture borders Tokyo to the east and is home to Narita Aiport which welcomes more than 15 million international tourists annually. While Narita Airport is a Japanese airport that is well known around the world, most people arriving from abroad end up traveling to Tokyo right away. This is such a pity. In Chiba Prefecture, visitors can relax alongside gorgeous nature and beautiful oceans and enjoy a variety of experiences. The prefecture also features many historical locations where visitors can experience firsthand the culture and traditions of Japan. Because Chiba does not get as crowded as Tokyo, visitors can enjoy temples, museums, and other historical buildings at a leisurely pace. Chiba, with its oceans and temperate climate, is also great for enjoying cuisine packed with agricultural and livestock products and fresh seafood. We hope everyone who reads this pamphlet has a wonderful time experiencing the nature of Chiba Prefecture and the culture and traditions of Japan! A SHORT TRIP FROM NARITA AIRPORT Narita Boso-no-Mura The history of Naritasan Shinshoji Temple stretches back to the year Boso-no-Mura is a representation of a Japanese townscape 150 years 940. The "three-story pagoda" built in 1712 is especially a must-see for ago where visitors can feel as if they've gone back in time and learn about visitors. -

LIST of the WOOD PACKAGING MATERIAL PRODUCER for EXPORT 2007/2/10 Registration Number Registered Facility Address Phone

LIST OF THE WOOD PACKAGING MATERIAL PRODUCER FOR EXPORT 2007/2/10 Registration number Registered Facility Address Phone 0001002 ITOS CORPORATION KAMOME-JIGYOSHO 62-1 KAMOME-CHO NAKA-KU YOKOHAMA-SHI KANAGAWA, JAPAN 045-622-1421 ASAGAMI CORPORATION YOKOHAMA BRANCH YAMASHITA 0001004 279-10 YAMASHITA-CHO NAKA-KU YOKOHAMA-SHI KANAGAWA, JAPAN 045-651-2196 OFFICE 0001007 SEITARO ARAI & CO., LTD. TORIHAMA WAREHOUSE 12-57 TORIHAMA-CHO KANAZAWA-KU YOKOHAMA-SHI KANAGAWA, JAPAN 045-774-6600 0001008 ISHIKAWA CO., LTD. YOKOHAMA FACTORY 18-24 DAIKOKU-CHO TSURUMI-KU YOKOHAMA-SHI KANAGAWA, JAPAN 045-521-6171 0001010 ISHIWATA SHOTEN CO., LTD. 4-13-2 MATSUKAGE-CHO NAKA-KU YOKOHAMA-SHI KANAGAWA, JAPAN 045-641-5626 THE IZUMI EXPRESS CO., LTD. TOKYO BRANCH, PACKING 0001011 8 DAIKOKU-FUTO TSURUMI-KU YOKOHAMA-SHI KANAGAWA, JAPAN 045-504-9431 CENTER C/O KOUEI-SAGYO HONMOKUEIGYOUSHO, 3-1 HONMOKU-FUTO NAKA-KU 0001012 INAGAKI CO., LTD. HONMOKU B-2 CFS 045-260-1160 YOKOHAMA-SHI KANAGAWA, JAPAN 0001013 INOUE MOKUZAI CO., LTD. 895-3 SYAKE EBINA-SHI KANAGAWA, JAPAN 046-236-6512 0001015 UTOC CORPORATION T-1 OFFICE 15 DAIKOKU-FUTO TSURUMI-KU YOKOHAMA-SHI KANAGAWA, JAPAN 045-501-8379 0001016 UTOC CORPORATION HONMOKU B-1 OFFICE B-1, HONMOKU-FUTOU, NAKA-KU, YOKOHAMA-SHI, KANAGAWA, JAPAN 045-621-5781 0001017 UTOC CORPORATION HONMOKU D-5 CFS 1-16, HONMOKU-FUTOU, NAKA-KU, YOKOHAMA-SHI, KANAGAWA, JAPAN 045-623-1241 0001018 UTOC CORPORATION HONMOKU B-3 OFFICE B-3, HONMOKU-FUTOU, NAKA-KU, YOKOHAMA-SHI, KANAGAWA, JAPAN 045-621-6226 0001020 A.B. SHOUKAI CO., LTD. -

Lions Clubs International Club Membership Register Summary the Clubs and Membership Figures Reflect Changes As of March 2005

LIONS CLUBS INTERNATIONAL CLUB MEMBERSHIP REGISTER SUMMARY THE CLUBS AND MEMBERSHIP FIGURES REFLECT CHANGES AS OF MARCH 2005 CLUB CLUB LAST MMR FCL YR MEMBERSHI P CHANGES TOTAL DIST IDENT NBR CLUB NAME STATUS RPT DATE OB NEW RENST TRANS DROPS NETCG MEMBERS 5494 025243 ABIKO 333 C 4 03-2005 14 3 0 0 -2 1 15 5494 025249 ASAHI 333 C 4 03-2005 80 1 0 0 -1 0 80 5494 025254 BOSHUASAI L C 333 C 4 03-2005 15 1 0 0 -2 -1 14 5494 025255 BOSHU SHIRAHAMA L C 333 C 4 03-2005 20 1 0 0 -2 -1 19 5494 025257 CHIBA 333 C 4 03-2005 59 2 0 0 -3 -1 58 5494 025258 CHIBA CHUO 333 C 4 03-2005 30 0 0 0 0 0 30 5494 025259 CHIBA ECHO 333 C 4 03-2005 33 0 1 0 -2 -1 32 5494 025260 CHIBA KEIYO 333 C 4 03-2005 29 1 0 0 0 1 30 5494 025261 CHOSHI 333 C 4 03-2005 46 6 0 0 0 6 52 5494 025266 FUNABASHI 333 C 4 03-2005 20 2 0 0 -1 1 21 5494 025267 FUNABASHI CHUO 333 C 4 02-2005 58 17 0 0 -3 14 72 5494 025268 FUNABASHI HIGASHI 333 C 4 03-2005 27 5 0 0 -2 3 30 5494 025269 FUTTSU 333 C 4 03-2005 29 0 0 0 -2 -2 27 5494 025276 ICHIKAWA 333 C 4 03-2005 33 3 0 0 -2 1 34 5494 025277 ICHIHARA MINAMI 333 C 4 02-2005 28 2 0 0 -2 0 28 5494 025278 ICHIKAWA HIGASHI 333 C 4 03-2005 19 2 0 0 0 2 21 5494 025279 IIOKA 333 C 4 03-2005 36 2 0 0 -1 1 37 5494 025282 ICHIHARA 333 C 4 03-2005 27 1 0 0 -1 0 27 5494 025292 KAMAGAYA 333 C 4 03-2005 30 2 0 0 0 2 32 5494 025297 KAMOGAWA 333 C 4 03-2005 42 3 1 0 -4 0 42 5494 025299 KASHIWA 333 C 4 03-2005 48 0 0 0 -1 -1 47 5494 025302 BOSO KATSUURA L C 333 C 4 03-2005 67 3 1 0 -3 1 68 5494 025303 KOZAKI 333 C 4 03-2005 34 0 0 0 -2 -2 32 5494 025307 KAZUSA -

Summary of Family Membership and Gender by Club MBR0018 As of June, 2009

Summary of Family Membership and Gender by Club MBR0018 as of June, 2009 Club Fam. Unit Fam. Unit Club Ttl. Club Ttl. District Number Club Name HH's 1/2 Dues Females Male TOTAL District 333 C 25243 ABIKO 5 5 6 7 13 District 333 C 25249 ASAHI 0 0 2 75 77 District 333 C 25254 BOSHUASAI L C 0 0 3 11 14 District 333 C 25257 CHIBA 9 8 9 51 60 District 333 C 25258 CHIBA CHUO 3 3 4 21 25 District 333 C 25259 CHIBA ECHO 0 0 2 24 26 District 333 C 25260 CHIBA KEIYO 0 0 1 19 20 District 333 C 25261 CHOSHI 2 2 1 45 46 District 333 C 25266 FUNABASHI 4 4 5 27 32 District 333 C 25267 FUNABASHI CHUO 5 5 8 56 64 District 333 C 25268 FUNABASHI HIGASHI 0 0 0 23 23 District 333 C 25269 FUTTSU 1 0 1 21 22 District 333 C 25276 ICHIKAWA 0 0 2 36 38 District 333 C 25277 ICHIHARA MINAMI 1 1 0 33 33 District 333 C 25278 ICHIKAWA HIGASHI 0 0 2 14 16 District 333 C 25279 IIOKA 0 0 0 36 36 District 333 C 25282 ICHIHARA 9 9 7 26 33 District 333 C 25292 KAMAGAYA 12 12 13 31 44 District 333 C 25297 KAMOGAWA 0 0 0 37 37 District 333 C 25299 KASHIWA 0 0 4 41 45 District 333 C 25302 BOSO KATSUURA L C 0 0 3 54 57 District 333 C 25303 KOZAKI 0 0 2 25 27 District 333 C 25307 KAZUSA 0 0 1 45 46 District 333 C 25308 KAZUSA ICHINOMIYA L C 0 0 1 26 27 District 333 C 25309 KIMITSU CHUO 0 0 1 18 19 District 333 C 25310 KIMITSU 5 5 14 42 56 District 333 C 25311 KISARAZU CHUO 1 1 5 14 19 District 333 C 25314 KISARAZU 0 0 1 14 15 District 333 C 25316 KISARAZU KINREI 3 3 5 11 16 District 333 C 25330 MATSUDO 0 0 0 27 27 District 333 C 25331 SOBU CHUO L C 0 0 0 39 39 District 333 C -

Press Release

Press Release Press Release (This is provisional translation. Please refer to the original text written in Japanese.) April 3, 2013 Policy Planning and Communication Division, Inspection and Safety Division, Department of Food Safety To Press and those who may concern, Cancellation of Instruction to restrict distribution of foods based on the Act on Special Measures Concerning Nuclear Emergency Preparedness, direction of Director-General of the Nuclear Emergency Response Headquarters Today, based on the Act on Special Measures Concerning Nuclear Emergency Preparedness, Director-General of the Nuclear Emergency Response Headquarters has cancelled its restriction of distribution of Tea leaves produced in Ushiku-shi for Governors of Ibaraki. 1. With regard to Ibaraki prefecture, the restriction of distribution of Tea leaves produced in Ushiku-shi is cancelled today. (1) The Instruction of the Nuclear Emergency Response Headquarters is attached as attachment 1. (2) The application of Ibaraki prefecture is attached as attachment 2. 2. The list of Instructions on the restriction of distribution and/or consumption of food concerned in accordance with the Act on Special Measures Concerning Nuclear Emergency Preparedness is attached as reference. Reference: omitted Attachment 2: omitted (Attachment 1) Instruction 3 April 2013 From Director-General of the Nuclear Emergency Response Headquarters To Governor of Ibaraki Prefecture, The Instruction to the Prefecture on November 9 2012 based on the Article 20.2 of the Act on Special Measures Concerning Nuclear Emergency Preparedness (Act No. 156, 1999) shall be changed as follows. 1. Restrictive requirements shall apply to heads of relevant municipalities and food business operators concerned not to distribute any log-grown shiitakes (outdoor cultivation) produced in Tsuchiura-shi, Hitachinaka-shi, Moriya-shi, Hitachiomiya-shi, Naka-shi, Namegata-shi, Hokota-shi, Tsukubamirai-shi Omitama-shi, Ibaraki-machi and Ami-machi for the time being. -

![Growth Strategy for "Sustainable Management" [PDF:993KB]](https://docslib.b-cdn.net/cover/7571/growth-strategy-for-sustainable-management-pdf-993kb-1047571.webp)

Growth Strategy for "Sustainable Management" [PDF:993KB]

Growth Strategy for “Sustainable Management” Medium Term Management Plan The 13th Medium Term Management Plan Best Bank 2020 Final stage-3 years of value co-creation From April 1, 2017 to March 31, 2020 This medium term management plan is for the final stage (three years) to accomplish our ultimate goal - to become the “best retail” banking group - by the target year of 2020 as set by the previous medium Our vision term management plan and to create the foundations for responding to environmental changes expected to occur over the medium to long term. We will bolster productivity and solidify customer confidence, and realize sustainable growth, by co-creating value (value co-creation) with our stakeholders, such as customers, shareholders, employees, and regional communities, etc. We aim to become the “best retail” banking group that provides top-class customer satisfaction through advanced services, and to be highly regarded by our regional customers, both individuals and SMEs. CS (Customer Satisfaction) ES (Employee Satisfaction) SS (Social Satisfaction) Ensure the “Customer Make a work environment Drive regional first policy” and respond where all employees can development, by speedily to customers’ realize their potential gathering the entire needs by providing with enthusiasm through Chiba Bank Group as the advanced services and diversity and work style leading bank in the area. solutions. reform. Key Issues Co-creating Realizing work style Strengthening 1 customer value 2 reforms that allow all 3 a sustainable employees to shine