The NEVADA PLAN for School Finance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

State Abbreviations

State Abbreviations Postal Abbreviations for States/Territories On July 1, 1963, the Post Office Department introduced the five-digit ZIP Code. At the time, 10/1963– 1831 1874 1943 6/1963 present most addressing equipment could accommodate only 23 characters (including spaces) in the Alabama Al. Ala. Ala. ALA AL Alaska -- Alaska Alaska ALSK AK bottom line of the address. To make room for Arizona -- Ariz. Ariz. ARIZ AZ the ZIP Code, state names needed to be Arkansas Ar. T. Ark. Ark. ARK AR abbreviated. The Department provided an initial California -- Cal. Calif. CALIF CA list of abbreviations in June 1963, but many had Colorado -- Colo. Colo. COL CO three or four letters, which was still too long. In Connecticut Ct. Conn. Conn. CONN CT Delaware De. Del. Del. DEL DE October 1963, the Department settled on the District of D. C. D. C. D. C. DC DC current two-letter abbreviations. Since that time, Columbia only one change has been made: in 1969, at the Florida Fl. T. Fla. Fla. FLA FL request of the Canadian postal administration, Georgia Ga. Ga. Ga. GA GA Hawaii -- -- Hawaii HAW HI the abbreviation for Nebraska, originally NB, Idaho -- Idaho Idaho IDA ID was changed to NE, to avoid confusion with Illinois Il. Ill. Ill. ILL IL New Brunswick in Canada. Indiana Ia. Ind. Ind. IND IN Iowa -- Iowa Iowa IOWA IA Kansas -- Kans. Kans. KANS KS A list of state abbreviations since 1831 is Kentucky Ky. Ky. Ky. KY KY provided at right. A more complete list of current Louisiana La. La. -

Azar V. Azar, 146 N.W.2D 148 (N.D

N.D. Supreme Court Azar v. Azar, 146 N.W.2d 148 (N.D. 1966) Filed Nov. 4, 1966 [Go to Documents] IN THE SUPREME COURT STATE OF NORTH DAKOTA James J. Azar, Plaintiff and Respondent, v. Betty Azar, Defendant and Appellant. Case No. 8257 [146 N.W.2d 149] Syllabus of the Court 1. Extreme cruelty as a ground for divorce is an infliction of grievous bodily injury or grievous mental suffering. Section 14-05-05, N.D.C.C. 2. Whether one party to a divorce action has inflicted grievous mental suffering upon the other is a question of fact to be determined from all the circumstances in the case. 3. Upon a trial de novo on appeal, the findings of fact of the trial judge are entitled to appreciable weight. 4. When a divorce is granted, the trial court has continuing jurisdiction with regard to the custody, care, education, and welfare of the minor children of the marriage. Section 14-05-22, N.D.C.C. 5. In the matter of awarding custody of the children of the parties to an action for divorce, the trial court is vested with a large discretion, and its discretion will ordinarily not be interfered with except for an abuse thereof. 6. In a divorce proceeding the court shall make such equitable distribution of the real and personal property of the parties as may seem just and proper. Section 14-05-24, N.D.C.C. Appeal from a judgment of the District Court of Burleigh County, Honorable C. F. Kelsch, Special Judge. -

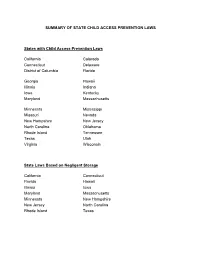

Summary of State Child Access Prevention Laws

SUMMARY OF STATE CHILD ACCESS PREVENTION LAWS States with Child Access Prevention Laws California Colorado Connecticut Delaware District of Columbia Florida Georgia Hawaii Illinois Indiana Iowa Kentucky Maryland Massachusetts Minnesota Mississippi Missouri Nevada New Hampshire New Jersey North Carolina Oklahoma Rhode Island Tennessee Texas Utah Virginia Wisconsin State Laws Based on Negligent Storage California Connecticut Florida Hawaii Illinois Iowa Maryland Massachusetts Minnesota New Hampshire New Jersey North Carolina Rhode Island Texas States Imposing Criminal Liability for Allowing a Child to Gain Access to the Firearm, Regardless of Whether the Child Uses the Firearm or Causes Injury Hawaii Maryland Massachusetts Minnesota New Jersey Texas States Imposing Criminal Liability Only if a Child Uses or Possesses the Firearm California Connecticut Florida Illinois Iowa New Hampshire North Carolina Rhode Island States Imposing Criminal Liability for Negligent Storage of Unloaded Firearms California Hawaii Massachusetts State Laws Prohibiting Intentional, Knowing or Reckless Provision of Firearms to Minors Colorado Delaware Georgia Indiana Kentucky Mississippi Missouri Nevada Oklahoma Tennessee Utah Virginia Wisconsin Description of State Child Access Prevention Laws The majority of states have laws designed to prevent children from accessing firearms. The strongest laws impose criminal liability when a minor gains access to a negligently stored firearm. The weakest prohibit persons from directly providing a firearm to a minor. There is a wide range of laws that fall somewhere between these extremes, including laws that impose criminal liability for negligently stored firearms, but only where the child uses the firearm and causes death or serious injury. Weaker laws impose liability only in the event of reckless, knowing or intentional conduct by the adult. -

List of Surrounding States *For Those Chapters That Are Made up of More Than One State We Will Submit Education to the States and Surround States of the Chapter

List of Surrounding States *For those Chapters that are made up of more than one state we will submit education to the states and surround states of the Chapter. Hawaii accepts credit for education if approved in state in which class is being held Accepts credit for education if approved in state in which class is being held Virginia will accept Continuing Education hours without prior approval. All Qualifying Education must be approved by them. Offering In Will submit to Alaska Alabama Florida Georgia Mississippi South Carolina Texas Arkansas Kansas Louisiana Missouri Mississippi Oklahoma Tennessee Texas Arizona California Colorado New Mexico Nevada Utah California Arizona Nevada Oregon Colorado Arizona Kansas Nebraska New Mexico Oklahoma Texas Utah Wyoming Connecticut Massachusetts New Jersey New York Rhode Island District of Columbia Delaware Maryland Pennsylvania Virginia West Virginia Delaware District of Columbia Maryland New Jersey Pennsylvania Florida Alabama Georgia Georgia Alabama Florida North Carolina South Carolina Tennessee Hawaii Iowa Illinois Missouri Minnesota Nebraska South Dakota Wisconsin Idaho Montana Nevada Oregon Utah Washington Wyoming Illinois Illinois Indiana Kentucky Michigan Missouri Tennessee Wisconsin Indiana Illinois Kentucky Michigan Ohio Wisconsin Kansas Colorado Missouri Nebraska Oklahoma Kentucky Illinois Indiana Missouri Ohio Tennessee Virginia West Virginia Louisiana Arkansas Mississippi Texas Massachusetts Connecticut Maine New Hampshire New York Rhode Island Vermont Maryland Delaware District of Columbia -

2007 Nebraska Depth Chart–Nevada

1 0 2 0 3 0 4 0 5 0 4 0 3 0 2 0 1 0 Nebraska Football Game Notes - Game 1 Nebraska vs. Nevada 2007 Nebraska Depth Chart–Nevada OFFENSE DEFENSE Career Starts H-BACK: 85 J.B. Phillips** (6-3, 245, Sr., Colleyville, Texas) O END: 99 Barry Turner** (6-3, 265, Jr., Antioch, Tenn.) 81 Josh Mueller*** (6-5, 265, Jr., Columbus, Neb.) 88 Clayton Sievers** (6-4, 260, Jr., Elkhorn, Neb.) Offense Career 49 Dreu Young (6-4, 220, RFr., Cozad, Neb.) 84 Tony Sullivan (6-3, 240, Sr., Wahoo, Neb.) Name, Position Starts 86 Sean Hill (6-3, 250, Sr.)/44 Mike McNeill (6-4, 225, RFr.) Terrence Nunn, Sr., WR ............... 27 DT: 43 Ty Steinkuhler** (6-3, 285, Jr., Lincoln, Neb.) J.B. Phillips, Sr., HB ..................... 24 LT: 77 Carl Nicks* (6-5, 330, Sr., Salinas, Calif.) 97 Kevin Dixon (6-3, 295, Jr., Vero Beach, Fla.) Matt Slauson, Jr., OG .................. 14 Mike Huff, Jr., OG ........................ 13 65 Mike Smith (6-6, 290, RFr., Las Vegas, Nev.) 63 Ben Martin (6-4, 270, RFr., Lincoln, Neb.) Brett Byford, Sr., C ....................... 13 Nate Swift, Jr., WR ........................ 8 LG: 62 Andy Christensen* (6-3, 305, Jr., Bennington, Neb.) NT: 93 Ndamukong Suh* (6-4, 305, Soph., Portland, Ore.) Andy Christensen, Jr., OG ............. 8 69 Jordan Picou (6-2, 305, Sr., Rialto, Calif.) 56 Shukree Barfield (6-4, 310, Jr.)/ 96 Brandon Johnson* (6-3, 315, Sr.) Marlon Lucky, Jr., IB ...................... 6 Lydon Murtha, Jr., OT .................... 6 C: 59 Brett Byford* (6-3, 300, Sr., Hartselle, Ala.) B END: 98 Zach Potter** (6-7, 285, Jr., Omaha, Neb.) Josh Mueller, Sr., HB .................... -

California-Nevada Region

Research Guides for both historic and modern Native Communities relating to records held at the National Archives California Nevada Introduction Page Introduction Page Historic Native Communities Historic Native Communities Modern Native Communities Modern Native Communities Sample Document Beginning of the Treaty of Peace and Friendship between the U.S. Government and the Kahwea, San Luis Rey, and Cocomcahra Indians. Signed at the Village of Temecula, California, 1/5/1852. National Archives. https://catalog.archives.gov/id/55030733 National Archives Native Communities Research Guides. https://www.archives.gov/education/native-communities California Native Communities To perform a search of more general records of California’s Native People in the National Archives Online Catalog, use Advanced Search. Enter California in the search box and 75 in the Record Group box (Bureau of Indian Affairs). There are several great resources available for general information and material for kids about the Native People of California, such as the Native Languages and National Museum of the American Indian websites. Type California into the main search box for both. Related state agencies and universities may also hold records or information about these communities. Examples might include the California State Archives, the Online Archive of California, and the University of California Santa Barbara Native American Collections. Historic California Native Communities Federally Recognized Native Communities in California (2018) Sample Document Map of Selected Site for Indian Reservation in Mendocino County, California, 7/30/1856. National Archives: https://catalog.archives.gov/id/50926106 National Archives Native Communities Research Guides. https://www.archives.gov/education/native-communities Historic California Native Communities For a map of historic language areas in California, see Native Languages. -

Milkweeds of Nevada & Utah

MILKWEEDS OF NEVADA & UTAH Milkweeds (Asclepias spp.) are herbaceous perennial plants named for their milky sap. These plants occur in a wide range of habitats, including intact natural communities on roadsides and highly disturbed roadsides. As required host plants for monarch (Danaus plexippus) caterpillars, milkweeds play an KEY essential role in the butterfly’s life cycle (see reverse). Vegetation management that allows milkweeds to MAY BE MORE persist can support monarchs. This guide can help you recognize the most common native species found TOLERANT OF MOWING on roadsides in your region. The most common milkweeds in roadsides in Nevada & Utah (in alphabetical order): Spider milkweed (A. asperula ssp. asperula) Desert milkweed (A. erosa) PLANT: Upright, unbranched to branched stout stems; with fine hairs; PLANT: Multiple spreading stems, unbranched to few branches; usually grows in clumps. LEAVES: Opposite; oval- to lance-shaped; smooth to with smooth. LEAVES: Alternate; lance-shaped; usually folded lengthwise. fine hairs. HABITAT: Washes, gulches, canyons, disturbed areas in deserts, HABITAT: Grasslands, disturbed areas. SOILS: Clayey, gravelly, sandy, rocky creosote bush and sagebrush communities. SOILS: Sandy; dry. BLOOM: limestone, dry. BLOOM: Apr–Jun; light green with touches of purple. Apr–Oct; yellowish or cream; flower buds are hairy. Narrowleaf milkweed (A. fascicularis) Showy milkweed (A. speciosa) PLANT: Thin upright branched stems; smooth. LEAVES: Opposite to whorled; narrow to lance-shaped; folded lengthwise; mostly smooth. HABITAT: Grasslands, wetland-riparian areas, open woodlands, chaparral, sagebrush, PLANT: Stout upright, unbranched stems; hairy. LEAVES: Opposite; oval- disturbed areas, banks of streams and irrigation ditches, fallow fields.SOILS: shaped; hairy. HABITAT: Grasslands, old fields, disturbed areas, edges of Sandy to clayey, tolerates saline; dry–moist. -

NEVADA's ROADMAP to RECOVERY

NEVADA’s ROADMAP TO RECOVERY Updated March 12, 2021 NEVADA’s ROADMAP TO RECOVERY March 2021 OVERVIEW As Nevada navigates the COVID-19 global pandemic and continues vaccinating residents through an efficient and equitable approach, plans for a safe reopening must focus on how we can continue mitigating the spread while getting Nevadans back to work, protecting and recovering our economy, and getting our students back to in-person learning in the safest way possible. According to state public health officials, a critical component of a successful reopening plan is that current restrictions must be eased incrementally and we continue to follow the mitigation measures that are proven to work. Commonly recommended or required mitigation measures are still the best way to protect people until wide-spread vaccination becomes available, including: ✓ limiting the number of people in enclosed spaces, 1 ✓ social distancing of at least 6 feet, 2 ✓ requiring the use of masks, 3, 4 ✓ increasing ventilation, 5 and ✓ using disinfectants on high-touch surfaces. 6 Each mitigation measure reduces overall risk and combining all of these measures has proven to be the most effective. As leaders, businesses and members of the public continue to assess the risk associated with specific activities and work together to mitigate the spread and decrease community transmission, they must remember that the risk of infection from COVID-19 increases as: ✓ the size of groups increases, 7, 8, 9 ✓ the length of exposure increases, 10 ✓ the amount of ventilation (indoors or outdoors) decreases, 11, 12 and ✓ the amount of time unmasked increases. 13 It’s for these reasons that the State is taking a responsible approach to reopening aimed at ensuring success for the long term and not just in the immediate future, while providing predictability through a clear timeline. -

Colorado River Basin States Representatives of Arizona, California, Colorado, Nevada, New Mexico, and Wyoming

Colorado River Basin States Representatives of Arizona, California, Colorado, Nevada, New Mexico, and Wyoming September 8, 2020 VIA ELECTRONIC MAIL – COPIES TO FOLLOW VIA US MAIL The Honorable David L. Bernhardt, Secretary U. S. Department of the Interior 1849 C Street, NW Washington, DC 20240 Dear Secretary Bernhardt: As Governors’ representatives of the Colorado River Basin States of Arizona, California, Colorado, Nevada, New Mexico, and Wyoming, we write to respectfully request that your office refrain from issuing a Final Environmental Impact Statement (FEIS) or Record of Decision (ROD) regarding the Lake Powell Pipeline until such time as the seven Basin States and the Department of the Interior (Interior) are able to reach consensus regarding outstanding legal and operational concerns raised by the proposed Lake Powell Pipeline project. The Colorado River Basin States face daunting challenges as populations continue to grow, water demands increase, and supplies diminish. In addressing these challenges, the Basin States, together with the past several presidential administrations, have cultivated cooperative relationships that yielded greater understanding of the unique issues facing each state and a more comprehensive recognition of basin-wide obstacles to sustainable and resilient river operations. At the same time, the Basin States have been careful to preserve each state’s rights and obligations under the 1922 Colorado River Compact, the 1948 Upper Colorado River Basin Compact, and other elements of the Law of the River. It is in that spirit that we write to you today. The proposed Lake Powell Pipeline project will divert water from the Upper Basin to serve communities located within the Lower Basin in Utah. -

Jurisdiction Comparison for Wealth Transfer Planning Jurisdiction Comparison for Wealth Transfer Planning

Jurisdiction Comparison for Wealth Transfer Planning Jurisdiction Comparison for Wealth Transfer Planning The following chart summarizes state laws that client families should consider when establishing wealth transfer plans and structures, including taxation, trust laws, asset protection, and regulated and unregulated private trust companies. TAXATION Law Wyoming Delaware Nevada South Dakota Tax Imposed Due to Resident No Yes No No Settlor Tax Imposed Due to Resident No No No No Fiduciary Tax Imposed Due to Resident No Yes No No Beneficiary Resident Non-Grantor Trusts 6.6%, deduction allowed Maximum Resident Non-Grantor None for nonresident None None Trust Income/Capital Gains Tax beneficiaries Corporate Income Tax None 8.7% of DE income None None LLC Income Tax None None None None Estate/Gift Tax None None None None Life Insurance Premium Tax 2.5% for the first $100K, Qualified None 1.75% None 0.08% thereafter 0.75% for the first $100K, 2% below $100K, none 2.5% for the first $100K, Non-Qualified 3.5% 0.075% thereafter thereafter 0.08% thereafter Yes, but only on first Retaliatory Yes Yes Yes $100K annual premium 255 buffalo way · po box 1905 · jackson, wy 83001 phone: 307-733-3327 · fax: 307-733-5037 · willowstreetgroup.com MODERN TRUST LAWS Law Wyoming delAware nevada south dakota Directed Trust Yes Yes Yes Yes Trust Protector Yes Yes Yes Yes NJSA Statute Yes Yes Yes Yes Virtual Representation Yes Yes Yes Yes By Holder of General Yes Yes Yes No Power By Parent/Guardian Yes Yes Yes Yes By Person with Identical Yes Yes Yes Yes Interest -

DESIGN GUIDELINES for NEVADA CITY, CALIFORNIA Originally Adopted September, 1995 City Council Adopted Revisions August 12

DESIGN GUIDELINES For NEVADA CITY, CALIFORNIA originally ADopted SEptembEr, 1995 City Council adopted revisions August 12. 2015 Nevada City, 1920 Acknowledgements Nevada City City Council Jennifer Ray, Mayor Evans Phelps, Vice-Mayor Duane Strawser Terri Andersen Robert Bergman Nevada City City Staff Mark Prestwich, City Manager Cindy Siegfried, City Planner Harold DeGraw, City Attorney William J. Falconi, City Engineer Verne Taylor, Director of Public Works Photographs and Credits Searls Library (historical photos) Nevada County Memories, Presented by The Union City Staff 1910 2010 2 Table of Contents PAGE 1.0 INTRODUCTION 1.1 Historic Background of Nevada City 5 1.2 Nevada City’s Philosophy 7 1.3 Purpose and Use of the Design Guidelines 8 2.0 DESIGN REVIEW PROCESS 2.1 Planning Commission Approvals 10 2.2 Staff Approvals 11 2.3 Appeals 11 2.4 Permit Time Limits 11 3.0 NEIGHBORHOOD CONTEXT 12 4.0 ARCHITECTURAL DESIGN WITHIN HISTORICAL DISTRICT 4.1 History of Historical District 14 A. Residential Projects within Historical District 22 B. Commercial Projects within Historical District 27 C. Exterior Lighting 31 D. Map indicating lots bordering/bounding Historical District (subject to Historical District Standards) 34 5.0 ARCHITECTURAL DESIGN OUTSIDE HISTORICAL DISTRICT 5.1 Existing Residential Neighborhoods 35 5.2 New Residential Neighborhoods 46 6.0 DESIGN / SITE DEVELOPMENT STANDARDS IN ALL RESIDENTIAL NEIGHBORHOODS 6.1 Site Planning/Site Constraints 48 6.2 Watercourses 48 6.3 Steep slopes 48 6.4 Volume, Scale, Massing 49 6.5 Grading/Slope -

Research That Informed Our Logo and Brand Target Audience

VISIT CARSON CITY LOGO AND BRAND THE RESEARCH THAT INFORMED OUR LOGO AND BRAND TARGET AUDIENCE OLDER WEEKDAY TRAVELERS • Retirees are on the road and they’re avid travelers • They like to take their time, avoid the crowds • Value relaxation and rejuvenation • Interested in multi-generational travel and family-friendly destinations • 60% travel by car to their destination Source: https://www.aarp.org/research/topics/life/info-2017/2018-travel-trends.html TARGET AUDIENCE OLDER WEEKDAY TRAVELERS Their favorite brands speak to the glory days of their ‘Woodstock-Summer of Love’ youth, but don’t remind them of how long ago that was. This audience find ads with concepts of family, love, and togetherness highly relatable and likeable. BRANDS THAT APPEAL TO THIS AUDIENCE Source: https://www.considerable.com/entertainment/trivia/the-brands-boomers-love-in-2019/ https://www.acemetrix.com/insights/blog/best-practices-creative-success-among-baby-boomers/ TARGET AUDIENCE MILLENNIAL FAMILIES • More than half (58%) of U.S. Millennials who traveled overnight last year have children under the age of 18 in the household • They value quality time, relaxation, safety and convenience • Less interested in metropolitan areas • Prefer destinations that are easy to get to Source: https://www.travelagentcentral.com/running-your-business/stats-44-millennials-travel-kids TARGET AUDIENCE MILLENNIAL FAMILIES Millennials are fast-paced, so they value a brand that is easy to understand. They gravitate toward design that is simple, yet creative: they want to understand your message in a matter of seconds. BRANDS THAT APPEAL TO THIS AUDIENCE SURVEYS & INTERVIEWS SURVEY Stakeholders who participated felt the current logo did not represent Carson City: • “Star reminds me of Texas” • “Very basic and looks too political” • “Not sure what it signifies” INTERVIEWS • “I can’t picture the logo right now.