An Enterprise Map of Tanzania

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

AUSTRALIAN OFFICIAL JOURNAL of TRADE MARKS 1 February 2007

Vol: 21 , No. 5 1 February 2007 AUSTRALIAN OFFICIAL JOURNAL OF TRADE MARKS Did you know a searchable version of this journal is now available online? It's FREE and EASY to SEARCH. Find it at http://pericles.ipaustralia.gov.au/ols/epublish/content/olsEpublications.jsp or using the "Online Journals" link on the IP Australia home page. The Australian Official Journal of Designs is part of the Official Journal issued by the Commissioner of Patents for the purposes of the Patents Act 1990, the Trade Marks Act 1995 and Designs Act 2003. This Page Left Intentionally Blank (ISSN 0819-1808) AUSTRALIAN OFFICIAL JOURNAL OF TRADE MARKS 1 February 2007 Contents General Information & Notices IR means "International Registration" Amendments and Changes Application/IRs Amended and Changes ...................... 1706 Registrations/Protected IRs Amended and Changed ................ 1707 Applications/IRs Accepted for Registartion/Protection .......... 1417 Applications/IRs Filed Nos 1154986 to 1156299 ............................. 1399 Applications/IRs Lapsed, Withdrawn and Refused Lapsed ...................................... 1707 Withdrawn..................................... 1708 Refused ...................................... 1708 Assignments, Trasnmittals and Transfers .................. 1708 Cancellations of Entries in Register ...................... 1710 Notices ........................................ 1705 Opposition Proceedings ............................. 1703 Removal/Cessation of Protection for Non-use Proceedings ....... 1711 Renewal of Registration/IR -

Tracing Buddhist Responses to the Crisis of Cosmography

University of Calgary PRISM: University of Calgary's Digital Repository Graduate Studies The Vault: Electronic Theses and Dissertations 2020-08-17 Tracing Buddhist Responses to the Crisis of Cosmography Ereshefsky, Joshua Ian Ereshefsky, J. I. (2020). Tracing Buddhist Responses to the Crisis of Cosmography (Unpublished master's thesis). University of Calgary, Calgary, AB. http://hdl.handle.net/1880/112477 master thesis University of Calgary graduate students retain copyright ownership and moral rights for their thesis. You may use this material in any way that is permitted by the Copyright Act or through licensing that has been assigned to the document. For uses that are not allowable under copyright legislation or licensing, you are required to seek permission. Downloaded from PRISM: https://prism.ucalgary.ca UNIVERSITY OF CALGARY Tracing Buddhist Responses to the Crisis of Cosmography by Joshua Ian Ereshefsky A THESIS SUBMITTED TO THE FACULTY OF GRADUATE STUDIES IN PARTIAL FULFILMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF ARTS GRADUATE PROGRAM IN RELIGIOUS STUDIES CALGARY, ALBERTA AUGUST, 2020 © Joshua Ian Ereshefsky 2020 i ABSTRACT Buddhists, across different schools and regions, traditionally posited a similar world model—one that is flat and centered by giant Mount Meru. This world model is chiefly featured in Vasubandhu’s fourth century CE text, the Abhidharmakośabhāṣyam. In 1552, Christian missionary Francis Xavier introduced European spherical-world cosmography to Japan, precipitating what this thesis terms the Buddhist -

GLOSARIO CARPINTERIA Y EBANISTERÍA Escuelas Taller

GLOSARIO DE CARPINTERIA Y EBANISTERÍA PARA Escuelas Taller Desarrollado por el Grupo de Trabajo “Seguimiento, Ampliación e Intercambio” (SAI) “Grupo Mobila” Especialidad Carpintería y Ebanistería Servef – Paterna - Valencia Año 2006 Autores Calatayud C., Bartolomé Ferrando L. Manuel González S., Juan José Maestro D., Fernando Mestre P., Francisco Dispuestos a proseguir la actualización del mismo, y el agradecimiento anticipado de las colaboraciones que se puedan hacer sobre el mismo a la dirección: [email protected] El grupo de trabajo de “Seguimiento, Ampliación e Intercambio” de la especialidad de carpintería y ebanistería, presenta en este documento el resultado de su recopilación de términos afines a estas especialidades, bajo la denominación Glosario de Carpintería y Ebanistería para Escuelas taller”. El “Grupo Mobila” ha querido contribuir con éste instrumento a atender el sentir de muchos profesionales y entidades vinculadas a la enseñanza de la carpintería y ebanistería, para que se compendiaran conocimientos relevantes a su esfera de actuación. Este trabajo se lleva a cabo, por tanto, para cooperar al mantenimiento de los conocimientos de la materia y quiere ser un referente indispensable para la formación de aquellas personas que deseen iniciarse en éste campo laboral por medio de las Escuelas Taller, Casas de Oficios, Talleres de Empleo o la Formación Profesional Ocupacional. El manual se constituirá sin duda en recurso didáctico para docentes de dicho ámbito en la que existe una necesidad permanente de herramientas específicas para la enseñanza. Esperamos que el desarrollo de ésta experiencia sea satisfactoria para el aprendizaje de la carpintería y la ebanistería, y su aprovechamiento equiparable a la ilusión puesta en la elaboración del mismo. -

Understanding Rwanda's Agribusiness and Manufacturing

Understanding Rwanda’s Agribusiness Manufacturing and SectorsUnderstanding Rwanda’s This book comes after the 50th anniversary of Rwanda’s Independence and provides the first ever comprehensive overview of firms in the country’s agribusiness and manufacturing sectors. Understanding Rwanda’s Agribusiness and Manufacturing Sectors puts these sectors into context historically, explaining how decisions and initiatives going back to the 1930s have contributed to determining the shape Understanding and composition of agribusiness and manufacturing in Rwanda today. These sectors, more than any others, have followed the ups Rwanda’s and downs of Rwanda’s history. The book also provides an in-depth Agribusiness and analysis of agribusiness and manufacturing in Rwanda today, with a focus on understanding the origins, evolution and capabilities of Manufacturing firms, and how these capabilities came to be. This overview, or Sectors “Enterprise Mapping”, gives the reader a detailed understanding of the ownership structures, products, systems, resources and exports of leading firms in Rwanda’s agribusiness and manufacturing sectors today. Finally, this book individually profiles forty-three of Rwanda’s largest manufacturing and agribusiness firms. This book is targeted at policymakers, academics, businesspeople, and prospective investors interested in gaining a better understanding of Rwanda’s industrial sector. Sachin Gathani and Dimitri Stoelinga Gathani and Stoelinga With a Foreword by François Kanimba, Minister of Trade and Industry, and an Introduction -

Thai Kingship During the Ayutthaya Period : a Note on Its Divine Aspects Concerning Indra*

Thai Kingship during the Ayutthaya Period : A Note on Its Divine Aspects Concerning Indra* Woraporn Poopongpan Abstract This article is an initial attempt to highlight the divine aspects of Thai kingship during the Ayutthaya period, the interesting characteristic of which was an association of the king’s divinity with the Buddhist and Brahman god, Indra. Thai concept of the king’s divinity was identified closely with many Brahman gods such as Narayana, Rama or Siva (Isuan) but the divine aspects concerning Indra had a special place in Thai intellectual thinking as attested by ceremonies associated with the kingship recorded in Palatine Law and other sources. Thai kingship associated with Indra was reflected in the following elements: 1. The Royal ceremonies 2. The names of Indra’s residences 3. The number of the king’s consorts The article concludes that the emphasis on the king’s divine being as Indra derived not only from the influence of Brahmanism on the Thai society but more importantly from the high status of Indra in Buddhist belief. This can be easily understood since Buddhism is the main religion of Thai society. While some aspects * This article is based on the PhD dissertation “The Palatine Law as a source for Thai History from Ayutthaya period to 1805”, Submitted to the Department of History, Chulalongkorn University. It would not have been possible without considerable helps and valuable guidance from Dr. Dhiravat na Pombejra, my advisor, and all kind helps from Miss Apinya Odthon, my close friend. Silpakorn University International Journal Vol.7 : 143-171, 2007 Ayutthaya Thai Kingship Concerning Indra Silpakorn University International Journal Vol.7, 2007 of kingship are derived from Brahmanic Indra because Thailand adopted several conceptions of state and kingship from India, it was the Thai Buddhist understanding of Indra as a supporter of the Buddha that had a more significant impact. -

Siberia and India: Historical Cultural Affinities

Dr. K. Warikoo 1 © Vivekananda International Foundation 2020 Published in 2020 by Vivekananda International Foundation 3, San Martin Marg | Chanakyapuri | New Delhi - 110021 Tel: 011-24121764 | Fax: 011-66173415 E-mail: [email protected] Website: www.vifindia.org Follow us on Twitter | @vifindia Facebook | /vifindia All Rights Reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form, or by any means electronic, mechanical, photocopying, recording or otherwise without the prior permission of the publisher Dr. K. Warikoo is former Professor, Centre for Inner Asian Studies, School of International Studies, Jawaharlal Nehru University, New Delhi. He is currently Senior Fellow, Nehru Memorial Museum and Library, New Delhi. This paper is based on the author’s writings published earlier, which have been updated and consolidated at one place. All photos have been taken by the author during his field studies in the region. Siberia and India: Historical Cultural Affinities India and Eurasia have had close social and cultural linkages, as Buddhism spread from India to Central Asia, Mongolia, Buryatia, Tuva and far wide. Buddhism provides a direct link between India and the peoples of Siberia (Buryatia, Chita, Irkutsk, Tuva, Altai, Urals etc.) who have distinctive historico-cultural affinities with the Indian Himalayas particularly due to common traditions and Buddhist culture. Revival of Buddhism in Siberia is of great importance to India in terms of restoring and reinvigorating the lost linkages. The Eurasianism of Russia, which is a Eurasian country due to its geographical situation, brings it closer to India in historical-cultural, political and economic terms. -

The Food Industry and Supermarkets in Eastern Africa: a Preliminary Report on Research in Tanzania and Ethiopia

Fukunishi ed., African Producers in the New Trend of Globalization: An Interim Report, Chosakenyu Hokokusho, Institute of Developing Economies, 2010. Chapter 2 The Food Industry and Supermarkets in Eastern Africa: A preliminary report on research in Tanzania and Ethiopia Akio Nishiura Abstract In recent years, domestic demand, via supermarkets, has begun to exert a considerable influence on agricultural production and food supply in eastern Africa. Thus, demand-driven approach is useful for providing an introduction to the growth of agriculture and the food industry. Analyzing the mechanism of the food chain from agriculture to food processing to food retailing within eastern Africa, this study aims to analyze the business relationships and coordination and competition among South African capital, Kenyan capital and local capital in the food industry and supermarkets in eastern Africa. In this paper, some examples of food manufacturers and supermarkets have been introduced with reference to Tanzania and Ethiopia as an interim report. Key Words; value chains, food industry, supermarket, eastern Africa 1. Introduction The importance of the role of the agricultural sector in the economies of eastern Africa cannot be denied, particularly in terms of employment and exports. Table 1 shows the structure of food and agricultural raw materials exports in Ethiopia, Kenya, Tanzania and Uganda. Food and agricultural raw materials exports account for 40% of total exports in all four countries. This percentage is far higher than the average for the countries of Sub-Saharan Africa. Except for gold in Tanzania, mineral products are not major contributors to the economies of eastern Africa. It is often said that in order to overcome the difficulties that hamper the agricultural sector in the region – problems such as the limitation of the markets for agricultural products and fluctuations in commodity prices – the promotion of high value-added products should be the key factor. -

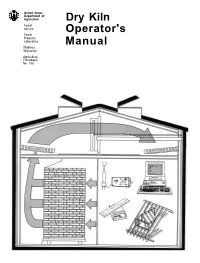

Dry Kiln Operator's Manual

United States Department of Agriculture Dry Kiln Forest Service Operator's Forest Products Laboratory Manual Madison, Wisconsin Agriculture Handbook No. 188 Dry Kiln Operator’s Manual Edited by William T. Simpson, Research Forest Products Technologist United States Department of Agriculture Forest Service Forest Products Laboratory 1 Madison, Wisconsin Revised August 1991 Agriculture Handbook 188 1The Forest Products Laboratory is maintained in cooperation with the University of Wisconsin. This publication reports research involving pesticides. It does not contain recommendations for their use, nor does it imply that the uses discussed here have been registered. All uses of pesticides must be registered by appropriate State and/or Federal agencies before they can be recommended. CAUTION, Pesticides can be injurious to humans, domestic animals, desirable plants, and fish or other wildlife-if they are not handled or applied properly. Use all pesticides selectively and carefully. Follow recommended practices for the disposal of surplus pesticides aand pesticide containers. Preface Acknowledgments The purpose of this manual is to describe both the ba- Many people helped in the revision. We visited many sic and practical aspects of kiln drying lumber. The mills to make sure we understood current and develop- manual is intended for several types of audiences. ing kiln-drying technology as practiced in industry, and First and foremost, it is a practical guide for the kiln we thank all the people who allowed us to visit. Pro- operator-a reference manual to turn to when questions fessor John L. Hill of the University of New Hampshire arise. It is also intended for mill managers, so that they provided the background for the section of chapter 6 can see the importance and complexity of lumber dry- on the statistical basis for kiln samples. -

Hansard 17 Mar 1998

17 Mar 1998 Petitions 321 TUESDAY, 17 MARCH 1998 PETITIONS The Clerk announced the receipt of the following petitions— Mr SPEAKER (Hon. N. J. Turner, Nicklin) read prayers and took the chair at 9.30 a.m. Paedophilia From Mrs Bird (299 petitioners) requesting the House to act immediately to ASSENT TO BILLS establish a royal commission into paedophilia and Assent to the following Bills reported by Mr sexual assault against children. Speaker— Tobacco Products (Prevention of Supply to Home Help, Ipswich Children) Bill; From Mr Hamill (296 petitioners) Griffith University Bill; requesting the House and the Minister for Health Queensland University of Technology Bill; to restore the provision of Home Help services to those Ipswich residents who are experiencing Central Queensland University Bill; hardship as a result of cuts to service provision University of Queensland Bill; and further increase the allocation of funds for University of Southern Queensland Bill; the provision of such services in order that the needs of those requiring these services can be Eagle Farm Racecourse Bill; properly met. Law Courts and State Buildings Protective Security Amendment Bill; Police Resources, Wynnum Offshore Minerals Bill; From Mr Lucas (1,158 petitioners) Tweed River Entrance Sand Bypassing requesting the House to call on the Police Project Agreement Bill. Minister, the Honourable T. R. Cooper, MLA, to allocate sufficient police resources to the Wynnum Police District to bring its police to PARLIAMENTARY SCHOOL population ratio up to at least the average rate for RESOURCES PROJECT the rest of Queensland and, further, to ensure DOCUMENTARY that at night there is a minimum of two uniformed Mr SPEAKER: Order! I wish to advise police cars operating within the Wynnum district honourable members that photographers will be of the Wynnum Police District (i.e. -

Regional Integration And

The African Review, Vol. 45, No. 2 (Special Issue) December, 2018:1-23 Can “The Is” and “The Ought” be Married? Creating a Sustainable Legal Framework for Intangible Property in the East African Community Anthony C.K. Kakooza Abstract The Common Market Protocol of the East African Community (EAC) serves the purpose of encouraging free movement of goods and services across the borders of the EAC Partner States. However, recent legal battles in Uganda and Rwanda highlight the fact that the territorial nature of Intellectual Property Rights is at variance with the spirit of free trade within the EAC, and the legal protection meant to go with such free trade. Coupled with this is the fact that national bor- ders sometimes cut across ethnic groupings that share cultural traits. There is an increasing need to protect Traditional Knowledge (TK) and Traditional Cultural Expressions (TCEs) from mis- appropriation and exploitation, which inevitably pit different communities and their host coun- tries against each other within the EAC. This is primarily due to the fact that the Partner States within the EAC have responded differently to the need for policy and legal frameworks regarding the protection of TK and TCEs. This paper looks at the contrast between the general interests of the EAC Partner States as portrayed in key treaties that they have signed, and their legal obliga- tions and interests as derived from their respective policy and legal frameworks pertaining to the protection of Intellectual Property, TK and TCEs. The paper points out the underlying challenges that have enabled the situation as it is to be different from what it ought to be in terms of gener- ating enjoyment of free movement of goods and services, as well as promoting a better IP and quasi-IP (TK and TCEs) environment in the EAC. -

Quality Assessment of Drinking Water in Sumve Kwimba District

American Journal of Engineering Research (AJER) 2018 American Journal of Engineering Research (AJER) e-ISSN: 2320-0847 p-ISSN : 2320-0936 Volume-7, Issue-5, pp-26-33 www.ajer.org Research Paper Open Access Quality Assessment of Drinking Water in Sumve Kwimba District 1Aisa. S. Oberlin and 2Steven Ntoga 1Department of Civil Engineering Dar es Salaam Institute of Technology, Tanzania 2Department of Civil Engineering St. Augustine University, Tanzania Corresponding Author: Aisa. S. Oberlin ABSTRACT: The aim of this study was to analyze physical-chemical and bacteriological quality of the drinking water in Sumve ward in Kwimba district (Mwanza). A total of 120 samples from a piped water supply scheme were collected applying EWURA, and TBS TZS 789:2008 procedures. Bacteriological parameters were analyzed using the most probable number method to detect and count the total coliform and Escherichia coli (E. coli). The physicochemical parameters were analyzed using standard methods to examine Total Dissolved Solids (TDS), temperature, electric conductivity, pH iron, manganese, chloride, fluoride, nitrate, ammonia and total hardness. The results were compared against drinking water quality standards laid by World Health Organization (WHO) and Tanzania Bureau of Standard (TBS). The total bacteria count in the water samples ranged from 300CFU/100ml to 4200CFU/100ml which exceeds those recommended by WHO of less than 10 coliform cells/100ml of water and those of TBS of 0/100ml. Water samples found with E.Coli numbers ranged between 10/100ml to 200/100ml which is above the permissible level of 0/100ml specified by WHO and TBS. The physicochemical results of the water samples ranged as follows: pH(8.13 to 8.52), turbidity(0.38 to 1.73NTU), Total Dissolved Solids (371mg/l to379mg/l), electrical conductivity (790 to 820 μs/cm),), temperature(26.90C to 27.90C), Nitrate(7.24 to 12.4 mg/l), Ammonium(2.85 to 4.6 mg/L), Manganese(2.4 to 4.9 mg/l), Chloride(13/l to 19.9 mg/l), Fluoride(0.82mg/l to 4.4 mg/l), Iron(0mg/l and 0.08mg/l), and total hardness. -

REPLICATING MAMATOTO: PROCESS EVALUATION REPORT 2020 Matovelo, Dismas;Brenner, Jenn; Mercader, Hannah;Shabani, Girles;Kanuti, Victoria;

REPLICATING MAMATOTO: PROCESS EVALUATION REPORT 2020 Matovelo, Dismas;Brenner, Jenn; Mercader, Hannah;Shabani, Girles;Kanuti, Victoria; © 2020, DISMAS MATOVELO This work is licensed under the Creative Commons Attribution License (https://creativecommons.org/licenses/by/4.0/legalcode), which permits unrestricted use, distribution, and reproduction, provided the original work is properly credited. Cette œuvre est mise à disposition selon les termes de la licence Creative Commons Attribution (https://creativecommons.org/licenses/by/4.0/legalcode), qui permet l’utilisation, la distribution et la reproduction sans restriction, pourvu que le mérite de la création originale soit adéquatement reconnu. IDRC Grant/ Subvention du CRDI: 108024-001-Replicating the MamaToto Program in Rural Tanzania (IMCHA) REPLICATING THE MAMATOTO PROGRAMME IN RURAL TANZANIA Final Process Evaluation Report September 202 0 Prepared for the International Development Research Centre Innovating for Maternal and Child Health in Africa (IMCHA) Initiative Table of Contents Study Team and Acknowledgements ....................................................................................... 3 1. Executive Summary.............................................................................................................. 5 2. List of Acronyms .................................................................................................................. 7 3. Background ........................................................................................................................