East Tennessee Foundation 2010 Summary Assets: Funds

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report on Charitable Solicitations

COLORADO SECRETARY OF STATE’S OFFICE ANNUAL REPORT ON CHARITABLE SOLICITATIONS 2003 Part 2 Part Two of the 2003 Annual Report provides summary financial information for all charitable organizations that filed financial reports covering any period that ended in 2002. Information believed to be of particular interest to potential donors has been excerpted from the complete financial report for each organization. On the revenue side, only Total Revenue and Contributions are displayed in the report. Each organization’s complete financial report includes additional revenue categories for Government Grants, Program Service Revenue, Investments, Special Events and Activities, Sales, and Other Expenses. On the expense side, the report displays Total Expenses, Program Services Expenses, Administration-Management-General Expenses, and Fundraising Expenses. Each organization’s complete financial report also includes expense categories for Payments to Affiliates and Other Expenses, which are not reflected in this report. The financial information displayed is information that was on file with the Secretary of State’s office as of noon, December 19, 2003. Since financial reports are due by the 15th day of the fifth month following the close of an organization’s fiscal year, the due dates vary. Nevertheless, the last 2002 reports due were those of calendar year organizations, whose accounting periods ended on Dec. 31, 2002. The due date for calendar year organizations was May 15, 2003. Since up to two extensions of the deadline may be requested by a charitable organization (three months each), all 2002 financial reports were due by Nov. 15, 2003, at the latest. For a number of reasons, it is possible that a charitable organization could be registered now, despite not being listed in Part Two of the 2003 Annual Report. -

Constructing and Performing an On-Air Radio Identity in a Changing Media Landscape

CONSTRUCTING AND PERFORMING AN ON-AIR RADIO IDENTITY IN A CHANGING MEDIA LANDSCAPE A Dissertation Submitted to the Temple University Graduate Board In Partial Fulfillment of the Requirements for the Degree DOCTOR OF PHILOSOPHY by David F. Crider January 2014 Examining Committee Members: Dr. Nancy Morris, Advisory Chair, Department of Media Studies and Production Dr. Patrick Murphy, Department of Media Studies and Production Dr. Donnalyn Pompper, Department of Strategic Communication Dr. Catherine Hastings, External Member, Susquehanna University ii © Copyright 2014 by David F. Crider All Rights Reserved iii ABSTRACT The radio industry is fighting to stay relevant in an age of expanding media options. Scholarship has slackened, and media experts say that radio’s best days are in the past. This dissertation investigates how today’s radio announcer presents him/herself on the air as a personality, creating and performing a self that is meant for mass consumption by a listening audience. A participant observation of eleven different broadcast sites was conducted, backed by interviews with most key on-air personnel at each site. A grounded theory approach was used for data analysis. The resulting theoretical model focuses on the performance itself as the focal point that determines a successful (positive) interaction for personality and listener. Associated processes include narrative formation of the on- air personality, communication that takes place outside of the performance, effects of setting and situation, the role of the listening audience, and the reduction of social distance between personality and listener. The model demonstrates that a personality performed with the intent of being realistic and relatable will be more likely to cement a connection with the listener that leads to repeated listening and ultimately loyalty and fidelity to that personality. -

Annual Report 2013

Annual Report 2013 Doyle Fund to Benefit Makenzie Goode Chairman’s Report New Funds Helping Page 2 Doyle Field Page 4 Memorial Athletic Families Achieve Their Page 3 Scholarship Charitable Goals Page 8 Helping donors doing good work...forever Chair’s Report FROM THE CHAIR Dear Friends of the Foundation, Nearly 150 donor funds have been established since our inception. These funds are helping feed those who are hungry, investing in education, the arts and environment. The breadth of support is impressive, not only touching on every aspect of life, but reaching a diverse group of people throughout the 33 communities we serve. Makenzie Goode Memorial Athletic Scholarship The Foundation’s funds are helping improve the quality of life for all of us. What is particularly gratifying is helping donors achieve their charitable goals. So many of them have a passion or an important cause they care very deeply about. A fund at the foundation allows them to support their charitable interest— forever, if they choose. We believe one of the reasons we have done so well is our guiding principle of creating partnerships with our donors, nonprofits and the community. This collaborative approach, I believe, allows us and the donors to accomplish so much more. As you’ll see in this report, it was a very busy year at the Foundation, with hundreds of grants and donor distributions being made to important community programs and initiatives. The success of the Foundation wouldn’t be possible without the support of our generous donors. So, thank you very much for allowing us to be your partner in helping to improve our community. -

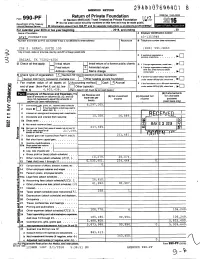

Form 990-PF Or Section 4947 ( A)(1) Trust Treated As Private Foundation \2 ^O^ Do Not Enter Social Security Numbers on This Form As It May Be Made Public

/ ^V AMENDED RETURN YC7^^V VU 8 Return of Private Foundation OMB No 1545-0052 Form 990-PF or Section 4947 ( a)(1) Trust Treated as Private Foundation \2 ^O^ Do not enter social security numbers on this form as it may be made public. Department of the Treasury ► and its separate instructions /form990pf. • Internal Revenue Service ► Information about Form 990-PF is at For calendar y ear 2016 or tax y ear beg inning , 2016 , and ending , 20 Name of foundation A Employer Identification number AT&T FOUNDATION 43-1353948 Number and street (or P 0 box number if mall is not delivered to street address) Room/suite B Telephone number (see instructions) 208 S. AKARD, SUITE 100 (800) 591-9663 City or town, state or province, country, and ZIP or foreign postal code q C If exemption application is ► pending, check here . DALLAS, TX 75202-4206 G Check all that apply: Initial return Initial return of a former public charity D 1 Foreign organizations , check here. ► El Final return X Amended return 2 Foreign organizations meeting the q 85% test , check here and attach . ► Address change Name change computation H Check type of organization' X Section 501(c)(3) exempt private foundation E If private foundation status was terminated Section chantable trust Other taxable p rivate foundation El 4947 ( a )( 1 ) nonexem pt under section 507(b)(1)(A), check here . ► Fair market value of all assets at J Accounting method. L_J Cash X Accrual F 11 the foundation is in a 60-month termination end of year (from Part ll, col. -

The Broadcast Decency Enforcement Act of 2004

THE BROADCAST DECENCY ENFORCEMENT ACT OF 2004 HEARINGS BEFORE THE SUBCOMMITTEE ON TELECOMMUNICATIONS AND THE INTERNET OF THE COMMITTEE ON ENERGY AND COMMERCE HOUSE OF REPRESENTATIVES ONE HUNDRED EIGHTH CONGRESS SECOND SESSION ON H.R. 3717 FEBRUARY 11 and 26, 2004 Serial No. 108–68 Printed for the use of the Committee on Energy and Commerce ( Available via the World Wide Web: http://www.access.gpo.gov/congress/house U.S. GOVERNMENT PRINTING OFFICE 92–537PDF WASHINGTON : 2004 For sale by the Superintendent of Documents, U.S. Government Printing Office Internet: bookstore.gpo.gov Phone: toll free (866) 512–1800; DC area (202) 512–1800 Fax: (202) 512–2250 Mail: Stop SSOP, Washington, DC 20402–0001 VerDate 11-MAY-2000 12:56 Apr 22, 2004 Jkt 000000 PO 00000 Frm 00001 Fmt 5011 Sfmt 5011 92537.TXT HCOM1 PsN: HCOM1 COMMITTEE ON ENERGY AND COMMERCE W.J. ‘‘BILLY’’ TAUZIN, Louisiana, Chairman RALPH M. HALL, Texas JOHN D. DINGELL, Michigan MICHAEL BILIRAKIS, Florida Ranking Member JOE BARTON, Texas HENRY A. WAXMAN, California FRED UPTON, Michigan EDWARD J. MARKEY, Massachusetts CLIFF STEARNS, Florida RICK BOUCHER, Virginia PAUL E. GILLMOR, Ohio EDOLPHUS TOWNS, New York JAMES C. GREENWOOD, Pennsylvania FRANK PALLONE, Jr., New Jersey CHRISTOPHER COX, California SHERROD BROWN, Ohio NATHAN DEAL, Georgia BART GORDON, Tennessee RICHARD BURR, North Carolina PETER DEUTSCH, Florida Vice Chairman BOBBY L. RUSH, Illinois ED WHITFIELD, Kentucky ANNA G. ESHOO, California CHARLIE NORWOOD, Georgia BART STUPAK, Michigan BARBARA CUBIN, Wyoming ELIOT L. ENGEL, New York JOHN SHIMKUS, Illinois ALBERT R. WYNN, Maryland HEATHER WILSON, New Mexico GENE GREEN, Texas JOHN B. -

Return of Organization Exempt from Income Tax 01V113 No 1545-M

Return of Organization Exempt From Income Tax 01V113 No 1545-M Form 990 Under section 501(c), 527, or 4947( a)(1) of the Internal Revenue Code ( except black lung 2006 benefit trust or private foundation ) Department of the Treasury Open to Public requirements. Internal Revenue Service ► The organization may have to use a copy of this return to satisfy state reporting inspection A For the 2008 calendar year , or tax year beginning JUL 1 and endin B Check if C Name of organization D Employer identification number applicable Please use IRS Addresschan e label or Ochang AT I ONAL PHILANTHROPIC T 23-7825575 (or P.O. box if mail is not delivered to street address) Room/suite E Telephone number L_j change e Number and street re'mturn SpecificSe 65 TOWNSHIP LINE ROAD 150 215-277-3010 Final Instruc- =retum tons city or town, state or country, and ZIP + 4 F Accounting method Cash ® Accrual Amended return ENK INTOWN PA 19046 Applicahon pending • Section 501 ( c)(3) organizations and 4947( a)(1) nonexempt charitable trusts H and I are not applicable to section 527 organizations must attach a completed Schedule A ( Form 990 or 990-EZ). H(a) Is this a group return for afflllates7 Yes [!]No G Webslte: . NPTRUST . ORG H(b) If 'Yes, enter number of N/A J Organization type (checkonlyone ® 501(c) ( 3 (insert no) 0 4947(a)(1) or L-1 H(c) Are all affiliates Included? N/A L_JYes [:::] No (if 'No," attach a list.) not a 509(a)(3) supporting organization and gross K Check here ► 0 if the organization is its H(d) Is this a separate return filed by an or- receipts are normally not more than $25,000. -

Report on Charitable Organizations in Mississippi Page 2

Page 1 Report on Charitable Organizations in Mississippi Page 2 Dear Fellow Mississippians: Mississippi continues to be one of the top-ranked states in the country supporting charitable giving. The generosity of our citizens is known nationally, and time after time our citizens have risen to the occasion to help Mississippians in need, as well as our fellow citizens across the country. Informed charitable giving helps ensure your hard earned money, property and services are dedicated to advance the core charitable purpose or mission of the organizations you support. Disclosure of charitable revenue and spending exposes unscrupulous groups who might prey upon the generosity of our citizens by lining their pockets under the guise of selfless motives. Additionally, transparency in financial reporting promotes the good work of credible organizations who are responsible stewards of your financial contributions and other support. For these reasons we are pleased to announce that the Report on Charitable Organizations in Mississippi is now available on our web site. This publication will enable you to make informed decisions on your charitable giving by presenting the financial activity for the charity’s most recent fiscal year. The Council of Better Business Bureaus recommends that at least sixty-five percent (65%) of total expenses of a charitable organization should be spent on program activities directly related to the organization’s purposes. Fundraising costs by the organization should not exceed thirty-five percent (35%) of related contributions. However, there are some instances when a departure from these standards would be reasonable. For example, newly created organizations may have higher administrative expenses due to start-up costs; and, large gifts or donor restrictions on the use of contributed funds could skew an organization’s apparent management of funds in either a favorable or unfavorable light. -

The Tradition of Caring Jefferson Awards Mission Statement

The Tradition of Caring Jefferson Awards Mission Statement The Tradition of Caring Jefferson Awards honor the highest ideals and achievements in the field of public service in KELOLAND. By honoring the Tradition of Caring Jefferson Awards recipients, it is the goal of KELOLAND TV to inspire others to become involved in community and public service. We recognize outstanding dedication, sacrifice and accomplishment by individuals. KELO-TV KDLO-TV KPLO-TV KCLO-TV February 3, 2004 The Honorable M. Mike Rounds, Governor State of South Dakota Capitol Building Pierre, SD 57501 Dear Governor Rounds: KELOLAND TV is proud to announce the 2004 JeffersodTradition of Caring Awards. These awards seek to honor extraordinary people in our area who engage in community and public service. These awards are sponsored by KELO-TV and Toshiba America Business Solutions of Mitchell, SD. We would like to extend you an invitation to be our guest and honor our winners as keynote speaker at our annual awards luncheon. For most of these winners, this event will likely be the only major recognition for a lifetime of tireless efforts in public service. This year we will honor three categories, Seniors (65 & older), Youth (18 & under) and General. Your speech need only be ten to fifteen minutes and focus on the importance of public service. In the recent past our speakers have included Senate Minority Leader Tom Daschle, Congressman John Thune, and Senator George McGovern. The date for the luncheon has not been set at this time in an effort to be flexible with the opportunities in your schedule. -

Jewish Donor Charitie a Recor $272

e are privileged to continue serving the Jewish community by providing an easy and efficient vehicle to streamline charitable giving and facilitate philanthropy. This has been another record-breaking year for the Jewish Communal Fund (JCF). WA leader in the world of Jewish philanthropy, JCF continues to be the largest and most active Jewish donor advised fund in the country, managing $1.2 billion in charitable assets. For the fiscal year ending June 30, 2013 our diverse donor base granted more than $270 million to thousands of not-for-profits in all sectors. In addition to these generous grants recommended by our donors, JCF makes a community gift of $2 million to the UJA-Federation of New York’s Annual Campaign. JCF’s institutional endowment, our Special Gifts Fund, awarded an additional $767,000 in grants to projects and agencies in the New York Jewish community. Among those grants was one for $240,000 to provide day camp scholarships to families impacted by Hurricane Sandy that enabled 276 children to attend day camp. This is the power and impact of our JCF community! The Jewish Communal Fund is dedicated to providing our donors and their families with outstanding personal service and the philanthropic community has taken notice. Once again, JCF received a four-star rating (the highest distinction possible) from Charity Navigator, an independent and well- respected charity evaluator, and we maintained our place as one of the highest-ranking Jewish organization in the Chronicle of Philanthropy’s Top 400 national charities list. As JCF continues to grow, we know that we must continue to innovate, educate and create new ways to serve our network of donors and the Jewish community. -

Deirdre Imus Green Activist and Best Selling Author

Memorypreserving your Spring 2012 The Magazine of Health and Hope Deirdre Imus Green Activist and Best Selling Author The latest news on Alzheimer’s research and treatment Diane Keaton Talks About Her Family and Her Book Remember Help MetLife Foundation find a cure for Alzheimer’s. In December 2011, MetLife Foundation launched Remember Me, an interactive experience featuring real stories from people lost to Alzheimer’s disease. The goal of the site is to raise $1 million for Alzheimer’s disease research, education and caregiver support by asking people to symbolically restore a memory in honor of someone they may know – or may have known – impacted by the disease. Each time a visitor saves a memory, MetLife Foundation will donate $1 until the $1 million goal is met. The online experience at www.saveamemory.org is an immersive gallery containing images and poignant memories of people who have passed away from Alzheimer’s disease. To showcase the memory loss and emotional toll associated with the disease, the person with Alzheimer’s is removed from each image. Visitors are then encouraged to choose a photo, and with one simple click, save the memory and help meet the $1 million goal. After the visitors save the memory, the person with Alzheimer’s disease will reappear and their story will be Save this Memory shared. This single click will trigger MetLife Foundation to donate $1 for each memory saved, as a running tally of saved memories remains on the site. Please save more by visiting www.saveamemory.org MetLife Save a Memory Ad.indd 1 4/12/12 8:53 AM Features West 46th Street & 12th Avenue New York, NY 10036 1-800-ALZ-INFO www.ALZinfo.org Kent L. -

Don Imus and the Rutgers Women's Basketball Team

Kennedy School of Government C15‐08‐1920.0 Case Program Crossing the Line: Don Imus and the Rutgers Women’s Basketball Team On April 4, 2007, in the early minutes of his morning radio talk show, host Don Imus jokingly remarked on the Rutgers University women’s basketball team, which had lost a national college championship game the previous night. Picking up on a comment by his producer and longtime sidekick, Bernard McGuirk, who had described the Rutgers players as “some hard‐core hos,” Imus said, “That’s some nappy‐headed hos there.” The remark was, wrote public television host Gwen Ifill, “a shockingly concise sexual and racial insult”—a “ho” was, in street argot, a whore, and “nappy‐headed” a derogatory allusion to the texture of African‐American hair— “tossed out in a volley of male camaraderie by a group of amused, middle‐aged white men.” 1 This was by no means the first time Imus and the regulars on his show had inserted racial and sexual innuendo into their early morning banter. “Imus in the Morning” had long been, in the words of Newsweek, “a mix of the high‐minded and the profane,” 2 a show where serious conversations with prominent politicians and journalists alternated with what was often characterized as crass “locker‐room” humor. Over the years, Imus and his cohorts had directed gibes at homosexuals, blacks, Jews, and other ethnic minorities while poking fun at prominent figures in sports, entertainment, and politics. Occasionally, there was a public outcry over some of the more egregious insults, forcing Imus to defend himself against charges that he was a bigot; but eventually the uproar—which seldom made headlines—would die down, and Imus, whose popular four‐hour show was nationally syndicated through CBS Radio and simulcast on MSNBC‐ TV, ultimately emerged unscathed and unrepentant. -

The Barretstown Experience Author(S) Kearney, Peter James Publication Date 2011-12 Original Citation Kearney, P.J

UCC Library and UCC researchers have made this item openly available. Please let us know how this has helped you. Thanks! Title The Barretstown experience Author(s) Kearney, Peter James Publication date 2011-12 Original citation Kearney, P.J. 2011. The Barretstown experience. PhD Thesis, University College Cork. Type of publication Doctoral thesis Rights © 2011, Peter J. Kearney http://creativecommons.org/licenses/by-nc-nd/3.0/ Item downloaded http://hdl.handle.net/10468/695 from Downloaded on 2021-10-10T19:37:21Z The Barretstown Experience Peter James Kearney PhD Thesis University College Cork Department of Sociology, School of Philosophy and Sociology. December 2011 Head of Department: Professor Arpad Szakolczai Supervisor: Dr Kieran Keohane TABLE OF CONTENTS Declaration …………………………………………………………. 6 Acknowledgements ……………………………………………………. 7 1. Abstract …………………………………………………………. 8 2. Introduction ………………………………………………………… 12 3. The Barretstown Experience as a Rite of Passage INTRODUCTION …………………………………………………...... 27 Barretstown in History EXPERIENCE, SOCIAL DRAMAS AND RITES OF PASSAGE ….. 28 The Experience of Camp Experience and Ritual Social Dramas Ritual Communication Ritual Types Rites Of Passage Stigma CHILDHOOD CANCER AND SOCIAL THEORY ………………… 42 THE BARRETSTOWN EXPERIENCE …………………………..... 44 Rites of Separation Liminality, Communitas Reintegration DISCUSSION ……………………………………………………..... 51 CONCLUSION …………………………………………………….. 57 4. Tripartite Camp Experiences in America, U.K., and Europe INTRODUCTION …………………………………………………... 60 The Painted Turtle