Heimavellir Hf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nasdaq Stockholm Welcomes Logistea to First North

Nasdaq Stockholm Welcomes Logistea to First North Stockholm, May 8, 2017 — Nasdaq (Nasdaq: NDAQ) announces that the trading in Logistea AB’s shares (short name: LOG) commenced today on Nasdaq First North in Stockholm. Logistea belongs to the financial sector (sub sector: real estate) and is the 35th company to be admitted to trading on Nasdaq’s Nordic markets* in 2017. Logistea is a real estate company that owns and manages the property Örja 1:20, located along the E6 highway in Landskrona, Sweden. The property consists of a logistics terminal and an office building, with a total, rentable area of 42 000 square meters. Its largest tenant is DSV. For more information, please visit www.logistea.se. “We welcome Logistea to Nasdaq First North,” said Adam Kostyál, SVP and Head of European listings at Nasdaq. “We congratulate the company on its listing, and look forward to supporting them with the investor exposure that comes with a Nasdaq First North listing.” Logistea AB has appointed FNCA Sweden AB as the Certified Adviser. *Main markets and Nasdaq First North at Nasdaq Copenhagen, Nasdaq Helsinki, Nasdaq Iceland and Nasdaq Stockholm. About Nasdaq First North Nasdaq First North is regulated as a multilateral trading facility, operated by the different exchanges within Nasdaq Nordic (Nasdaq First North Denmark is regulated as an alternative marketplace). It does not have the legal status as an EU-regulated market. Companies at Nasdaq First North are subject to the rules of Nasdaq First North and not the legal requirements for admission to trading on a regulated market. The risk in such an investment may be higher than on the main market. -

1 Not for Release, Publication Or Distribution in Whole Or

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN THE UNITED STATES, CANADA, AUSTRALIA, SOUTH AFRICA OR JAPAN. Marel: Final Offer Price set at EUR 3.70 per Offer Share Marel hf. (“Marel”), a leading global provider of advanced food processing equipment, systems, software and services to the poultry, meat and fish industries, has set the final price for the shares (the “Offer Shares”) sold in the offering and listing on Euronext Amsterdam (the “Offering) at EUR 3.70 per Offer Share (the “Offer Price”). Listing of and first trading in Marel’s shares (the “Shares”) on an “as-if-and-when-issued/delivered” basis on Euronext Amsterdam commence on Friday 7 June 2019. The Offer Price has been set at EUR 3.70, implying a market capitalisation for Marel of EUR 2.82 billion. The Offering comprises approximately 90.9 million Shares. In addition, Marel has granted a customary Over-allotment Option (as defined and described below) representing approximately 9.1 million Shares. The Offering represents 15% of Marel’s entire share capital, assuming full exercise of the Over-allotment Option. Total offer size amounts to EUR 336.36 million, and will increase to EUR 370 million assuming full exercise of the Over-allotment Option. The Offering was multiple times oversubscribed at the Offer Price with strong demand from both institutional and retail investors. Free-float following completion of the Offering is expected to be 75.0%, and will increase to 75.3% assuming full exercise of the Over-allotment Option. Listing of the Shares and first day of conditional trading on Euronext Amsterdam on an “as-if- and-when-issued/delivered” basis commence on 7 June 2019 under the symbol “MAREL”. -

Final Report Amending ITS on Main Indices and Recognised Exchanges

Final Report Amendment to Commission Implementing Regulation (EU) 2016/1646 11 December 2019 | ESMA70-156-1535 Table of Contents 1 Executive Summary ....................................................................................................... 4 2 Introduction .................................................................................................................... 5 3 Main indices ................................................................................................................... 6 3.1 General approach ................................................................................................... 6 3.2 Analysis ................................................................................................................... 7 3.3 Conclusions............................................................................................................. 8 4 Recognised exchanges .................................................................................................. 9 4.1 General approach ................................................................................................... 9 4.2 Conclusions............................................................................................................. 9 4.2.1 Treatment of third-country exchanges .............................................................. 9 4.2.2 Impact of Brexit ...............................................................................................10 5 Annexes ........................................................................................................................12 -

Iceland's Implementation of the 2030 Agenda for Sustainable Development

June 2019 Iceland's Implementation of the 2030 Agenda for Sustainable Development Voluntary National Review Government of Iceland Prime Minister’s Office Contents PRESS BOX TO GO TO CHAPTER Message from the Prime Minister very Friday at noon, hundreds of young people gather out- side Althingi, Iceland’s Parliament, insisting on radical action against climate change. They are a part of an international Emovement of young people who rightly point out the fact that today’s decisions determine their future. Climate change is a crisis for humanity as a whole; rendering traditional territorial borders meaningless. International collaboration is the only way forward. The Millennium Development Goals, adopted in 2000, were often referred to as “the world’s biggest promise”. They were a global agreement to reduce poverty and human deprivation. And they did. The MDGs lifted more than one billion people out of extreme poverty. The goals provided access to water and sanitation; drove down child mortality; drastically improved maternal health; cut the number of children out of school; and made huge advances in combatting HIV/AIDS and malaria. The Sustainable Development Goals are a bold commitment to finish what has been started. Coinciding with the historic Paris Agreement on climate change, the SDGs are the promise our young people are calling for, of sustainability, equality and wellbeing for all. The SDGs are also an important reminder that sustainable development is not just an issue for faraway places. Each and every one of us has both rights and obligations in this context. While some of the SDGs might feel distant from our daily lives, they encompass everything that makes life worthwhile, such as education, water, peace and equality, to name just a few. -

Doing Data Differently

General Company Overview Doing data differently V.14.9. Company Overview Helping the global financial community make informed decisions through the provision of fast, accurate, timely and affordable reference data services With more than 20 years of experience, we offer comprehensive and complete securities reference and pricing data for equities, fixed income and derivative instruments around the globe. Our customers can rely on our successful track record to efficiently deliver high quality data sets including: § Worldwide Corporate Actions § Worldwide Fixed Income § Security Reference File § Worldwide End-of-Day Prices Exchange Data International has recently expanded its data coverage to include economic data. Currently it has three products: § African Economic Data www.africadata.com § Economic Indicator Service (EIS) § Global Economic Data Our professional sales, support and data/research teams deliver the lowest cost of ownership whilst at the same time being the most responsive to client requests. As a result of our on-going commitment to providing cost effective and innovative data solutions, whilst at the same time ensuring the highest standards, we have been awarded the internationally recognized symbol of quality ISO 9001. Headquartered in United Kingdom, we have staff in Canada, India, Morocco, South Africa and United States. www.exchange-data.com 2 Company Overview Contents Reference Data ............................................................................................................................................ -

Over 100 Exchanges Worldwide 'Ring the Bell for Gender Equality in 2021' with Women in Etfs and Five Partner Organizations

OVER 100 EXCHANGES WORLDWIDE 'RING THE BELL FOR GENDER EQUALITY IN 2021’ WITH WOMEN IN ETFS AND FIVE PARTNER ORGANIZATIONS Wednesday March 3, 2021, London – For the seventh consecutive year, a global collaboration across over 100 exchanges around the world plan to hold a bell ringing event to celebrate International Women’s Day 2021 (8 March 2020). The events - which start on Monday 1 March, and will last for two weeks - are a partnership between IFC, Sustainable Stock Exchanges (SSE) Initiative, UN Global Compact, UN Women, the World Federation of Exchanges and Women in ETFs, The UN Women’s theme for International Women’s Day 2021 - “Women in leadership: Achieving an equal future in a COVID-19 world ” celebrates the tremendous efforts by women and girls around the world in shaping a more equal future and recovery from the COVID-19 pandemic. Women leaders and women’s organizations have demonstrated their skills, knowledge and networks to effectively lead in COVID-19 response and recovery efforts. Today there is more recognition than ever before that women bring different experiences, perspectives and skills to the table, and make irreplaceable contributions to decisions, policies and laws that work better for all. Women in ETFs leadership globally are united in the view that “There is a natural synergy for Women in ETFs to celebrate International Women’s Day with bell ringings. Gender equality is central to driving the global economy and the private sector has an important role to play. Our mission is to create opportunities for professional development and advancement of women by expanding connections among women and men in the financial industry.” The list of exchanges and organisations that have registered to hold an in person or virtual bell ringing event are shown on the following pages. -

Attachment (.Pdf)

November 7th, 2018 Press release on the earnings of Sýn hf. for the Third quarter of 2018: The merger starting to generate positive results with EBITDA increase of 21% The interim financial report for Sýn hf. for the third quarter of 2018, was approved by the company’s Board of Directors and CEO at a board meeting on November 7th 2018. In December 2017 the company purchased certain assets and operations of 365 Miðlar hf., and this influences the comparison between periods. • Revenue in the third quarter of 2018 amounted to ISK 5,449 million, an increase of 59% from the previous year. Income in the first nine months of the year increased by ISK 6,233 million, or 63%. • The quarter’s EBITDA amounted to ISK 1,032 million, an increase by ISK 178 million from previous year. EBITDA for the first nine months amounted to ISK 2,468 million, a 6% increase from previous year. • EBITDA adjusted for one off items in relation to the acquisition amounted to ISK 1,038 million, a 21% increase from the previous year. • Profit in the period amounted to ISK 226 million, a decrease of 22% from the previous year. Profit for the first nine months of the year amounted to ISK 278 million, a 62% decrease from previous year. • Profit per share was ISK 0.76 in Q3 and was ISK 0.94 for the first nine months of the year. • The quarter‘s investment activities amounted to ISK 516 million, an increase of 40% from the previous year due to integration projects. -

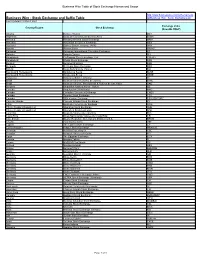

Stock Exchange and Suffix Table Ml/Business Wire Stock Exchanges.Pdf Last Updated 12 March 2021

Business Wire Table of Stock Exchange Names and Usage http://www.businesswire.com/schema/news Business Wire - Stock Exchange and Suffix Table ml/Business_Wire_Stock_Exchanges.pdf Last Updated 12 March 2021 Exchange Value Country/Region Stock Exchange (NewsML ONLY) Albania Bursa e Tiranës BET Argentina Bolsa de Comercio de Buenos Aires BCBA Armenia Nasdaq Armenia Stock Exchange ARM Australia Australian Securities Exchange ASX Australia Sydney Stock Exchange (APX) APX Austria Wiener Börse WBAG Bahamas Bahamas International Securities Exchange BS Bahrain Bahrain Bourse BH Bangladesh Chittagong Stock Exchange, Ltd. CSEBD Bangladesh Dhaka Stock Exchange DSE Belgium Euronext Brussels BSE Bermuda Bermuda Stock Exchange BSX Bolivia Bolsa Boliviana de Valores BO Bosnia and Herzegovina Banjalucka Berza BLSE Bosnia and Herzegovina Sarajevska Berza SASE Botswana Botswana Stock Exchange BT Brazil Bolsa de Valores do Rio de Janeiro BVRJ Brazil Bolsa de Valores, Mercadorias & Futuros de Sao Paulo SAO Bulgaria Balgarska fondova borsa - Sofiya BB Canada Aequitas NEO Exchange NEO Canada Canadian Securities Exchange CNSX Canada Toronto Stock Exchange TSX Canada TSX Venture Exchange TSX VENTURE Cayman Islands Cayman Islands Stock Exchange KY Chile Bolsa de Comercio de Santiago SGO China, People's Republic of Shanghai Stock Exchange SHH China, People's Republic of Shenzhen Stock Exchange SHZ Colombia Bolsa de Valores de Colombia BVC Costa Rica Bolsa Nacional de Valores de Costa Rica CR Cote d'Ivoire Bourse Regionale Des Valeurs Mobilieres S.A. BRVM Croatia -

Heimavellir Hf

Heimavellir hf. Consolidated Financial Statements 2018 *These Consolidated Financial Statements are translated from the original Icelandic version. Should there be discrepancies between the two versions, the Icelandic version will take priority over the translated version. Heimavellir hf. Lágmúli 6 108 Reykjavík Reg.no. 440315-1190 Table of Contents Page Endorsment and Statement by the Board of Directors and the CEO ....................................................................... 3 Intependent Auditor's Report ................................................................................................................................... 5 Consolidated Statement of Profit or Loss and Comprehensive Income .................................................................. 8 Consolidated Statement of Financial Position .......................................................................................................... 9 Consolidated Statement of Changes in Equity ......................................................................................................... 10 Consolidated Statement of Cash Flows ................................................................................................................... 11 Notes to the Consolidated Financial Statements ...................................................................................................... 12 Unaudited statements Quarterly statement ................................................................................................................................................. -

Economy of Iceland 2016

ECONOMY OF ICELAND Contents 5 Introduction 7 1 Country and people 13 2 Structure of the economy Boxes: The individual transferable quota system 20 Sectoral limitations on foreign direct investment 21 29 3 Financial system 39 4 Public sector Box: The tax system 44 Iceland's fiscal framework 49 53 5 Monetary and financial stability policies Box: New policy instrument to temper and affect the composition of capital inflows 57 59 6 External position 67 7 Government, corporate, and household balance sheets 75 8 Capital account liberalisation Box: Stability conditions and stability contributions 81 83 Appendix Published by: The Central Bank of Iceland, Kalkofnsvegur 1, 150 Reykjavík, Iceland Tel: (+354) 569 9600, fax: (+354) 569 9605 E-mail: [email protected] Website: www.sedlabanki.is Editorial Board and staff: Rannveig Sigurdardóttir, chairman Hördur Gardarsson Elís Pétursson Gerdur Ísberg Jónas Thórdarson Ragnheidur Jónsdóttir October 2016 Printing: ODDI ehf. Economy of Iceland is also published on the Central Bank of Iceland website. ISSN 1024-6680 Material may be reproduced from Economy of Iceland, but an acknowledgement of source is kindly requested. In Economy of Iceland, monetary figures are generally presented in euros; however, in certain instances, amounts are expressed in US dollars. The amount in Icelandic krónur is included in pa- rentheses, as most figures are originally in krónur. Stocks at the end of the period are calculated using the period-end exchange rate, whereas flows are calculated using the average exchange rate for the period. Icelandic letters: ð/Ð (pronounced like th in English this) þ/Þ (pronounced like th in English think) Symbols: * Preliminary or estimated data. -

2021 06 23 Solid Clouds Company Description Signed

This Company Description (hereafter referred to as the “Company Description”) has been prepared by Solid Clouds hf., reg. no. 600913-2550, address at Eiðistorg 17, 170 Seltjarnarnes, an Icelandic public limited company (hereafter referred to as the “Company”, “Solid Clouds” or the “Issuer”) in relation to a proposed listing of Solid Clouds’s shares (hereafter referred to as the “Shares”) on the Nasdaq First North Iceland market (hereafter referred to as “First North” or “First North Iceland”). In parallel with the issuance of this Company Description, the Company will launch a public offering (hereafter referred to as “the Offering”) whereby Arion Bank will act as the Manager of the Offering. The Offering will consist of (i) orderbook for subscriptions amounting to ISK 100,000 and up to ISK 15,000,000 and (ii) orderbook for subscriptions over the size of ISK 15,000,000. As the proceeds from the public offering is less than EUR 8,000,000, the Offering is exempt from issuing a prospectus in accordance with article 3 under the Act on Prospectus for Securities When Offered to the Public Offering and Admitted to Trading on a Regulated Market no. 14/2020 or Regulation (EU) 2017/1129 of the European Parliament and of the Council. The public offering is expected to close on 30 June 2021 and the shares subsequently admitted to trading on the First North Market. The Company Description has been drawn up under the responsibility of the Issuer, Solid Clouds, and it has been reviewed by Nasdaq Iceland. This Company Description does not constitute a prospectus under the Act on Prospectus for Securities When Offered to the Public Offering or Admitted to Trading on a Regulated Market no. -

The Problem with European Stock Markets

THE PROBLEM WITH EUROPEAN STOCK MARKETS Analysis of the fragmented stock exchange landscape in Europe, how it is holding back growth in capital markets – and what we can do about it March 2021 by William Wright & Eivind Friis Hamre SUMMARY It is not new news that Europe has a complex patchwork of equity markets, stock exchanges and post-trade infrastructure, but this short paper paints this problem in particularly stark terms. The genesis of this paper came from two simple thought experiments: first, can we draw a diagram of the structure of European equity markets on one page? And second, what would the US stock market look like if every state has its own stock exchange? If you read nothing else in this report, please look at the map of the US market on page three and the diagram of European equity markets on page six. Here is a quick summary of this paper: > The elephant in the room The complex patchwork of European equity markets is a huge obstacle to building bigger and better capital markets at a time when the European economy needs them more than ever. We can tinker at the edges with the detail of regulation, but so as long as Europe has 22 different stock exchange groups operating 35 different exchange for listings, 41 exchanges for trading, and nearly 40 different CCPs and CSDs, not much will change. > Punching below its weight The European equity market is less than half the size of the US but has three times as many exchange groups; more than 10 times as many exchanges for listings; more than twice as many exchanges for trading; and roughly 20 times as many post-trade infrastructure providers.