Federal Communications Commission FCC 02-193 Before the Federal

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Draft Copy « License Modernization «

Approved by OMB (Office of Management and Budget) | OMB Control Number 3060-0113 (REFERENCE COPY - Not for submission) Broadcast Equal Employment Opportunity Program Report FRN: 0002711737 File Number: 0000109231 Submit Date: 03/25/2020 Call Sign: WIKY-FM Facility ID: 61014 City: EVANSVILLE State: IN Service: Full Power FM Purpose: EEO Report Status: Received Status Date: 03/25/2020 Filing Status: Active General Section Question Response Information Application Description Description of the application (255 characters max.) is 2020 Evansville EU license visible only to you and is not part of the submitted renewal - EEO application. It will be displayed in your Applications workspace. Attachments Are attachments (other than associated schedules) being No filed with this application? Licensee Name, Type and Contact Information Licensee Information Applicant Applicant Address Phone Email Type MIDWEST COMMUNICATIONS, 904 GRAND AVE. +1 (715) 842- paul.rahmlow@mwcradio. Company INC. WAUSAU, WI 4137 com 54403 United States Contact Contact Name Address Phone Email Contact Type Representatives John Neely , Esq . Suite 203 +1 (301) 933-6304 [email protected] Legal Representative Miller and Neely PC 3750 University Blvd., west Kensington, MD 20895 United States Common Facility Identifier Call Sign City State Time Brokerage Agreement Stations 61014 WIKY-FM EVANSVILLE IN No 73350 WLYD CHANDLER IN No 61055 WABX EVANSVILLE IN No 51072 WSTO OWENSBORO KY No Program Report Section Question Response Questions Discrimination Complaints Have any pending -

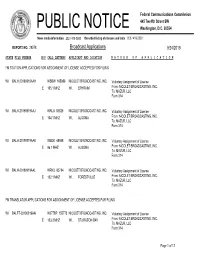

Broadcast Applications 9/24/2019

Federal Communications Commission 445 Twelfth Street SW PUBLIC NOTICE Washington, D.C. 20554 News media information 202 / 418-0500 Recorded listing of releases and texts 202 / 418-2222 REPORT NO. 29578 Broadcast Applications 9/24/2019 STATE FILE NUMBER E/P CALL LETTERS APPLICANT AND LOCATION N A T U R E O F A P P L I C A T I O N FM STATION APPLICATIONS FOR ASSIGNMENT OF LICENSE ACCEPTED FOR FILING WI BALH-20190919AAH WSBW 165986 NICOLET BROADCASTING, INC. Voluntary Assignment of License E 105.1 MHZ WI , EPHRAIM From: NICOLET BROADCASTING, INC. To: MAZUR, LLC Form 314 WI BALH-20190919AAJ WRLU 85829 NICOLET BROADCASTING, INC. Voluntary Assignment of License E 104.1 MHZ WI , ALGOMA From: NICOLET BROADCASTING, INC. To: MAZUR, LLC Form 314 WI BALH-20190919AAK WBDK 48848 NICOLET BROADCASTING, INC. Voluntary Assignment of License E 96.7 MHZ WI , ALGOMA From: NICOLET BROADCASTING, INC. To: MAZUR, LLC Form 314 WI BALH-20190919AAL WRKU 85794 NICOLET BROADCASTING, INC. Voluntary Assignment of License E 102.1 MHZ WI , FORESTVILLE From: NICOLET BROADCASTING, INC. To: MAZUR, LLC Form 314 FM TRANSLATOR APPLICATIONS FOR ASSIGNMENT OF LICENSE ACCEPTED FOR FILING WI BALFT-20190919AAI W277BP 155773 NICOLET BROADCASTING, INC. Voluntary Assignment of License E 103.3 MHZ WI , STURGEON BAY From: NICOLET BROADCASTING, INC. To: MAZUR, LLC Form 314 Page 1 of 12 Federal Communications Commission 445 Twelfth Street SW PUBLIC NOTICE Washington, D.C. 20554 News media information 202 / 418-0500 Recorded listing of releases and texts 202 / 418-2222 REPORT NO. 29578 Broadcast Applications 9/24/2019 STATE FILE NUMBER E/P CALL LETTERS APPLICANT AND LOCATION N A T U R E O F A P P L I C A T I O N FM TRANSLATOR APPLICATIONS FOR ASSIGNMENT OF LICENSE ACCEPTED FOR FILING GA BAL-20190919AAV W222AF 83640 IMMANUEL BROADCASTING Voluntary Assignment of License NETWORK, INC. -

Kimberly Area School District

Kimberly Area School District Pupil Transportation Handbook Lamers Bus Lines (920) 832-8800 Rev. 7/25/16 Kimberly Area School District Student Transportation Services and Policies The Kimberly Area School District complies with all state regulations concerning transportation of regular and special educational students. All transportation arrangements are made by the School District Transportation Director with approved carriers. This handbook is distributed to all students, parents, teachers, school bus drivers, and school administrators to be used as a quick reference on transportation rules and guidelines. Additional information is found in the District Transportation Manuals. ALL FAMILIES USING BUSING SERVICES MUST RETURN THE AGREEMENT ON THE LAST PAGE Eligibility for Transportation Services The Kimberly Area School District provides transportation for: 1. Students who reside more than two (2) miles from the school they are required to attend in their home attendance areas 2. Students who are placed in a special education program outside of their home attendance area, also for students who attend special education programs in their home attendance area if the IEP evaluation team deems transportation necessary for the safety of the child 3. Students whose paths to their schools are found to be unusually hazardous (the school district will follow Wisconsin statute 121.54(9) each time it receives a request for transportation in hazardous areas). School Closing and Cancellations School closings, cancellations and delays can be found on local radio and television stations between 6:00 and 7:00 am, or during the day if a situation develops after students arrive at school. Our emergency phone contact system will place an automated phone call to all student’s homes. -

School Closing/Early Dismissal/Late Start

SCHOOL CLOSING/EARLY DISMISSAL/LATE START INFORMATION Notifications: ● Emails: All parents & guardians will receive an email of a cancellation or delay, unless you have opted-out of Weather alerts ● Text Messages: If you want to receive a text message, click this link for information and how to sign-up ● Phone Calls: No phone calls will be made for school cancellations or delays due to weather. Automated phone calls will be made for emergency/weather related early dismissal. Below are other ways school cancellations and delays will be published: ● District website ● District Facebook and T witter page ● Local TV stations ● Local radio stations ● Local news websites If you want to modify your alert settings, here are the steps: ● Log into Skyward Family Access ● Click on Skylert – located on left-side ● Click Edit ● Add any alternative email addresses and/or phone numbers where you would like alerts sent ● Check the boxes for each corresponding categories for all of your email addresses and phone numbers ● Click Save The winter months often bring weather changes which impact student transportation. Listed below is information related to inclement weather. Many elementary students (Fairview, Hillcrest, Lannoye and Sunnyside) are picked up and dropped off by a bus that runs a middle school/high school route first. The second route bus may be running a bit behind schedule on days when the weather causes slower travel. Whenever roads require slow bus travel, please be aware that your children will be arriving home later than the usual time. It may be as much as a half-hour or more later. -

Linda Baun's Dedication Will Leave

SEPTEMBER/OCTOBER 2020 CHAIR’S COLUMN Prepare for election season Baun takes bow after 14 years at WBA We are now entering the election window. One very WBA Vice President Linda Baun will retire from the important heads up: You must upload everything organization in September after 14 years. to your Political File (orders, copy, audio or video) Baun joined the WBA in 2006 and led numerous WBA as soon as possible. As soon as possible is the catch events including the Broadcasters Clinic, the WBA phrase. Numerous broadcast companies, large and Awards for Excellence program and Awards Gala, the small, have signed off on Consent Decrees with the Student Seminar, the winter and summer confer- FCC for violating this phrase. What I have been told is, ences, and many other WBA events including count- get it in your Political File by the next day. less social events and broadcast training sessions. She Linda Baun Chris Bernier There are so many great examples of creative pro- coordinated the WBA’s EEO Assistance Action Plan, WBA Chair gramming and selling around the state. Many of you ran several committees, and handled administration are running the classic Packer games in place of the of the WBA office. normal preseason games. With high school football moved to the “Linda’s shoes will be impossible to fill,” said WBA President and CEO spring in Michigan our radio stations there will air archived games Michelle Vetterkind. “Linda earned a well-deserved reputation for from past successful seasons. This has been well received and we always going above and beyond what our members expected of her were able to hang on to billing for the fall. -

Unauthorized Practice of Law Committee

RHODE ISLAND SUPREME COURT i . UNAUTHORIZED PRACTICE OF LAW COMMITTEE IN RE: WILLIAM E. PAPLAUSKAS, JR. UPLC 2015-6 l A endix Vol. II Table 0f Contents i Exhibit 1 Complaint (dated August 5, 2015). Exhibit 2 Notice 0f Complaint t0 Respondent (dated February 29, 2016). Exhibit 3 Response to Complaint (filed on March 15, 2016). Exhibit 4 Notary Held Harmless form. Exhibit 5 Affidavit of Vincent Majewski. Exhibit 6 Affidavit of Rebecca Majewski. ‘ . Exhibit 7 Subpoena from Committee to JPMorgan Chase Bank. Exhibit 8 Subpoena from Committee to ServiceLink. Exhibit 9 Records produced by JPMorgan Chase Bank in response t0 subpoena. — “A11 Terms Met.” Exhibit 9, pg.13. - “Signature Verification Affidavit.” Exhibit 9, pg. 14. — “Signature Verification Page.” Exhibit 9, pg. 15. - “Borrower’s Identification Statement.” Exhibit 9, pg. 16. - “Errors and Omissions/Comvliance Agreement.” Exhibit 9, pg. 25. — “Mortgage.” Exhibit 9, pg. 47—73. 9/5/2618 8:51 AM . Exhibit 10 Records produced by ServiceLink in response to subpoena. - “Settlement Statement, HUD-l .” Exhibit 10, pg. 78—81. - “Truth in Lending Disclosure.” Exhibit 10, pg. 86—87. - “Note.” Exhibit 10, pg. 90-92. - “Uniform Residential Loan Application.” Exhibit 1 0, pg. 93-96. - “Request for Taxpayer Identification Number and Certification.” Exhibit 10, pg. 99. - “Request for Transcript of Tax Return.” Exhibit IO, pg. 104. - “Document Correction Agreement.” Exhibit 1 0, pg. 108. - “Lock—In Ageement.” Exhibit 10, pg. 109-1 10. - “Acknowledgement of Receipt of Appraisal/Evaluation.” Exhibit 1 0, pg. 11 1. - “Notice ofNonrefundabilitV of Loan Fees.” Exhibit 10, pg. 117. - “Mortgage Commitment Letter.” Exhibit 10, pg. -

Stations Monitored

Stations Monitored 10/01/2019 Format Call Letters Market Station Name Adult Contemporary WHBC-FM AKRON, OH MIX 94.1 Adult Contemporary WKDD-FM AKRON, OH 98.1 WKDD Adult Contemporary WRVE-FM ALBANY-SCHENECTADY-TROY, NY 99.5 THE RIVER Adult Contemporary WYJB-FM ALBANY-SCHENECTADY-TROY, NY B95.5 Adult Contemporary KDRF-FM ALBUQUERQUE, NM 103.3 eD FM Adult Contemporary KMGA-FM ALBUQUERQUE, NM 99.5 MAGIC FM Adult Contemporary KPEK-FM ALBUQUERQUE, NM 100.3 THE PEAK Adult Contemporary WLEV-FM ALLENTOWN-BETHLEHEM, PA 100.7 WLEV Adult Contemporary KMVN-FM ANCHORAGE, AK MOViN 105.7 Adult Contemporary KMXS-FM ANCHORAGE, AK MIX 103.1 Adult Contemporary WOXL-FS ASHEVILLE, NC MIX 96.5 Adult Contemporary WSB-FM ATLANTA, GA B98.5 Adult Contemporary WSTR-FM ATLANTA, GA STAR 94.1 Adult Contemporary WFPG-FM ATLANTIC CITY-CAPE MAY, NJ LITE ROCK 96.9 Adult Contemporary WSJO-FM ATLANTIC CITY-CAPE MAY, NJ SOJO 104.9 Adult Contemporary KAMX-FM AUSTIN, TX MIX 94.7 Adult Contemporary KBPA-FM AUSTIN, TX 103.5 BOB FM Adult Contemporary KKMJ-FM AUSTIN, TX MAJIC 95.5 Adult Contemporary WLIF-FM BALTIMORE, MD TODAY'S 101.9 Adult Contemporary WQSR-FM BALTIMORE, MD 102.7 JACK FM Adult Contemporary WWMX-FM BALTIMORE, MD MIX 106.5 Adult Contemporary KRVE-FM BATON ROUGE, LA 96.1 THE RIVER Adult Contemporary WMJY-FS BILOXI-GULFPORT-PASCAGOULA, MS MAGIC 93.7 Adult Contemporary WMJJ-FM BIRMINGHAM, AL MAGIC 96 Adult Contemporary KCIX-FM BOISE, ID MIX 106 Adult Contemporary KXLT-FM BOISE, ID LITE 107.9 Adult Contemporary WMJX-FM BOSTON, MA MAGIC 106.7 Adult Contemporary WWBX-FM -

Afterschool Closing Form

WSD Elementary Out-of-School Learning Programs Emergency Weather Cancellation Plan (PLEASE KEEP TOP HALF OF SHEET) Weather or mechanical breakdowns sometimes require early or emergency dismissal during the school day. District-wide emergency dismissals are announced on the television and radio stations listed below. This Emergency Weather Cancellation Plan addresses those times when there is not an early dismissal and the District has not cancelled all after-school programs, but weather conditions are worsening. Programs offered by the Out-of-school learning programs may announce cancellation of after-school programs (independent of a District decision) to assure safety of students, staff, and volunteers in its programs at the following schools: Hawthorn Hills, Lincoln, Stettin, Thomas Jefferson, Grant, GD Jones and Riverview. This decision will be announced by 1:00 PM on television and radio stations listed below and by phone and/or e-mail via School Messenger. (This may precede a District-wide decision.) If after-school programs must be cancelled, we would like to know that you have made plans for your child(ren). Please complete the form below and return it to your out-of-school Enrichment Coordinator. Discuss the plan with your child/children. It is difficult for students to telephone for instructions at these times, so we will keep a copy of your after-school plan on file. Please plan ahead to assure the safety of your child and inform us of any changes in this plan. It is the responsibility of parents to be attentive to cancellations and to act accordingly to your child’s plan in the event of a cancellation. -

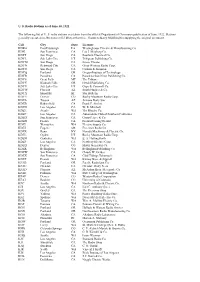

U. S. Radio Stations As of June 30, 1922 the Following List of U. S. Radio

U. S. Radio Stations as of June 30, 1922 The following list of U. S. radio stations was taken from the official Department of Commerce publication of June, 1922. Stations generally operated on 360 meters (833 kHz) at this time. Thanks to Barry Mishkind for supplying the original document. Call City State Licensee KDKA East Pittsburgh PA Westinghouse Electric & Manufacturing Co. KDN San Francisco CA Leo J. Meyberg Co. KDPT San Diego CA Southern Electrical Co. KDYL Salt Lake City UT Telegram Publishing Co. KDYM San Diego CA Savoy Theater KDYN Redwood City CA Great Western Radio Corp. KDYO San Diego CA Carlson & Simpson KDYQ Portland OR Oregon Institute of Technology KDYR Pasadena CA Pasadena Star-News Publishing Co. KDYS Great Falls MT The Tribune KDYU Klamath Falls OR Herald Publishing Co. KDYV Salt Lake City UT Cope & Cornwell Co. KDYW Phoenix AZ Smith Hughes & Co. KDYX Honolulu HI Star Bulletin KDYY Denver CO Rocky Mountain Radio Corp. KDZA Tucson AZ Arizona Daily Star KDZB Bakersfield CA Frank E. Siefert KDZD Los Angeles CA W. R. Mitchell KDZE Seattle WA The Rhodes Co. KDZF Los Angeles CA Automobile Club of Southern California KDZG San Francisco CA Cyrus Peirce & Co. KDZH Fresno CA Fresno Evening Herald KDZI Wenatchee WA Electric Supply Co. KDZJ Eugene OR Excelsior Radio Co. KDZK Reno NV Nevada Machinery & Electric Co. KDZL Ogden UT Rocky Mountain Radio Corp. KDZM Centralia WA E. A. Hollingworth KDZP Los Angeles CA Newbery Electric Corp. KDZQ Denver CO Motor Generator Co. KDZR Bellingham WA Bellingham Publishing Co. KDZW San Francisco CA Claude W. -

2014 Winners

Social and Digital Media Award Winners & Television Award Winners All Markets Large Market Television BEST WEBSITE FOCUSED ON JOURNALISM BEST SPOT NEWS 1st Place: WI Public Radio, WPR.ORG 1st Place: WITI TV, Police Officer Not Charged in Shooting 2nd Place: WUWM FM, WUWM.COM 2nd Place: WISN TV, Freeway Shutdown 3rd Place: WISC TV, Channel3000.com 3rd Place: WISN TV, Hamilton Decision BEST NON-NEWS WEBSITE (MUSIC & ENTERTAINMENT) BEST MORNING NEWSCAST 1st Place: WYMS FM, 88Nine Radio Milwaukee 1st Place: WISN TV, Miller Park Fire & Train Derailment Website 2nd Place: WTMJ TV, Verona Tornado Coverage 2nd Place: WOZZ FM, Rock 94.7 3rd Place: WITI TV, Fox6 Wakeup ‐ November 5 3rd Place: WKZG FM, www.myKZradio.com BEST EVENING NEWSCAST BEST NICHE WEBSITE 1st Place: WITI TV, FOX6 News at 5:00 ‐ December 22 1st Place: WUWM FM, WUWM "More than My Record" 2nd Place: WITI TV, FOX6 News at 9:00 ‐ June 26 2nd Place: WISC TV, Community Websites 3rd Place: WISN TV, Summer Storms 3rd Place: WYMS FM, 88Nine Radio Milwaukee BEST NEWS WRITING Voting Guide 1st Place: WITI TV, “Santa Bob” BEST SPECIAL WEB PROJECT 2nd Place: WISN TV, Potter Adoption 1st Place: WYMS FM, Field Report Interactive 3rd Place: WTMJ TV, The Ice Bucket Reality Timeline for Field Report Day BEST HARD NEWS/INVESTIGATIVE 2nd Place: WBAY TV, Flying with the Thunderbirds 1st Place: WTMJ TV, I‐Team: Cause for Alarm 3rd Place: WISC TV, Election Night Map 2nd Place: WTMJ TV, I‐Team: DPW on the Clock BEST USE OF USER-GENERATED CONTENT 3rd Place: WYTU TV, Suicidio: Decisión de vida o muerte -

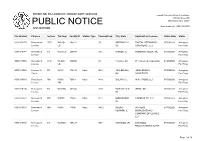

Public Notice >> Licensing and Management System Admin >>

REPORT NO. PN-1-200803-01 | PUBLISH DATE: 08/03/2020 Federal Communications Commission 445 12th Street SW PUBLIC NOTICE Washington, D.C. 20554 News media info. (202) 418-0500 APPLICATIONS File Number Purpose Service Call Sign Facility ID Station Type Channel/Freq. City, State Applicant or Licensee Status Date Status 0000119275 Renewal of LPD WNGS- 190222 33 GREENVILLE, DIGITAL NETWORKS- 07/30/2020 Accepted License LD SC SOUTHEAST, LLC For Filing 0000119148 Renewal of FX W253CR 200584 98.5 MARION, IL FISHBACK MEDIA, INC. 07/30/2020 Accepted License For Filing 0000118904 Renewal of LPD WLDW- 182006 23 Florence, SC DTV America Corporation 07/29/2020 Accepted License LD For Filing 0000119388 License To FS KLRC 174140 Main 90.9 TAHLEQUAH, JOHN BROWN 07/30/2020 Accepted Cover OK UNIVERSITY For Filing 0000119069 Renewal of FM WISH- 70601 Main 98.9 GALATIA, IL WISH RADIO, LLC 07/30/2020 Accepted License FM For Filing 0000119104 Renewal of FX W230BU 142640 93.9 ROTHSCHILD, WRIG, INC. 07/30/2020 Accepted License WI For Filing 0000119231 Renewal of FM WXXM 17383 Main 92.1 SUN PRAIRIE, CAPSTAR TX, LLC 07/30/2020 Accepted License WI For Filing 0000119070 Renewal of AM WMIX 73096 Main 940.0 MOUNT WITHERS 07/30/2020 Accepted License VERNON, IL BROADCASTING For Filing COMPANY OF ILLINOIS, LLC 0000119330 Renewal of FX W259BC 155147 99.7 BARABOO, WI BARABOO 07/30/2020 Accepted License BROADCASTING CORP. For Filing Page 1 of 29 REPORT NO. PN-1-200803-01 | PUBLISH DATE: 08/03/2020 Federal Communications Commission 445 12th Street SW PUBLIC NOTICE Washington, D.C. -

2015 CITGO Advertising Campaign Media Schedule

2015 CITGO Advertising Campaign Media Schedule We’re revved up about this year’s brand advertising campaign! It’s all about TriCLEAN® gasoline—our quality gasoline with its own to-do list of helping to keep intake valves and fuel injectors clean, and emissions to a minimum. And, our clever advertising will show consumers how it works continuously, just like they do! We’re also gearing up online and via social media for the 3rd annual Fueling Education promotion this summer as well as an Ultimate Road Trip giveaway in the fall where your customers have the chance to win a Jeep®! With this much good going on, they won’t be able to resist fueling up—and fueling good—at your neighborhood CITGO locations! National Media Nationally, our TriCLEAN campaign will be seen on the MLB Network and all team websites. On top of that, we’ll also engage consumers with Fueling Good Road Trip and similar content through social media channels sites like Facebook, Twitter, Instagram and YouTube. JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC MLB Network, Online, Radio, Movie TriCLEAN Campaign Theater, Outdoor, Social Media Radio, Social Ultimate Road Trip Promotion Media Online and Fueling Education Promotion Social Media Public Relations Press Release and Event Support Local Media: Green Bay / Appleton, WI The following high-impact media schedule has been placed in your market: Outdoor • Campaign: TriCLEAN Gasoline • Flight Dates: 6/15/15 to 8/9/15 • Target Audience: Adults 18-49 • Total Boards/Month: 13 Boards / Month CONNECT WITH US: @Fueling_Good #FGRT