JLBC Tax Handbook, 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

REPLACING CORPORATE TAX REVENUES with a MARK to MARKET TAX on SHAREHOLDER INCOME Eric Toder and Alan D

REPLACING CORPORATE TAX REVENUES WITH A MARK TO MARKET TAX ON SHAREHOLDER INCOME Eric Toder and Alan D. Viard October 2016 ABSTRACT We propose reducing the corporate tax rate to 15 percent and replacing the foregone revenue with a tax at ordinary income rates on the accrued, or mark-to-market income of American shareholders of publicly traded corporations, accompanied by an imputation credit for U.S. corporate income taxes paid. The proposal would dramatically reduce the tax significance of the source of corporate profits and the residence of corporations, both of which can be easily manipulated. Lowering the corporate tax rate to 15 percent would encouraging a capital inflow to the United States and reduce incentives to shift reported profits overseas and engage in inversion transactions while continuing to impose tax on foreigners who earn economic rents from investing in the United States. The proposal includes provisions for averaging of mark-to- market income, transition relief for firms that move from closely held to publicly traded status, and other measures to address the challenges of mark-to-market taxation. We estimate that the proposal would be approximately revenue-neutral and would make the distribution of the tax burden slightly more progressive. A revised version of the article was been published in the September 2016 issue of the National Tax Journal, Volume 69 (3), 701-731. The findings and conclusions contained within are those of the author and do not necessarily reflect positions or policies of the Tax Policy Center or its funders. I. INTRODUCTION This paper presents a proposal for reform of the taxation of corporate income. -

A Study and Comparison of the Consumption Basis of Taxation

W&M ScholarWorks Dissertations, Theses, and Masters Projects Theses, Dissertations, & Master Projects 1964 A Study and Comparison of the Consumption Basis of Taxation Douglas Wayne Blevins College of William & Mary - Arts & Sciences Follow this and additional works at: https://scholarworks.wm.edu/etd Part of the Finance Commons Recommended Citation Blevins, Douglas Wayne, "A Study and Comparison of the Consumption Basis of Taxation" (1964). Dissertations, Theses, and Masters Projects. Paper 1539624554. https://dx.doi.org/doi:10.21220/s2-n8af-t738 This Thesis is brought to you for free and open access by the Theses, Dissertations, & Master Projects at W&M ScholarWorks. It has been accepted for inclusion in Dissertations, Theses, and Masters Projects by an authorized administrator of W&M ScholarWorks. For more information, please contact [email protected]. A STUDY AND COMPARISON OF THE CONSUMPTION BASIS OF TAXATION 1 FOREWORD This treatise is a study and comparison ©f the three measures of economic well-being and their use as bases far financing govern ment. Particular emphasis is given to the study ©f the consumption basis ef taxation. Submitted in compliance with the requirements for the Master ef Arts degree in Taxation. Douglas W. Blevins 2 TABLE OF CONTENTS Foreword Part I. Introduction. A. Sources of Revenue. B. Principles ef taxation. 1. Canons ef Adam Smith. 2* Characteristics ef tax systems. % Economic effects. 4. E quity. 5. Compliance. 6. Shifting and incidence. Part II. Measures ef Economic Well-Being. A. Current income as a measure. 1. Income. 2. Definition ef income. a. The economic definition. b. The tax definition. -

Historical Tax Law Changes Luxury Tax on Liquor

Historical Tax Law Changes Luxury Tax on Liquor Laws 1933, 1st Special Session, Chapter 18 levied the first Arizona state Luxury Tax on Liquor. The tax rates established by this law are shown below: 10¢ on each 16 ounces, or fractional part thereof, for malt extracts 10¢ on each container of spirituous liquor containing 16 ounces or less 10¢ on each 16 ounces of spirituous liquor in containers of more than 16 ounces 3¢ on each container of vinous liquor containing 16 ounces or less 3¢ on each 16 ounces of vinous liquor in containers of more than 16 ounces 5¢ on each gallon of malt liquor The tax was paid by the purchase of stamps affixed to each container of liquor and malt extract and canceled prior to sale. Taxes were payable to the State Tax Commission, prior to or at the time of the sale of the product. Of the total receipts collected, 96% was dedicated to the Board of Public Welfare and the remaining 4% was appropriated for the use of the State Tax Commission. The tax was a temporary tax and expired on March 1, 1935. (Effective June 28, 1933) Laws 1935, Chapter 14 extended the provisions of Laws 1933, 1st Special Session, Chapter 18 to May 1, 1935. (Effective February 20, 1935) Laws 1935, Chapter 78 permanently enacted the provisions of Laws 1933, 1st Special Session, Chapter 18, with respect to the Luxury tax on Liquor. The tax rates levied on containers of spirituous liquor and vinous liquor were replaced with the rates shown below: 5¢ on each container of spirituous liquor containing 8 ounces or less 5¢ on each 8 ounces of spirituous -

The Financial Secrecy Index: Shedding New Light on the Geography of Secrecy

The Financial Secrecy Index: Shedding New Light on the Geography of Secrecy Alex Cobham, Petr Janský, and Markus Meinzer Abstract Both academic research and public policy debate around tax havens and offshore finance typically suffer from a lack of definitional consistency. Unsurprisingly then, there is little agreement about which jurisdictions ought to be considered as tax havens—or which policy measures would result in their not being so considered. In this article we explore and make operational an alternative concept, that of a secrecy jurisdiction and present the findings of the resulting Financial Secrecy Index (FSI). The FSI ranks countries and jurisdictions according to their contribution to opacity in global financial flows, revealing a quite different geography of financial secrecy from the image of small island tax havens that may still dominate popular perceptions and some of the literature on offshore finance. Some major (secrecy-supplying) economies now come into focus. Instead of a binary division between tax havens and others, the results show a secrecy spectrum, on which all jurisdictions can be situated, and that adjustment lfor the scale of business is necessary in order to compare impact propensity. This approach has the potential to support more precise and granular research findings and policy recommendations. JEL Codes: F36, F65 Working Paper 404 www.cgdev.org May 2015 The Financial Secrecy Index: Shedding New Light on the Geography of Secrecy Alex Cobham Tax Justice Network Petr Janský Institute of Economic Studies, Faculty of Social Sciences, Charles University in Prague Markus Meinzer Tax Justice Network A version of this paper is published in Economic Geography (July 2015). -

ACEA Tax Guide 2018.Pdf

2018 WWW.ACEA.BE Foreword The 2018 edition of the European Automobile Manufacturers’ Association’s annual Tax Guide provides an overview of specific taxes that are levied on motor vehicles in European countries, as well as in other key markets around the world. This comprehensive guide counts more than 300 pages, making it an indispensable tool for anyone interested in the European automotive industry and relevant policies. The 2018 Tax Guide contains all the latest information about taxes on vehicle acquisition (VAT, sales tax, registration tax), taxes on vehicle ownership (annual circulation tax, road tax) and taxes on motoring (fuel tax). Besides the 28 member states of the European Union, as well as the EFTA countries (Iceland, Norway and Switzerland), this Tax Guide also covers countries such as Brazil, China, India, Japan, Russia, South Korea, Turkey and the United States. The Tax Guide is compiled with the help of the national associations of motor vehicle manufacturers in all these countries. I would like to extend our sincere gratitude to all involved for making the latest information available for this publication. Erik Jonnaert ACEA Secretary General Copyright Reproduction of the content of this document is not permitted without the prior written consent of ACEA. Whenever reproduction is permitted, ACEA shall be referred to as source of the information. Summary EU member countries 5 EFTA 245 Other countries 254 EU member states EU summary tables 5 Austria 10 Belgium 19 Bulgaria 42 Croatia 48 Cyprus 52 Czech Republic 55 Denmark 65 Estonia 79 Finland 82 France 88 Germany 100 Greece 108 Hungary 119 Ireland 125 Italy 137 Latvia 148 Lithuania 154 Luxembourg 158 Malta 168 Netherlands 171 Poland 179 Portugal 184 Romania 194 Slovakia 198 Slovenia 211 Spain 215 Sweden 224 United Kingdom 234 01 EU summary tables Chapter prepared by Francesca Piazza [email protected] ACEA European Automobile Manufacturers’ Association Avenue des Nerviens 85 B — 1040 Brussels T. -

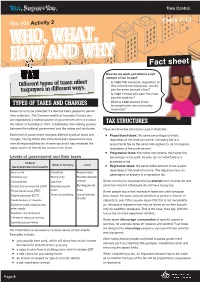

WHO, WHAT, HOW and WHY Fact Sheet

Ta x , Super+You. Take Control. Years 7-12 Tax 101 Activity 2 WHO, WHAT, HOW AND WHY Fact sheet How do we work out what is a fair amount of tax to pay? • Is it fair that everyone, regardless of Different types of taxes affect their income and expenses, should taxpayers in different ways. pay the same amount of tax? • Is it fair if those who earn the most pay the most tax? • What is a fair amount of tax TYPES OF TAXES AND CHARGES for people who use community resources? Taxes can only be collected if a law has been passed to permit their collection. The Commonwealth of Australia Constitution Act established a federal system of government when it created TAX STRUCTURES the nation of Australia in 1901. It distributes law-making powers between the national government and the states and territories. There are three tax structures used in Australia: Each level of government imposes different types of taxes and Proportional taxes: the same percentage is levied, charges. During World War II the Australian Government took regardless of the level of income. Company tax is a over all responsibilities for income tax and it has remained the proportional tax as the same rate applies for all companies, major source of federal tax revenue ever since. regardless of the profit earned. Progressive taxes: the higher the income, the higher the Levels of government and their taxes percentage of tax paid. Income tax for individuals is a Federal progressive tax. State or territory Local (Australian/Commonwealth) Regressive taxes: the same dollar amount of tax is paid, regardless of the level of income. -

Investors' Reaction to a Reform of Corporate Income Taxation

Investors' Reaction to a Reform of Corporate Income Taxation Dennis Voeller z (University of Mannheim) Jens M¨uller z (University of Graz) Draft: November 2011 Abstract: This paper investigates the stock market response to the corporate tax reform in Germany of 2008. The reform included a decrease in the statutary corporate income tax rate from 25% to 15% and a considerable reduction of interest taxation at the shareholder level. As a result, it provided for a higher tax benefit of debt. As it comprises changes in corporate taxation as well as the introduction of a final withholding tax on capital income, the German tax reform act of 2008 allows for a joint consideration of investors' reactions on both changes in corporate and personal income taxes. Analyzing company returns around fifteen events in 2006 and 2007 which mark important steps in the legislatory process preceding the passage of the reform, the study provides evidence on whether investors expect a reduction in their respective tax burden. Especially, it considers differences in investors' reactions depending on the financial structure of a company. While no significant average market reactions can be observed, the results suggest positive price reactions of highly levered companies. Keywords: Tax Reform, Corporate Income Tax, Stock Market Reaction JEL Classification: G30, G32, H25, H32 z University of Mannheim, Schloss Ostfl¨ugel,D-68161 Mannheim, Germany, [email protected]. z University of Graz, Universit¨atsstraße15, A-8010 Graz, Austria, [email protected]. 1 Introduction Previous literature provides evidence that companies adjust their capital structure as a response to changes in the tax treatment of different sources of finance. -

Excise Duties in Finland in a Historical Perspective

Excise Duties in Finland in a Historical Perspective Leila Juanto 1 Excise Duties as Consumption Taxes In Finland, “excise duties” denote a certain, distinct group of consumption taxes. However, the term is not defined unambiguously in the literature, and problems abound when one begins looking for equivalents in the history of taxation in Finland or in the tax systems of other countries. As used today, the term nevertheless refers quite consistently to taxes that are levied on the basis of particular legislation and, in principle, explicitly called excise taxes in that legislation. In this perspective - the formal concept of excise duties - the excise duties in Finland comprise the excise duty on manufactured tobacco, the excise duty on alcohol and alcoholic beverages, the excise duty on electricity and certain energy sources, and the excise duty on soft drinks. One thing serving to clarify the concept of excise duty in the European Union, of which Finland is a member, is that excise duties fall into the category known as harmonized taxes. Clearly, EC Directives profoundly influence the content of the excise duties levied on certain products. As excise duties are part of the system of consumption taxation, it is appropriate to discuss their distinctive features and the ways in which they differ from the other taxes in that category. Here, the salient concept to consider is that of a material excise duty; in other words, taxes that share distinctive features can be classified as belonging to the same group. Consumption taxes are taxes levied on the consumption of goods and services; the taxes can be subdivided into general and selective consumption taxes according to how extensive the group of commodities is to which the tax applies.1 In terms of this classification, excise duties are selective taxes, the tax 1 Here, there is no reason to consider the occasional question whether the taxes on commodities used in entrepreneurial activity fall into the category of consumption taxes or whether such taxes are merely taxes on consumption by private households. -

Drawing the Line Between Takings and Taxation: the Continuous Burdens Principle, and Its Broader Application

Drawing the Line Between Takings and Taxation: The Continuous Burdens Principle, and Its Broader Application Eric Kades† Professor, William & Mary Law School (757) 221-3828 [email protected] CONTENTS I. Introduction ..................................................1 II. Existing Commentary on Distinguishing Taxes and Takings .........3 A. A Simple Solution: Taxation’s General Liabilities Versus Taking’s Specific Assets ............................................4 B. More Nuanced Classical Views ..............................9 C. The Policy Goals of Takings Favor the Classical View ..........17 III. The Primary Battle Ground to Date: Legality of Progressive Taxation ...........................................................19 A. History & Positive Legal Doctrine ...........................20 B. Normative Considerations of Progressive Income Taxation ........................................................25 IV. The Continuous Burdens Principle (CBP) ........................34 A. The Continuous Burdens Principle ..........................35 B. The Continuous Marginal Burdens Principle & Current Takings Doctrine ................................................56 C. Normative Foundations for the CBP .........................59 V. Fees, Special Assessments, & Specific Taxes ......................65 VI. Packaging & Logrolling .......................................69 VII. Conclusion .................................................74 †Thanks to Lynda Butler, Bob Ellickson, Jim Krier, Glynn Lunney, Tom Merrill, Ron Rosenberg, Cynthia Ward, and -

Luxury Tax: to Be Or Not to Be? to What Extent Will Nigeria Benefit from the Proposed Luxury Tax?

Luxury Tax: To be or not to be? To what extent will Nigeria benefit from the proposed luxury tax? Introducing luxury tax on certain items would increase the cost of those goods or services; therefore, more individuals may opt to make purchase at cheaper prices from the black market. An increased patronage of the black market is especially problematic because when taxable persons begin to operate in the informal market, the tax base is eroded. By: Bitrus Baba Introduction In recent times, the Nigerian Government has been showing interest in this form of taxation as Whether it seems timely or a little too late, a response to the declining revenues from oil Nigeria seems to be keen on measures to make and to deal with social imbalance. In November the “rich” pay more and therefore address 2014, the past administration announced plans redistribution of wealth through taxation of to introduce luxury taxes in the form of luxury items. surcharges on items such as private jets, luxury yachts, luxury cars, business class/first class tickets on airlines etc. The plan at the time Generally, luxury tax is a tax on luxury goods included the following: and services i.e. goods and services that are not essential and consumed by only a niche. It could be implemented through a sales tax system, 10% import surcharge on new private jets; value added tax system, or customs duty system 39% import surcharge on luxury yachts; of taxation. It typically affects the wealthy as 5% import surcharge on luxury cars; opposed to the vast majority of the populace undisclosed surcharge on business and first because the wealthy are the most likely to class plane tickets; purchase luxury items. -

The Character and Determinants of Corporate Capital Gains

The Character and Determinants of Corporate Capital Gains Mihir A. Desai Harvard University and National Bureau of Economic Research William M. Gentry Williams College and National Bureau of Economic Research November 2003 This paper was prepared for the Tax Policy and the Economy Conference in November 2003 in Washington DC. We thank John Graham, Jim Hines and Jim Poterba for helpful comments and Sean Lubens for helpful research assistance. Desai thanks the Division of Research of Harvard Business School for generous funding. The Character and Determinants of Corporate Capital Gains ABSTRACT This paper analyzes how corporate capital gains taxes affect the capital gain realization decisions of firms. The paper outlines the tax treatment of corporate capital gains, the consequent incentives for firms with gains and losses, the efficiency consequences of these taxes in the context of other taxes and capital market distortions, and the response of firms to these incentives. Despite receiving limited attention, corporate capital gain realizations have averaged 30 percent of individual capital gain realizations over the last fifty years and have increased dramatically in importance over the last decade. By 1999, the ratio of net long-term capital gains to income subject to tax was 21 percent and was distributed across a variety of industries suggesting the importance of realization behavior to corporate financing decisions. Time-series analysis of aggregate realization behavior demonstrates that corporate capital gains taxes impact realization behavior significantly. Similarly, an analysis of firm-level investment and property, plant, and equipment (PPE) disposal decisions and gain recognition behavior similarly suggests an important role for these taxes in determining when firms raise money by disposing of assets and realizing gains. -

UBS Financial Services Inc

Ratings: Moody’s: “Aa1” Standard & Poor’s: “AAA” Fitch: “AAA” (See “RATINGS” herein) OFFICIAL STATEMENT Dated: April 19, 2011 NEW ISSUE: BOOK-ENTRY-ONLY In the opinion of Bond Counsel, interest on the Bonds is excludable from gross income for purposes of federal income taxation under existing law, subject to the matters described under “TAX MATTERS-Tax Exemption” herein, including the alternative minimum tax on corporations. $15,000,000 CITY OF CARROLLTON, TEXAS (Dallas, Denton and Collin Counties) GENERAL OBLIGATION IMPROVEMENT BONDS, SERIES 2011 Dated: April 15, 2011 Due: August 15, as shown below Interest on the $15,000,000 City of Carrollton, Texas, General Obligation Improvement Bonds, Series 2011 (the “Bonds”), will be payable August 15 and February 15 of each year, commencing August 15, 2011 until maturity or prior redemption. The Bonds will be issued only in fully registered form in any integral multiple of $5,000 of principal amount, for any one maturity. Principal of the Bonds will be payable to the registered owner at maturity or prior redemption upon their presentation and surrender to the Paying Agent/Registrar (the “Paying Agent/Registrar”), initially U.S. Bank N.A.. Interest on the Bonds will be payable, by check, dated as of the interest payment date, and mailed first class, postage prepaid, by the Paying Agent/Registrar to the registered owners as shown on the records of the Paying Agent/Registrar on the Record Date (see “Record Date for Interest Payment” herein), or by such other method, acceptable to the Paying Agent/Registrar, requested by, and at the risk and expense of, the registered owner.