Company Update

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

![COMPANY NOTE Canvest Environmental Protection Group Company [1381.HK; HK$4.09; NOT RATED] – More Growth on the Way](https://docslib.b-cdn.net/cover/1758/company-note-canvest-environmental-protection-group-company-1381-hk-hk-4-09-not-rated-more-growth-on-the-way-281758.webp)

COMPANY NOTE Canvest Environmental Protection Group Company [1381.HK; HK$4.09; NOT RATED] – More Growth on the Way

June 14, 2017 COMPANY NOTE Canvest Environmental Protection Group Company [1381.HK; HK$4.09; NOT RATED] – More growth on the way Analyst: Kelly Zou ([email protected]; Tel: (852) 3698 6319) Event: We visited Canvest Environmental Protection Group Company Canvest Environmental Protection Group Company (Canvest) on 13 June and had a discussion with mgmt regarding its latest business updates. Canvest is the 2nd largest waste-to-energy (WTE) provider 5.00 300 in Guangdong and the 11th largest in China in terms of daily municipal solid 4.50 250 waste (MSW) processing capacity. The Company enjoys competitive 4.00 200 advantages in Guangdong in terms of its established track record and WTE 3.50 150 technology. It is also seeking opportunities to expand into other regional markets in China. The latest company movements for its business expansion 3.00 100 in 1H17 include: 1) the further strengthening of its relationship with local 2.50 50 governments in Guangdong Province via entering into a strategic cooperation 2.00 0 agreements with BOC&UTRUST Private Equity Fund Management Jul-16 Apr-16 Oct-16 Apr-17 Jan-16 Jun-16 Jan-17 Jun-17 Mar-16 Mar-17 Feb-16 Feb-17 Aug-16 Sep-16 Nov-16 Dec-16 May-17 (BOC&UTRUST) and Guangdong Finance Investment International, which May-16 has a business association with the People’s Government of Guangdong Turnover(HK$m, rhs) Price(HK$) Province; and 2) the issuance of 300m new shares to an indirect wholly owned subsidiary of Shanghai Industrial Holdings Limited (SIHL) in Q1. -

First Fossil Cobitid (Teleostei: Cypriniformes)

第53卷 第4期 古 脊 椎 动 物 学 报 pp. 299-309 2015年10月 VERTEBRATA PALASIATICA figs. 1-3 First fossil cobitid (Teleostei: Cypriniformes) from Early- Middle Oligocene deposits of South China CHEN Geng-Jiao1,2 LIAO Wei1 LEI Xue-Qiang1 (1 Natural History Museum of Guangxi Zhuang Autonomous Region Nanning 530012 [email protected]) (2 State Key Laboratory of Palaeobiology and Stratigraphy (Nanjing Institute of Geology and Palaeontology, Chinese Academy of Sciences) Nanjing 210008) Abstract †Cobitis nanningensis sp. nov., the earliest fossil cobitid fish from Early-Middle Oligocene deposits of Nanning Basin, Guangxi Zhuang Autonomous Region, southern China, is described here. The new species is represented by specimens of the distinctive suborbital spine. The bifid suborbital spines are 1.8−3.0 mm in length. Their laterocaudal processes are thinner and shorter than their mediocaudal processes, and the lengths of the laterocaudal processes are about 1/3 of those of the mediocaudal ones. The lateral process of the spine is prominent. The new species most closely resembles †Cobitis primigenus from the Late Oligocene deposits of Germany, but in †C. nanningensis the lateral process of the suborbital spine is more developed. The discovery of the new species and other previously known fossils of Cobitis indicate that the Cobitidae family has had a wide distribution in Eurasia since at least Oligocene. Key words Nanning Basin, Guangxi; Early-Middle Oligocene; Cypriniformes, Cobitidae, suborbital spine Nanning Basin is a Paleogene inland faulted basin situated in the southern part of Guangxi Zhuang Autonomous Region, South China. Since the first investigation by Zhu Tinghu in 1920s in this basin, many Eocene and Oligocene fossils of invertebrates (e.g. -

An Overview of the Red Imported Fire Ant (Hymenoptera: Formicidae) in Mainland China

Zhang et al.: Imported Fire Ants in Mainland China 723 AN OVERVIEW OF THE RED IMPORTED FIRE ANT (HYMENOPTERA: FORMICIDAE) IN MAINLAND CHINA RUNZHI ZHANG1,2, YINGCHAO LI1, NING LIU1 AND SANFORD D. PORTER3 1State Key Laboratory of Integrated Management of Pest Insects and Rodents, Institute of Zoology, Chinese Academy of Sciences, Beijing 100101, China 2E-mail: [email protected] 3USDA-ARS, Center for Medical, Agricultural and Veterinary Entomology, 1600 SW 23rd Drive, Gainesville, FL 32608 ABSTRACT The red imported fire ant, Solenopsis invicta Buren is a serious invasive insect that is native to South America. Its presence was officially announced in mainland China in Jan 2005. To date, it has been identified in 4 provinces in mainland China (Guangdong, Guangxi, Hunan, Fujian) in a total of 31 municipal districts. The total area reported to be infested by S. invicta in late 2006 was about 7,120 ha, mainly in Guangdong Province (6,332 ha). Most of the re- ported human stings are in the heavily infested area around Wuchuan City. The most com- monly reported reactions have been abnormal redness of the skin, sterile pustules, hives, pain, and/or fever. It has been predicted that most of mainland China is viable habitat for red imported fire ants, including 25 of 31 provinces. The probable northern limit of expan- sion reaches Shandong, Tianjing, south Henan, and Shanxi provinces. Traditional and new insecticides including the bait N-butyl perfluorooctane sulfonamide and the contact insecti- cide Yichaoqing have been developed and used to control S. invicta. The Ministry of Agricul- ture and the Chinese government have established an 8-year eradication program (2006 to 2013) for S. -

Anisotropic Patterns of Liver Cancer Prevalence in Guangxi in Southwest China: Is Local Climate a Contributing Factor?

DOI:http://dx.doi.org/10.7314/APJCP.2015.16.8.3579 Anisotropic Patterns of Liver Cancer Prevalence in Guangxi in Southwest China: Is Local Climate a Contributing Factor? RESEARCH ARTICLE Anisotropic Patterns of Liver Cancer Prevalence in Guangxi in Southwest China: Is Local Climate a Contributing Factor? Wei Deng1&, Long Long2&*, Xian-Yan Tang3, Tian-Ren Huang1, Ji-Lin Li1, Min- Hua Rong1, Ke-Zhi Li1, Hai-Zhou Liu1 Abstract Geographic information system (GIS) technology has useful applications for epidemiology, enabling the detection of spatial patterns of disease dispersion and locating geographic areas at increased risk. In this study, we applied GIS technology to characterize the spatial pattern of mortality due to liver cancer in the autonomous region of Guangxi Zhuang in southwest China. A database with liver cancer mortality data for 1971-1973, 1990-1992, and 2004-2005, including geographic locations and climate conditions, was constructed, and the appropriate associations were investigated. It was found that the regions with the highest mortality rates were central Guangxi with Guigang City at the center, and southwest Guangxi centered in Fusui County. Regions with the lowest mortality rates were eastern Guangxi with Pingnan County at the center, and northern Guangxi centered in Sanjiang and Rongshui counties. Regarding climate conditions, in the 1990s the mortality rate of liver cancer positively correlated with average temperature and average minimum temperature, and negatively correlated with average precipitation. In 2004 through 2005, mortality due to liver cancer positively correlated with the average minimum temperature. Regions of high mortality had lower average humidity and higher average barometric pressure than did regions of low mortality. -

Interim Report

(於開曼群島註冊成立的有限公司) (Incorporated in the Cayman Islands with limited liability) 股份代號 : 1381 Stock Code : 1381 中期報告 INTERIM REPORT 2018 2018 中期報告 INTERIM REPORT 2018 CONTENTS MSW PROCESSING AND WTE PROCESS START MSW TRANSFER MSW COLLECTION AND STATION TRANSPORTATION SMOKESTACK INCINERATOR WEIGHING DISCHARGE PLATFORM CONTINUOUS EMISSION STATION MONITORING SYSTEM >850 SPRAY DRYER ABSORBER BAGHOUSE Storage Pool Bottom Ash Leachate WASTEWATER TREATMENT LIME AND ACTIVATED CARBON 2 Project Overview 28 Interim Condensed Consolidated Balance Sheet 4 Financial Highlights 30 Interim Condensed Consolidated Statement of 5 Corporate Milestones Changes in Equity 6 Chairlady’s Statement 32 Interim Condensed Consolidated Statement of 9 Management Discussion and Analysis Cash Flows 22 Corporate Governance 34 Notes to the Condensed Consolidated 25 Report on Review of Interim Financial Information Interim Financial Information 26 Interim Condensed Consolidated Statement of 60 Other Information Profit or Loss 65 Corporate Information 27 Interim Condensed Consolidated Statement of 67 Glossary Comprehensive Income MSW TRANSFER MSW COLLECTION AND STATION TRANSPORTATION SMOKESTACK INCINERATOR WEIGHING DISCHARGE PLATFORM CONTINUOUS EMISSION STATION MONITORING SYSTEM >850 SPRAY DRYER ABSORBER BAGHOUSE Storage Pool Bottom Ash Leachate WASTEWATER TREATMENT LIME AND ACTIVATED CARBON PROJECT OVERVIEW 17 Jianyang JIANGXI SICHUAN GUIZHOU 16 Xinfeng Xingyi 15 Laibin Qingyuan GUANGDONG 13 7 Lufeng Xinyi 9 4-5 Beiliu 14 GUANGXI 10 1-3 8 Dongguan 12 Zhongshan Zhanjiang 6 Dianbai -

Council Implementing Regulation (EU) No 412/2013 of 13 May 2013 Imposing a Definitive

Council Implementing Regulation (EU) No 412/2013 of 13 May 2013 imposing a definitive... 1 Document Generated: 2021-01-17 Changes to legislation: There are currently no known outstanding effects for the Council Implementing Regulation (EU) No 412/2013. (See end of Document for details) ANNEX I Co-operating Chinese exporting producers not sampled Name TARIC additional code Amaida Ceramic Product Co., Ltd. B357 Asianera Porcelain (Tangshan) Ltd. B358 Beiliu Changlong Ceramics Co., Ltd. B359 Beiliu Chengda Ceramic Co., Ltd. B360 Beiliu City Heyun Building Materials Co., B361 Ltd. Beiliu Jiasheng Porcelain Co., Ltd. B362 Beiliu Quanli Ceramic Co., Ltd. B363 Beiliu Shimin Porcelain Co., Ltd. B364 Beiliu Windview Industries Ltd. B365 Cameo China (Fengfeng) Co., Ltd. B366 Changsha Happy Go Products Developing B367 Co., Ltd. Chao An Huadayu Craftwork Factory B368 Chaoan County Fengtang Town HaoYe B369 Ceramic Fty Chao'an Lian Xing Yuan Ceramics Co., Ltd. B370 Chaoan Oh Yeah Ceramics Industrial Co., B371 Ltd. Chaoan Shengyang Crafts Industrial Co., Ltd B372 Chaoan Xin Yuan Ceramics Factory B373 Chao'an Yongsheng Ceramic Industry Co., B374 Ltd. Chaozhou Baodayi Porcelain Co., Ltd. B375 Chaozhou Baode Ceramics Co., Ltd, B376 Chaozhou Baolian Ceramics Co., Ltd. B377 Chaozhou Big Arrow Ceramics Industrial B378 Co., Ltd. Chaozhou Boshifa Ceramics Making Co., B379 Ltd. Chaozhou Cantake Craft Co., Ltd. B380 Chaozhou Ceramics Industry and Trade B381 General Corp. 2 Council Implementing Regulation (EU) No 412/2013 of 13 May 2013 imposing a definitive... Document Generated: 2021-01-17 Changes to legislation: There are currently no known outstanding effects for the Council Implementing Regulation (EU) No 412/2013. -

Modern Liu Bao

Liu Bao Tea 現 Modern Liu Bao Tea 代 Production in Wuzhou City 六 茶人: Donated by Wuzhou City Agricultural Bureau 堡 茶 In recent years, as the influence of Chinese black tea, or hei- cha, has risen, Wuzhou’s Liu Bao tea has also seen a swell in popularity. Its distinctive flavor and beneficial health proper- 生 ties have gradually earned it renewed recognition and esteem among the world’s tea lovers. Aged Liu Bao has been play- 產 fully referred to as “an antique you can drink,” and is often copared to the famous vintages of puerh tea. iu Bao tea was originally pro- yearly temperature is between 19.3°C slightly acidic, with a pH level between L duced in several small villages and 21.4°C, while the monthly aver- 4.5 and 6.5. The soil layer is deep and in Cangwu County, part of the age is over 10°C throughout Wuzhou loose, with plenty of humus, nutrients, Wuzhou City area in Guangxi, includ- (except for Mengshan County, where and water, providing a fertile environ- ing Lion Village and the tea’s name- the monthly average is below 10°C). ment ideal for growing tea and culti- sake, Liu Bao Village. The industry has The highest recorded temperature vating the microorganisms that are grown a lot since then, and Liu Bao is is 39.9°C and the lowest is -3.2°C. unique to Liu Bao. now produced in other surrounding The average yearly rainfall is between Wuzhou’s geographical, climate, villages and townships such as Cangwu 1400–1600 millimeters, with around and soil conditions are unique to the County’s Libu, Jingnan, and Shatou; 1533.7–1789 hours of sunshine per area and contribute to the region’s mi- Teng County’s Lingjing, Jinji, Xinqing year, and a typical relative humidity of crobial diversity and the growth of the and Mengjiang; Mengshan County’s 76%–82%. -

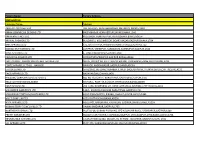

Factory Name

Factory Name Factory Address BANGLADESH Company Name Address AKH ECO APPARELS LTD 495, BALITHA, SHAH BELISHWER, DHAMRAI, DHAKA-1800 AMAN GRAPHICS & DESIGNS LTD NAZIMNAGAR HEMAYETPUR,SAVAR,DHAKA,1340 AMAN KNITTINGS LTD KULASHUR, HEMAYETPUR,SAVAR,DHAKA,BANGLADESH ARRIVAL FASHION LTD BUILDING 1, KOLOMESSOR, BOARD BAZAR,GAZIPUR,DHAKA,1704 BHIS APPARELS LTD 671, DATTA PARA, HOSSAIN MARKET,TONGI,GAZIPUR,1712 BONIAN KNIT FASHION LTD LATIFPUR, SHREEPUR, SARDAGONI,KASHIMPUR,GAZIPUR,1346 BOVS APPARELS LTD BORKAN,1, JAMUR MONIPURMUCHIPARA,DHAKA,1340 HOTAPARA, MIRZAPUR UNION, PS : CASSIOPEA FASHION LTD JOYDEVPUR,MIRZAPUR,GAZIPUR,BANGLADESH CHITTAGONG FASHION SPECIALISED TEXTILES LTD NO 26, ROAD # 04, CHITTAGONG EXPORT PROCESSING ZONE,CHITTAGONG,4223 CORTZ APPARELS LTD (1) - NAWJOR NAWJOR, KADDA BAZAR,GAZIPUR,BANGLADESH ETTADE JEANS LTD A-127-131,135-138,142-145,B-501-503,1670/2091, BUILDING NUMBER 3, WEST BSCIC SHOLASHAHAR, HOSIERY IND. ATURAR ESTATE, DEPOT,CHITTAGONG,4211 SHASAN,FATULLAH, FAKIR APPARELS LTD NARAYANGANJ,DHAKA,1400 HAESONG CORPORATION LTD. UNIT-2 NO, NO HIZAL HATI, BAROI PARA, KALIAKOIR,GAZIPUR,1705 HELA CLOTHING BANGLADESH SECTOR:1, PLOT: 53,54,66,67,CHITTAGONG,BANGLADESH KDS FASHION LTD 253 / 254, NASIRABAD I/A, AMIN JUTE MILLS, BAYEZID, CHITTAGONG,4211 MAJUMDER GARMENTS LTD. 113/1, MUDAFA PASCHIM PARA,TONGI,GAZIPUR,1711 MILLENNIUM TEXTILES (SOUTHERN) LTD PLOTBARA #RANGAMATIA, 29-32, SECTOR ZIRABO, # 3, EXPORT ASHULIA,SAVAR,DHAKA,1341 PROCESSING ZONE, CHITTAGONG- MULTI SHAF LIMITED 4223,CHITTAGONG,BANGLADESH NAFA APPARELS LTD HIJOLHATI, -

A New Genus and Species of Labeonini (Teleostei: Cyprinidae) from the Pearl River in China

RESEARCH ARTICLE A new genus and species of Labeonini (Teleostei: Cyprinidae) from the Pearl River in China Lan-Ping Zheng1, You He2, Jun-Xing Yang1*, Lun-Biao Wu3 1 State Key Laboratory of Genetic Resources and Evolution, Kunming Institute of Zoology, Chinese Academy of Sciences, Kunming, China, 2 Shanghai Synchrotron Radiation Facility, Shanghai Institute of Applied Physics, Chinese Academy of Sciences, Shanghai, China, 3 Fishery Bureau of Beiliu City, Beiliu, China a1111111111 a1111111111 * [email protected] a1111111111 a1111111111 a1111111111 Abstract Zuojiangia jingxiensis, both a new genus and species, is described from the Pearl River in China. It is distinguished from all other genera and species of Labeonini by the unique com- OPEN ACCESS bination of modified oromandibular structures and head skeleton: a well-developed, pendu- Citation: Zheng L-P, He Y, Yang J-X, Wu L-B lous, and conspicuously arched rostral fold, with an entirely crenulated margin; prominent (2018) A new genus and species of Labeonini papillae densely covering the margin of the rostral fold and anterior part of the lower lip; long (Teleostei: Cyprinidae) from the Pearl River in postlabial grooves, partitioning the lower lip into three parts; transverse branch of dentary China. PLoS ONE 13(7): e0199973. https://doi.org/ longer than half the length of the longitudinal branch; stubby lateral process present at the 10.1371/journal.pone.0199973 anterolateral margin of the longitudinal branch of the dentary, close to the corner; in the Editor: Zuogang Peng, SOUTHWEST UNIVERSITY, upper jaw, the premaxilla bears a triangular ascending process tapering to a point; maxilla CHINA exhibits a pair of articular heads at the anterodorsal margin, and a distinct fingerlike Received: August 2, 2017 descending process posterior to the medial articular head embracing the ascending process Accepted: June 11, 2018 of the premaxilla. -

Freshwater Shrimps from Karst Caves of Southern China, With

Zoological Studies 57: 27 (2018) doi:10.6620/ZS.2018.57-27 Open Access Freshwater Shrimps from Karst Caves of Southern China, with Descriptions of Seven New Species and the Identity of Typhlocaridina linyunensis Li and Luo, 2001 (Crustacea: Decapoda: Caridea) Yixiong Cai1,* and Peter Kee Lin Ng2 1National Biodiversity Centre, National Parks Board, 1 Cluny Road, Singapore 259569, Republic of Singapore 2Lee Kong Chian Natural History Museum, National University of Singapore, 2 Conservatory Drive, Singapore 117377, Republic of Singapore. E-mail: [email protected] (Received 30 December 2017; Accepted 30 April 2018; Published 26 June 2018; Communicated by Benny K.K. Chan) Citation: Cai Y, Ng PKL. 2018. Freshwater shrimps from karst caves of southern China, with descriptions of seven new species and the identity of Typhlocaridina linyunensis Li and Luo, 2001 (Crustacea: Decapoda: Caridea). Zool Stud 57:27. doi:10.6620/ZS.2018.57-27. Yixiong Cai and Peter Kee Lin Ng (2018) Seven new atyid shrimp species of the genus Caridina H. Milne Edwards, 1837 are described from southern China: C. longshan sp. nov., C. alu sp. nov., C. spinicrus sp. nov., C. beiliu sp. nov., C. jiangkou sp. nov., C. guilin sp. nov. and C. laticarpalis sp. nov. Descriptions and figures for all taxa are provided, and taxa are compared with their closest congeners. An updated list of all cave atyid and palaemonid shrimp species found in China is provided. Caridina semiblepsia Guo, Choy and Gui, 1996 is here regarded as a junior subjective synonym of C. ablepsia Guo, Jiang and Zhang, 1992. One poorly known species, Typhlocaridina linyunensis Li and Luo, 2001, described from a cave in Guangxi is here shown to be a palaemonid instead of an atyid, and is actually the senior synonym of Macrobrachium lingyunense Li, Cai and Clarke, 2006. -

Rebellion of the Cadres: the 1967 Implosion of the Chinese Party-State

Rebellion of the Cadres: The 1967 Implosion of the Chinese Party-State Andrew G. Walder* ABSTRACT Accounts of the tumultuous initial phase of the Cultural Revolution portray party-state cadres primarily as targets of a popular insurgency. Cadres in Party and government organs in fact were themselves in widespread rebellion against their superiors after October 1966, and rebel cadres were a major force in the national wave of power seizures that destroyed the civilian state in early 1967. The rebellion was a form of bureaucratic politics in a setting characterized by rapidly shifting signals and high uncertainty, in which the rebels’ motives were generated after the onset of the Cultural Revolution. Cadres played a central role in the destruction of the political institutions to which their vested interests were inextricably linked. he Cultural Revolution initially impressed scholars as a window on inequal- Tity and group conflict in a type of society long characterized as totalitarian. Observers immediately noted evidence that a series of social constituencies mo- bilized to advance their claims.1 Sent-down youth, contract and temporary work- ers, students from politically stigmatized households, demobilized soldiers, and other groups organized to press their interests and make demands against Party authorities.2 Mass insurgencies that seemed to reflect underlying group tensions * The author gratefully acknowledges the substantive and editorial suggestions of the editors, Anita Chan and Jonathan Unger, and the critical comments of two reviewers. National Science Foundation Grant SBS-1021134, “Political Movements in an Authoritarian Hierarchy,” supported some of the research reported in this article. 1. Michel Oksenberg, “Occupational Groups in Chinese Society and the Cultural Revolution,” and Ezra F. -

Canvest (1381 HK)

BOCOM Int’l Research Company Update Environmental Last Close Target Price Upside 15 June 2018 HK$4.20 HK$5.81 +38% Canvest (1381 HK) Project execution on track; maintain Buy Project execution on track: We had an update with the company. We found no Stock Rating material change in project execution, and expect Beiliu phase 1 and Lufeng phase 1 to start operation this year. Meanwhile, local government has speeded up site BUY selection for Qingyuan phase 1, for which we expect construction could start as early as 4Q18. We estimate Canvest’s waste processing capacity in operation to reach 1-year stock performance HSI 1381.HK 13.7/16.1/18.6ktpd in 2018/19/20E. 30% 20% Update on new investments at associate level: Regarding the new investment in 10% waste collection business via acquisition of Johnson Cleaning Services (JCS), Canvest 0% is still working closely with Huafa Group on further business expansion in the Bay -10% Area. We still expect Huafa Group’s extensive network in mainland China to support Jun-17 Oct-17 Feb-18 May-1818 further expansion of JCS’ waste collection business. Our base case is that JCS could Source: Bloomberg contribute ~HK$16m net profit per year at Canvest’s associate level. Stock data 52w high (HK$) 4.80 New long-term loan could help finance new projects/M&As: Canvest has recently 52w low (HK$) 4.01 secured a 60-month HK$1.176bn syndicated loan led by the International Finance Market cap (HK$ m) 10,312 Corporation. We expect Canvest to use this loan to finance new greenfield projects Avg daily vol (m) 2.92 and M&As.