Sep. 01, 2017Press INPEX-Operated Ichthys LNG Project Celebrates

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

"K"Line Report 2019

“K” LINE REPORT 2019 Contents “K” LINE Group Value Creation Foundation of Value Creation 1 Corporate Principle and Vision 30 CSR – ESG Initiatives – 2 Corporate Value Creation Story 32 Environmental Preservation 2 Special Feature 1: 100 Years of 36 Safety in Navigation and Cargo Operations Exploration and Creation 38 Human Resource Development 6 “K” LINE Group Value Creation Model 40 ESG Interview 8 Financial and ESG Highlights 45 Corporate Governance 50 Directors, Audit & Supervisory Board Members 10 Message from the President and Executive Officers / Organization 15 Special Feature 2: Emphasizing Function-Specific Strategies Value Creation Initiatives Financial Section / Corporate Data 16 At a Glance 52 10-Year Financial and ESG Data 18 Business Overview 54 Financial Analysis 18 Dry Bulk segment 56 Consolidated Financial Statements 18 Coal & Iron Ore Carrier Business/ 88 Global Network Bulk Carrier Business 90 Major Subsidiaries and Affiliates 20 Energy Resource Transport segment 92 Outline of the Company/Stock Information 20 Tanker Business 21 Thermal Coal Carrier Business 22 LNG Carrier Business, Liquefied Gas Business, Offshore Energy E&P Business 24 Product Logistics segment 24 Car Carrier Business, Automotive Logistics Business 26 Logistics Business 28 Short Sea and Coastal Business 29 Containership Business External Recognition In appraisal of efforts to enhance our CSR initiatives, “K” LINE has been selected as a component in Socially Responsible Investment (SRI) and ESG indices used all over the world. ● FTSE4 Good Index Series ● FTSE Blossom Japan Index ● ETHIBEL EXCELLENCE Investment Register ● Dow Jones Sustainability Asia/Pacific Index ● MSCI Japan Empowering Women Index (WIN) Further, in recognition of its disclosure of climate change infor- mation and efforts to reduce greenhouse gas emissions, “K” LINE was selected in the “CDP Climate A List” and the “Supplier Climate A List” for the third consecutive year. -

Published on July 21, 2021 1. Changes in Constituents 2

Results of the Periodic Review and Component Stocks of Tokyo Stock Exchange Dividend Focus 100 Index (Effective July 30, 2021) Published on July 21, 2021 1. Changes in Constituents Addition(18) Deletion(18) CodeName Code Name 1414SHO-BOND Holdings Co.,Ltd. 1801 TAISEI CORPORATION 2154BeNext-Yumeshin Group Co. 1802 OBAYASHI CORPORATION 3191JOYFUL HONDA CO.,LTD. 1812 KAJIMA CORPORATION 4452Kao Corporation 2502 Asahi Group Holdings,Ltd. 5401NIPPON STEEL CORPORATION 4004 Showa Denko K.K. 5713Sumitomo Metal Mining Co.,Ltd. 4183 Mitsui Chemicals,Inc. 5802Sumitomo Electric Industries,Ltd. 4204 Sekisui Chemical Co.,Ltd. 5851RYOBI LIMITED 4324 DENTSU GROUP INC. 6028TechnoPro Holdings,Inc. 4768 OTSUKA CORPORATION 6502TOSHIBA CORPORATION 4927 POLA ORBIS HOLDINGS INC. 6503Mitsubishi Electric Corporation 5105 Toyo Tire Corporation 6988NITTO DENKO CORPORATION 5301 TOKAI CARBON CO.,LTD. 7011Mitsubishi Heavy Industries,Ltd. 6269 MODEC,INC. 7202ISUZU MOTORS LIMITED 6448 BROTHER INDUSTRIES,LTD. 7267HONDA MOTOR CO.,LTD. 6501 Hitachi,Ltd. 7956PIGEON CORPORATION 7270 SUBARU CORPORATION 9062NIPPON EXPRESS CO.,LTD. 8015 TOYOTA TSUSHO CORPORATION 9101Nippon Yusen Kabushiki Kaisha 8473 SBI Holdings,Inc. 2.Dividend yield (estimated) 3.50% 3. Constituent Issues (sort by local code) No. local code name 1 1414 SHO-BOND Holdings Co.,Ltd. 2 1605 INPEX CORPORATION 3 1878 DAITO TRUST CONSTRUCTION CO.,LTD. 4 1911 Sumitomo Forestry Co.,Ltd. 5 1925 DAIWA HOUSE INDUSTRY CO.,LTD. 6 1954 Nippon Koei Co.,Ltd. 7 2154 BeNext-Yumeshin Group Co. 8 2503 Kirin Holdings Company,Limited 9 2579 Coca-Cola Bottlers Japan Holdings Inc. 10 2914 JAPAN TOBACCO INC. 11 3003 Hulic Co.,Ltd. 12 3105 Nisshinbo Holdings Inc. 13 3191 JOYFUL HONDA CO.,LTD. -

Ichthys LNG Project Secures New Shipping Vessels

Public Relations Group, Corporate Communications Unit Akasaka Biz Tower, 5-3-1 Akasaka, Minato-ku, Tokyo 107-6332 JAPAN 4 June 2013 Ichthys LNG Project Secures New Shipping Vessels INPEX CORPORATION (INPEX) is pleased to announce shipbuilding and shipping contracts for two new vessels which will offtake and deliver LNG from the Ichthys LNG Project offshore Western Australia to Japan and Taiwan. Through its wholly owned subsidiary INPEX Shipping Co., Ltd. (‘INPEX Shipping’), one LNG vessel will be jointly owned with Kawasaki Kisen Kaisha, Ltd. (‘”K” Line’) through Ocean Breeze LNG Transport S. A. and built by Mitsubishi Heavy Industries, Ltd. The vessel will be operated by Ocean Breeze LNG Transport S. A. as a time charter. The 155,300 cubic metre capacity carrier will offtake 900,000 tonnes per annum of LNG from the Ichthys LNG Project and features an innovative peapod-shaped continuous cover protecting the four moss spherical tanks. The reduced weight combined with reheated steam turbine propulsion will contribute to an expected 20 per cent or more decrease in fuel consumption per unit cargo compared to conventional vessels. A second, 182,000 cubic metre capacity vessel will also be operated as a time charter by “K” Line for delivery to CPC Corporation, Taiwan. These arrangements will contribute to strengthening INPEX’s global gas supply chain which connects INPEX’s overseas gas assets with its Naoetsu LNG Receiving Terminal in Joetsu and its natural gas pipeline network in Japan. About the Ichthys LNG Project The Ichthys LNG Project is a Joint Venture between INPEX group companies (the Operator), major partner TOTAL group companies and the Australian subsidiaries of Tokyo Gas, Osaka Gas, Chubu Electric Power and Toho Gas. -

October 31St, 2016 to Whom It May Concern, Kawasaki Kisen Kaisha

October 31 st , 2016 To Whom it May Concern, Kawasaki Kisen Kaisha, Ltd. Eizo Murakami, President & CEO Mitsui O.S.K. Lines, Ltd. Junichiro Ikeda, President & CEO Nippon Yusen Kabushiki Kaisha Tadaaki Naito, President Notice of Agreement to the Integration of Container Shipping Businesses Kawasaki Kisen Kaisha, Ltd., Mitsui O.S.K. Lines Ltd., and Nippon Yusen Kabushiki Kaisha have agreed, after the resolution by the board of directors of each company held today, and subject to regulatory approval from the authorities, to establish a new joint-venture company to integrate the container shipping businesses (including worldwide terminal operating businesses excluding Japan) of all three companies and to sign a business integration contract and a shareholders agreement. 1. Background Although growing modestly, the container shipping industry has struggled in recent years due to a decline in the container growth rate and the rapid influx of newly built vessels. These two factors have contributed to an imbalance of supply and demand which has destabilized the industry and has created an environment that is adverse to container line profitability. In order to combat these factors, industry participants have sought to gain scale merit through mergers and acquisitions and consequently the structure of the industry is changing through consolidation. Under these circumstances, three companies have now decided to integrate their respective container shipping on an equal footing to ensure future stable, efficient and competitive business operations. The new joint-venture company is expected to create a synergy effect by utilizing the best practices of the three companies. And by taking advantage of scale merit of its vessel fleet totaling 1.4 million TEUs, realize integration effect of approximately 110 billion Japanese Yen annually and seek swiftly financial performance stabilization. -

Some OCR Attending Companies (AY 2018) (In Japanese Syllabary Order)

VII. Reference Some OCR Attending Companies (AY 2018) (In Japanese syllabary order) RGF Professional Recruitment Japan Credit Saison Co.,Ltd. Japan Aviation Electronics Industry, Limited IHI Corporation Kobe Steel, Ltd. Nissha Co., Ltd. AISIN AW CO., LTD. INPEX CORPORATION Nippon Travel Agency Co.,Ltd. IRISOHYAMA INC. KOKUYO Co.,Ltd. PERSOL CAREER CO., LTD. Accenture Japan Ltd Cosmo Oil Co., Ltd. Pasona Group Inc. Akebono Brake Industry Co., Ltd. KONICA MINOLTA, INC. Panasonic Corporation Asahi Kasei Corp. KOBAYASHI PHARMACEUTICAL CO., LTD. Hankyu Hanshin Department Stores,Inc. ASICS Corporation Komatsu Ltd. BANDAI NAMCO Entertainment Inc. Azbil Corporation Sunstar Inc. Hitachi Chemical Company, Ltd. Adecco Ltd. JFE Steel Corporation Hitachi Kokusai Electric Inc. Adways Inc. JTB Corp. Hitachi, Ltd. Amazon Com, Inc. SHIMADZU CORPORATION Hilton Tokyo INTAGE Inc. SHIMIZU CORPORATION FamilyMart Co., Ltd. UENO Co.,Ltd. NIPPON STEEL CORPORATION Foster Electric Company, Limited American International Group, Inc. Ernst & Young ShinNihon LLC Fuji Xerox Co., Ltd. H.I.S.Co.,Ltd. Suzuyo & Co., Ltd. FUJITSU LIMITED SMBC Nikko Securities Inc. Sumitomo Electric Industries, Ltd. FUJIFILM Corporation es Networks Co., Ltd. SEPTENI HOLDINGS CO.,LTD. HORIBA, Ltd. NEC Capital Solutions Limited ALL NIPPON AIRWAYS CO., LTD Mizuho Financial Group, Inc. NOK CORPORATION SoftBank Corp. MISUMI GROUP INC. NTT DATA Corporation Solaseed Air Inc. Mitsui Chemicals, Inc. NTT DOCOMO, INC. The Dai-ichi Life Insurance Company, Limited Sumitomo Mitsui Banking Corporation EBARA CORPORATION TAISEI CORPORATION Sumitomo Mitsui Trust Bank, Limited OKAMURA CORPORATION TANAKA KIKINZOKU GROUP Sumitomo Mitsui Finance and Leasing Company, Limited OMRON Corporation CENTRAL JAPAN INTERNATIONAL AIRPORT COMPANY , LIMITED Isetan Mitsukoshi Ltd. Kao Customer Marketing Co., Ltd. -

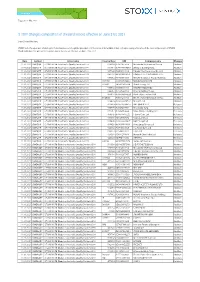

STOXX Changes Composition of Dividend Indices Effective on June 21St, 2021

Zug, June 11th, 2021 STOXX Changes composition of Dividend Indices effective on June 21st, 2021 Dear Sir and Madam, STOXX Ltd., the operator of Qontigo’s index business and a global provider of innovative and tradable index concepts, today announced the new composition of STOXX Dividend Indices as part of the regular quarterly review effective on June 21st, 2021 Date Symbol Index name Internal Key ISIN Company name Changes 11.06.2021 ISMAQDP iSTOXX MUTB Asia/Pacific Quality Dividend 100 659668 JP3902900004 Mitsubishi UFJ Financial Group Addition 11.06.2021 ISMAQDP iSTOXX MUTB Asia/Pacific Quality Dividend 100 607614 AU000000WBC1 Westpac Banking Corp. Addition 11.06.2021 ISMAQDP iSTOXX MUTB Asia/Pacific Quality Dividend 100 687044 JP3463000004 Takeda Pharmaceutical Co. Ltd. Addition 11.06.2021 ISMAQDP iSTOXX MUTB Asia/Pacific Quality Dividend 100 643532 HK0006000050 POWER ASSETS HOLDINGS LTD Addition 11.06.2021 ISMAQDP iSTOXX MUTB Asia/Pacific Quality Dividend 100 687012 JP3890310000 MS&AD Insurance Group Holdings Addition 11.06.2021 ISMAQDP iSTOXX MUTB Asia/Pacific Quality Dividend 100 AU506F AU000000MPL3 MEDIBANK PRIVATE Addition 11.06.2021 ISMAQDP iSTOXX MUTB Asia/Pacific Quality Dividend 100 B15F66 TH0902010014 Thai Beverage PCL Addition 11.06.2021 ISMAQDP iSTOXX MUTB Asia/Pacific Quality Dividend 100 698502 JP3939000000 YAMADA HOLDINGS Addition 11.06.2021 ISMAQDP iSTOXX MUTB Asia/Pacific Quality Dividend 100 644212 JP3126340003 Alfresa Holdings Corp. Addition 11.06.2021 ISMAQDP iSTOXX MUTB Asia/Pacific Quality Dividend 100 607624 AU000000BOQ8 Bank of Queensland Ltd. Addition 11.06.2021 ISMAQDP iSTOXX MUTB Asia/Pacific Quality Dividend 100 B02Q32 JP3551200003 Electric Power Development Co. -

INPEX Invests in Japan Methane Hydrate Operating Co., Ltd

Public Relations Group, Corporate Communications Unit Akasaka Biz Tower, 5-3-1 Akasaka, Minato-ku, Tokyo 107-6332 JAPAN October 1, 2014 INPEX Invests in Japan Methane Hydrate Operating Co., Ltd. INPEX CORPORATION (“INPEX”, President & CEO: Toshiaki Kitamura) is pleased to announce today it has invested in Japan Methane Hydrate Operating Co., Ltd., a joint venture company established on October 1, 2014 aiming to participate in the Medium to Long-term Offshore Production Test of methane hydrate conducted by the Japanese government. INPEX is committed to utilizing the technology, knowledge and experience it has accumulated through its oil and natural gas upstream business operations to contribute to research on Japan’s methane hydrate resources. Please refer to the attachment for the October 1 announcement issued by Japan Methane Hydrate Exploration Co., Ltd. Please see our website about INPEX as below; www.inpex.co.jp/english/index.html Media Contact: INPEX Tokyo Office, Public Relations Group, Tel) +81-3-5572-0233 October 1, 2014 Company Name: Japan Methane Hydrate Operating Co., Ltd. (JMH) President: Shoichi Ishii Inquiries: Masanori Abe, General Manager, Planning Department TEL: +81-3-6268-7200 Establishment of New Company for Participation in R & D Project of Pore-filling Type Methane Hydrate It is pleased to announce that Japan Methane Hydrate Operating Co., Ltd. (JMH) was established on October 1, 2014 aiming to participate in the Medium to Long-term Offshore Production Test from pore-filling type methane hydrate which will be conducted by the Japanese government. A substantial quantity of methane hydrate is estimated in the offshore areas around Japan. -

Lazard Japanese Strategic Equity Fund Monthly Commentary

Lazard Japanese Strategic Equity Fund AUG Commentary 2021 Market Overview Markets were on the weak side for the rst few weeks of the month due to concerns that rapidly increasing delta variant cases around the world would side-track the current global economic recovery following pandemic period lows. However, the market made a strong recovery in the last week-and-a-half, with the TOPIX Total Return index nishing the month up a solid 3.2% in yen terms. Tokyo managed to host a reasonably successful Olympics and Japan even produced a strong showing in the medal count, particularly in gold medals. Portfolio Review During the month, the portfolio underperformed the TOPIX Total Return Index which returned 3.2% in yen terms. Being underweight and stock selection in consumer discretionary, and stock selection in the materials and utilities sectors were top contributors to performance. Being underweight and stock selection in health care, stock selection in communication services, and being underweight and stock selection in information technology sectors were negative. During the month, the top positive contributors to relative performance included: • Nippon Steel, Japan’s largest steel manufacturer, was strong after reporting better-than-expected rst-quarter earnings and raising its full-year guidance. • Mitsui O.S.K.Lines, a leading shipping company, continued to rise due to stronger-than-expected earnings and a better-than- expected dividend increase. • Makita, a leading global manufacturer of power tools, raised full-year guidance as its rst-quarter saw continued strong demand globally. • Dai-ichi Life Holdings, a leading life insurance company, rose as the yield on 10-year U.S. -

To Transition Loan Borrowed by Kawasaki Kisen Kaisha,Ltd

20-D-1347 March 12, 2021 JCR Climate Transition Finance Evaluation By Japan Credit Rating Agency, Ltd. Japan Credit Rating Agency Ltd.(JCR) announces results of the Climate Transition Finance Evaluation JCR Assigned Green 1 (T) to Transition Loan of Kawasaki Kisen Kaisha, Ltd. Subject : Long-term loan Type : Long-term loan Mizuho Bank, Ltd., Sumitomo Mitsui Trust Bank, Limited Lender : (Transition Structuring Agents) Mizuho Securities Co., Ltd. Lease : Arranger (Transition Structuring Agent) Borrowing Amount : Approx. JPY 5.9 billion Execution Date : March 12, 2021 Repayment due date : September 12, 2035 Repayment method : Scheduled repayment Fund for purchasing a Next-Generation Environmentally-Friendly LNG-fueled Use of proceeds : Car Carrier <Climate Transition Finance Evaluation Results> Overall Evaluation Green 1(T) Greenness/Transition Evaluation gt1 (Use of Proceeds) Management, Operation and m1 Transparency Evaluation 1/21 https://www.jcr.co.jp/en/ Chapter 1: Evaluation Overview [Company Profile] Kawasaki Kisen Kaisha, Ltd. (K Line) is an integrated logistics company primarily operates shipping business. It was established in 1919 as a separate entity from Kawasaki Dockyard Co., Ltd. (now Kawasaki Heavy Industries), and is one of the three major domestic shipping companies. K Line and consolidated subsidiaries (collectively K Line Group) operate in three business segments: "Dry Bulk," "Energy Resource Transport," and "Product Logistics." K Line boasts one of the world's largest fleets of car carriers, dry bulkers, and LNG carriers, and has an excellent customer base at home and abroad. Among the major shipping companies, the scale of businesses other than oil tankers and marine transportation is small. For the fiscal year ended March 2020 (FY 2019), K Line’s sales were broken down into by segment as 31.8% for Dry Bulk, 11.5% for Energy Resources Transport, and 52.3% for Product Logistics. -

The 88Th Term Interim Report (PDF 519KB)

The 88th Term Interim Report April 1, 2012 to September 30, 2012 Index To Our Shareholders ………………… 1 Topics …………………………………… 3 Summary of Consolidated Financial Statements … 7 Information about NSSMC shares …… 9 Securities Code: 5401 010_0299302832412.indd 2 2012/12/07 17:17:44 To Our Shareholders We would like to thank you for your continued understanding and support. On October 1, 2012, Nippon Steel Corporation (hereinafter referred to as “the former Nippon Steel”) and Sumitomo Metal Industries, Ltd. (hereinafter referred to as “the former Sumitomo Metals”), have merged to become Nippon Steel & Sumitomo Metal Corporation (hereinafter referred to as “NSSMC”). The climate of the steel business is changing faster and more drastically than it has ever been. Facing this challenge, we will act speedily and decisively to raise our corporate value and achieve sustainable growth. (Overview of Business Operations and Performance for the First Half of Fiscal 2012) President & COO, Tomono (left) and Chairman & CEO, Muneoka (right) We would like to present the overview of business operations during the first half of fiscal 2012 (April 1, 2012 to September 30, 2012). The slowdown of the global economy intensified during the first half of fiscal 2012 due to recessive economic conditions in Europe and slowing growth in China and other emerging economies. The Japanese economy continued to gradually recover as consumer spending and private capital investment remained favorable despite being influenced by the persistently record-high yen and the slowdown in overseas economies. Under such an environment, domestic demand for steel remained relatively constant due to solid demand for construction and automobile manufacturing, despite a large decrease in demand for use in shipbuilding. -

Austrade-Japan Investment in Australia

JAPANESE INVESTMENT IN AUSTRALIA A trusted partnership – celebrating the 60th anniversary of the 1957 Australia – Japan Agreement on Commerce Disclaimer Copyright © Commonwealth of Australia 2017 This report has been prepared by the Commonwealth of Australia represented by the Australian Trade and Investment Commission (Austrade). The report is a general overview and is not intended to The material in this document is licensed under a Creative Commons provide exhaustive coverage of the topic. The information is made Attribution – 4.0 International licence, with the exception of: available on the understanding that the Commonwealth of Australia is • the Commonwealth Coat of Arms not providing professional advice. • the Australian Trade and Investment Commission’s logo While care has been taken to ensure the information in this report is • any third party material accurate, the Commonwealth does not accept any liability for any • any material protected by a trade mark loss arising from reliance on the information, or from any error or • any images and photographs. omission, in the report. More information on this CC BY licence is set out at the creative Any person relying on this information does so at their own risk. The commons website: https://creativecommons.org/licenses/by/4.0/ Commonwealth recommends the person exercise their own skill and legalcode. Enquiries about this licence and any use of this document care, including obtaining professional advice, in relation to their use of can be sent to: [email protected]. the information for their purposes. The Commonwealth does not endorse any company or activity referred to in the report, and does Attribution not accept responsibility for any losses suffered in connection with Before reusing any part of this document, including reproduction, any company or its activities. -

Upstream Investment Trends for Japanese LNG Buyers and Developers

0 Upstream investment trends for Japanese LNG buyers and developers Ryuta KITAMURA JOGMEC International LNG Congress 2016 14th March, 2016 Japan Oil, Gas and Metals National Corporation (JOGMEC) 1 Established: February 29, 2004 [succeeded the functions of Japan National Oil Corporation(JNOC)] President: Keisuke Kuroki Capital: 751 Billion Yen (As of January, 2016) = around 6.83 Billion US$ (110US$/Yen) Mission Securing Stable Supply of Oil, Natural Gas, Coal and Mineral Resources for Japanese Industries and Citizens Activities Oil & Gas Upstream Metals Strategy & Stockpiling Mine Pollution Coal Strategy & Geothermal Investment and Exploration, and Control Exploration, and Resources Research & Development Technology Technological Development Development Support JOGMEC Oil & Gas Upstream Projects (Natural Gas) 2 North Montney Shale Gas Project Horn River Shale Gas Project (Canada) (Canada) Cordova Shale Gas Project Sakhalin I Project (Canada) (Russia) Cutbank Dawson Shale Gas Project (Canada) Rovuma Offshore Area 1 Project Tangguh LNG Project (Mozambique) (Indonesia) PNG LNG Project Block B (Papua New Guinea ) (Vietnam) Abadi LNG Project (Indonesia) Ichthys LNG Project Equity Capital (50) Wheatstone LNG Project (Australia) (Australia) Liability Guarantee (12) (As of Jan, 2015) (Source: JOGMEC) Electricity Mix in Japan 3 10*8kWh No nuclear plant in operation in 2014FY Sendai plant in 29.3 Kyushu has been restarted in Aug. 2015 43.2 42.5 2 reactors in operation (Sendai) and 1 more (Takahama) under 28.6 preparation at the 1.7 0.0 moment Fukushima