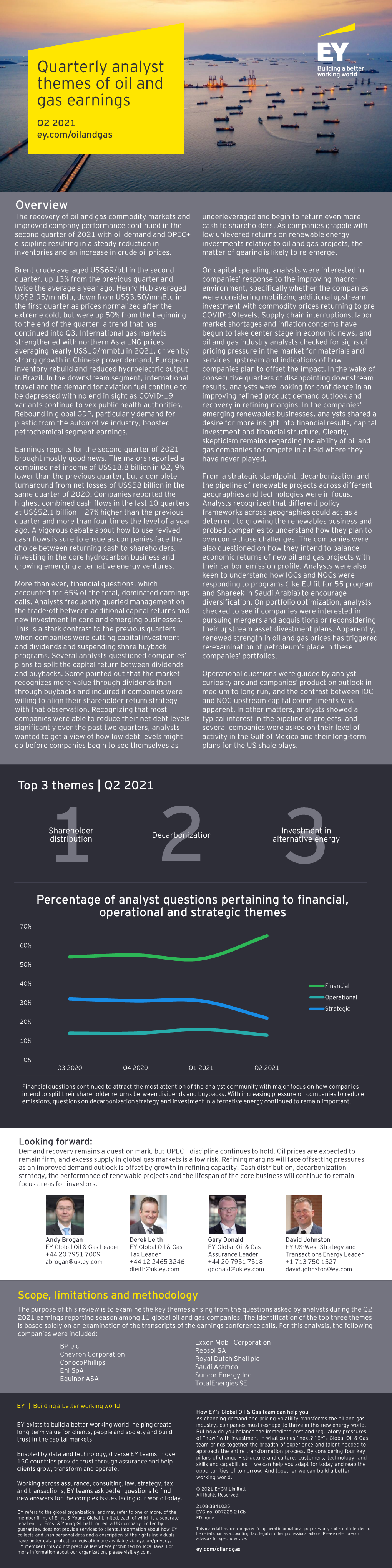

Quarterly Analyst Themes of Oil and Gas Earnings

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NEW YORK ------X CITY of NEW YORK, : : Plaintiff, : No

UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK ---------------------------------X CITY OF NEW YORK, : : Plaintiff, : No. 18 Civ. 182 (JFK) -against- : : OPINION & ORDER BP P.L.C., CHEVRON CORPORATION, : CONOCOPHILLIPS, : EXXON MOBIL CORPORATION, : and ROYAL DUTCH SHELL, PC, : : Defendants. : ---------------------------------X APPEARANCES FOR PLAINTIFF CITY OF NEW YORK: Zachary W. Carter Susan E. Amron Kathleen C. Schmid Margaret C. Holden Noah Kazis CORPORATION COUNSEL OF THE CITY OF NEW YORK Steve W. Berman Matthew F. Pawa Benjamin A. Krass Wesley Kelman HAGENS BERMAN SOBOL SHAPIRO LLP Christopher A. Seeger Stephen A. Weiss Diogenes P. Kekatos SEEGER WEISS LLP FOR DEFENDANT CHEVRON CORPORATION: Caitlin J. Halligan Andrea E. Neuman Anne Champion Theodore J. Boutrous, Jr. William E. Thomson Joshua S. Lipshitz GIBSON, DUNN & CRUTCHER LLP Herbert J. Stern Joel M. Silverstein STERN & KILCULLEN, LLC Neal S. Manne Johnny W. Carter Erica Harris Steven Shepard Laranda Walker Kemper Diehl Michael Adamson SUSMAN GODFREY LLP FOR DEFENDANT EXXON MOBIL CORPORATION: Theodore V. Wells, Jr. Daniel J. Toal Jaren Janghorbani PAUL, WEISS, RIFKIND, WHARTON & GARRISON, LLP M. Randall Oppenheimer Dawn Sestito O’MELVENY & MYERS LLP Patrick J. Conlon EXXON MOBIL CORPORATION FOR DEFENDANT CONOCOPHILLIPS: John F. Savarese Jeffrey M. Wintner Ben M. Germana Johnathan Siegel WACHTELL, LIPTON, ROSEN & KATZ Tracie J. Renfroe Carol M. Wood KING & SPALDING LLP JOHN F. KEENAN, United States District Judge: Before the Court is a motion by Defendants Chevron Corporation (“Chevron”), ConocoPhillips, and Exxon Mobil Corporation (“Exxon”) (together, the “U.S.-based Defendants”) to dismiss Plaintiff City of New York’s (the “City”) amended complaint under Federal Rules of Civil Procedure 12(b)(1) and 12(b)(6). -

Climate and Energy Benchmark in Oil and Gas Insights Report

Climate and Energy Benchmark in Oil and Gas Insights Report Partners XxxxContents Introduction 3 Five key findings 5 Key finding 1: Staying within 1.5°C means companies must 6 keep oil and gas in the ground Key finding 2: Smoke and mirrors: companies are deflecting 8 attention from their inaction and ineffective climate strategies Key finding 3: Greatest contributors to climate change show 11 limited recognition of emissions responsibility through targets and planning Key finding 4: Empty promises: companies’ capital 12 expenditure in low-carbon technologies not nearly enough Key finding 5:National oil companies: big emissions, 16 little transparency, virtually no accountability Ranking 19 Module Summaries 25 Module 1: Targets 25 Module 2: Material Investment 28 Module 3: Intangible Investment 31 Module 4: Sold Products 32 Module 5: Management 34 Module 6: Supplier Engagement 37 Module 7: Client Engagement 39 Module 8: Policy Engagement 41 Module 9: Business Model 43 CLIMATE AND ENERGY BENCHMARK IN OIL AND GAS - INSIGHTS REPORT 2 Introduction Our world needs a major decarbonisation and energy transformation to WBA’s Climate and Energy Benchmark measures and ranks the world’s prevent the climate crisis we’re facing and meet the Paris Agreement goal 100 most influential oil and gas companies on their low-carbon transition. of limiting global warming to 1.5°C. Without urgent climate action, we will The Oil and Gas Benchmark is the first comprehensive assessment experience more extreme weather events, rising sea levels and immense of companies in the oil and gas sector using the International Energy negative impacts on ecosystems. -

Integrating Into Our Strategy

INTEGRATING CLIMATE INTO OUR STRATEGY • 03 MAY 2017 Integrating Climate Into Our Strategy INTEGRATING CLIMATE INTO OUR STRATEGY • 03 CONTENTS Foreword by Patrick Pouyanné, Chairman and Chief Executive Officer, Total 05 Three Questions for Patricia Barbizet, Lead Independent Director of Total 09 _____________ SHAPING TOMORROW’S ENERGY Interview with Fatih Birol, Executive Director of the International Energy Agency 11 The 2°C Objective: Challenges Ahead for Every Form of Energy 12 Carbon Pricing, the Key to Achieving the 2°C Scenario 14 Interview with Erik Solheim, Executive Director of UN Environment 15 Oil and Gas Companies Join Forces 16 Interview with Bill Gates, Breakthrough Energy Ventures 18 _____________ TAKING ACTION TODAY Integrating Climate into Our Strategy 20 An Ambition Consistent with the 2°C Scenario 22 Greenhouse Gas Emissions Down 23% Since 2010 23 Natural Gas, the Key Energy Resource for Fast Climate Action 24 Switching to Natural Gas from Coal for Power Generation 26 Investigating and Strictly Limiting Methane Emissions 27 Providing Affordable Natural Gas 28 CCUS, Critical to Carbon Neutrality 29 A Resilient Portfolio 30 Low-Carbon Businesses to Become the Responsible Energy Major 32 Acquisitions That Exemplify Our Low-Carbon Strategy 33 Accelerating the Solar Energy Transition 34 Affordable, Reliable and Clean Energy 35 Saft, Offering Industrial Solutions to the Climate Change Challenge 36 The La Mède Biorefinery, a Responsible Transformation 37 Energy Efficiency: Optimizing Energy Consumption 38 _____________ FOCUS ON TRANSPORTATION Offering a Balanced Response to New Challenges 40 Our Initiatives 42 ______________ OUR FIGURES 45 04 • INTEGRATING CLIMATE INTO OUR STRATEGY Total at a Glance More than 98,109 4 million employees customers served in our at January 31, 2017 service stations each day after the sale of Atotech A Global Energy Leader No. -

Oil and Gas News Briefs, July 26, 2021

Oil and Gas News Briefs Compiled by Larry Persily July 26, 2021 Saudis want to be ‘last man standing’ as oil demand declines (Bloomberg; July 21) – Saudi Energy Minister Prince Abdulaziz bin Salman’s decisions after flying home from a tumultuous OPEC meeting in Vienna in March 2020 exposed a new Saudi policy — bolder, defiant of a growing global consensus on climate change, and more controlled by the royal family. They also reflected what Abdulaziz sees as his destiny: To ensure that the last barrel of oil on Earth comes from a Saudi well. As he said at a private event in June, according to a source, “We are still going to be the last man standing, and every molecule of hydrocarbon will come out.” All of this has huge implications for world energy markets. Abdulaziz, the first member of the royal family to be the kingdom’s energy minister, is the most important person in the oil market today. But a rancorous OPEC+ meeting in July showed just how difficult it’s going to be for him to consistently get his way in an era when oil-producing nations — their self-interests often in conflict — are contemplating a future of declining oil demand. Saudi Arabia’s power is under threat as the world seeks to move away from oil and other fossil fuels. Beneath the kingdom’s desert there are about 265 billion barrels of oil, worth almost $20 trillion at current prices. It’s a massive prize, but one that may be worthless someday if the global economy figures out how to keep churning without oil. -

Chevron Sustainability Report 2020

2020 corporate sustainability report for complete reporting, visit chevron.com/sustainability 2020 ESG highlights protecting the empowering getting results environment people the right way $15M climate change resilience increase in our investment advancing a lower-carbon future to address racial equity 40% of our Board were women highlighted three action areas for advancing a lower-carbon future in our Climate Change Resilience report 12 networks 2020 marked the 20th $400M anniversary of our first spent on woman- and formal employee network minority-owned businesses joined the World Bank’s Zero Routine Flaring by 2030 initiative chevron 2020 climate lobbying 40% report targeted reduction in oil carbon intensity 26% issued our first targeted reduction in climate lobbying report gas carbon intensity 51 years of our Employee Assistance Program During the pandemic, it offered virtual programs for our employees and their families, including mindfulness and yoga instruction. 40%+ joined the of outstanding common Environmental, social and governance (ESG) data WBCSD’s Value Chain Carbon are as of December 31, 2020, and exclude spend that stock represented in substantive Transparency Pathfinder is ultimately shared with our partners. ESG engagements message from our chairman and CEO In the face of this environment, our people responded with resilience, embracing adversity as an opportunity to learn and improve. Though we shared hardships, the lessons of 2020 “Over the past year, made us a better company, and strengthened our ongoing we, like every company, commitment to help advance a better future for all. navigated a world We believe energy enables modern life and powers human facing the economic and progress. -

Sustainable Energy Transition: Opportunities Abound

1 PERSPECTI VE Sustainable energy transition: opportunities abound July 2021 For investment professionals only 2 On 18 May 2021, the International Energy Agency THE UTILITIES SECTOR IS ON THE RIGHT TRACK (IEA) published its report “Net Zero by 2050. A Utility companies are setting themselves apart from oil and Roadmap for the Global Energy Sector”. The IEA was gas companies in a positive sense. This is partly due to market established in 1974 as the oil sector watchdog of differences, other shareholders and more stringent Western countries. Over the past 47 years, this regulations. agency has mainly been considered a strong The table below shows that this does not necessarily affect supporter of fossil fuels. This is precisely why its returns. The table shows returns versus the capital employed. report came as a big surprise to the oil sector, While this is only one variable and the companies shown differ politicians, climate activists and investors alike. The in size, financial strategy, activities, etc., it does show that report outlines how carbon emissions could be there are opportunities to maintain returns on investments in sustainable activities. reduced to zero by 2050. That goal can be seen as a 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 GEM necessary condition for complying with the Paris O&G Royal Dutch Climate Agreement, which aims to limit global -6.87 6.68 9.13 5.50 2.58 1.73 6.81 7.65 12.95 15.68 11.46 8.02 6.78 Shell PLC o TotalEnergies warming to 1.5 C (above pre-industrial levels). -

Optimism Returns As the Oil Majors Post Stronger Results Themes from the Oil Majors’ Q2 2021 Earnings Calls

August 2021 Optimism returns as the oil majors post stronger results Themes from the oil majors’ Q2 2021 earnings calls The oil majors reported results for the calls. This remained the case despite the US- second quarter that were typically ahead of based companies being asked fewer questions expectations. Compared to the prior quarter, on the theme this period. management teams were more optimistic on the near-term outlook despite some uncertainty Top five themes from questions asked created by the spread of the Delta variant. by anlysts - number of questions that Companies expressed confidence in both the relate to a theme continuing market recovery and their underlying business performance. 0 Stronger results were widely anticipated 0 on the back of a more supportive macro 0 environment. However, the scale of the increase 20 in shareholder distributions proposed by most companies was above the level expected 10 0 by some analysts. Consequently, a significant 2 2020 2020 2020 1 2021 2 2021 Energy transition Shareholder distributions number of questions were posed around Capital allocation Portfolio optimisation commitments by the oil majors to return some Production outlook of their excess cash generation to shareholders. Analysts sought more detail on the metrics and oil price assumptions used by the companies to Policy frameworks were the main theme arrive at their dividend figure. Some companies explored by analysts, accounting for 44% of all also signalled an intention to commence share questions on the energy transition. Around half buyback programmes. These companies fielded of these questions focused on the European questions on the split between dividends Commission’s 'fit for 55' package of proposals and buybacks going forward and any upside aimed at reducing its greenhouse gas emissions distribution potential if oil prices trend above by 55% by 2030. -

Table of Contents Accounting Auditor

Chevron 2021 annual stockholders meeting – additional questions June 16, 2021 We addressed as many questions during the meeting as time permitted. Responses to other questions are below. A summary or an answer to a question that represents the others has been used where we received multiple inquires on the same topic. We appreciate hearing from our investors. table of contents accounting auditor ..................................................................................................................... 2 advocacy .................................................................................................................................. 2 annual stockholders meeting ........................................................................................................ 2 Board of Directors ..................................................................................................................... 2 China ....................................................................................................................................... 5 climate change and energy transition............................................................................................. 5 climate change litigation ............................................................................................................. 8 corporate headquarters................................................................................................................ 8 COVID-19............................................................................................................................... -

10.30% Pa JB Callable Multi Barrier

INDICATIVE KEY INFORMATION – 26 JULY 2021 1/10 10.30% P.A. JB CALLABLE MULTI BARRIER REVERSE CONVERTIBLE (65%) ON REPSOL SA, TOTALENERGIES SE, ROYAL DUTCH SHELL PLC (the "Products") SSPA SWISS DERIVATIVE MAP© / EUSIPA DERIVATIVE MAP© BARRIER REVERSE CONVERTIBLE (1230) CONTINUOUS BARRIER OBSERVATION – CASH SETTLEMENT – EUR – QUARTERLY CALLABLE This document is for information purposes only and until the Initial Fixing Date the terms are indicative and may be amended. A Product does not constitute a collective investment scheme within the meaning of the Swiss Federal Act on Collective Investment Schemes. Therefore, it is not subject to authorisation by the Swiss Financial Market Supervisory Authority FINMA ("FINMA") and potential investors do not benefit from the specific investor protection provided under the CISA and are exposed to the credit risk of the Issuer. I. Product Description Terms Swiss Security 112475275 Coupon 10.30% p.a. Number (Valor) Initial Fixing Date: 29 July 2021, being the date on which the ISIN CH1124752754 Initial Level and the Strike and the Barrier are fixed. Symbol MEQVJB Issue Date/Payment Date: 05 August 2021, being the date on which the Products are issued and the Issue Price is paid. Issue Size up to EUR 20,000,000 (may be increased/ decreased at any time) Final Fixing Date: 29 July 2022, being the date on which the Final Level will be fixed. Subscription Period 26 July 2021 – 29 July 2021, 16:00 CET Last Trading Date: 29 July 2022, until the official close on the SIX Swiss Exchange, being the last date on which the Products Issue Currency EUR may be traded. -

Notice of Meeting COMBINED SHAREHOLDERS' MEETING 2021 Friday May 28, 2021 at 10:00 Am As a Closed Session at the Company's Registered Office

Notice of meeting COMBINED SHAREHOLDERS' MEETING 2021 Friday May 28, 2021 at 10:00 am As a closed session at the Company's registered office Documents covered by Article R. 225-81 of the French Commercial Code SUMMARY 3 MESSAGE from the Chairman and CEO 4 AGENDA of the Combined Shareholders' Meeting 5 How to VOTE 9 2020 RESULTS Key figures and outlook 14 COMPOSITION of the Board of Directors of TOTAL SE 16 Board of Directors’ report on the proposed RESOLUTIONS 29 Proposed RESOLUTIONS 02 I TOTAL Combined Shareholders’ Meeting 2021 MESSAGE from the Chairman and CEO Dear Madam/Sir, Dear Shareholders, For the second year running, your Annual Shareholders’ Meeting will be held in a closed session at the Company headquarters on Friday, May 28, 2021 at 10 am. We have no other choice, given that the emergency health situation owing to the Covid-19 pandemic has been extended until June 01, and that the ultimate priorities are to ensure that you are not exposed to any health risks, and to guarantee everyone equal access to the Shareholders’ Meeting. In 2020, your commitment to supporting the resolutions approved by your Board of Directors and your high level of participation (over 500 questions asked ahead of the Shareholders’ Meeting and live), proved that shareholder democracy thrives in your Company. Once again this year, we are doing our utmost to make remote attendance easy for you: Ý Ahead of the Shareholders’ Meeting, we invite you to vote either via Internet using the simple and secure system, or via postal mail. -

A Case Study of Chevron Nigeria

Investing in Fragile Contexts: A Case Study of Chevron Nigeria Background to Chevron in Nigeria: Chevron is one of the world's leading integrated energy companies. Its roots go back to the formation of Pacific Coast Oil Company in 1876. That company later became Standard Oil Company of California and, subsequently, Chevron Corporation. Chevron acquired Gulf Oil Corporation in 1984, merged with Texaco (formerly The Texas Fuel Company, formed in Beaumont, Texas, in 1901) in 2001 and acquired Unocal in 2005. These mergers and acquisitions have strengthened Chevron's position as an energy industry leader, increasing its crude oil and natural gas assets around the world. Chevron is involved in virtually every facet of the energy industry. It has a diverse and highly skilled global workforce of approximately 64,700 employees. Its business operations traverse 100 countries. In 2014, Chevron's average net production was 2.571 million oil-equivalent barrels per day. About 74 percent of that production occurred outside the United States. At the end of 2014, Chevron had a global refining capacity of 1.9 million barrels of oil per day. Challenges: Nigeria is the most populous country in Africa and has the largest economy on the continent. It has an estimated population of 170million people who are from different ethnic backgrounds and speak more than 200 languages. The country has a high rate of unemployment and poverty, and outbreaks of violent, inter-ethnic conflicts are rife. Governance and transparency is sometimes a challenge. Nigeria gained its independence from Great Britain in October, 1960 and Chevron arrived in the country a year after. -

Conference Preview Register Today for In-Person Or Virtual Attendance

Held under the patronage of His Highness Sheikh Hamdan Bin Mohammed Bin Rashid Al Maktoum Crown Prince of Dubai, United Arab Emirates Host Organisation SPE Annual Technical Conference and Exhibition (ATCE) The New Oil and Gas Journey: Agility, Innovation, and Value Creation Dubai World Trade Centre 21–23 September 2021 United Arab Emirates www.atce.org Conference Preview Register today for in-person or virtual attendance Destination Partner Official Airline About ATCE 2021 2 Committees 3 Conference General Chair Ali Al Jarwan Ali Al Jarwan Dragon Oil ATCE Conference General Chair CEO Dragon Oil Executive Advisory Committee Chair Executive Advisory Committee Vice Chair Shauna Noonan Tom Blasingame 2020 SPE President 2021 SPE President Texas A&M University The most vibrant, novel, and futuristic city of Occidental Petroleum the world, Dubai, is once again proudly hosting the SPE Annual Technical Conference and Exhibition Programme Committee Chair Programme Committee Vice Chair Fareed Abdulla AlHashmi Andrei Popa (ATCE), a place where progressive thinking turns Dragon Oil Chevron into unique and innovative technologies benefitting both regional and global companies, who are Executive Advisory Committee determined to continue serving humanity with net-zero impact on our precious environment. Sharif Abadir Khalid bin Hadi Leonardo Stefani ATCE in Dubai is positioned to attract the best in TAQA Siemens Energy Eni the oil and gas industry so don’t miss this unique Ibrahim Al Alawi Thomas Burke Phongsthorn Thavisin opportunity where you will be able to witness, AlMansoori Specialized Valaris PTT Exploration and Production discuss, and benefit from this world-class event and Engineering Toshikazu Ebato Public Company Limited (PTTEP) at the same time visit the EXPO 2020 with plenty of Abdulaziz O.