Interim Financial Statements 8

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

12. BANKING 12.1 Scheduled Banks Operating in Pakistan Pakistani Banks

12. BANKING 12.1 Scheduled Banks Operating in Pakistan Pakistani Banks Public Sector Banks Nationalized Banks 1. First Women Bank Limited 2. National Bank of Pakistan Specialized Banks 1. Industrial Development Bank of Pakistan (IDBP) 2. Punjab Provincial Co-operative Bank Limited (PPCB) 3. Zarai Traqiati Bank Limited 4. SME Bank Ltd. Provincial Banks 1. The Bank of Khyber 2. The Bank of Punjab Private Domestic Banks Privatized Bank 1. Allied Bank of Pakistan Limited 2. Muslim Commercial Bank Limited 3. United Bank Limited 4. Habib Bank Ltd. Private Banks 1. Askari Commercial Bank Limited 2. Bank Al-Falah Ltd. 3. Bank Al-Habib Ltd. 4. Bolan Bank Ltd. 5. Faysal Bank Ltd. 6. KASB Bank Limited 7. Meezan Bank Ltd. 8. Metropolitan Bank Ltd 9. Prime Commercial Bank Ltd. 10. PICIC Commercial Bank Ltd. 11. Saudi-Pak Commercial Bank Limited 12. Soneri Bank Ltd. 13. Union Bank Ltd. Contd. 139 12.1 Scheduled Banks Operating in Pakistan Private Banks 14. Crescent Commercial Bank Ltd. 15. Dawood bank Ltd. 16. NDLC - IFIC Bank Ltd. Foreign Banks 1. ABN AMRO Bank NV 2. Al-Baraka Islamic Bank BSC 3. American Express Bank Ltd. 4. Citi Bank NA 5. Deutsche Bank AE 6. Habib Bank AG Zurich 7. Oman International Bank SAOG 8. Rupali Bank Ltd 9. Standard Chartered Bank Ltd. 10. The Bank of Tokyo-Mitsubishi Ltd. 11. The Hong Kong & Shanghai Banking Corporation Ltd. Source: SBP Note: Banks operating as on 30th June, 2004 140 12.2 State Bank of Pakistan - Assets of the Issue Department (Million Rupees) Last Day of June Particulars 2003 2004 2005 Total Assets 522,891.0 611,903.7 705,865.7 1. -

MONEY and CREDIT HIGHLIGHTS Stock As on End June (Rs Million) Items / Years 2006 2007 A

MONEY AND CREDIT HIGHLIGHTS Stock as on end June (Rs million) Items / Years 2006 2007 A. Components of Monetary Assets Currency in Circulation 740,390 840,181 Demand Deposits 1,085,665 2,643,778 Other Deposits 4,931 7,012 (M1)a 1,830,986 3,490,971 Time Deposits 1,380,418 366,872 Foreign Currency Deposits 195,501 207,312 Total Monetary Assets (M2)b 3,406,905 4,065,155 I. Public Sector Borrowing (Net) 833,686 926,530 - Budgetary Support 708,037 810,053 - Commodity Operation 107,762 98,552 - Effect of Zakat etc. (14,308) (14,269) - Privatization proceeds 37,657 37,657 II. Non-Government Sector 2,190,769 2,576,474 - Autonomous Bodies 36,979 58,148 - Private Sector (Net) 2,153,790 2,518,326 a. Private Sector 2,113,890 2,479,608 b. Public Sector Corporation 47,237 46,010 c. PSEs Special Accounts Debt (23,225) (23,478) Repayment with SBP d. Organization Institution 15,889 16,187 (SBP credit to NBFIs) III. Other Item (Net) (327,346) (422,223) IV. Domestic Credit 2,696,564 3,080,263 V. Foreign Assets (Net) 710,341 984,892 VI. Monetary Assets (M2)b 3,406,905 4,065,155 TABLE 5.1 COMPONENTS OF MONETARY ASSETS (Rs million) Stocks at end June (a) 2000 2001 2002 2003 2004 2005 2006 2007 (P) 1. Currency Issued 376,997 396,548 462,095 527,557 617,508 712,480 791,834 901,401 2. Currency held by SBP 1,851 1,905 1,865 2,565 2,960 3,107 3,005 3,148 3. -

Faysal Funds

Accounts forthe Quarter Ended September 30, 2008 FAYSAL BALANCED GROWTH FUND The Faysal Balanced Growth Fund (FBGF) is an open-ended mutual fund. The units of FBGF are listed on the Karachi Stock Exchange and were initially offered to the public on April 19, 2004. FBGFseeks to provide long-term capital appreciation with a conservative risk profile and a medium to long-term investment horizon. FBGF's investment philosophy is to provide stable returns by investing in a portfolio balanced between equities and fixed income instruments. Fund Information Management Company Faysal Asset Management Limited Board of Directors of the Management Company Mr. Khalid Siddiq Tirmizey, Chairman Mr. Salman Haider Sheikh, Chief Executive Officer Mr. Sanaullah Qureshi, Director Mr. Syed Majid AIi, Director Mr. Feroz Rizvi, Director CFO of the Management Company Mr. Abdul Razzak Usman Company Secretary of the Management Company Mr. M. Siddique Memon Audit Committee Mr. Feroz Rizvi, Chairman Mr. Sanaullah Qureshi, Member Mr. Syed Majid Ali, Member Trustee Central Depository Company of Pakistan Limited Suit #. M-13, 16, Mezzanine Floor, Progressive Plaza, Beaumont Road, Near PIDC House, Karachi. Bankers to the Fund Faysal Bank Limited MCB Bank Limited Bank Alfalah Limited Atlas Bank Limited The Bank of Punjab Auditors Ford Rhodes Sidat Hyder & Co., Chartered Accountants Legal Advisor Mohsin Tayebely & Co., 2nd Floor, Dime Centre, BC-4, Block-9, KDA-5, Clifton, Karachi. Registrars Gangjees Registrar Services (Pvt) Limited Room # 506, 5th Floor, Clifton Centre, Kehkashan Clifton - Karachi. Distributors Access Financial Services (Pvt.) Ltd. AKD Securities (Pvt.) Limited Faysal Asset Management Limited Faysal Bank Limited PICIC Commercial Bank Limited Reliance Financial Products (Pvt.) Limited Invest Capital & Securities (Pvt.) Limited Flow(Private) Limited IGI Investment Bank Limited Pak Oman Investment Bank Limited Alfalah Securities (Pvt) Limited JS Global Capital Limited t"''' e , FAYSAL BALANCED ~ . -

Prospectus, Especially the Risk Factors Given at Para 4.11 of This Prospectus Before Making Any Investment Decision

ADVICE FOR INVESTORS INVESTORS ARE STRONGLY ADVISED IN THEIR OWN INTEREST TO CAREFULLY READ THE CONTENTS OF THIS PROSPECTUS, ESPECIALLY THE RISK FACTORS GIVEN AT PARA 4.11 OF THIS PROSPECTUS BEFORE MAKING ANY INVESTMENT DECISION. SUBMISSION OF FALSE AND FICTITIOUS APPLICATIONS ARE PROHIBITED AND SUCH APPLICATIONS’ MONEY MAY BE FORFEITED UNDER SECTION 87(8) OF THE SECURITIES ACT, 2015. SONERI BANK LIMITED PROSPECTUS THE ISSUE SIZE OF FULLY PAID UP, RATED, LISTED, PERPETUAL, UNSECURED, SUBORDINATED, NON-CUMULATIVE AND CONTINGENT CONVERTIBLE DEBT INSTRUMENTS IN THE NATURE OF TERM FINANCE CERTIFICATES (“TFCS”) IS PKR 4,000 MILLION, OUT OF WHICH TFCS OF PKR 3,600 MILLION (90% OF ISSUE SIZE) ARE ISSUED TO THE PRE-IPO INVESTORS AND PKR 400 MILLION (10% OF ISSUE SIZE) ARE BEING OFFERED TO THE GENERAL PUBLIC BY WAY OF INITIAL PUBLIC OFFER THROUGH THIS PROSPECTUS RATE OF RETURN: PERPETUAL INSTRUMENT @ 6 MONTH KIBOR* (ASK SIDE) PLUS 2.00% P.A INSTRUMENT RATING: A (SINGLE A) BY THE PAKISTAN CREDIT RATING COMPANY LIMITED LONG TERM ENTITY RATING: “AA-” (DOUBLE A MINUS) SHORT TERM ENTITY RATING: “A1+” (A ONE PLUS) BY THE PAKISTAN CREDIT RATING AGENCY LIMITED AS PER PSX’S LISTING OF COMPANIES AND SECURITIES REGULATIONS, THE DRAFT PROSPECTUS WAS PLACED ON PSX’S WEBSITE, FOR SEEKING PUBLIC COMMENTS, FOR SEVEN (7) WORKING DAYS STARTING FROM OCTOBER 18, 2018 TO OCTOBER 26, 2018. NO COMMENTS HAVE BEEN RECEIVED ON THE DRAFT PROSPECTUS. DATE OF PUBLIC SUBSCRIPTION: FROM DECEMBER 5, 2018 TO DECEMBER 6, 2018 (FROM: 9:00 AM TO 5:00 PM) (BOTH DAYS INCLUSIVE) CONSULTANT TO THE ISSUE BANKERS TO THE ISSUE (RETAIL PORTION) Allied Bank Limited Askari Bank Limited Bank Alfalah Limited** Bank Al Habib Limited Faysal Bank Limited Habib Metropolitan Bank Limited JS Bank Limited MCB Bank Limited Silk Bank Limited Soneri Bank Limited United Bank Limited** **In order to facilitate investors, United Bank Limited (“UBL”) and Bank Alfalah Limited (“BAFL”) are providing the facility of electronic submission of application (e‐IPO) to their account holders. -

A Case of Pakistan's Banking Sector

Business Review Volume 9 Issue 2 July-December 2014 Article 3 7-1-2014 Wealth effect of mergers & acquisitions in emerging market: A case of Pakistan’s banking sector Sana Tauseef Institute of Business Administration Karachi, Pakistan Mohammad Nishat Institute of Business Administration Karachi, Pakistan Follow this and additional works at: https://ir.iba.edu.pk/businessreview Part of the Business Analytics Commons, Business and Corporate Communications Commons, Corporate Finance Commons, and the Finance and Financial Management Commons This work is licensed under a Creative Commons Attribution 4.0 International License. iRepository Citation Tauseef, S., & Nishat, M. (2014). Wealth effect of mergers & acquisitions in emerging market: A case of Pakistan’s banking sector. Business Review, 9(2), 24-39. Retrieved from https://ir.iba.edu.pk/ businessreview/vol9/iss2/3 This article is brought to you by iRepository for open access under the Creative Commons Attribution 4.0 License. For more information, please contact [email protected]. https://ir.iba.edu.pk/businessreview/vol9/iss2/3 Business Review – Volume 9 Number 2 July – December 2014 ARTICLE WEALTH EFFECT OF MERGERS & ACQUISITIONS IN EMERGING MARKET: A CASE OF PAKISTAN’S BANKING SECTOR Sana Tauseef, Institute of Business Administration Karachi, Pakistan Mohammad Nishat, Institute of Business Administration Karachi, Pakistan Abstract This study investigates the short-term market response associated with the announcement of seven merger and acquisition deals in the banking sector of Pakistan during the period 2003 to 2008 using the event study methodology. The results indicate statistically significant investor reactions around the merger announcements. For individual target and bidder banks, the cumulative abnormal returns (CARs) range from significant positive to significant negative. -

Bulletin 21 Aug 07.FH10

July - August, 2007 Contents § Editors Corner ii § Abstract of the Bulletin 4 § Mutual Funds Development Pakistan Perspective 5 § Introduction to Mutual Fund Industry in Pakistan 8 § Prospects of Local Mutual Funds Industry 10 § Monetary Policy Statement July-December 2007 Key Features 12 § Monetary Policy Implications for the Banking Sector 14 § Trade Policy 2007-08 Highlights 15 § Performance of Microfinance Banks Operating in Pakistan 17 § Market Analysis 18 § Commercial Banks Listed on KSE at a Glance 22 § Book Reviews 23 § Pakistan Economy Key Economic Indicators 24 NBP Performance at a Glance July - August, 2007 Editors Corner Dear Readers, Pakistan celebrated 60 years of independence on August 14, 2007. The journey the nation has traversed during the last six decades has been both of achievement and difficulties. Each decade has had its challenges, success and disappointments. Various economic policies and planning processes have been pursued, giving a direction/determining the course of the economy. These policy changes have had far reaching economic consequences. Some have benefitted the economy and supported in the growth of the sub-sectors, while others have had unfavourable consequences for the different segments of the economy/population. The initial years were a period of adjustment for the new nation, with the government shouldering the task of settling the people and building an economic base. Considerable economic growth and development took place in the decade of the 60s, with significant increases in industrial and agricultural production and in the different sectors of the economy. This was despite many constraints and hurdles. It was a period when the public sector played a significant role of a facilitator and director, encouraging the private sector to come forward. -

Maple Leaf Cement Factory Limited Annual Report 2001

Maple Leaf Cement Factory Limited Annual Report 2001 Contents Company Information Notice of Meeting Directors' Report Five Years Summary Auditors' Report Balance Sheet Profit and Loss Account Cash Flow Statement Statement of Equity Notes To The Accounts Pattern of Shareholding COMPANY INFORMATION Board of Directors Auditors Mr. Tariq Sayeed Saigol Ford, Rhodes, Robson, Morrow Chairman/Chief Executive Chartered Accountants Mr. Aamir Fayyaz Sheikh Legal Advisors Mr. Sayeed Tariq Saigol 1. Cornelius Lane and Mufti Mr. Waleed Tariq Saigol Advocates & Solicitors, Mr. Zamiruddin Azar Lahore. Rana Muhammad Hanif 2. Mr. Nomaan Akram Raja Mr. Muhammad Riyaz Husain Bokhari Barrister-At-Law (Representing FLS & IFU, Denmark) Raja Mohammad Akram & Co. Mr. Mahmood Ahmed Advocates and Legal Consultants, (Representing Crescent Investment Bank Ltd.) Lahore. Company Secretary Registered Office Mr. Mohammad Sharif 42-Lawrence Road, Lahore. Phone: (042) 6278904-5 Bankers of the Company Fax: (042) 6363184 Muslim Commercial Bank Limited E-mail: [email protected] The Bank of Punjab Allied Bank of Pakistan Limited Factory Soneri Bank Limited Iskanderabad Distt. Mianwali. Habib Bank Limited Phones: (0459) 392237-8 PICIC Commercial Bank Limited United Bank Limited National Bank of Pakistan NOTICE OF THE ANNUAL GENERAL MEETING Notice is hereby given that the 41st Annual General Meeting of the members of Maple Leaf Cement Factory Limited will be held at its Registered Office, 42-Lawrence Road, Lahore on Wednesday, 26th December, 2001 at 10:30 A.M. to transact the following business: 1) To confirm the minutes of last General Meeting. 2) To receive and adopt Audited Accounts of the Company for the year ended June 30, 2001 together with Auditors' and Directors' Reports thereon. -

Maryam Naeem MC080202354 MBA (HRM)

Maryam Naeem MC080202354 MBA (HRM) National Bank of Pakistan Civil line branch Gujranwala Brief Introduction of NBP Overview Business volume Competitors Overview of National Bank of Pakistan “One way to keep momentum going is to have constantly greater goals” National Bank o f Pakistan was established on November 9, 1949 as a semi public commercial bank. The main purpose of the National Bank of Pakistan at its initial stage was to extend credit to the agriculture sector. At that time the crises were on their peak so the main purpose of National Bank of Pakistan was to face the problems that had arisen with regar d to financing of jute trade. Overview… National Bank started its functions on November 20, 1949 with its very important eight jute centers in the East Pakistan. Mr.Ghulam Farooq was announced the first chairman of Jute Board and Mumtaz Hassan was announced the first chairman of National Bank of Pak istan. National Bank of Pakistan was remained totally under the Jute Operations till 1950. The first M.D of the National Bank of Pakistan was Mr. M.A. Muhajir. In 1952 Governor of State Bank of Pakistan decided to replace Imperial Bank of India by National Bank of Pakistan. Overview… By becoming Mr. Mumtaz Hassan the MD of NBP, the number of branches, deposits and the number of employees had increased significantly as compare earlier, it was all happen by the great struggle of Mr. Mumtaz Hussan. to 2.31 billion, and staff to 14, 963. Up to 1965, the shareholders had received 225% of their original investment. -

Effectiveness of Pakistani Banks After Merger and Acquisition

onomics Ec & of M l a a n n r a g u e o Ullah et al., Int J Econ Manag Sci 2015, 5:1 m J l e a n International Journal of Economics & n t DOI: 10.4172/2162-6359.1000311 o S i t c a i e n n r c e t e n s I ISSN: 2162-6359 Management Sciences ResearchResearch Article Article OpenOpen Access Access Effectiveness of Pakistani Banks after Merger and Acquisition Muhammad Rizwan Ullah1*, Muhammad Azam2, Muhammad Awais1 and Mamoona Majeed3 1Department of Banking and Finance, Government College University Faisalabad, Pakistan 2Department of Business Administration, Virtual University Islamabad, Pakistan 3Department of Commerce and Finance, Superior University Lahore, Pakistan Abstract The aim of merger of banks is to increase the value of banks in one way or another. The days of globalization and liberalization are in and there is a rash of merger and acquisition which is sweeping the corporate world. Consolidation in banking industry should essentially be synergy-driven to obtain a quantum leap in the effectiveness of the merged entity. It can be attained by merging complementary strength, serving a greater number of customers in a good way with more differentiated skills and products, giving a well geographical spread, comprising the cost of combined entity, better utilization of available resources, recognizing the opportunities for cross selling, deriving economies of scale and reduced competition. Over the last span, the banking industry in Pakistan has not only grown-up in terms of size but also consolidated, matured and diversified to contribute towards constructing a strong financial system. -

Group Sustainability Report 2019

Group Sustainability Report 2019 Group Sustainability Report 2019 Contents Sir Sultan Chinoy 04 Note from International Steels Limited Waste Management 48 Shareholders 58 CEO – Mr. Yousuf H. Mirza 34 Amir S. Chinoy 06 Finished Goods and Delivery 49 Suppliers 59 International Steels Limited (ISL) Group Companies 08 Environmental Compliance 50 Society 59 Company Overview 35 Group Values and Culture 08 Sustainability Indicators 35 Environmental Impact Goals 51 Health 60 Group Code of Conduct 10 OHSE Awards 35 III. Social Impact 53 Education 61 A Historical Perspective 12 Circular Economy 36 Internal Stakeholders 53 Education for the Underprivileged 61 Introductory Note from our Advisor, I. Economic Impact 38 Talent Acquisition 53 Vocational Training 62 Mr. Towfiq H. Chinoy 14 Statement of Value Addition 39 Diversity 53 Art and Architectural Community 62 Certifications 16 VIS Ratings 40 Compensation and Benefits 54 Social Welfare 65 External Associations 20 Economic Impact Goals 40 Employee Engagement 54 Prevention of Unethical Activities 65 UNDP Sustainable Development Goals 21 II. Environmental Impact 42 Health and Safety 55 Social Impact Goals 65 Note from International Industries Supply Chain 44 Trainings 56 Ending Comments 66 Limited CEO - Mr. Riyaz T. Chinoy 32 Raw Material and Energy Right to Collective Bargaining 58 International Industries Limited (IIL) Requirements 45 External Stakeholders 58 Company Overview 33 Production Planning 46 Customers 58 Sustainability Indicators 33 Production Process 47 OHSE Awards 33 Reporting Methodology The data collected in this report was collected from primary sources that included in our Group’s internal and external stakeholders. The Global Reporting Initiatives (GRI) indexes have been used as a guideline to create this report. -

Audited Financial Statements 2007

Askari Bank Limited Financial Statements 2007 53 Financial Statements of Askari Bank Limited (formerly Askari Commercial Bank Limited) for the year ended December 31, 2007 Askari Bank Limited Annual Report 2007 54 Financial Statements 2007 55 Statement of Compliance with the Code of Corporate Governance for the year ended December 31, 2007 This statement is being presented to comply with the Prudential Regulation No.XXIX, responsibilities of the Board of Directors, issued vide BSD Circular No.15, dated June 13, 2002 and the Code of Corporate Governance as contained in Listing Regulations of the stock exchanges where the Bank’s shares are listed for the purpose of establishing a framework of good governance, whereby a listed company is managed in compliance with the best practices of corporate governance. The Bank has applied the principles contained in the Code in the following manner: 1. The Bank encourages representation of independent non-executive directors and directors representing minority interests on its Board of Directors. At present the Board includes at least 11 non-executive Directors of which 3 independent Directors represent minority shareholders. 2. The Directors have confirmed that none of them is serving as a director in more than ten listed companies, including Askari Bank Limited (formerly, Askari Commercial Bank Limited), except Mr. Tariq Iqbal Khan who has been exempted for the purpose of this clause by the Securities and Exchange Commission of Pakistan (SECP). 3. All the resident directors of the Bank are registered as taxpayers and none of them has defaulted in payment of any loan to a banking company, a DFI or an NBFI or, being a member of a stock exchange, has been declared as a defaulter by that stock exchange. -

1St QUARTER ENDED SEPTEMBER 30, 2016

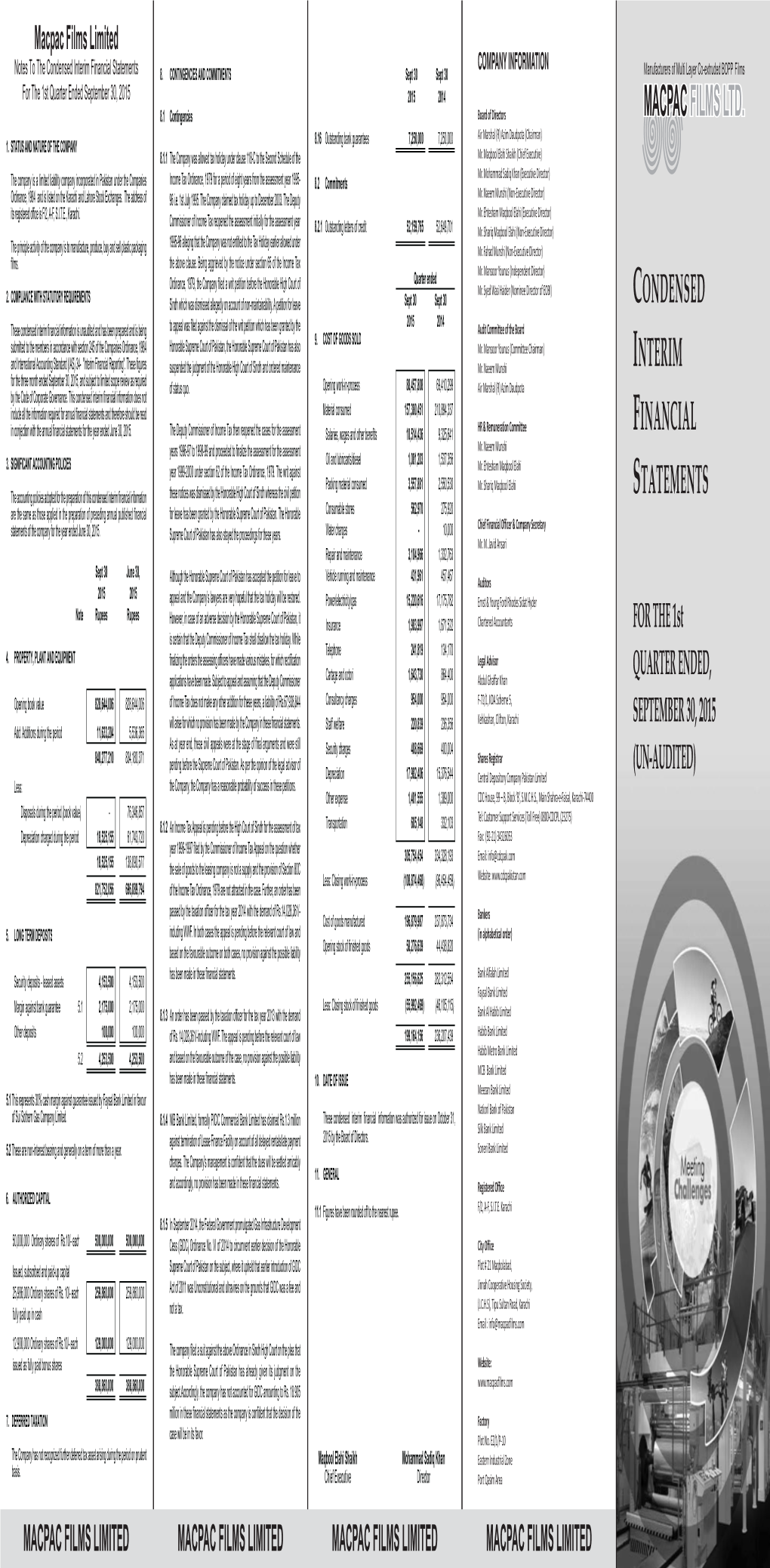

7.1.6 In December 2015, High Court of Sindh impugned the insertion of Tariff Heading NOTES TO THE CONDENSED INTERIM FINANCIAL STATEMENTS 7. CONTINGENCIES AND COMMITMENTS COMPANY INFORMATION 9830.0000 in the second schedule to the Sindh Sales Tax on Services Act 2011, FOR THE 1st QUARTER ENDED SEPTEMBER 30, 2016 7.1 Contingencies through the Finance Act 2013. and subsequent show cause notice issued by the Board of Directors 1. The Company and its Operations Sindh Revenue Board as "Services provided in the matter of manufacturing or Air Marshal Azim Daudpota (Chairman) 7.1.1 The Company was allowed tax holiday under clause 118-C to the Second Schedule processing for others on toll basis. of the Income Tax Ordinance, 1979 for a period of eight years from the assessment Mr. Maqbool Elahi Shaikh (Chief Executive) Macpac Films Limited (the Company) was incorporated on August 19, 1993, in Mr. Mohammad Sadiq Khan (Executive Director) Pakistan as a limited liability company under the Companies Ordinance, 1984 and is year 1995-96 i.e. 1st July 1995. The Company claimed tax holiday up to December The Company filed a suit before the Honourable High Court of Sindh and court 2003. The Deputy Commissioner of Income Tax reopened the assessment initially for Mr. Naeem Munshi (Non-Executive Director) listed on the Pakistan Stock Exchange Limited. The registered office of the Company granted an ad interim order in favour of Company, which is still in Operation, The suit Mr. Ehtesham Maqbool Elahi (Executive Director) is situated at F/2, A – F, S.I.T.E, Karachi, Pakistan and city office is at Plot# 21 the assessment year 1995-96 alleging that the Company was not entitled to the Tax is still pending befor the High Court of Sindh and Company has reasonable Holiday earlier allowed under the above clause.