Full Page Fax Print

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

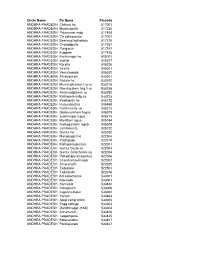

Post Offices

Circle Name Po Name Pincode ANDHRA PRADESH Chittoor ho 517001 ANDHRA PRADESH Madanapalle 517325 ANDHRA PRADESH Palamaner mdg 517408 ANDHRA PRADESH Ctr collectorate 517002 ANDHRA PRADESH Beerangi kothakota 517370 ANDHRA PRADESH Chowdepalle 517257 ANDHRA PRADESH Punganur 517247 ANDHRA PRADESH Kuppam 517425 ANDHRA PRADESH Karimnagar ho 505001 ANDHRA PRADESH Jagtial 505327 ANDHRA PRADESH Koratla 505326 ANDHRA PRADESH Sirsilla 505301 ANDHRA PRADESH Vemulawada 505302 ANDHRA PRADESH Amalapuram 533201 ANDHRA PRADESH Razole ho 533242 ANDHRA PRADESH Mummidivaram lsg so 533216 ANDHRA PRADESH Ravulapalem hsg ii so 533238 ANDHRA PRADESH Antarvedipalem so 533252 ANDHRA PRADESH Kothapeta mdg so 533223 ANDHRA PRADESH Peddapalli ho 505172 ANDHRA PRADESH Huzurabad ho 505468 ANDHRA PRADESH Fertilizercity so 505210 ANDHRA PRADESH Godavarikhani hsgso 505209 ANDHRA PRADESH Jyothinagar lsgso 505215 ANDHRA PRADESH Manthani lsgso 505184 ANDHRA PRADESH Ramagundam lsgso 505208 ANDHRA PRADESH Jammikunta 505122 ANDHRA PRADESH Guntur ho 522002 ANDHRA PRADESH Mangalagiri ho 522503 ANDHRA PRADESH Prathipadu 522019 ANDHRA PRADESH Kothapeta(guntur) 522001 ANDHRA PRADESH Guntur bazar so 522003 ANDHRA PRADESH Guntur collectorate so 522004 ANDHRA PRADESH Pattabhipuram(guntur) 522006 ANDHRA PRADESH Chandramoulinagar 522007 ANDHRA PRADESH Amaravathi 522020 ANDHRA PRADESH Tadepalle 522501 ANDHRA PRADESH Tadikonda 522236 ANDHRA PRADESH Kd-collectorate 533001 ANDHRA PRADESH Kakinada 533001 ANDHRA PRADESH Samalkot 533440 ANDHRA PRADESH Indrapalem 533006 ANDHRA PRADESH Jagannaickpur -

F:\Rank Lists 2010-2015 of Care

1 SMITHA IB KALLARA 3 HENA R RAJ (1st Rank by mark) ATTINGAL 4 SUMEESH N S KADAKKAVOOR 5 JOY J SARASAM TRIVANDRUM 7 ARUN KUMAR D POTHENCODE 8 ARATHI P A KATTAIKONOM 9 BEENA AS ATTINGAL 13 MINI BS THATTAKKADU 17 SREEJA M. PILLAI ALTHARAMOODU 25 SREEVIDYA S CHIRAYINKIL 26 PRAVEEN P KILIMANOOR 29 FAROOK S HAMEED VARKALA 30 LEEMA S KILIMANOOR 35 LAKSHMI UR VATTIYOORKAVU 44 DHANYA P NAIR VENJARAMOOD 51 ANIL KUMAR T KALLAMBALAM 53 DIVYA T RAJ KADAKKAVOOR 58 ARCHANA SM EDACKODE 58 APARNA LR THONNAKKAL 61 SAVITHA SV CHANTHAVILA 66 NAYANTHARA V ANAYARA 69 SABITA IR KALLAMBALAM 70 SHAILAKUMARI M CHIRAYINKIL 71 NIMITHA N KADAVILA 71 NYCY S NAGAROOR 84 REENAS M MANGALAPURAM 86 BEENA S ATTINGAL 93 PADMA PRIYA SB KAZHAKUTTOM 98 PREENA R S IRULOOR 114 SUNIL KUMAR S PULIMATH 116 JAPIN KS PULIMATH 127 JOYMOL ATTINGAL 131 SHENA U S ATTINGAL 134 SOUMYA SS VAMANAPURAM 136 RATHEESH B R CHIRAYINKIL 142 VEENA V KILIMANOOR 145 RIJIN MS KAVALAYOOR 148 PREGIL LAL P V AYIROOPPARA 160 SUNU A KODUVAZHANNOOR 166 LEKHA ML CHIRAYINKIL 175 GEETHU VIJAYAN OYOOR 176 AKHILA V R VATTIYOORKAVU 176 NEETHU M S ATTINGAL 182 LALU J L VARKALA 187 AKHILA R ARAYALOOR 188 SIMNA K VENGODE 190 BEENA L ELAMKULAM 196 NAUSHAD HUSSAIN A PUTHUKULANGARA 197 DIPINKUMAR K AVANAVANCHERY 198 REJI KP CHIRAYINKIL 203 SANDEEP S VAKKANADU 204 ANJANA PS CHIRAYINKIL 211 LATHIKA P ATTINGAL 214 BIJU MS PARAVOOR 215 NEETHA SATHEESAN CHIRAYINKEEZHU 215 ARYA DEV U POTHENCODE 216 HIMA KRISHNAN U S ALIYADU 218 SHYNIDAS S R VILAYIL MOOLA 219 ASHA S MOHAN KOLLAM 220 ASWATHY S KANNAMBA 220 SREEJA C R VARKALA -

[email protected]

INDIAN OVERSEAS BANK ANOOPARA BRANCH MMH BUILDING, ANOOPARA ROAD AVANAVANCHERRY Ph-0470-2632315, 2632568 E mail: [email protected] A/c: Radhakrishnan Nair B ---------------------------------------------------------------------- TENDER/BID DOCUMENT --------------------------------------------------------- (For e- auction) Authorised Officer Indian Overseas Bank Regional Office IOB Buildings, M G Road Trivandrum- 695 0001 Phone: 0471-2471571, 2478218 Email- [email protected] INDIAN OVERSEAS BANK ANOOPARA BRANCH E-AUCTION SALE NOTICE SALE OF IMMOVABLE PROPERTY MORTGAGED TO THE BANK UNDER THE SECURITISATION AND RECONSTRUCTION OF FINANCIAL ASSETS AND ENFORCEMENT OF SECURITY INTEREST ACT, 2002 Whereas Mr.Radhakrishnan Nair B has borrowed monies from Indian Overseas Bank against the mortgage of the immovable properties more fully described in the schedule hereunder and on upon classification of the account as NPA, the Bank has issued a demand notice under Section 13(2) of the SARFAESI Act, 2002 (Act) on 04.09.2018 to Mr.Radhakrishnan Nair B, S/o.Balakrishna Pillai, Karthi Bhavan, Avanavancherry PO, Chirayinkeezhu to pay the amount due to the Bank, being Rs.10,83,715/- as on 04.09.2018 together with further interest at contractual rates and rests along with costs, charges etc till date of repayment within 60 days from the date of receipt of the said notice. Whereas the borrowers & guarantors having failed to pay the amount dues in full to the Bank as called for in the said demand notice, the Bank has taken possession of the secured assets more fully described in the schedule hereunder on 08.05.2019 under Section 13 (4) of the Act with the right to sell the same in “As is where is” and “As is what is” basis under Section13(4) of the Act read with Rules 8 &9 of the Security interest (Enforcement) Rules, 2002 for realization of Bank’s dues. -

Mgl-Int-1-2013-Unpaid Shareholders List As on 31

DEMAT ID_FOLIO NAME WARRANT NO MICR DIVIDEND AMOUNT ADDRESS 1 ADDRESS 2 ADDRESS 3 ADDRESS 4 CITY PINCODE JH1 JH2 000404 MOHAMMED SHAFEEQ 27 508 30000.00 PUTHIYAVEETIL HOUSE CHENTHRAPPINNI TRICHUR DIST. KERALA DR. ABDUL HAMEED P.A. 002679 NARAYANAN P S 51 532 12000.00 PANAT HOUSE P O KARAYAVATTOM, VALAPAD THRISSUR KERALA 001431 JITENDRA DATTA MISRA 89 570 36000.00 BHRATI AJAY TENAMENTS 5 VASTRAL RAOD WADODHAV PO AHMEDABAD 382415 IN30066910088862 K PHANISRI 116 597 15900.00 Q NO 197A SECTOR I UKKUNAGARAM VISAKHAPATNAM 530032 IN30047640586716 P C MURALEEDHARAN NAIR 120 601 15000.00 DOOR NO 92 U P STAIRS DEVIKALAYA 8TH MAIN RD 9TH CROSS SARASWATHIPURAM MYSORE 570009 001424 BALARAMAN S N 126 607 60000.00 14 ESOOF LUBBAI ST TRIPLICANE MADRAS 600005 002473 GUNASEKARAN V 128 609 30000.00 NO.5/1324,18TH MAIN ROAD ANNA NAGAR WEST CHENNAI 600040 000697 AMALA S. 143 624 12000.00 36 CAR STREET SOWRIPALAYAM COIMBATORE TAMILNADU 641028 000953 SELVAN P. 150 631 18000.00 18, DHANALAKSHMI NAGAR AVARAMPALAYAM ROAD, COIMBATORE TAMILNADU 641044 001209 PANCHIKKAL NARAYANAN 153 634 60000.00 NANU BHAVAN KACHERIPARA KANNUR KERALA 670009 002985 BABY MATHEW 173 654 12000.00 PUTHRUSSERY HOUSE PULIKKAYAM KODANCHERY CALICUT 673580 001680 RAVI P 182 663 30000.00 SUDARSAN CHEMBAKKASSERY TATTAMANGALAM KERALA 678102 001440 RAJI GOPALAN 198 679 60000.00 ANASWARA KUTTIPURAM THIROOR ROAD KUTTYPURAM KERALA 679571 001756 UNNIKRISHNAN P 222 703 30000.00 'SREE SAILAM' PUDUKULAM ROAD PUTHURKKARA, AYYANTHOLE POST THRISSUR 680003 AMBIKA C P 1201090001296071 REBIN SUNNY 227 708 18750.00 21/14 BEETHEL P O AYYANTHOLE THRISSUR 680003 IN30163741039292 NEENAMMA VINCENT 260 741 18000.00 PLOT NO103 NEHRUNAGAR KURIACHIRA THRISSUR 680006 002191 PRESANNA BABU M V 310 791 30000.00 MURIYANKATTIL HOUSE EDAKULAM IRINJALAKUDA, THRISSUR KERALA 680121 SHAILA BABU 001567 ABUBAKER P B 375 856 15000.00 PUITHIYAVEETIL HOUSE P O KURUMPILAVU THRISSUR KERALA 680564 IN30163741303442 REKHA M P 419 900 20250.00 FLAT NO 571 LUCKY HOME PLAZA NEAR TRIPRAYAR TEMPLE NATTIKA P O THRISSUR 680566 1201090004031286 KUMARAN K K . -

Location Code Numbers, Trivandrum

CENSUS OF INDIA 1981 LOCATION CODE NUMBERS TRIVANDR.UM DISTRICT JJXL".wv",,-,n ....,~: u~NSUS OPERATIONq K'E RALA CONTENTS PAGE 1 . Towns and taluks -Trivandrum district 1 2. T owns and their constituent wards 2 3. Jurisdiction of towns 8 4. Villages-Trivandrum distl'lct 11 5. Villages and their constituent karas- Chil'ayinkil taluk 15 6. Vilbges and their constituent karas~ NC'dumangad taluk 20 7. Villages and their constituent karas- Trivandrum taluk 24 8, Villages and t hpir constituent karas- Neyyattinkilra t:duk 28 9. Forest Divisions and their constituent ranges- Trivandrum district 35 SMT 106/2009/84- (Tvm.)-l TOWNS AND TALUKS Complete Sl. No. location code number Towns 1 Varkala Municipality 10-11-! 2 Attingal Municipality 10 .. 1I-II 3 Nedumangad Municipality ID-ll-III 4 Kadakampally (Census town) IO-ll-IV 5 Triv'mdrum Corporation IO .. II-V Thumba (Urban outgrowth) IO-ll-VA 6 Neyyattinkara Municipality IO-I1-VI Taluks Chirayinkil 10·11-1 2 Nedumangad 10-11-2 3 Trivandrum 10-11-3 4 Neyyattinkara 10-11-4 --- 1 106/2009/84 (Tvm.)-2 TOWNS AND THEIR CONSTITUENT WARDS Ward Complete gl.N" Number/Name location codt number Varkala (Code No. I) 1 Kurackanni 10-11-1·1 Kurackanni A 10-11-1-1A Kurackanni B IO-11-I-lB 2 Varkala Conservancy town 10-11-1-2 Varkala Conservancy town A 10-II-1-2A Varkala Cunservancy town B 10-11-I-2B 3 Varkala Rural 10-11-1-3 Varkala Rural A IO-11-I-3A Varkala Rural B 10-11-1-3B Varkala Rural C IO-1l-I-3C Attingal Municipality (Code No. -

Building Stone Quarry of Mr. Sasidhara Kurup

Building Stone Quarry of Mr. Sasidhara Kurup 14 Building Stone Quarry of Mr. Sasidhara Kurup Chapter- I Introduction 1.1 Brief Foreword of Project proponent and Project Site Sri. Sasidhara Kurup. K, has applied a fresh quarrying lease for operating Granite Building Stone over an extent of 1.1405 Ha at Re Survey. No 156/7-1-1,156/7-1-2,160/7-A,160/6 in Elamba village, Chirayinkeezhu Taluk, Thiruvananthapuram District, Kerala. Possession, Tax Paid certificates are enclosed as Annexure No’s. 2, 3 Mining Plan for Granite Building Stone quarry of Sri. Sasidhara Kurup. K at Re Survey. No 156/7-1-1,156/7-1-2,160/7-A,160/6 in Elamba village, Chirayinkeezhu Taluk, Thiruvananthapuram District, Kerala for total mine lease area of 1.1405 Ha is approved by District Geologist, Department of Mining and Geology, Thiruvananthapuram. This Granite Building Stone Quarry to submit application to statutory authorities like Department of Mining & Geology, DEIAA and to receive Environmental Clearance from DEIAA, Kerala. Attested Copy of Photo ID of the Authorized Signatory is enclosed as Annexure No-1. This feasibility report for Granite Building Stone Quarry over an extent of 1.1405 Ha at Re Survey No 156/7-1-1,156/7-1-2,160/7-A,160/6 in Elamba village, Chirayinkeezhu Taluk, Thiruvananthapuram District, is prepared towards getting environmental clearance from DEIAA Kerala. 15 Building Stone Quarry of Mr. Sasidhara Kurup Chapter- II 2.1 Project Description Project Proponent Sasidhara Kurup. K Mailing Address Panavila Veedu Elamba P.O, Avanavancherry Attingal, Thiruvananthapuram Re Sy.No’s 156/7-1-1,156/7-1-2,160/7-A,160/6 Location Elamba village Chirayinkeezhu Taluk Thiruvananthapuram District Kerala State Quarry Lease Area 1.1405 Ha Type of land Private Land 2.2 Salient features of the study area Latitude 8°42'11.65"N to 8°42'16.58"N Longitude 76°51'44.34"E to 76°51'48.56"E Nearest Town Attingal-10Km Nearest Railway Station Chirayinkeezhu Railway Station - 20Km Nearest Airport Trivandrum international airport -30Km Highest 80m above MSL. -

Trivandrum District, Kerala State

TECHNICAL REPORTS: SERIES ‘D’ CONSERVE WATER – SAVE LIFE भारत सरकार GOVERNMENT OF INDIA जल संसाधन मंत्रालय MINISTRY OF WATER RESOURCES कᴂ द्रीय भजू ल बो셍 ड CENTRAL GROUND WATER BOARD केरल क्षेत्र KERALA REGION भूजल सूचना पुस्तिका, त्रिवᴂद्रम स्ज쥍ला, केरल रा煍य GROUND WATER INFORMATION BOOKLET OF TRIVANDRUM DISTRICT, KERALA STATE तत셁वनंतपुरम Thiruvananthapuram December 2013 GOVERNMENT OF INDIA MINISTRY OF WATER RESOURCES CENTRAL GROUND WATER BOARD GROUND WATER INFORMATION BOOKLET OF TRIVANDRUM DISTRICT, KERALA रानी वी आर वैज्ञातनक ग Rani V.R. Scientist C KERALA REGION BHUJAL BHAVAN KEDARAM, KESAVADASAPURAM NH-IV, FARIDABAD THIRUVANANTHAPURAM – 695 004 HARYANA- 121 001 TEL: 0471-2442175 TEL: 0129-12419075 FAX: 0471-2442191 FAX: 0129-2142524 GROUNDWATER INFORMATION BOOKLET TRIVANDRUM DISTRICT, KERALA Contents 1.0 INTRODUCTION ................................................................................................................ 1 2.0 RAINFALL AND CLIMATE ........................................................................................... 3 3.0 GEOMORPHOLOGY AND SOIL TYPES ................................................................... 5 4.0 GROUND WATER SCENARIO...................................................................................... 6 5.0 GROUNDWATER MANAGEMENT STRATEGY ................................................. 12 6.0 GROUNDWATER RELATED ISSUES AND PROBLEMS ................................. 15 7.0 AWARENESS & TRAINING ACTIVITY ................................................................. 15 8.0 -

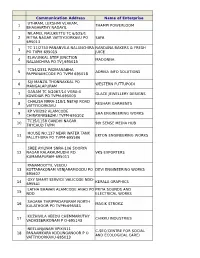

Communication Address Name of Enterprise 1 THAMPI

Communication Address Name of Enterprise UTHRAM, LEKSHMI VLAKAM, 1 THAMPI POWERLOOM BHAGAVATHY NADAYIL NILAMEL NALUKETTU TC 6/525/1 2 MITRA NAGAR VATTIYOORKAVU PO SAFA 695013 TC 11/2750 PANANVILA NALANCHIRA NANDANA BAKERS & FRESH 3 PO TVPM 695015 JUICE ELAVUNKAL STEP JUNCTION 4 MADONNA NALANCHIRA PO TV[,695015 TC54/2331 PADMANABHA 5 ADRIKA INFO SOLUTIONS PAPPANAMCODE PO TVPM 695018 SIJI MANZIL THONNAKKAL PO 6 WESTERN PUTTUPODI MANGALAPURAM GANAM TC 5/2067/14 VGRA-4 7 GLACE JEWELLERY DESIGNS KOWDIAR PO TVPM-695003 CHALISA NRRA-118/1 NETAJI ROAD 8 RESHAM GARMENTS VATTIYOORKAVU KP VIII/292 ALAMCODE 9 SHA ENGINEERING WORKS CHIRAYINKEEZHU TVPM-695102 TC15/1158 GANDHI NAGAR 10 9th SENSE MEDIA HUB THYCAUD TVPM HOUSE NO.137 NEAR WATER TANK 11 EKTON ENGINEERING WORKS PALLITHURA PO TVPM-695586 SREE AYILYAM SNRA-106 SOORYA 12 NAGAR KALAKAUMUDHI RD. VKS EXPORTERS KUMARAPURAM-695011 PANAMOOTTIL VEEDU 13 KOTTARAKONAM VENJARAMOODU PO DEVI ENGINEERING WORKS 695607 OXY SMART SERVICE VALICODE NDD- 14 KERALA GRAPHICS 695541 LATHA BHAVAN ALAMCODE ANAD PO PRIYA SOUNDS AND 15 NDD ELECTRICAL WORKS SAGARA THRIPPADAPURAM NORTH 16 MAGIK STROKZ KULATHOOR PO TVPM-695583 KUZHIVILA VEEDU CHEMMARUTHY 17 CHIKKU INDUSTRIES VADASSERIKONAM P O-695143 NEELANJANAM VPIX/511 C-SEC(CENTRE FOR SOCIAL 18 PANAAMKARA KODUNGANOOR P O AND ECOLOGICAL CARE) VATTIYOORKAVU-695013 ZENITH COTTAGE CHATHANPARA GURUPRASADAM READYMADE 19 THOTTAKKADU PO PIN695605 GARMENTS KARTHIKA VP 9/669 20 KODUNGANOORPO KULASEKHARAM GEETHAM 695013 SHAMLA MANZIL ARUKIL, 21 KUNNUMPURAM KUTTICHAL PO- N A R FLOUR MILLS 695574 RENVIL APARTMENTS TC1/1517 22 NAVARANGAM LANE MEDICAL VIJU ENTERPRISE COLLEGE PO NIKUNJAM, KRA-94,KEDARAM CORGENTZ INFOTECH PRIVATE 23 NAGAR,PATTOM PO, TRIVANDRUM LIMITED KALLUVELIL HOUSE KANDAMTHITTA 24 AMALA AYURVEDIC PHARMA PANTHA PO TVM PUTHEN PURACKAL KP IV/450-C 25 NEAR AL-UTHMAN SCHOOL AARC METAL AND WOOD MENAMKULAM TVPM KINAVU HOUSE TC 18/913 (4) 26 KALYANI DRESS WORLD ARAMADA PO TVPM THAZHE VILAYIL VEEDU OPP. -

Ground Floor ,Nadar Building No-1371, Trichy Road ,Ciombatore

Sl.No IFSC Code Branch Name District State Branch Address Email Id Contact Number JT Trade Centre, Near X-ray Junction, TSC Road, Alleppy- 1 ESMF0001189 CHERTHALA ALAPUZHA KERALA [email protected] 9656058079 Cherthala Road, Alleppy Dist-688524, Kerala. Kainakari Building Ground Floor & First Floor 15/492D, BL-04/27 GF and 1329 sq feet First floor Near to Power 2 ESMF0001197 ALAPUZHA ALAPUZHA KERALA [email protected] 9633553111 House Shavakottapalam Ernakulam- Alapuzha Road Alapuzha PIN 688007 Geo Commercial Complex, Ground Floor VI/62,63, BL- 3 ESMF0001208 MAVELIKARA ALAPUZHA KERALA 55/17, Mitchel Junction, Haripad- Chengannur Road, [email protected] 8589905454 Mavelikara, PIN-690514 Door No 21/22, Gloria Arcade, Near R K Junction, N H 4 ESMF0001230 HARIPAD ALAPUZHA KERALA [email protected] 8589905709 66, Haripad, Alapuzha, Pin : 690514 Golden House, 820 , 8th Block, Ganapati Temple Road 5 ESMF0001172 KORAMANGALA BANGALORE KARNATAKA [email protected] 9902114807 Koramangla,Bangalore,560034 TRICHY ROAD - Ground Floor ,Nadar Building No-1371, Trichy Road 6 ESMF0001175 COIMBATORE TAMIL NADU [email protected] 7904758925 COIMBATORE ,Ciombatore,641018 38/211 A, Grace Tower, Near Edappally Bye Pass 7 ESMF0001103 EDAPALLY ERNAKULAM KERALA [email protected] 8589969687 Junction, Edappally – Ernakulam 682024 20/1170 A, Near Jacobite Church, Kottayam Road, 8 ESMF0001111 PERUMBAVOOR ERNAKULAM KERALA [email protected] 8589020431 Perumbavoor, Ernakulum 683542. Ground Floor, Pearl tower,Near Signal 9 -

Manappuram Finance Ltd IV/470A(Old) W638A(New) Manappuram House Valapad Post, Thrissur-680567 Ph: 0487- 3050417/415/3104500 List

Manappuram Finance Ltd IV/470A(Old) W638A(New) Manappuram House Valapad Post, Thrissur-680567 Ph: 0487- 3050417/415/3104500 FOLIO / DEMAT ID NAME ADDRESS LINE 1 ADDRESS LINE 2 List of Unpaid Dividend as on ADDRESS09.08.2016 LINE (Dividend 3 for the periods 2008-09 toADDRESS 2015-16) LINE 4 PINCOD DIV.AMOUNT DWNO MICR PERIOD IEPF. TR. DATE 000642 JNANAPRAKASH P.S. POZHEKKADAVIL HOUSE P.O.KARAYAVATTAM TRICHUR DIST. KERALA STATE 1800.00 16400038 54773 2015-16 4TH INTERIM DIVIDEND 26-APR-23 000671 SHEFABI K M C/O.SEENATH HUSSAIN CHINNAKKAL HOME PO. VALAPAD PAINOOR 1800.00 16400039 54774 2015-16 4TH INTERIM DIVIDEND 26-APR-23 000691 BHARGAVI V.R. C/O K.C.VISHWAMBARAN,P.B.NO.63 ADV.KAYCEE & KAYCEE AYYANTHOLE TRICHUR DISTRICT KERALA STATE 1800.00 16400040 54775 2015-16 4TH INTERIM DIVIDEND 26-APR-23 000902 SREENIVAS M.V. SAI SREE, KOORKKENCHERY TRICHUR - 7 KERALA STATE 1800.00 16400046 54781 2015-16 4TH INTERIM DIVIDEND 26-APR-23 001036 SANKAR T.C. DAYA MANDIRAM TRICHUR - 4. KERALA 9000.00 16400052 54787 2015-16 4TH INTERIM DIVIDEND 26-APR-23 002626 DAMODARAN NAMBOODIRI K T KANJIYIL THAMARAPPILLY MANA P O MANALOOR THRISSUR KERALA 3600.00 16400071 54806 2015-16 4TH INTERIM DIVIDEND 26-APR-23 002679 NARAYANAN P S PANAT HOUSE P O KARAYAVATTOM, VALAPAD THRISSUR KERALA 3600.00 16400074 54809 2015-16 4TH INTERIM DIVIDEND 26-APR-23 002769 RAMLATH V E ELLATHPARAMBIL HOUSE NATTIKA BEACH P O THRISSUR KERALA 1800.00 16400079 54814 2015-16 4TH INTERIM DIVIDEND 26-APR-23 002966 KUNHIRAMAN K KADAVATH HOUSE OZHINHA VALAPPU (PO) (DIST) KARASAGOD 000000 1800.00 -

Thiruvananthapuram

INCULCATE-2013 DISTRICTWISE LIST OF APPLICANTS THIRUVANANTHAPURAM Sl.No RollNo Name App. -

District Census Handbook, Trivandrum, Part XIII-A & B, Series-10

CENSUS OF INDIA' SERIES 10 KERALA DISTRICT CENSUS HANDBOOK' TRIVANDRUM DISTRICT PART XIII-A & B VILLAGE DIRECTORY AND TOWN DIRE,CTORY PRIMARY CENSUS ABSTRACT M. VIJAYAN~NI OF THE INDtAN ADMINISTRATIVE SERVICE DIR~CTOR OF. CENSUS OPERATIONS ;.:.l.. KERALA 1981 CENSUS PUBLICATION PROGRAMMB KERALA STATE Paper/Part number Title and subject matter Paper 1 ofl981 . Provisional Population Totals Paper 2 of 1981 Rural-urban Composition (Provisional Totals} Workers and Kon-workers (Provisional Totals) Disabled persons Paper 3 ofl981 Final Population Totals Paper 4 of 1981 Primary Census Abstract for Scheduled Castes and Scheduled Tribes Paper 5 of 1981 Final totals of workers and non-workers Part I - A Administration Report-Enum~ration I Not for "ale. >-For office . Administration Report-Tabulation J use only Part II - A General Population Tables (1"\ series - Tables A-I to A-5) PartII - B Primary Census Abstract Part 111- A General Economic Tables {B Series-Tables B-1 to B-IO) Part III- B General Economic Tables (B Series-Tables B-ll to B-22) Part IV- A Social and Cultural Tables (C Series- C-I to C-6 . Part IV "- B Social and Cultural Tables (C Series-Tables C-7 to C-9) Part IV - C . Household Composition Table (C Series--Table C-I0) PartY - A Migration tables (D Series-Tables D-I to D-4) PartY - B Migration Tables (D Sreies-Tables D-5 to D-I2) Part VI - A Fertility Tables (F Series-Tables F-I to F-19) . Part VI - B Fertility Tables (F Series-Tables F-20 to F-28) Part VII Houses and Disabled!Populatio'h-Report and Tables (H Series-Tables H-I and H-2) Part VIII-A Household Tables (HH Series-Tables HH-I to HH-16) PartVIII-B Household Tables(HH Series-Tables (RR-I7 RR-I7 SC and RH-I7 Part IX Special Tables on Scheduled Castes .and Scheduled Tribes (SC Series-Tables SG:l to SC-6; ST Sel'ies--Tables ST t9 ST-9) Pa.rtX - A State Town Directory .