NYC BCTC PROJECT LABOR AGREEMENTS - AS of AUGUST 20, 2014 Page 1 of 9 Contractors Should Not Rely on This Spreadsheet for the Exact Terms/Scope of the PLA

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

An Insight Into the Luxury Residential Market

an insight into the luxury residential market FOREWORD - The “hottest” ranking luxury primary housing market in 2017 and early 2018 have shown robust growth in luxury the world is Victoria, BC, with strong year-on-year luxury real estate sales across most geographical markets. A stable sales volumes and high domestic demand. global economy, a strong stock market, low interest rates and rising consumer confidence served as positive tailwinds for - Santa Fe, New Mexico, is the “hottest” luxury second-home the luxury residential real estate markets. Still, there continue market, reaching sales volumes of million-dollar-plus homes to be a multitude of issues presenting both opportunities and not seen since pre-crisis years. challenges for prime property investors and sellers across - Trophy home sales dipped in 2017—only three homes the globe. Luxury markets are increasingly impacted by achieved the US$100 million+ “billionaire’s benchmark”— macroeconomic factors from political uncertainty, natural as the year’s 10 most expensive homes sold worldwide for disasters and terrorism fears to high equity prices, shifting aggregate of $1.24 billion, down from $1.32 billion in 2016. buyer demographics, currency risks, and increased taxes and - Star architects are now almost a prerequisite for high-end buying restrictions on residential real estate. residential developments, dominating the landscape of This year’s Luxury Defined presents insights into the world emerging luxury corridors like West Chelsea in New York. of luxury real estate and captures the collective wisdom and - Inventory constraints remained an issue in many prime insights of our global network—comprised of 27,000 agents property markets, as buyers from different, traditionally operating out of 940 offices globally—as well as specialists non-competing demographic and lifestyle cohorts competed from the broader Christie’s world. -

Building Envelope • Sustainability Consulting

BUILDING ENVELOPE • SUSTAINABILITY CONSULTING • MONITORING 40 Bond Street InterActiveCorp (IAC) Headquarters 841 Broadway New York, NY New York, NY New York, NY Hearst Tower World Trade Centers 1-4, 7 Bank of America at New York, NY 9/11 Memorial and Museum One Bryant Park New York, NY New York, NY FIRM INTRODUCTION Vidaris, Inc. is a consulting firm specializing in building envelope, sustainability and energy efficiency. The company was created by combining the legacy firms of Israel Berger and Associates, LLC (IBA) and Viridian Energy & Environmental, LLC. Formed in 1994, IBA established an exterior wall consulting practice providing niche services to real estate owners, owner representatives and architects. Services were provided for new construction as well as investigation, repositioning, repair, and restoration of existing buildings. Later expansion included roofing as well as waterproofing consulting, encompassing the entire building envelope. IBA developed into an industry-leading resource. Viridian Energy & Environmental was established in 2006, providing consulting services to assist building owners and managers in energy efficiency, sustainability and LEED certifications. Energy modeling expertise set Viridian apart from other consultants offering more standardized service and support. In 2011, IBA and Viridian Energy & Environmental merged their specialized service offerings to form Vidaris. As building envelope designs and mechanical systems were becoming more complex, the two companies recognized that it was an opportunity, more so a necessity, for them to be able to provide a holistic approach to these closely related disciplines for their clients. Deep technical knowledge, a long proven track record, reputation, and a sophisticated analytical approach would allow Vidaris to provide a level of service second to none. -

CITYREALTY NEW DEVELOPMENT REPORT MANHATTAN NEW DEVELOPMENT REPORT May 2015 Summary

MAY 2015 MANHATTAN NEW DEVELOPMENT REPORT CITYREALTY NEW DEVELOPMENT REPORT MANHATTAN NEW DEVELOPMENT REPORT May 2015 Summary Apartment prices in new development condominiums in Manhattan have increased at a fast clip, a trend boosted by the upper end of the market. Sales of new condominium units included in this report are expected to aggregate between $27.6 and $33.6 billion in sales through 2019. The average price of these new development units is expected to reach a record of $5.9 million per unit in 2015. At the same time, far fewer units are being built than during the last development boom, in the mid-2000s, therefore the number of closed sales is expected to increase more modestly than their prices. 2013 2014 2015-2019* TOTAL NEW DEVELOPMENT SALES $2.7B $4.1B $27.6B-$33.6B+ Pricing information for the 4,881 new development units covered in this report comes from active and in-contract listings, offering plans, and projections based on listing prices. For a complete list of buildings included in this report, see pages 5-6 (New Developments by Building Detail). Ultimately, sales of these apartments will total roughly $27.6 to $33.6 billion through 2019. Sales in new developments totaled $4.1 billion in 2014, up 50 percent from 2013. The 2013 total, $2.7 billion, also represented a significant increase from the $1.9 billion recorded in 2012. While total sales volume has increased in recent years, it is still substantially less than at the height of the market, in 2008, when new development sales totaled $10.4 billion. -

Condos for New on Billionaires'

September 5, 2019 https://therealdeal.com/2019/09/05/serial-buyers-trade-old-condos-for-new-on-billionaires-row/ Serial buyers trade “old” condos for new on Billionaires’ Row Sting, Daniel Och and Bob Diamond are just a few who’ve left 15 CPW for “newer” condos By E.B. Solomont For many, a move coincides with a huge life event — relocating when a marriage begins or ends, upsizing to make room for a new baby or downsizing when kids move out. But for an uber-rich set of buyers in Manhattan, it comes down to shininess. Over the past few months, serial buyers with deep pockets have swapped “older” condos for new ones. They’ve traded Central Park West for Park Avenue; limestone for a glass curtain wall; Christian de Portzamparc for Robert A.M. Stern. Take Sting and his wife, Trudie, who paid $65.7 million for a penthouse at 220 Central Park South after unloading their pad at 15 Central Park West for a cool $50 million. The couple paid $26.5 million at 15 CPW in 2008, records show. Or the rocker’s neighbor, Daniel Och, who is reportedly among the buyers at 220 CPS and recently listed his penthouse at 15 CPW for $57.5 million. Real estate developers are doing it, too. This summer, Related Companies boss Stephen Ross listed his Time Warner Center penthouse — which he received as a “distribution” — for $75 million. Now, Ross is moving west, to his company’s Hudson Yards megadevelopment. “There’s a certain personality that wants the new ‘It,’ whether it’s a handbag, car, vacation spot or home,” said Douglas Elliman’s Noble Black. -

Tall Building Numbers Again on the Rise by Daniel Safarik and Antony Wood

Tall Building Numbers Again on the Rise By Daniel Safarik and Antony Wood ® y all appearances, the small increase in the total number of • Panama added two buildings over 200 meters, bringing the tall-building completions from 2012 into 2013 is indicative small Central American nation’s count up to 19. It had none of a return to the prevalent trend of increasing completions as recently as 2008. Of the 73 buildings over 200 meters each year over the past decade. Perhaps 2012, with itsCopyright small completed in 2013, only one, 1717 Broadway in New York, Byear-on-year drop in completions, was the last year to register the full was in the United States. effect of the 2008/2009 global financial crisis, and a small sigh of relief can be let out in the tall-building industry as we begin 2014. Key Worldwide Market Snapshots of 2013 At the same time, it is important to note that 2013 was the second- Asia most successful year ever, in terms of 200-meter-plus (656 feet) building completion, with 73 buildings of 200 meters or greater height Asia completely dominated the world tall-building industry, at 74 completed. When examined in the broad course of skyscraper comple- percent of worldwide completions with 53 buildings in 2013, against tions since 2000, the rate is still increasing. From 2000 to 2013, the 53 percent with 35 buildings in 2012. Asia now contains 45 percent total number of 200-meter-plus buildings in existence increased from of the 100 Tallest Buildings in the World. -

New York Power Developers Talk Luxury Real Estate News Pt. 1 | October 26, 2016

New York Power Developers Talk Luxury Real Estate News Pt. 1 | October 26, 2016 REDEFINING THE CITY: JEFF BLAU Photo Credit: VisualHouse-NelsonByrd Jeff Blau is chief executive officer and a partner at Related Companies, one of the country’s largest private real estate development firms. He has overseen more than $20 billion of new developments in virtually every sector of the industry. Tell us about your latest project and what makes it unique in the hyper-competitive New York market. Hudson Yards is unlike any other development in the country. Spread across 28 acres on the West Side of Manhattan, it presented us with a unique opportunity to build a whole new neighborhood from the ground up. And because we are building from scratch, we’ve been able to bring to market a residential offering that can’t be found anywhere else in the world. We know that people want to live and work in a true mixed-use community that has something for everyone. They want all elements of their lifestyle right at their doorstep. That is exactly what you will find at Hudson Yards. So whether you want to shop in the city’s first Neiman Marcus, eat in a different restaurant every week, work out, hit the spa, or spend time outdoors, Hudson Yards will have something for you. There’s been a softening of very high-end residential sales this year. Will this continue or do you predict an uptick? There will always be cycles in the residential market. That’s why, as a developer, it is so important to have a diverse mix of residences on the market at any point in time. -

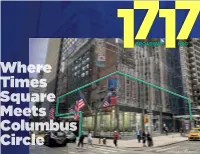

1717 Broadway Provides New Opportunities with Commanding Storefront Visibility at the Northwest Corner of 54Th Street

Where Times Square Meets Columbus Circle CONCEPTUAL RENDERING 1717 Broadway provides new opportunities with commanding storefront visibility at the northwest corner of 54th Street. Located at the base of a 70-story, 639-room dual hotel building, this unique space is the perfect retail, dining and entertainment destination! With an expansive wraparound glass storefront, the opportunities range in size from 950-12,033 square feet providing unbeatable flexibility and visibility for travelers, residents and office workers alike! A Retail Convergence Existing Conditions GROUND FLOOR SPACE DETAILS SECOND & FIFTH FLOOR ACCESS EXISTING CONDITIONS Ground Floor Space A 1,630 SF SPACE B Space B 1,143 SF BROADWAY 1,143 SF Second Floor Space C 7,318 SF 85 FT HOTEL LOBBY CEILING HEIGHTS Ground Floor 19 FT SPACE A 1,630 SF Second Floor 19 FT 45 FT COMMENTS WEST 54TH STREET All uses considered All logical ground floor divisions considered SECOND FLOOR An additional 1,200 SF area available to be built for a Mezzanine space Second Floor tenant to utilize a dedicated entrance on Broadway for direct access to the Second Floor – vertical transportation in place (stair and elevator) Several flexible signage opportunities available SPACE C 7,318 SF MECHANICAL MEZZANINE Details734 SF GROUND FLOOR SECOND FLOOR SCENARIO 1 SECOND & FIFTH FLOOR ACCESS SINGLE TENANT LAYOUT Ground Floor Space A 2,773 SF BROADWAY Second Floor Space B 7,318 SF 85 FT SPACE B CEILING HEIGHTS HOTEL LOBBY MECHANICAL 7,318 SF MEZZANINE Ground Floor 19 FT 734 SF SPACE A Second Floor 19 FT -

Manhattan Office Market

Manhattan Offi ce Market 1 ST QUARTER 2016 REPORT A NEWS RECAP AND MARKET SNAPSHOT Pictured: 915 Broadway Looking Ahead Finance Department’s Tentative Assessment Roll Takes High Retail Rents into Account Consumers are not the only ones attracted by the luxury offerings along the city’s prime 5th Avenue retail corridor between 48th and 59th Streets where activity has raised retail rents. The city’s Department of Finance is getting in on the action, prompting the agency to increase tax assessments on some of the high-profi le properties. A tentative tax roll released last month for the 2016-2017 tax year brings the total market value of New York City’s real estate to over $1 trillion — reportedly for the fi rst time. The overall taxable assessed values for the city would increase 8.10%. Brooklyn’s assessed values accounted for the sharpest rise of 9.83% from FY 2015/2016, followed by Manhattan’s 8.47% increase. Although some properties along the 5th Avenue corridor had a reduction in valuations the properties were primarily offi ce, not retail according to a reported analysis of the tentative tax roll details. Building owners have the opportunity to appeal the increase; but an unexpected rise in market value — and hence real estate taxes, will negatively impact the building’s bottom line and value. Typically tenants incur the burden of most of the tax increases from the time the lease is signed, and the landlord pays the taxes that existed before the signing; but in some cases the tenant increase in capped, leaving the burden of the additional expense on the landlord. -

New York, NY Hotel Descriptions

New York, NY Hotel Descriptions Algonquin Hotel 59 West 44th Street Indulge in a true 4-star experience at the Algonquin Hotel. With a picture-perfect location in Midtown Manhattan, NYC, steps away from the excitement of Times Square, our hotel makes it easy to explore world-famous landmarks. Our history of providing first-class service to influential guests makes us the perfect destination for a one-of-a-kind romantic getaway to NYC. Our historic hotel is overflowing with 4-star amenities, such as a fully stocked fitness center, free Wi-Fi access in all hotel rooms and public areas and exquisite American dining at our signature Round Table Restaurant. Host your event here in Midtown Manhattan to enjoy almost 5,000 square feet of stylishly appointed venue space and a convenient location in the heart of the city. We're moments from a variety of renowned attractions, including Bryant Park, Rockefeller Center and the Theater District. Discover unparalleled historic grandeur at The Algonquin Hotel Times Square, Autograph Collection. Candlewood Suites Times Square 339 West 39th Street Candlewood Suites Times Square has the perfect location for Extended Stay business and leisure travelers. Our NYC hotel is convenient to the major businesses in Times Square and the attractions of New York City. Our Times Square address places us within walking distance of the Jacob Javitz Convention Center, Madison Square Garden, Penn Station, Port Authority, Hudson yard, Ernst & Young, New York Times Building and Amazon among others. Our All-Suite hotel offers a comfortable work space and free high-speed internet access. -

The Cityrealty 100 Report 2020

THE CITYREALTY 100 REPORT 2020 DECEMBER 2020 THE CityRealty is the website for NYC real estate, providing high-quality listings and tailored agent matching for pro- spective apartment buyers, as well as in-depth analysis of the New York real estate market. 1100 THE CITYREALTY 100 REPORT 2020 About The CityRealty 100 The CityRealty 100 is an index comprising the top 100 condominium buildings in Manhattan. Several factors—including a building’s sales history, prominence, and CityRealty’s rating for the property—are used to determine which buildings are included in the index. This report tracks the performance of those buildings for the one-year period ending September 30, 2020. CityRealty releases regular reports on the CityRealty 100 to track the change in prices of the top 100 Manhattan condo buildings. After falling in 2018 from all-time highs achieved in 2016 and 2017, the index’s average price / foot and total sales volumes were roughly flat in 2020 as compared to 2019, with the average price per square foot increasing 2% to $2,649. For the 12 months ending Sep 30, there were 846 sales which accounted for $4.94B in sales volume. Manhattan real estate, as viewed through the lens of this report, focuses on the city's top tier of buildings, which are seen as a relatively stable and good investment. The stagnation in prices and volume, especially in buildings not new to the market, reflects a market that has been saturated with high-end product, and prices in the 3rd quarter of 2020 reflect an overall downward trend. -

View the Market Study of TDR Values in the Theater Subdistrict

VALUATION ADVISORY SERVICES Market Study of TDR Values in the Theater Subdistrict Prepared for New York City Economic Development Corporation Partnership. Performance. April 15, 2016 1166 Avenue of the Americas 15th Floor New York, NY 10036 T 212.729.7140 F 212.591.9300 www.avisonyoung.com Theater Subdistrict Fund Zoning Text Amendment Market Study of TDR Values in the Theater Subdistrict Theater Subdistrict Fund Zoning Text Amendment 1 Market Study of TDR Values in the Theater Subdistrict Theater Subdistrict Fund Zoning Text Amendment 2 Market Study of TDR Values in the Theater Subdistrict Theater Subdistrict Fund Zoning Text Amendment 3 Market Study of TDR Values in the Theater Subdistrict Theater Subdistrict Fund Zoning Text Amendment 4 MARKET STUDY SCOPE & METHODOLOGY Theater Subdistrict Fund Zoning Text Amendment 5 MARKET FINDINGS WITHIN THE STUDY AREA MARKET FINDINGS WITHIN THE STUDY AREA Adjustments for Changes in Market Conditions 1/01-9/01: 1% per mo. 9/07-8/08: 0% per mo. 10/01-12/02: 0% per mo. 9/08: -30% 1/03-12/04: 1% per mo. 10/08-6/10: 0% per mo. 1/05-6/05: 2% per mo. 7/10-12/12: 0.5% per mo. 7/05-12/05: 1% per mo. 1/13-8/15: 2.0% per mo. 1/06-8/07: 0.5% per mo. 9/15-12/15: 0.5% per mo. Theater Subdistrict Fund Zoning Text Amendment 6 1. LAND SALES (COMMERCIAL & RESIDENTIAL) Theater Subdistrict Fund Zoning Text Amendment 7 1. LAND SALES (COMMERCIAL & RESIDENTIAL) Theater Subdistrict Fund Zoning Text Amendment 8 1. -

Manhattan New Development Report

JUNE 2016 Manhattan New Development Report MANHATTAN NEW DEVELOPMENT REPORT June 2016 New Buildings by Neighborhood Condominium development has largely centered on Midtown over the past several years, but there will be a wave of new construction and conversions in the Financial District in the near future, with large buildings such as 50 West Street, One Seaport and 125 Greenwich Street contributing to the roughly 1,250 new apartments slated for the neighborhood. NEW DEVELOPMENT KEY: UNITS: 10+ 50+ 100+ 150+ 200+ Unit Count NEIGHBORHOOD # OF UNITS NEIGHBORHOOD # OF UNITS Financial District 1,251 Broadway Corridor 264 Midtown West 1,229 Murray Hill 249 Lower East Side 912 East Village 207 Riverside Dr./West End Ave. 881 Chelsea 201 Flatiron/Union Square 499 SOHO 165 Gramercy Park 494 Central Park West 160 Tribeca 493 West Village 125 Midtown East 345 Beekman/Sutton Place 113 Yorkville 282 Carnegie Hill 105 2 June 2016 MANHATTAN NEW DEVELOPMENT REPORT Summary Condominium development is a multi-billion dollar business in Manhattan, and new apartment sales are poised to reach a level not seen since last decade’s boom cycle by 2018. While fewer developers in 2016 are signing on to build sky-grazing towers with penthouses that cost $100 million or more, condominium prices are still on an upward trajectory, with anticipated sales totaling roughly $30 billion through 2019. In total, 92 condominium projects with roughly 8,000 new apartments are under construction or proposed. Total New Development Sales (in Billions) $14B $12B $10.3B New development sales $10B totaled $5.4 billion last year, $8.4B up significantly from the $4.1 $8B billion in sales recorded in 2014.