Bristol University Holdings As at 3Oth September 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

View Annual Report

GROWTH THROUGH INNOVATION Halma plc Annual Report and Accounts 2012 Overview 01 Investment Proposition 02 Group at a Glance 04 Strategy and Business Model 06 Innovation in Healthcare and Analysis 08 Innovation in Infrastructure Sensors 10 Innovation in Industrial Safety Business review 12 Chairman’s Statement 14 Performance against Strategy 20 Strategic Review 25 Strategy in Action 30 Sector Reviews 30 Health and Analysis 38 Infrastructure Sensors 46 Industrial Safety 54 Financial Review 59 Risk Management and Internal Control 61 Principal Risks and Uncertainties 64 Corporate Responsibility Governance 68 Board of Directors and Executive Board 71 Chairman’s Introduction to Governance 72 Corporate Governance 76 Audit Committee Report 78 Nomination Committee Report 79 Remuneration Committee Report 80 Remuneration Report 87 Other Statutory Information 90 Directors’ Responsibilities Financial statements 91 Independent Auditor’s Report – Group 92 Consolidated Income Statement 92 Consolidated Statement of Comprehensive Income and Expenditure 93 Consolidated Balance Sheet 94 Consolidated Statement of Changes in Equity 95 Consolidated Cash Flow Statement 96 Accounting Policies 102 Notes to the Accounts 135 Independent Auditor’s Report – Company 136 Company Balance Sheet 137 Notes to the Company Accounts 142 Summary 2003 to 2012 144 Halma Directory 148 Shareholder Information and Advisers Overview Business review Governance Financial statements INVESTMENT PROS PO ITION Halma has an impressive record of creating sustained shareholder value through the economic cycle. We have consistently delivered record profits, high returns, strong cash flows, low levels of balance sheet gearing and have a 30+ year track record of growing dividend payments by 5% or more every year. Our ability to achieve record profits through the recent periods of economic turbulence is derived from our strategy of having a group of businesses building strong competitive advantage in specialised safety, health and environmental technology markets with resilient growth drivers. -

VONTOBEL FOREIGN OPPORTUNITIES FUND SCHEDULE of INVESTMENTS (Unaudited) DECEMBER 31, 2020

VONTOBEL FOREIGN OPPORTUNITIES FUND SCHEDULE OF INVESTMENTS (Unaudited) DECEMBER 31, 2020 ($ reported in thousands) Shares Value Shares Value COMMON STOCKS—99.0% Information Technology—continued Keyence Corp. (Japan) 47,705 $ 26,797 Communication Services—5.0% Mastercard, Inc. Class A (United States) 95,484 34,082 Cellnex Telecom SA 144A (Spain)(1) 175,403 $ 10,525 (2) Obic Co. Ltd. (Japan) 110,682 22,221 CTS Eventim AG & Co. KGaA (Germany) 453,514 30,140 Tata Consultancy Services Ltd. (India) 699,816 27,418 Tencent Holdings Ltd. (China) 211,318 15,374 Topicus.com, Inc. (Canada) 55,270 209 56,039 194,876 Consumer Discretionary—14.1% Materials—4.4% adidas AG (Germany)(2) 55,581 20,228 (2) Air Liquide SA (France) 131,929 21,637 Alibaba Group Holding Ltd. (China) 577,713 17,333 Asian Paints Ltd. (India) 716,026 27,091 Alibaba Group Holding Ltd. Sponsored ADR (China)(2) 71,937 16,742 Ferrari NV (Italy) 132,190 30,465 48,728 Flutter Entertainment plc (Ireland)(2) 188,778 38,491 LVMH Moet Hennessy Louis Vuitton SE (France) 55,405 34,580 TOTAL COMMON STOCKS (Identified Cost $725,173) 1,104,557 157,839 TOTAL LONG-TERM INVESTMENTS—99.0% Consumer Staples—18.2% (Identified Cost $725,173) 1,104,557 Alimentation Couche-Tard, Inc. Class B (Canada) 1,014,470 34,573 Asahi Group Holdings Ltd. (Japan)(3) 840,866 34,561 SHORT-TERM INVESTMENT—0.7% Diageo plc (United Kingdom) 966,387 38,034 Mondelez International, Inc. Class A (United States) 460,250 26,911 SECURITIES LENDING COLLATERAL—0.7% Nestle S.A. -

Halma Plc Annual Report and Accounts 2013

Halma plc Halma plc Misbourne Court Rectory Way INVESTMENT Amersham Bucks HP7 0DE A Tel +44(0)1494 721111 nnual PROPOSITION Fax +44(0)1494 728032 Web www.halma.com R epor Halma has an impressive record of creating sustained shareholder value through the economic cycle. We have consistently delivered record profits, high returns, strong t and t and cash flows with low levels of balance sheet gearing and have a 30+ year track record of growing dividend payments by 5% or more every year. A ccount Our ability to achieve record profits through the recent periods of economic turbulence is derived from our strategy of having a group of businesses building strong competitive advantage in specialised safety, health and environmental technology markets with resilient growth drivers. s 2013 These growth drivers, such as increasing Health and Safety regulation, mean that demand for our products is sustained, in both developed and developing regions, through periods of significant macro-economic change. Organic growth generates the financial and business resources we need to fund acquisitions and keep increasing dividends. We generate organic growth momentum by increasing levels of investment in people development, new product development and establishing platforms for growth in developing markets. Here, the need for improving Safety, Health and Environmental regulation is increasingly recognised by governments and demanded by the wider population. Over the long term, we actively manage the mix of businesses in our Group to ensure we can sustain strong growth and returns. We acquire businesses to accelerate penetration of more attractive market niches, we merge businesses when market characteristics change and we exit markets which offer less attractive long-term growth and returns through carefully planned disposals. -

Common Stocks — 104.5%

Eaton Vance Tax-Advantaged Global Dividend Income Fund January 31, 2021 PORTFOLIO OF INVESTMENTS (Unaudited) Common Stocks — 104.5% Security Shares Value Aerospace & Defense — 0.8% Safran S.A.(1) 98,721 $ 12,409,977 $ 12,409,977 Banks — 6.7% Bank of New York Mellon Corp. (The) 518,654 $ 20,657,989 Citigroup, Inc. 301,884 17,506,253 HDFC Bank, Ltd.(1) 512,073 9,775,702 ING Groep NV(1) 1,676,061 14,902,461 Japan Post Bank Co., Ltd. 445,438 3,851,696 Mitsubishi UFJ Financial Group, Inc. 2,506,237 11,317,609 Mizuho Financial Group, Inc. 292,522 3,856,120 Sumitomo Mitsui Financial Group, Inc. 186,747 5,801,916 Wells Fargo & Co. 341,979 10,218,332 $ 97,888,078 Beverages — 1.0% Diageo PLC 378,117 $ 15,180,328 $ 15,180,328 Biotechnology — 1.2% CSL, Ltd. 82,845 $ 17,175,550 $ 17,175,550 Building Products — 0.9% Assa Abloy AB, Class B 509,607 $ 12,603,485 $ 12,603,485 Chemicals — 0.7% Sika AG 38,393 $ 10,447,185 $ 10,447,185 Construction & Engineering — 0.0% Abengoa S.A., Class A(1)(2) 311,491 $ 0 Abengoa S.A., Class B(1)(2) 3,220,895 0 $0 Construction Materials — 0.9% CRH PLC 332,889 $ 13,660,033 $ 13,660,033 Consumer Finance — 0.6% Capital One Financial Corp. 79,722 $ 8,311,816 $ 8,311,816 1 Security Shares Value Diversified Financial Services — 2.5% Berkshire Hathaway, Inc., Class B(1) 101,853 $ 23,209,243 ORIX Corp. -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47 -

Portfolio Investment Report

December 2019 Bristol University Holdings as at 31st December 2019 Please note that the following information is valid as at 31/12/2019. The provision of this information does not constitute a recommendation, investment advice, nor financial promotion. Holdings are subject to change without notice and their accuracy and completeness cannot be guaranteed. No part of this document may be reproduced in any manner without Rathbones prior permission. As per the University’s Investment policy, the portfolio is moving to full fossil fuel divestment and a measurable reduction in the carbon intensity of the investments over time. To date, the only remaining direct position in the Oil & Gas sector is Equinor, representing approximately 0.78% of the portfolio. Direct investment in the Energy sector which is used to measure carbon intensity, includes Orsted, SSE and National Grid. These stocks represent approximately 4.94% of the portfolio. SECURITY NAME SECTOR TREASURY 1 7/8% I/L Stock 22/11/2022 UK Index Linked Government Bonds TREASURY 2 1/2% I/L Stock 17/07/2024 UK Index Linked Government Bonds RABOBANK NEDERLAND 2.25% Snr MTN 23/03/2022 UK Inv Grade Bonds - Higher Quality COVENTRY BUILDING SOCIETY 1.875% Bonds 24/10/2023 UK Inv Grade Bonds - Higher Quality KREDITANST FUR WIE 5.5% MTN 18/6/2025 UK Inv Grade Bonds - Higher Quality EURO INVESTMENT BANK 3.75% MTN 7/12/2027 UK Inv Grade Bonds - Higher Quality A2 DOMINION HOUSING GROUP LTD 3.5% Bonds 15/11/2028 UK Inv Grade Bonds - Higher Quality FIDELITY INTERNATIONAL 6.75% Notes 19/10/2020 UK Investment -

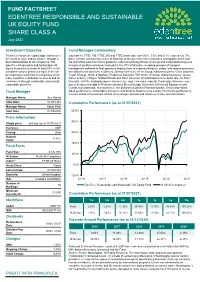

EDENTREE RESPONSIBLE and SUSTAINABLE UK EQUITY FUND SHARE CLASS a July 2021

FUND FACTSHEET EDENTREE RESPONSIBLE AND SUSTAINABLE UK EQUITY FUND SHARE CLASS A July 2021 Investment Objective Fund Manager Commentary To achieve long-term capital appreciation over July saw the FTSE 100, FTSE 250 and FTSE small cap return 0.6%, 3.0% and 0.1% respectively. The five years or more and an income, through a prime minister announced a move to step four of the government’s coronavirus easing plan which saw diversified portfolio of UK companies. The the end of the work from home guidance, enforced wearing of face coverings and social distancing rules. EdenTree Responsible and Sustainable UK In terms of portfolio activity we took part in the IPO of Microlise, a leading provider of transport Equity Fund aims to invest at least 80% in UK management software to fleet operators helping them to improve efficiency, safety, and reduce emissions. companies whose primary listing is in the UK We added to the positions in Spectris, Johnson Services, Keller Group, National Express, Close Brothers, by investing in a portfolio of companies which Taylor Wimpey, Smith & Nephew, Prudential, Bioventix, WH Smith, IP Group, Sabre Insurance, James make a positive contribution to society and the Fisher & Sons, Clinigen, Mattioli Woods and Hotel Chocolat. We participated in a capital raise by Hotel environment through sustainable and socially Chocolat, with the funding being used to increase long term sales capacity. Fund outperformance was responsible practices. due to being overweight in Pharmaceuticals & Biotechnology, Electronic & Electrical Equipment and Construction Materials. At a stock level, the positions in Dechra Pharmaceuticals, Genus and Halma Fund Manager aided performance, whilst Sabre Insurance and Smith & Nephew were a drag. -

Portfolio of Investments

PORTFOLIO OF INVESTMENTS Variable Portfolio – Partners International Growth Fund, September 30, 2020 (Unaudited) (Percentages represent value of investments compared to net assets) Investments in securities Common Stocks 99.4% Common Stocks (continued) Issuer Shares Value ($) Issuer Shares Value ($) Argentina 1.1% France 9.9% (a) MercadoLibre, Inc. 11,044 11,954,909 Air Liquide SA 33,000 5,230,820 Australia 3.3% Airbus Group SE(a) 115,226 8,356,836 Aristocrat Leisure Ltd. 382,096 8,332,956 Capgemini SE 100,870 12,941,155 Atlassian Corp. PLC, Class A(a) 34,922 6,348,471 Dassault Systemes 30,100 5,616,121 Cochlear Ltd. 21,100 3,014,527 L’Oreal SA 53,085 17,275,402 CSL Ltd. 90,068 18,605,054 LVMH Moet Hennessy Louis Vuitton SE 60,510 28,312,668 Total 36,301,008 Safran SA(a) 109,109 10,734,920 Canada 3.6% Sartorius Stedim Biotech 23,028 7,948,411 Alimentation Couche-Tard, Inc., Class B 179,500 6,250,922 Teleperformance SA 26,943 8,306,583 Brookfield Asset Management, Inc., Class A 129,004 4,264,872 Total SE 113,620 3,902,001 Canadian National Railway Co. 187,926 20,014,109 Total 108,624,917 Dollarama, Inc. 223,415 8,563,780 Germany 5.5% Total 39,093,683 Adidas AG(a) 18,700 6,039,018 China 9.0% Infineon Technologies AG 652,214 18,383,168 Alibaba Group Holding Ltd.(a) 950,520 34,894,654 Rational AG 13,768 10,799,191 CNOOC Ltd. -

Rothschild & Co Risk-Based Europe Index

Rothschild & Co Risk-Based Europe Index Indicative Index Weight Data as of January 31, 2020 on close Constituent Exchange Country Index Weight (%) Chocoladefabriken Lindt & Spru Switzerland 1.91 EDP Renovaveis SA Portugal 1.55 Aroundtown SA Germany 1.47 LEG Immobilien AG Germany 1.36 Deutsche Wohnen SE Germany 1.27 Vonovia SE Germany 1.26 E.ON SE Germany 1.24 Iberdrola SA Spain 1.23 Deutsche Telekom AG Germany 1.10 HAL Trust Netherlands 1.10 Sampo Oyj Finland 1.10 Nestle SA Switzerland 1.06 Swiss Re AG Switzerland 1.04 Orange SA France 1.03 Unilever NV Netherlands 1.00 Swiss Life Holding AG Switzerland 1.00 EDP - Energias de Portugal SA Portugal 0.99 Zurich Insurance Group AG Switzerland 0.99 Roche Holding AG Switzerland 0.99 Orkla ASA Norway 0.99 Assicurazioni Generali SpA Italy 0.97 Novozymes A/S Denmark 0.97 Givaudan SA Switzerland 0.93 Koninklijke Ahold Delhaize NV Netherlands 0.91 Proximus SADP Belgium 0.90 Muenchener Rueckversicherungs- Germany 0.90 Hannover Rueck SE Germany 0.89 Beiersdorf AG Germany 0.89 Imperial Brands PLC United Kingdom 0.89 Ageas Belgium 0.89 Geberit AG Switzerland 0.88 Novartis AG Switzerland 0.88 National Grid PLC United Kingdom 0.87 Orsted A/S Denmark 0.86 Telenor ASA Norway 0.85 Veolia Environnement SA France 0.85 Kerry Group PLC Ireland 0.84 Merck KGaA Germany 0.83 Coloplast A/S Denmark 0.83 Unilever PLC United Kingdom 0.83 Reckitt Benckiser Group PLC United Kingdom 0.82 Deutsche Boerse AG Germany 0.82 OMV AG Austria 0.81 Sofina SA Belgium 0.81 Ferrovial SA Spain 0.81 Terna Rete Elettrica Nazionale Italy -

Agenda Item 4B-02 Attachment 2

Attachment 2, Page 1 of 5 CalPERS 2013 Northern Ireland Report CalPERS Holdings of Non-US Companies with Operations in Northern Ireland as of December 31, 2013 Equity Exposure Fixed Income Exposure Company Name Country Number of shares Market Value Par Value Market Value Total Market Value 3I GROUP PLC United Kingdom 2,574,784 $ 16,422,524.30 $ 16,422,524.30 Abertis Infraestructuras, S.A. Spain 1,593,291 $ 35,456,913.79 $ 35,456,913.79 Adecco S.A. Switzerland 496,749 $ 39,433,833.03 $ 39,433,833.03 Aer Lingus Group PLC Ireland 690,822 $ 1,220,358.65 $ 1,220,358.65 AGF Management Limited Canada 473,502 $ 5,913,761.45 $ 5,913,761.45 Akzo Nobel N.V. Netherlands 913,438 $ 70,913,548.72 $ 70,913,548.72 Allianz SE Germany 1,688,214 $ 303,229,768.85 $ 303,229,768.85 Anglo American PLC United Kingdom 7,998,118 $ 174,864,659.74 $ 174,864,659.74 AON PLC United Kingdom 884,243 $ 74,179,145.27 $ 74,179,145.27 ASSOCIATED BRITISH FOODS PLC United Kingdom 942,014 $ 38,147,125.08 $ 38,147,125.08 AstraZeneca PLC United Kingdom 4,953,597 $ 293,321,909.59 $ 293,321,909.59 ATOS S.A. France 268,961 $ 24,382,739.52 $ 24,382,739.52 AVIVA PLC United Kingdom 10,790,113 $ 80,366,392.33 $ 80,366,392.33 Axa SA France 7,018,874 $ 195,464,125.84 28,000,000 $ 28,389,999.68 $ 223,854,125.52 AYALA CORPORATION Philippines 609,480 $ 7,113,403.71 $ 7,113,403.71 BABCOCK INTERNATIONAL GROUP PLC United Kingdom 1,071,215 $ 24,040,391.35 $ 24,040,391.35 Banco Santander, S.A. -

FTSE UK 100 ESG Select

2 FTSE Russell Publications 19 August 2021 FTSE UK 100 ESG Select Indicative Index Weight Data as at Closing on 30 June 2021 Constituent Index weight (%) Country Constituent Index weight (%) Country Constituent Index weight (%) Country 3i Group 0.83 UNITED KINGDOM Halfords Group 0.06 UNITED KINGDOM Prudential 2.67 UNITED KINGDOM 888 Holdings 0.08 UNITED KINGDOM Harbour Energy PLC 0.01 UNITED KINGDOM Rathbone Brothers 0.08 UNITED KINGDOM Anglo American 2.62 UNITED KINGDOM Helical 0.03 UNITED KINGDOM Reckitt Benckiser Group 3.01 UNITED KINGDOM Ashmore Group 0.13 UNITED KINGDOM Helios Towers 0.07 UNITED KINGDOM Rio Tinto 4.8 UNITED KINGDOM Associated British Foods 0.65 UNITED KINGDOM Hiscox 0.21 UNITED KINGDOM River and Mercantile Group 0.01 UNITED KINGDOM Aviva 1.18 UNITED KINGDOM HSBC Hldgs 6.33 UNITED KINGDOM Royal Dutch Shell A 4.41 UNITED KINGDOM Barclays 2.15 UNITED KINGDOM Imperial Brands 1.09 UNITED KINGDOM Royal Dutch Shell B 3.85 UNITED KINGDOM Barratt Developments 0.52 UNITED KINGDOM Informa 0.56 UNITED KINGDOM Royal Mail 0.39 UNITED KINGDOM BHP Group Plc 3.29 UNITED KINGDOM Intermediate Capital Group 0.44 UNITED KINGDOM Schroders 0.29 UNITED KINGDOM BP 4.66 UNITED KINGDOM International Personal Finance 0.02 UNITED KINGDOM Severn Trent 0.44 UNITED KINGDOM British American Tobacco 4.75 UNITED KINGDOM Intertek Group 0.66 UNITED KINGDOM Shaftesbury 0.12 UNITED KINGDOM Britvic 0.19 UNITED KINGDOM IP Group 0.09 UNITED KINGDOM Smith (DS) 0.4 UNITED KINGDOM BT Group 1.26 UNITED KINGDOM Johnson Matthey 0.43 UNITED KINGDOM Smurfit Kappa Group 0.76 UNITED KINGDOM Burberry Group 0.62 UNITED KINGDOM Jupiter Fund Management 0.09 UNITED KINGDOM Spirent Communications 0.11 UNITED KINGDOM Cairn Energy 0.05 UNITED KINGDOM Kingfisher 0.57 UNITED KINGDOM St.