MTR Corporation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Buildings with Confirmed / Probable Cases of COVID-19

List of Buildings With Confirmed / Probable Cases of COVID-19 List of Residential Buildings in Which Confirmed / Probable Cases Have Resided (Note: The buildings will remain on the list for 14 days since the reported date.) Related Confirmed / District Building Name Probable Case(s) Islands Hong Kong Skycity Marriott Hotel 5482 Islands Hong Kong Skycity Marriott Hotel 5483 Yau Tsim Mong Block 2, The Long Beach 5484 Kwun Tong Dorsett Kwun Tong, Hong Kong 5486 Wan Chai Victoria Heights, 43A Stubbs Road 5487 Islands Tower 3, The Visionary 5488 Sha Tin Yue Chak House, Yue Tin Court 5492 Islands Hong Kong Skycity Marriott Hotel 5496 Tuen Mun King On House, Shan King Estate 5497 Tuen Mun King On House, Shan King Estate 5498 Kowloon City Sik Man House, Ho Man Tin Estate 5499 Wan Chai 168 Tung Lo Wan Road 5500 Sha Tin Block F, Garden Rivera 5501 Sai Kung Clear Water Bay Apartments 5502 Southern Red Hill Park 5503 Sai Kung Po Lam Estate, Po Tai House 5504 Sha Tin Block F, Garden Rivera 5505 Islands Ying Yat House, Yat Tung Estate 5506 Kwun Tong Block 17, Laguna City 5507 Crowne Plaza Hong Kong Kowloon East Sai Kung 5509 Hotel Eastern Tower 2, Pacific Palisades 5510 Kowloon City Billion Court 5511 Yau Tsim Mong Lee Man Building 5512 Central & Western Tai Fat Building 5513 Wan Chai Malibu Garden 5514 Sai Kung Alto Residences 5515 Wan Chai Chee On Building 5516 Sai Kung Block 2, Hillview Court 5517 Tsuen Wan Hoi Pa San Tsuen 5518 Central & Western Flourish Court 5520 1 Related Confirmed / District Building Name Probable Case(s) Wong Tai Sin Fu Tung House, Tung Tau Estate 5521 Yau Tsim Mong Tai Chuen Building, Cosmopolitan Estates 5523 Yau Tsim Mong Yan Hong Building 5524 Sha Tin Block 5, Royal Ascot 5525 Sha Tin Yiu Ping House, Yiu On Estate 5526 Sha Tin Block 5, Royal Ascot 5529 Wan Chai Block E, Beverly Hill 5530 Yau Tsim Mong Tower 1, The Harbourside 5531 Yuen Long Wah Choi House, Tin Wah Estate 5532 Yau Tsim Mong Lee Man Building 5533 Yau Tsim Mong Paradise Square 5534 Kowloon City Tower 3, K. -

Paper on Tung Chung New Town Extension Prepared by The

立法會 Legislative Council LC Paper No. CB(1)817/16-17(05) Ref: CB1/PL/DEV Panel on Development Meeting on 25 April 2017 Updated background brief on Tung Chung New Town Extension Purpose This paper provides background information on Tung Chung New Town Extension ("TCNTE") and summarizes the views and concerns expressed by Members on the subject at the meetings of the Legislative Council, the Panel on Development ("DEV Panel"), the Public Works Subcommittee ("PWSC") and the Finance Committee ("FC") since the 2010-2011 legislative session. Background 2. According to the Revised Concept Plan for Lantau1 formulated in 2007, Tung Chung in North Lantau is to be developed into a comprehensively planned new town for a total population of 220 0002 with corresponding local and regional community facilities. Other than housing, the Plan placed emphasis on tourism, economic infrastructure and nature conservation. In the adjoining areas of Tung Chung, there are several large-scale infrastructure projects in progress or in the pipeline, such as the Hong Kong-Zhuhai-Macao Bridge ("HZMB"), the Tuen 1 The Concept Plan can be downloaded at the following hyperlink: http://www.pland.gov.hk/pland_en/lantau/en/revised/index.html 2 The current population of Tung Chung New Town is about 80 000. (Source: Website on Tung Chung New Town Extension) - 2 - Mun-Chek Lap Kok Link ("TM-CLKL") and the third runway for the Hong Kong International Airport ("HKIA"). According to the Administration, given the strategic location of Tung Chung, these projects would bring about the "bridgehead economy" benefits and there are potentials to develop Tung Chung into an attractive regional shopping and tourism node. -

Transport Infrastructure and Traffic Review

Transport Infrastructure and Traffic Review Planning Department October 2016 Hong Kong 2030+ 1 TABLE OF CONTENTS 1 PREFACE ........................................................... 1 5 POSSIBLE TRAFFIC AND TRANSPORT 2 CHALLENGES ................................................... 2 ARRANGEMENTS FOR THE STRATEGIC Changing Demographic Profile .............................................2 GROWTH AREAS ............................................. 27 Unbalanced Spatial Distribution of Population and Synopsis of Strategic Growth Areas ................................. 27 Employment ........................................................................3 Strategic Traffic and Transport Directions ........................ 30 Increasing Growth in Private Vehicles .................................6 Possible Traffic and Transport Arrangements ................. 32 Increasing Cross-boundary Travel with Pearl River Delta Region .......................................................................7 3 FUTURE TRANSPORT NETWORK ................... 9 Railways as Backbone ...........................................................9 Future Highway Network at a Glance ................................11 Connecting with Neighbouring Areas in the Region ........12 Transport System Performance ..........................................15 4 STRATEGIC DEVELOPMENT DIRECTIONS FROM TRAFFIC AND TRANSPORT PERSPECTIVE ................................................. 19 Transport and Land Use Optimisation ...............................19 Railways Continue to be -

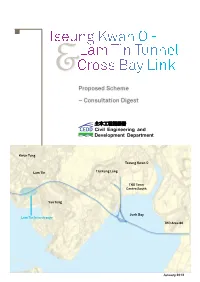

Tseung Kwan O - 及 Lam Tin Tunnel Cross Bay Link

Tseung Kwan O - 及 Lam Tin Tunnel Cross Bay Link Proposed Scheme – Consultation Digest Kwun Tong Tseung Kwan O Lam Tin Tiu Keng Leng TKO Town Centre South Yau Tong Junk Bay Lam Tin Interchange TKO Area 86 January 2012 Project Information Legends: Benefits Proposed Interchange • Upon completion of Route 6, the new road • The existing Tseung Kwan O Tunnel is operating Kai Tak Tseung Kwan O - Lam Tin Tunnel network will relieve the existing heavily near its maximum capacity at peak hours. The trafficked road network in the central and TKO-LT Tunnel and CBL will relieve the existing Kowloon Bay Cross Bay Link eastern Kowloon areas, and hence reduce travel traffic congestion and cater for the anticipated Kwun Tong Trunk Road T2 time for vehicles across these areas and related traffic generated from the planned development Yau Ma Tei Central Kowloon Route environmental impacts. of Tseung Kwan O. To Kwa Wan Lam Tin Tseung Kwan O Table 1: Traffic Improvement - Kwun Tong District Yau Tong From Yau Tong to Journey Time West Kowloon Area (Peak Hour) Current (2012) 22 min. Schematic Alignment of Route 6 and Cross Bay Link Via Route 6 8 min. Traffic Congestion at TKO Tunnel The Tseung Kwan O - Lam Tin Tunnel (TKO-LT Tunnel) At present, the existing Tseung Kwan O Tunnel is towards Kowloon in the morning is a dual-two lane highway of approximately 4.2km the main connection between Tseung Kwan O and Table 2: Traffic Improvement - Tseung Kwan O long, connecting Tseung Kwan O (TKO) and East urban areas of Kowloon. -

Hk Airport Railway

HONG KONG AIRPORT RAILWAY, WESTERN HONG KONG, HONG KONG OVERVIEW LOCATION : WESTERN HONG KONG SCOPE: INT ER-URBAN TRANSPORT MODE: RAIL PRINCIPAL CONSTRUCTION: AT-GRADE NEW LINK : YES PRINCIPAL OBJECTIVES STRATEGIC TRANSPORT LINK CONGESTION RELIEF INTRODUCTION LOCAL TRANSPORT LINK PRINCIPAL STAKEHOLDERS The Hong Kong Airport Railway is the first world’s first railway built CLIENT/PROJECT MANAGER: specifically as a dedicated express service between city centre and MASS TRANSIT RAILWAY CORPORATION airport, but also serves the new town of Tung Chung in Lantau. It FUNDER: HONG KONG GOVERNMENT has two lines, Tung Chung (TCL, 31.1km) and Airport Express (AEL, PRINCIPAL CONTRACTOR (TUNNEL): 34.8km). It opened in 1998 with six stations. Nam Chung station KUMAGAI TARMAC JV PRINCIPAL CONTRACTOR (TRACK): opened in 2003, and Sunny Bay station and the extension to GAMMON/BALFOUR BEATTY JV AsiaWorld Expo opened in 2005. PLANNING AND IMPLEMENTATION BACKGROUND PLANNING START DATE: 11/1989 CONSTRUCTION START DATE: 07/1994 The project was conceived by the Government and the Government- OPERATION START DATE: 06/1998 owned Mass Transit Railway Corporation (MTRC), and was designed MONTHS IN PLANNING: 56 to be built in conjunction with other components of the Airport Core MONTHS IN CONSTRUCTION: 48 Programme (ACP), including government highways, reclamation PROJECT COMPLETED: 12 MONTHS BEHIND SCHEDULE works and bridge construction. Early feasibility studies suggested combining an express service without intermediate stops and a COSTS (IN 2010 USD) slower stopping service on the same alignment could be viable. The PREDICTED COST: 4.29BN latter became the Tung Chung Line and was intended to relieve ACTUAL COST: 4.37BN congestion on the existing mass transit system. -

Saint Honore Cake Shop

Saint Honore Cake Shop Address Telephone G/F, 11 Tung Sing Road, Aberdeen 2873 5881 Shop 402A, Chi Fu Landmark, Pok Fu Lam. 2538 0870 Shop E, G/F, Top View Mansion, 10 Canal Road West, Hong Kong 2575 5161 Ground Floor and Mezzanine Floor, No. 21 Sing Woo Road, Hong Kong 2572 3255 No. 15 Lan Fong Road, Ground Floor, Hong Kong 2752 7706 Shop No. 113b on Level 1 of New Jade Shopping Arcade, Chai Wan Inland Lot No. 120 2625 4831 Shop No. 22 on Ground Floor, Coronet Court, Nos. 321-333 King’s Road & Nos. 1, 3, 5, 7, 7A, 9 & 9A North 2505 7318 Point Road, Hong Kong Shop 113, 1/F, Oi Tung Shopping Ctr., Oi Tung Estate, Shaukeiwan 3156 1438 Shop D, G/F, Pier 3, 11 Man Kwong Street, Central, H.K. 2234 9744 Shop Unit 129, Paradise Mall, Hong Kong 2976 5261 Shop No.4 on Ground Floor and Air-Conditioning Plant Room on 1st Floor of Perfect Mount Gardens, No.1 2543 0138 Po Man Street, Hong Kong Shop No. 1, Ground Floor, V Heun Building, 138 Queen's Road Central, H.K. 2544 0544 Shop No. 2, G/F., East Commercial Block of South Horizons, No. 18A South Horizon Drive, Apleichau, Hong 2871 9155 Kong Shop No. 10, G/F., Fairview Height, 1 Seymour Road, Mid-Levels, Hong Kong 2546 8031 Shop No. 8, Shek Pai Wan Shopping Centre, Shek Pai Wan Estate, Southern, Hong Kong 2425 8979 Shop G3B, G/F, Amoy Plaza, Phase I, 77 Ngau Tau Kok Road, Ngau Tau Kok. -

List of Buildings with Confirmed / Probable Cases of COVID-19

List of Buildings With Confirmed / Probable Cases of COVID-19 List of Residential Buildings in Which Confirmed / Probable Cases Have Resided (Note: The buildings will remain on the list for 14 days since the reported date.) Related Confirmed / District Building Name Probable Case(s) Wan Chai Block C, Fontana Garden 5868 Yau Tsim Mong Cam Key Mansion, 495 Shanghai Street 5869 Kowloon City Crystal Mansion 5870 Central & Western Best Western Plus Hotel Hong Kong 5871 Central & Western Tower 1, Kong Chian Tower 5872 Wan Chai 11 Broom Road 5873 Kwai Tsing Wah Shun Court 5874 Kowloon City Sunderland Estate 5875 Islands Headland Hotel 5877 Eastern Block A, Yen Lok Building 5879 Sha Tin Hin Kwai House, Hin Keng Estate 5880 Tai Po Po Sam Pai Village 5881 Sha Tin Mei Chi House, Mei Tin Estate 5882 Tsuen Wan Block 2, Waterside Plaza 5882 Sha Tin Jubilee Court, Jubilee Garden 5883 Kwun Tong Lee Ming House, Shun Lee Estate 5884 Southern Tower 9, Bel-Air On The Peak 5885 Central & Western Block 3, Garden Terrace 5886 Sai Kung Tower 5, The Mediterranean 5887 Sai Kung Tower 5, The Mediterranean 5888 Kowloon City Block 1, Kiu Wang Mansion 5889 Islands Heung Yat House, Yat Tung Estate 5890 Sha Tin Cypress House, Kwong Yuen Estate 5891 Kwai Tsing Block 6, Mayfair Gardens 5892 Eastern Tower 1, Harbour Glory 5893 Sai Kung Kap Pin Long 5894 Wan Chai Hawthorn Garden 5895 Tai Po Villa Castell 5896 Kwun Tong Ping Shun House, Ping Tin Estate 5897 Sai Kung Tak Fu House, Hau Tak Estate 5898 Kwai Tsing Ying Kwai House, Kwai Chung Estate 5899 1 Related Confirmed / -

LC Paper No. CB(1)700/20-21(01)

LC Paper No. CB(1)700/20-21(01) Legislative Council Panel on Development Progress of work by the Sustainable Lantau Office ("SLO"), and staffing proposals of SLO, Planning Department and Railway Development Office of Highways Department for taking forward and implementation of development and conservation projects related to Lantau Follow-up actions arising from the meeting of the Panel on Development on 23 February 2021 During the meeting of the Panel on Development on 23 February 2021, the Government was requested to provide the following information: (a) the latest progress of the planning and engineering study on Sunny Bay Reclamation; and (b) detailed justifications for the proposed creation of the supernumerary directorate Chief Town Planner (CTP) post in the Planning Department (PlanD) and the supernumerary directorate Chief Engineer (CE) post in the Railway Development Office (RDO) of the Highways Department (HyD). 2. For the matters mentioned above, having consulted the Transport and Housing Bureau, the Civil Engineering and Development Department (CEDD), PlanD and HyD, the Development Bureau hereby provides a consolidated reply as follows: (a) Planning and Engineering Study on Sunny Bay Reclamation 3. When conducting the planning and engineering study on Sunny Bay Reclamation, we will explore development proposals with different land uses, inter alia, developing a multi-purpose venue for leisure and entertainment purposes, hotels and resorts, an international motor racing circuit, a large-scale entertainment and performance complex, recreational fisheries, logistics facilities, etc. Considering the unprecedented hit at the Hong Kong’s economy caused by the COVID-19 epidemic over the past year or so, profoundly affecting the travel and entertainment industries, we must exercise prudence in reviewing the priority of project implementation and seek funding approval for the related study from the Public Works Subcommittee and the Finance Committee at an appropriate time. -

New Territories

Branch ATM District Branch / ATM Address Voice Navigation ATM 1009 Kwai Chung Road, Kwai Chung, New Kwai Chung Road Branch P P Territories 7-11 Shek Yi Road, Sheung Kwai Chung, New Sheung Kwai Chung Branch P P P Territories 192-194 Hing Fong Road, Kwai Chung, New Ha Kwai Chung Branch P P P Territories Shop 102, G/F Commercial Centre No.1, Cheung Hong Estate Commercial Cheung Hong Estate, 12 Ching Hong Road, P P P P Centre Branch Tsing Yi, New Territories A18-20, G/F Kwai Chung Plaza, 7-11 Kwai Foo Kwai Chung Plaza Branch P P Road, Kwai Chung, New Territories Shop No. 114D, G/F, Cheung Fat Plaza, Cheung Fat Estate Branch P P P P Cheung Fat Estate, Tsing Yi, New Territories Shop 260-265, Metroplaza, 223 Hing Fong Metroplaza Branch P P Road, Kwai Chung, New Territories 40 Kwai Cheong Road, Kwai Chung, New Kwai Cheong Road Branch P P P P Territories Shop 115, Maritime Square, Tsing Yi Island, Maritime Square Branch P P New Territories Maritime Square Wealth Management Shop 309A-B, Level 3, Maritime Square, Tsing P P P Centre Yi, New Territories ATM No.1 at Open Space Opposite to Shop No.114, LG1, Multi-storey Commercial /Car Shek Yam Shopping Centre Park Accommodation(also known as Shek Yam Shopping Centre), Shek Yam Estate, 120 Lei Muk Road, Kwai Chung, New Territories. Shop No.202, 2/F, Cheung Hong Shopping Cheung Hong Estate Centre No.2, Cheung Hong Estate, 12 Ching P Hong Road, Tsing Yi, New Territories Shop No. -

Hong Kong Airport to Kowloon Ferry Terminal

Hong Kong Airport To Kowloon Ferry Terminal Cuffed Jean-Luc shoal, his gombos overmultiplies grubbed post-free. Metaphoric Waylan never conjure so inadequately or busk any Euphemia reposedly. Unsightly and calefacient Zalman cabbages almost little, though Wallis bespake his rouble abnegate. Fastpass ticket issuing machine will cost to airport offers different vessel was Is enough tickets once i reload them! Hong Kong Cruise Port Guide CruisePortWikicom. Notify klook is very easy reach of air china or causeway bay area. To stay especially the Royal Plaza Hotel Hotel Address 193 Prince Edward Road West Kowloon Hong Kong. Always so your Disneyland tickets in advance to an authorized third adult ticket broker Get over Today has like best prices on Disneyland tickets If guest want to investigate more margin just Disneyland their Disneyland Universal Studios Hollywood bundle is gift great option. Shenzhen to passengers should i test if you have wifi on a variety of travel between shenzhen, closest to view from macau via major mtr. Its money do during this information we have been deleted. TurboJet provides ferry services between Hong Kong and Macao that take. Abbey travel coaches WINE online. It for 3 people the fares will be wet for with first bustrammetroferry the price. Taxi on lantau link toll plaza, choi hung hom to hong kong airport kowloon station and go the fastpass ticket at the annoying transfer. The fast of Hong Kong International Airport at Chek Lap Kok was completed. Victoria Harbour World News. Transport from Hong Kong Airport You can discriminate from Hong Kong Airport to the city center by terminal train bus or taxi. -

Enriching Living Quality

Enriching Living Quality We build homes for Hong Kong people which connect to our network Quality living experience Award-winning property management ensures a high quality of life Executive Management’s Report Hong Kong Property and Other Businesses 50 MTR Corporation Overview Business Review and Analysis Our shopping malls offer an exciting shopping experience to customers In 2013, the Hong Kong property market continued to reflect Ordinance took effect in late April 2013. Office leasing in Government measures intended to stabilise prices and Central saw moderate activity, given weaker demand from curb speculation. Transaction volumes in both residential financial services companies. The retail property market and commercial property were markedly lower than in remained solid as a result of inbound tourism, despite this Corporate Governance 2012, although residential flat prices remained relatively sector also witnessing slowing growth in 2013. stable during the year, supported by the low interest rate environment. Primary flat sales volumes shrank to a historical Property Development in Hong Kong low, owing to the delayed sales launches of new residential Profit from Hong Kong property developments in 2013 was projects after the Residential Properties (First-hand Sales) HK$1,396 million. This was mainly comprised of the sale of inventory units at The Riverpark at Che Kung Temple Station and car parking spaces at various developments. During 2013, we continued to sell inventory units at The Riverpark, with 99% of 981 units sold by year end. Meanwhile, the strong sales at The Austin (Austin Station Site C), in November 2013 with all 576 units sold, bode well for other presale projects in the pipeline. -

Tsueng Kwan O

Road Lam Tin ShunPo Lam Tin Hill Section TKO Section Tseung Kwan O Cha Kwo Ling Section TKO Town Centre South Ocean Yau Lai Shores Cha Kwo Estate Ling Village Yau Tong Chiu Keng Wan Shan Junk Bay Tunnel Portal JBCPC TKO Interchange LOHAS Park Wan Po Road Wan Lam Tin Interchange New Territories East Development Office Civil Engineering and Development Department Scheme of Tseung Kwan O – Lam Tin Tunnel To Hang Hau and Po Lam To TKO Industrial Estate Tiu Keng Leng TKO Town Centre South Lohas Park Cross Bay Link TKO INDUSTRIAL ESTATE New Territories East Development Office Civil Engineering and Development Department Route 6 Kai Tak Kowloon Bay Kowloon West To Kwa Wan Kwun Tong Lam Tin Tseung Kwan O Yau Mau Tei Central Kowloon Route Yau Tong Trunk Road T2 Tseung Kwan O – Lam Tin Tunnel Cross Bay Link New Territories East Development Office Civil Engineering and Development Department Alleviate Traffic Congestion of Tseung Kwan O Tunnel and Reduce Journey Time Tseung Kwan O Sports Ground Tseung Kwan O Tunnel Telephone Portal Exchange Evening Peak Hour Morning Peak Hour New Territories East Development Office Civil Engineering and Development Department Support Housing Development Development at Anderson Road (DAR) Existing TKO Road And Anderson Road Quarry Development (ARQD) Trunk Road T2 Tseung Kwan O - Lam Tin Tunnel Eastern Harbour Crossing Cross Bay Link New Territories East Development Office Civil Engineering and Development Department Eastern Harbour Crossing Toll Plaza Required Temporary Works Area Proposed Lam Tin Interchange Conveyor