Columbia University Revenue Bonds, Series 2020A

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Columbia University Facts 2014

1754 Royal Charter establishes King's College Graduate School of Architecture, Planning and under King George II of England. Preservation, est. 1881, 1784 Renamed Columbia College by New York Dean Amale Andraos State Legislature. School of the Arts, est. 1965, 1857 College moves from Park Place, near the Dean Carol Becker present City Hall, to 49th and Madison. 1864 Students enter the School of Mines, now Graduate School of Arts and Sciences, est. 1880, The Fu Foundation School of Engineering Dean Carlos J. Alonso and Applied Science. Graduate School of Business, est. 1916, 1889 Barnard College becomes an affiliate of Dean R. Glenn Hubbard Columbia. 1896 Trustees formally designate Columbia as a Columbia College, est. 1754, university. Dean James J. Valentini 1897 The University moves to its present site in School of Continuing Education, est. 2002, Morningside Heights. Dean Kristine Billmyer 1928 Opening of the Columbia-Presbyterian Medical Center, the first to combine College of Dental Medicine, est. 1916, teaching, research, and patient care. Dean Christian Stohler 1947 Nevis Laboratories is founded in The Fu Foundation School of Engineering and Irvington, New York, offering facilities for Applied Science, est. 1864, experimental physics research. Dean Mary C. Boyce 1949 The Lamont-Doherty Earth Observatory opens in Palisades, New York. School of General Studies, est. 1947, 1983 The first Columbia College class to include Dean Peter J. Awn women arrives on campus in September. School of International and Public Affairs, est. 1946, 2002 Lee C. Bollinger begins term as Columbia's Dean Merit Janow 19th president. th Graduate School of Journalism, est. -

2019 Standard 509 Information Report

COLUMBIA UNIVERSITY - 2019 Standard 509 Information Report 435 West 116th Street ABA New York, NY 10027 Approved Phone: 212-854-2640 Since Website: law.columbia.edu 1923 http://www.abarequireddisclosures.org Report Generated on: 12-04-2019 The Basics 2019 First Year Class (Oct 6th 2018-Oct 5th 2019) Type of school Private 2019 Application deadline 11/15/2019 2/15/2020 Completed Applications 7193 Application fee $85 Offers of Admission 1141 Financial aid deadline 3/1/2020 Acceptance Rate (Percent) 15.86% Enrollees from Applicant pool 329 Academic Calendar Enrollment rate from Completed Applications 4.57% Term Semester Enrollment rate from Offers of Admission 28.83% Months students may begin studying law Aug/Sept Other first-year enrollees 35 Months the Law school confers degrees Oct/May All Full Time Part Time # of credit hours required to earn the JD 84 Total in First-year class 364 364 0 LSAT All Full Time Part Time Curricular Offerings 2018-2019 75th Percentile 173 173 0 2018-2019 50th Percentile 172 172 0 Typical first-year section size, excluding all 99 small sections taught by full-time faculty 25th Percentile 169 169 0 Number of course titles,beyond the first 342 # not included in LSAT calculations 8 8 0 year curricular,offered last year Number of upper division class room UGPA All Full Time Part Time course sections with an enrollment: 75th Percentile 3.89 3.89 0.00 Under 25 260 50th Percentile 3.80 3.80 0.00 25 to 49 46 25th Percentile 3.69 3.69 0.00 50 to 74 18 # not included in UGPA calculations 17 17 0 75 to 99 5 Faculty Resources -

Barnard College Bulletin 2017-18 3

English .................................................................................... 201 TABLE OF CONTENTS Environmental Biology ........................................................... 221 Barnard College ........................................................................................ 2 Environmental Science .......................................................... 226 Message from the President ............................................................ 2 European Studies ................................................................... 234 The College ........................................................................................ 2 Film Studies ........................................................................... 238 Admissions ........................................................................................ 4 First-Year Writing ................................................................... 242 Financial Information ........................................................................ 6 First-Year Seminar ................................................................. 244 Financial Aid ...................................................................................... 6 French ..................................................................................... 253 Academic Policies & Procedures ..................................................... 6 German ................................................................................... 259 Enrollment Confirmation ........................................................... -

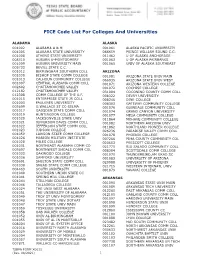

FICE Code List for Colleges and Universities (X0011)

FICE Code List For Colleges And Universities ALABAMA ALASKA 001002 ALABAMA A & M 001061 ALASKA PACIFIC UNIVERSITY 001005 ALABAMA STATE UNIVERSITY 066659 PRINCE WILLIAM SOUND C.C. 001008 ATHENS STATE UNIVERSITY 011462 U OF ALASKA ANCHORAGE 008310 AUBURN U-MONTGOMERY 001063 U OF ALASKA FAIRBANKS 001009 AUBURN UNIVERSITY MAIN 001065 UNIV OF ALASKA SOUTHEAST 005733 BEVILL STATE C.C. 001012 BIRMINGHAM SOUTHERN COLL ARIZONA 001030 BISHOP STATE COMM COLLEGE 001081 ARIZONA STATE UNIV MAIN 001013 CALHOUN COMMUNITY COLLEGE 066935 ARIZONA STATE UNIV WEST 001007 CENTRAL ALABAMA COMM COLL 001071 ARIZONA WESTERN COLLEGE 002602 CHATTAHOOCHEE VALLEY 001072 COCHISE COLLEGE 012182 CHATTAHOOCHEE VALLEY 031004 COCONINO COUNTY COMM COLL 012308 COMM COLLEGE OF THE A.F. 008322 DEVRY UNIVERSITY 001015 ENTERPRISE STATE JR COLL 008246 DINE COLLEGE 001003 FAULKNER UNIVERSITY 008303 GATEWAY COMMUNITY COLLEGE 005699 G.WALLACE ST CC-SELMA 001076 GLENDALE COMMUNITY COLL 001017 GADSDEN STATE COMM COLL 001074 GRAND CANYON UNIVERSITY 001019 HUNTINGDON COLLEGE 001077 MESA COMMUNITY COLLEGE 001020 JACKSONVILLE STATE UNIV 011864 MOHAVE COMMUNITY COLLEGE 001021 JEFFERSON DAVIS COMM COLL 001082 NORTHERN ARIZONA UNIV 001022 JEFFERSON STATE COMM COLL 011862 NORTHLAND PIONEER COLLEGE 001023 JUDSON COLLEGE 026236 PARADISE VALLEY COMM COLL 001059 LAWSON STATE COMM COLLEGE 001078 PHOENIX COLLEGE 001026 MARION MILITARY INSTITUTE 007266 PIMA COUNTY COMMUNITY COL 001028 MILES COLLEGE 020653 PRESCOTT COLLEGE 001031 NORTHEAST ALABAMA COMM CO 021775 RIO SALADO COMMUNITY COLL 005697 NORTHWEST -

St. Francis College Career Development Center

St. Francis College Career Development Center TABLE SCHOOL GRADUATE PROGRAMS OFFERED NUMBER Across the Pond: Study in the UK All Graduate Programs in the United Kingdom 1 The university boasts more than 70 top tier graduate programs Adelphi University across Arts and Sciences, Business, Emergency Management, 2 Education, Nursing and Public Health, Psychology, and Social Work MSEd in School Counseling; MSEd/CAS in Mental Health Counseling; MSEd in Literacy with Special Education Extension; Alfred University Master of Public Administration; Master of Business Administration; 3 CAS in Mental Health Counseling; CAS in Gerontology Clinical Services; CAS in Gerontology Management and Administration American University of Antigua, College of Medicine Medical Degree (MD) 4 MS in Child Life, MSED with a variety of specialties including early Bank Street Graduate School of Education Childhood, Special Education and Literacy. MSED/MSW, Education 5 Leadership including in the Arts, Early Childhood, and Mathematics MS in Environmental Policy, MS in Climate Science and Policy, MBA Bard Graduate Programs in Sustainability 6 in Sustainability Baruch College, Zicklin School of Business MS in Business Degree Programs, MBA Majors 7 Page 1 St. Francis College Career Development Center Juris Doctorage (J.D.), Master of Laws (LL.M.), and Doctor of the Benjamin N. Cardozo School of Law 8 Science and Law (J.S.D) Brooklyn Law School J.D., LL.M 9 Accounting, Applied Behavior Analysis, Art Therapy, Business Caldwell University 10 Administration, Counseling, Education, -

List of Colleges and Universities in New York City from Wikipedia, the Free Encyclopedia

List of coleges and univer sit ies in New Yor k Cit y - Wikipedia1, 2 /t 1h8e/ 1f 2r ee encyclopedia List of colleges and universities in New York City From Wikipedia, the free encyclopedia This is a list of colleges and universities entirely in, or with a campus in, New York City. The Ailey School (Alvin Ailey American Dance Crew) American Academy McAllister Institute American Academy of Dramatic Arts American Musical and Dramatic Academy Art Institute of New York City ASA College (http://www.asa.edu) Bank Street College of Education Bard College (Globalization and International Affairs Program) Barnard College (affiliated with Columbia University) Berkeley College Bethel Seminary of the East Boricua College Bramson ORT College Briarcliffe College - The Queens Center Brooklyn Law School Christie's Education Inc City University of New York (CUNY) (multiple campuses) Baruch College Borough of Manhattan Community College Brooklyn College Bronx Community College City College of New York Sophie Davis School of Biomedical Education CUNY Baccalaureate for Unique and Interdisciplinary Studies CUNY Graduate Center CUNY School of Professional Studies CUNY Graduate School of Journalism CUNY William E. Macaulay Honors College CUNY School of Law (at Queens College) College of Staten Island Hostos Community College Hunter College John Jay College of Criminal Justice Kingsborough Community College LaGuardia Community College Lehman College Medgar Evers College New York City College of Technology en. wikipedia. or g/ wiki/ List _of _coleges_and_univer -

2020 Standard 509 Information Report

COLUMBIA UNIVERSITY - 2020 Standard 509 Information Report 435 West 116th Street ABA New York, NY 10027 Approved Phone: 212-854-2640 Since Website: law.columbia.edu 1923 http://www.abarequireddisclosures.org Report Generated on: 12-18-2020 The Basics 2020 First Year Class (Oct 6th 2019-Oct 5th 2020) Type of school Private 2020 Application deadline 11/15/2020 2/15/2021 Completed Applications 6986 Offers of Admission 1166 Application fee $85 Acceptance Rate (Percent) 16.69% Financial aid deadline 3/1/2020 Enrollees from Applicant pool 377 Enrollment rate from Completed Applications 5.40% Academic Calendar Enrollment rate from Offers of Admission 32.33% Term Semester Other first-year enrollees 17 Months students may begin studying law Aug/Sept All Full Time Part Time Months the Law school confers degrees Oct/May Total in First-year class 394 394 0 # of credit hours required to earn the JD 84 LSAT All Full Time Part Time 75th Percentile 173 173 0 Curricular Offerings 2019-2020 50th Percentile 172 172 0 25th Percentile 169 169 0 2019-2020 # not included in LSAT 16 16 0 Typical first-year section size, excluding 99 calculations Legal Research & Writing Other Admissions Tests Number 75th 50th 25th Number of course titles,beyond the first 385 Enrolled Percentile Percentile Percentile year curricular,offered last year GRE 18 Number of upper division class room course sections with an enrollment: Verbal Reasoning 170 166 164 Under 25 256 Quantitative Reasoning 168 162 156 25 to 49 60 Analytical Writing 5.5 5 4.5 UGPA All Full Time Part Time 50 to -

Columbia University Facts 2020

Columbia University Facts 2020 Campuses Schools and Colleges Lamont-Doherty Earth Observatory, 1949 Graduate School of Architecture, Planning The Fu Foundation School of Engineering and Palisades, New York and Preservation, 1881 Applied Science, 1864 Dean Amale Andraos Dean Mary C. Boyce Manhattanville, 2016 125th & Broadway, New York, New York School of the Arts, 1965 School of General Studies, 1947 Dean Carol Becker Dean Lisa Rosen-Metsch Medical Center, 1928 168th & Broadway, New York, New York Graduate School of Arts and Sciences, 1880 School of International and Public Affairs, 1946 Dean Carlos J. Alonso Dean Merit Janow Morningside Heights, 1867 116th & Broadway, New York, New York Columbia Business School, 1916 Columbia Journalism School, 1912 Dean Costis Maglaras Dean Steve Coll Nevis Laboratories, 1947 Irvington, New York Columbia College, 1754 Columbia Law School, 1858 Dean James J. Valentini Dean Gillian Lester Reid Hall, 1964 Paris, France College of Dental Medicine, 1916 School of Nursing, 1892 Dean Christian Stohler Dean Lorraine Frazier Vagelos College of Physicians and Surgeons, 1767 Interim Dean Anil Rustgi Global Centers School of Professional Studies, 2002 Interim Dean Troy J. Eggers Paris, Mailman School of Public Health, 1922 France Beijing, Dean Linda Fried Columbia Istanbul, China School of Social Work, 1898 University Turkey in the City of Tunis, Dean Melissa D. Begg New York Tunisia Amman, Mumbai, Jordan India Affiliated Institutions Nairobi, Kenya Barnard College, 1889 Rio de Janeiro, Jewish Theological Seminary, 1886 Santiago, Brazil Chile Teachers College, 1880 Union Theological Seminary, 1836 Trustees (as of December 2020) Senior Leadership Chief Executive Officer, the Columbia Lisa Carnoy Joseph A. -

The Justinian Volume 1942 Article 1 Issue 2 August

The Justinian Volume 1942 Article 1 Issue 2 August 1942 The uJ stinian Follow this and additional works at: https://brooklynworks.brooklaw.edu/justinian Recommended Citation (1942) "The usJ tinian," The Justinian: Vol. 1942 : Iss. 2 , Article 1. Available at: https://brooklynworks.brooklaw.edu/justinian/vol1942/iss2/1 This Article is brought to you for free and open access by the Special Collections at BrooklynWorks. It has been accepted for inclusion in The usJ tinian by an authorized editor of BrooklynWorks. et al.: The Justinian FALL FALL 1 SEMESTER SEMESTER ISSUE ISSUE Brooklyn Law School . St. Lawrence University VOL. :XII. NO. 1. Brooklyn, N. Y. Wed., Aug. 26, 1942 By Subscription Brooklyn Law School Opens 42 nd Year Justice Theodore Stitt SUMMER Stitt, '12, Named COMMENCEMENT Fall Semester EXERCISES Starts Sept. 28; Jurist, Domestic will be held September 10, Relations Court at 8:30 P. M. Plans Announced Brooklyn Attorney Designated in the Accelerated Courses Available by Mayor to Seat A UDITO RI UM Under Court of Appeals on Bench Brooklyn Law School New R ules of TERM RUNS TO 1944 St. Lawrence University DEAN NOTES CHANGES Designee to Important Judicial Post Speaker Had Long Career in J ustice Edward Lannsky Tells of Curriculum Readjustments Public Service Presi ding Justice. Appellate to Meet N eede of Present· Division, Second Department Day Students Theodore Stitt, '12, Brooklyn attorney, was sworn in by Mayor A cordial invitation to attend The Brooklyn Law Scbool of LaGuardia as a justice of the is extended to all alumni and other friends of the School St. -

Home Page Design Options

P O S T - S E C O N D A R Y S C H O O L L E G A L O U T R E A C H A L U M N I M A T R I C U L A T I O N 78.1% of Legal Outreach Alumni have matriculated to Colleges and Universities ranked "Most Competitive" (48.4%), "Highly Competitive" (11.5%), or "Very Competitive" (18.2%) by Barron's College Profiles Most & Highly Competitive Colleges Attended American University, 2 Dickinson College, 7 Sarah Lawrence College, 3 Amherst College, 7 Duke University, 4 Skidmore College, 14 Babson College, 4 Emory University, 3 Smith College, 21 Bard College, 2 Fordham University, 9 SUNY Binghamton University, 19 Barnard College, 4 Franklin & Marshall College, 9 SUNY Stony Brook University, 18 CUNY Baruch College, 16 George Washington University, 1 Swarthmore College, 4 Bentley University, 4 Georgetown University, 6 Trinity College, 12 Boston College, 2 Georgia Institute of Technology, 1 Tufts University, 5 Boston University, 2 Hamilton College, 15 Tulane University, 1 Bowdoin College, 2 Hampshire College, 16 Union College, 1 Brandeis University, 16 Harvard University, 5 University of California, Berkeley, 1 Brown University, 4 Haverford College, 3 University of Chicago, 1 Bryn Mawr College, 4 College of the Holy Cross, 1 University of Michigan, 4 Bucknell University, 2 Hobart and Williams Smith Colleges, 16 University of Pennsylvania, 6 Carnegie Mellon University, 5 Lafayette College, 5 University of Pittsburgh, 1 Case Western University, 1 Lawrence University, 1 University of Rochester, 18 Clark University, 1 Lehigh University, 3 University of Virginia, 3 Colby College, 6 Middlebury College, 10 Vanderbilt University, 2 Colgate University, 3 Massachusetts Institute of Technology, 3 Vassar College, 1 College of Mount St. -

Columbia University Facts 2016

1754 Royal Charter establishes King's College Graduate School of Architecture, Planning and under King George II of England. Preservation, est. 1881, 1784 Renamed Columbia College by New York Dean Amale Andraos State Legislature. School of the Arts, est. 1965, 1857 College moves from Park Place, near the Dean Carol Becker present City Hall, to 49th and Madison. 1864 Students enter the School of Mines, now Graduate School of Arts and Sciences, est. 1880, The Fu Foundation School of Engineering Dean Carlos J. Alonso and Applied Science. Graduate School of Business, est. 1916, 1889 Barnard College becomes an affiliate of Dean R. Glenn Hubbard Columbia. 1896 Trustees formally designate Columbia as a Columbia College, est. 1754, university. Dean James J. Valentini 1897 The University moves to its present site in School of Professional Studies, est. 2002, Morningside Heights. Dean Jason Wingard 1928 Opening of the Columbia-Presbyterian Medical Center, the first to combine College of Dental Medicine, est. 1916, teaching, research, and patient care. Dean Christian Stohler 1947 Nevis Laboratories is founded in The Fu Foundation School of Engineering and Irvington, New York, offering facilities for Applied Science, est. 1864, experimental physics research. Dean Mary C. Boyce 1949 The Lamont-Doherty Earth Observatory opens in Palisades, New York. School of General Studies, est. 1947, 1983 The first Columbia College class to include Dean Peter J. Awn women arrives on campus in September. School of International and Public Affairs, est. 1946, 2002 Lee C. Bollinger begins term as Columbia's Dean Merit Janow 19th president. Graduate School of Journalism, est. 1912, 2004 Commemoration of Columbia's 250th Dean Steve Coll anniversary. -

Columbia University FACTS 2011

Columbia University FACTS 2011 TIMELINE SCHOOLS AND COLLEGES 1754 Royal Charter establishes King's College under School of Architecture, Planning and Preservation, King George II of England. est. 1896, Dean Mark Wigley 1784 Renamed Columbia College by New York State Legislature. School of the Arts, est. 1948, 1810 Final revisions are made to the Charter under Dean Carol Becker which the University operates today. Graduate School of Arts & Sciences, est. 1880, 1849 College moves from Park Place, near present Dean Carlos J. Alonso City Hall, to 49th and Madison. 1889 Barnard College becomes an affiliate of Graduate School of Business, est. 1916, Columbia. Dean R. Glenn Hubbard 1896 Trustees formally designate Columbia as a university. Columbia College, est. 1754, 1897 The University moves from 49th and Madison Interim Dean James J. Valentini to its present site in Morningside Heights. 1928 Opening of the Columbia-Presbyterian Medical School of Continuing Education, est. 2002, Center, the first such center to combine Kristine Billmyer teaching, research, and patient care. College of Dental Medicine, est. 1917, 1947 Nevis Laboratories is founded in Irvington, Dean Ira B. Lamster New York, offering facilities for experimental physics research. The Fu Foundation School of Engineering and 1949 The Lamont-Doherty Earth Observatory, a Applied Science, est. 1864, world-renowned research center dedicated to Dean Feniosky Peña-Mora understanding the natural world, opens in Palisades, New York. School of General Studies, est. 1947, 1954 Columbia's Bicentennial Celebration. Dean Peter J. Awn 1983 The first Columbia College class to include women arrives on campus in September. School of International & Public Affairs, 2002 Lee C.