Hong Kong Property: Not Crying Wolf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Buildings with Confirmed / Probable Cases of COVID-19

List of Buildings With Confirmed / Probable Cases of COVID-19 List of Residential Buildings in Which Confirmed / Probable Cases Have Resided (Note: The buildings will remain on the list for 14 days since the reported date.) Related Confirmed / District Building Name Probable Case(s) Islands Hong Kong Skycity Marriott Hotel 5482 Islands Hong Kong Skycity Marriott Hotel 5483 Yau Tsim Mong Block 2, The Long Beach 5484 Kwun Tong Dorsett Kwun Tong, Hong Kong 5486 Wan Chai Victoria Heights, 43A Stubbs Road 5487 Islands Tower 3, The Visionary 5488 Sha Tin Yue Chak House, Yue Tin Court 5492 Islands Hong Kong Skycity Marriott Hotel 5496 Tuen Mun King On House, Shan King Estate 5497 Tuen Mun King On House, Shan King Estate 5498 Kowloon City Sik Man House, Ho Man Tin Estate 5499 Wan Chai 168 Tung Lo Wan Road 5500 Sha Tin Block F, Garden Rivera 5501 Sai Kung Clear Water Bay Apartments 5502 Southern Red Hill Park 5503 Sai Kung Po Lam Estate, Po Tai House 5504 Sha Tin Block F, Garden Rivera 5505 Islands Ying Yat House, Yat Tung Estate 5506 Kwun Tong Block 17, Laguna City 5507 Crowne Plaza Hong Kong Kowloon East Sai Kung 5509 Hotel Eastern Tower 2, Pacific Palisades 5510 Kowloon City Billion Court 5511 Yau Tsim Mong Lee Man Building 5512 Central & Western Tai Fat Building 5513 Wan Chai Malibu Garden 5514 Sai Kung Alto Residences 5515 Wan Chai Chee On Building 5516 Sai Kung Block 2, Hillview Court 5517 Tsuen Wan Hoi Pa San Tsuen 5518 Central & Western Flourish Court 5520 1 Related Confirmed / District Building Name Probable Case(s) Wong Tai Sin Fu Tung House, Tung Tau Estate 5521 Yau Tsim Mong Tai Chuen Building, Cosmopolitan Estates 5523 Yau Tsim Mong Yan Hong Building 5524 Sha Tin Block 5, Royal Ascot 5525 Sha Tin Yiu Ping House, Yiu On Estate 5526 Sha Tin Block 5, Royal Ascot 5529 Wan Chai Block E, Beverly Hill 5530 Yau Tsim Mong Tower 1, The Harbourside 5531 Yuen Long Wah Choi House, Tin Wah Estate 5532 Yau Tsim Mong Lee Man Building 5533 Yau Tsim Mong Paradise Square 5534 Kowloon City Tower 3, K. -

1193Rd Minutes

Minutes of 1193rd Meeting of the Town Planning Board held on 17.1.2019 Present Permanent Secretary for Development Chairperson (Planning and Lands) Ms Bernadette H.H. Linn Professor S.C. Wong Vice-chairperson Mr Lincoln L.H. Huang Mr Sunny L.K. Ho Dr F.C. Chan Mr David Y.T. Lui Dr Frankie W.C. Yeung Mr Peter K.T. Yuen Mr Philip S.L. Kan Dr Lawrence W.C. Poon Mr Wilson Y.W. Fung Dr C.H. Hau Mr Alex T.H. Lai Professor T.S. Liu Ms Sandy H.Y. Wong Mr Franklin Yu - 2 - Mr Daniel K.S. Lau Ms Lilian S.K. Law Mr K.W. Leung Professor John C.Y. Ng Chief Traffic Engineer (Hong Kong) Transport Department Mr Eddie S.K. Leung Chief Engineer (Works) Home Affairs Department Mr Martin W.C. Kwan Deputy Director of Environmental Protection (1) Environmental Protection Department Mr. Elvis W.K. Au Assistant Director (Regional 1) Lands Department Mr. Simon S.W. Wang Director of Planning Mr Raymond K.W. Lee Deputy Director of Planning/District Secretary Ms Jacinta K.C. Woo Absent with Apologies Mr H.W. Cheung Mr Ivan C.S. Fu Mr Stephen H.B. Yau Mr K.K. Cheung Mr Thomas O.S. Ho Dr Lawrence K.C. Li Mr Stephen L.H. Liu Miss Winnie W.M. Ng Mr Stanley T.S. Choi - 3 - Mr L.T. Kwok Dr Jeanne C.Y. Ng Professor Jonathan W.C. Wong Mr Ricky W.Y. Yu In Attendance Assistant Director of Planning/Board Ms Fiona S.Y. -

ATTACHMENT 1 Barcode:3800584-02 C-570-107 INV - Investigation

ATTACHMENT 1 Barcode:3800584-02 C-570-107 INV - Investigation - Chinese Producers of Wooden Cabinets and Vanities Company Name Company Information Company Name: A Shipping A Shipping Street Address: Room 1102, No. 288 Building No 4., Wuhua Road, Hongkou City: Shanghai Company Name: AA Cabinetry AA Cabinetry Street Address: Fanzhong Road Minzhong Town City: Zhongshan Company Name: Achiever Import and Export Co., Ltd. Street Address: No. 103 Taihe Road Gaoming Achiever Import And Export Co., City: Foshan Ltd. Country: PRC Phone: 0757-88828138 Company Name: Adornus Cabinetry Street Address: No.1 Man Xing Road Adornus Cabinetry City: Manshan Town, Lingang District Country: PRC Company Name: Aershin Cabinet Street Address: No.88 Xingyuan Avenue City: Rugao Aershin Cabinet Province/State: Jiangsu Country: PRC Phone: 13801858741 Website: http://www.aershin.com/i14470-m28456.htmIS Company Name: Air Sea Transport Street Address: 10F No. 71, Sung Chiang Road Air Sea Transport City: Taipei Country: Taiwan Company Name: All Ways Forwarding (PRe) Co., Ltd. Street Address: No. 268 South Zhongshan Rd. All Ways Forwarding (China) Co., City: Huangpu Ltd. Zip Code: 200010 Country: PRC Company Name: All Ways Logistics International (Asia Pacific) LLC. Street Address: Room 1106, No. 969 South, Zhongshan Road All Ways Logisitcs Asia City: Shanghai Country: PRC Company Name: Allan Street Address: No.188, Fengtai Road City: Hefei Allan Province/State: Anhui Zip Code: 23041 Country: PRC Company Name: Alliance Asia Co Lim Street Address: 2176 Rm100710 F Ho King Ctr No 2 6 Fa Yuen Street Alliance Asia Co Li City: Mongkok Country: PRC Company Name: ALMI Shipping and Logistics Street Address: Room 601 No. -

Thailand) PCL, 45% (Of Paid-Up Capital)

Annual Report 2018 2018 ANNUAL REPORT PP PRIME PUBLIC COMPANY LIMITED PP PRIME PUBLIC COMPANY LIMITED Head Office: 69/5 Moo 5 Rama 2 Road, Bang Khan Taek, EMPOWERING Muangsamut Songkhram, Samut Songkhram 75000 FOR SUSTAINABILITY PP Prime Public Company Limited 1 3 4 7 8 18 34 37 43 44 45 64 75 95 96 99 100 111 112 118 2 Annual Report 2018 PP Prime Public Company Limited 3 4 Annual Report 2018 PP Prime Public Company Limited 5 Board of Directors 6 Annual Report 2018 Board of Directors Financial Information 2018 2017 2016 Sales (Baht) 2,121,449,514 1,875,523,686 2,240,181,809 Net Profit (Loss) (Baht) (110,084,444) (252,406,913) 232,314,148 Earning (Loss)per Share (Baht) (0.20) (0.45) 0.41 Total Asset (Baht) 3,339,876,952 3,987,770,023 3,569,307,914 Total Liabilities (Baht) 2,526,867,363 2,610,754,228 1,749,962,003 Shareholders’ Equity (Baht) 813,009,589 1,377,015,795 1,819,345,911 Book Value (Baht) 1.44 2.45 3.23 Return on Asset (%) (3.00) (6.68) 6.51 Return on Equity (%) (10.05) (15.79) 12.77 Debt to Shareholders (times) 3.11 1.90 0.96 Dividend Yield (%) 0.00 0.00 0.00 P/E Ratio (times) 0.00 0.00 0.00 PP Prime Public Company Limited 7 Policy and Business Overview ภาพรวมธุรกิจ Future TLUXE Food Farm The company focuses on developing the tiger shrimp for sale. During the past 30 years or so, the business in line with the full-cycle strategy i.e. -

List of Buildings with Confirmed / Probable Cases of COVID-19

List of Buildings With Confirmed / Probable Cases of COVID-19 List of Residential Buildings in Which Confirmed / Probable Cases Have Resided (Note: The buildings will remain on the list for 14 days since the reported date.) Related Confirmed / District Building Name Probable Case(s) Wan Chai Block C, Fontana Garden 5868 Yau Tsim Mong Cam Key Mansion, 495 Shanghai Street 5869 Kowloon City Crystal Mansion 5870 Central & Western Best Western Plus Hotel Hong Kong 5871 Central & Western Tower 1, Kong Chian Tower 5872 Wan Chai 11 Broom Road 5873 Kwai Tsing Wah Shun Court 5874 Kowloon City Sunderland Estate 5875 Islands Headland Hotel 5877 Eastern Block A, Yen Lok Building 5879 Sha Tin Hin Kwai House, Hin Keng Estate 5880 Tai Po Po Sam Pai Village 5881 Sha Tin Mei Chi House, Mei Tin Estate 5882 Tsuen Wan Block 2, Waterside Plaza 5882 Sha Tin Jubilee Court, Jubilee Garden 5883 Kwun Tong Lee Ming House, Shun Lee Estate 5884 Southern Tower 9, Bel-Air On The Peak 5885 Central & Western Block 3, Garden Terrace 5886 Sai Kung Tower 5, The Mediterranean 5887 Sai Kung Tower 5, The Mediterranean 5888 Kowloon City Block 1, Kiu Wang Mansion 5889 Islands Heung Yat House, Yat Tung Estate 5890 Sha Tin Cypress House, Kwong Yuen Estate 5891 Kwai Tsing Block 6, Mayfair Gardens 5892 Eastern Tower 1, Harbour Glory 5893 Sai Kung Kap Pin Long 5894 Wan Chai Hawthorn Garden 5895 Tai Po Villa Castell 5896 Kwun Tong Ping Shun House, Ping Tin Estate 5897 Sai Kung Tak Fu House, Hau Tak Estate 5898 Kwai Tsing Ying Kwai House, Kwai Chung Estate 5899 1 Related Confirmed / -

Febrúar 2021

Hugverka tíðindi 38. árg | 2. tbl | 15. feb. 2021 Útgefandi: Hugverkastofan Ábyrgðarmaður: Borghildur Erlingsdóttir Afgreiðsla: Engjateigi 3, 105 Reykjavík Sími: 580 9400, Bréfasími: 580 9401 Afgreiðslutími: kl. 10-15 virka daga Heimasíða: www.hugverk.is Áskriftargjald: 4.300,- Verð í lausasölu: kr. 500,- eintakið Rafræn útgáfa: ISSN 1670-0104 Efnisyfirlit Vörumerki Einkaleyfi Skráð landsbundin vörumerki.......................................... 4 Veitt einkaleyfi (B)…………………………………………………….. 164 Birt landsbundin vörumerki………………………………………. 8 Evrópsk einkaleyfi í gildi á Íslandi (T3)............................ 165 Alþjóðlegar vörumerkjaskráningar.................................. 40 Breytt útgáfa evrópskra einkaleyfa í gildi á Íslandi eftir takmörkun (T4)……….………...……………………………………… 178 Breytingar í vörumerkjaskrá...……………………………….…… 58 Beiðni um endurveitingu…………………………………………… 179 Breyting skv. 54 gr. laga nr. 45/1997 um vörumerki…... 71 Umsóknir um viðbótarvernd (I1)……………….……………….. 180 Takmarkanir og viðbætur………………………………………….. 72 Veitt viðbótarvottorð (I2)…………………………………………… 181 Framsöl að hluta………………………………………………………. 73 Framlenging á viðbótarvottorði…………………………………. 182 Veðsetning vörumerkja…………………………………………….. 74 Breytingar í einkaleyfaskrá............................................... 183 Endurnýjuð vörumerki………………………………………………. 75 Leiðréttingar..................................................................... 185 Afmáð vörumerki……………………………………………………… 76 Andmæli………………………………………………………………….. 77 Úrskurðir í áfrýjunarmálum……………………………………….. 78 Hönnun -

Updated: Sep 14, 2020

Updated: Sep 14, 2020 ASHK members receive valuable offers and discounts from more than 30 selected retailers in Hong Kong. To enjoy these exclusive privileges, simply present your valid ASHK membership card at the participating outlets. Please check our website for the latest offers! Enjoy 10% discount on regular-priced items to 45R 45R has surpassed fashion and adhering to its belief in the beauty of nostalgia and quality craftsmanship. The timeless designs feel like an old favorite at the very first time it is worn and it is of such quality that 45R clothing can be passed on from generation to generation. Exquisite materials and craftsmanship conveys the luxurious-causal styling to daily life. Terms and conditions apply: - Promotion cannot be used in conjunction with any other promotions - Please present Asia Society Hong Kong Center Membership Card to shop staff before billing Shop Directory: - Valid until 31 December 2020 7, Star Street, Wan Chai, Tel: 2861 1145 - Benefits are subject to change without prior notice and Sidefame Shop 3083, IFC Mall, Tel: 2556 9745 Ltd reserves the right to decide on the eligibility of benefits Shop 201, The Lee Gardens One, Tel: 2504 2445 Shop 2515, Harbour City Tel: 2175 5545 Enjoy 15% discount at AMMO Residing at the Asia Society Hong Kong Center, AMMO is an Italian Japanese fusion restaurant inspired by the botanical surroundings. From today onwards, all ASHK members enjoy 15% off upon presentation of a valid Asia Society Hong Kong Center membership card when settling the bill. Hope you enjoy this new exclusive offers available to ASHK members only. -

Name of Buildings Awarded the Quality Water Supply Scheme for Buildings – Fresh Water (Plus) Certificate (As at 8 February 2018)

Name of Buildings awarded the Quality Water Supply Scheme for Buildings – Fresh Water (Plus) Certificate (as at 8 February 2018) Name of Building Type of Building District @Convoy Commercial/Industrial/Public Utilities Eastern 1 & 3 Ede Road Private/HOS Residential Kowloon City 1 Duddell Street Commercial/Industrial/Public Utilities Central & Western 100 QRC Commercial/Industrial/Public Utilities Central & Western 102 Austin Road Commercial/Industrial/Public Utilities Yau Tsim Mong 1063 King's Road Private/HOS Residential Eastern 11 MacDonnell Road Private/HOS Residential Central & Western 111 Lee Nam Road Commercial/Industrial/Public Utilities Southern 12 Shouson Hill Road Private/HOS Residential Central & Western 127 Repulse Bay Road Private/HOS Residential Southern 12W Commercial/Industrial/Public Utilities Tai Po 15 Homantin Hill Private/HOS Residential Yau Tsim Mong 15W Commercial/Industrial/Public Utilities Tai Po 168 Queen's Road Central Commercial/Industrial/Public Utilities Central & Western 16W Commercial/Industrial/Public Utilities Tai Po 17-19 Ashley Road Commercial/Industrial/Public Utilities Yau Tsim Mong 18 Farm Road (Shopping Arcade) Commercial/Industrial/Public Utilities Kowloon City 18 Upper East Private/HOS Residential Eastern 1881 Heritage Commercial/Industrial/Public Utilities Yau Tsim Mong 211 Johnston Road Commercial/Industrial/Public Utilities Wan Chai 225 Nathan Road Commercial/Industrial/Public Utilities Yau Tsim Mong Name of Buildings awarded the Quality Water Supply Scheme for Buildings – Fresh Water (Plus) -

English Version

Indoor Air Quality Certificate Award Ceremony COS Centre 38/F and 39/F Offices (CIC Headquarters) Millennium City 6 Common Areas Wai Ming Block, Caritas Medical Centre Offices and Public Areas of Whole Building Premises Awarded with “Excellent Class” Certificate (Whole Building) COSCO Tower, Grand Millennium Plaza Public Areas of Whole Building Mira Place Tower A Public Areas of Whole Office Building Wharf T&T Centre 11/F Office (BOC Group Life Assurance Millennium City 5 BEA Tower D • PARK Baby Care Room and Feeding Room on Level 1 Mount One 3/F Function Room and 5/F Clubhouse Company Limited) Modern Terminals Limited - Administration Devon House Public Areas of Whole Building MTR Hung Hom Building Public Areas on G/F and 1/F Wharf T&T Centre Public Areas from 5/F to 17/F Building Dorset House Public Areas of Whole Building Nan Fung Tower Room 1201-1207 (Mandatory Provident Fund Wheelock House Office Floors from 3/F to 24/F Noble Hill Club House EcoPark Administration Building Offices, Reception, Visitor Centre and Seminar Schemes Authority) Wireless Centre Public Areas of Whole Building One Citygate Room Nina Tower Office Areas from 15/F to 38/F World Commerce Centre in Harbour City Public Areas from 5/F to 10/F One Exchange Square Edinburgh Tower Whole Office Building Ocean Centre in Harbour City Public Areas from 5/F to 17/F World Commerce Centre in Harbour City Public Areas from 11/F to 17/F One International Finance Centre Electric Centre 9/F Office Ocean Walk Baby Care Room World Finance Centre - North Tower in Harbour City Public Areas from 5/F to 17/F Sai Kung Outdoor Recreation Centre - Electric Tower Areas Equipped with MVAC System of The Office Tower, Convention Plaza 11/F & 36/F to 39/F (HKTDC) World Finance Centre - South Tower in Harbour City Public Areas from 5/F to 17/F Games Hall Whole Building Olympic House Public Areas of 1/F and 2/F World Tech Centre 16/F (Hong Yip Service Co. -

![Directors and Parties Involved in the [Redacted]](https://docslib.b-cdn.net/cover/9284/directors-and-parties-involved-in-the-redacted-2369284.webp)

Directors and Parties Involved in the [Redacted]

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE. THE INFORMATION IN THIS DOCUMENT MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT. DIRECTORS AND PARTIES INVOLVED IN THE [REDACTED] DIRECTORS Name Residential address Nationality Executive Director Mr. Li Zhongchao (李忠超) Room 201, Unit 9, Block 5 Chinese Dongjing Liyuan 755 Jinhua Road 2nd Section Jinjiang District Chengdu Sichuan PRC Non-executive Directors Mr. Zhang Jianming (張建明) Room 2001, Unit 1, Block 2 Chinese Changcheng Bandao Chengbang Phase I High-tech District Chengdu Sichuan PRC Mr. You Wenzhou (游文洲) Room 301, Unit 1, Block 7 Chinese CR Phoenix City Phase II 966 Tianfu 2nd Street High-tech District Chengdu Sichuan PRC Ms. Wang Yu (王玉) Room 801, Unit 2, Block 14 Chinese One City South 88 Jinshang West 2nd Road High-tech District Chengdu Sichuan PRC –66– THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE. THE INFORMATION IN THIS DOCUMENT MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT. DIRECTORS AND PARTIES INVOLVED IN THE [REDACTED] Independent non-executive Directors Dr. Yang Jirui (楊繼瑞) No. 1, 18/F, Block 7 Chinese Chengda Paradise 920 Shijicheng Road High-tech District Chengdu Sichuan PRC Mr. Chan Chi Fung Leo 21B, Tsui King Court Chinese (陳志峰) 18 Water Street Sai Ying Pun Hong Kong Mr. Ran Lichun (冉立春) Room 1403, Block 4 Chinese Sky Ville Phase I 99 Huiyuan North Road Jinjiang District Chengdu Sichuan PRC Please see the section headed “Directors and senior management” in this document for further details of our Directors. -

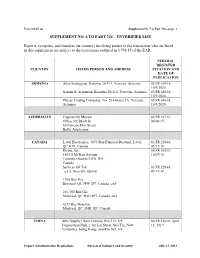

SUPPLEMENT NO. 6 to PART 744 – UNVERIFIED LIST Exports, Reexports, and Transfers

Unverified List Supplement No. 7 to Part 744—page 1 SUPPLEMENT NO. 6 TO PART 744 – UNVERIFIED LIST Exports, reexports, and transfers (in-country) involving parties to the transaction who are listed in this supplement are subject to the restrictions outlined in § 744.15 of the EAR. FEDERAL REGISTER COUNTRY LISTED PERSON AND ADDRESS CITATION AND DATE OF PUBLICATION ARMENIA Atlas Sanatgaran, Komitas 26/114, Yerevan, Armenia 85 FR 64014, 10/9/2020. Iranian & Armenian, Komitas 26/114, Yerevan, Armenia 85 FR 64014, 10/9/2020. Piricas Trading Company, No. 20 Heratsi 2A, Yerevan, 85 FR 64014, Armenia 10/9/2020. AZERBAIJAN Caspian Oil Montaj 82 FR 16732, Office 39, Block B 04/06/17. 30 Kaverochkin Street Baku, Azerbaijan CANADA Laval Electronics, 3073 Rue Edmond-Rostand, Laval, 83 FR 22844, QC H7P, Canada 05/17/18. Rizma, Inc. 80 FR 60532, 1403-8 McKee Avenue 10/07/15. Toronto, Ontario M2N 7E5 Canada Services GP Tek 83 FR 22844, a.k.a. Nouvelle Option 05/17/18. 1305 Rue Pise Brossard, QC J4W 2P7, Canada; and 203-760 Rue Gal Montreal, QC H4G 2P7, Canada; and 6271 Rue Beaulieu Montreal, QC, H4E 3E9, Canada CHINA Able Supply Chain Limited, Rm 511, 5/F, 84 FR 14610, April Corporation Park, 1 On Lai Street, Sha Tin, New 11, 2019. Territories, Hong Kong; and Rm 605, 6/F, Export Administration Regulations Bureau of Industry and Security July 12, 2021 Unverified List Supplement No. 7 to Part 744—page 2 Corporation Park, 1 On Lai Street, Sha Tin, New Territories, Hong Kong; and Unit C, 9/F, Winning House, No. -

List of Licensed Banks Which Are Not Currently Issuing and Facilitating The

List of licensed banks which are not currently issuing and facilitating the issue of SVF Licence Effective Date Name of Licenced Bank (in alphabetical order) Address of the Principal Place of Business in Hong Kong Number (dd/mm/yyyy) ABN AMRO BANK N.V. UNITS 7001-06 & 7008B, LEVEL 70, INTERNATIONAL COMMERCE CENTRE, 1 AUSTIN ROAD WEST, KOWLOON, HONG KONG. SVFB299 13/11/2016 AGRICULTURAL BANK OF CHINA LIMITED 25/F, AGRICULTURAL BANK OF CHINA TOWER, 50 CONNAUGHT ROAD CENTRAL, HONG KONG. SVFB235 13/11/2016 AIRSTAR BANK LIMITED SUITES 3201-07, TOWER 5, THE GATEWAY, HARBOUR CITY, TSIM SHA TSUI, KOWLOON SVFB329 09/05/2019 ANT BANK (HONG KONG) LIMITED SUITES 2312-13, 23/F, TOWER ONE, TIMES SQUARE, 1 MATHESON STREET, CAUSEWAY BAY, HONG KONG SVFB331 09/05/2019 AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED 22/F, THREE EXCHANGE SQUARE, 8 CONNAUGHT PLACE, CENTRAL, HONG KONG. SVFB164 13/11/2016 AXIS BANK LIMITED SUITE 1707-1708, CENTRAL PLAZA, 18 HARBOUR ROAD, WANCHAI, HONG KONG SVFB281 13/11/2016 BANCO BILBAO VIZCAYA ARGENTARIA S.A. UNIT 9507, LEVEL 95, INTERNATIONAL COMMERCE CENTRE, 1 AUSTIN ROAD WEST, KOWLOON. SVFB157 13/11/2016 BANCO SANTANDER, S.A. 10/F, TWO INTERNATIONAL FINANCE CENTRE, 8 FINANCE STREET, CENTRAL, HONG KONG. SVFB289 13/11/2016 BANGKOK BANK PUBLIC COMPANY LIMITED BANGKOK BANK BUILDING, 28 DES VOEUX ROAD, CENTRAL, HONG KONG. SVFB036 13/11/2016 BANK J. SAFRA SARASIN AG 40/F, EDINBURGH TOWER, THE LANDMARK, 15 QUEEN'S ROAD CENTRAL, HONG KONG. SVFB297 13/11/2016 BANK JULIUS BAER & CO. LTD. 39/F, ONE INTERNATIONAL FINANCE CENTRE, 1 HARBOUR VIEW STREET, CENTRAL, HONG KONG.