Cambridge Office/Lab Marketview

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2012 Financial Markets Preview Living Creatively

REPRINT FROM JANUARY 2, 2012 BioCentury ™ THE BERNSTEIN REPORT ON BIOBUSINESS Article Reprint • Page 1 of 8 2012 Financial Markets Preview Living creatively By Stacy Lawrence “As the capital markets Viren Mehta of Mehta Partners. “Many Senior Writer companies don’t have any option but to For small, early stage biotech compa- continue to be difficult, raise at lower valuations.” nies, 2012 could be the year of living traditional investors are able He added: “Many companies are not creatively. able to defer any longer. The moment Although public biotechs raised more to extract terms that are comes for many companies when they funds last year than ever before, the vast have to swallow hard and accept painful majority of the money was debt financing more and more onerous.” dilution.” by established companies with marketed products. Thus while the overall numbers Todd Wyche, Brinson Patrick look good and are likely to continue to do Cash on hand so, precommercial companies will have to large and mid-cap companies (see “The Market volatility and macroeconomic get creative with their financings. 1% Effect,” page 2). risk had most buysiders sitting on the Many of these companies avoided rais- In 2011, public biotechs raised $43 sidelines through the back half of 2011. ing money in 2011 because they didn’t billion, easily eclipsing the record $33.1 Bankers are hopeful that this year will be like the valuations, but Wall Streeters say billion in 2000. But debt accounted for more stable, in which case investors might they are now running out of cash. As a 82% of the total dollars raised, compared be willing to support more deal flow dur- result, they will have to use the tricks at to only 19% in 2000 (see “Debt Domi- ing 1H12 (see “Fear Factor,” page 5). -

Amgen Inc. V. Sanofi, No

No. IN THE Supreme Court of the United States ———— AMGEN INC., AMGEN MANUFACTURING LIMITED, AND AMGEN USA, INC., Petitioners, v. SANOFI, AVENTISUB LLC, REGENERON PHARMACEUTICALS INC., AND SANOFI-AVENTIS U.S., LLC, Respondents. ———— On Petition for a Writ of Certiorari to the United States Court of Appeals for the Federal Circuit ———— PETITION FOR A WRIT OF CERTIORARI ———— STUART L. WATT JEFFREY A. LAMKEN WENDY A. WHITEFORD Counsel of Record ERICA S. OLSON MICHAEL G. PATTILLO, JR. EMILY C. JOHNSON SARAH J. NEWMAN AMGEN INC. MOLOLAMKEN LLP One Amgen Center Drive The Watergate, Suite 660 Thousand Oaks, CA 91320 600 New Hampshire Ave., NW (805) 447-1000 Washington, D.C. 20037 (202) 556-2000 [email protected] Counsel for Petitioners :,/621(3(635,17,1*&2,1&± ±:$6+,1*721'& QUESTION PRESENTED The 1952 Patent Act requires patents to “contain a written description of the invention, and of the manner and process of making and using it.” 35 U.S.C. §112(a). The “written description” must be “in such full, clear, concise, and exact terms as to enable any person skilled in the art to which it pertains, or with which it is most nearly connected, to make and use the same.” Ibid. “The object of the statute is to require the patentee to describe his invention so that others may construct and use it after the expiration of the patent.” Schriber-Schroth Co. v. Cleveland Tr. Co., 305 U.S. 47, 57 (1938). The Federal Circuit has construed §112(a) as impos- ing separate “written description” and “enablement” re- quirements subject to different standards. -

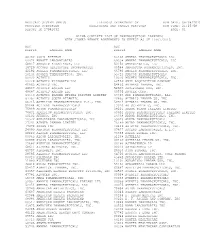

Medicaid System (Mmis) Illinois Department of Run Date: 08/08/2015 Provider Subsystem Healthcare and Family Services Run Time: 21:25:58 Report Id 2794D052 Page: 01

MEDICAID SYSTEM (MMIS) ILLINOIS DEPARTMENT OF RUN DATE: 08/08/2015 PROVIDER SUBSYSTEM HEALTHCARE AND FAMILY SERVICES RUN TIME: 21:25:58 REPORT ID 2794D052 PAGE: 01 ALPHA COMPLETE LIST OF PHARMACEUTICAL LABELERS WITH SIGNED REBATE AGREEMENTS IN EFFECT AS OF 10/01/2015 NDC NDC PREFIX LABELER NAME PREFIX LABELER NAME 68782 (OSI) EYETECH 65162 AMNEAL PHARMACEUTICALS LLC 00074 ABBOTT LABORATORIES 69238 AMNEAL PHARMACEUTICALS, LLC 68817 ABRAXIS BIOSCIENCE, LLC 53150 AMNEAL-AGILA, LLC 16729 ACCORD HEALTHCARE INCORPORATED 00548 AMPHASTAR PHARMACEUTICALS, INC. 42192 ACELLA PHARMACEUTICALS, LLC 66780 AMYLIN PHARMACEUTICALS, INC. 10144 ACORDA THERAPEUTICS, INC. 55724 ANACOR PHARMACEUTICALS 00472 ACTAVIS 10370 ANCHEN PHARMACEUTICALS, INC. 00228 ACTAVIS ELIZABETH LLC 62559 ANIP ACQUISITION COMPANY 45963 ACTAVIS INC. 54436 ANTARES PHARMA, INC. 46987 ACTAVIS KADIAN LLC 52609 APO-PHARMA USA, INC. 49687 ACTAVIS KADIAN LLC 60505 APOTEX CORP. 14550 ACTAVIS PHARMA MFGING PRIVATE LIMITED 63323 APP PHARMACEUTICALS, LLC. 67767 ACTAVIS SOUTH ATLANTIC 42865 APTALIS PHARMA US, INC 66215 ACTELION PHARMACEUTICALS U.S., INC. 58914 APTALIS PHARMA US, INC. 52244 ACTIENT PHARMACEUTICALS 13310 AR SCIENTIFIC, INC. 75989 ACTON PHARMACEUTICALS 08221 ARBOR PHARM IRELAND LIMITED 76431 AEGERION PHARMACEUTICALS, INC. 60631 ARBOR PHARMACEUTICALS IRELAND LIMITED 50102 AFAXYS, INC. 24338 ARBOR PHARMACEUTICALS, INC. 10572 AFFORDABLE PHARMACEUTICALS, LLC 59923 AREVA PHARMACEUTICALS 27241 AJANTA PHARMA LIMITED 76189 ARIAD PHARMACEUTICALS, INC. 17478 AKORN INC 24486 ARISTOS PHARMACEUTICALS, INC. 24090 AKRIMAX PHARMACEUTICALS LLC 67877 ASCEND LABORATORIES, L.L.C. 68220 ALAVEN PHARMACEUTICAL, LLC 76388 ASPEN GLOBAL INC. 00065 ALCON LABORATORIES, INC. 51248 ASTELLAS 00998 ALCON LABORATORIES, INC. 00469 ASTELLAS PHARMA US, INC. 25682 ALEXION PHARMACEUTICALS 00186 ASTRAZENECA LP 68611 ALIMERA SCIENCES, INC. -

Amgen 2008 Annual Report and Financial Summary Pioneering Science Delivers Vital Medicines

Amgen 2008 Annual Report and Financial Summary Pioneering science delivers vital medicines About Amgen Products Amgen discovers, develops, manufactures Aranesp® (darbepoetin alfa) and delivers innovative human therapeutics. ® A biotechnology pioneer since 1980, Amgen Enbrel (etanercept) was one of the fi rst companies to realize ® the new science’s promise by bringing EPOGEN (Epoetin alfa) safe and effective medicines from the lab Neulasta® (pegfi lgrastim) to the manufacturing plant to patients. NEUPOGEN® (Filgrastim) Amgen therapeutics have changed the practice of medicine, helping millions of Nplate® (romiplostim) people around the world in the fi ght against ® cancer, kidney disease, rheumatoid Sensipar (cinacalcet) arthritis and other serious illnesses, and so Vectibix® (panitumumab) far, more than 15 million patients worldwide have been treated with Amgen products. With a broad and deep pipeline of potential new medicines, Amgen remains committed to advancing science to dramatically improve people’s lives. 0405 06 07 08 0405 06 07 08 0405 06 07 08 0405 06 07 08 Total revenues “Adjusted” earnings Cash fl ow from “Adjusted” research and ($ in millions) per share (EPS)* operations development (R&D) expenses* (Diluted) ($ in millions) ($ in millions) 2008 $15,003 2008 $4.55 2008 $5,988 2008 $2,910 2007 14,771 2007 4.29 2007 5,401 2007 3,064 2006 14,268 2006 3.90 2006 5,389 2006 3,191 2005 12,430 2005 3.20 2005 4,911 2005 2,302 2004 10,550 2004 2.40 2004 3,697 2004 1,996 * “ Adjusted” EPS and “adjusted” R&D expenses are non-GAAP fi nancial measures. See page 8 for reconciliations of these non-GAAP fi nancial measures to U.S. -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Form

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington D.C. 20549 Form 10-K (Mark One) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF ☒ 1934 For the fiscal year ended December 31, 2008 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT ☐ OF 1934 Commission file number 000-12477 Amgen Inc. (Exact name of registrant as specified in its charter) Delaware 95-3540776 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) One Amgen Center Drive, 91320-1799 Thousand Oaks, California (Zip Code) (Address of principal executive offices) (805) 447-1000 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(g) of the Act: Common stock, $0.0001 par value; preferred share purchase rights (Title of class) Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or Section 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐ Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. -

Patient Services, Inc. 2014 Annual Report Table of Contents

Patient Services, Inc. 2014 Annual Report Table of ConTenTs 2014 Board of Directors and Sponsors .......................................................................................... 3 Pharmaceutical, Provider Industries, Corporate, Government and Individual Sponsors ............ 3-5 Ways to Support PSI ..................................................................................................................... 6 2014 Executive Message ................................................................................................................ 7 Marketing and Development ........................................................................................................ 8 Government Relations .................................................................................................................. 9 Operations and Program Reimbursement ....................................................................................10 PSI Traditional Programs ....................................................................................................... 11-13 IT Department ............................................................................................................................14 ACCESS® Program ......................................................................................................................15 Message from our Board Treasurer ..............................................................................................16 Statement of Activities .................................................................................................................17 -

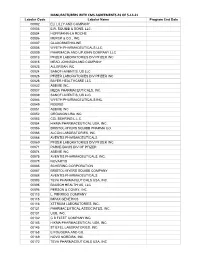

05/09/2016 Provider Subsystem Healthcare and Family Services Run Time: 04:25:50 Report Id 2794D052 Page: 01

MEDICAID SYSTEM (MMIS) ILLINOIS DEPARTMENT OF RUN DATE: 05/09/2016 PROVIDER SUBSYSTEM HEALTHCARE AND FAMILY SERVICES RUN TIME: 04:25:50 REPORT ID 2794D052 PAGE: 01 ALPHA COMPLETE LIST OF PHARMACEUTICAL LABELERS WITH SIGNED REBATE AGREEMENTS IN EFFECT AS OF 07/01/2016 NDC NDC PREFIX LABELER NAME PREFIX LABELER NAME 68782 (OSI) EYETECH 55513 AMGEN USA 00074 ABBOTT LABORATORIES 58406 AMGEN/IMMUNEX 68817 ABRAXIS BIOSCIENCE, LLC 53746 AMNEAL PHARMACEUTICALS 16729 ACCORD HEALTHCARE INCORPORATED 65162 AMNEAL PHARMACEUTICALS LLC 42192 ACELLA PHARMACEUTICALS, LLC 69238 AMNEAL PHARMACEUTICALS, LLC 10144 ACORDA THERAPEUTICS, INC. 53150 AMNEAL-AGILA, LLC 00472 ACTAVIS 00548 AMPHASTAR PHARMACEUTICALS, INC. 00228 ACTAVIS ELIZABETH LLC 69918 AMRING PHARMACEUTICALS, INC. 45963 ACTAVIS INC. 66780 AMYLIN PHARMACEUTICALS, INC. 46987 ACTAVIS KADIAN LLC 55724 ANACOR PHARMACEUTICALS 49687 ACTAVIS KADIAN LLC 10370 ANCHEN PHARMACEUTICALS, INC. 14550 ACTAVIS PHARMA MFGING PRIVATE LIMITED 43595 ANGELINI PHARMA, INC. 61874 ACTAVIS PHARMA, INC. 62559 ANIP ACQUISITION COMPANY 67767 ACTAVIS SOUTH ATLANTIC 54436 ANTARES PHARMA, INC. 66215 ACTELION PHARMACEUTICALS U.S., INC. 52609 APO-PHARMA USA, INC. 52244 ACTIENT PHARMACEUTICALS 60505 APOTEX CORP. 75989 ACTON PHARMACEUTICALS 63323 APP PHARMACEUTICALS, LLC. 69547 ADAPT PHARMA INC. 43485 APRECIA PHARMACEUTICALS COMPANY 76431 AEGERION PHARMACEUTICALS, INC. 42865 APTALIS PHARMA US, INC 50102 AFAXYS, INC. 58914 APTALIS PHARMA US, INC. 10572 AFFORDABLE PHARMACEUTICALS, LLC 13310 AR SCIENTIFIC, INC. 27241 AJANTA PHARMA LIMITED 08221 ARBOR PHARM IRELAND LIMITED 17478 AKORN INC 60631 ARBOR PHARMACEUTICALS IRELAND LIMITED 24090 AKRIMAX PHARMACEUTICALS LLC 24338 ARBOR PHARMACEUTICALS, INC. 68220 ALAVEN PHARMACEUTICAL, LLC 59923 AREVA PHARMACEUTICALS 00065 ALCON LABORATORIES, INC. 76189 ARIAD PHARMACEUTICALS, INC. 00998 ALCON LABORATORIES, INC. 24486 ARISTOS PHARMACEUTICALS, INC. -

Rebateable Manufacturers

Rebateable Labelers – July 2021 Manufacturers are responsible for updating their eligible drugs and pricing with CMS. Montana Healthcare Programs will not pay for an NDC not updated with CMS. Note: Some manufacturers on this list may have some NDCs that are covered and others that are not. Manufacturer ID Manufacturer Name 00002 ELI LILLY AND COMPANY 00003 E.R. SQUIBB & SONS, LLC. 00004 HOFFMANN-LA ROCHE 00006 MERCK & CO., INC. 00007 GLAXOSMITHKLINE 00008 WYETH PHARMACEUTICALS LLC, 00009 PHARMACIA AND UPJOHN COMPANY LLC 00013 PFIZER LABORATORIES DIV PFIZER INC 00015 MEAD JOHNSON AND COMPANY 00023 ALLERGAN INC 00024 SANOFI-AVENTIS, US LLC 00025 PFIZER LABORATORIES DIV PFIZER INC 00026 BAYER HEALTHCARE LLC 00032 ABBVIE INC. 00037 MEDA PHARMACEUTICALS, INC. 00039 SANOFI-AVENTIS, US LLC 00046 WYETH PHARMACEUTICALS INC. 00049 ROERIG 00051 ABBVIE INC 00052 ORGANON USA INC. 00053 CSL BEHRING L.L.C. 00054 HIKMA PHARMACEUTICAL USA, INC. 00056 BRISTOL-MYERS SQUIBB PHARMA CO. 00065 ALCON LABORATORIES, INC. 00068 AVENTIS PHARMACEUTICALS 00069 PFIZER LABORATORIES DIV PFIZER INC 00071 PARKE-DAVIS DIV OF PFIZER 00074 ABBVIE INC 00075 AVENTIS PHARMACEUTICALS, INC. 00078 NOVARTIS 00085 SCHERING CORPORATION 00087 BRISTOL-MYERS SQUIBB COMPANY 00088 AVENTIS PHARMACEUTICALS 00093 TEVA PHARMACEUTICALS USA, INC. 00095 BAUSCH HEALTH US, LLC Page 1 of 19 Manufacturer ID Manufacturer Name 00096 PERSON & COVEY, INC. 00113 L. PERRIGO COMPANY 00115 IMPAX GENERICS 00116 XTTRIUM LABORATORIES, INC. 00121 PHARMACEUTICAL ASSOCIATES, INC. 00131 UCB, INC. 00132 C B FLEET COMPANY INC 00143 HIKMA PHARMACEUTICAL USA, INC. 00145 STIEFEL LABORATORIES, INC, 00168 E FOUGERA AND CO. 00169 NOVO NORDISK, INC. 00172 TEVA PHARMACEUTICALS USA, INC 00173 GLAXOSMITHKLINE 00178 MISSION PHARMACAL COMPANY 00185 EON LABS, INC. -

United States Securities and Exchange Commission Washington, D.C

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K/A (Amendment No. 1) (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2016 or ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number: 001-33500 JAZZ PHARMACEUTICALS PUBLIC LIMITED COMPANY (Exact name of registrant as specified in its charter) Ireland 98-1032470 (State or other jurisdiction of (I.R.S. Employer Identification incorporation or organization) No.) Fifth Floor, Waterloo Exchange Waterloo Road, Dublin 4, Ireland 011-353-1-634-7800 (Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) Securities registered pursuant to Section 12(b) of the Act: Name of each exchange on Title of each class which registered Ordinary shares, nominal The NASDAQ Stock Market value $0.0001 per share LLC Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

The Bottom 99

The Top 100 July 1, 2013 A list of stocks topping our custom 'torpedo’ screen. Updated monthly. BDE Black Diamond Inc. Consumer Discretionary BYD Boyd Gaming Corp. Consumer Discretionary CZR Caesars Entertainment Corp. Consumer Discretionary JCP J.C. Penney Co. Inc. Consumer Discretionary TPX Tempur Sealy International Inc. Consumer Discretionary ARP Atlas Resource Partners LP Energy ATLS Atlas Energy L.P. Energy BPZ BPZ Resources Inc. Energy CLNE Clean Energy Fuels Corp. Energy CQP Cheniere Energy Partners L.P. Energy EROC Eagle Rock Energy Partners L.P. Energy GDP Goodrich Petroleum Corp. Energy GEVO Gevo Inc. Energy GPOR Gulfport Energy Corp. Energy KWK Quicksilver Resources Inc. Energy MHR Magnum Hunter Resources Corp. Energy MWE MarkWest Energy Partners L.P. Energy PVR PVR Partners L.P. Energy VTG Vantage Drilling Co. Energy XTEX Crosstex Energy L.P. Energy XTXI Crosstex Energy Inc. Energy Z Zillow Inc. Cl A Financials ACHN Achillion Pharmaceuticals Inc. Health Care ACRX AcelRx Pharmaceuticals Inc. Health Care ACUR Acura Pharmaceuticals Inc. Health Care AGEN Agenus Inc. Health Care ARAY Accuray Inc. Health Care ARIA Ariad Pharmaceuticals Inc. Health Care ATHN athenahealth Inc. Health Care ATHX Athersys Inc. Health Care ATRS Antares Pharma Inc. Health Care BAXS Baxano Surgical Inc. Health Care BDSI BioDelivery Sciences International Inc. Health Care BMRN BioMarin Pharmaceutical Inc. Health Care CCXI ChemoCentryx Inc Health Care CRIS Curis Inc. Health Care CUR Neuralstem Inc. Health Care DVAX Dynavax Technologies Corp. Health Care EXEL Exelixis Inc. Health Care GWAY Greenway Medical Technologies Inc. Health Care HALO Halozyme Therapeutics Inc. Health Care HMSY HMS Holdings Corp. -

The Trials of Amgen

IAM ISSUE 18_TEXT 26/5/06 17:40 Page 43 Feature Amgen The trials of Amgen It is a company that has become used to major patent litigation. But Amgen’s latest battle could turn out to be the most significant yet, especially at the end of a period when acquisitions and the establishment of a venture fund have marked a change in strategy The Lilly perspective By Victoria Slind-Flor Almost simultaneously with the patent’s issuance, Ariad filed suit against Lilly in A very big patent is threatening the world’s federal court in Boston. Ariad charged largest biotech company. Although Amgen infringement by two different Lilly drugs: Incorporated of Thousand Oaks, California, sits Evista, which treats osteoporosis; and on top of a powerhouse portfolio of rights and Xigris, which is used against toxic shock. produces bioengineered drugs for diseases According to members of the biotech patent affecting a broad swathe of the population, bar, Ariad also contacted Amgen and as many Amgen products could potentially be many as 50 other biotech and pharma infringing a patent assigned to a small companies, warning them they were Cambridge, Massachusetts, biotech company. potentially infringing the patent. If a jury verdict handed down in early May The case went to trial this year before against Eli Lilly and Company is any indication, US District Judge Rya Zobel and in early Amgen officials need to be very concerned. May, a jury awarded Ariad more than US$62 The patent in question relates to a million in royalties for past infringement and method of inhibiting a certain kind of human a 2.3% royalty on future sales of Lily’s two protein involved with cellular response to drugs up to 2019. -

MANUFACTURERS with CMS AGREEMENTS AS of 5-14-21 Labeler Code Labeler Name Program End Date 00002 ELI LILLY and COMPANY 00003 E.R

MANUFACTURERS WITH CMS AGREEMENTS AS OF 5-14-21 Labeler Code Labeler Name Program End Date 00002 ELI LILLY AND COMPANY 00003 E.R. SQUIBB & SONS, LLC. 00004 HOFFMANN-LA ROCHE 00006 MERCK & CO., INC. 00007 GLAXOSMITHKLINE 00008 WYETH PHARMACEUTICALS LLC, 00009 PHARMACIA AND UPJOHN COMPANY LLC 00013 PFIZER LABORATORIES DIV PFIZER INC 00015 MEAD JOHNSON AND COMPANY 00023 ALLERGAN INC 00024 SANOFI-AVENTIS, US LLC 00025 PFIZER LABORATORIES DIV PFIZER INC 00026 BAYER HEALTHCARE LLC 00032 ABBVIE INC. 00037 MEDA PHARMACEUTICALS, INC. 00039 SANOFI-AVENTIS, US LLC 00046 WYETH PHARMACEUTICALS INC. 00049 ROERIG 00051 ABBVIE INC 00052 ORGANON USA INC. 00053 CSL BEHRING L.L.C. 00054 HIKMA PHARMACEUTICAL USA, INC. 00056 BRISTOL-MYERS SQUIBB PHARMA CO. 00065 ALCON LABORATORIES, INC. 00068 AVENTIS PHARMACEUTICALS 00069 PFIZER LABORATORIES DIV PFIZER INC 00071 PARKE-DAVIS DIV OF PFIZER 00074 ABBVIE INC 00075 AVENTIS PHARMACEUTICALS, INC. 00078 NOVARTIS 00085 SCHERING CORPORATION 00087 BRISTOL-MYERS SQUIBB COMPANY 00088 AVENTIS PHARMACEUTICALS 00093 TEVA PHARMACEUTICALS USA, INC. 00095 BAUSCH HEALTH US, LLC 00096 PERSON & COVEY, INC. 00113 L. PERRIGO COMPANY 00115 IMPAX GENERICS 00116 XTTRIUM LABORATORIES, INC. 00121 PHARMACEUTICAL ASSOCIATES, INC. 00131 UCB, INC. 00132 C B FLEET COMPANY INC 00143 HIKMA PHARMACEUTICAL USA, INC. 00145 STIEFEL LABORATORIES, INC, 00168 E FOUGERA AND CO. 00169 NOVO NORDISK, INC. 00172 TEVA PHARMACEUTICALS USA, INC Labeler Code Labeler Name Program End Date 00173 GLAXOSMITHKLINE 00178 MISSION PHARMACAL COMPANY 00185 EON LABS, INC. 00186 ASTRAZENECA PHARMACEUTICALS LP 00187 BAUSCH HEALTH US, LLC. 00206 WYETH PHARMACEUTICALS LLC, 00224 KONSYL PHARMACEUTICALS, INC. 00225 B. F. ASCHER AND COMPANY, INC. 00228 ACTAVIS PHARMA, INC.