Goat Milk Proc RELEASE .Pub

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Eating a Low-Fiber Diet

Page 1 of 2 Eating a Low-fiber Diet What is fiber? Sample Menu Fiber is the part of food that the body cannot digest. Breakfast: It helps form stools (bowel movements). 1 scrambled egg 1 slice white toast with 1 teaspoon margarine If you eat less fiber, you may: ½ cup Cream of Wheat with sugar • Reduce belly pain, diarrhea (loose, watery stools) ½ cup milk and other digestive problems ½ cup pulp-free orange juice • Have fewer and smaller stools Snack: • Decrease inflammation (pain, redness and ½ cup canned fruit cocktail (in juice) swelling) in the GI (gastro-intestinal) tract 6 saltine crackers • Promote healing in the GI tract. Lunch: For a list of foods allowed in a low-fiber diet, see the Tuna sandwich on white bread back of this page. 1 cup cream of chicken soup ½ cup canned peaches (in light syrup) Why might I need a low-fiber diet? 1 cup lemonade You may need a low-fiber diet if you have: Snack: ½ cup cottage cheese • Inflamed bowels 1 medium apple, sliced and peeled • Crohn’s disease • Diverticular disease Dinner: 3 ounces well-cooked chicken breast • Ulcerative colitis 1 cup white rice • Radiation therapy to the belly area ½ cup cooked canned carrots • Chemotherapy 1 white dinner roll with 1 teaspoon margarine 1 slice angel food cake • An upcoming colonoscopy 1 cup herbal tea • Surgery on your intestines or in the belly area. For informational purposes only. Not to replace the advice of your health care provider. Copyright © 2007 Fairview Health Services. All rights reserved. Clinically reviewed by Shyamala Ganesh, Manager Clinical Nutrition. -

Plastic Fact Sheet

Fact Sheet Plastic Manufacturing plastics from recycled materials saves 70% of the energy required to make virgin plastic product from fossil fuels. Did you know…? Recycling plastic Australia produces more than 1.5 million tonnes of plastics All plastic is potentially recyclable, however, due to complex collection, every year, which is more than sorting and cleaning processes, only certain plastic bottles and containers 71kg per person. This includes: are currently accepted for recycling at your local Material Recovery Facility (MRF). Whether a type of plastic can be recycled in your area depends on its • 50,000 tonnes Plastic Identification Code. To help identify different plastics, manufacturers of soft drink bottles stamp a Plastic Identification Code on their products. This code is a number inside a triangle with chasing arrows, and is usually found on the bottom • 30,000 tonnes of the products, stamped on the plastic itself. of milk bottles • 10,000 tonnes of detergent At present plastic bottles and containers with the numbers 1, 2 and 5 are and shampoo bottles the most commonly recycled plastics, and include items such as milk and soft drink bottles and ice-cream containers. However, recycling technology is improving The rest is made up of shrink- all the time, and some local Councils are beginning to recycle other plastics, such wrap, film, shopping bags as 3, 4, 6 and 7. Check with your local Council, or look at the sticker on your and other types of plastics. recycling bin, to find out which plastic bottles and containers you can recycle. Australians used 3.9 billion plastic bags in 2007. -

Let's Make Butter

F Let’s MAKE BUTTER FAMILY Equipment • 1 carton of double or single cream (250ml) • 1 jam jar with a lid or a plastic container for younger children • 1 glass • 1 plate • A strong pair of arms Background A mixture is made up of two or more substances which are jumbled together. For example for Information breakfast you may have a bowl of cereal and milk, this is a mixture. Cream is also a mixture. Let’s see how we can separate cream into two parts, a solid and a liquid. What to do 1. Take the cream out of the fridge. Do you notice that it feels cold? 2. Leave the cream on the table for about an hour. It shouldn’t feel cold now, unlike when it came out of the fridge. 3. Pour the cream into the jar until it is about half full. 4. Screw the lid on tight. 5. Take the jar and start shaking it up and down. Play some music and have fun dancing as you shake. Stop and look at the cream in your jar every few minutes. What do you notice? What After about 15 minutes you’ll feel something solid in the jar. Keep going until you see a solid lump. happens? Take the lid off the jam jar. What do you see? The solid yellow lump is butter and the whitish liquid is buttermilk. Why did this Cream is a mixture. It is made of tiny drops of water mixed with fat droplets and protein. Shaking happen? the cream in the jar makes the fat droplets stick together, forming butter. -

Cream Ingredients

Cream Ingredients Cream is prepared from milk by centrifugal separation. United States standards require cream containing a minimum of 36% fat to be labeled “heavy whipping” cream. Cream used as an ingredient contains 36% to 40% fat. By standardizing with skim milk, cream of different fat levels can be produced. Light whipping cream and light (“coffee” or “table”) cream contain 30% to 36% and 18% to 30% fat, respectively. Specific homogenization and heat treatments bring about desirable grades of viscosity in cream products. Cream should be stored under refrigeration. It can be quick-frozen and stored frozen until used. Typical Composition for Fluid Milk Cream Products (%) Cream Product Water Fat Protein Lactose Ash Half-and-Half 80.2 11.5 3.1 4.5 0.7 Light Cream 74.0 18.3 2.9 4.2 0.6 Light Whipping Cream 62.9 30.5 2.5 3.6 0.5 Heavy Cream 57.3 36.8 2.2 3.2 0.5 Plastic Cream 18.2 80.0 0.7 1.0 0.1 Sour Cream, Cultured 71.0 21.0 3.2 4.3 0.7 Source: Chandan R. (1997), Dairy-Based Ingredients, Eagen Press, St. Paul, Minn. Cream Varieties Half-and-Half is a product containing between 10.5% and 18% milkfat, according to federal regulations. It can be pasteurized or ultrapasteurized and may be homogenized. The titratable acidity, expressed as lactic acid, is not less than 0.5%. If nutritive sweeteners or bulky flavoring ingredients are added, the final product must contain not less than 8.4% milkfat. -

How to Read a Label for a Milk-Free Diet All FDA-Regulated Manufactured Food Products That Contain Milk As an Ingredient Are Required by U.S

How to Read a Label for a Milk-Free Diet All FDA-regulated manufactured food products that contain milk as an ingredient are required by U.S. law to list the word “milk” on the product label. Avoid foods that contain milk or any of these ingredients: butter, butter fat, butter oil, butter milk (in all forms, including acid, butter ester(s) condensed, derivative, dry, buttermilk evaporated, goat’s milk and milk casein from other animals, low fat, malted, casein hydrolysate milkfat, nonfat, powder, protein, caseinates (in all forms) skimmed, solids, whole) cheese milk protein hydrolysate pudding cottage cheese ® cream Recaldent curds rennet casein custard sour cream, sour cream solids diacetyl sour milk solids ghee tagatose whey (in all forms) half-and-half 11781 Lee Jackson Hwy. lactalbumin, lactalbumin phosphate whey protein hydrolysate lactoferrin yogurt Suite 160 lactose Fairfax, VA 22033-3309 lactulose Phone: 703-691-3179 Milk is sometimes found in the following: Fax: 703-691-2713 artificial butter flavor luncheon meat, hot dogs, sausages www.foodallergy.org baked goods margarine caramel candies nisin [email protected] chocolate nondairy products lactic acid starter culture and other nougat bacterial cultures How to Read a Label for a How to Read a Label for a Peanut-Free Diet Soy-Free Diet All FDA-regulated manufactured food products that contain peanut as an All FDA-regulated manufactured food products that ingredient are required by U.S. law to list the word “peanut” on the product contain soy as an ingredient are required by U.S. law to label. list the word “soy” on the product label. -

Full Cream Goat Milk Powder

Full Cream Goat Milk Powder Medium heat Product description Full Cream Goat Milk Powder. Medium heat Ingredients Origin The Netherlands Material 100 % Goat Milk GMO There are no genetically modified organism present. Chemical / Physical characteristics Milk fat 31 % (typical) Protein (N*6,38) 26 % (typical) Lactose 35 % (typical) Ash 6 % (typical) Moisture 5 % (maximum) Cow milk Absent (detection limit 1% Ridascreen 5112) Antibiotics According to NL and EU Food legislation Foreign matter Absent Insolubillity 0,1 ml (maximum) Scorched particals disc A (typical, disc B maximum) Titratable acidity 0,15 % lactic acid (maximum) Microbiological values Total plate count ≤ 10.000 cfu/g Yeasts and moulds ≤ 50 + ≤ 50 cfu/g Coliforms ≤10 / 1 g Thermophilic spores ≤ 100 cfu/g Spores of Bacillus Cereus ≤ 100 cfu/g Staphylococcus aureus Absent / 1 g Salmonella Absent / 25 g Packing information Packaging Multiply paper bag with PE liner, 25 kg net. Storage The product should be stored in a cool, dry and dark enviroment. Shelf life If proper stored a shelf life of 18 months can be guarenteed. Date: 17/03/2017 • Version: 2.0 Version: • Date: 17/03/2017 Hyproca Dairy Products B.V. • Dokter van Deenweg 150 • 8025 BM Zwolle • The Netherlands Phone +31 (0)88 11 63 600 • Internet www.hyproca-dairy-products.com E-mail [email protected] Recombining Best proportion 25 kg Full Cream Goat Milk Powder with 187,5 litres water. Nutritional information (100 g) Energy 2184 kj Vitamin B1 Thiamine 0,3 mg 523 Kcal Vitamin B2 Riboflavin 1,0 mg Fat 31 g Vitamin -

Vacuum Pasteurization of Cream for Butter

STATION BULLETIN 368 JANUARY 1940 Vacuum Pasteurization of Cream for Butter By G. H. WILSTER II Oregon State System of Higher Education Agricultural Experiment Station Oregon State College Corvallis TABLE OF CONTENTS Page Summary 6 Vactnim Pasteurization of Cream for Butter 9 History of Pasteurization 10 Effect of Pasteurization on the Number of Bacteria, Yeasts, Molds and Enzymes in Cream 11 History and Development of Pasteurization and Vacreation in New Zealand13 Feed and Weed Flavors in Milk, Cream, and Butter 14 Introduction of Vacreation in the United States 16 The Treatment of Cream by Vacreation 16 Method of Conducting the Investigational Work 18 Results Obtained from the Investigational Work 20 Scores of the Fresh Butter (Weekly Scorings) 21 Scores by the Federal Butter Grader at Portland 24 Scores of the Butter after Holding it for One Month 27 Scores of the Butter after Storing it for Four Months 29 Influence of Pasteurization on the Bacteria, Yeasts, and Molds 32 Vacreation of Premium and First Grade Cream 34 The Influence of Vacreation of Cream Tainted with Weed Flavor on the Quality of Butter 37 Vacreated Cream Butter Obtained from New Zealand 39 Discussion of the Results Obtained Additional Investigational Projects Involving Vacreation now in Prog- ress at the Oregon Agricultural Experiment Station 47 Bibliography 47 FOREWORD of the several functions of the Oregon Agricultural Experi- ONEment Station is to improve through research and investigation the market quality of the agricultural products of the state. The object of the particular investigation reported herein was to determine whether or not a newer method of pasteurization would improve the marketability of butter by removing certain undesirable flavors and improving the body, texture, and keeping quality. -

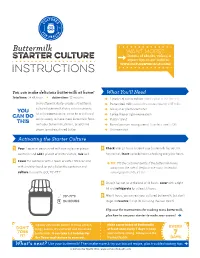

Instructions for Making Cultured Buttermilk

Buttermilk Want more? Dozens of eBooks, videos, & Starter culture expert tips on our website: mwww.culturesforhealth.com Instructions R You can make delicious buttermilk at home! What You’ll Need Total time: 24-48 hours _ Active time: 30 minutes 1 packet of starter culture (store extras in the freezer) Our buttermilk starter creates a traditional o Pasteurized milk (avoid ultra-pasteurized or UHT milk) cultured buttermilk that is rich in nutrients. o Glass jar or plastic container you As an heirloom culture, it can be re-cultured o Coffee filter or tight-weave cloth can do continuously to make more buttermilk. Bake o Rubber band this with your buttermilk, drink it, or add it to o Non-aluminum mixing utensil (stainless steel is OK) cream to make cultured butter. o Thermometer o Activating the Starter Culture >1 Pour 1 quart of pasteurized milk into a glass or plastic >3 Check after 24 hours to see if your buttermilk has set. If it container and add 1 packet of starter culture; mix well. has not set, leave up to 48 hours, checking every few hours. 2 Cover the container with a towel or coffee filter secured > TIP: Tilt the container gently. If the buttermilk moves with a rubber band, or put a lid on the container and oaway from the side of the jar in one mass, instead of culture in a warm spot, 70°-77°F. running up the side, it’s set. Once it has set, or at the end of 48 hours, with a tight >4 cover lid and refrigerate for at least 6 hours. -

Salted Sweet Cream Butter

Salted Sweet Cream Butter Our creamy and flavourful salted sweet cream butter is produced using fresh milk from grass-fed cows which contains beta carotene and Vitamin A. Product Offerings Typical Nutritional Analysis - 25kg blocks Per 100g Energy 3059kJ/744kcal Key Applications Fat 80.0g of which saturates 53.0g Carbohydrate 0.6g Retail and Food Services of which sugars 0.6g Protein 0.6g Culinary - Baking, Frying, Saucing for both Salt 1.8g sweet and savoury dishes Soups, Sauces and Ready Meals Typical Composition Calorific Ratio Pyramid Table Butter Milk solids (non-fat) 2% Butterfat 80% Key Characteristics FFA 0.338% - Silky and creamy texture pH 6.4-7.0 - Excellent flavour - Golden yellow in colour - Produced with milk from grass-fed cows 0.6% 80.0% 0.6% Carbs Fats Protein * Please note all stated values are typical, always clarify minimum/maximum levels with an Ornua Specification. Exports to over 110 Delivers creative Ireland’s largest dairy Milk from countries worldwide customer solutions product exporter grass-fed cows Salted Sweet Cream Butter Microbiological Standards Compliance Product Declaration Food Safety Standards Parameter Max S.P.C 5000 per g Coliforms Not detected E. coli Not detected Halal Kosher Certified to Yeast 50 per g GFSI Standards Mould 50 per g Salmonella Not detected Quality Assurance Shelf Life Ornua is committed to supplying its customers with milk products which are manufactured to the highest food safety and quality - 3 months from date of manufacture if stored standards. Ornua products meet all applicable EU legislation and chilled (0°C to +5°C) our supplying manufacturing sites are accredited to the highest - 24 months from date of manufacture if standards. -

Cream Cheese, Cream Service

United States Department of Agriculture USDA Specifications Agricultural Marketing for Cream Cheese, Cream Service Dairy Cheese with other Foods, and Division Related Products Effective August 22, 1994 USDA Specifications for Cream Cheese, Cream Cheese with other Foods, and Related Products 1.0 Plant Requirements. Cream cheese and related products shall be manufactured and packaged in accordance with the requirements contained in 7 CFR Part 58, Grading and Inspection, General Specifications for Approved Plants and Standards for Grades of Dairy Products. 2.0 Product Temperature Requirements. The cheese shall be cooled to 450 F. prior to inspection, then tempered to 450 F. to 550 F. for product evaluation. 3.0 Regulatory. 3.1 Cream cheese shall comply with the Food and Drug Standards of Identity for Cream cheese (21 CFR Part 133.133). 3.2 Neufchatel cheese shall comply with the Food and Drug Standards of Identity for Neufchatel (21 CFR Part 133.162). 3.3 Reduced fat and Light Cream cheese shall comply with all applicable Federal regulations including those contained in 21 CFR Part 133.133 for Cream cheese, 21 CFR Part 101.62 for nutrient content claims for fat, and 21 CFR Part 130.10 for foods named by use of a nutrient content claim and standardized term. 3.4 Cream cheese with other foods, such as strawberries, chives and salmon shall comply with all applicable Federal regulations contained in 21 CFR Part 133.134. 3.5 Neufchatel cheese with other foods shall comply with all applicable Federal regulations including those contained in 21 CFR Part 133.162 for Neufchatel. -

A Study of Brown Glass Milk Bottles, with Special Reference to Their

November. 1920 Research Bulletin No. 64 A STUDY OF BROWN GLASS MILK BOTTLES With Special Reference to Their Use in Pre venting Abnormal Flavors Due to Light BY B. W. HAMMER AND W. A. CORDES AGRICULTURAL EXPERIMENT STATION IOWA STATE COLLEGE OF AGRICULTURE AND MECHANIC ARTS DAIRY SECTION AMES, IOWA OFFICERS AND STAFF IOWA AGRICULTURAL EX PERIMENT STATION Raymond A. Pearson, M.S.A., LL.D., President C. F. Curtiss, M.S.A., D.S., Director W. H. Stevenson, A .B ., B.S.A., Vice-Director AGRICULTURAL ECONOMICS E. G. Nourse, Ph.D., Chief C. W. Hammans, B.S. (in A .), Asst. AGRICULTURAL ENGINEERING J. B. Davidson, B.S., M.E., A.E., E. V. Collins, B.S. in A.E., B.S. in Chief Agron., Assistant Chief W . A. Foster, B.S. in E., B.Arch., Assistant AGRONOMY W. H. Stevenson, A.B., B.S. A., Chief Paul Emerson, B.S., M.S., Ph.D., As- H. D. Hughes, B.S., M.S.A., Chief in sistant Chief in Soil Bacteriology Farm Crops F. S. Wilkins, B.S., M.S., Assistant P. E. Brown, B.S., A.M., Ph.D., Chief Chief in Farm Crops in Soil Chemistry and Bacteriology T. H. Benton, B.S., M.S., Soil Sur- L . C. Burnett, B.S.A ., M.S., Chief in veyor Cereal Breeding H. J. Harper, B.S., M.S., Field Ex- L. W . Forman, B.S.A., M.S., Chief periments in Field Experiments D . S. Gray, Soil Surveyor J. L. Robinson, B.S., M.S., Superin- W . G. -

Churning Butter

Churning Butter Collect • 1 Cup heavy whipping cream • Clear glass pint jar with a tight lid, or a few baby food jars • Spatula • Bowl • Cold water • A clock (optional) Making a Butter Churner 1. Leave the cream out until it reaches room temperature. 2. Fill the jar halfway with cream and screw the lid on very tight. 3. Shake the cream and observe its viscosity (how thick or thin it is). What is cream made of? Cream comes from milk. Milk is produced by all mammals and contains water and fat, as well as other nutrients such as protein and calcium. Since fat is less dense than water, milk will separate if left to sit. Once the small fat globules float to the top, the fatty cream layer can be skimmed off. Shake, shake, shake! 4. Check the time and start shaking the cream. Taking turns with a friend is best. 5. Notice the cream starting to foam and thicken. You made whipped cream! 6. Keep shaking and observe changes. What is happening to the cream? The tiny fat globules inside the cream repel one another. This keeps the tiny beads of fat separate as the cream sloshes around. When you start to really shake the cream, you add energy to the mix. The globules smash together and join up into bigger and bigger globs of fat. As they get bigger, the globules have a harder time moving past each other. You can feel that change as the cream gets thicker and thicker. Making Butter 7. Stop shaking the jar once you see a solid clump in the center of the jar surrounded by a thin milky liquid.