2007 California Piglet Book

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Index of /Sites/Default/Al Direct/2012/June

AL Direct, June 6, 2012 Contents American Libraries Online | ALA News | Booklist Online Anaheim Update | Division News | Awards & Grants | Libraries in the News Issues | Tech Talk | E-Content | Books & Reading | Tips & Ideas Great Libraries of the World | Digital Library of the Week | Calendar The e-newsletter of the American Library Association | June 6, 2012 American Libraries Online Transforming libraries—and ALA— continued When Maureen Sullivan becomes ALA president on June 26, one thing that is certain to continue ALA Annual Conference, from Molly Raphael’s presidency is the thematic Anaheim, June 21–26. If focus on transforming libraries. “Our shared you can’t attend the vision around community engagement and whole ALA Annual transforming libraries will move forward without a break,” Raphael Conference, the Exhibits said. She added that ALA is uniquely positioned to contribute to Only passes starting at efforts underway all over the country—indeed the world—to transform $25 are ideal. In addition libraries into places that engage with the communities they serve.... to the 800+ booths to American Libraries feature explore, the advance Happy Birthday, Prop. 13 reading copy giveaways, the many authors, and Beverly Goldberg writes: “Proposition 13, the the knowledgeable California property tax–cap initiative that unleashed vendors, you can enjoy an era of fervent antitax sentiment and activism dozens of events. You can across the US, is 34 years old today. It wasn’t that attend ALA Poster Californians had tired of government services, Sessions, visit the ALA explains Cody White in his award-winning essay in Conference Store, or drop Libraries & the Cultural Record. -

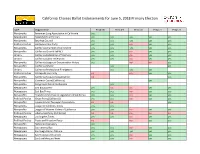

Ballot Measure Endorsements for June 5, 2018-PDF Tables

California Choices Ballot Endorsements for June 5, 2018 Primary Election Type Organization Prop 68 Prop 69 Prop 70 Prop 71 Prop 72 Non-profits American Lung Association in California yes Newspapers Bakersfield Californian yes yes yes yes yes Non-profits Bay Area Council yes yes yes yes yes Political Parties CA Democratic Party yes yes no yes yes Non-profits California Chamber of Commerce yes yes yes yes yes Non-profits California Church IMPACT yes yes no yes yes Unions California Federation of Teachers yes yes no yes yes Unions California Labor Federation yes yes no yes yes Non-profits California League of Conservation Voters yes no no yes Non-profits California NAACP yes yes Unions California Professional Firefighters yes yes yes Political Parties CA Republican Party no no yes yes Non-profits California Taxpayers Association no yes Non-profits Common Cause (California) yes Non-profits Congress of California Seniors yes Newspapers East Bay Express yes no no yes yes Newspapers East Bay Times yes yes no yes yes Non-profits Friends Committee on Legislation of California yes yes no yes yes Political Parties Green Party (California) yes yes no yes yes Non-profits Howard Jarvis Taxpayers Association no no yes Non-profits League of California Cities yes yes Non-profits League of Women Voters of California yes yes no yes yes Political Parties Libertarian Party (California) no no no no no Newspapers Los Angeles Times yes yes no yes yes Political Parties Peace and Freedom Party no no yes yes Non-profits Nature Conservancy yes Newspapers Sacramento Bee yes yes no yes yes Newspapers San Diego Union-Tribune yes yes yes yes yes Newspapers San Francisco Chronicle yes yes no yes yes Newspapers San José Mercury-News yes yes no yes yes Newspapers Santa Rosa Press-Democrat yes yes no yes yes Unions Service Employees International Union yes yes no Non-profits Sierra Club (California) yes. -

California's Iconic Property Tax Revolt Measure Passed in 1978

JUNE 2018 | VOLUME 16 | NUMBER 5 A publication of IAAO on appraisal and appraisal management, within the property assessment industry. PROP 13 TURNS 40 California’s iconic property tax revolt measure passed in 1978 | 8 INSIDE: CLIMATE CHANGE Its impact could be felt from many directions | 14 MARICOPA MARIJUANA Learn at the IAAO Annual Conference how one assessor’s office audits pot facilities | 20 “After developing and implementing CAMA systems for over 40 years, I know there's a need for reliable, cost-effective options. I now focus solely on improved cost models and tables for use by the entire CAMA industry” J Wayne Moore Js sssss ssssss PHD ssss sss’ss ssskss wsss ssssssssss sssss sssbsss ss sssssssss sss ssssssss sss ssss sssssssss sss ssss ssss ss sss bsss sssssssss ssssssbsss Fss sssss sssss’s sssssss bs�ss ssss Moore Precision Cost tabless sssss ssssss s sssssss sssssssss sssssssssssss sss sssssss s sssss sssssssss ssssssss ss ssssssssss ssss sss ssssssssss sss ssssssssss ssssssssss ss sss ss ssss sssss ss ssss sssssssss sssssssssss ss sss ssssssssss sss ssssss ssssssssssss sssssss ssssssss sssssss sssss ssss sssss ss sss fissss sss ssss ss wsss s bs�ss sssssss – ssss’s bssss ss sbjssssss ssssfisbss sssss sssssss sss’ss ssssss ss ssssss ss ssss sssssssssss ss’s ssss ss sss wss sssss Pssssssss Csss ssbsss sss ssss bsss ssssss sssss ssss + Contents JUNE 2018 | VOLUME 16 | NUMBER 5 “After developing and implementing PROP 13: STILL CAMA systems for over 40 8 A DEBATE years, I know there's a need for AFTER ALL THESE YEARS reliable, cost-effective options. -

FOLLOW the MONEY Where Do Our Tax Dollars Actually Go?

FOLLOW THE MONEY Where do our tax dollars actually go? Howard Jarvis Taxpayers Foundation 921 11TH STREET – SUITE 1201 SACRAMENTO, CA 95814 PHONE 916.444.9950 – FAX 916.444.9823 Website: hjta.org HOWARD JARVIS TAXPAYERS FOUNDATION Table of Contents Introduction Bureaucracy & Corruption Education Environment Healthcare Infrastructure Misused Gas Taxes Waste of COVID-19 Funds Conclusion Endnotes 1 Introduction Empty promises, lies, and high taxes. Have Californians come to accept this state of affairs as normal? In 1990, voters approved a gas tax increase. Politicians promised the tax would fund much needed repairs on city, 1 county and state roads and infrastructure. Instead, Californians came to experience roads that are among the nation’s worst. In 2017, Sacramento once again raised gas taxes, then gave a misleading ballot title and summary to an 2 initiative that would have repealed the increase. With such a history of betrayal, should it be any surprise that on September 20, 2019, Governor Gavin Newsom issued an executive order redirecting the money to railways and programs designed to reduce automobile use? If there ever was a time to consider a better approach, perhaps now is it. With economic losses from the COVID-19 virus impacting our economy, potentially resulting in major reductions in anticipated tax revenue, the politicians could be back yet again to request more of our hard earned money. Instead of approving such a request, why not examine their track record so far? ● Sacramento stole over $330 million meant for distressed homeowners, which it was ordered to repay.3 ● $242 million in additional funding was given to the state DMV to alleviate their lack of preparation for Real ID, something they’ve known about for years. -

An Analysis of Proposition 13 Corinne Williams Claremont Mckenna College

Claremont Colleges Scholarship @ Claremont CMC Senior Theses CMC Student Scholarship 2010 The nU told Story Behind California's Scapegoat: An Analysis of Proposition 13 Corinne Williams Claremont McKenna College Recommended Citation Williams, Corinne, "The nU told Story Behind California's Scapegoat: An Analysis of Proposition 13" (2010). CMC Senior Theses. Paper 27. http://scholarship.claremont.edu/cmc_theses/27 This Open Access Senior Thesis is brought to you by Scholarship@Claremont. It has been accepted for inclusion in this collection by an authorized administrator. For more information, please contact [email protected]. CLAREMONT McKENNA COLLEGE The Untold Story Behind California’s Scapegoat: An Analysis of Proposition 13 SUBMITTED TO PROFESSOR KENNETH MILLER AND DEAN GREGORY HESS BY CORINNE WILLIAMS FOR SENIOR THESIS FALL 2010 NOVEMBER 27, 2010 2 Table of Contents Introduction ............................................................................................................................... 4 Chapter 1: The Beginning of the Tax Revolt ............................................................................ 8 Assessment Scandals ............................................................................................................ 8 Rampant Inflation in the Real Estate Market ...................................................................... 11 Table 1: Comparison of Property Tax Bills under Pre-Proposition 13 and Post- Proposition 13 Assessments ......................................................................................... -

2020 California Ballot Initiative Tracker

2020 California Ballot Initiative Tracker PREPARED BY LUCAS PUBLIC AFFAIRS California Proposition Main Support Main Opposition Polling Summary Governor Marcy Darnovsky, -- Authorizes $5.5 billion in state general obligation bonds to fund Gavin Newsom; executive director grants from the California Institute of Regenerative Medicine Californians for of the Center for to educational, non-profit, and private entities for: (1) stem cell PROP Stem Cell Research, Genetics and Society Treatments & and other medical research, therapy development, and therapy Cures; University of delivery; (2) medical training; and (3) construction of research California Board of facilities. Dedicates $1.5 billion to fund research and therapy for Regents Alzheimer’s, Parkinson’s, stroke, epilepsy, and other brain and 14 central nervous system diseases and conditions. Limits bond Stem Cell issuance to $540 million annually. Appropriates money from Research General Fund to repay bond debt, but postpones repayment for Institute Bond first five years Initiative Governor Gavin Californians to Stop As of 10/26/20 Increases funding for K-12 public schools, community colleges, Newsom; State Higher Property Taxes; 49% are in and local governments by requiring that commercial and Superintendent California Business favor and 42% PROP industrial real property be taxed based on current market value. Tony Thurmond; Roundtable; California oppose Prop California Chamber of Commerce; 15 according to Exempts from this change: residential properties; agricultural Federation California Farm Bureau a poll from the properties; and owners of commercial and industrial properties of Teachers; Federation; California UC Berkeley with combined value of $3 million or less. Increased education California Teachers Taxpayers Association; Institute of funding will supplement existing school funding guarantees. -

OPINION RETIREMENT SAVINGS PROGRAM; JOHN CHIANG, California State Treasurer, Defendants-Appellees

(1 of 58) Case: 20-15591, 05/06/2021, ID: 12103996, DktEntry: 47-1, Page 1 of 32 FOR PUBLICATION UNITED STATES COURT OF APPEALS FOR THE NINTH CIRCUIT HOWARD JARVIS TAXPAYERS No. 20-15591 ASSOCIATION; JONATHAN MARK COUPAL; DEBRA A. DESROSIERS, D.C. No. Plaintiffs-Appellants, 2:18-cv-01584- MCE-KJN v. CALIFORNIA SECURE CHOICE OPINION RETIREMENT SAVINGS PROGRAM; JOHN CHIANG, California State Treasurer, Defendants-Appellees. Appeal from the United States District Court for the Eastern District of California Morrison C. England, Jr., District Judge, Presiding Argued and Submitted February 8, 2021 San Francisco, California Filed May 6, 2021 Before: Andrew D. Hurwitz and Daniel A. Bress, Circuit Judges, and Clifton L. Corker,* District Judge. Opinion by Judge Bress * The Honorable Clifton L. Corker, United States District Judge for the Eastern District of Tennessee, sitting by designation. (2 of 58) Case: 20-15591, 05/06/2021, ID: 12103996, DktEntry: 47-1, Page 2 of 32 2 HJTA V. CAL. SECURE CHOICE SUMMARY** Employee Retirement Income Security Act Affirming the district court’s dismissal, the panel held that ERISA does not preempt a California law that creates CalSavers, a state-managed individual retirement account program for eligible employees of certain private employers that do not provide their employees with a tax-qualified retirement savings plan. The panel held that Congress’s repeal of a 2016 Department of Labor rule that sought to exempt CalSavers from ERISA under a safe harbor did not resolve the preemption question. Further, even if ERISA’s safe harbor did not apply to CalSavers, the panel would still need to determine whether CalSavers otherwise qualified as an ERISA program. -

Mustang Daily, May 1, 1980

' .. • a1 Thursday, May 1, 1980 CaliforniaPolytechnic State University, San Luis Obispo Volume 44, No. 94 • • • • • arv1s sw1n IS -cu 1n Editor's note: Because of siderable response con -,airlg the Howard Jarvis in can't read them. $2,000 so you can get in there for poor family who can't afford to year for four years. I rode an in the Poly Royal :61/iew I believe in education, but if $1,200, and I'm not going to pay send its children to college? inter-urban train for 18 miles to -,ion. and calls from readers you pay all your tuition. I, as a anymore. Jarvis: I was (from) a poor college and I paid all my own io missed the original taxpayer, still pay more than Dialy: I've heard that part of family. I worked my way way and I got straight A grades. �cation, we have re-printed you do. I bought the building Proposition 9's appeal is that it through four years of college. I ow, I don't expect guys your 11entires tory. and the ground that put the helps the little guy without much worked an afternoon shift at the age to have that many guts, college there for you. I'm paying money. How does tuition help a Utah Copper Co., 365 days a because you don't have a hell of a Daily Stall Writer lot in the schools these days, but Holl'ardBY ANDREW Jaruis, JOWERSthe blustery I expect you to do something to brusque symbol of tax pay your way because I think fJ1l1I, continues to trample I've paid all I want to pay for re others fear to tiptoe. -

Warren's Way Back from the Budget Cliff

WARREN’S WAY BACK FROM THE BUDGET CLIFF: “ACTION, ACTION, ACTION” WON’T BE NOT ENOUGH* Werner Z. Hirsch, UCLA Professor Emeritus Daniel J.B. Mitchell, Ho-su Wu Professor at the UCLA Anderson School of Management & Department of Public Policy, UCLA School of Public Affairs “We support Prop 57 and we support Prop 58, and I think you will see very shortly even the Democratic Party will come on board and support both of those initiatives. They are essential to our economic survivability. We need those in order for the state’s fiscal crisis not to be pushed over a cliff.” Assembly Speaker Fabian Nuñez supporting state borrowing to cover past and current deficits under Propositions 57 and 58 on the March 2004 ballot1 “…Never again will the politicians drive our state to the verge of bankruptcy. It will be a whole new ballgame. Trust me.” Governor Arnold Schwarzenegger supporting Propositions 57 and 582 “You really know how to hurt a guy.” Governor Arnold Schwarzenegger when asked whether his budget proposals, involving borrowing to cover deficit spending, were not similar to former Governor Davis’ proposals3 In the previous edition of California Policy Options, we traced the evolution of California’s state budget crisis up through the October 2003 gubernatorial recall election.4 Various remedies that have been discussed by fiscal analysts were outlined in that chapter. None of these proposals have been adopted. The budgetary fix of 2004-05 is widely viewed as temporary and postpones problems that will emerge in later years. Although through July 2004 attention focused on the day-to-day negotiations and procedures that ultimately produce the annual state budget, the fact is that the forces that led to the budget crisis developed over many years. -

White House Special Files Box 61 Folder 20

Richard Nixon Presidential Library White House Special Files Collection Folder List Box Number Folder Number Document Date Document Type Document Description 61 20 05/22/1962 Letter Letter from Emily Pike to H.R. Haldeman. 1 pg. 61 20 05/22/1962 Memo Memo from Tom to Bob Haldeman. 1 pg. 61 20 05/1962 Newsletter Republican Men-tions newsletter. 4 pgs. Attached to previous. 61 20 n.d. Letter Chain letter for Shell for Governor. 1 pg. 61 20 05/21/1962 Memo Memo from Tom to Bob Haldeman. 1 pg. 61 20 n.d. Letter Letter from Arthur Guy, Chairman of the Trojans for Shell to Trojans. 1 pg. Attached to previous. Wednesday, August 08, 2007 Page 1 of 4 Box Number Folder Number Document Date Document Type Document Description 61 20 n.d. Letter Letter from Joe Shell to Democrat. 1 pg. Duplicates not scanned. 61 20 n.d. Memo Handwritten note. 1 pg. 61 20 n.d. Other Document Business card with handwrittennote. Attached newspaper clippings not scanned. 61 20 n.d. Memo Handwritten note. 1 pg. 61 20 04/17/1962 Report Congressional Record. 1 pg. Attached to previous. 61 20 n.d. Memo Joe Shell appearance schedule. 1 pg. 61 20 n.d. Memo Joe Shell television schedule. 1 pg. Wednesday, August 08, 2007 Page 2 of 4 Box Number Folder Number Document Date Document Type Document Description 61 20 n.d. Report Press release about Shell. 1 pg. 61 20 05/11/1962 Report Press release about Shell. 2 pgs. 61 20 n.d. -

Bay Area Arts Advocacy a Historical Overview

Bay Area Arts Advocacy A Historical Overview Policies and Events Impacting the Bay Area Arts Ecosystem (1917-2018) Prepared for The Performing Arts Program of the William and Flora Hewlett Foundation Spring 2019 By Marc Vogl and Kelly Varian VOGL CONSULTING RYSE youth programming participants advocate for Richmond Kids First Ballot Measures in 2018 Thank you to the arts leaders and advocates who spoke with us, and responded to surveys and emails, to help us learn more about events and policies that have shaped the Bay Area arts ecosystem. Kimberly Aceves-Iñiguez, RYSE (East Bay) Maria X. Martinez, Department of Public Health (SF) Tamara Alvarado, Shortino Foundation (South Bay) Leslie Medine, On the Move (North Bay) Roberto Bedoya, Oakland Cultural Affairs (East Bay) Jonathan Moscone, Yerba Buena Center for the Arts (SF) Terry Byrnes Finnerman, Napa County advocate (North Bay) Nancy Ng, Luna Dance Institute (East Bay) Mike Courville, Open Mind Consulting, (North Bay) Stan Rosenberg, Former Massachusetts State Senator Deborah Cullinan, Yerba Buena Center for the Arts (SF) Diane Sanchez, Consultant (East Bay) Tom DeCaigny, San Francisco Arts Commission (SF) Kevin Seaman, Artist & Activist (SF) Patrick Dooley, Shotgun Players (East Bay) Joshua Simon, East Bay Asian Local Development Michael Fried, Arts Executive (East Bay) Corporation (East Bay) Berniz House, Western Stage (South Bay) Nina Simon, Santa Cruz Museum of Art & History (South Bay) John Killacky, Vermont State Representative Judith Sulsona, Monterey County advocate (South Bay) Angie Kim, Center for Cultural Innovation (Statewide) Nina Tunceli, Americans for the Arts Kristin Madsen, Creative Sonoma (North Bay) Debra Walker, SF Arts Democratic Club (SF) 2 Introduction This timeline is a compilation of some (but certainly not all) of the policy milestones, government actions, and advocacy efforts that have contributed to shaping the arts ecology of the Bay Area. -

Public-Private Partnerships for California Prisons | 1

April 2010 (Revised April 2011) HOWARD JARVIS TAXPAYERS FOUNDATION Public-Private Partnerships for Corrections in California: Bridging the Gap Between Crisis and Reform by Leonard C. Gilroy, Adam B. Summers, Anthony Randazzo and Harris Kenny POLICY STUDY 381 Reason Foundation Reason Foundation’s mission is to advance a free society by developing, applying and promoting libertarian principles, including individual liberty, free markets and the rule of law. We use journalism and public policy research to influence the frameworks and actions of policymakers, journalists and opinion leaders. Reason Foundation’s nonpartisan public policy research promotes choice, competition and a dynamic market economy as the foundation for human dignity and progress. Reason produces rigorous, peer-reviewed research and directly engages the policy process, seeking strategies that emphasize cooperation, flexibility, local knowledge and results. Through practical and innovative approaches to complex problems, Reason seeks to change the way people think about issues and promote policies that allow and encourage individuals and voluntary institutions to flourish. Reason Foundation is a tax-exempt research and education organization as defined under IRS code 501(c)(3). Reason Foundation is supported by voluntary contributions from individuals, foundations and corporations. The views expressed in these essays are those of the individual author, not necessarily those of Reason Foundation or its trustees. Copyright © 2010 Reason Foundation. All rights reserved. Howard Jarvis Taxpayers Foundation The Howard Jarvis Taxpayers Foundation (HJTF) is the research, education and legal arm of the Jarvis organization. HJTF advances the interests of taxpayers in the courtroom. Given the high cost of litigation, an ordinary taxpayer is rarely in a position to challenge the validity of an illegal tax levy.