Marital Status Change Do Not Use This Area

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Thompson Nickel Belt–Type Units in the Northeastern Kisseynew Domain, Manitoba (Parts of NTS 63O) by H.V

GS-9 Thompson Nickel Belt–type units in the northeastern Kisseynew Domain, Manitoba (parts of NTS 63O) by H.V. Zwanzig, L. Murphy, J.A. Percival1, J.B. Whalen1 and N. Rayner1 Zwanzig, H.V., Murphy, L., Percival, J.A., Whalen, J.B. and Rayner, N. 2006: Thompson Nickel Belt–type units in the northeastern Kisseynew Domain, Manitoba (parts of NTS 63O); in Report of Activities 2006, Manitoba Science, Tech- nology, Energy and Mines, Manitoba Geological Survey, p. 85–103. Summary Domain (KD) in the internal zone Remapping a corridor from the Thompson Nickel Belt of Trans-Hudson Orogen (Figure (TNB) 60 km west to Threepoint Lake (south of Nelson GS-9-1). The general region is marked by a high-gravity House) and a preliminary interpretation of geochemistry anomaly (Viljoen et al., 1999) and Nd isotope data provide new evidence for an Archean The area, which was last mapped between 1971 age of crystallization and/or mantle extraction of biotite and 1973 (Baldwin et al., 1979; Frohlinger and granulite facies orthogneiss in the northeastern part of Kendrick, 1979; Kendrick, 1979a–c; Kendrick et al., the Kisseynew Domain. The gneiss occurs in local struc- 1979), has been considered until recently to be underlain tural culminations mantled by, and probably interleaved solely by juvenile Paleoproterozoic greywacke-mudstone with, heterogeneous paragneiss that may overlie it uncon- migmatite (Burntwood Group), local meta-arkose formably. A composite stratigraphic section through the (Sickle Group) and granitoid rocks largely derived narrow belts of this paragneiss comprises basal quartz- by partial melting of the metasedimentary rocks (e.g., ite (containing only Archean detrital zircons) and minor White, 2005). -

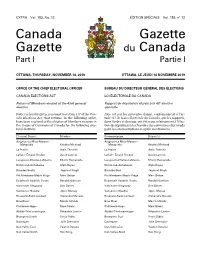

Canada Gazette, Part I

EXTRA Vol. 153, No. 12 ÉDITION SPÉCIALE Vol. 153, no 12 Canada Gazette Gazette du Canada Part I Partie I OTTAWA, THURSDAY, NOVEMBER 14, 2019 OTTAWA, LE JEUDI 14 NOVEMBRE 2019 OFFICE OF THE CHIEF ELECTORAL OFFICER BUREAU DU DIRECTEUR GÉNÉRAL DES ÉLECTIONS CANADA ELECTIONS ACT LOI ÉLECTORALE DU CANADA Return of Members elected at the 43rd general Rapport de député(e)s élu(e)s à la 43e élection election générale Notice is hereby given, pursuant to section 317 of the Can- Avis est par les présentes donné, conformément à l’ar- ada Elections Act, that returns, in the following order, ticle 317 de la Loi électorale du Canada, que les rapports, have been received of the election of Members to serve in dans l’ordre ci-dessous, ont été reçus relativement à l’élec- the House of Commons of Canada for the following elec- tion de député(e)s à la Chambre des communes du Canada toral districts: pour les circonscriptions ci-après mentionnées : Electoral District Member Circonscription Député(e) Avignon–La Mitis–Matane– Avignon–La Mitis–Matane– Matapédia Kristina Michaud Matapédia Kristina Michaud La Prairie Alain Therrien La Prairie Alain Therrien LaSalle–Émard–Verdun David Lametti LaSalle–Émard–Verdun David Lametti Longueuil–Charles-LeMoyne Sherry Romanado Longueuil–Charles-LeMoyne Sherry Romanado Richmond–Arthabaska Alain Rayes Richmond–Arthabaska Alain Rayes Burnaby South Jagmeet Singh Burnaby-Sud Jagmeet Singh Pitt Meadows–Maple Ridge Marc Dalton Pitt Meadows–Maple Ridge Marc Dalton Esquimalt–Saanich–Sooke Randall Garrison Esquimalt–Saanich–Sooke -

Combining Production and Exploration in the Shaw Dome Nickel Belt

FACT SHEET | WINTER 2012 TSX: LBE RECENT PRICE Combining production $0.14 (AS OF FEB 17) 52-WEEK RANGE: and exploration in the $0.07 - $0.22 Shaw Dome Nickel Belt AVERAGE 3-MONTH VOLUME 79,000 ISSUED & OUTSTANDING SHARES 206,477,365 MARKET CAPITALIZATION $28.9 MILLION CASH & INVESTMENTS $1.2 MILLION (AS OF SEP 30, 2011) YEAR END DECEMBER 31 Liberty Mines is focused on the exploration, development and production of nickel and related base metals from its assets in Ontario, Canada. Liberty owns and operates the only nickel concentrator in the Shaw Dome, a prospective nickel belt region near Timmins, Ontario. PROPERTY LOCATIONS Liberty’s short-term objectives include the resumption of production activities in Q1 2012 when the refurbishment of its tailings pond facility is expected to be completed. Over the longer term, the Company plans an aggressive exploration HART program on its current properties in the Timmins area to increase its resource REDSTONE MCWATTERS base for the Redstone Mill. The Company is also focused on growth opportunities, and is looking to expand its portfolio beyond the Timmins area. MATHESON TIMMINS Redstone Mill NICKEL MARKET OUTLOOK Demand for nickel is expected to grow by 9.5% in 2012, driven largely by QUEBEC consumption in China and increasing 9.5% stainless steel production. expected growth of nickel GROVES demand in 2012 MCARA / RAY INVESTMENT HIGHLIGHTS • Strong leadership team with significant mining and operational experience • Only mill facility within the Shaw Dome nickel belt ONTARIO • Progressing towards the re-start of McWatters Mine and Redstone Mill, and positive cash flow SUDBURY • Solid pipeline of exploration projects NORTH BAY Liberty’s Producing Mines • Strategic relationship with Jilin Jien Nickel Industry Co. -

On the Election Agenda

RNs put health care on the election agenda WINDSOR TORONTO RNAO’s Essex chapter hosted its Politics and Pancakes event on Sept. 16 in Windsor. Teresa Piruzza, On Sept. 22, RNAO’s Regions 6 and 7 and RNAO Home Office Liberal candidate for Windsor West (right), discusses her party’s platform with local nurses (L to R) co-hosted an all-candidates debate with (R to L) Kitchener- Debbie Kane, Amanda Ellard-Ryall, and Essex chapter president Jennifer Johnston. Waterloo Conservative MPP Elizabeth Witmer, Green Party Leader Michael Schreiner, St. Paul’s Liberal MPP Eric Hoskins, and Nickel Belt NDP MPP France Gélinas. Toronto Star columnist Carol Goar (at podium) acted as moderator. Windsor RN Jennifer Johnston says she would do it again in a hosted debates that drew anywhere from 80 to 400 participants. heartbeat. Planning an all-candidates debate in the run-up to “i can’t stress enough the importance of getting closely involved the provincial election was a lot of work, but it was manageable – in an election. by sharing the views of nurses with colleagues, even fun – with the help of fellow executive members from peers and the public at large, RNs can – and do – influence the the essex chapter. “there won’t be another election for four years, outcome of an election,” says RNAO executive director doris but maybe we’ll plan something with politicians for Nursing Grinspun. “When you get people talking – whether they’re talking Week,” the essex chapter president speculates, adding with a about specific nursing issues or the health of the population touch of humour that “politicians are always politicking.” in general – you awaken a passion that ultimately translates into Johnston was one of several RNAO members who planned ballots at voting stations across the province.” political events for the first time this fall. -

2018 Election Liberal Party of Ontario Candidates

2018 Election Liberal Party of Ontario Candidates NAME RIDING WEBSITE LINK Joe Dickson Ajax [email protected] Naheed Yaqubian Aurora-Oak Ridges- [email protected] Richmond Hill Ann Hoggarth Barrie-Innisfil [email protected] Robert Quaiff Bay of Quinte [email protected] Arthur Potts Beaches-East York [email protected] Safdar Hussain Brampton Centre [email protected] Dr. Parminder Singh Brampton East [email protected] Harinder Malhi Brampton North [email protected] Sukhwant Thethi Brampton South [email protected] Vic Dhillon Brampton West [email protected] Ruby Toor Brantford-Brant [email protected] Francesca Dobbyn Bruce-Grey-Owen Sound [email protected] Eleanor McMahon Burlington [email protected] Kathryn McGarry Cambridge [email protected] Theresa Qadri Carleton [email protected] Margaret Schleier Stahl Chatham-Kent-Leamington [email protected] Cristina Martins Davenport [email protected] Michael Coteau Don Valley East [email protected] Shelley Carroll Don Valley North [email protected] Kathleen Wynne Don Valley West [email protected] Bob Gordanier Dufferin-Caledon [email protected] Granville Anderson Durham [email protected] 1 | P a g e NAME RIDING WEBSITE LINK Mike Colle Eglinton-Lawrence [email protected] Carlie Forsythe -

LIST of YOUR MPPS in the PROVINCE of ONTARIO | LISTE DE VOS DÉPUTÉS PROVINCIAUX POUR LA PROVINCE DE L’ONTARIO As of April 2021 | À Jour Du Mois D’Avril 2021

LIST OF YOUR MPPS IN THE PROVINCE OF ONTARIO | LISTE DE VOS DÉPUTÉS PROVINCIAUX POUR LA PROVINCE DE L’ONTARIO As of April 2021 | À jour du mois d’avril 2021 NAME | NOM RIDING | CIRCONSCRIPTION CAUCUS | PARTI Anand, Deepak Mississauga—Malton Progressive Conservative Party of Ontario Andrew, Jill Toronto—St. Paul's New Democratic Party of Ontario Armstrong, Teresa J. London—Fanshawe New Democratic Party of Ontario Arnott, Hon. Ted Wellington—Halton Hills Progressive Conservative Party of Ontario Arthur, Ian Kingston and the Islands New Democratic Party of Ontario Baber, Roman York Centre Independent Babikian, Aris Scarborough—Agincourt Progressive Conservative Party of Ontario Bailey, Robert Sarnia—Lambton Progressive Conservative Party of Ontario Barrett, Toby Haldimand—Norfolk Progressive Conservative Party of Ontario Begum, Doly Scarborough Southwest New Democratic Party of Ontario Bell, Jessica University—Rosedale New Democratic Party of Ontario Berns-McGown, Rima Beaches—East York New Democratic Party of Ontario Bethlenfalvy, Hon. Peter Pickering—Uxbridge Progressive Conservative Party of Ontario Bisson, Gilles Timmins New Democratic Party of Ontario Blais, Stephen Orléans Ontario Liberal Party Bouma, Will Brantford—Brant Progressive Conservative Party of Ontario Bourgouin, Guy Mushkegowuk—James Bay New Democratic Party of Ontario Burch, Jeff Niagara Centre New Democratic Party of Ontario G:\Hotlines\President's Message 2021\2021-04-14_List of MPPS in Ontario.docx Calandra, Hon. Paul Markham—Stouffville Progressive Conservative Party -

The Thirty-Eighth Meeting of the Council of the City of Greater Sudbury

THE THIRTY-EIGHTH MEETING OF THE COUNCIL OF THE CITY OF GREATER SUDBURY Committee Room C-11 Thursday, October 10th, 2002 Tom Davies Square Commencement: 5:05 p.m. DEPUTY MAYOR ELDON GAINER, IN THE CHAIR Present Councillors Bradley; Callaghan; Courtemanche; Craig; Davey; Dupuis; Kilgour; Lalonde; McIntaggart; Portelance; Petryna City Officials M. Mieto, Acting Chief Administrative Officer; D. Belisle, General Manager of Public Works; C. Hallsworth, General Manager of Citizen & Leisure Services; D. Nadorozny, General Manager of Economic Development & Planning Services; H. Salter, Deputy City Solicitor; W. Ropp, Interim Fire Chief; P. Thomson, Director of Human Resources; C. Mahaffy, Manager of Financial Planning and Policy; M. Gauvreau, Manager of Current Accounting Operations; C. Salazar, Manager of Corporate Strategy & Policy Analysis; P. Aitken, Government Relations/Policy Analyst; T. Mowry, City Clerk; G. Ward, Council Secretary Others B. Freelandt, Freelandt Caldwell Reilly; O. Poloni, KPMG Declarations of None declared. Pecuniary Interest “In Camera” 2002-590 Bradley/Dupuis: That we move "In Camera" to deal with property and personnel matters in accordance with Article 15.5 of the City of Greater Sudbury Procedure By-law 2002-202 and the Municipal Act, R.S.O. 1990, c.M.45, s.55(5). CARRIED Recess At 7:00 p.m., Council recessed. Reconvene At 7:08 p.m., Council moved to the Council Chamber to continue the regular meeting. Chair DEPUTY MAYOR DOUG CRAIG, IN THE CHAIR Present Councillors Bradley; Callaghan (D8:10 pm); Courtemanche; Davey (A7:47 pm); Dupuis; Gainer; Kilgour; Lalonde; McIntaggart; Portelance; Petryna City Officials M. Mieto, Acting Chief Administrative Officer; D. -

Legislative Assembly of Ontario INDIVIDUAL MEMBERS

Legislative Assembly of Ontario INDIVIDUAL MEMBERS' EXPENDITURES FOR THE FISCAL YEAR 2020 - 2021 PREPARED FOR THE SPEAKER: HON. TED ARNOTT FINANCIAL SERVICES JUNE 2021 CE DOCUMENT EST ÉGALEMENT PUBLIÉ EN FRANÇAIS MEMBERS' TRAVEL AND TORONTO ACCOMMODATION EXPENSES 2020-2021 TRAVEL BETWEEN TRAVEL RESIDENCE AND QUEEN'S ASSEMBLY FAMILY TOTAL WITHIN TORONTO PARK TRAVEL TRAVEL POINTS RIDING ACCOMMODATION TOTAL (includes committee) MEMBER RIDING (1) (2) (3) (4) (5) (6) $ $ $ $ $$ ANAND, DEEPAK 2,459 37 1.0 2,789 5,285 Mississauga -- Malton ANDREW, JILL 2,179 1,751 1.0 3,930 Toronto -- St. Paul's ARMSTRONG, TERESA J. 3,557 23,294 26,851 London -- Fanshawe ARNOTT, HON. TED 4,603 286 4,889 Wellington -- Halton Hills ARTHUR, IAN 3,962 13 27,062 31,038 Kingston and the Islands BABER, ROMAN York Centre BABIKIAN, ARIS Scarborough -- Agincourt BAILEY, ROBERT 6,590 836 24,750 32,176 Sarnia -- Lambton BARRETT, TOBY 1,302 2,802 16,953 21,057 Haldimand -- Norfolk BEGUM, DOLY Scarborough Southwest BELL, JESSICA University -- Rosedale BERNS-MCGOWN, RIMA Beaches -- East York BETHLENFALVY, HON. PETER Pickering -- Uxbridge BISSON, GILLES 25,080 4,985 25,380 55,445 Timmins BLAIS, STEPHEN 11,428 0.5 27,384 38,812 Orléans BOUMA, WILL 1,589 34 1.0 159 28,056 29,838 Brantford -- Brant BOURGOUIN, GUY 11,153 1.0 7,802 28,207 47,162 Mushkegowuk -- James Bay (N) BURCH, JEFF 2,513 26,428 28,942 Niagara Centre CALANDRA, HON. PAUL 4,773 4,773 Markham -- Stouffville Page 1 MEMBERS' TRAVEL AND TORONTO ACCOMMODATION EXPENSES 2020-2021 TRAVEL BETWEEN TRAVEL RESIDENCE AND QUEEN'S ASSEMBLY FAMILY TOTAL WITHIN TORONTO PARK TRAVEL TRAVEL POINTS RIDING ACCOMMODATION TOTAL (includes committee) MEMBER RIDING (1) (2) (3) (4) (5) (6) $ $ $ $ $$ CHO, HON. -

The ONTARIO ENERGY REPORT Bruce Power Is Helping Ontario Achieve a Number of Important Policy Goals While Simultaneously Advancing Nuclear Medicine and Human Health

The ONTARIO ENERGY REPORT Bruce Power is helping Ontario achieve a number of important policy goals while simultaneously advancing nuclear medicine and human health. Bruce Power is and will remain a key contributor to keeping Ontario’s electricity system clean, while providing low-cost electricity rates that help Ontario business grow and families prosper. ONTARIO’S SUPPLY MIX Electricity supply in Ontario comes from a diverse mix of different fig. 1 Ontario’s Electricity Production in 2019 fuel types: wind, solar, hydro (waterpower), natural gas, and nuclear. These fuel types have different supply characteristics, all of which Biofuel 0.45% Solar 0.25% Wind 7.4% are needed to meet the province’s demand. Managing a balanced supply mix which is flexible, reliable, affordable, and low-emitting as possible ensures Ontario always has the electricity it needs to keep the lights on. Hydro ONTARIO’S SUPPLY MIX INCLUDES: 24.5% • Base-load supply includes sources like nuclear and hydro. They are low-cost, reliable, Greenhouse Gas Emission (GHG)-free and supply electricity 24/7. Nuclear 61% • Intermittent supply includes sources like wind and solar. They Gas 6.4% provide electricity when the wind is blowing and the sun is shining. This output is highly variable. Source: IESO • Peaking supply sources like natural gas and peaking hydro are used when demand is at its highest. They are flexible and can come online quickly should the need arise. fig. 2 Ontario Generation (2007-2019) • Flexible nuclear from the Bruce Power site. Bruce Power's Nuclear Natural Gas Hydro Coal Non-hydro renewables eight-unit site adds flexible, dynamic capability. -

Federal Government (CMHC) Investments in Housing ‐ November 2015 to November 2018

Federal Government (CMHC) Investments in Housing ‐ November 2015 to November 2018 # Province Federal Riding Funding* Subsidy** 1 Alberta Banff‐Airdrie$ 9,972,484.00 $ 2,445,696.00 2 Alberta Battle River‐Crowfoot $ 379,569.00 $ 7,643.00 3 Alberta Bow River $ 10,900,199.00 $ 4,049,270.00 4 Alberta Calgary Centre$ 47,293,104.00 $ 801,215.00 5 Alberta Calgary Confederation$ 2,853,025.00 $ 559,310.00 6 Alberta Calgary Forest Lawn$ 1,060,788.00 $ 3,100,964.00 7 Alberta Calgary Heritage$ 107,000.00 $ 702,919.00 8 Alberta Calgary Midnapore$ 168,000.00 $ 261,991.00 9 Alberta Calgary Nose Hill$ 404,700.00 $ 764,519.00 10 Alberta Calgary Rocky Ridge $ 258,000.00 $ 57,724.00 11 Alberta Calgary Shepard$ 857,932.00 $ 541,918.00 12 Alberta Calgary Signal Hill$ 1,490,355.00 $ 602,482.00 13 Alberta Calgary Skyview $ 202,000.00 $ 231,724.00 14 Alberta Edmonton Centre$ 948,133.00 $ 3,504,371.98 15 Alberta Edmonton Griesbach$ 9,160,315.00 $ 3,378,752.00 16 Alberta Edmonton Manning $ 548,723.00 $ 4,296,014.00 17 Alberta Edmonton Mill Woods $ 19,709,762.00 $ 1,033,302.00 18 Alberta Edmonton Riverbend$ 105,000.00 $ ‐ 19 Alberta Edmonton Strathcona$ 1,025,886.00 $ 1,110,745.00 20 Alberta Edmonton West$ 582,000.00 $ 1,068,463.00 21 Alberta Edmonton‐‐Wetaskiwin$ 6,502,933.00 $ 2,620.00 22 Alberta Foothills$ 19,361,952.00 $ 152,210.00 23 Alberta Fort McMurray‐‐Cold Lake $ 6,416,365.00 $ 7,857,709.00 24 Alberta Grande Prairie‐Mackenzie $ 1,683,643.00 $ 1,648,013.00 25 Alberta Lakeland$ 20,646,958.00 $ 3,040,248.00 26 Alberta Lethbridge$ 1,442,864.00 $ 8,019,066.00 27 Alberta Medicine Hat‐‐Cardston‐‐Warner $ 13,345,981.00 $ 4,423,088.00 28 Alberta Peace River‐‐Westlock $ 7,094,534.00 $ 6,358,849.52 29 Alberta Red Deer‐‐Lacombe$ 10,949,003.00 $ 4,183,893.00 30 Alberta Red Deer‐‐Mountain View $ 8,828,733.00 $ ‐ 31 Alberta Sherwood Park‐Fort Saskatchewan$ 14,298,902.00 $ 1,094,979.00 32 Alberta St. -

Powering Innovation, Jobs & Economic Growth

Powering Innovation, Jobs & Economic Growth Canada’s Largest Infrastructure Project: Providing Low-Cost Electricity to 2064 A joint economic impact analysis from the Provincial Building and Construction Trades Council of Ontario, the Canadian Manufacturers & Exporters and Bruce Power. This economic impact analysis has been developed using publicly available information that has been quoted throughout the document. It has not used any information that has not been previously disclosed in the public domain. The authors of the document sought to provide a directional sense of economic impacts and, although the figures may vary in the future depending on commercial negotiations to be concluded to turn the Long-Term Energy Plan policy position into action, they will not materially impact either the economic impacts from the investment program or the contribution of this electricity output to stable and affordable electricity rates. Pour obtenir une traduction en français, veuillez contacter: [email protected] Table of Contents 4 Executive Summary: Powering Innovation, Jobs & Economic Growth 9 Stable & Affordable Rates 10 Direct & Secondary Benefits of Operations 12 Ontario Economic Impact Map 14 Economic Benefits of Renewing the Bruce Power Fleet 15 Securing Skills, Knowledge & Innovation 16 Health & the Low-Carbon Economy 18 Indigenous Relations Supplier Network 20 Local Economic Development 22 Summary of Benefits Executive Summary Powering Innovation, Jobs & Economic Growth Ontario’s 2017 Long-Term Energy Plan (LTEP) is Key Source of Stable, Low-cost Rates focused on the customer while ensuring a reliable, clean and innovative energy system. It’s the balance As the report outlines, Bruce Power provides more that many jurisdictions throughout the world are than 30 per cent of Ontario’s electricity at 30 per cent trying to achieve to ensure a clean supply of power less than the average cost to produce residential power. -

Where to Send Your T2 Return

Where to send your T2 Return We have seven Tax Centres in Canada responsible for processing T2 (for corporations) returns. To avoid delays in the processing of the corporation's T2 return, please consult the chart below to determine under which Tax Centre the T2 returns are being processed. Corporations served by Tax Services Send your return to the following: Offices in: British Columbia, Yukon Territory, and Tax Centre Regina 9755 King George Highway Surrey BC V3T 5E1 Alberta, Manitoba, Northwest Territories, Tax Centre London, Saskatoon, Thunder Bay, and 66 Stapon Road Windsor Winnipeg MB R3C 3M2 Toronto Centre, Toronto East, Tax Centre Toronto North, Toronto West, and Sudbury 1050 Notre Dame Avenue (Sudbury/Nickel Belt only*) Sudbury ON P3A 5C1 Laval, Montréal, Nunavut, Ottawa, Rouyn- Tax Centre Noranda, Sherbrooke, and Sudbury 4695 12th Avenue (North-Eastern Ontario only**) Shawinigan-Sud QC G9N 7S6 Chicoutimi, Montérégie-Rive-Sud, Tax Centre Outaouais, Québec, Rimouski, and Trois- 2251 René Lévesque Boulevard Rivières Jonquière QC G7S 5J1 New Brunswick, Newfoundland and Tax Centre Labrador, Nova Scotia, Kingston, 290 Empire Avenue Peterborough, and St. Catharines St. John's NF A1B 3Z1 Prince Edward Island, Belleville, Hamilton, Tax Centre and Kitchener/Waterloo 275 Pope Road Summerside PE C1N 6A2 For more information about the filing of your corporation's income tax return (T2), please contact your Tax Services Office. * Sudbury/Nickel Belt areas includes all postal codes beginning with P3A, P3B, P3C, P3E, P3G, P3L, P3N, P3P, P3Y, and all postal codes beginning with P0M and ending with 1A0, 1B0, 1A0, 1E0, 1H0, 1J0, 1K0, 1L0, 1M0, 1N0, 1P0, 1R0, 1S0, 1T0, 1V0, 1W0, 1Y0, 2C0, 2E0, 2M0, 2R0, 2S0, 2X0, 2Y0, 3A0, 3B0, 3C0, 3E0 and 3H0.