Nomination Contestant's Campaign Return (EC 20171) – Instructions

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Thompson Nickel Belt–Type Units in the Northeastern Kisseynew Domain, Manitoba (Parts of NTS 63O) by H.V

GS-9 Thompson Nickel Belt–type units in the northeastern Kisseynew Domain, Manitoba (parts of NTS 63O) by H.V. Zwanzig, L. Murphy, J.A. Percival1, J.B. Whalen1 and N. Rayner1 Zwanzig, H.V., Murphy, L., Percival, J.A., Whalen, J.B. and Rayner, N. 2006: Thompson Nickel Belt–type units in the northeastern Kisseynew Domain, Manitoba (parts of NTS 63O); in Report of Activities 2006, Manitoba Science, Tech- nology, Energy and Mines, Manitoba Geological Survey, p. 85–103. Summary Domain (KD) in the internal zone Remapping a corridor from the Thompson Nickel Belt of Trans-Hudson Orogen (Figure (TNB) 60 km west to Threepoint Lake (south of Nelson GS-9-1). The general region is marked by a high-gravity House) and a preliminary interpretation of geochemistry anomaly (Viljoen et al., 1999) and Nd isotope data provide new evidence for an Archean The area, which was last mapped between 1971 age of crystallization and/or mantle extraction of biotite and 1973 (Baldwin et al., 1979; Frohlinger and granulite facies orthogneiss in the northeastern part of Kendrick, 1979; Kendrick, 1979a–c; Kendrick et al., the Kisseynew Domain. The gneiss occurs in local struc- 1979), has been considered until recently to be underlain tural culminations mantled by, and probably interleaved solely by juvenile Paleoproterozoic greywacke-mudstone with, heterogeneous paragneiss that may overlie it uncon- migmatite (Burntwood Group), local meta-arkose formably. A composite stratigraphic section through the (Sickle Group) and granitoid rocks largely derived narrow belts of this paragneiss comprises basal quartz- by partial melting of the metasedimentary rocks (e.g., ite (containing only Archean detrital zircons) and minor White, 2005). -

Descendants of Joseph Day

Descendants of Joseph Day Generation 1 1. JOSEPH1 DAY was born on 04 Apr 1672 in Glen Falls, New York. He died on 14 Jun 1742 in Attleboro, Bristol, Massachusetts, USA. He married ELIZABETH GOOCH. She was born on 04 Feb 1674 in Wells, York, Maine, USA. She died on 10 Dec 1717 in Attleboro, Bristol, Massachusetts, USA. Joseph Day and Elizabeth Gooch had the following children: i. SUSANNA2 DAY was born on 11 Apr 1696 in Gloucester, Essex, MA. She died on 19 Jun 1720 in Gloucester, Essex, Massachusetts, USA. She married DAVID RING. ii. JOSEPH DAY was born on 03 Mar 1697 in Gloucester, Essex, Massachusetts. He died in 1785 in York, York Co, Maine. He married HANNAH HOPPIN. She was born in 1731. iii. JAMES DAY was born on 24 Dec 1699 in Gloucester, Essex, MA. He married MARY RING. iv. REBECCA DAY was born on 08 Oct 1701 in Gloucester, Essex, MA. v. ELIZABETH DAY was born on 19 Jan 1702 in Gloucester, Essex, MA. She died after 1744 in Providence, RI. She married JAMES STEPHENS. vi. SARAH DAY was born on 21 Mar 1705 in Gloucester, Essex, MA. vii. BETHIA DAY was born on 19 Apr 1707 in Gloucester, Essex, MA. She married WILLIAM JUNIOR RING. He was born on 09 Jan 1713 in Gloucester, Essex, Massachusetts, USA. He died in Gloucester, Essex, Massachusetts, United States. viii. JEREMIAH DAY was born on 29 Jan 1710 in Gloucester, Essex, MA. ix. HANNAH DAY was born on 12 May 1713 in Gloucester, Essex, MA. 2. x. WILLIAM DAY was born on 20 Jul 1714 in Gloucester, Essex, Massachusetts, USA. -

Candidates Yorkshire Region

Page | 1 LIBERAL/LIBERAL DEMOCRAT CANDIDATES IN THE YORKSHIRE AND HUMBERSIDE REGION 1945-2015 Constituencies in the county of Yorkshire (excluding Cleveland and Teesside) INCLUDING SDP CANDIDATES in the GENERAL ELECTIONS of 1983 and 1987 PREFACE A number of difficulties have been encountered in compiling this Index which have not been resolved in an entirely satisfactory manner. Local government boundary changes in the early 1970s led to the creation of the Cleveland and HuMberside Counties. Cleveland and adjacent constituencies have been included in the Index for the North East Region. HuMberside constituencies coMMencing with the General Election of February 1974 are included in the Yorkshire Region. The region has been home to an impressive gallery of party personalities, several of whoM receive extended entries. The spirited independence with respect to LPO HQ in London which the Yorkshire Regional Party has often shown, and the relatively strong direction it has exerted over its constituency associations, would account for the formidable challenge maintained in the Region at successive general elections, even in the direst years of party fortunes. Yorkshire appears to have been rather less willing in 1950 to heed to the dictates of the Martell Plan (see article below) than other regions. Even so, until the 1970s there were several Labour-held Mining and industrial constituencies where the Party declined to fight. InforMation on Many candidates reMains sparse. SDP candidates particularly, over 1983-87, seem to have been an anonyMous battalion indeed, few if any of them leaving a Mark on any field of huMan endeavour. 1 Page | 2 THE MARTELL PLAN The Martell Plan, mentioned in passing throughout the regional directories was the electoral strategy adopted by the Liberal Party for the General Election of 1950. -

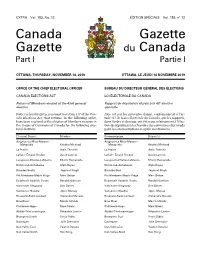

Canada Gazette, Part I

EXTRA Vol. 153, No. 12 ÉDITION SPÉCIALE Vol. 153, no 12 Canada Gazette Gazette du Canada Part I Partie I OTTAWA, THURSDAY, NOVEMBER 14, 2019 OTTAWA, LE JEUDI 14 NOVEMBRE 2019 OFFICE OF THE CHIEF ELECTORAL OFFICER BUREAU DU DIRECTEUR GÉNÉRAL DES ÉLECTIONS CANADA ELECTIONS ACT LOI ÉLECTORALE DU CANADA Return of Members elected at the 43rd general Rapport de député(e)s élu(e)s à la 43e élection election générale Notice is hereby given, pursuant to section 317 of the Can- Avis est par les présentes donné, conformément à l’ar- ada Elections Act, that returns, in the following order, ticle 317 de la Loi électorale du Canada, que les rapports, have been received of the election of Members to serve in dans l’ordre ci-dessous, ont été reçus relativement à l’élec- the House of Commons of Canada for the following elec- tion de député(e)s à la Chambre des communes du Canada toral districts: pour les circonscriptions ci-après mentionnées : Electoral District Member Circonscription Député(e) Avignon–La Mitis–Matane– Avignon–La Mitis–Matane– Matapédia Kristina Michaud Matapédia Kristina Michaud La Prairie Alain Therrien La Prairie Alain Therrien LaSalle–Émard–Verdun David Lametti LaSalle–Émard–Verdun David Lametti Longueuil–Charles-LeMoyne Sherry Romanado Longueuil–Charles-LeMoyne Sherry Romanado Richmond–Arthabaska Alain Rayes Richmond–Arthabaska Alain Rayes Burnaby South Jagmeet Singh Burnaby-Sud Jagmeet Singh Pitt Meadows–Maple Ridge Marc Dalton Pitt Meadows–Maple Ridge Marc Dalton Esquimalt–Saanich–Sooke Randall Garrison Esquimalt–Saanich–Sooke -

Ron Joyce Children's Health Centre

Ron Joyce Children’s Health Centre 325 Wellington Street North, Hamilton, Ontario | 905.521.2100 ext. 75395 Wheeling BIRGE ST. Track Playground Ron Joyce P Children’s Health Centre Main Entrance Regional Short term drop off Research P David Braley David Braley Rehabilitation Centre COPELAND AVE. Centre P Well-Health Wellington Lot Hamilton General Hospital Staff Entrance FERGUSON AVE. N. FERGUSON AVE. b MPFH N ST. WELLINGTON b N. AVE. VICTORIA BARTON ST. E. b b P Barton Lot Staff Entrance N Ron Joyce Children’s Health Centre 325 Wellington Street North, Hamilton, Ontario | 905.521.2100 ext. 75395 Driving Directions: HSR Bus Transit: From Toronto From Toronto 1. Take QEW to Highway 403 West (to Hamilton) • Traveling from the west – Take the # 2 Barton bus and take the Main Street East exit. traveling east. Exit at the Barton and Ferguson stop. 2. Continue on Main Street to Victoria Avenue, • Traveling from the east – Take the # 2 Barton bus for about 2.8 kms. traveling west. Exit at the Barton and Ferguson stop. 3. Turn left on Victoria Avenue. Visitor Parking (rates may change) 4. Continue on Victoria Avenue for about 1.3 kms and turn left at Birge Street. Wellington Lot 5. Turn left onto Wellington Street. • For short term drop off and pick up, of less than 20 minutes, enter off of Wellington Street. No cost. 6. The Ron Joyce Children’s Health Centre is on the right. • For long term parking, enter off of either Wellington Street or from From Niagara Region the north side of Barton Street. -

Table 5 Number of WITB Recipients and Amount Credited by Federal Electoral District, 2017 Table 5 Number of WITB Recipients

Table 5 Number of WITB recipients and amount credited by Federal Electoral District, 2017 Assessed WITB Federal Electoral District Number of WITB Credit Recipients ($ dollars) Abbotsford 4,500 3,486,000 Abitibi--Baie-James--Nunavik--Eeyou 3,490 2,603,000 Abitibi--Témiscamingue 2,490 1,885,000 Acadie--Bathurst 3,050 2,136,000 Ahuntsic-Cartierville 5,720 4,838,000 Ajax 6,060 5,296,000 Alfred-Pellan 3,800 3,288,000 Algoma--Manitoulin--Kapuskasing 2,620 1,994,000 Argenteuil--La Petite-Nation 3,830 3,225,000 Aurora--Oak Ridges--Richmond Hill 5,450 4,925,000 Avalon 2,220 1,624,000 Avignon--La Mitis--Matane--Matapédia 1,890 1,359,000 Banff--Airdrie 4,950 3,765,000 Barrie--Innisfil 4,990 4,188,000 Barrie--Springwater--Oro-Medonte 4,590 3,666,000 Battle River--Crowfoot 4,450 3,520,000 Battlefords--Lloydminster 2,680 2,107,000 Bay of Quinte 4,240 3,244,000 Beaches--East York 5,240 4,286,000 Beauce 2,610 2,135,000 Beauport--Côte-de-Beaupré--Île d’Orléans--Charlevoix 2,140 1,774,000 Beauport--Limoilou 3,280 2,651,000 Beauséjour 2,680 2,000,000 Bellechasse--Les Etchemins--Lévis 2,710 2,185,000 Beloeil--Chambly 2,960 2,466,000 Berthier--Maskinongé 3,410 2,764,000 Bonavista--Burin--Trinity 2,070 1,457,000 Bourassa 6,410 5,345,000 Bow River 4,480 3,643,000 (Continued) Notes: 1. All counts are rounded to the nearest ten and all amounts are rounded to the nearest thousand. -

List of Mps on the Hill Names Political Affiliation Constituency

List of MPs on the Hill Names Political Affiliation Constituency Adam Vaughan Liberal Spadina – Fort York, ON Alaina Lockhart Liberal Fundy Royal, NB Ali Ehsassi Liberal Willowdale, ON Alistair MacGregor NDP Cowichan – Malahat – Langford, BC Anthony Housefather Liberal Mount Royal, BC Arnold Viersen Conservative Peace River – Westlock, AB Bill Casey Liberal Cumberland Colchester, NS Bob Benzen Conservative Calgary Heritage, AB Bob Zimmer Conservative Prince George – Peace River – Northern Rockies, BC Carol Hughes NDP Algoma – Manitoulin – Kapuskasing, ON Cathay Wagantall Conservative Yorkton – Melville, SK Cathy McLeod Conservative Kamloops – Thompson – Cariboo, BC Celina Ceasar-Chavannes Liberal Whitby, ON Cheryl Gallant Conservative Renfrew – Nipissing – Pembroke, ON Chris Bittle Liberal St. Catharines, ON Christine Moore NDP Abitibi – Témiscamingue, QC Dan Ruimy Liberal Pitt Meadows – Maple Ridge, BC Dan Van Kesteren Conservative Chatham-Kent – Leamington, ON Dan Vandal Liberal Saint Boniface – Saint Vital, MB Daniel Blaikie NDP Elmwood – Transcona, MB Darrell Samson Liberal Sackville – Preston – Chezzetcook, NS Darren Fisher Liberal Darthmouth – Cole Harbour, NS David Anderson Conservative Cypress Hills – Grasslands, SK David Christopherson NDP Hamilton Centre, ON David Graham Liberal Laurentides – Labelle, QC David Sweet Conservative Flamborough – Glanbrook, ON David Tilson Conservative Dufferin – Caledon, ON David Yurdiga Conservative Fort McMurray – Cold Lake, AB Deborah Schulte Liberal King – Vaughan, ON Earl Dreeshen Conservative -

Alberta Hansard

Province of Alberta The 30th Legislature Second Session Alberta Hansard Wednesday afternoon, March 10, 2021 Day 82 The Honourable Nathan M. Cooper, Speaker Legislative Assembly of Alberta The 30th Legislature Second Session Cooper, Hon. Nathan M., Olds-Didsbury-Three Hills (UC), Speaker Pitt, Angela D., Airdrie-East (UC), Deputy Speaker and Chair of Committees Milliken, Nicholas, Calgary-Currie (UC), Deputy Chair of Committees Aheer, Hon. Leela Sharon, Chestermere-Strathmore (UC) Nally, Hon. Dale, Morinville-St. Albert (UC), Allard, Tracy L., Grande Prairie (UC) Deputy Government House Leader Amery, Mickey K., Calgary-Cross (UC) Neudorf, Nathan T., Lethbridge-East (UC) Armstrong-Homeniuk, Jackie, Nicolaides, Hon. Demetrios, Calgary-Bow (UC) Fort Saskatchewan-Vegreville (UC) Nielsen, Christian E., Edmonton-Decore (NDP) Barnes, Drew, Cypress-Medicine Hat (UC) Nixon, Hon. Jason, Rimbey-Rocky Mountain House-Sundre (UC), Bilous, Deron, Edmonton-Beverly-Clareview (NDP) Government House Leader Carson, Jonathon, Edmonton-West Henday (NDP) Nixon, Jeremy P., Calgary-Klein (UC) Ceci, Joe, Calgary-Buffalo (NDP) Notley, Rachel, Edmonton-Strathcona (NDP), Copping, Hon. Jason C., Calgary-Varsity (UC) Leader of the Official Opposition Dach, Lorne, Edmonton-McClung (NDP), Orr, Ronald, Lacombe-Ponoka (UC) Official Opposition Deputy Whip Pancholi, Rakhi, Edmonton-Whitemud (NDP) Dang, Thomas, Edmonton-South (NDP), Official Opposition Deputy House Leader Panda, Hon. Prasad, Calgary-Edgemont (UC) Deol, Jasvir, Edmonton-Meadows (NDP) Phillips, Shannon, Lethbridge-West (NDP) Dreeshen, Hon. Devin, Innisfail-Sylvan Lake (UC) Pon, Hon. Josephine, Calgary-Beddington (UC) Eggen, David, Edmonton-North West (NDP), Rehn, Pat, Lesser Slave Lake (Ind) Official Opposition Whip Reid, Roger W., Livingstone-Macleod (UC) Ellis, Mike, Calgary-West (UC), Renaud, Marie F., St. -

R:\Facility Management\Seating Plans\2021\2021.02.15\CAD Dwgs

Legislative Assembly of Ontario Seating Plan MPPs and various House officers sit in the legislative chamber when the House is in session. The Speaker’s dais is at one end of the chamber, and the main doors are at the opposite end of the chamber. The Speaker sits facing the main doors. The government sits on the right side of the Speaker in four rows. The opposition sits on the left side of the Speaker in three rows. The first row is closest to the centre of the chamber. The seats in each row are ordered from the Speaker’s dais to the main doors. Speaker and other House officers The Speaker of the House sits at one end of the chamber. Above the Speaker’s dais is the press gallery. To the right of the Speaker’s dais are two seats designated for legislative counsel. One is assigned to M. Spakowski; the second is unassigned. In front of the Speaker, in the middle of the chamber, is the clerks’ table. The Clerks-at-the-Table include Todd Decker, Trevor Day, Tonia Grannum, William Short, Valerie Quioc Lim, and Meghan Stenson. Beyond the clerks’ table is the Hansard table with two seats for Hansard reporters. Beyond the Hansard table, just before the main doors, sits the Sergeant-at-Arms, Jackie Gordon. Above the Sergeant-at-Arms is the Speaker’s gallery. Government side, row 1: Hon. Jeff Yurek Elgin—Middlesex—London Minister of the Environment, Conservation and Parks Hon. Stephen Lecce King—Vaughan Minister of Education Hon. Caroline Mulroney York—Simcoe Minister of Transportation; Minister of Francophone Affairs Hon. -

Candidate's Statement of Unpaid Claims and Loans 18 Or 36 Months

Candidate’s Statement of Unpaid Claims and Loans 18 or 36 Months after Election Day (EC 20003) – Instructions When to use this form The official agent for a candidate must submit this form to Elections Canada if unpaid amounts recorded in the candidate’s electoral campaign return are still unpaid 18 months or 36 months after election day. The first update must be submitted no later than 19 months after the election date, covering unpaid claims and loans as of 18 months after election day. The second update must be submitted no later than 37 months after election day, covering unpaid claims and loans as of 36 months after election day. Note that when a claim or loan is paid in full, the official agent must submit an amended Candidate’s Electoral Campaign Return (EC 20120) showing the payments and the sources of funds for the payments within 30 days after making the final payment. Tips for completing this form Part 1 ED code, Electoral district: Refer to Annex I for a list of electoral district codes and names. Declaration: The official agent must sign the declaration attesting to the completeness and accuracy of the statement by hand. Alternatively, if the Candidate’s Statement of Unpaid Claims and Loans 18 or 36 Months after Election Day is submitted online using the Political Entities Service Centre, handwritten signatures are replaced by digital consent during the submission process. The official agent must be the agent in Elections Canada’s registry at the time of signing. Part 2 Unpaid claims and loans: Detail all unpaid claims and loans from Part 5 of the Candidate’s Electoral Campaign Return (EC 20121) that remain unpaid. -

Report of the Federal Electoral Boundaries Commission for the Province of British Columbia 2012

Redistribution Federal Electoral Districts Redécoupage 2012 Circonscriptions fédérales Report of the Federal Electoral Boundaries Commission for the Province of British Columbia 2012 Your Representation in the House of Commons Votre représentation à la Chambre des communes Your Representation in the House of Commons Votre représentation à la Chambre des communes Your Representation in the House of Commons Votre représentation à la Chambre des communes Your Representation in the House of Commons Votre représentation à la Chambre des communes Your Representation in the House of Commons Votre représentation à la Chambre des communes Your Representation in the House of Commons Votre représenta- tion à la Chambre des communes Your Representation in the House of Commons Votre représentation à la Chambre des communes Your Representation in the House of Commons Your Representation in the House of Commons Votre représentation à la Chambre des communes Your Representation in the House of Commons Votre représentation à la Chambre des communes Your Representation in the House of Commons Votre représentation à la Chambre des communes Your Representation in the House of Commons Votre représentation à la Chambre des communes Your Representation in the House of Commons Votre représentation à la Chambre des communes Your Representation in the House of Commons Votre représentation à la Chambre des communes Your Representation in the House of Commons Votre représenta- tion à la Chambre des communes Your Representation in the House of Commons Votre représentation -

NA0425 Alberta

2012 ALBERTA PROVINCIAL ELECTION RESULTS 1. Dunvegan-central Peace-Notley 73. Olds-Didsbury-Three Hills 2. Lesser Slave Lake 74. Peace River 3. Calgary-Acadia 75. Red Deer-North 4. Calgary-Bow 76. Red Deer-South 5. Calgary-Buffalo 77. Rimbey-Rocky Mountain House-Sundre 6. Calgary-Cross 78. Sherwood Park 7. Calgary-Currie 79. Spruce Grove-St. Albert 8. Calgary-East 80. St. Albert 9. Calgary-Elbow 81. Stony Plain 74 59 10. Calgary-Fish Creek 82. Strathcona-Sherwood Park 11. Calgary-Foothills 83. Strathmore-Brooks 12. Calgary-Fort 84. Vermilion-Lloydminster 13. Calgary-Glenmore 85. West Yellowhead 14. Calgary-Greenway 86. Wetaskiwin-Camrose 15. Calgary-Hawkwood 87. Whitecourt-Ste. Anne 16. Calgary-Hays 58 17. Calgary-Klein 18. Calgary-Lougheed RED DEER 1 19. Calgary-Mackay-nose Hill 64 20. Calgary-McCall 21. Calgary-Mountain View 75 22. Calgary-North West 23. Calgary-Northern Hills 24. Calgary-Shaw 2 25. Calgary-South East 76 26. Calgary-Varsity 64 27. Calgary-West 28. Edmonton-Beverly-clareview 62 29. Edmonton-Calder LETHBRIDGE 30. Edmonton-Castle Downs 31. Edmonton-Centre 68 70- 65 32. Edmonton-Decore 33. Edmonton-Ellerslie 61 50 34. Edmonton-Glenora 48 52 35. Edmonton-Gold Bar 69 36. Edmonton-Highlands-norwood 37. Edmonton-Manning 38. Edmonton-McClung 53 85 87 39. Edmonton-Meadowlark 79 60 40. Edmonton-Mill Creek 81 EDMONTON 82 41. Edmonton-Mill Woods 84 56 67 42. Edmonton-Riverview 48 43. Edmonton-Rutherford 86 79 37 44. Edmonton-South West 45. Edmonton-Strathcona 30 51 80 60 66 46. Edmonton-Whitemud 29 32 47.