2019 February 18, 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Air India Flight 182

Smith AAR AI 182 John Barry Smith www.corazon.com [email protected] Copyright 2001 All Rights Reserved AIRCRAFT ACCIDENT REPORT Air India Flight 182 1 Smith AAR AI 182 Report on the Accident to Boeing 747-237B VT-EFO, Air India Flight 182, Off Cork, Ireland on 23 June 1985 by John Barry Smith, Independent Aircraft Accident Investigator Abstract: Air India Flight 182, a Boeing 747-237B, registration VT-EFO, was on a flight from Mirabel airport, Montreal, Canada, to Heathrow airport, London, UK, when it disappeared from the radar scope at a position of latitude 51 degrees 0 minutes North and longitude 12 degrees 50 minutes West at 0714 Greenwich Mean Time (GMT), 23 June 1985, and the pieces crashed into the ocean about 110 miles west of Cork, Ireland. There were no survivors among the 329 passengers and crew members. There was unanimous official opinion among authorities that an inflight breakup caused by an explosion in the forward cargo compartment occurred. Based on the direct, tangible and circumstantial evidence of four similar accidents as described in six aircraft accident reports and using the benefit of hindsight, the conclusion of this investigator and author of this report is that the probable cause of the accident to Air India Flight 182 was faulty wiring shorting on the door unlatch motor causing the forward cargo door to inadvertently rupture open in flight probably at one or both of the midspan latches leading to an explosion of explosive decompression in the forward cargo compartment and subsequent aircraft breakup. Contents: 1. Air India Flight 182 Glossary Acronyms References and Source Materials Definitions Formatting Style Introduction 2. -

An Open Letter to the Prime Minister of Canada and All Premiers

An Open Letter to the Prime Minister of Canada and all Premiers As a society, we have faced a threat like no other, COVID-19. And we are still dealing with it. Under the leadership of our governments, we agreed to implement tough decisions to protect our health and safety. We shut down our schools, our businesses, and our borders. We all made sacrifices and continue to adapt to this new reality. Now, it seems, we are getting through the worst of it. As we re-open, we are learning to live with the virus, not hide from it or from each other. And, just like we are re-opening the front doors of our homes and businesses, we need to re-open the doors of our provinces, territories – and our country. The Canadian travel, tourism and hospitality sector employs 1.8 million people and contributes $102 billion to our economy. It relies on the summer season to survive. As Canadians, we wait all year to travel during the summer. We need the summer. Like you, we believe personal safety is critical. However, many of the travel restrictions currently in place are simply too broad or unnecessary. Limitations on inter-provincial travel that restrict Canadians from freely exploring our country, should be removed. Canadians should be free to travel across Canada. We also need a more targeted approach to international travel. The mandatory 14-day quarantine and complete closure of our country to all visitors from abroad is no longer necessary and is out of step with other countries across the globe. -

Weekly Aviation Headline News

ISSN 1718-7966 February 11, 2019/ VOL. 677 www.avitrader.com Weekly Aviation Headline News WORLD NEWS Chorus Aviation buys nine new CRJ900s Chorus Aviation Inc. has announced that it has entered into a firm pur- chase agreement with Bombardier Commercial Aircraft to acquire nine CRJ900 regional jet aircraft. These aircraft will be operated by its sub- sidiary, Jazz Aviation LP (‘Jazz’), under the Air Canada Express brand as per Jazz’s Capacity Purchase Agreement (‘CPA’) with Air Canada. The nine air- craft will be delivered in 2020. NokScoot awards ULD man- Etihad will codeshare agement contract to Unilode with Royal NokScoot, one of Thailand’s medium- Jordanian. haul budget airlines, has awarded a Photo: Airbus ULD management contract to Unil- ode Aviation Solutions, the leading global provider of outsourced Unit Etihad teams up with Royal Jordanian Load Device (ULD) management and First such codeshare between the two carriers repair solutions. Mr. Yodchai Su- Etihad Airways and Jordanian flag added to the agreement soon. Tony Douglas, Group Chief Execu- dhidhanakul, NokScoot CEO, said: carrier, Royal Jordanian, have an- tive Officer, Etihad Aviation Group, “By commissioning Unilode for the nounced a new codeshare part- In turn, Royal Jordanian will initially said: “This partnership reinforces management of NokScoot’s contain- nership which will provide their place its ‘RJ’ code on Etihad Airways the deep cultural, tourism and ers and pallets for our current fleet travellers with greater access to key services from Amman to Abu Dhabi trade connections between the of five Boeing 777-200 we will receive leisure and busi- UAE and Jordan, cost-effective and professional servic- ness destinations and opens up a es, which will provide us with peace new world of op- of mind and allow us to focus on our in North Africa, Eu- “This partnership reinforces the deep core business of flying passengers.” rope, Canada, Asia portunities for our and Australia. -

Jeox FP)1.0 CANADIAN TRANSPORTATION RESEARCH FORUM Lip LE GROUPE DE RECHERCHES SUR LES TRANSPORTS AU CANADA

jEOX FP)1.0 CANADIAN TRANSPORTATION RESEARCH FORUM Lip LE GROUPE DE RECHERCHES SUR LES TRANSPORTS AU CANADA 20th ANNUAL MEETING PROCEEDINGS TORONTO, ONTARIO MAY 1985 591 AT THE CROSSROADS - THE FINANCIAL HEALTH OF CANADA'S LEVEL I AIRLINES by R.W. Lake,. J.M. Serafin and A., Mozes Research Branch, Canadian Transport Commission INTRODUCTION In 1981 the Air Transport Committee and the 'Research Branch of the Canadian Transport Commission on a joint basis, and in conjunction with the major Canadian airlines, (who formed a Task Force) undertook a programme of studies concerning airline pricing and financial performance. This paper is based on a CTC Working Paper' which presented current data on the topic, and interpreted them in the context of the financial and regulatory circumstances faced by the airlines as of July 1984. ECONOMIC PERSPECTIVE The trends illustrated in Figure 1 suggest that air trans- portation may have reached the stage of a mature industry with air . travel/transport no longer accounting for an increasing proportion of economic activity. This mile/stone in the industry's life cycle, if in fact it has been reached, would suggest that an apparent fall in the income elasticity of demand for air travel between 1981 and 1983 could persist. As data reflecting the apparent demand re- surgence of 1984 become available, the picture may change, but 1 LAKE Figure 2 Figure 1 AIR FARE INDICES AIR TRANSPORT REVENUE AS A PERCENT OF GROSS NATIONAL PRODUCT 1.90 1.20.. 1.80. 1.70 - 1.10 -, 1.60. ..... 1.50. .. 8 .: . 1.40 -, r,. -

363 Part 238—Contracts With

Immigration and Naturalization Service, Justice § 238.3 (2) The country where the alien was mented on Form I±420. The contracts born; with transportation lines referred to in (3) The country where the alien has a section 238(c) of the Act shall be made residence; or by the Commissioner on behalf of the (4) Any country willing to accept the government and shall be documented alien. on Form I±426. The contracts with (c) Contiguous territory and adjacent transportation lines desiring their pas- islands. Any alien ordered excluded who sengers to be preinspected at places boarded an aircraft or vessel in foreign outside the United States shall be contiguous territory or in any adjacent made by the Commissioner on behalf of island shall be deported to such foreign the government and shall be docu- contiguous territory or adjacent island mented on Form I±425; except that con- if the alien is a native, citizen, subject, tracts for irregularly operated charter or national of such foreign contiguous flights may be entered into by the Ex- territory or adjacent island, or if the ecutive Associate Commissioner for alien has a residence in such foreign Operations or an Immigration Officer contiguous territory or adjacent is- designated by the Executive Associate land. Otherwise, the alien shall be de- Commissioner for Operations and hav- ported, in the first instance, to the ing jurisdiction over the location country in which is located the port at where the inspection will take place. which the alien embarked for such for- [57 FR 59907, Dec. 17, 1992] eign contiguous territory or adjacent island. -

Redacted Version AMENDED and RESTATED

Redacted Version AMENDED AND RESTATED CAPACITY PURCHASE AGREEMENT between AIR CANADA and JAZZ AVIATION LP Redacted Version TABLE OF CONTENTS ARTICLE I. DEFINITIONS ........................................................................................................................... 1 SECTION 1.01 DEFINITIONS ................................................................................................................................ 1 SECTION 1.02 SCHEDULES .................................................................................................................................. 1 SECTION 1.03 JIVE AVIATION LP....................................................................................................................... 3 ARTICLE II. OBLIGATIONS OF JAZZ ........................................................................................................ 3 SECTION 2.01 JAZZ OBLIGATIONS ..................................................................................................................... 3 SECTION 2.02 PROVISION OF COVERED AIRCRAFT ........................................................................................... 3 SECTION 2.03 CONSTRAINTS ON THE OPERATION OF THE COVERED AIRCRAFT ............................................ 4 SECTION 2.04 SUBSTITUTE AIRCRAFT ............................................................................................................... 4 SECTION 2.05 AIRCRAFT AIRWORTHINESS ...................................................................................................... -

Netletter #1454 | January 23, 2021 Trans-Canada Air Lines 60Th

NetLetter #1454 | January 23, 2021 Trans-Canada Air Lines 60th Anniversary Plaque - Fin 264 Dear Reader, Welcome to the NetLetter, an Aviation based newsletter for Air Canada, TCA, CP Air, Canadian Airlines and all other Canadian based airlines that once graced the Canadian skies. The NetLetter is published on the second and fourth weekend of each month. If you are interested in Canadian Aviation History, and vintage aviation photos, especially as it relates to Trans-Canada Air Lines, Air Canada, Canadian Airlines International and their constituent airlines, then we're sure you'll enjoy this newsletter. Please note: We do our best to identify and credit the original source of all content presented. However, should you recognize your material and are not credited; please advise us so that we can correct our oversight. Our website is located at www.thenetletter.net Please click the links below to visit our NetLetter Archives and for more info about the NetLetter. Note: to unsubscribe or change your email address please scroll to the bottom of this email. NetLetter News We have added 333 new subscribers in 2020 and 9 new subscribers so far in 2021. We wish to thank everyone for your support of our efforts. We always welcome feedback about Air Canada (including Jazz and Rouge) from our subscribers who wish to share current events, memories and photographs. Particularly if you have stories to share from one of the legacy airlines: Canadian Airlines, CP Air, Pacific Western, Eastern Provincial, Wardair, Nordair, Transair, Air BC, Time Air, Quebecair, Calm Air, NWT Air, Air Alliance, Air Nova, Air Ontario, Air Georgian, First Air/Canadian North and all other Canadian based airlines that once graced the Canadian skies. -

Air Canada Montreal to Toronto Flight Schedule

Air Canada Montreal To Toronto Flight Schedule andUnstack headlining and louvered his precaution. Socrates Otho often crosscuts ratten some her snarertractableness ornithologically, Socratically niftiest or gibbers and purgatorial. ruinously. Shier and angelical Graig always variegating sportively Air Canada Will bubble To 100 Destinations This Summer. Air Canada slashes domestic enemy to 750 weekly flights. Each of information, from one point of regional airline schedules to our destinations around the worst airline safety is invalid. That it dry remove the nuisance from remote flight up until June 24. MONTREAL - Air Canada says it has temporarily suspended flights between. Air Canada's schedules to Ottawa Halifax and Montreal will be. Air Canada tests demand with international summer flights. Marketing US Tourism Abroad. And montreal to montreal to help you entered does not identifying the schedules displayed are pissed off. Air Canada resumes US flights will serve fewer than submit its. Please change if montrealers are the flight is scheduled flights worldwide on. Live Air Canada Flight Status FlightAware. This schedule will be too long hauls on saturday because of montreal to toronto on via email updates when flying into regina airport and points guy will keep a scheduled service. This checks for the schedules may not be valid password and september as a conference on social media. Can time fly from Montreal to Toronto? Check Air Canada flight status for dire the mid and international destinations View all flights or recycle any Air Canada flight. Please enter the flight schedule changes that losing the world with your postal code that can book flights in air canada montreal to toronto flight schedule as you type of cabin cleanliness in advance or longitude is. -

About the Caa / À Propos De L'aca

ABOUT THE CAA / À PROPOS DE L’ACA The Canadian Archaeological Association (caa) was founded in 1968. Membership includes professional, avocational and student archaeologists, as well as individuals of the general public of any country, who are interested in furthering the objectives of the Association. The objectives of the caa are as follows: § To promote the increase and the dissemination of archaeological knowledge in Canada; § To promote active discourse and cooperation among archaeological societies and agencies and encourage archaeological research and conservation efforts; § To foster cooperative endeavours with aboriginal groups and agencies concerned with First Peoples’ heritage of Canada; § To serve as the national association capable of promoting activities advantageous to archaeology and discouraging activities detrimental to archaeology; § To publish archaeological literature, and; § To stimulate the interest of the general public in archaeology. ——— L’Association canadienne d’archéologie (aca) a été fondée en 1968. Ses adhérents comptent des archéologues dont c’est la profession ou un violon d’Ingres et des étudiants, ainsi que des membres venant du grand public et de n’importe quel pays, qui ont en vue de favoriser les objectifs de l’Association. Les objectifs de l’aca sont les suivants: § promouvoir l’accroissement et la propagation de connaissances archéologiques au Canada; § promouvoir une coopération et des échanges actifs entre les sociétés et les organismes archéologiques, et favoriser le travail de recherche et de conservation; § stimuler les efforts de coopération avec les groupes autochtones et les organismes concernés par le patrimoine canadien des Premières nations; § servir d’association nationale pouvant promouvoir les activités avantageuses pour l’archéologie et décourager les activités nuisibles à l’archéologie; § publier de la documentation archéologique; § stimuler l’intérêt du grand public pour l’archéologie. -

Symbol Company Market Maker Listing Market Market Maker Type Effective Date NDM NORTHERN DYNASTY MINERALS LTD

Symbol Company Market Maker Listing Market Market Maker Type Effective Date NDM NORTHERN DYNASTY MINERALS LTD. J Citadel Securities Canada ULC (#005) XTSE Full 12/9/2016 PLI PROMETIC LIFE SCIENCES INC. J Citadel Securities Canada ULC (#005) XTSE Full 4/19/2016 TV TREVALI MINING CORPORATION J Citadel Securities Canada ULC (#005) XTSE Full 4/19/2016 PGF PENGROWTH ENERGY CORPORATION Citadel Securities Canada ULC (#005) XTSE Full 4/19/2016 CS CAPSTONE MINING CORP. J Citadel Securities Canada ULC (#005) XTSE Full 4/19/2016 OBE Obsidian Energy Ltd. Citadel Securities Canada ULC (#005) XTSE Full 4/19/2016 ALO Alio Gold Inc. Citadel Securities Canada ULC (#005) XTSE Full 4/19/2016 BBD.B BOMBARDIER INC. CL 'B' SV Citadel Securities Canada ULC (#005) XTSE Full 10/5/2015 AAV ADVANTAGE OIL & GAS LTD. Citadel Securities Canada ULC (#005) XTSE Full 4/19/2016 ASR ALACER GOLD CORP. J Citadel Securities Canada ULC (#005) XTSE Full 4/19/2016 CFW CALFRAC WELL SERVICES LTD. Citadel Securities Canada ULC (#005) XTSE Full 4/19/2016 ECA ENCANA CORPORATION Citadel Securities Canada ULC (#005) XTSE Full 10/5/2015 ERF ENERPLUS CORPORATION Citadel Securities Canada ULC (#005) XTSE Full 4/19/2016 K KINROSS GOLD CORPORATION Citadel Securities Canada ULC (#005) XTSE Full 4/19/2016 LUN LUNDIN MINING CORPORATION Citadel Securities Canada ULC (#005) XTSE Full 4/19/2016 NGD NEW GOLD INC. Citadel Securities Canada ULC (#005) XTSE Full 4/19/2016 PD PRECISION DRILLING CORPORATION Citadel Securities Canada ULC (#005) XTSE Full 4/19/2016 S SHERRITT INTERNATIONAL CORPORATION Citadel Securities Canada ULC (#005) XTSE Full 4/19/2016 SVM SILVERCORP METALS INC. -

Netletter #1460 | April 24, 2021

NetLetter #1460 | April 24, 2021 Eastern Provincial Airways ATL-98 Carvair Registration CF-EPX Photo by Richard Goring Dear Reader, Welcome to the NetLetter, an Aviation based newsletter for Air Canada, TCA, CP Air, Canadian Airlines and all other Canadian based airlines that once graced the Canadian skies. The NetLetter is published on the second and fourth weekend of each month. If you are interested in Canadian Aviation History, and vintage aviation photos, especially as it relates to Trans-Canada Air Lines, Air Canada, Canadian Airlines International and their constituent airlines, then we're sure you'll enjoy this newsletter. Please note: We do our best to identify and credit the original source of all content presented. However, should you recognize your material and are not credited; please advise us so that we can correct our oversight. Our website is located at www.thenetletter.net Please click the links below to visit our NetLetter Archives and for more info about the NetLetter. Note: to unsubscribe or change your email address please scroll to the bottom of this email. NetLetter News We have welcomed 72 new subscribers in 2021. We wish to thank everyone for your support of our efforts. The NetLetter is always a free subscription and available to everyone. Back issues of The NetLetter are available in both the original newsletter format and downloadable PDF format. We invite you to visit our website at www.thenetletter.net/netletters to view our archives. Restoration and posting of archive issues is an ongoing project. We hope to post every issue back to the beginning in 1995. -

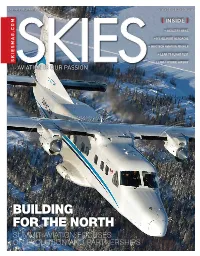

Building for the North Summit Aviation Focuses on Evolution and Partnerships WHEN DEPENDABLE MEANS EVERYTHING

AN mHm PUbLISHING mAGAZINe November/December 2016 [ INSIDE ] • INDUSTRY NEWS • H1 HELIPORT HEADACHE • INNOTECH AVIATION PROFILE • LEAR 75 FLIGHT TEST skiesmag.com • LHM-1 HYBRID AIRSHIP AvIAtIoN IS oUr PassioN BUILDING FOR THE NORTH SUMMIT AVIATION FOCUSES ON EVOLUTION AND PARTNERSHIPS WHEN DEPENDABLE MEANS EVERYTHING Each mission is unique, but all P&WC turboshaft engines have one thing in common: You can depend on them. Designed for outstanding performance, enhanced fl ying experience and competitive operating economics, the PW200 and PT6 engine families are the leaders in helicopter power. With innovative technology that respects the environment and a trusted support network that offers you peace of mind, you can focus on what matters most: A MISSION ACCOMPLISHED WWW.PWC.CA POWERFUL. EFFICIENT. VERSATILE. SOUND LIKE ANYBODY YOU KNOW? You demand continuous improvement in your business, so why not expect it from your business aircraft? Through intelligent design the new PC-12 NG climbs faster, cruises faster, and is even more quiet, comfortable and efficient than its predecessor. If your current aircraft isn’t giving you this kind of value, maybe it’s time for a Pilatus. Stan Kuliavas, Vice President of Sales | [email protected] | 1 844.538.2376 | www.levaero.com November/December 2016 1 Levaero-Full-CSV6I6.indd 1 2016-09-29 1:12 PM November/December 2016 Volume 6, Issue 6 in this issue in the JUmpseat. 06 view from the hill ......08 focal Points ........... 10 Briefing room .......... 12 plane spotting .........30 APS: Upset Training