Economic Survey 2018/19

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nepal Human Rights Year Book 2021 (ENGLISH EDITION) (This Report Covers the Period - January to December 2020)

Nepal Human Rights Year Book 2021 (ENGLISH EDITION) (This Report Covers the Period - January to December 2020) Editor-In-Chief Shree Ram Bajagain Editor Aarya Adhikari Editorial Team Govinda Prasad Tripathee Ramesh Prasad Timalsina Data Analyst Anuj KC Cover/Graphic Designer Gita Mali For Human Rights and Social Justice Informal Sector Service Centre (INSEC) Nagarjun Municipality-10, Syuchatar, Kathmandu POBox : 2726, Kathmandu, Nepal Tel: +977-1-5218770 Fax:+977-1-5218251 E-mail: [email protected] Website: www.insec.org.np; www.inseconline.org All materials published in this book may be used with due acknowledgement. First Edition 1000 Copies February 19, 2021 © Informal Sector Service Centre (INSEC) ISBN: 978-9937-9239-5-8 Printed at Dream Graphic Press Kathmandu Contents Acknowledgement Acronyms and Abbreviations Foreword CHAPTERS Chapter 1 Situation of Human Rights in 2020: Overall Assessment Accountability Towards Commitment 1 Review of the Social and Political Issues Raised in the Last 29 Years of Nepal Human Rights Year Book 25 Chapter 2 State and Human Rights Chapter 2.1 Judiciary 37 Chapter 2.2 Executive 47 Chapter 2.3 Legislature 57 Chapter 3 Study Report 3.1 Status of Implementation of the Labor Act at Tea Gardens of Province 1 69 3.2 Witchcraft, an Evil Practice: Continuation of Violence against Women 73 3.3 Natural Disasters in Sindhupalchok and Their Effects on Economic and Social Rights 78 3.4 Problems and Challenges of Sugarcane Farmers 82 3.5 Child Marriage and Violations of Child Rights in Karnali Province 88 36 Socio-economic -

![Wild Mammals of the Annapurna Conservation Area Cggk"0F{ ;+/If0f If]Qsf :Tgwf/L Jgohgt' Wild Mammals of the Annapurna Conservation Area - 2019](https://docslib.b-cdn.net/cover/7316/wild-mammals-of-the-annapurna-conservation-area-cggk-0f-if0f-if-qsf-tgwf-l-jgohgt-wild-mammals-of-the-annapurna-conservation-area-2019-127316.webp)

Wild Mammals of the Annapurna Conservation Area Cggk"0F{ ;+/If0f If]Qsf :Tgwf/L Jgohgt' Wild Mammals of the Annapurna Conservation Area - 2019

Wild Mammals of the Annapurna Conservation Area cGgk"0f{ ;+/If0f If]qsf :tgwf/L jGohGt' Wild Mammals of the Annapurna Conservation Area - 2019 ISBN 978-9937-8522-8-9978-9937-8522-8-9 9 789937 852289 National Trust for Nature Conservation Annapurna Conservation Area Project Khumaltar, Lalitpur, Nepal Hariyo Kharka, Pokhara, Kaski, Nepal National Trust for Nature Conservation P.O. Box: 3712, Kathmandu, Nepal P.O. Box: 183, Kaski, Nepal Tel: +977-1-5526571, 5526573, Fax: +977-1-5526570 Tel: +977-61-431102, 430802, Fax: +977-61-431203 Annapurna Conservation Area Project Email: [email protected] Email: [email protected] Website: www.ntnc.org.np Website: www.ntnc.org.np 2019 Wild Mammals of the Annapurna Conservation Area cGgk"0f{ ;+/If0f If]qsf :tgwf/L jGohGt' National Trust for Nature Conservation Annapurna Conservation Area Project 2019 Wild Mammals of the Annapurna Conservation Area cGgk"0f{ ;+/If0f If]qsf :tgwf/L jGohGt' Published by © NTNC-ACAP, 2019 All rights reserved Any reproduction in full or in part must mention the title and credit NTNC-ACAP. Reviewers Prof. Karan Bahadur Shah (Himalayan Nature), Dr. Naresh Subedi (NTNC, Khumaltar), Dr. Will Duckworth (IUCN) and Yadav Ghimirey (Friends of Nature, Nepal). Compilers Rishi Baral, Ashok Subedi and Shailendra Kumar Yadav Suggested Citation Baral R., Subedi A. & Yadav S.K. (Compilers), 2019. Wild Mammals of the Annapurna Conservation Area. National Trust for Nature Conservation, Annapurna Conservation Area Project, Pokhara, Nepal. First Edition : 700 Copies ISBN : 978-9937-8522-8-9 Front Cover : Yellow-bellied Weasel (Mustela kathiah), back cover: Orange- bellied Himalayan Squirrel (Dremomys lokriah). -

Logistics Capacity Assessment Nepal

IA LCA – Nepal 2009 Version 1.05 Logistics Capacity Assessment Nepal Country Name Nepal Official Name Federal Democratic Republic of Nepal Regional Bureau Bangkok, Thailand Assessment Assessment Date: From 16 October 2009 To: 6 November 2009 Name of the assessors Rich Moseanko – World Vision International John Jung – World Vision International Rajendra Kumar Lal – World Food Programme, Nepal Country Office Title/position Email contact At HQ: [email protected] 1/105 IA LCA – Nepal 2009 Version 1.05 TABLE OF CONTENTS 1. Country Profile....................................................................................................................................................................3 1.1. Introduction / Background.........................................................................................................................................5 1.2. Humanitarian Background ........................................................................................................................................6 1.3. National Regulatory Departments/Bureau and Quality Control/Relevant Laboratories ......................................16 1.4. Customs Information...............................................................................................................................................18 2. Logistics Infrastructure .....................................................................................................................................................33 2.1. Port Assessment .....................................................................................................................................................33 -

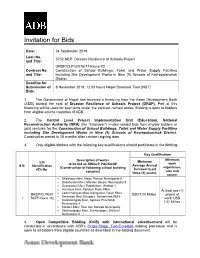

3702-NEP: Disaster Resilience of Schools Project and Title: DRSP/CLPIU/076/77-Kavre-02 Contract No

Invitation for Bids Date: 24 September 2019 Loan No. 3702-NEP: Disaster Resilience of Schools Project and Title: DRSP/CLPIU/076/77-Kavre-02 Contract No. Construction of School Buildings, Toilet and Water Supply Facilities and Title: including Site Development Works in Nine (9) Schools of Kavrepalanchok District Deadline for Submission of 8 November 2019, 12:00 hours Nepal Standard Time (NST) Bids: 1. The Government of Nepal has received a financing from the Asian Development Bank (ADB) toward the cost of Disaster Resilience of Schools Project (DRSP). Part of this financing will be used for payments under the contract named above. Bidding is open to bidders from eligible source countries of ADB. 2. The Central Level Project Implementation Unit (Education), National Reconstruction Authority (NRA) (the “Employer”) invites sealed bids from eligible bidders or joint ventures for the Construction of School Buildings, Toilet and Water Supply Facilities including Site Development Works in Nine (9) Schools of Kavrepalanchok District. Construction period is 18 months after contract signing date. 3. Only eligible bidders with the following key qualifications should participate in the bidding: Key Qualification Minimum Description of works Minimum Lot work to be bid as SINGLE PACKAGE Average Annual S.N. Identification experience, (Construction of following school building Turnover (Last (ID) No. size and complex) three (3) years). nature. • Bhaleswor Mavi, Malpi, Panauti Municipality-8 • Dedithumka Mavi, Mandan Deupur Municipality-9 • Gyaneswori Mavi, Padalichaur, Anaikot-1 • Himalaya Mavi, Pipalbot, Rosh RM-6 At least one (1) • Laxmi Narayan Mavi, Narayantar, Roshi RM-2 DRSP/CLPIU/0 USD 7.00 Million project of Saraswati Mavi, Bhugdeu, Bethanchok RM-6 1 76/77-Kavre -02 • worth USD • Sarbamangala Mavi, Aglekot, Panchkhal Municipality-3 2.52 Million. -

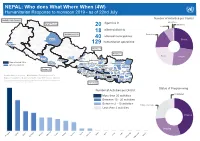

NEPAL: Who Does What Where When (4W)

NEPAL: Who does What Where When (4W) Humanitarian Response to monsoon 2019 - as of 22nd July Number of Activities per Cluster SudurPaschim Province Agencies in Education Karnali Province Nutrition 20 Health Darchula 18 affected districts Gandaki Province Protection affected municipalities Province 7 Province 6 Dolpa 40 Shelter humanitarian operations Kanchanpur 129 Kanchanpur Kailali Province 4 Province 3 Bardiya Gorkha Kaski Province 1 Rasuwa Food Banke Province 5 WASH Dang Tanahu Dhading Dang ProvinceKathmandu 3 Palpa KathmanduDhading Dolakha Most affected HHs Kathmandu KapilbastuKapilbastu Nawalparasi Kavrepalanchok Sankhuwasabha Rupandehi Chitawan Affected Districts MakwanpurMakwanpurLalitpurLalitpur Ramechhap ProvinceTaplejung 1 Okhaldhunga Province 5 Parsa SindhuliSindhuli Parsa Khotang Bhojpur Bara PanchtharPanchthar Sarlahi Rautahat Sarlahi Udayapur DhankutaBara Rautahat MahottariDhanusa Udayapur Ilam Creation date: 23 July 2019 Glide Number: FL-2019-000083-NPL Mahottari DhanusaSiraha Sunsari Sources: Nepal Survey Department, MoHA, Nepal HCT clusters - 22nd July Siraha SaptariSunsari Morang Jhapa The boundaries and names shown and the designations used on this map do not imply ocial Province 2 Saptari Morang Jhapa endorsement or acceptance by the United Nations. Province 2 Status of Programming Number of Activities per District Completed More than 20 activities Between 10 - 20 activities Between 2 - 10 activities Status unknown Less than 2 activities Planned On-going Bara Parsa Banke Kaski Kaski Sarlahi Siraha Morang Udayapur Saptari Sunsari Sindhuli Surkhet Rautahat Mahottari Dhanusa Kathmandu Makwanpur Early Grand District Education Health Nutrition WASH Shelter/NFI Logistic Food Protection Recovery Total Banke 1 1 Bara 1 1 Dhanusa 2 2 Kailai 1 1 Kaski 1 1 Kathmandu 1 1 Mahottari 1 2 2 7 12 Makwanpur 1 1 Morang 2 6 1 9 Parsa 1 1 2 Rautahat 1 8 5 6 8 28 Saptari 2 2 2 2 8 Sarlahi 1 4 2 9 4 20 Sindhuli 1 5 6 Siraha 1 4 1 5 2 13 Sunsari 1 1 5 7 Surkhet 0 1 0 0 1 Udayapur 1 1 5 2 9 N/A 1 3 1 1 6 Grand Total 1 10 1 31 36 0 29 21 0 129. -

Editorial Board

Editorial Board Chief Editor Prof. Dr. Prem Sagar Chapagain Editors Dr. Ashok Pande Dr. Anila Jha Managing Editor Hemanta Dangal This views expressed in the articles are soley of the individual authors and do not nec- essarily reflect the views ofSocial Protection Civil Society Network-Nepal. © Social Protection Civil Society Network (SPCSN)-Nepal About the Journal With an objective to bring learnings, issues and voices on social protection through experts in regard to inform the social protection audiences, practitioners, stakeholders and actors as well as to suggest policymakers to adequately design social protection programs to fill the gaps and delivery transparency and accountability, Social Protection Civil Society Network (SPCSN) expects to publish the introductory issue of Journal of Social Protection in both print and online versions. Review Process This journal was published by Social Protection Civil Society Network (SPCSN) with supports of Save the Children Nepal Country Office in collaboration with Save the Children Finland & Ministry of Foreign Affairs Finland and with management supports from Children, Woman in Social Service and Human Rights (CWISH), Nepal. Editorial and Business Office Published by SPCSN Buddhanagar, Kathmandu Email: [email protected] Website: www.spcsnnepal.org Social Protection Civil Society Network (SPCSN) ISSN: ....................... Designed by: Krishna Subedi Printed at: .................... Journal of Social Protection, 2020 Volumn 1 December 2020 Contents Boosting the Impact of Nepal’s Child Grant through a Parenting Intervention ............................................................................................. 1-10 - Disa Sjöblom Social Protection in Health: Characteristics and Coverage of Health Insurance Program in Nepal ................................................... 11-26 - Geha Nath Khanal and Bhagawan Regmi Making Shock Responsive Social Protection System in Nepalese Context .................................................................................... -

Maternal Health Care in Nepal: Trends and Determinants

Maternal Health Care in Nepal: Trends and Determinants DHS Further Analysis Reports No. 118 DHS Further Analysis Reports No. 118 Maternal Health Care in Nepal: Trends and Determinants Krishna Kumar Aryal1 Sharad K Sharma2 Mukti Nath Khanal3 Bihungum Bista4 Shiv Lal Sharma2 Shambhu Kafle5 Mona Mehta Steffen6 ICF Rockville, Maryland, USA January 2019 1 DFID/NHSP3/MEOR, Abt Associates 2 Department of Health Services, Ministry of Health and Population, Nepal 3 Population Division, Ministry of Health and Population, Nepal 4 Nepal Health Research Council 5 Health Coordination Division, Ministry of Health and Population, Nepal 6 The DHS Program, ICF Corresponding author: Krishna Kumar Aryal, DFID Nepal Health Sector Programme 3 (NHSP3), Monitoring, Evaluation and Operational Research (MEOR) Project, Abt Associates, Lalitpur-10, Lalitpur, Nepal; phone: +977 9851123730; email: [email protected]. Ministry of Health and Population Acknowledgments: The authors would like to thank DFID Nepal for its support and technical assistance in producing this report. We would like to sincerely acknowledge the support from Joseph James (Abt Britain), Scott Roantree (Abt Britain), and Peter Godwin (DFID/NHSP3/MEOR Project) to produce this report. Special thanks are extended to Dr. Sharad K Sharma and Mr. Mukti Nath Khanal from MoHP for steering the overall report write up. We also extend our gratitude to Tom Fish (ICF) for creating a comparable Province indicator for the 2011 Nepal DHS survey, and to Kerry MacQuarrie (Avenir Health) and Jennifer Yourkavitch (ICF) for their assistance with the tables and graphics in the report. We further express gratitude to the reviewers of this study, Lindsay Mallick (Avenir Health), Sabita Tuladhar and Shilu Adhikari (USAID), and Punya Paudel (Family Welfare Division/MoHP). -

Situation Update #71- Coronavirus Disease 2019 (COVID-19)

Situation Update #71- Coronavirus Disease 2019 (COVID-19) WHO Country Office for Nepal Reporting Date: 17 - 23 August 2021 SITUATION OVERVIEW HIGHLIGHTS *Data as of HEOC of MoHP Situation Report, 23 NEPAL August 2021 (Data as of 24 August 2021, 07:00:00 hours) • Of the total COVID-19 positive cases, 93.5% (700097) 748,981 (RT-PCR) and of cases have recovered and 5.1% (38,351) of cases 80,462 (Antigen RDT) are active. confirmed cases • Of the total active cases, 91.6% (35,132) cases are in 10,533 deaths home isolation; 8.3% (3,219) of cases are undergoing 3,839,395 RT-PCR tests and 435,177 Antigen RDT hospital/institutional isolation. While 1.7% (679) of active cases require ICU admission, 25.9% (176) of SOUTH-EAST ASIA REGION the ICU admitted patients require ventilator support. (Data as of 22 August 2021) • Twenty one districts have reported more than 500 40,522,861 confirmed cases active cases. 627,864 deaths • Among the total new cases (14143) reported this GLOBAL week, 27.9% (3946) are from Kathmandu district (Data as of 22 August 2021) followed by Kaski district 11.2% (1580). Most of the 211,288,358 confirmed cases new cases about 40.5% (5732) have been reported 4,422,666 deaths from Kathmandu valley (Kathmandu, Lalitpur and Bhaktapur districts), Bagmati Province. • COVID-19 vaccination coverage status (as of 23 August 2021) ChAdOx1-S* SARS-CoV-2 Vaccine (Vero Cell) Johnson and Johnson Vaccine First dose : 199,7470 First dose : 2,946,262 Single Dose : 1,335,816 Second dose : 1,031,779 Second dose : 1,490,003 * COVISHIELD (manufactured by Serum Institute of India), Japanese-made COVID-19 AstraZeneca vaccine, Swedish AstraZeneca vaccine NEPAL EPIDEMIOLOGICAL SITUATION • As of 24 August 2021, 07:00:00 hours (week no. -

Situation Update #49 - Coronavirus Disease 2019 (COVID-19) WHO Country Office for Nepal Reporting Date: 16 - 22 March 2021

Situation Update #49 - Coronavirus Disease 2019 (COVID-19) WHO Country Office for Nepal Reporting Date: 16 - 22 March 2021 HIGHLIGHTS* SITUATION OVERVIEW ● Of the total COVID-19 positive cases, 98.5% of cases have recovered and 0.37% (1017) of cases NEPAL are active. (Data as of 23 March 2021, 07:00:00 hours) ● Of the total COVID-19 deaths, the most common 276,056 confirmed cases co-morbidity identified in fatal cases was 3,019 deaths hypertension (39.9%). 2,240,998 RT-PCR tests ● New cases have been reported from 21 districts. ● There have been 1,756,702 people (438,879 in 1st phase and 1,317,823 in 2nd phase - 77% of the SOUTH-EAST ASIA REGION target population) who have received the 1st dose (Data as of 21 March 2021, 10am CET) of COVID-19 Vaccine. 14,182,826 confirmed cases ● Vaccine wastage rate of 2nd phase is less than 1 214,790 deaths percent. ● Second dose of COVID-19 vaccine will begin from GLOBAL 20 April 2021. (Data as of 21 March 2021, 10am CET) *Data as of COVID-19 Update, MoHP, 22 March 2021 122,536,880 confirmed cases 2,703,780 deaths NEPAL EPIDEMIOLOGICAL SITUATION • As of 23 March 2021, T07:00:00 hours (week no. 12), a total 276,056 COVID-19 cases were confirmed in the country through polymerase chain reaction (RT-PCR); 2,240,998 RT-PCR tests have been performed nationwide by 66 designated COVID-19 labs functional across the nation. • All 7 provinces in the country are now experiencing transmission via clusters of cases. -

Oli's Temple Visit Carries an Underlying Political Message, Leaders and Observers

WITHOUT F EAR OR FAVOUR Nepal’s largest selling English daily Vol XXVIII No. 329 | 8 pages | Rs.5 O O Printed simultaneously in Kathmandu, Biratnagar, Bharatpur and Nepalgunj 24.5 C -5.4 C Tuesday, January 26, 2021 | 13-10-2077 Dipayal Jumla Campaigners decry use of force by police on peaceful civic protest against the House dissolution move Unwarned, protesters were hit by water cannons and beaten up as they marched towards Baluwatar. Earlier in the day, rights activists were rounded up from same area. ANUP OJHA Dahayang Rai, among others, led the KATHMANDU, JAN 25 protest. But no sooner had the demonstra- The KP Sharma Oli administration’s tors reached close to Baluwatar, the intolerance of dissent and civil liberty official residence of Prime Minister was in full display on Monday. Police Oli, than police charged batons and on Monday afternoon brutally charged used water cannons to disperse them, members of civil society, who had in what was reminiscent of the days gathered under the umbrella of Brihat when protesters were assaulted dur- Nagarik Andolan, when they were ing the 2006 movement, which is marching towards Baluwatar to pro- dubbed the second Jana Andolan, the test against Oli’s decision to dissolve first being the 1990 movement. the House on December 20. The 1990 movement ushered in In a statement in the evening, democracy in the country and the sec- Brihat Nagarik Andolan said that the ond culminated in the abolition of government forcefully led the peaceful monarc h y. protest into a violent clash. In a video clip by photojournalist “The police intervention in a Narayan Maharjan of Setopati, an peaceful protest shows KP Sharma online news portal, Wagle is seen fall- Oli government’s fearful and ing down due to the force of the water suppressive mindset,” reads the cannon, and many others being bru- POST PHOTO: ANGAD DHAKAL statement. -

National Profile 2020/2021 R O GRAM

NVCYE PROGRAM 1 2 0 /2 20 20 Profile l na Natio NVCYE PROGRAM Contact Person: Santoshi Chalise Kalanki -14, Kathmandu, Nepal Tel: +977-15234504 E-mail: [email protected] Website: www.icyenepal.org PO Box: 1865 Nepal: An Introduction Official Name: Nepal Population: 35,142,064 (2019 est.,) Official Language: Nepali Currency: Rupees (NPR) Standard Time Zone: UTC+05:45 Capital: Kathmandu Founded in 1768 Government: Federal Democratic Republic of Nepal Current President: Biddhyadevi Bhandari Nepal has 77 department’s (districts), six metropolitan cities (Kathmandu, Janakpur, Biratnagar, Bharatpur, Pokhara and Lalitpur) and 753 new municipalities and rural municipalities. Geography: Nepal is a landlocked country, surrounded by India on three sides and by China's Tibet Autonomous Region to the north. The shape of the country is rectangular with a width of about 650 kilometres and a length of about 200 kilometers. The total landmass is 147,181 square kilometres. Nepal is dependent on India for transit facilities and access to the sea. All the goods and raw materials arrive into Nepal from the Bay of Bengal and through Kolkata. Though small in size, Nepal contains great diversity in landscape. The south of Nepal, which borders India, is flat and known locally as Terai. The Terai is situated about 300 meters above sea level. The landscape then dramatically changes to mid-hills of over 1000 meters and reaches as high as 8000 meters with the Himalayas in the north bordering China. This rise in elevation is punctuated by valleys situated between mountain ranges. Within this maze of mountains, hills, ridges, and low valleys, changes in altitude have resulted in great ecological variations and have given rise to many different cultures, traditions, and languages. -

2.3 Nepal Road Network

2.3 Nepal Road Network Overview Primary Roads in Nepal Major Road Construction Projects Distance Matrix Road Security Weighbridges and Axle Load Limits Road Class and Surface Conditions Province 1 Province 2 Bagmati Province Gandaki Province Province 5 Karnali Province Sudurpashchim Province Overview Roads are the predominant mode of transport in Nepal. Road network of Nepal is categorized into the strategic road network (SRN), which comprises of highways and feeder roads, and the local road network (LRN), comprising of district roads and Urban roads. Nepal’s road network consists of about 64,500 km of roads. Of these, about 13,500 km belong to the SRN, the core network of national highways and feeder roads connecting district headquarters. (Picture : Nepal Road Standard 2070) The network density is low, at 14 kms per 100 km2 and 0.9 km per 1,000 people. 60% of the road network is concentrated in the lowland (Terai) areas. A Department of Roads (DoR’s) survey shows that 50% of the population of the hill areas still must walk two hours to reach an SRN road. Two of the 77 district headquarters, namely Humla, and Dolpa are yet to be connected to the SRN. Page 1 (Source: Sector Assessment [Summary]: Road Transport) Primary Roads in Nepal S. Rd. Name of Highway Length Node Feature Remarks N. Ref. (km) No. Start Point End Point 1 H01 Mahendra Highway 1027.67 Mechi Bridge, Jhapa Gadda chowki Border, East to West of Country Border Kanchanpur 2 H02 Tribhuvan Highway 159.66 Tribhuvan Statue, Sirsiya Bridge, Birgunj Connects biggest Customs to Capital Tripureshwor Border 3 H03 Arniko Highway 112.83 Maitighar Junction, KTM Friendship Bridge, Connects Chinese border to Capital Kodari Border 4 H04 Prithvi Highway 173.43 Naubise (TRP) Prithvi Chowk, Pokhara Connects Province 3 to Province 4 5 H05 Narayanghat - Mugling 36.16 Pulchowk, Naryanghat Mugling Naryanghat to Mugling Highway (PRM) 6 H06 Dhulikhel Sindhuli 198 Bhittamod border, Dhulikhel (ARM) 135.94 Km.