Chapter 2 Banking Industry

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

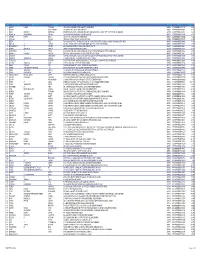

Section 124- Unpaid and Unclaimed Dividend

Sr No First Name Middle Name Last Name Address Pincode Folio Amount 1 ASHOK KUMAR GOLCHHA 305 ASHOKA CHAMBERS ADARSHNAGAR HYDERABAD 500063 0000000000B9A0011390 36.00 2 ADAMALI ABDULLABHOY 20, SUKEAS LANE, 3RD FLOOR, KOLKATA 700001 0000000000B9A0050954 150.00 3 AMAR MANOHAR MOTIWALA DR MOTIWALA'S CLINIC, SUNDARAM BUILDING VIKRAM SARABHAI MARG, OPP POLYTECHNIC AHMEDABAD 380015 0000000000B9A0102113 12.00 4 AMRATLAL BHAGWANDAS GANDHI 14 GULABPARK NEAR BASANT CINEMA CHEMBUR 400074 0000000000B9A0102806 30.00 5 ARVIND KUMAR DESAI H NO 2-1-563/2 NALLAKUNTA HYDERABAD 500044 0000000000B9A0106500 30.00 6 BIBISHAB S PATHAN 1005 DENA TOWER OPP ADUJAN PATIYA SURAT 395009 0000000000B9B0007570 144.00 7 BEENA DAVE 703 KRISHNA APT NEXT TO POISAR DEPOT OPP OUR LADY REMEDY SCHOOL S V ROAD, KANDIVILI (W) MUMBAI 400067 0000000000B9B0009430 30.00 8 BABULAL S LADHANI 9 ABDUL REHMAN STREET 3RD FLOOR ROOM NO 62 YUSUF BUILDING MUMBAI 400003 0000000000B9B0100587 30.00 9 BHAGWANDAS Z BAPHNA MAIN ROAD DAHANU DIST THANA W RLY MAHARASHTRA 401601 0000000000B9B0102431 48.00 10 BHARAT MOHANLAL VADALIA MAHADEVIA ROAD MANAVADAR GUJARAT 362630 0000000000B9B0103101 60.00 11 BHARATBHAI R PATEL 45 KRISHNA PARK SOC JASODA NAGAR RD NR GAUR NO KUVO PO GIDC VATVA AHMEDABAD 382445 0000000000B9B0103233 48.00 12 BHARATI PRAKASH HINDUJA 505 A NEEL KANTH 98 MARINE DRIVE P O BOX NO 2397 MUMBAI 400002 0000000000B9B0103411 60.00 13 BHASKAR SUBRAMANY FLAT NO 7 3RD FLOOR 41 SEA LAND CO OP HSG SOCIETY OPP HOTEL PRESIDENT CUFFE PARADE MUMBAI 400005 0000000000B9B0103985 96.00 14 BHASKER CHAMPAKLAL -

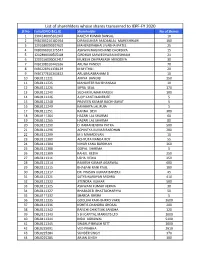

DBL Share Transferred List.Xlsx

List of sharehlders whose shares transerred to IEPF‐FY 2020 Sl No Folio/DPID &CL ID Shareholder No of Shares 1 1304140005162947 RAKESH KUMAR BANSAL 10 2 IN30305210182764 DIPAKKUMAR MADANLAL MAHESHWARI 100 3 1202680000107629 MAHENDRABHAI JIVABHAI PATEL 25 4 IN30066910175547 ASHWIN NAGINCHAND CHORDIYA 15 5 1202890000505108 GIRDHAR SARWESHWAR MESHRAM 21 6 1203150000062419 MUKESH OMPRAKASH NIMODIYA 30 7 IN30198310442636 ARUNA PANDEY 70 8 IN30226911138129 M MYTHILI 20 9 IN30177410343452 ARULRAJABRAHAM D 10 10 DBL0111221 AMIYA BANERJI 250 11 DBL0111225 MAHAVEER RAJ BHANSALI 10 12 DBL0111226 SIPRA SEAL 170 13 DBL0111240 SUDHIR KUMAR PAREEK 100 14 DBL0111246 AJOY KANTI BANERJEE 5 15 DBL0111248 PRAVEEN KUMAR BACHHAWAT 5 16 DBL0111249 KANHAIYA LAL RUIA 5 17 DBL0111251 RANNA DEVI 300 18 DBL0111264 HAZARI LAL SHARMA 60 19 DBL0111265 HAZARI LAL SHARMA 80 20 DBL0111290 D RAMANENDRA PATRA 500 21 DBL0111296 ACHINTYA KUMAR BARDHAN 200 22 DBL0111299 M S MAHADEVAN 10 23 DBL0111300 ACHYUTA NANDA ROY 55 24 DBL0111304 NIHAR KANA BARDHAN 360 25 DBL0111308 GOPAL SHARMA 5 26 DBL0111309 RAHUL KEDIA 250 27 DBL0111311 USHA KEDIA 250 28 DBL0111314 RAMESH KUMAR AGARWAL 600 29 DBL0111315 BHABANI RANI PAUL 100 30 DBL0111317 DR PRASUN KUMAR BANERJI 45 31 DBL0111321 SATYA NARAYAN MISHRA 410 32 DBL0111322 JITENDRA KUMAR 500 33 DBL0111325 ASHWANI KUMAR VERMA 30 34 DBL0111327 BHABADEB BHATTACHARYYA 50 35 DBL0111332 SHARDA KHERA 5 36 DBL0111335 GOOLBAI KAIKHSHRRO VAKIL 3600 37 DBL0111336 KSHITIS CHANDRA GHOSAL 200 38 DBL0111342 RANCHI CHIKITSAK SANGHA 120 39 DBL0111343 S B I CAPITAL MARKETS LTD 1000 40 DBL0111344 INDU AGRAWAL 5400 41 DBL0111345 SWARUP BIKASH SETT 1000 42 DBL0225091 VED PRABHA 2610 43 DBL0225284 SUNDER SINGH 370 44 DBL0225285 ARJAN SINGH 100 45 DBL0225286 SAIN DASS AGGARWAL. -

Banking – Law & Practice

RELEVANT FOR DECEMBER, 2019 SESSION ONWARDS STUDY MATERIAL PROFESSIONAL PROGRAMME BANKING – LAW & PRACTICE MODULE 3 ELECTIVE PAPER 9.1 i © THE INSTITUTE OF COMPANY SECRETARIES OF INDIA TIMING OF HEADQUARTERS Monday to Friday Office Timings – 9.00 A.M. to 5.30 P.M. Public Dealing Timings Without financial transactions – 9.30 A.M. to 5.00 P.M. With financial transactions – 9.30 A.M. to 4.00 P.M. Phones 011-45341000 Fax 011-24626727 Website www.icsi.edu E-mail [email protected] Laser Typesetting by AArushi Graphics, Prashant Vihar, New Delhi, and Printed at M P Printers/June 2019 ii PROFESSIONAL PROGRAMME BANKING – LAW & PRACTICE In the contemporary perspective, Indian economy is considered as the one of the fastest growing and emerging economies in the world. Contributing to its high growth are many critical sectors including Agriculture, Banking Industry, Capital Market, Money Market, Financial Services and many more. Among all, ‘Banking Sector’ has unarguably been one of the most distinguished sectors of Indian economy. Indeed, the development of any country depends on the economic growth, the country achieves over a period of time. This confirms the very fact that the role of financial sector in shaping fortunes for Indian economy has been even more critical, as India since independence has been equally focussed on other channels of growth too along with resilient industrial sector and the domestic savings in the government instruments. This prompted India to majorly depend on sectors for its dynamic progression. Considering the fact that banking sector plays a significant role in the economic empowerment and global growth of the country, a balanced and vigil regulation on Banking Sector has been always mandated to ensure the transparent run of this sector while avoiding any tantamount of fraud and malpractices injurious to the interest of investors, stakeholders and country as a whole. -

Technological Security Aspects for Internet Banking

Volume : 3 | Issue : 6 | June 2014 ISSN - 2250-1991 Research Paper Management Technological Security Aspects for Internet Banking Assistant Professor, Department of MBA, Supreme Knowledge Soumyajit Das Foundation Group of Institutions, West Bengal University of Tech- nology, Mankundu,Hooghly, West Bengal. Associate Professor and Head, Department of Commerce & Man- Dr. Pranam Dhar agement, West Bengal State University, Barasat, West Bengal. The present day banking business is, to a great extent, dependent on ‘Electronic Banking’. The term ‘Electronic Banking’ means banking through internet i.e Internet Banking where the physical presence of the consumers in the bank is not mandatory. Electronic banking, also known as electronic fund transfer (EFT), uses computer and electronic technology as a substitute for the negotiable instruments like cheques, drafts etc and other paper transactions. EFTs are initiated through devices like cards or codes that let one or those one authorizes, access one’s account. Because of the commercial failure of videotex these banking services never became popular except in France where the use of videotex (Minitel) was subsidised by the telecom provider and the UK, where the prestel system was used. As Internet Banking is a relatively new area of ABSTRACT banking in India so people in India are still not very conversant with electronic banking. Further as it is directly related to money and fund, people are very hesitant about using it because of different farudulant activities. So as far Internet banking is concerned customers are very keen to safeguard them by consolidating the security aspects of Internet Banking. KEYWORDS Electronic Banking, Electronic Fund Transfer(EFT), Electronic Technology, Prestel, Security 1.0. -

Law of Banking

LAW OF BANKING M. S. RAMA RAO B.Sc., M.A., M.L. Class-room live lectures edited, enlarged and updated Msrlawbooks 1 LAW OF BANKING By M S RAMA RAO B.Sc.,M.A.,M.l., 1 Page msrlawbooks LAW OF BANKING ……. 2 LAW OF BANKING CONTENTS 1 Chapter Page Chapter Page !. Banking Regulation Act 5. Pass Book 23 Meaning R.B.I. 3 Scope, Mistakes Banking Companies Nationalisation 6. Genera! Manager 25 Bankers Evidence Act 7. Negotiable Instruments 2. Customer & Banker 9 Definition 26 Relationship Assignability Genera! Lien,safety Vault Cheque Secrecy of Account Cheque & B/E Honoring of cheques B/E 3. Opening of Accounts 16 P/N Precautions Material alteration Minor’s account 8 Cheques Joint account Crossing 33 Partnership Bearer Companies Marked Cheque, date Married woman 9. Paying Banker 37 Purdanishin woman 10. Collecting Banker 39 Trust 11. Bank Advances H.U.F. Stock Exchange 42 4. Types of Accounts 21 Goods & documents Current Account 12. Miscellaneous F.D. 1. Travellers Cheque 44 S.B. 2. UTI Closing of Account IDBI 3. B/L 4. 5.Hundi 6.Garnishee order REFERENCE 59 2 Page msrlawbooks LAW OF BANKING ……. 3 CHAPTER 1 BANKING REGULATION ACT 1949 1.1 : Reserve Bank of India The Reserve Bank of India, which is the central bank of our nation, was established in 1935 under R.B.I.Act 1934. It took over the currency issue authority and credit control from the then Imperial Bank of India. The Bank was nationalised in 1948. Composition: Central Board of Directors : 20 Members; Headquarters : Bombay. -

The Bay Area-Silicon Valley and India Convergence and Alignment in the Innovation Age Project Lead Sponsors

June 2019 The Bay Area-Silicon Valley and India Convergence and Alignment in the Innovation Age Project Lead Sponsors Project Supporting Sponsors ABOUT THE BAY AREA COUNCIL ECONOMIC INSTITUTE Since 1990, the Bay Area Council Economic Institute and the state, including infrastructure, globalization, has been the leading think tank focused on the science and technology, and health policy. It is guided economic and policy issues facing the San Francisco by a Board of Advisors drawn from influential leaders in Bay Area-Silicon Valley, one of the most dynamic regions the corporate, academic, non-profit, and government in the United States and the world’s leading center sectors. The Institute is housed at and supported by for technology and innovation. A valued forum for the Bay Area Council, a public policy organization that stakeholder engagement and a respected source of includes hundreds of the region’s largest employers information and fact-based analysis, the Institute is a and is committed to keeping the Bay Area the trusted partner and adviser to both business leaders world’s most competitive economy and best place and government officials. Through its economic and to live. The Institute also supports and manages the policy research and its many partnerships, the Institute Bay Area Science and Innovation Consortium (BASIC), addresses major factors impacting the competitiveness, a partnership of Northern California’s leading scientific economic development and quality of life of the region research laboratories and thinkers. Contents Executive Summary ...................................................4 CHAPTER 6 Information Technology: Upward Mobility .............51 Introduction ...............................................................7 Government Initiatives ............................................. 54 CHAPTER 1 Trends ...................................................................... 55 India’s Economy: Poised for Takeoff .........................9 The Bay Area-IT Connection Shifts ........................ -

Metamorphosis Into a Digital Economy

Swiping India into the future Metamorphosis into a digital economy November 2017 KPMG.com/in Table of contents 06 07 08 10 11 15 18 © 2017 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 20 21 23 26 © 2017 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved 05 Swiping India into the future © 2017 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 06 Introduction The Indian payments landscape As per a latest study, the has undergone radical country’s digital payment transformation in the last ecosystem is poised to few years and it has gained reach USD500 billion by further momentum after the the year 202001. Frictional recent demonetisation by the inefficiencies associated government. The current push with cash transactions could by the government towards further propel digital payments. digitisation and start-up India’s cash to Gross Domestic incubation programmes augurs Product (GDP) ratio of 12.04 well for the industry. Many per cent is substantially innovative players like Paytm, higher than other comparable MobiKwik, PhonePe, etc. have countries02. At the same time, emerged in the recent past India ranks very low in respect and disrupted the market of digital transactions as well as quickly. -

Banking and Insurance Law 2017

LL.B VI TERM Banking, Insurance Law and Negotiable Instruments Cases Selected and Edited by O.B. Lal Gunjan Gupta Arti Aneja FACULTY OF LAW UNIVERSITY OF DELHI, DELHI- 110 007 January, 2017 LL.B. VI Term Paper: LB – 6032 – Banking, Insurance Law and Negotiable Instruments PART – A: BANKING Prescribed Legislation: The Banking Regulation Act, 1949 (B.R. Act) Prescribed Books: 1. C.R. Datta & P.M. Bakshi, M.L. Tannan’s Banking - Law and Practice in India (21th ed., 2008) 2. R.K. Gupta, Banking - Law and Practice (2nd ed. 2008) 3. Mark Hapgood, Paget’s Law of Banking (13th ed., 2007) 4. M.L. Tannam, Banking Law and Practice in India (23rd ed., 2010) Topic 1: The Evolution of Banking Services and its History in India History of Banking in India, Bank Nationalization and social control over banking, Various types of Banks and their functions, Contract between banker and customer: their rights and duties, Role and functions of Banking Institutions. Topic 2: Banking System in India and Control by Reserve Bank of India Definition of ‘bank’, ‘banker’, ‘banking’, ‘banking companies’; Development of banking business and companies; Regulations and restrictions; Powers and control exercised by the Reserve Bank of India (B.R. Act, sections 5-36AD) 1. Sajjan Bank (Pvt.) Ltd. v. Reserve Bank of India, AIR 1961 Mad. 8 2. Canara Bank v. P.R.N. Upadhyaya (1998) 6 SCC 526 PART B: INSURANCE Prescribed Legislations: 1. The Insurance Act, 1938 2. The Marine Insurance Act, 1963 3. The Life Insurance Corporation Act, 1956 4. The General Insurance Business (Nationalization) Act, 1972 5. -

S.NO TYPE FOLIO No./DP ID and CLIENT ID NAME of HOLDER NO

S.NO TYPE FOLIO No./DP ID AND CLIENT ID NAME OF HOLDER NO. OF SHARES 1 PHY DEL0000049 RAGHUBAR DAYAL GOEL 92 2 PHY DEL0000050 NARAYANRAO JANRAO DESHMUKH 1040 3 PHY DEL0000051 NALINI MUKHERJEA 1305 4 PHY DEL0000052 MALIK RAM JALI 10 5 PHY DEL0000053 SARASWATHI BAI 90 6 PHY DEL0000054 DAULAT RAM JAIN. 25 7 PHY DEL0000055 DUGGAL BACHAN LALL 225 8 PHY DEL0000056 MOHAMMAD ABID HUSAIN 10 9 PHY DEL0000057 SHAMSHER SINGH CHAUDHURI 25 10 PHY DEL0000058 QUDISA BANO 1548 11 PHY DEL0000059 PRANJIVANDAS KALYANDAS DEVIDAS 228 12 PHY DEL0000060 BRIJ LAL MEDIRATTA 210 13 PHY DEL0000061 ALCINA PACHECO DE FIGUEIREDO 1065 14 PHY DEL0000063 JACK ANTHONY DE SOUSA 160 15 PHY DEL0000064 SHEELA RAY 10 16 PHY DEL0000086 PREMCHAND 680 17 PHY DEL0000087 JALLANDHARI RAM 185 18 PHY DEL0000089 W.B.METRE 2640 19 PHY DEL0000090 SUSHILA DEVI 1770 20 PHY DEL0000091 SURENDRANATH JAIN 50 21 PHY DEL0000092 LABHU RAM BHARDWAJ 80 22 PHY DEL0000093 HANS RAJ 410 23 PHY DEL0000094 DHANWANTI 320 24 PHY DEL0000095 MADHO PERSHAD KHANNAH 210 25 PHY DEL0000096 KISHAN CHAND NANDWANI 305 26 PHY DEL0000097 MADAN MOHAN SHOURIE. 765 27 PHY DEL0000098 MOHAN SINGH KOHLI 1466 28 PHY DEL0000099 LALJI PRASAD SINHA 225 29 PHY DEL0000100 PIYARE LAL BHATIA 210 30 PHY DEL0000101 RAJENDRA KUMAR CHOUDHURY 90 31 PHY DEL0000102 V.H.ADVANI 25 32 PHY DEL0000103 ROSHAN DEVI DINA NATH MARWAHA 466 33 PHY DEL0000104 MOHAN LAL 800 34 PHY DEL0000105 SHANTI SWAROOP 572 35 PHY DEL0000106 SEWA RAM SEHGAL 466 36 PHY DEL0000107 SHRIDHAR RAO GAOSANDHE 10 37 PHY DEL0000108 MONI BAI 305 38 PHY DEL0000109 JAI NARAIN. -

Bank Mergers and Indian Economy

INTERNATIONAL JOURNAL FOR INNOVATIVE RESEARCH IN MULTIDISCIPLINARY FIELD ISSN: 2455-0620 Volume - 5, Issue - 6, June – 2019 Monthly, Peer-Reviewed, Refereed, Indexed Journal with IC Value: 86.87 Scientific Journal Impact Factor: 6.497 Received Date: 02/06/2019 Acceptance Date: 12/06/2019 Publication Date: 30/06/2019 Bank Mergers and Indian Economy Raj Kumari Associate Professor, PG Department of Commerce S.G.G.S. Khalsa College, Mahilpur E mail: [email protected] Abstract: Banking sector is one of the important sector which is affecting growth of Indian economy. Due to multinational players the banks both public and private intense competition. Moreover e-commerce and online banking has made small banks difficult to survive. As a result, Mergers and acquisitions are the order of the day. The study includes various aspects of bank mergers. The paper presents the merger of banks in post liberalisation period and its effect on the Indian economy. The data has been collected from secondary sources. Key Words: Mergers & acquisition, financial parameters, Indian banks. 1. INTRODUCTION: Banking sector is one of the fastest growing sector in India and affecting growth of Indian economy. Merger is the amalgamation of two groups into single entity. It is the process of combining two business entities under the common ownership. Usually merger occurs when an independent bank loses its charter and becomes a part of an existing bank with. In Indian banking sector Mergers and acquisitions has become admired trend throughout the country. A large number of public sector bank, private sector bank and other banks are engaged in mergers and acquisitions activities in India. -

Annual Report-2020

Letter of Transmittal All Shareholders, Bangladesh Bank, Bangladesh Securities and Exchange Commission, Dhaka Stock Exchange Limited and Chittagong Stock Exchange Limited. Subject: Annual Report for the year ended December 31, 2020 Dear Sir(s), We are delighted to enclose a copy of the Annual Report 2020 together with the audited Financial Statements as at the position of December 31, 2020. The report includes Income Statements, Cash Flow Statements along with notes thereon of Uttara Bank Limited and its subsidiaries namely “ Uttara Bank Securities Limited ” and “UB Capital & Investment Limited”. This is for your kind information and record please. Best regards, Yours sincerely, Iftekhar Zaman Executive General Manager & Secretary CONTENTS Notice of the 38th Annual General Meeting 4 Corporate Information 5 Highlights of 37th Annual General Meeting 6 Board of Directors 7 Executive Committee, Audit Committee & Risk Management Committee 8 SMT, ERMC & ALCO 9 Directors’ Profiles 10 Message from the Chairman 18 Message from the Vice Chairman 20 Message from the Managing Director & CEO 22 CEO and CFO’s declaration to the Board 25 Report of the Audit Committee 26 Photo Album 28 Some activities of Uttara Bank Limited 30 Name of the Executives 34 Directors’ Report 35 Five years at a Glance 72 Corporate Governance 74 Certificate on compliance status of Corporate Governance Guidelines of BSEC 75 Report on Risk Management 85 Report on Green Banking 108 Report on Corporate Social Responsibility 110 Credit Rating Report (Surveillance) 112 Auditors’ Report 114 Consolidated Financial Statements 120 Financial Statements: Uttara Bank Limited 126 Notes to the Financial Statements 132 Highlights on overall activities of the Bank 186 Annexures 187 Financial Statements: Off-Shore Banking Unit 192 Value Added Statement 200 Economic Value added Statement 201 Market Value Addition Statement 202 Auditors Report to the Shareholders of Uttara Bank Securities Ltd. -

![Finance Series[Show]](https://docslib.b-cdn.net/cover/1549/finance-series-show-6431549.webp)

Finance Series[Show]

Bank From Wikipedia, the free encyclopedia Jump to: navigation, search For other uses, see Bank (disambiguation). "Banker" and "Bankers" redirect here. For other uses, see Banker (disambiguation). This article needs additional citations for verification. Please help improve this article by adding citations to reliable sources. Unsourced material may be challenged and removed. (July 2009) Banking A series on financial services Types of banks[show] Bank accounts[show] Bank cards[show] Funds transfer[show] Banking terms[show] Finance series[show] v t e Finance Financial markets[show] Financial instruments[show] Corporate finance[show] Personal finance[show] Public finance[show] Banks and banking[show] Financial regulation[show] Standards[show] Economic history[show] v t e A bank is a financial institution and a financial intermediary that accepts deposits and channels those deposits into lending activities, either directly by loaning or indirectly through capital markets. A bank links together customers that have capital deficits and customers with capital surpluses. Due to their influential status within the financial system and upon national economies, banks are highly regulated in most countries. Most nations have institutionalised a system known as fractional reserve banking, in which banks hold only a small reserve of the funds deposited and lend out the rest for profit. They are generally subject to minimum capital requirements based on an international set of capital standards, known as the Basel Accords. Banking in its modern sense evolved in the 14th century in the rich cities of Renaissance Italy but in many ways was a continuation of ideas and concepts of credit and lending that had its roots in the ancient world.