Bank of India Act, 1934

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Banking Awareness Question Bank V2

www.BankExamsToday.com www.BankExamsToday.com www.BankExamsToday.com Banking Awareness By Ramandeep Singh Question Bank v2 www.BankExamsToday.com S. NO. Banking AwarenessTOPICS Question Bank v2 PAGE NO. 1. 2. 3. History of Banking 2 - 4 4. Reserve Bank of India 4 - 7 5. NABARD 7 – 10 6. IRDAwww.BankExamsToday.com10 - 12 7. BIS 12 - 15 8. International Organizations 16 - 18 9. National Housing Bank 19 - 21 10. Credit/Debit Cards 21 - 24 11. Fiscal Policy 24 - 27 12. ATM 27 - 30 13. Banking OMBUDSMAN (Part 2) 30 - 33 14. Letter of Credit 33 - 36 15. WTO 36 - 39 16. World Bank 39 - 42 17. Allahabad Bank 42 - 45 18. Syndicate Bank 45 – 48 19. Oriental Bank of Commerce 48 - 51 20. Axis Bank 51 – 54 21. Punjab & Sind Bank 55 – 58 22. Bank of Baroda 58 – 60 23. ICICI Bank 60 – 63 24. PNB 63 – 66 25. United Bank of India 66 – 69 26. Vijaya Bank 69 - 72 27. ICICI Bank 72 – 75 28. Credit/Debit Cards (Part 2) 75 – 78 Canara Bank 78 – 81 Mixed Topics 81 - 121 By Ramandeep Singh Page 2 www.BankExamsToday.com HISTORY OF BANKINGBanking Awareness Question Bank v2 Q1. First Bank established in India was: a) Bank of India b) Bank of Hindustan c) General Bankwww.BankExamsToday.com of India d) None of The Above Q2. Bank of Hindustan was established in ____: a) 1700 b) 1770 c) 1780 d) None of The Above Q3. Which among the following is correct regarding Bank of Hindustan: a) The bank was established at calcutta under European management. -

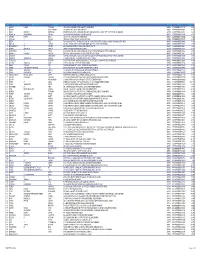

Section 124- Unpaid and Unclaimed Dividend

Sr No First Name Middle Name Last Name Address Pincode Folio Amount 1 ASHOK KUMAR GOLCHHA 305 ASHOKA CHAMBERS ADARSHNAGAR HYDERABAD 500063 0000000000B9A0011390 36.00 2 ADAMALI ABDULLABHOY 20, SUKEAS LANE, 3RD FLOOR, KOLKATA 700001 0000000000B9A0050954 150.00 3 AMAR MANOHAR MOTIWALA DR MOTIWALA'S CLINIC, SUNDARAM BUILDING VIKRAM SARABHAI MARG, OPP POLYTECHNIC AHMEDABAD 380015 0000000000B9A0102113 12.00 4 AMRATLAL BHAGWANDAS GANDHI 14 GULABPARK NEAR BASANT CINEMA CHEMBUR 400074 0000000000B9A0102806 30.00 5 ARVIND KUMAR DESAI H NO 2-1-563/2 NALLAKUNTA HYDERABAD 500044 0000000000B9A0106500 30.00 6 BIBISHAB S PATHAN 1005 DENA TOWER OPP ADUJAN PATIYA SURAT 395009 0000000000B9B0007570 144.00 7 BEENA DAVE 703 KRISHNA APT NEXT TO POISAR DEPOT OPP OUR LADY REMEDY SCHOOL S V ROAD, KANDIVILI (W) MUMBAI 400067 0000000000B9B0009430 30.00 8 BABULAL S LADHANI 9 ABDUL REHMAN STREET 3RD FLOOR ROOM NO 62 YUSUF BUILDING MUMBAI 400003 0000000000B9B0100587 30.00 9 BHAGWANDAS Z BAPHNA MAIN ROAD DAHANU DIST THANA W RLY MAHARASHTRA 401601 0000000000B9B0102431 48.00 10 BHARAT MOHANLAL VADALIA MAHADEVIA ROAD MANAVADAR GUJARAT 362630 0000000000B9B0103101 60.00 11 BHARATBHAI R PATEL 45 KRISHNA PARK SOC JASODA NAGAR RD NR GAUR NO KUVO PO GIDC VATVA AHMEDABAD 382445 0000000000B9B0103233 48.00 12 BHARATI PRAKASH HINDUJA 505 A NEEL KANTH 98 MARINE DRIVE P O BOX NO 2397 MUMBAI 400002 0000000000B9B0103411 60.00 13 BHASKAR SUBRAMANY FLAT NO 7 3RD FLOOR 41 SEA LAND CO OP HSG SOCIETY OPP HOTEL PRESIDENT CUFFE PARADE MUMBAI 400005 0000000000B9B0103985 96.00 14 BHASKER CHAMPAKLAL -

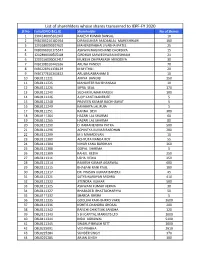

DBL Share Transferred List.Xlsx

List of sharehlders whose shares transerred to IEPF‐FY 2020 Sl No Folio/DPID &CL ID Shareholder No of Shares 1 1304140005162947 RAKESH KUMAR BANSAL 10 2 IN30305210182764 DIPAKKUMAR MADANLAL MAHESHWARI 100 3 1202680000107629 MAHENDRABHAI JIVABHAI PATEL 25 4 IN30066910175547 ASHWIN NAGINCHAND CHORDIYA 15 5 1202890000505108 GIRDHAR SARWESHWAR MESHRAM 21 6 1203150000062419 MUKESH OMPRAKASH NIMODIYA 30 7 IN30198310442636 ARUNA PANDEY 70 8 IN30226911138129 M MYTHILI 20 9 IN30177410343452 ARULRAJABRAHAM D 10 10 DBL0111221 AMIYA BANERJI 250 11 DBL0111225 MAHAVEER RAJ BHANSALI 10 12 DBL0111226 SIPRA SEAL 170 13 DBL0111240 SUDHIR KUMAR PAREEK 100 14 DBL0111246 AJOY KANTI BANERJEE 5 15 DBL0111248 PRAVEEN KUMAR BACHHAWAT 5 16 DBL0111249 KANHAIYA LAL RUIA 5 17 DBL0111251 RANNA DEVI 300 18 DBL0111264 HAZARI LAL SHARMA 60 19 DBL0111265 HAZARI LAL SHARMA 80 20 DBL0111290 D RAMANENDRA PATRA 500 21 DBL0111296 ACHINTYA KUMAR BARDHAN 200 22 DBL0111299 M S MAHADEVAN 10 23 DBL0111300 ACHYUTA NANDA ROY 55 24 DBL0111304 NIHAR KANA BARDHAN 360 25 DBL0111308 GOPAL SHARMA 5 26 DBL0111309 RAHUL KEDIA 250 27 DBL0111311 USHA KEDIA 250 28 DBL0111314 RAMESH KUMAR AGARWAL 600 29 DBL0111315 BHABANI RANI PAUL 100 30 DBL0111317 DR PRASUN KUMAR BANERJI 45 31 DBL0111321 SATYA NARAYAN MISHRA 410 32 DBL0111322 JITENDRA KUMAR 500 33 DBL0111325 ASHWANI KUMAR VERMA 30 34 DBL0111327 BHABADEB BHATTACHARYYA 50 35 DBL0111332 SHARDA KHERA 5 36 DBL0111335 GOOLBAI KAIKHSHRRO VAKIL 3600 37 DBL0111336 KSHITIS CHANDRA GHOSAL 200 38 DBL0111342 RANCHI CHIKITSAK SANGHA 120 39 DBL0111343 S B I CAPITAL MARKETS LTD 1000 40 DBL0111344 INDU AGRAWAL 5400 41 DBL0111345 SWARUP BIKASH SETT 1000 42 DBL0225091 VED PRABHA 2610 43 DBL0225284 SUNDER SINGH 370 44 DBL0225285 ARJAN SINGH 100 45 DBL0225286 SAIN DASS AGGARWAL. -

0113 Titlepage

APRACA FinPower Programme A Review of Rural Finance Innovations in Asia: New Approaches, Best Practices and Lessons Ramon C. Yedra With Special Sponsorship of the International Fund for Agricultural Development (IFAD) APRACA FinPower Publication 2007/4 A Review of Rural Finance Innovations in Asia: New Approaches, Best Practices and Lessons Ramon C. Yedra With Special Sponsorship of the International Fund for Agricultural Development (IFAD) i Published by: Asia-Pacific Rural and Agricultural Credit Association (APRACA) Printing by: Erawan Printing Press Distribution: For copies write to: The Secretary General Asia-Pacific Rural and Agricultural Credit Association (APRACA) 39 Maliwan Mansion, Phra Atit Road Bangkok 10200, Thailand Tel: (66-2) 280-0195, 697-4360 Fax: (66-2) 280-1524 E-mail: [email protected] Website: www.apraca.org Editing: Benedicto S. Bayaua Layout credit: Sofia Champanand E-Copies: E-copies in PDF file can also be downloaded from APRACA’s website. This review is published by APRACA under the auspices of the IFAD-supported APRACA FinPower Program. The review was commissioned through APRACA CENTRAB, the training and research arm of APRACA. The data gathered were based on primary and secondary data, interviews and information with key informants in selected APRACA represented countries. Opinions expressed by the author do not necessarily represent the official views of APRACA nor of IFAD. This review is published during the incumbency of Mr. Thiraphong Tangthirasunan (APRACA Chairman), Dr. Do Tat Ngoc (APRACA Vice-Chairman), Mr. Benedicto S. Bayaua (Secretary General). ii MESSAGE from the APRACA CHAIRMAN and VICE-CHAIRMAN reetings! This review of rural financial innovations and best practices is a testimony of APRACA’s G strong commitment to pursue the promotion of efficient and effective rural financial systems and broadened access to rural financial services in order to help reduce rural poverty among countries in Asia and the Pacific. -

Do Bank Mergers, a Panacea for Indian Banking Ailment - an Empirical Study of World’S Experience

IOSR Journal of Business and Management (IOSR-JBM) e-ISSN: 2278-487X, p-ISSN: 2319-7668. Volume 21, Issue 10. Series. V (October. 2019), PP 01-08 www.iosrjournals.org Do Bank Mergers, A Panacea For Indian Banking Ailment - An Empirical Study Of World’s Experience G.V.L.Narasamamba Corresponding Author: G.V.L.Narasamamba ABSTRACT: In the changed scenario of world, with globalization, the need for strong financial systems in different countries, to compete with their global partners successfully, has become the need of the hour. It’s not an exception for India also. A strong financial system is possible for a country with its strong banking system only. But unfortunately the banking systems of many emerging economies are fragmented in terms of the number and size of institutions, ownership patterns, competitiveness, use of modern technology, and other structural features. Most of the Asian Banks are family owned whereas in Latin America and Central Europe, banks were historically owned by the government. Some commercial banks in emerging economies are at the cutting edge of technology and financial innovation, but many are struggling with management of credit and liquidity risks. Banking crises in many countries have weakened the financial systems. In this context, the natural alternative emerged was to improve the structure and efficiency of the banking industry through consolidation and mergers among other financial sector reforms. In India improvement of operational and distribution efficiency of commercial banks has always been an issue for discussion for the Indian policy makers. Government of India in consultation with RBI has, over the years, appointed several committees to suggest structural changes towards this objective. -

Merger and Acquisitions in the Indian Banking Sector

Research Article Volume 1 Issue 6 2015 ISSN: 2395-7964 SS INTERNATIONAL JOURNAL OF MULTIDISCIPLINARY RESEARCH Merger and Acquisitions in the Indian Banking Sector Prof.D. Suryachandra Rao Faculty of Commerce and Management Krishna University Machilipatnam, A.P Dr. M. Venkateswara Rao Principal Kunda College of Technology & Management Vijayawada, A.P., India Abstract The International Banking scenario has shown major changes in the past few years in terms of the Mergers and Acquisitions. Mergers and Acquisition is a useful tool for the growth and expansion in any Industry and the Indian Banking Sector is no exception. It is helpful for the survival of the weak banks by merging into the larger bank. Due to the financial system deregulation, entry of new players and products with advanced technology, globalization of the financial markets, changing customer behaviour, wider services at cheaper rates, shareholder wealth demands etc., have been on rise. This study shows the impact of Mergers and Acquisitions in the Indian Banking sector. For this purpose, a comparison between pre and post merger performance in terms of Operating Profit Margin, Net Profit Margin, Return on Assets, Return on Equity, Earning per Share, Debt Equity Ratio, Dividend Payout Ratio and Market Share Price has been made. In the initial stage, after merging, there may not be a significant improvement due to teething problems but later they may improve upon. Key words: Mergers. Acquisitions, Financial Performance, Ratio, Profitability 76 01.00 Introduction Mergers and Acquisitions is one of the widely used strategies by the banks to strengthen and maintain their position in the market. -

United Bank of India

DISCLOSURE DOCUMENT Private & Confidential – Not for Circulation [This is a Disclosure Document prepared in conformity with Securities and Exchange Board of India (Issue and Listing of Debt Securities) Regulations, 2008 issued vide circular No. LAD-NRO/GN/2008/13/127878 dated June 06, 2008] UNITED BANK OF INDIA (A Government of India Undertaking) Constituted under the Banking Companies (Acquisition & Transfer of Undertakings) Act, 1970 Head Office: 11, Hemanta Basu Sarani, Kolkata – 700 001, West Bengal Tel: (033) 22483857, 22480592 Fax: 91-33-22420897, 22489391 Website: www.unitedbankofindia.com E-mail:[email protected], [email protected], [email protected] DISCLOSURE DOCUMENT FOR PRIVATE PLACEMENT OF UNSECURED REDEEMABLE NON- CONVERTIBLE SUBORDINATED TIER-II BONDS (SERIES VII) IN THE NATURE OF PROMISSORY NOTES OF RS. 10 LAKH EACH FOR CASH AT PAR AGGREGATING RS.100 CRORE WITH AN OPTION TO RETAIN OVERSUBSCRIPTION OF RS.100 CRORE REGISTRARS TO THE ISSUE TRUSTEE FOR THE BONDHOLDERS Link Intime India Pvt. Ltd. IDBI Trusteeship Services Ltd. C-13, Pannalal Silk Mills Compound Registered Office LBS Marg, Bhandup (West) Asian Building, Ground Floor Mumbai – 400 078 17, R Kamani Marg, Ballard Estate Tel: (022) 2596 3838 Mumbai – 400 001 Fax: 91-22-2594 6969 Tel: (022) 4080 7000 E-mail: [email protected] Fax: 91-22-6631 1776 / 4080 7080 E-mail: [email protected] SOLE ARRANGERS TO THE ISSUE IDFC Ltd, Naman Chambers, C-32, G-Block, Bandra-Kurla Complex, Bandra (E), Mumbai 400 051. ISSUE OPENS ON: December 28, 2011 ISSUE CLOSES ON: December 28, 2011 1 DISCLOSURE DOCUMENT TABLE OF CONTENTS INDEX TITLE I. -

Banking – Law & Practice

RELEVANT FOR DECEMBER, 2019 SESSION ONWARDS STUDY MATERIAL PROFESSIONAL PROGRAMME BANKING – LAW & PRACTICE MODULE 3 ELECTIVE PAPER 9.1 i © THE INSTITUTE OF COMPANY SECRETARIES OF INDIA TIMING OF HEADQUARTERS Monday to Friday Office Timings – 9.00 A.M. to 5.30 P.M. Public Dealing Timings Without financial transactions – 9.30 A.M. to 5.00 P.M. With financial transactions – 9.30 A.M. to 4.00 P.M. Phones 011-45341000 Fax 011-24626727 Website www.icsi.edu E-mail [email protected] Laser Typesetting by AArushi Graphics, Prashant Vihar, New Delhi, and Printed at M P Printers/June 2019 ii PROFESSIONAL PROGRAMME BANKING – LAW & PRACTICE In the contemporary perspective, Indian economy is considered as the one of the fastest growing and emerging economies in the world. Contributing to its high growth are many critical sectors including Agriculture, Banking Industry, Capital Market, Money Market, Financial Services and many more. Among all, ‘Banking Sector’ has unarguably been one of the most distinguished sectors of Indian economy. Indeed, the development of any country depends on the economic growth, the country achieves over a period of time. This confirms the very fact that the role of financial sector in shaping fortunes for Indian economy has been even more critical, as India since independence has been equally focussed on other channels of growth too along with resilient industrial sector and the domestic savings in the government instruments. This prompted India to majorly depend on sectors for its dynamic progression. Considering the fact that banking sector plays a significant role in the economic empowerment and global growth of the country, a balanced and vigil regulation on Banking Sector has been always mandated to ensure the transparent run of this sector while avoiding any tantamount of fraud and malpractices injurious to the interest of investors, stakeholders and country as a whole. -

Technological Security Aspects for Internet Banking

Volume : 3 | Issue : 6 | June 2014 ISSN - 2250-1991 Research Paper Management Technological Security Aspects for Internet Banking Assistant Professor, Department of MBA, Supreme Knowledge Soumyajit Das Foundation Group of Institutions, West Bengal University of Tech- nology, Mankundu,Hooghly, West Bengal. Associate Professor and Head, Department of Commerce & Man- Dr. Pranam Dhar agement, West Bengal State University, Barasat, West Bengal. The present day banking business is, to a great extent, dependent on ‘Electronic Banking’. The term ‘Electronic Banking’ means banking through internet i.e Internet Banking where the physical presence of the consumers in the bank is not mandatory. Electronic banking, also known as electronic fund transfer (EFT), uses computer and electronic technology as a substitute for the negotiable instruments like cheques, drafts etc and other paper transactions. EFTs are initiated through devices like cards or codes that let one or those one authorizes, access one’s account. Because of the commercial failure of videotex these banking services never became popular except in France where the use of videotex (Minitel) was subsidised by the telecom provider and the UK, where the prestel system was used. As Internet Banking is a relatively new area of ABSTRACT banking in India so people in India are still not very conversant with electronic banking. Further as it is directly related to money and fund, people are very hesitant about using it because of different farudulant activities. So as far Internet banking is concerned customers are very keen to safeguard them by consolidating the security aspects of Internet Banking. KEYWORDS Electronic Banking, Electronic Fund Transfer(EFT), Electronic Technology, Prestel, Security 1.0. -

Banks in News • Firms in News 3

Preface Dear Readers, The ‘Current Affairs’ section is an integral part of any examination. This edition of Manthan has been developed by our team to help you cover all the important events of the month for the upcoming exams like Banking, Insurance, CLAT, MBA etc. This comprehensive bulletin will help you prepare the section in a vivid manner. We hope that our sincere efforts will serve you in a better way to fulfil aspirations. Happy Reading! Best Wishes Team CL Contents 1. POLITY AND GOVERNANCE .................................................................................. 1–26 • National • International 2. ECONOMY AND FINANCE................................................................................... 27–44 • Economy News • Banks in News • Firms in News 3. SCIENCE AND TECHNOLOGY ........................................................................... 45–53 • Inventions/Discoveries • Health/ Disease 4. ECOLOGY AND ENVIRONMENT ......................................................................... 54–55 5. SPORTS ................................................................................................................ 56–62 • Sports Personalities in News • Sport Events 6. AWARDS............................................................................................................... 63–70 7. PERSONS IN NEWS ............................................................................................ 71–74 8. MISCELLANEOUS .............................................................................................. -

View Annual Report

As filed with the Securities and Exchange Commission on July 12, 2018 UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F ‘ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR È ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended March 31, 2018 OR ‘ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to OR ‘ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report Commission file number 000-54189 KABUSHIKI KAISHA MITSUBISHI UFJ FINANCIAL GROUP (Exact name of Registrant as specified in its charter) MITSUBISHI UFJ FINANCIAL GROUP, INC. (Translation of Registrant’s name into English) Japan (Jurisdiction of incorporation or organization) 7-1, Marunouchi 2-chome Chiyoda-ku, Tokyo 100-8330 Japan (Address of principal executive offices) Kazutaka Yoneda, +81-3-3240-8111, +81-3-3240-7073, same address as above (Name, Telephone, Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common stock, without par value ................................................................. NewYork Stock Exchange(1) American depositary shares, each of which represents one share of common stock .......................... NewYork Stock Exchange (1) The listing of the registrant’s common stock on the New York Stock Exchange is for technical purposes only and without trading privileges. -

Law of Banking

LAW OF BANKING M. S. RAMA RAO B.Sc., M.A., M.L. Class-room live lectures edited, enlarged and updated Msrlawbooks 1 LAW OF BANKING By M S RAMA RAO B.Sc.,M.A.,M.l., 1 Page msrlawbooks LAW OF BANKING ……. 2 LAW OF BANKING CONTENTS 1 Chapter Page Chapter Page !. Banking Regulation Act 5. Pass Book 23 Meaning R.B.I. 3 Scope, Mistakes Banking Companies Nationalisation 6. Genera! Manager 25 Bankers Evidence Act 7. Negotiable Instruments 2. Customer & Banker 9 Definition 26 Relationship Assignability Genera! Lien,safety Vault Cheque Secrecy of Account Cheque & B/E Honoring of cheques B/E 3. Opening of Accounts 16 P/N Precautions Material alteration Minor’s account 8 Cheques Joint account Crossing 33 Partnership Bearer Companies Marked Cheque, date Married woman 9. Paying Banker 37 Purdanishin woman 10. Collecting Banker 39 Trust 11. Bank Advances H.U.F. Stock Exchange 42 4. Types of Accounts 21 Goods & documents Current Account 12. Miscellaneous F.D. 1. Travellers Cheque 44 S.B. 2. UTI Closing of Account IDBI 3. B/L 4. 5.Hundi 6.Garnishee order REFERENCE 59 2 Page msrlawbooks LAW OF BANKING ……. 3 CHAPTER 1 BANKING REGULATION ACT 1949 1.1 : Reserve Bank of India The Reserve Bank of India, which is the central bank of our nation, was established in 1935 under R.B.I.Act 1934. It took over the currency issue authority and credit control from the then Imperial Bank of India. The Bank was nationalised in 1948. Composition: Central Board of Directors : 20 Members; Headquarters : Bombay.