Ark Restaurants Corp

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Foxwoods Resort Casino Winstar Resort Casino Mohegan Sun Resort Casino

Foxwoods Resort Casino Winstar Resort Casino Mohegan Sun Resort Casino LOCATION Mashantucket, Connecticut Thackerville, Oklahoma Uncasville, Connecticut Hotel HOTELS 4 2 1 (2 by Fall 2016) HOTEL Rooms 2,266 1500 1200 (1600 by Fall 2016) HOTEL Amenities 2 Spas Spa Spa Gambling Legal Gambling Age 21 18 21 CASINO SIZE 323,376 Square Feet 519,000 square feet 300,000+ Square Feet SMOKE-FREE Designated areas on CASINO Designated areas on CASINO Designated areas on CASINO GAMING FLOOR FLOOR FLOOR # OF SLOTS & Electronic Games 5500 7,200 5000 Over 300 Tables - includes Over 300 Tables - includes 98 Tables - includes Midi Baccarat, Baccarat, Midi-Baccaran, Baccarat, Blackjack, Caribean Blackjack, Caribean Stud, Three Blackjack, Caribean Stud, Stud, Roulette, Three Card Card Poker, Card-based Craps & Roulette, Three Card Poker, Poker, Craps, Crazy 4 Poker, TABLE GAMES Roulette, Crazy 4 Poker, Spanish Craps, Crazy 4 Poker, Spanish Spanish 21, Let It Ride, Pai Gow 21, Let It Ride, Pai Gow Poker, 21, Let It Ride, Pai Gow Poker, Poker, Pai Gow Tiles, ‘Money’ ‘Money’ Wheel, Ultimate Texas Pai Gow Tiles, ‘Money’ Wheel, Wheel, Ultimate Texas Hold'Em, Mississippi Stud Ultimate Texas Hold'Em, Hold'Em, Mississippi Stud Mississippi Stud FOXWOODS REWARDS Four Momentum - 5 Levels. CLUB PASSPORT - Three Levels. REWARDS CLUB Levels - No affiliation to other Affiliated with Resorts (AC) & No affiliation to other casinos. casinos. Mohegan Sun Poconos (PA) POKER 97 Tables - WPT Affiliation 46 Smoke-free Tables 42 Smoke-free Tables ADDITIONAL Racebook; Bingo Center -

Structured Finance

Corporates Gaming / U.S.A. 2014 Outlook: U.S. Gaming Deleveraging Potential Outlook Report High Leverage Is So 2013: After a busy 2013, with a first-ever gaming/REIT spin-off and three Rating Outlook major debt-funded M&A transactions, gaming companies are positioned with solid FCF profiles, STABLE limited development prospects and stringent credit agreement provisions. Fitch Ratings believes this is a formula for meaningful deleveraging across the industry. Notable exceptions (2013: STABLE) could be the U.S.-based Macau operators, which will be ramping up developments on Cotai and currently maintain low leverage levels in Macau. A handful of lightly leveraged companies may also look to increase shareholder-friendly activity. Finally, a Gaming REIT: Fitch believes the entrance of REITs into the gaming sector will potentially drive up trading EV/EBITDA multiples, provide new sources of capital (e.g. sale and leaseback), create better transparency on the value of physical casino assets and the gaming licenses (retained by the operator) and possibly increase tolerance for higher leverage. Tepid Domestic Growth Prospects: 2014 casino openings in Ohio, Baltimore and possibly Lake Charles, LA will grow but also cannibalize their respective markets. Same-store growth will continue to be soft, although we project regional markets to fare better relative to 2013 as the effects from the sequester and the payroll tax holiday rollback will anniversary. Operators with exposure to the Las Vegas Strip and Macau will continue to benefit. We project 3% gaming revenue growth for the Las Vegas Strip (5% RevPAR growth) and 12% for Macau. Sector Outlook Greater Interest Rate Sensitivity: Many gaming companies used term loans to refinance STABLE fixed-rate notes or execute M&As. -

Casino Development: How Would Casinos Affect New England's

C Horn C A Symposium Sponsored by the Federal Reserve Bank of Boston Robert Tannenwald, Editor Special Report No. 2 Published in October 1995 Preface / iii Welcome and introduction / v Cathy E. Minehan Panel I: impact on income and Jobs The extent to which casino development fosters the economic growth of a state or local area has been vigorously debated. What evidence of the economic effects of casino development do we have, based on both theory and empirical research? What can New England ]earn from regions where casinos are more widespread? What are the methodological issues in estimating casinos’ impact on jobs and income? Introduction Robert Tannenwa]d The Impact of Casino Gambling on income and Jobs / 3 Ear] L. Grino]s Gambling and the Law®: Endless Fields of Dreams® I. Nelson Rose indian Gaming’s impact on income and Jobs / 47 S. Timothy Wapato High=Stakes Casinos and Economic Growth / 52 Arthur W. Wright Panel ll: Implica~ons for Public Sector Revenues Casinos pay substantial taxes and fees to state and local governments. What is the optimal way to tax casinos? To what extent do taxes and fees collected from casinos displace public revenue generated by other forms of state-sponsored gambling, such as lotteries and parimutuel betting? Do revenues from casino taxes displace revenues from sales taxes? Who ultimately bears the burden of casino taxes? introduction / 59 Gary S. Sasse The Promise of Public Revenue from Casinos Charles T. Clotfelter Steven D. Gold Finances: The Case of New Jersey / 74 Ran3ana G. Madhusudhan Perspective of the Treasurer of Massachusetts / 87 The Honorable Joseph D. -

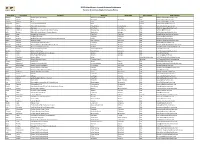

2013 Helmsbriscoe Annual Business Conference Partner Attendees Alpha Company Name

2013 HelmsBriscoe Annual Business Conference Partner Attendees Alpha Company Name First Name Last Name Company Work City Work State Work Country Email Address Patricia Baleyto Abama Golf & Spa Resort Santa Cruz de Tenerife Spain [email protected] Natalie Moran Accor New York New York USA [email protected] Ludovic Dupont Accor Paris France [email protected] Stephanie Tang Accor Global Sales Paris Paris France [email protected] Katie Schultz ACE Conference Center Philadelphia Pennsylvania USA [email protected] Madeline Aguiar Ace Hotel New York New York USA [email protected] Larry Atchison Albuquerque Convention & Visitors Bureau Albuquerque New Mexico USA [email protected] Beth Brown Alpharetta Convention & Visitors Bureau Alpharetta Georgia USA [email protected] Sheryl Lang Amsterdam Hospitality New York New York USA [email protected] David Katz Anaheim Marriott Anaheim California USA [email protected] Barbara Kenney Anaheim/Orange County Visitor & Convention Bureau Dallas Texas USA [email protected] Jamie Carrow Argonaut Hotel San Francisco California USA [email protected] Kara Schmitt Aria Resort & Casino & Vdara Las Vegas Nevada USA [email protected] Amanda Wilhelm Arizona Biltmore, A Waldorf Astoria Resort Phoenix Arizona USA [email protected] Deborah Academia Arizona Grand Resort & Spa Phoenix Arizona USA [email protected] Hal Davis Aruba Convention Bureau Jacksonville Beach Florida USA [email protected] -

Creating a Resort from a Resort

Spectrum Gaming Group LLC 1001 Tilton Road, Suite 201 Northfield NJ 08225 March 10, 2006 Economic Study, Feasibility Report Regarding proposed Pocono Manor casino/hotel complex Prepared for Matzel and Associates Acquisition LLC Executive Summary..................................................................................................................... 4 Introduction .................................................................................................................................. 6 Background: Capital investment ............................................................................................... 8 Working with public sector: parallel interests......................................................................... 9 Construction estimates.............................................................................................................. 11 Projecting gaming revenue....................................................................................................... 12 Core markets...........................................................................................................13 Gaming revenue model: assumptions...........................................................................13 Number of slots: Initial installation of 3,000 units.....................................................13 Determining optimal level of machines..................................................................... 17 Peak‐period analysis: Justifying 5,000 slots ...........................................................18 -

Steve Brecher Wins $1,025,500 Poker Palooza

FAIRWAY JAY’S MASTERS PREVIEW ROUNDERLIFE.com KEN DAVITIAN BORAT’S CHUM EXUDES CHARISMA AND CLASS ROY JONES JR Y’ALL MUST HAVE FORGOT STEVE BRECHER WINS $1,025,500 NICK BINGER SURVIVING LONGEST FINAL FROM $50 TABLE IN WPT HISTORY TO $1,000,000 ALL CANADIAN FINAL WSOP CIRCUIT EVENT FEATURED MONTREAL’S SAMUEL CHARTIER VS POKER TORONTO’S JOHN NIXON PALOOZA APRIL 2009 $4.95US DREAM A LITTLE DREAM INSIDE: POKER + ENTERTAINMENT + FOOD + MUSIC + SPOR T S + G I R L S Live the EXCLUSIVE WEB VIDEO AT ROUNDERLIFE.COM ROUNDER GIRLS AFTER DARK • PLAYER INTERVIEWS HOT NEWS AND EVENTS CASINO AND RESTAURANT REVIEWS BEHIND THE SCENE FOOTAGE LETTER FROM THE EDITOR Before you can be a legend, PUBLISHER You gotta get in the game. he World Series of Poker Circuit Event, recently held at Caesars Atlantic Greg McDonald - [email protected] City, has consistently become one of the most well attended events on the circuit schedule. e eleven tournaments that took place from Mach 4th - 14th attracted EDITOR-IN-CHIEF T Evert Caldwell - [email protected] over 5000 players and generated more than $3 million dollars in prize money. is years champion was 23 year old Montreal, Quebec native, Samuel Chartier. e young pro MANAGING EDITOR took home $322,944, and the Circuit Champion’s gold ring for his eff ort. Second place Johnny Kampis fi nisher John Nixon from Toronto, Ontario, made it an All Canadian fi nal. e full time student took home $177,619. Could this be the year a Canadian wins the WSOP Main CONTRIBUTING EDITOR Event ? Canadians were well represented at last years Main Event, making up the highest Dave Lukow percentage of players from a country outside of the US. -

Culberson Classic and $1.54 Million the 2008 Rounder of the Year Lee Childs Last Tango from Student to Teacher in Panama

FAIRWAY JAY’S TIPS ON BETTING COLLEGE BASKETBALL ROUNDERLIFE.com DAVID “CHINO” RHEEM MATT “CUB” WINS WPT DOYLE BRUNSON CULBERSON CLASSIC AND $1.54 MILLION THE 2008 ROUNDER OF THE YEAR LEE CHILDS LAST TANGO FROM STUDENT TO TEACHER IN PANAMA JANUARY 2009 $4.95US INSIDE: POKER + ENTERTAINMENT + FOOD + MUSIC + SPOR T S + G I R L S Hard Rock Hotel Biloxi is proud to announce we have achieved Four Diamond status. 777 BEACH BLVD. BILOXI, MS 39530 | 877.877.6256 | hardrockbiloxi.com LETTER FROM THE EDITOR PUBLISHER Greg McDonald EDITOR-IN-CHIEF with the Southern Evert Caldwell Poker Championship. e two weeks of non stop tournament action get under way Friday January 2nd, with single and mega satellites. ere are a variety of poker MANAGING EDITOR disciplines to choose from including No-Limit Hold ‘Em, Seven Card Stud, Limit Hold ‘Em, Johnny Kampis Seven Card Stud 8 or Better, Omaha 8 or Better, Pot Limit Omaha and Horse. e Buy- CONTRIBUTING EDITOR Ins range from $300 to the $10,000 WPT televised Main Event. Bill Edler won last year’s Dave Lukow championship in dramatic fashion. After being all in on his big blind with 17 players left, Edler came back to capture fi rst place and $747,615. is event is expected to be one of the ART & DESIGN biggest poker events to date in the Southern Region. Casey Wiesel, Nathan Hess, Whitney Prewitt John Phan fi nished 2008 as the number one ranked player in the world in most scoring PHOTOGRAPHY Jack Criswell, Marty McBride systems that include world wide tournaments. -

The Impact of Casino Revenue-Sharing on Tourism Efforts in Niagara Falls USA: 2006-2016

State University of New York College at Buffalo - Buffalo State College Digital Commons at Buffalo State Public Administration Master’s Projects Public Administration 12-2017 The mpI act of Casino Revenue-Sharing on Tourism Efforts in Niagara Falls USA: 2006-2016 Anthony L. Astran State University of New York College at Buffalo - Buffalo State College, [email protected] Advisor Laurie A. Buonanno, Ph.D. First Reader Laurie A. Buonanno, Ph.D. Second Reader Frank V. Ciaccia, MPA Third Reader James A. Gold, Ph.D. To learn more about the and its educational programs, research, and resources, go to http://publicadministration.buffalostate.edu/. Recommended Citation Astran, Anthony L., "The mpI act of Casino Revenue-Sharing on Tourism Efforts in Niagara Falls USA: 2006-2016" (2017). Public Administration Master’s Projects. 22. http://digitalcommons.buffalostate.edu/mpa_projects/22 Follow this and additional works at: http://digitalcommons.buffalostate.edu/mpa_projects Part of the Advertising and Promotion Management Commons, Gaming and Casino Operations Management Commons, Marketing Commons, Public Administration Commons, Public Relations and Advertising Commons, Recreation, Parks and Tourism Administration Commons, Tourism Commons, Tourism and Travel Commons, Urban Studies Commons, and the Urban Studies and Planning Commons The Impact of Casino Revenue-Sharing on Tourism Efforts in Niagara Falls USA: 2006-2016 Tony Astran, APR In partial fulfillment of requirements for PAD 690 Masters Project SUNY Buffalo State December 14, 2017 Project Adviser: Laurie A. Buonanno, Ph.D. Second Readers: Frank V. Ciaccia, MPA; James A. Gold, Ph.D. ABSTRACT This qualitative case study examines the intersection of a Native-owned casino, revenue- sharing with its host community, and the impact of tourism marketing efforts vis-à-vis funds provided to the community’s tourism agency. -

2016 Salary Index & Casino Update

HUMAN CAPITAL Marc Weiswasser 2016 SALARY INDEX & CASINO UPDATE As of this writing the presi- • Small Casino: 300-999 machines Table Games dential race is neck and neck • Midsized Casino: 1,000-1,999 machines In the U.S. there are a total of 21,811 table between Hillary Clinton and • Large Casino: 2,000-2,999 machines games, which is down by 326 YOY. Let's utilize Donald Trump, and by the • Mega Casino: More than 3,000 machines this chart to classify table games (excluding time you read this the win- poker): ner will have been selected. I Utilizing this chart, we find there are a total have not made up my mind of 647 casinos in these categories, down by 3 • Small Casino: 1-19 tables as to who will be the best YOY. There are 344 small casinos (down by • Midsized Casino: 20-69 tables candidate, however, in full disclosure I lost money 3); 200 midsized casinos (up by 1); 78 large • Large Casino: 70-149 tables not once, but twice on Trump stock in the 80s casinos (down by 2); and 25 mega casinos (up • Mega Casino: More than 150 tables when he went bankrupt on my naïve, but hopeful by 1). investments. So I am not about to make any pre- Breaking down the numbers, in the U.S. there dictions at this time, but enough about politics Mega Casinos a total of 849 properties that house at least and onto something we know is a certainty. Four of the top five mega properties in the one table game (down by 18 YOY). -

Case 15-10104-LSS Doc 309 Filed 04/08/15 Page 1 of 98

Case 15-10104-LSS Doc 309 Filed 04/08/15 Page 1 of 98 UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE In re: Chapter 11 HIPCRICKET, INC.,1 Case No. 15-10104 (LSS) Debtor. AFFIDAVIT OF SERVICE STATE OF CALIFORNIA } } ss.: COUNTY OF LOS ANGELES } DARLEEN SAHAGUN, being duly sworn, deposes and says: 1. I am employed by Rust Consulting/Omni Bankruptcy, located at 5955 DeSoto Avenue, Suite 100, Woodland Hills, CA 91367. I am over the age of eighteen years and am not a party to the above-captioned action. 2. On April 3, 2015, I caused to be served the: a) Notice of (I) Conditional Approval of the Amended Disclosure Statement; (II) Hearing to Consider Confirmation of the Plan; (III) Deadline for Filing Objections to Confirmation of the Plan; (IV) Deadline for Voting on the Plan; and (V) Bar Date for Filing Administrative Claims Established by the Plan, (the “Notice”), b) Amended Plan of Reorganization of the Debtor Dated March 31, 2015 [Docket No. 293], c) Amended Disclosure Statement for the Plan of Reorganization of Hipcricket, Inc. [Docket No. 294], d) Committee Plan Support Letter (re: Recommendation of Creditors’ Committee in Favor of Chapter 11 Plan of Reorganization), (2a through 2d collectively referred to as the “Solicitation Package”) e) Class 3 General Unsecured Claims Ballot to Accept or Reject Chapter 11 Plan of Reorganization (the “Class 3 Ballot”), 1 The last four digits of the Debtor’s tax identification number are 2076. The location of the Debtor’s headquarters and the service address for the Debtor is 110 110th Avenue NE. -

Stephen J. Karoul

Curriculum Vitae Stephen J. Karoul Career summary: As one of the world's more experienced casino marketing executives, I have helped establish creative marketing programs for casinos in North and South America, Asia, the Middle East, Africa and Europe. I have worked for some of the leading gaming companies in the world and have an exceptional record of success. With an excellent track record for almost four decades, I bring many unique skills, incredible contacts and knowledge combined with hands-on experience from over 125 countries which help lead to positive business results for my clients. WORK EXPERIENCE: Euro-Asia Consulting: June 30, 2001 to Present – Casino and Business Consulting. As Founder & CEO of a small boutique casino consulting company I have the luxury to pick and choose from numerous different types of consulting opportunities both gaming and non-gaming. Most of my work comes from word of mouth referrals from industry peers and from past satisfied clients. www.euroasiacasino.com is quite unique and viewed as an industry resource for information in addition to consulting expertise. Foxwoods Resort Casino / MGM Grand at Foxwoods: August 19, 2010 to May 13, 2011: (Second tour – eight years total) Vice President of Casino Marketing responsible for Player Development, Casino Hosts, Casino Sales Executives, Casino Coordinators, New Business Development, Casino Bus Marketing, Asian Marketing, International Marketing, Junkets and our Butler staff. I also worked to help optimize and maximize revenue from our Poker and Bingo Operations in addition to Table Games and Slots. I was the originator of several innovative new concepts that included Team Hosting – Team Selling, the CCZ (Customer Comfort Zone) and Collateralized Casino Credit among other creative new ideas. -

Where Is the Industry Heading?

REPOR MARCH.APRIL 2015 15-03-19 2:06 PM T MEETINGS INCENTIVE TRAVEL CONFERENCES CONVENTIONS EXHIBITIONS SOURCING DESTINATIONS REWARDS MEASUREMENTS BUDGETS PROCUREMENT TECHNOLOGY MARKETING SOCIAL MEDIA ATTENDEES SHOW MANAGERS CORPORATE 2015 2015 GOVERNMENT WHERE IS THE INDUSTRY HEADING? MARKE BUSINESS EVENTS+TECHNOLOGY+PROFESSIONAL DEVELOPMENT+DESTINATIONS+REWARDS+ ASSOCIATION THIRD-PARTY PLANNERS SUCCESS PM 40069240 EDUCATION IN p01-03 Cover4.indd 1 Global sales expertise that links you to a world of possibilities. ARIZONA FLORIDA (con’t) MASSACHUSETTS TENNESSEE BERMUDA* Arizona Grand Resort & Spa Loews Royal Pacific InterContinental Boston Loews Vanderbilt Hotel Elbow Beach Resort Fairmont Scottsdale Princess at Universal Orlando® Loews Boston Hotel The Peabody Hotel Fairmont Hamilton Princess Loews Ventana Canyon Naples Grande Beach Resort Ocean Edge Resort & Golf Club Fairmont Southampton Omni Scottsdale Resort & Spa Ocean Reef Club Seaport Hotel & World TEXAS Newstead Belmont Hills A world of possibilities... Royal Palms Resort and Spa Omni Orlando Resort at Trade Center At&T Executive Education Golf Resort & Spa The Wigwam ChampionsGate The Langham Boston and Conference Center Rosewood Tucker’s Point One Ocean Resort & Spa Hotel Valencia Riverwalk The Reefs Resort & Club CALIFORNIA PGA National Resort & Spa MICHIGAN InterContinental Dallas Bacara Resort & Spa Ponte Vedra Inn & Club Amway Grand Plaza La Cantera Hill Country Resort CANADA Hard Rock Hotel San Diego Ponte Vedra Lodge & Club MGM Grand Detroit Omni Dallas Hotel Loews Hotel