Daito Trust Construction Co., Ltd. 16-1, Konan 2-Chome, Minato-Ku, Tokyo

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Japan 500 2010 A-Z

FT Japan 500 2010 A-Z Japan rank Company 2010 77 Bank 305 Abc-Mart 280 Accordia Golf 487 Acom 260 Adeka 496 Advantest 156 Aeon 85 Aeon Credit Service 340 Aeon Mall 192 Air Water 301 Aisin Seiki 89 Ajinomoto 113 Alfresa Holdings 300 All Nippon Airways 109 Alps Electric 433 Amada 213 Aoyama Trading 470 Aozora Bank 293 Asahi Breweries 86 Asahi Glass 55 Asahi Kasei 104 Asics 330 Astellas Pharma 40 Autobacs Seven 451 Awa Bank 413 Bank of Iwate 472 Bank of Kyoto 208 Bank of Yokohama 123 Benesse Holdings 170 Bridgestone 52 Brother Industries 212 Canon 6 Canon Marketing Japan 320 Capcom 428 Casio Computer 310 Central Glass 484 Central Japan Railway 42 Century Tokyo Leasing 397 Chiba Bank 144 Chiyoda 264 Chubu Electric Power 35 Chugai Pharmaceuticals 71 Chugoku Bank 224 Chugoku Electric Power 107 Chuo Mitsui Trust 130 Circle K Sunkus 482 Citizen Holding 283 Coca-Cola West 345 Comsys Holdings 408 Cosmo Oil 323 Credit Saison 247 Dai Nippon Printing 81 Daicel Chemical Industries 271 Daido Steel 341 Daihatsu Motor 185 Daiichi Sankyo 56 Daikin Industries 59 Dainippon Screen Mnfg. 453 Dainippon Sumitomo Pharma 201 Daio Paper 485 Japan rank Company 2010 Daishi Bank 426 Daito Trust Construction 137 Daiwa House Industry 117 Daiwa Securities Group 84 Dena 204 Denki Kagaku Kogyo 307 Denso 22 Dentsu 108 Dic 360 Disco 315 Don Quijote 348 Dowa 339 Duskin 448 Eaccess 486 East Japan Railway 18 Ebara 309 Edion 476 Eisai 70 Electric Power Development 140 Elpida Memory 189 Exedy 454 Ezaki Glico 364 Familymart 226 Fancl 439 Fanuc 23 Fast Retailing 37 FCC 493 FP 500 Fuji Electric 326 Fuji Heavy Industries 186 Fuji Media 207 Fuji Oil 437 Fujifilm 38 Fujikura 317 Fujitsu 54 Fukuoka Financial 199 Fukuyama Transp. -

Published on July 21, 2021 1. Changes in Constituents 2

Results of the Periodic Review and Component Stocks of Tokyo Stock Exchange Dividend Focus 100 Index (Effective July 30, 2021) Published on July 21, 2021 1. Changes in Constituents Addition(18) Deletion(18) CodeName Code Name 1414SHO-BOND Holdings Co.,Ltd. 1801 TAISEI CORPORATION 2154BeNext-Yumeshin Group Co. 1802 OBAYASHI CORPORATION 3191JOYFUL HONDA CO.,LTD. 1812 KAJIMA CORPORATION 4452Kao Corporation 2502 Asahi Group Holdings,Ltd. 5401NIPPON STEEL CORPORATION 4004 Showa Denko K.K. 5713Sumitomo Metal Mining Co.,Ltd. 4183 Mitsui Chemicals,Inc. 5802Sumitomo Electric Industries,Ltd. 4204 Sekisui Chemical Co.,Ltd. 5851RYOBI LIMITED 4324 DENTSU GROUP INC. 6028TechnoPro Holdings,Inc. 4768 OTSUKA CORPORATION 6502TOSHIBA CORPORATION 4927 POLA ORBIS HOLDINGS INC. 6503Mitsubishi Electric Corporation 5105 Toyo Tire Corporation 6988NITTO DENKO CORPORATION 5301 TOKAI CARBON CO.,LTD. 7011Mitsubishi Heavy Industries,Ltd. 6269 MODEC,INC. 7202ISUZU MOTORS LIMITED 6448 BROTHER INDUSTRIES,LTD. 7267HONDA MOTOR CO.,LTD. 6501 Hitachi,Ltd. 7956PIGEON CORPORATION 7270 SUBARU CORPORATION 9062NIPPON EXPRESS CO.,LTD. 8015 TOYOTA TSUSHO CORPORATION 9101Nippon Yusen Kabushiki Kaisha 8473 SBI Holdings,Inc. 2.Dividend yield (estimated) 3.50% 3. Constituent Issues (sort by local code) No. local code name 1 1414 SHO-BOND Holdings Co.,Ltd. 2 1605 INPEX CORPORATION 3 1878 DAITO TRUST CONSTRUCTION CO.,LTD. 4 1911 Sumitomo Forestry Co.,Ltd. 5 1925 DAIWA HOUSE INDUSTRY CO.,LTD. 6 1954 Nippon Koei Co.,Ltd. 7 2154 BeNext-Yumeshin Group Co. 8 2503 Kirin Holdings Company,Limited 9 2579 Coca-Cola Bottlers Japan Holdings Inc. 10 2914 JAPAN TOBACCO INC. 11 3003 Hulic Co.,Ltd. 12 3105 Nisshinbo Holdings Inc. 13 3191 JOYFUL HONDA CO.,LTD. -

NSCC Important Notice

OTC# 206 Date: October 23, 2008 To: ALL PARTICIPANTS - OTC COMPARISON SYSTEM CASHIER, MANAGER REORGANIZATION Attention: OPERATIONS PARTNER/OFFICER, MANAGER P&S DEPT. CASHIER, MANAGER REORGANIZATION, GLOSSARY DEPT UPDATES TO THE LIST OF OTC CLEARED SECURITIES From: Underwriting Subject: OTC THIS NSCC OTC IMPORTANT NOTICE IS NOW AVAILABLE ON THE NSCC WEB SITE. THE WEB SITE WWW.DTCC.COM IS PASSWORD PROTECTED AND IS OPEN TO ALL FULL-SETTLING MEMBERS OR OTHER NSCC PARTICIPANTS. FIRMS THAT WANT ACCESS TO THE NOTICES OF CHANGES TO THE LIST OF OTC CLEARED SECURITIES SHOULD CALL THEIR NSCC ACCOUNT MANAGER AT 800-422- 0582 TO OBTAIN THE APPROPRIATE INFORMATION FOR ACCESS. UPDATE CUSIP # SYMBOL NAME DATE ADD G6481L101 NWCYF NEW CITY ENERGY LTD, ST HELIER 10/23/2008 ORDINARY SHARES (JERSEY) ADD N70967117 KNLJF KONINKLIJKE DELFTSCH 10/23/2008 AARDEWERK-FABRIEK DE PORCELEYNE FLES OR ADD *** Y2560F107 FSRCF FIRST RESOURCES LTD ORDINARY 10/23/2008 SHARES (SINGAPORE) ADD 00289R102 ABGOY ABENGOA SA UNSPONSORED ADR 10/23/2008 (SPAIN) ADD 004326104 ACXIY ACCIONA SA UNSPONSORED ADR 10/23/2008 (SPAIN) ADD 00444E103 ANIOY ACERINOX SA UNSPONSORED ADR 10/23/2008 (SPAIN) ADD 019146109 AECJY ALLIED ELECTRONICS CORP LTD 10/23/2008 UNSPONSORED ADR (SOUTH AFRICA) ADD 04313V204 AKPN ARTHUR KAPLAN COSMETICS, INC. 10/23/2008 COMMON STOCK ADD 05355Q102 AVEPY AVENG LTD UNSPONSORED ADR 10/23/2008 (SOUTH AFRICA) ADD 058779109 BLHEY BALOISE HOLDING AG UNSPONSORED 10/23/2008 Non-Confidential DTCC is now offering enhanced access to all important notices via a new, Web-based subscription service. The new notification system leverages RSS Newsfeeds, providing significant benefits including real-time updates and customizable delivery. -

JPX-Nikkei Index 400 Constituents (Applied on August 31, 2021) Published on August 6, 2021 No

JPX-Nikkei Index 400 Constituents (applied on August 31, 2021) Published on August 6, 2021 No. of constituents : 400 (Note) The No. of constituents is subject to change due to de-listing. etc. (Note) As for the market division, "1"=1st section, "2"=2nd section, "M"=Mothers, "J"=JASDAQ. Code Market Divison Issue Code Market Divison Issue 1332 1 Nippon Suisan Kaisha,Ltd. 3048 1 BIC CAMERA INC. 1417 1 MIRAIT Holdings Corporation 3064 1 MonotaRO Co.,Ltd. 1605 1 INPEX CORPORATION 3088 1 Matsumotokiyoshi Holdings Co.,Ltd. 1719 1 HAZAMA ANDO CORPORATION 3092 1 ZOZO,Inc. 1720 1 TOKYU CONSTRUCTION CO., LTD. 3107 1 Daiwabo Holdings Co.,Ltd. 1721 1 COMSYS Holdings Corporation 3116 1 TOYOTA BOSHOKU CORPORATION 1766 1 TOKEN CORPORATION 3141 1 WELCIA HOLDINGS CO.,LTD. 1801 1 TAISEI CORPORATION 3148 1 CREATE SD HOLDINGS CO.,LTD. 1802 1 OBAYASHI CORPORATION 3167 1 TOKAI Holdings Corporation 1803 1 SHIMIZU CORPORATION 3231 1 Nomura Real Estate Holdings,Inc. 1808 1 HASEKO Corporation 3244 1 Samty Co.,Ltd. 1812 1 KAJIMA CORPORATION 3254 1 PRESSANCE CORPORATION 1820 1 Nishimatsu Construction Co.,Ltd. 3288 1 Open House Co.,Ltd. 1821 1 Sumitomo Mitsui Construction Co., Ltd. 3289 1 Tokyu Fudosan Holdings Corporation 1824 1 MAEDA CORPORATION 3291 1 Iida Group Holdings Co.,Ltd. 1860 1 TODA CORPORATION 3349 1 COSMOS Pharmaceutical Corporation 1861 1 Kumagai Gumi Co.,Ltd. 3360 1 SHIP HEALTHCARE HOLDINGS,INC. 1878 1 DAITO TRUST CONSTRUCTION CO.,LTD. 3382 1 Seven & I Holdings Co.,Ltd. 1881 1 NIPPO CORPORATION 3391 1 TSURUHA HOLDINGS INC. 1893 1 PENTA-OCEAN CONSTRUCTION CO.,LTD. -

Integrated Report 2020 Daiwa House Group Integrated Report 2020 30 Chapter Developing Our Businesses

Chapter Developing our Businesses Business Overview Summary of business Annual performance The Story of the Group’s Value Creation Single-Family Houses Bolstering competitiveness by expanding business opportunities deriving As a pioneer of industrialized construction, we build Houses sold (Domestic) housing infrastructure—the homes so essential to peo- Single-family houses from social issues ple’s wellbeing. Offering a rich product lineup designed (contracting) 5,917 to accommodate all thinkable needs for safe and enrich- Single-family houses Daiwa House Industry has evolved a distinctive business portfolio by addressing social issues through enhanced and expanded value chains ing living environments, we build both subdivisions and (subdivision) 2,066 custom houses. ZEH ratio 41% and broader product variations anticipating future needs. This diverse portfolio and the ability it gives us to draw on Group synergies enable us to offer customers comprehensive business proposals, the ultimate strength that drives our performance and growth. Leveraging this strength, we contribute to society by redeveloping existing communities as well as building whole new ones with a consistent vision. Our Rental Housing Business accommodates diversifying Rental Housing Rental housing units sold rental-housing needs. Our services feature vertically (Domestic) Message from the CEO integrated support from soil evaluation to design, Rental housing (low-rise) 31,334 FY2019 principal performance indices by business segment construction, and handover for landowners -

Global-Recon-2020-Japan.Pdf

SAVE THE DATE Global REcon 2020 REconnaissance of Global REal Estate Conference May 19 – 21, 2020 | Otemachi Tower, Tokyo Join leading REITs and Real Estate executives at Mizuho’s Global Real Estate Conference in Tokyo. Our conference will feature 1x1 meetings with REITs, Developers, Infrastructure and related companies from around the world. Some thematic small will be hosted. Yoshihiro Hashimoto (Japan Real Estate AN) and Yosuke Ohata (Japan REIT AN) will also host a tour, providing access to sites relating to key sector topics. REGISTRATION OPEN For more information, please contact your Mizuho representative or Corporate Access at [email protected] mizuho-sc.com/english Mizuho Securities Co., Ltd. Mizuho Securities Co., Ltd. Participating Corporates Invited 65 Corporates Mizuho Securities Co., Ltd. Invited 29 REITs Focus ADTV Market # TICKER Company Name Attendance Description Sector 6 mths* Cap* 1 3292 JP AEON REIT INVESTMENT CORP Confirmed Commercial REIT 8.9 2572.3 invests mainly in suburban shopping centers invests mainly in commercial properties which are 2 3453 JP KENEDIX RETAIL REIT CORP Confirmed Commercial REIT 7.8 1325.7 shopping centers, and super markets INVINCIBLE INVESTMENT 3 8963 JP Confirmed Hotel REIT 20.6 3284.2 Invests primarily in hotel and residential assets CORP 4 3478 JP MORI TRUST HOTEL REIT INC Hotel REIT 1.6 703.0 invests in Hotels and related facilities invests in real estate properties used for logistics 5 3283 JP NIPPON PROLOGIS REIT INC Confirmed Logistics REIT 19.5 6430.0 businesses focuses on investing in logistics facilities in Tokyo and 6 3466 JP LASALLE LOGIPORT REIT Confirmed Logistics REIT 11.0 2074.4 Osaka area 7 2979 JP SOSILA LOGISTICS REIT INC Logistics REIT 11.1 573.8 invests in logistics facilities and other fields. -

TOPIX100 Constituents (As of October 31, 2019) No. Code Issue No. Code Issue 1 1605 INPEX CORPORATION 51 7201 NISSAN MOTOR CO.,LTD

TOPIX100 Constituents (as of October 31, 2019) No. Code Issue No. Code Issue 1 1605 INPEX CORPORATION 51 7201 NISSAN MOTOR CO.,LTD. 2 1878 DAITO TRUST CONSTRUCTION CO.,LTD. 52 7202 ISUZU MOTORS LIMITED 3 1925 DAIWA HOUSE INDUSTRY CO.,LTD. 53 7203 TOYOTA MOTOR CORPORATION 4 1928 Sekisui House,Ltd. 54 7267 HONDA MOTOR CO.,LTD. 5 2502 Asahi Group Holdings,Ltd. 55 7269 SUZUKI MOTOR CORPORATION 6 2503 Kirin Holdings Company,Limited 56 7270 SUBARU CORPORATION 7 2802 Ajinomoto Co.,Inc. 57 7733 OLYMPUS CORPORATION 8 2914 JAPAN TOBACCO INC. 58 7741 HOYA CORPORATION 9 3382 Seven & I Holdings Co.,Ltd. 59 7751 CANON INC. 10 3402 TORAY INDUSTRIES,INC. 60 7832 BANDAI NAMCO Holdings Inc. 11 3407 ASAHI KASEI CORPORATION 61 7974 Nintendo Co.,Ltd. 12 4063 Shin-Etsu Chemical Co.,Ltd. 62 8001 ITOCHU Corporation 13 4188 Mitsubishi Chemical Holdings Corporation 63 8002 Marubeni Corporation 14 4452 Kao Corporation 64 8031 MITSUI & CO.,LTD. 15 4502 Takeda Pharmaceutical Company Limited 65 8035 Tokyo Electron Limited 16 4503 Astellas Pharma Inc. 66 8053 SUMITOMO CORPORATION 17 4507 Shionogi & Co.,Ltd. 67 8058 Mitsubishi Corporation 18 4519 CHUGAI PHARMACEUTICAL CO.,LTD. 68 8113 UNICHARM CORPORATION 19 4523 Eisai Co.,Ltd. 69 8267 AEON CO.,LTD. 20 4528 ONO PHARMACEUTICAL CO.,LTD. 70 8306 Mitsubishi UFJ Financial Group,Inc. 21 4543 TERUMO CORPORATION 71 8308 Resona Holdings, Inc. 22 4568 DAIICHI SANKYO COMPANY,LIMITED 72 8309 Sumitomo Mitsui Trust Holdings,Inc. 23 4578 Otsuka Holdings Co.,Ltd. 73 8316 Sumitomo Mitsui Financial Group,Inc. 24 4661 ORIENTAL LAND CO.,LTD. -

Stoxx® Japan 600 Esg-X Index

STOXX® JAPAN 600 ESG-X INDEX Components1 Company Supersector Country Weight (%) Toyota Motor Corp. Automobiles & Parts Japan 3.87 Sony Corp. Consumer Products & Services Japan 2.55 Softbank Group Corp. Telecommunications Japan 2.44 Keyence Corp. Industrial Goods & Services Japan 1.77 RECRUIT HOLDINGS Industrial Goods & Services Japan 1.54 Mitsubishi UFJ Financial Group Banks Japan 1.48 Shin-Etsu Chemical Co. Ltd. Chemicals Japan 1.36 Nippon Telegraph & Telephone C Telecommunications Japan 1.36 Nintendo Co. Ltd. Consumer Products & Services Japan 1.30 Nidec Corp. Technology Japan 1.30 Fast Retailing Co. Ltd. Retail Japan 1.25 Daikin Industries Ltd. Construction & Materials Japan 1.19 Takeda Pharmaceutical Co. Ltd. Health Care Japan 1.18 Tokyo Electron Ltd. Technology Japan 1.16 Honda Motor Co. Ltd. Automobiles & Parts Japan 1.10 Daiichi Sankyo Co. Ltd. Health Care Japan 1.08 Sumitomo Mitsui Financial Grou Banks Japan 1.04 Murata Manufacturing Co. Ltd. Technology Japan 1.03 KDDI Corp. Telecommunications Japan 1.02 Hitachi Ltd. Industrial Goods & Services Japan 0.92 Itochu Corp. Industrial Goods & Services Japan 0.92 Fanuc Ltd. Industrial Goods & Services Japan 0.90 Hoya Corp. Health Care Japan 0.84 Mitsubishi Corp. Industrial Goods & Services Japan 0.83 Mizuho Financial Group Inc. Banks Japan 0.76 SOFTBANK Telecommunications Japan 0.75 Denso Corp. Automobiles & Parts Japan 0.72 Mitsui & Co. Ltd. Industrial Goods & Services Japan 0.71 Tokio Marine Holdings Inc. Insurance Japan 0.70 Oriental Land Co. Ltd. Travel & Leisure Japan 0.68 SMC Corp. Industrial Goods & Services Japan 0.68 Mitsubishi Electric Corp. Industrial Goods & Services Japan 0.67 Seven & I Holdings Co. -

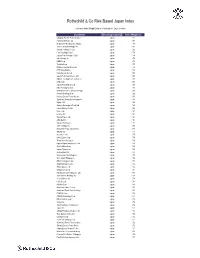

R&Co Risk-Based Japan Index

Rothschild & Co Risk-Based Japan Index Indicative Index Weight Data as of June 30, 2021 on close Constituent Exchange Country Index Weight(%) McDonald's Holdings Co Japan L Japan 1.29 Idemitsu Kosan Co Ltd Japan 1.12 SoftBank Corp Japan 1.05 Nintendo Co Ltd Japan 0.86 Hitachi Metals Ltd Japan 0.83 Yakult Honsha Co Ltd Japan 0.82 Iwatani Corp Japan 0.81 ENEOS Holdings Inc Japan 0.79 FUJIFILM Holdings Corp Japan 0.78 KDDI Corp Japan 0.75 Toshiba Corp Japan 0.73 Calbee Inc Japan 0.73 Ajinomoto Co Inc Japan 0.72 Eisai Co Ltd Japan 0.72 Nissin Foods Holdings Co Ltd Japan 0.71 Morinaga Milk Industry Co Ltd Japan 0.70 Japan Tobacco Inc Japan 0.66 H.U. Group Holdings Inc Japan 0.66 JCR Pharmaceuticals Co Ltd Japan 0.64 MEIJI Holdings Co Ltd Japan 0.64 Yamazaki Baking Co Ltd Japan 0.63 Chugoku Electric Power Co Inc/ Japan 0.63 Nippon Gas Co Ltd Japan 0.63 PeptiDream Inc Japan 0.62 Chubu Electric Power Co Inc Japan 0.62 Seven & i Holdings Co Ltd Japan 0.62 FP Corp Japan 0.61 Pola Orbis Holdings Inc Japan 0.61 Lion Corp Japan 0.61 Shiseido Co Ltd Japan 0.60 Nippon Telegraph & Telephone C Japan 0.60 Nichirei Corp Japan 0.59 Japan Post Bank Co Ltd Japan 0.59 Kobayashi Pharmaceutical Co Lt Japan 0.59 Anritsu Corp Japan 0.58 Skylark Holdings Co Ltd Japan 0.58 Kyowa Kirin Co Ltd Japan 0.58 Lawson Inc Japan 0.58 Suntory Beverage & Food Ltd Japan 0.57 Kinden Corp Japan 0.57 MS&AD Insurance Group Holdings Japan 0.56 Shimano Inc Japan 0.56 Mitsubishi Corp Japan 0.56 Zensho Holdings Co Ltd Japan 0.56 Tokai Carbon Co Ltd Japan 0.56 Japan Post Holdings Co Ltd -

Rothschild & Co Risk-Based Japan Index

Rothschild & Co Risk-Based Japan Index Indicative Index Weight Data as of January 31, 2020 on close Constituent Exchange Country Index Weight (%) Chugoku Electric Power Co Inc/ Japan 1.01 Yamada Denki Co Ltd Japan 0.91 McDonald's Holdings Co Japan L Japan 0.88 Sushiro Global Holdings Ltd Japan 0.82 Skylark Holdings Co Ltd Japan 0.82 Fast Retailing Co Ltd Japan 0.78 Japan Post Holdings Co Ltd Japan 0.78 Ain Holdings Inc Japan 0.78 KDDI Corp Japan 0.77 Toshiba Corp Japan 0.75 Mizuho Financial Group Inc Japan 0.74 NTT DOCOMO Inc Japan 0.73 Kobe Bussan Co Ltd Japan 0.72 Japan Post Insurance Co Ltd Japan 0.69 Nippon Telegraph & Telephone C Japan 0.69 LINE Corp Japan 0.69 Japan Post Bank Co Ltd Japan 0.68 Nitori Holdings Co Ltd Japan 0.67 MS&AD Insurance Group Holdings Japan 0.66 Konami Holdings Corp Japan 0.66 Kyushu Electric Power Co Inc Japan 0.65 Sumitomo Realty & Development Japan 0.65 Fujitsu Ltd Japan 0.63 Suntory Beverage & Food Ltd Japan 0.63 Japan Airlines Co Ltd Japan 0.62 NEC Corp Japan 0.61 Lawson Inc Japan 0.60 Sekisui House Ltd Japan 0.60 ABC-Mart Inc Japan 0.60 Kyushu Railway Co Japan 0.60 ANA Holdings Inc Japan 0.59 Mitsubishi Heavy Industries Lt Japan 0.58 ORIX Corp Japan 0.57 Secom Co Ltd Japan 0.57 Seiko Epson Corp Japan 0.56 Trend Micro Inc/Japan Japan 0.56 Nippon Paper Industries Co Ltd Japan 0.56 Suzuki Motor Corp Japan 0.56 Japan Tobacco Inc Japan 0.55 Aozora Bank Ltd Japan 0.55 Sony Financial Holdings Inc Japan 0.55 West Japan Railway Co Japan 0.54 MEIJI Holdings Co Ltd Japan 0.54 Sugi Holdings Co Ltd Japan 0.54 Tokyo -

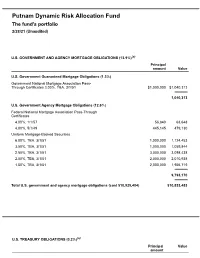

Dynamic Risk Allocation Fund Q3 Portfolio Holdings

Putnam Dynamic Risk Allocation Fund The fund's portfolio 2/28/21 (Unaudited) U.S. GOVERNMENT AND AGENCY MORTGAGE OBLIGATIONS (13.9%)(a) Principal amount Value U.S. Government Guaranteed Mortgage Obligations (1.3%) Government National Mortgage Association Pass- Through Certificates 3.00%, TBA, 3/1/51 $1,000,000 $1,040,313 1,040,313 U.S. Government Agency Mortgage Obligations (12.6%) Federal National Mortgage Association Pass-Through Certificates 4.00%, 1/1/57 56,840 63,648 4.00%, 5/1/49 445,145 479,130 Uniform Mortgage-Backed Securities 6.00%, TBA, 3/1/51 1,000,000 1,124,453 3.50%, TBA, 3/1/51 1,000,000 1,059,844 2.50%, TBA, 3/1/51 3,000,000 3,098,438 2.00%, TBA, 3/1/51 2,000,000 2,010,938 1.50%, TBA, 3/1/51 2,000,000 1,956,719 9,793,170 Total U.S. government and agency mortgage obligations (cost $10,925,404) $10,833,483 U.S. TREASURY OBLIGATIONS (0.2%)(a) Principal Value amount U.S. Treasury Notes 2.00%, 4/30/24(i) $116,000 $122,910 Total U.S. treasury obligations (cost $122,910) $122,910 COMMON STOCKS (11.8%)(a) Shares Value Basic materials (1.3%) Anglo American PLC (United Kingdom) 2,799 $107,695 BHP Billiton, Ltd. (Australia) 438 16,558 BHP Group PLC (United Kingdom) 2,150 67,954 Compagnie De Saint-Gobain (France)(NON) 1,992 106,724 Covestro AG (Germany) 1,509 109,200 CRH PLC (Ireland) 1,562 67,483 Eiffage SA (France)(NON) 425 43,652 Fortescue Metals Group, Ltd. -

Calling on the Japanese Government to Raise Its 2030 Renewable Energy Target to 40-50%

18th January 2021 Calling on the Japanese government to raise its 2030 renewable energy target to 40-50% With commitments by EU countries, Japan, South Korea, Canada, New Zealand, and with the United States intending to join this year, ‘carbon neutral by 2050’ has become a common goal of more than 120 countries around the globe. Key to meeting the goal is the promotion of a rapid and significant expansion of renewable energy along with improvements in energy efficiency. EU countries and U.S. states have already set progressive goals to be reached by 2030, ranging from 40-74% share in each electricity mix. In contrast, Japan’s target shares of renewable energy for fiscal 2030 electricity mix is 22- 24%. In order for Japan to meet its responsibilities to be one of the leaders in global efforts, the target needs to be much more ambitious. An ambitious target will stimulate renewable energy deployment, and Japanese companies will be able to play a greater role in the global business environment, where decarbonization is accelerating. It will enable Japanese companies more committed to the challenge of mitigating the climate crisis. We, as part of the global business community, call for the renewable energy target for fiscal 2030 to be revised from 22-24% to 40-50% in the next Strategic Energy Plan formulated this year. Signatories (alphabetical order) (Total 92 companies) ADVANTEST CORPORATION DAIICHI SANKYO COMPANY, LIMITED AEON CO., LTD. Daito Trust Construction Co., Ltd. Ajinomoto Co., Inc. Daiwa House Industry Co., Ltd. AMITA HOLDINGS CO., LTD. Eisai Co., Ltd. ANA HOLDINGS INC.