Real World Performance of Hybrid and Electric Buses

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Minibus Or Coach Module 4 Driver CPC Questions and Answers

Minibus or coach Module 4 Driver CPC questions and answers The Initial Driver CPC qualification was introduced into the bus and coach industry on September 10th 2008. Exactly one year before Driver CPC came into force for the commercial goods (HGV) industry (September 10th 2009). Part of acquiring the PCV Initial Driver CPC qualification means having to pass the module 4 examination. Module 4 is the practical associated knowledge test that is carried out at a DSA approved test centre. There is no driving required (suffice for the rolling brake check.) Students will need a DSA approved vehicle to demonstrate their answers. This test is all about scenarios a professional PCV driver may encounter in his or her working life. It includes PCV drivers legal obligations (vehicles checks, not overloading, pre-use checking), as well as checking for illegal immigrants, dealing with emergency situations etc. The Module 4 exam will last approximately 20-30 minutes and the DSA examiner will ask approximately 5-6 questions. To be successful you must attain at least 75% for each question and at least 80% overall. This post looks at the possible questions you may be given for your minibus or coach Driver CPC module 4 examination. If you need HGV Module 4 questions and answers we recommend your visit our Module 4 HGV Driver CPC page. Module 4 requires competence of skills and knowledge in the following areas. Carrying passengers with due regard for safety rules and proper vehicle use. Ensuring passenger, comfort, safety and security. Preventing criminality and trafficking of illegal immigrants Assessing emergency situations Preventing physical risk The following should be used as a guide only. -

Electricity Consumption and Battery Lifespan Estimation for Transit Electric Buses: Drivetrain Simulations and Electrochemical Modelling

Electricity consumption and battery lifespan estimation for transit electric buses: drivetrain simulations and electrochemical modelling by Ana¨ıssiaFranca B.Eng, University of Victoria, 2015 A Thesis Submitted in Partial Fulfillment of the Requirements for the Degree of MASTER OF APPLIED SCIENCE in the Department of Mechanical Engineering c Anaissia Franca, 2018 University of Victoria All rights reserved. This thesis may not be reproduced in whole or in part, by photocopying or other means, without the permission of the author. ii Electricity consumption and battery lifespan estimation for transit electric buses: drivetrain simulations and electrochemical modelling by Ana¨ıssiaFranca B.Eng, University of Victoria, 2015 Supervisory Committee Dr. Curran Crawford, Supervisor (Department of Mechanical Engineering) Dr. Ned Djilali, Supervisor (Department of Mechanical engineering) iii ABSTRACT This thesis presents a battery electric bus energy consumption model (ECONS-M) coupled with an electrochemical battery capacity fade model (CFM). The underlying goals of the project were to develop analytical tools to support the integration of battery electric buses. ECONS-M projects the operating costs of electric bus and the potential emission reductions compared to diesel vehicles for a chosen transit route. CFM aims to predict the battery pack lifetime expected under the specific driving conditions of the route. A case study was run for a transit route in Victoria, BC chosen as a candidate to deploy a 2013 BYD electric bus. The novelty of this work mainly lays in its application to battery electric buses, as well as in the coupling of the ECONS-M and the electrochemical model to predict how long the batteries can last if the electric bus is deployed on a specific transit route everyday. -

Agreements That Have Undermined Venezuelan Democracy Xxxxxxxxxxxxxxxxxxxxxxthe Chinaxxxxxxxxxxxxxxxxxxxxxx Deals Agreements That Have Undermined Venezuelan Democracy

THE CHINA DEALS Agreements that have undermined Venezuelan democracy xxxxxxxxxxxxxxxxxxxxxxThe Chinaxxxxxxxxxxxxxxxxxxxxxx Deals Agreements that have undermined Venezuelan democracy August 2020 1 I Transparencia Venezuela THE CHINA DEALS Agreements that have undermined Venezuelan democracy Credits Transparencia Venezuela Mercedes De Freitas Executive management Editorial management Christi Rangel Research Coordinator Drafting of the document María Fernanda Sojo Editorial Coordinator María Alejandra Domínguez Design and layout With the collaboration of: Antonella Del Vecchio Javier Molina Jarmi Indriago Sonielys Rojas 2 I Transparencia Venezuela Introduction 4 1 Political and institutional context 7 1.1 Rules of exchange in the bilateral relations between 12 Venezuela and China 2 Cash flows from China to Venezuela 16 2.1 Cash flows through loans 17 2.1.1 China-Venezuela Joint Fund and Large 17 Volume Long Term Fund 2.1.2 Miscellaneous loans from China 21 2.2 Foreign Direct Investment 23 3 Experience of joint ventures and failed projects 26 3.1 Sinovensa, S.A. 26 3.2 Yutong Venezuela bus assembly plant 30 3.3 Failed projects 32 4 Governance gaps 37 5 Lessons from experience 40 5.1 Assessment of results, profits and losses 43 of parties involved 6 Policy recommendations 47 Annex 1 52 List of Venezuelan institutions and officials in charge of negotiations with China Table of Contents Table Annex 2 60 List of unavailable public information Annex 3 61 List of companies and agencies from China in Venezuela linked to the agreements since 1999 THE CHINA DEALS Agreements that have undermined Venezuelan democracy The People’s Republic of China was regarded by the Chávez and Maduro administrations as Venezuela’s great partner with common interests, co-signatory of more than 500 agreements in the past 20 years, and provider of multimillion-dollar loans that have brought about huge debts to the South American country. -

CATA Assessment of Articulated Bus Utilization

(Page left intentionally blank) Table of Contents EXECUTIVE SUMMARY .......................................................................................................................................................... E-1 Literature Review ................................................................................................................................................................................................................E-1 Operating Environment Review ........................................................................................................................................................................................E-1 Peer Community and Best Practices Review...................................................................................................................................................................E-2 Review of Policies and Procedures and Service Recommendations ...........................................................................................................................E-2 1 LITERATURE REVIEW ........................................................................................................................................................... 1 1.1 Best Practices in Operations ..................................................................................................................................................................................... 1 1.1.1 Integration into the Existing Fleet .......................................................................................................................................................................................................... -

Alternative Fuels in Public Transit: a Match Made on the Road

U.S. DEPARTMENT of ENERGY, March 2002 OFFICE of ENERGY EFFICIENCY and RENEWABLE ENERGY Alternative Fuels in Public Transit: A Match Made on the Road As alternative fuels compete with conventional fuels for Transit agencies across the nation operate approximately a place in public awareness and acceptance, one of their 75,000 buses. As shown in the table, transit buses con- most visible applications is in public transportation. sume more fuel per vehicle annually than some other Vehicles, particularly buses and shuttles, that carry niche market vehicles on average, although the fuel use people in large numbers, stand to gain much from using of individual buses varies widely. (Source: Charting the alternative fuels. Such high-demand fuel users can help Course for AFV Market Development and Sustainable sustain a fueling infrastructure that supports private Clean Cities Coalitions, Clean Cities, March 2001; see autos and other smaller vehicles. www.ccities.doe.gov/pdfs/ccstrategic.pdf.) Buses are the most visible Public transit operations are well suited to alternative Percentage of Vehicles fuel use. Transit vehicles often travel on contained transit vehicles and in Transit Fleets by Type routes with centralized fueling, they are serviced by account for 58% of the a team of technicians who can be trained consistently, transit vehicle miles trav- and they are part of fleets that travel many miles, so eled, but transit agencies economies of scale can be favorable. Transit agencies operate a variety of other also typically operate in urban areas that may have air vehicles that can also use quality concerns. Alternative fuel transit vehicles offer alternative fuels. -

A-1 Electric Bus & Fleet Transition Planning

A Proterra model battery electric powered bus (photo credit: Proterra, May 2021). 52 | page A-1 Electric Bus & Fleet Transition Planning Initiative: Assess the feasibility of transitioning Pace’s fleet toward battery electric and additional CNG technologies, as well as develop a transition plan for operations and facilities. Study other emerging technologies that can improve Pace’s environmental impact. Supports Goals: Responsiveness, Safety, Adaptability, Collaboration, Environmental Stewardship, Fiscal Solvency, and Integrity ACTION ITEM 1 Investigate and Plan for Battery Electric Bus (BEB) Pace is committed to the goals of environmental stewardship and economic sustainability, and recognizes how interest to electrify vehicles across private industry and US federal, state, and local governments has been intensifying throughout 2020-2021. Looking ahead, the agency will holistically evaluate a transition path to converting its fleet to battery electric buses (BEB). As a first step, Action Item 2 of the A-2 Capital Improvement Projects initiative describes Pace’s forthcoming Facilities Plan. This effort will include an investigation of the prerequisites that BEB technology requires to successfully operate. Once established, Pace will further plan what next steps and actions to take in pursuit of this vehicle propulsion system. A Union of Concerned Scientists 2017 study3 indicates that BEB’s have 70 percent lower global warming emissions than CNG or diesel hybrid buses even when considering the lifecycle emissions required to generate the necessary electricity. Similarly, a 2018 US PIRG Education Fund Study4 indicates that implementing BEB’s lower operational costs yields fuel and maintenance savings over a vehicle’s life cycle. Pace praises the efforts of many other transit agencies across the nation and world who are investing heavily in transitioning their fleets to BEB and other green, renewable, and environmentally-cognizant sources of vehicle propulsion. -

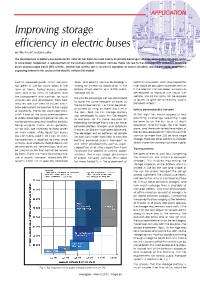

Improving Storage Efficiency in Electric Buses by Mike Rycroft, Features Editor

Improving storage efficiency in electric buses by Mike Rycroft, features editor The development of battery powered electric vehicles has been focused mainly on private passenger vehicles, while public transport seems to have been neglected. A reassessment of the journeys public transport vehicles make has led to the development of battery powered buses and bus rapid transit (BRT) systems. Several trial systems are in successful operation at various locations around the world, and there is a growing interest in this sector of the electric vehicle (EV) market. Electric powered public mass transport lanes, and electric vehicle technology is batteries and super- and ultra-capacitors has been in use for many years in the finding an increasing application in the than would be possible in a private vehicle. form of trams, trolley buses, subway battery driven electric bus (BDEB) public If the electric car has been successfully trains and other forms of transport, and transport sector. developed to replace the liquid fuel the components and controls for such vehicle, should the same not be applied The electric passenger car was developed vehicles are well developed. Tram-type to buses to give an all-electric public to have the same freedom of travel as vehicles are confined to routes which transport system? the liquid fuel version, i.e. it can be driven allow permanent connection to the supply anywhere as long as there was fuel in Battery powered public transport of electricity, mainly by overhead wires, the tank, and the EVs storage battery which have all the associated problems was developed to allow this. -

FOURIN's China Auto Data Directory Your Best Source of Information on the Chinese Automotive Industry and Market

FOURIN's China Auto Data Directory Your Best Source of Information on the Chinese Automotive Industry and Market ■Format: Excel ■Release Date: September 30, 2011 ■Price: 90,000JPY (excl. VAT for Japan orders) Invaluable Intelligence and Data to Support Any Automotive Business in China The only way you can stay ahead of the crowd and be the person of the moment is to have the best information available when you need it the most. FOURIN is beginning a new service offering a detailed and user-friendly database on major automakers and parts manufacturers in China. Data are provided to you in Excel format, allowing rapid searching, sorting and transfer. Based on years of close cooperation with trusted customers, the database is tailored to the needs of automotive industry professionals who are in need of detailed facts on major players in the Chinese automotive industry. Rather than wading through endless number of press releases and media reports, you choose the data that is important to you and see it in a well-organized table immediately. The database currently includes approximately 1,500 production bases and other facilities of around 200 Chinese and foreign automakers andparts suppliers. FOURIN's China Auto Data Directory (Sample) Data Source Location Location Establishment Operation Base Name Main Products (APC)/ Activities APC (units) Company (City) (Admin. Unit) Date Start CBU (4 platforms: Chery, Riich, Rely, Chery Automobile Co., Ltd. Wuhu Anhui Jan. 1997 Dec. 1999 CBU 900,000 units (2010) Karry), engines, transmissions 150,000 units (2010)→ Chery Automobile - No.1 Plant Wuhu Anhui Mar. 1997 Dec. -

The Influence of Passenger Load, Driving Cycle, Fuel Price and Different

Transportation https://doi.org/10.1007/s11116-018-9925-0 The infuence of passenger load, driving cycle, fuel price and diferent types of buses on the cost of transport service in the BRT system in Curitiba, Brazil Dennis Dreier1 · Semida Silveira1 · Dilip Khatiwada1 · Keiko V. O. Fonseca2 · Rafael Nieweglowski3 · Renan Schepanski3 © The Author(s) 2018 Abstract This study analyses the infuence of passenger load, driving cycle, fuel price and four diferent types of buses on the cost of transport service for one bus rapid transit (BRT) route in Curitiba, Brazil. First, the energy use is estimated for diferent passenger loads and driving cycles for a conventional bi-articulated bus (ConvBi), a hybrid-electric two- axle bus (HybTw), a hybrid-electric articulated bus (HybAr) and a plug-in hybrid-electric two-axle bus (PlugTw). Then, the fuel cost and uncertainty are estimated considering the fuel price trends in the past. Based on this and additional cost data, replacement scenarios for the currently operated ConvBi feet are determined using a techno-economic optimisa- tion model. The lowest fuel cost ranges for the passenger load are estimated for PlugTw amounting to (0.198–0.289) USD/km, followed by (0.255–0.315) USD/km for HybTw, (0.298–0.375) USD/km for HybAr and (0.552–0.809) USD/km for ConvBi. In contrast, C the coefcient of variation ( v ) of the combined standard uncertainty is the highest for C PlugTw ( v : 15–17%) due to stronger sensitivity to varying bus driver behaviour, whereas C it is the least for ConvBi ( v : 8%). -

The Route to Cleaner Buses a Guide to Operating Cleaner, Low Carbon Buses Preface

The Route to Cleaner Buses A guide to operating cleaner, low carbon buses Preface Over recent years, concerns have grown over the contribution TransportEnergy is funded by the Department for Transport of emissions from road vehicles to local air quality problems and the Scottish executive to reduce the impact of road and to increasing greenhouse gas emissions that contribute to transport through the following sustainable transport climate change. One result of this is a wider interest in cleaner programmes: PowerShift, CleanUp, BestPractice and the vehicle fuels and technologies.The Cleaner Bus Working New Vehicle Technology Fund.These programmes provide Group was formed by the Clear Zones initiative and the advice, information and grant funding to help organisations Energy Saving Trust TransportEnergy programme. Its overall in both the public and private sector switch to cleaner, aim is to help stimulate the market for clean bus technologies more efficient fleets. and products. Comprising representatives of the private and CATCH is a collaborative demonstration project co- public sectors, it has brought together users and suppliers in financed by the European Commission's an effort to gain a better understanding of the needs and LIFE-ENVIRONMENT Programme. CATCH is co-ordinated requirements of each party and to identify, and help overcome, by Merseytravel, with Liverpool City Council,Transport & the legal and procurement barriers. Travel Research Ltd,ARRIVA North West & Wales Ltd, This guide is one output from the Cleaner Bus Working -

Bi-Articulated Bi-Articulated

Bi-articulated Bus AGG 300 Handbuch_121x175_Doppel-Gelenkbus_en.indd 1 22.11.16 12:14 OMSI 2 Bi-articulated bus AGG 300 Developed by: Darius Bode Manual: Darius Bode, Aerosoft OMSI 2 Bi-articulated bus AGG 300 Manual Copyright: © 2016 / Aerosoft GmbH Airport Paderborn/Lippstadt D-33142 Bueren, Germany Tel: +49 (0) 29 55 / 76 03-10 Fax: +49 (0) 29 55 / 76 03-33 E-Mail: [email protected] Internet: www.aerosoft.de Add-on for www.aerosoft.com All trademarks and brand names are trademarks or registered of their respective owners. All rights reserved. OMSI 2 - The Omnibus simulator 2 3 Aerosoft GmbH 2016 OMSI 2 Bi-articulated bus AGG 300 Inhalt Introduction ...............................................................6 Bi-articulated AGG 300 and city bus A 330 ................. 6 Vehicle operation ......................................................8 Dashboard .................................................................. 8 Window console ....................................................... 10 Control lights ............................................................ 11 Main information display ........................................... 12 Ticket printer ............................................................. 13 Door controls ............................................................ 16 Stop display .............................................................. 16 Level control .............................................................. 16 Lights, energy-save and schoolbus function ............... 17 Air conditioning -

Totaltrack Holds the Line for Action Distribution Warehouse

Top Transport Vehicle Manufacturer Uses Intelligent Video to Prevent Intrusion and Scrap Metal Theft ioimage intelligent-video system installed to upgrade existing indoor and outdoor security at the Merkavim Merkavim Metal Works Ltd. Description: Transport & Bus Manufacturer founded in 1946 Cesarea Plant Employees: Approx. 300 Produces: Entire range of mini-buses, low-floor and articulated The theft and removal of items low-floor city buses, inter-city buses, tourist coaches, armored from outdoor sites that store and prisoner buses and other specialized passenger transport materials and equipment for solutions. Central Distribution Center: Production facility, covering over manufacturing and building 100,000 sqm, is located in Central Israel construction is becoming more widespread. Most often the damage far exceeded The assembly plant is located in the street or scrap value of the items an area that is surrounded by Worldwide equipment and scrap stolen farmland and open field areas. metal theft is costing billions of dollars and there are few ways Merkavim found that thieves were Thieves can easily scale to prevent these crimes or catch taking parts from busses and doing landscape walls and commercial these criminals. considerable damage in the process. wrought iron fences that protect Most often the damage far exceeded the the site. Just beyond the semi- The common reasons for the street or scrap value of the items stolen. decorative fences are access outbreak is an inability to watch On several occasions component steel roads, main streets and rail lines over expansive areas, absence used for manufacturing was stolen by that provide thieves access to the of security, or patchy traditional scrap metal thieves from the outdoor property as well as offer a means security that is too labor storage areas.