Innovative Etfs for Modern Portfolios

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Exchange Council Election Eurex Deutschland Preliminary Voter List – As of 16 August 2019

Exchange Council Election Eurex Deutschland Preliminary Voter List – as of 16 August 2019 Voter group 1a cooperative credit institutions Company State DZ BANK AG Deutsche Zentral-Genossenschaftsbank Germany Page - 1 - Exchange Council Election Eurex Deutschland Preliminary Voter List – as of 16 August 2019 Voter group 1b credit institutions under public law Company State Bayerische Landesbank Germany DekaBank Deutsche Girozentrale Germany Hamburger Sparkasse AG Germany Kreissparkasse Köln Germany Landesbank Hessen-Thüringen Girozentrale Germany Landesbank Saar Germany Norddeutsche Landesbank - Girozentrale Germany NRW.BANK Germany Sparkasse Pforzheim Calw Germany Page - 2 - Exchange Council Election Eurex Deutschland Preliminary Voter List – as of 16 August 2019 Voter group 1c other credit institutions Company State ABN AMRO Bank N.V. Netherlands ABN AMRO Clearing Bank N.V. Netherlands B. Metzler seel. Sohn & Co. KGaA Germany Baader Bank Aktiengesellschaft Germany Banca Akros S.p.A. Italy Banca IMI S.p.A Italy Banca Sella Holding S.p.A. Italy Banca Simetica S.p.A. Italy Banco Bilbao Vizcaya Argentaria S.A. Spain Banco Comercial Português S.A. Portugal Banco Santander S.A. Spain Bank J. Safra Sarasin AG Switzerland Bank Julius Bär & Co. AG Switzerland Bank Vontobel AG Switzerland Bankhaus Lampe KG Germany Bankia S.A. Spain Bankinter Spain Banque de Luxembourg Luxemburg Banque Lombard Odier & Cie SA Switzerland Banque Pictet & Cie SA Switzerland Barclays Bank Ireland Plc Ireland Barclays Bank PLC United Kingdom Basler Kantonalbank Switzerland Berner Kantonalbank AG Switzerland Bethmann Bank AG Germany BNP Paribas United Kingdom BNP Paribas (Suisse) SA Switzerland BNP Paribas Fortis SA/NV Belgium BNP Paribas S.A. Niederlassung Deutschland Germany BNP Paribas Securities Services S.C.A. -

A Guided Tour of the European ETF Marketplace

Morningstar Manager Research November 2014 A Guided Tour of the European ETF Marketplace Authors: Hortense Bioy, CFA Director of European Passive Strategies Research Jose Garcia-Zarate Senior Fund Analyst, European Passive Strategies Research Caroline Gutman Fund Analyst, European Passive Strategies Research Kenneth Lamont, CAIA Fund Analyst, European Passive Strategies Research Gordon Rose, CIIA, CAIA Fund Analyst, European Passive Strategies Research Executive Summary 2 Executive Summary 3 In this report, we analyse the evolution of the European exchange-traded product (ETP) market, scrutinising asset flows, discussing the competitive dynamics and commenting on the latest trends. 4 Foreword 3 We provide a comprehensive educational guide to the replication methods and portfolio manage- 5 The European ETP Landscape and ment techniques used by European providers of UCITS exchange-traded funds (ETFs). Recent Trends 3 We share the due diligence work we have conducted on Europe’s 10 largest UCITS ETF providers1, 16 A Guide to Replication Methods and namely iShares, db X-trackers, Lyxor, UBS, Source, Amundi, Vanguard, State Street, Deka, and Portfolio Management Techniques ComStage. In detailed profiles, we examine the most important aspects of their portfolio manage- 25 Provider Profiles ment techniques, ranging from the replication methods they employ and the way they optimise 25 Amundi ETF returns to the policies they have in place to manage risk. 28 ComStage 30 db X-trackers 34 Deka ETFs Landscape Highlights 37 iShares 3 Assets under management in European ETPs have more than doubled over the last five years to reach 39 Lyxor €362 billion at the end of September 2014. 43 Source 45 SPDR ETFs 3 ETPs represent only 5.5% of the total investment fund assets in Europe. -

Boost FTSE MIB 3X Short Daily ETP (3ITS)

Boost FTSE MIB 3x Short Daily ETP (3ITS) Obiettivi d’investimento Informazioni sul prodotto Boost FTSE MIB 3x Short Daily ETP è un Exchange Traded Product totalmente Nome del prodotto Boost FTSE MIB 3x Short Daily ETP collateralizzato, conforme alle normative UCITS. L'ETP replica l'indice FTSE MIB Ultra Short Strategy RT GR Index, fornendo una performance giornaliera Fattore di leva -3x triplice inversa (-3x) rispetto a quella dell'indice FTSE MIB Total Return Index, Metodo di replica Funded swap garantito da collaterale corretta in maniera tale da riflettere le commissioni, i costi e le entrate inerenti Overcollateralizzato Si (Collaterale) alla vendita allo scoperto di titoli azionari. Ad esempio, nel caso in cui il FTSE EUR MIB salga dell’1%, allora l’ETP scenderà del 3%, commissioni escluse. Tuttavia, Attivi fisici detenuti nel caso in cui il FTSE MIB scenda dell’1% allora l’ETP salirà del 3%, ISIN IE00B873CW36 commissioni escluse. SEDOL BD3CTP1 Informazioni aggiuntive Caratteristiche principali: Emittente Boost Issuer PLC • L’ETP amplifica i rendimenti dell’investimento con una semplice transazione Trustee Law Debenture Trust PLC • Liquidità. E’ scambiato su LSE esattamente come un titolo azionario e si Agente del collaterale Bank of New York Mellon avvale di molteplici partecipanti autorizzati (AP) e market maker (MM) Gestore Boost Management Limited • Il meccanismo di leva intraday implica che le perdite non potranno essere Commissioni di gestione 0.80% superiori all’investimento iniziale Tasso swap giornaliero 0.00083% • Facile -

Wisdomtree Announces Fourth Quarter and Year End 2014 Results

February 6, 2015 WisdomTree Announces Fourth Quarter and Year End 2014 Results $0.07 Diluted Net Income EPS for the Quarter and $0.44 for the Year $4.5 Billion Fourth Quarter Inflows and $5.1 Billion for the Year Declares $0.08 quarterly dividend NEW YORK, Feb. 6, 2015 (GLOBE NEWSWIRE) -- WisdomTree Investments, Inc. (Nasdaq:WETF), an exchange-traded fund ("ETF") and exchange-traded product ("ETP") sponsor and asset manager today reported net income of $9.6 million or $0.07 per diluted EPS in the fourth quarter. Pre-tax income was $16.7 million in the fourth quarter, an increase of 1.2% from the fourth quarter of 2013 and down 17.7% from the third quarter of 2014. Included in the quarter was a loss of $1.9 million, or $0.01 per diluted EPS, associated with the Company's European listed ETP business, which was acquired in April 2014. Pre-tax income is comparable to previous periods since the Company did not record income tax expense prior to 2014. For the year, net income was $61.1 million or $0.44 per diluted EPS. Pre-tax income was $73.5 million, an increase of 42.7% from the prior year. Excluding the results of our European listed ETP business, pre-tax income increased 52.6% from the prior year. WisdomTree CEO and President Jonathan Steinberg said, "Before discussing our strong fourth quarter and year of accomplishments, I'd first like to comment on WisdomTree's larger opportunity. The success of the $2 trillion ETF market is undeniable. -

10 Vragen Over Beleggen in ETF's, Hét Must-Have Product Voor Elke

10 vragen over beleggen in ETF’s, hét must-have product voor elke particuliere belegger 1. Wat is een ETF? Een ETF, of voluit exchange-traded fund, is een beursgenoteerd beleggingsfonds dat passief een groep aandelen, obligaties of andere effecten volgt. Ter illustratie, de eerste ETF ooit, de SPDR S&P 500 ETF, bootst het risico en rendement na van de Amerikaanse aandelenindex S&P 500. ETF’s zijn eind jaren 1980 in de Verenigde Staten bedacht als oplossing voor particuliere beleggers die passief wilden beleggen. In die periode werd het langzaamaan duidelijk dat het simpelweg volgen van een index op de lange termijn beter rendeert dan actief handelen in aandelen of obligaties. Ter illustratie nemen we een voorbeeld van de Amerikaanse S&P 500-index. Om het risico en rendement van die index te repliceren zijn alle 500 aandelen in die index nodig, met precies de juiste wegingen. Dat is een bijzonder lastige opgave voor een gemiddelde particuliere belegger. Een ETF lost dat probleem op. De uitgever van de ETF koopt alle aandelen van de S&P 500 op, stopt die in één fonds en geeft ETF’s uit die betaalbaar zijn voor particuliere beleggers. ETF’s worden trouwens ook wel eens indexfondsen, indextrackers, of simpelweg trackers genoemd. Belangrijk is dat een ETF per definitie genoteerd is aan de beurs, maar dat dit niet voor alle indexfondsen geldt. Er zijn ook indexfondsen die worden uitgegeven door vermogensbeheerders zonder dat ze een beursnotering hebben. Hierbij vindt de handel doorgaans één of twee keer per dag plaats. Om in niet-beursgenoteerde indexfondsen te kunnen handelen, moet er een overeenkomst zijn tussen de broker waar je als particuliere belegger een rekening hebt en de uitgever van het indexfonds. -

STATE STREET INSTITUTIONAL INVESTMENT TRUST Form

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-P Filing Date: 2021-05-28 | Period of Report: 2021-03-31 SEC Accession No. 0001752724-21-118932 (HTML Version on secdatabase.com) FILER STATE STREET INSTITUTIONAL INVESTMENT TRUST Mailing Address Business Address ONE LINCOLN STREET STATE STREET FINANCIAL CIK:1107414| IRS No.: 046910804 | State of Incorp.:MA | Fiscal Year End: 1231 BOSTON MA 02111 CENTER Type: NPORT-P | Act: 40 | File No.: 811-09819 | Film No.: 21979452 ONE LINCOLN STREET BOSTON MA 02111 6176623239 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Quarterly Report March 31, 2021 State Street Institutional Investment Trust State Street Equity 500 Index Fund State Street Equity 500 Index II Portfolio State Street Aggregate Bond Index Fund State Street Aggregate Bond Index Portfolio State Street Global All Cap Equity ex- U.S. Index Fund State Street Global All Cap Equity ex- U.S. Index Portfolio State Street Small/Mid Cap Equity Index Fund State Street Small/Mid Cap Equity Index Portfolio State Street Defensive Global Equity Fund State Street Emerging Markets Equity Index Fund State Street Hedged International Developed Equity Index Fund State Street Target Retirement Fund State Street Target Retirement 2020 Fund State Street Target Retirement 2025 Fund State Street Target Retirement 2030 Fund State Street Target Retirement 2035 Fund State Street Target Retirement 2040 Fund State Street Target Retirement 2045 Fund State Street Target Retirement 2050 Fund State Street Target Retirement 2055 Fund State Street Target Retirement 2060 Fund State Street Target Retirement 2065 Fund State Street International Value Spotlight Fund State Street China Equity Select Fund The information contained in this report is intended for the general information of shareholders of the Trust. -

Where & How to Buy Hanetf Products

Where & How to Buy HANetf Products \ Where & How to buy HANetf Products HANetf funds are available to buy through self-directed platforms and brokers, and intermediary platforms across Europe listed below. Institutional investors and intermediaries can trade directly through authorised participants (APs) and market makers. The HANetf Capital Markets Team has extensive experience trading ETFs and can help can assist with product switches and advise on cost effective ways to trade. If you would like more information on how to trade with APs/market makers, please contact our Capital Markets Team at [email protected]. For more information about the trading of ETFs, the different terminology and some useful hints & tips, please refer to our article “Trading ETFs: A Short Guide” United Kingdom UK Execution only platforms and brokers UK Intermediary/wrap platforms Hargreaves Lansdown Aegon Interactive Investor Ascentric Barclays Aviva Equitini Transact Share Centre Novia Halifax Old Mutual/Quilter AJ Bell You Invest AJ Bell Invest Centre Alliance trust Zurich/Embark IG Group Hubwise Jarvis Fidelity Fundsnetwork 7IM Nucleus Standard Life ATS Advised 1 [email protected] Where & How to Buy HANetf Products Germany and Austria Execution only platforms and brokers Augsburger Aktienbank MaxBlue/Deutsche Bank Comdirect Onvista Consorsbank S Broker Ebase Targo Bank Fil DepotBank Smartbroker Flatex Scalable Capital ING DiBa Trade Republic Italy Execution only platforms and brokers Banca Sella Fineco Bank Directa WeBank IWBank BinckBank Benelux Execution -

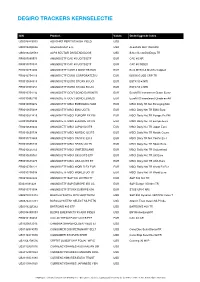

Degiro Trackers Kernselectie

DEGIRO TRACKERS KERNSELECTIE ISIN Product Valuta Onderliggende Index US00768Y5033 ADVSHRS PERITUS HIGH YIELD USD US00162Q8666 ALERIAN MLP ETF USD ALERIAN MLP INFRAST US00162Q8583 ALPS SECTOR DIVIDEND DOGS USD S-Net SectorDvdDogs TR FR0007080973 AMUNDI ETF CAC 40 UCITS ETF EUR CAC 40 NR FR0010878033 AMUNDI ETF CAC 40 UCITS ETF EUR CAC 40 INDEX FR0010754200 AMUNDI ETF CASH 3 MONTHS EUR EUR Euro MTS 0-6 Months Capped FR0010754119 AMUNDI ETF EURO CORPORATES U EUR IBOXX € LQD CRP TR FR0010654913 AMUNDI ETF EURO STOXX 50 UCI EUR ESTX 50 € NRt FR0010908251 AMUNDI ETF EURO STOXX 50 UCI EUR ESTX 50 € NRt FR0010754192 AMUNDI ETF GOVT BOND EUROMTS EUR EuroMTS Investment Grade Euroz FR0010892190 AMUNDI ETF GOVT BOND LOWEST EUR EuroMTS Investment Grade ex-AA FR0010959676 AMUNDI ETF MSCI EMERGING MAR EUR MSCI Daily TR Net Emerging Mar FR0010655688 AMUNDI ETF MSCI EMU UCITS EUR MSCI Daily Net TR EMU Euro FR0010821819 AMUNDI ETF MSCI EUROPE EX EM EUR MSCI Daily Net TR Europe Ex EM FR0010655696 AMUNDI ETF MSCI EUROPE UCITS EUR MSCI Daily Net TR Europe Euro FR0010688242 AMUNDI ETF MSCI JAPAN UCITS EUR MSCI Daily Net TR Japan Euro FR0010655738 AMUNDI ETF MSCI NORDIC UCITS EUR MSCI Daily Net TR Nordic Count FR0010713669 AMUNDI ETF MSCI PACIFIC EX J EUR MSCI Daily TR Net Pacific Ex J FR0010655746 AMUNDI ETF MSCI SPAIN UCITS EUR MSCI Daily Net TR Spain Euro FR0010655753 AMUNDI ETF MSCI SWITZERLAND EUR MSCI Daily Net TR Switzerland FR0010655761 AMUNDI ETF MSCI UK UCITS ETF EUR MSCI Daily Net TR UK Euro FR0010688275 AMUNDI ETF MSCI USA UCITS ET EUR MSCI Daily -

Exchange Traded Products Handbook 2015

Delta One Navigator Exchange Traded Products Handbook 2015 ETF Trading Lines: +49 89 378-17585 +39 02 8862-0660 +44 207 826-6444 Contents 1. WHAT ARE EXCHANGE TRADED FUNDS 8 2. REGULATORY FRAMEWORK 11 3. INDEX CONSTRUCTIONS 15 4. DIFFERENT ETF REPLICATION METHODS 17 5. SPECIAL FEATURES OF ETPS 23 6. LIQUIDITY OF AN ETF 29 7. ETF TRADING 33 8. CHOOSING THE RIGHT PRODUCT, THE RIGHT ETP 42 9. ETF LENDING & SECURITIES LENDING IN ETFS 46 10. EXCHANGE TRADED NOTES / COMMODITIES 49 11. LINEAR CERTIFICATES 57 12. BETA PRODUCTS: ETFs, FUTURES & SWAPS 60 13. MARKET CAP WEIGHTED ETFs / ETCs 69 14. SMART ßETA STRATEGY ETFs 104 4 5 PREFACE Dear Investor, the global stage is flooded with news from different regions all over the world. Besides the usual economic insecurity, the world looks closely at the strained situation in Russia, the IS war and the resultant migratory waves as well as the future political development in Greece. But despite these rather threatening political situations, the lower oil price, a weaker euro and a strengthen US economy generates significant positive impulses for the ongoing macro environment in 2015. Furthermore the predicted FED interest rate increase in June and the EZB quantitative easing policy remain the financial markets exciting in 2015. Regarding to this development the UniCredit economists forecast lower yields, flatter curves, tighter spreads and lower EUR-USD-exchange rate. In this framework ETFs are more than ever a rock solid investment vehicle, that allows the investor to translate ideas and opinions into trading decisions. The width of asset classes is still increasing. -

13.10.20 Greenbank-D

Management Team Disclaimer This presentation is not, and under no circumstances is to be construed as, a prospectus, advertisement or public offering of any securities of GreenBank Capital Inc. (“Securities”). No securities regulatory authority has reviewed this presentation or assessed the merits of any of the Securities. Any representation to the contrary is an offence. This presentation does not constitute an offer to sell to, or a solicitation of an offer to buy from, anyone in any country or jurisdiction. This presentation should not be construed as legal, tax, business or investment advice. Except as otherwise indicated, the information set forth in this presentation is effective as of the date set forth on the cover page. The information contained in this presentation may change after the date set forth on the cover page and GreenBank Capital Inc. does not undertake any obligation to update such information, except as required by law. Information has been included in this presentation from documents filed with the securities commissions or similar authorities in the Provinces of Canada, except Québec. A copy of the permanent information record may be obtained by accessing the disclosure documents available through the internet on the System for Electronic Document Analysis and Retrieval (SEDAR), which can be accessed at www.sedar.com. Forward looking statement All statements in this communication, other than those relating to historical facts, are “forward-looking statements.” These forward-looking statements are not guarantees of future performance and are subject to a number of assumptions, risks, and uncertainties, many of which are beyond our control and could cause actual results to differ materially from such statements. -

Flatex AG Corporate Presentation

CORPORATE PRESENTATION flatexDEGIRO AG | October 2020 First and leading pan-European online brokerage At a glance Investment highlights First, largest and fastest growing pan-European discount broker, well-positioned to consolidate a highly fragmented market Benefiting from near-term market volatility as well as long-term secular trends that are increasing the addressable market Best-in-class product portfolio and highly competitive pricing drive impressive customer growth and leading positions in several European countries Fully fledged online bank (no brick and mortar branches) with full German banking license & EU passport, a scalable proprietary core banking system and clear cost leadership Homegrown, scalable and recently modernized IT infrastructure with more than EUR 30 million invested over last three years Entrepreneurial, top interdisciplinary management team that is significantly invested in the business 3 flatexDEGIRO AG flatexDEGIRO at a glance Online Brokerage Including Credit and Treasury ▪ Leading European online broker serving highly active private investors and traders in 18 countries ▪ Operating under German banking license with EU passport enhances customer monetization and provides ancillary services to core online brokerage business ▪ Strong positioning in Germany, Netherlands and Austria with enormous potential to increase significantly European market share of currently approx. 8% Revenue Model and Contribution ▪ Online brokerage ▪ Credit and treasury (Commission income from clients and intelligent exchange and (Interest income on collateralized margin loans and low-risk product partner partnerships) treasury investments) Key Operating Metrics (flatex and DEGIRO pro forma) Number of Number of exchanges and Annualized Executed Annualized Executed Securities Customer B2C Customers OTC-partners Trades Trade Volume under Custody Cash Deposits >1,0 m >60 >70 m >EUR 300 bn >EUR 20 bn >EUR 2 bn Credit Book Average Interest Rate Return on Equity Markets Employees Balance Sheet Equity* (collateralized) (Loan Book) (before Tax)* >EUR 700 m >3% p.a. -

Boost NASDAQ 100® 3X Leverage Daily ETP (QQQ3)

Boost NASDAQ 100® 3x Leverage Daily ETP (QQQ3) Investment Objective Product Information Boost NASDAQ 100® 3x Leverage Daily ETP is a fully collateralised, Product Name Boost NASDAQ 100® 3x Leverage UCITS eligible Exchange-Traded Product. The ETP tracks the NASDAQ- Daily ETP 100® 3x Leveraged Notional Net Return index, providing three times the Leverage Factor 3x daily performance of the NASDAQ-100 Notional Net TR index, adjusted to Replication Method Funded Swap reflect fees and costs inherent to maintaining a leveraged position in Physical Assets Owned Yes (Collateral) stocks. Base Currency USD For example, if the NASDAQ 100 rises by 1%, then the ETP will rise by ISIN IE00B8W5C578 3%, excluding fees. However, if the NASDAQ 100 falls by 1%, then the SEDOL B8W5C57 ETP will fall by 3%, excluding fees. Additional Information Issuer Boost Issuer PLC Key Features Trustee Law Debenture Trust PLC • Magnify your returns in one simple trade Collateral Administrator Bank of New York Mellon • Liquid. Trades like an equity on the LSE, multiple authorised Manager Boost Management Limited participants (APs) and market makers (MMs) Annual Management Fee 0.75% • Intraday leverage mechanism means you cannot lose more than your Daily Swap Rate 0.00000% initial investment SIPP/ISA Yes • Simple to trade, no need for futures, no need to borrow cash or short UCITS Eligible Yes stocks UCITS Compliant No • Transparent structure with world class service providers and fully Stamp Duty No collateralised UK Fund Reporting Status Yes • Boost is independent and managed