Nokia Reports Q3 2007 Net Sales of EUR 12.9 Billion and EPS of EUR 0.40 Nokia Market Share Grows to an Estimated 39%; Total Device Operating Margin up Sequentially

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nokia in 2010 Review by the Board of Directors and Nokia Annual Accounts 2010

Nokia in 2010 Review by the Board of Directors and Nokia Annual Accounts 2010 Key data ........................................................................................................................................................................... 2 Review by the Board of Directors 2010 ................................................................................................................ 3 Annual Accounts 2010 Consolidated income statements, IFRS ................................................................................................................ 16 Consolidated statements of comprehensive income, IFRS ............................................................................. 17 Consolidated statements of financial position, IFRS ........................................................................................ 18 Consolidated statements of cash flows, IFRS ..................................................................................................... 19 Consolidated statements of changes in shareholders’ equity, IFRS ............................................................. 20 Notes to the consolidated financial statements ................................................................................................ 22 Income statements, parent company, FAS .......................................................................................................... 66 Balance sheets, parent company, FAS .................................................................................................................. -

Manual Do Utilizador Do Nokia 5310 Xpressmusic

Manual do Utilizador do Nokia 5310 XpressMusic 9203503 Edição 1 DECLARAÇÃO DE CONFORMIDADE NOKIA CORPORATION declara que este RM-303 está conforme com os requisitos essenciais e outras disposições da Directiva 1999/5/CE. É possível obter uma cópia da Declaração de Conformidade no endereço http://www.nokia.com/phones/declaration_of_conformity/. © 2007 Nokia. Todos os direitos reservados. Nokia, Nokia Connecting People, Visual Radio e Navi são marcas comerciais ou marcas registadas da Nokia Corporation. Nokia tune é uma marca sonora da Nokia Corporation. Os nomes de outros produtos e empresas mencionados neste documento poderão ser marcas comerciais ou nomes comerciais dos respectivos proprietários. É proibido reproduzir, transferir, distribuir ou armazenar a totalidade ou parte do conteúdo deste documento, seja sob que forma for, sem a prévia autorização escrita da Nokia. US Patent No 5818437 and other pending patents. T9 text input software Copyright © 1997-2007. Tegic Communications, Inc. All rights reserved. Includes RSA BSAFE cryptographic or security protocol software from RSA Security. Java and all Java-based marks are trademarks or registered trademarks of Sun Microsystems, Inc. This product is licensed under the MPEG-4 Visual Patent Portfolio License (i) for personal and noncommercial use in connection with information which has been encoded in compliance with the MPEG-4 Visual Standard by a consumer engaged in a personal and noncommercial activity and (ii) for use in connection with MPEG-4 video provided by a licensed video provider. No license is granted or shall be implied for any other use. Additional information, including that related to promotional, internal, and commercial uses, may be obtained from MPEG LA, LLC. -

Nokia 5310 Xpressmusic Data Sheet

Nokia 5310 XpressMusic Data Sheet Planned Market Introduction: Q4 2007 Mobile Phones Category: Xpress Technical Profile: System: Tri-band GSM 850/1800/1900 and 900/1800/1900 GPRS, EGPRS User Interface: Series 40 3rd Edition Dimensions: 103.8 mm x 44.7 mm x 9.9 mm (L x W x H) Volume: 44.8 cc Weight: 70.2 g Standby time: up to 12.5 days Inbox Color Available: Talk time: up to 5 hours Red, Blue Music playback time: up to 18 hours Display: 2.0”QVGA, up to Standard Sales Package Includes: 16.7 million colors • Nokia 5310 Xpress Music handset Battery: BL-4CT Battery, 860mAh, Li-Ion • Nokia Battery (BL-4CT) • Nokia Charger (AC-3) Music Features: • MicroUSB cable (CA-101) • Up to 3,000 songs with optional 4GB MicroSD card • Wired Stereo Headset (HS-45) • Play songs purchased from Nokia Music Store (WMDRM) • Remote Control (AD-57) • Hi-Fi audio with dedicated audio chip (DAC-33) • MicroSD card • FM Stereo Radio with RDS •User Guide • 3.5 mm connector for wide choice of Hi-Fi headphones •CD-ROM • Dedicated music keys Camera: • Music player supporting MP3, AAC, AAC+, eAAC+, M4A and WMA Resolution of images: 1600 x 1200 pixels • Bluetooth stereo audio Resolution of videos: QCIF (177 x 144 pixels) •Flight mode Image capture: JPEG (up to 65,536 colors) • Music player supporting album art Video Capture: H.263 Music Synchronization: Nokia Original Enhancements: Windows Media Player 10 and 11, Drag and Drop, Headsets: Nokia Bluetooth Stereo Headset (BH-5) Nokia PC Client (available Q4) Music: Nokia Minispeakers (MD-4) Additional Features: Connectivity: •2 megapixelcamera Bluetooth, MicroUSB, 3.5 mm AV Copyright © 2007 Nokia. -

Nokia 5310 Xpressmusic - Felhasználói Kézikönyv

Nokia 5310 XpressMusic - Felhasználói kézikönyv 9203518 1. kiadás MEGFELELŐSÉGI NYILATKOZAT A NOKIA CORPORATION kijelenti, hogy a(z) RM-303 jelű készülék mindenben megfelel az alapvető követelményeknek, valamint az 1999/5/EC irányelv egyéb vonatkozó rendelkezéseinek. A Megfelelőségi nyilatkozat egy példánya megtalálható a http:// www.nokia.com/phones/declaration_of_conformity/ címen. © 2007 Nokia. Minden jog fenntartva. A Nokia, a Nokia Connecting People, a Nokia Care, a Visual Radio és a Navi a Nokia Corporation védjegye, illetve bejegyzett védjegye. A Nokia tune a Nokia Corporation hangvédjegye. Az említett egyéb termékek és cégek neve tulajdonosuk védjegye lehet. A dokumentum vagy bármely része nem másolható, nem továbbítható, nem terjeszthető és nem tárolható a Nokia előzetes írásbeli engedélye nélkül. US Patent No 5818437 and other pending patents. T9 text input software Copyright © 1997-2007. Tegic Communications, Inc. All rights reserved. Includes RSA BSAFE cryptographic or security protocol software from RSA Security. Java and all Java-based marks are trademarks or registered trademarks of Sun Microsystems, Inc. This product is licensed under the MPEG-4 Visual Patent Portfolio License (i) for personal and noncommercial use in connection with information which has been encoded in compliance with the MPEG-4 Visual Standard by a consumer engaged in a personal and noncommercial activity and (ii) for use in connection with MPEG-4 video provided by a licensed video provider. No license is granted or shall be implied for any other use. Additional information, including that related to promotional, internal, and commercial uses, may be obtained from MPEG LA, LLC. See http:// www.mpegla.com. A terméket az MPEG-4 Visual Patent Portfolio License (i) személyes, nem üzleti célú felhasználásra engedélyezi olyan adatok tekintetében, amelyeket a vevő mint magánszemély az MPEG-4 képi szabványnak megfelelően, nem üzleti célból kódolt, valamint (ii) engedélyezett videoszolgáltató által kínált MPEG-4 formátumú videofilmekkel kapcsolatos felhasználásra. -

A Fugitive Success That Finland Is Quickly Becoming a Victim of Its Own Success

Professor Charles Sabel from Columbia Law School and Professor AnnaLee Saxenian from UC Berkeley argue in their book A Fugitive Success that Finland is quickly becoming a victim of its own success. In recent decades Finnish firms in the forest products and telecommunications industries have become world leaders. But the kind of discipline that made this success possible, and the public policies that furthered it, is unlikely to secure it in the future. Efficiency improvements and incremental A Fugitive Success innovations along the current business trajectory will gradually lead these industries into a dead-end unless they use innovation as a vehicle for transforming themselves into new higher value businesses. Saxenian and Sabel raise some serious concerns about the readiness of these industries, and the Finnish innovation system as a whole, for the needed transformation. A Fugitive Success is required reading for A Fugitive Success those involved in the development of the Finnish innovation environment and Finland’s Economic Future implementing the new national innovation strategy. Charles Sabel and AnnaLee Saxenian Sitra Reports 80 Sitra Reports the Finnish Innovation Fund ISBN 978-951-563-639-3 Itämerentori 2, P.O. Box 160, FI-00181 Helsinki, Finland, www.sitra.fi/en ISSN 1457-5728 80 Telephone +358 9 618 991, fax +358 9 645 072 URL: http://www.sitra.fi A Fugitive Success Finland’s Economic Future Sitra Reports 80 A Fugitive Success Finland’s Economic Future Charles Sabel AnnaLee Saxenian Sitra • HelSinki 3 Sitra Reports 80 Layout: Sisko Honkala Cover picture: Shutterstock © Sabel, Saxenian and Sitra ISBN 978-951-563-638-6 (paperback) ISSN 1457-571X (paperback) ISBN 978-951-563-639-3 (URL:http://www.sitra.fi) ISSN 1457-5728 (URL:http://www.sitra.fi) The publications can be ordered from Sitra, tel. -

Cell Phones and Pdas

eCycle Group - Check Prices Page 1 of 19 Track Your Shipment *** Introductory Print Cartridge Version Not Accepted February 4, 2010, 2:18 pm Print Check List *** We pay .10 cents for all cell phones NOT on the list *** To receive the most for your phones, they must include the battery and back cover. Model Price Apple Apple iPhone (16GB) $50.00 Apple iPhone (16GB) 3G $75.00 Apple iPhone (32GB) 3G $75.00 Apple iPhone (4GB) $20.00 Apple iPhone (8GB) $40.00 Apple iPhone (8GB) 3G $75.00 Audiovox Audiovox CDM-8930 $2.00 Audiovox PPC-6600KIT $1.00 Audiovox PPC-6601 $1.00 Audiovox PPC-6601KIT $1.00 Audiovox PPC-6700 $2.00 Audiovox PPC-XV6700 $5.00 Audiovox SMT-5500 $1.00 Audiovox SMT-5600 $1.00 Audiovox XV-6600WOC $2.00 Audiovox XV-6700 $3.00 Blackberry Blackberry 5790 $1.00 Blackberry 7100G $1.00 Blackberry 7100T $1.00 Blackberry 7105T $1.00 Blackberry 7130C $2.00 http://www.ecyclegroup.com/checkprices.php?content=cell 2/4/2010 eCycle Group - Check Prices Page 2 of 19 Search for Pricing Blackberry 7130G $2.50 Blackberry 7290 $3.00 Blackberry 8100 $19.00 Blackberry 8110 $18.00 Blackberry 8120 $19.00 Blackberry 8130 $2.50 Blackberry 8130C $6.00 Blackberry 8220 $22.00 Blackberry 8230 $15.00 Blackberry 8300 $23.00 Blackberry 8310 $23.00 Blackberry 8320 $28.00 Blackberry 8330 $5.00 Blackberry 8350 $20.00 Blackberry 8350i $45.00 Blackberry 8520 $35.00 Blackberry 8700C $6.50 Blackberry 8700G $8.50 Blackberry 8700R $7.50 Blackberry 8700V $6.00 Blackberry 8703 $1.00 Blackberry 8703E $1.50 Blackberry 8705G $1.00 Blackberry 8707G $5.00 Blackberry 8707V -

UNITED STATES SECURITIES and EXCHANGE COMMISSION FORM 20F Nokia Corporation

As filed with the Securities and Exchange Commission on March 5, 2009. UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20F ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2008 Commission file number 113202 Nokia Corporation (Exact name of Registrant as specified in its charter) Republic of Finland (Jurisdiction of incorporation) Keilalahdentie 4, P.O. Box 226, FI00045 NOKIA GROUP, Espoo, Finland (Address of principal executive offices) Kaarina Sta˚hlberg, Vice President, Assistant General Counsel Telephone: +358 (0) 7 18008000, Facsimile: +358 (0) 7 18038503 Keilalahdentie 4, P.O. Box 226, FI00045 NOKIA GROUP, Espoo, Finland (Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person) Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934 (the “Exchange Act”): Name of each exchange Title of each class on which registered American Depositary Shares New York Stock Exchange Shares New York Stock Exchange(1) (1) Not for trading, but only in connection with the registration of American Depositary Shares representing these shares, pursuant to the requirements of the Securities and Exchange Commission. Securities registered pursuant to Section 12(g) of the Exchange Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Exchange Act: None Indicate the number of outstanding shares of each of the registrant’s classes of capital or common stock as of the close of the period covered by the annual report. -

Nokia 5310 Xpressmusic Kullanım Kılavuzu

Nokia 5310 XpressMusic Kullanım Kılavuzu 9203531 Baskı 1 UYGUNLUK BİLDİRİMİ NOKIA CORPORATION şirketi, bu RM-303 ürününün 1999/5/EC sayılı Direktifin esas şartları ve diğer ilgili hükümlerine uygun olduğunu beyan eder. Uygunluk Bildirimi'nin bir kopyasını http://www.nokia.com/phones/declaration_of_conformity/. © 2007 Nokia telif hakkıdır. Tüm hakları mahfuzdur. Nokia, Nokia Connecting People, Visual Radio ve Navi, Nokia Corporation'ın ticari veya tescilli ticari markalarıdır. Nokia tune, Nokia Corporation'ın ses markasıdır. Burada adı geçen diğer ürün ve şirket isimleri, kendi sahiplerinin ticari markaları ve ticari adları olabilir. Bu belge içindekilerin tamamı veya bir bölümü, Nokia'nın önceden yazılı izni alınmaksızın herhangi bir biçimde yeniden oluşturulamaz, kopyalanamaz, çoğaltılamaz, taklit edilemez, başka bir yere aktarılamaz, dağıtılamaz, saklanamaz veya yedeklenemez. US Patent No 5818437 and other pending patents. T9 text input software Copyright © 1997-2007. Tegic Communications, Inc. All rights reserved. Includes RSA BSAFE cryptographic or security protocol software from RSA Security. Java and all Java-based marks are trademarks or registered trademarks of Sun Microsystems, Inc. This product is licensed under the MPEG-4 Visual Patent Portfolio License (i) for personal and noncommercial use in connection with information which has been encoded in compliance with the MPEG-4 Visual Standard by a consumer engaged in a personal and noncommercial activity and (ii) for use in connection with MPEG-4 video provided by a licensed video provider. No license is granted or shall be implied for any other use. Additional information, including that related to promotional, internal, and commercial uses, may be obtained from MPEG LA, LLC. See http:// www.mpegla.com. -

Form 20-F 2008 Form 20-F Nokia Form 20-F 2008 Copyright © 2009

Nokia 20-F Form 2008 Form 20-F 2008 Copyright © 2009. Nokia Corporation. All rights reserved. Copyright © 2009. Nokia Corporation. of Nokia Corporation. trademarks registered Nokia and Connecting People are As filed with the Securities and Exchange Commission on March 5, 2009. UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20F ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2008 Commission file number 113202 Nokia Corporation (Exact name of Registrant as specified in its charter) Republic of Finland (Jurisdiction of incorporation) Keilalahdentie 4, P.O. Box 226, FI00045 NOKIA GROUP, Espoo, Finland (Address of principal executive offices) Kaarina Sta˚hlberg, Vice President, Assistant General Counsel Telephone: +358 (0) 7 18008000, Facsimile: +358 (0) 7 18038503 Keilalahdentie 4, P.O. Box 226, FI00045 NOKIA GROUP, Espoo, Finland (Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person) Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934 (the “Exchange Act”): Name of each exchange Title of each class on which registered American Depositary Shares New York Stock Exchange Shares New York Stock Exchange(1) (1) Not for trading, but only in connection with the registration of American Depositary Shares representing these shares, pursuant to the requirements of the Securities and Exchange Commission. Securities registered pursuant to Section 12(g) of the Exchange Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Exchange Act: None Indicate the number of outstanding shares of each of the registrant’s classes of capital or common stock as of the close of the period covered by the annual report. -

BURY Compatibility List Generator

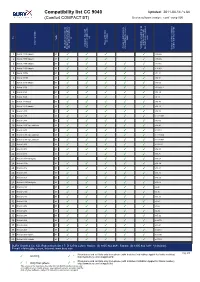

Compatibility list CC 9040 Updated: 2011-04-14 / v.64 (Comfort COMPACT BT) Device software version: comf_comp V05 on No key keys tags) Profile activation service provider Phone s REDIAL / private mode with Activation Bluetooth connection with device Bluetooth connection to used to test/ Comments after ignition is switched Access to mobile phone voice-dial function (voice the last connected phone Bluetooth device / phones Possibility to switch car kit Version of phone software 1 Nokia 2323 classic hf ✓ ✓ ✓ ✓ v 06.46 2 Nokia 2330 classic hf ✓ ✓ ✓ ✓ v 06.46 3 Nokia 2700 classic hf ✓ ✓ ✓ ✓ ✓ v 07.15 4 Nokia 2730 classic hf ✓ ✓ ✓ ✓ ✓ v 10.40 5 Nokia 3109c hf ✓ ✓ ✓ ✓ ✓ v07.21 6 Nokia 3110c hf ✓ ✓ ✓ ✓ ✓ v04.91 7 Nokia 3120 classic hf ✓ ✓ ✓ ✓ ✓ v10.00 8 Nokia 3230 hf ✓ ✓ ✓ ✓ ✓ v3.0505.2 9 Nokia 3250 hf ✓ ✓ ✓ ✓ ✓ v03.24 10 Nokia 3650 hf ✓ ✓ ✓ ✓ ✓ v4.13 11 Nokia 3710 fold hf ✓ ✓ ✓ ✓ ✓ v03.80 12 Nokia 3720 classic hf ✓ ✓ ✓ ✓ ✓ v09.10 13 Nokia 5200 hf ✓ ✓ ✓ ✓ ✓ v03.92 14 Nokia 5230 hf ✓ ✓ ✓ ✓ ✓ v 12.0.089 15 Nokia 5300 hf ✓ ✓ ✓ ✓ ✓ v05.00 16 Nokia 5310 XpressMusic hf ✓ ✓ ✓ ✓ ✓ v09.42 17 Nokia 5500 hf ✓ ✓ ✓ ✓ ✓ v 03.18 18 Nokia 5530 XpressMusic hf ✓ ✓ ✓ ✓ ✓ v 11.0.054 19 Nokia 5630 XpressMusic hf ✓ ✓ ✓ ✓ ✓ v 012.008 20 Nokia 5700 hf ✓ ✓ ✓ ✓ ✓ v 03.83.1 21 Nokia 6103 hf ✓ ✓ ✓ ✓ ✓ v04.90 22 Nokia 6021 hf ✓ ✓ ✓ ✓ ✓ v03.87 23 Nokia 6110 Navigator hf ✓ ✓ ✓ v03.58 24 Nokia 6124c hf ✓ ✓ ✓ ✓ ✓ v04.34 25 Nokia 6125 hf ✓ ✓ ✓ ✓ ✓ v03.71 26 Nokia 6131 hf ✓ ✓ ✓ ✓ v03.70 27 Nokia 6151 hf ✓ ✓ ✓ ✓ ✓ v03.56 28 Nokia 6210 Navigator hf ✓ ✓ ✓ ✓ ✓ v03.08 29 Nokia 6230 hf ✓ ✓ ✓ ✓ ✓ v5.40 30 Nokia 6230i hf ✓ ✓ ✓ ✓ ✓ v3.30 31 Nokia 6233 hf ✓ ✓ ✓ ✓ ✓ v03.70 32 Nokia 6234 hf ✓ ✓ ✓ ✓ ✓ v3.50 33 Nokia 6270 hf ✓ ✓ ✓ ✓ ✓ v3.66 34 Nokia 6280 hf ✓ ✓ ✓ ✓ ✓ v4.25 35 Nokia 6288 hf ✓ ✓ ✓ ✓ ✓ v05.92 36 Nokia 6300 hf ✓ ✓ ✓ ✓ ✓ v 04.70 37 Nokia 6300i hf ✓ ✓ ✓ ✓ ✓ v03.41 38 Nokia 6301 hf ✓ ✓ ✓ ✓ ✓ v 04.61 39 Nokia 6303 classic hf ✓ ✓ ✓ ✓ ✓ v 08.90 40 Nokia 6303i classic hf ✓ ✓ ✓ ✓ ✓ v 07.10 BURY GmbH & Co. -

Making Sense of Ambidexterity

Ekonomi och samhälle Economics and Society Skrifter utgivna vid Svenska handelshögskolan Publications of the Hanken School of Economics Nr 243 Seppo Laukkanen Making Sense of Ambidexterity A Process View of the Renewing Effects of Innovation Activities in a Multinational Enterprise Helsinki 2012 < Making Sense of Ambidexterity: A Process View of the Renewing Effects of Innovation Activities in a Multinational Enterprise Key words: innovation, ambidexterity, entrepreneurship, strategic renewal, multinational enterprise © Hanken School of Economics & Seppo Laukkanen, 2012 Seppo Laukkanen Hanken School of Economics Department of Management and Organization P.O.Box 479, 00101 Helsinki, Finland Hanken School of Economics ISBN 978-952-232-165-7 (printed) ISBN 978-952-232-166-4 (PDF) ISSN-L 0424-7256 ISSN 0424-7256 (printed) ISSN 2242-699X (PDF) Edita Prima Ltd, Helsinki 2012 i PREFACE It takes extraordinary effort and commitment to make a scientific contribution. This project took three years of persistent hard work, interspersed with short periods of total devotion, spent cloistered, focusing on this research project. These periods of total devotion enabled me as a researcher to dive deep into the minds of the innovators and fly high with the theories. Such immersion fostered lateral thinking and productive writing, both necessary to finalize this work. The unconditional support of my entire family was integral in this undertaking. Hanken has been a great academic home for the doctoral work. The great personalities, the state of the art competences and the rich international networks facilitated an elaborative way of working. The elaborative approach to research has been key to my discoveries. In particular, the vast academic experience and accommodating personality of Martin Lindell was crucial for developing the ability to do research grounded on real business rather than merely theoretical frameworks. -

Device Characteristics and Capabilities Discovery for Multimedia Content

Hindawi Publishing Corporation Journal of Computer Networks and Communications Volume 2012, Article ID 935653, 15 pages doi:10.1155/2012/935653 Research Article Device Characteristics and Capabilities Discovery for Multimedia Content Mohd Faisal Ibrahim,1 Saadiah Yahya,1 andMohdNasirTaib2 1 Faculty of Computer and Mathematical Sciences, Universiti Teknologi MARA, 40450 Shah Alam, Malaysia 2 Faculty of Electrical Engineering, Universiti Teknologi MARA, 40450 Shah Alam, Malaysia Correspondence should be addressed to Mohd Faisal Ibrahim, [email protected] Received 5 January 2012; Revised 20 April 2012; Accepted 21 April 2012 Academic Editor: Yueh M. Huang Copyright © 2012 Mohd Faisal Ibrahim et al. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. The rapid growth of web and mobile technologies has allowed people to access multimedia content from a wide range of heterogeneous client devices that have different characteristics and capabilities. In order to deliver the best presentation of content requested, the web system must possess a mechanism that is able to accurately discover the characteristics and capabilities of a client’s device. Existing content negotiation techniques mainly focus on static profiling approach without considering the combination of static and dynamic approaches that are capable of overcoming the device scalability issues. In view of these issues, we propose a hybrid approach for recognizing devices and their capabilities using token-based method. By proposing such solution, we can provide flexible, extensible, and scalable method that provides more accurate information in resolving the content negotiation issues.