Rt Hon Penny Mordaunt MP PAYMASTER GENERAL

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Cabinet Office Consultation on 'Better Use of Data in Government

Cabinet Office consultation on ‘Better use of data in government’ Response from the CLOSER Consortium CLOSER (Cohorts and Longitudinal Studies Enhancement Resources) is funded by the Economic and Social Research Council (ESRC) and Medical Research Council (MRC) to maximise the use, value and impact of the UK’s longitudinal studies. The network brings together eight leading longitudinal studies, the British Library and the UK Data Archive. CLOSER’s response to the consultation predominantly reflects our interest in being able to link individual administrative records to longitudinal survey data collected from that same individual. The linking of these two forms of data offers potential that exceeds the sum of the two approaches in isolation. While administrative records can provide enviable coverage and frequency, they rarely provide the richness and depth that comes from survey data collected to tackle specific research questions; conversely, survey data collection can be costly and challenging to administer, leading to missing data and possible biases which can be overcome by using administrative records to fill in the missing information. Consequently, combining the two can yield considerable benefits. For example, recent analysis of the National Pupil Database (NPD) and Higher Education Statistics Agency (HESA) found higher participation rates in higher education among a range of groups including ethnic-minorities.1 However, those records could not help explain these differences in participation; exploring this required linking individual -

THE GREEN BOOK Appraisal and Evaluation in Central Government

THE GREEN BOOK Appraisal and Evaluation in Central Government Treasury Guidance LONDON:TSO CONTENTS Page Page Contents iv Annex 1 Government intervention 51 Introduction 51 Preface v Economic efficiency 51 Chapter 1 Introduction and background 1 Equity 52 Introduction 1 Additionality 52 When to use the Green Book 2 Regeneration 54 Chapter 2 Overview of appraisal and Annex 2 Valuing non-market impacts 57 evaluation 3 Introduction 57 Introduction 3 Valuing non-market impacts 57 The appraisal and evaluation cycle 3 Current research/plausible estimates 59 The role of appraisal 3 Valuing environmental impacts 63 Process for appraisal and evaluation 4 Annex 3 Land and buildings 69 Presenting the results 6 Introduction 69 Managing appraisals and evaluations 7 Acquisition and use of property 69 Frameworks 8 Leases and rents 71 Issues relevant to appraisal and evaluation 9 Disposal of property 72 Chapter 3 Justifying action 11 Cost effective land use 72 Introduction 11 Annex 4 Risk and uncertainty 79 Reasons for government intervention 11 Introduction 79 Carrying out research 11 Risk management 79 Chapter 4 Setting objectives 13 Transferring risk 82 Introduction 13 Optimism bias 85 Objectives, outcomes, outputs and targets 13 Monte Carlo analysis 87 Irreversible risk 88 Chapter 5 Appraising the options 17 The cost of variability in outcomes 88 Introduction 17 Creating options 17 Annex 5 Distributional impacts 91 Valuing the costs and benefits of options 19 Introduction 91 Adjustments to values of costs and benefits 24 Distributional analysis 91 -

Head of Government Banking Service

Candidate Information Pack Head of Government Banking Service (SCS Payband 1) Reference: HOGB15 Closing Date – Midnight 31st January 2016 Contents Welcome Message from Justin Holliday, Chief Finance Officer for HM Revenue and Customs 1 Background Information 2 Background to Government Banking Service 2 Background to HM Revenue and Customs 3 About the Role 4 Person Specifications 6 How to Apply 7 Indicative Timeline 8 Terms, Conditions and Reunifications 8 Welcome message from Justin Holliday, Chief Finance Officer, HM Revenue and Customs This role provides you with the unique opportunity to make a substantial impact on the operation of government and on the UK payments sector as a whole. You will be responsible for leading the Government Banking Service as a commercially viable shared service, sustaining strong working relationships with the banks which deliver the underlying money transmissions and maintaining a reputation for timely and accurate reporting This is an important role and we are looking for someone with the skills to deliver successful change management and to both establish and lead operational teams as we develop the business at this exciting time. As a senior leader within HMRC, you will also play a large role in the Department’s transformation journey over the next five years. I look forward to receiving your application. Justin Holliday 1 Background Information Background to Government Banking Service The Government Banking Service is both a new and an old organisation. Although it was only formed in 2008 and came into full service in 2010, its roots are in the Office of HM Paymaster General that has been operating since 1836 as a banking shared service provider for government and the wider public sector. -

HM Revenues and Customs (148KB Pdf)

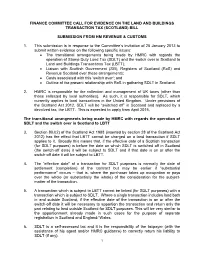

FINANCE COMMITTEE CALL FOR EVIDENCE ON THE LAND AND BUILDINGS TRANSACTION TAX (SCOTLAND) BILL SUBMISSION FROM HM REVENUE & CUSTOMS 1. This submission is in response to the Committee’s invitation of 25 January 2013 to submit written evidence on the following specific issues: The transitional arrangements being made by HMRC with regards the operation of Stamp Duty Land Tax (SDLT) and the switch over in Scotland to Land and Buildings Transactions Tax (LBTT); Liaison with Scottish Government (SG), Registers of Scotland (RoS) and Revenue Scotland over these arrangements; Costs associated with this ‘switch over’; and Outline of the present relationship with RoS in gathering SDLT in Scotland. 2. HMRC is responsible for the collection and management of UK taxes (other than those collected by local authorities). As such, it is responsible for SDLT, which currently applies to land transactions in the United Kingdom. Under provisions of the Scotland Act 2012, SDLT will be “switched off” in Scotland and replaced by a devolved tax, the LBTT. This is expected to apply from April 2015. The transitional arrangements being made by HMRC with regards the operation of SDLT and the switch over in Scotland to LBTT 3. Section 80J(2) of the Scotland Act 1998 (inserted by section 28 of the Scotland Act 2012) has the effect that LBTT cannot be charged on a land transaction if SDLT applies to it. Broadly this means that, if the effective date of a Scottish transaction (for SDLT purposes) is before the date on which SDLT is switched off in Scotland (the switch-off date) it will be subject to SDLT and if that date is on or after the switch-off date it will be subject to LBTT. -

Cabinet Secretary for Culture and External Affairs.Dot

Rt Hon Michael Gove MP Chancellor of the Duchy of Lancaster Cabinet Office 70 Whitehall London SW1A 2AS __ 17 June 2020 Dear Michael In our joint statement of 14 June, which expressed disappointment in your decision not to request an extension to transition before we had an opportunity to discuss this crucial matter ahead of the high level political stocktake, we said that we would write to you on the subject of ‘rebooting’ the process of engagement between the UK and Devolved Governments on the EU-UK negotiations. This letter sets out our thinking on this important subject. We have, in the meantime, received your letter of 14 June responding to our statement. As you acknowledged, we have different views on the way forward and our governments are not going to agree on the core fundamental positions with regard to the EU-UK future relationship. To our mind, this is all the more reason for us to re-double our efforts to work together for the benefit of business and communities in all parts of the United Kingdom, particularly as the option of an extension will no longer be open to the UK after the end of this month. It was because of the immutability of that deadline within the Withdrawal Agreement that we were so disappointed that the final decision was taken in advance of the meeting. While we have had the opportunity to register our views on this issue on several occasions, we would point out the difference between the quantity of meetings and other contacts between our administrations, and the quality of the engagement. -

Cabinet Office – Annual Report and Accounts 2020-21

Annual Report and Accounts 2020-21 HC 391 Annual Report and Accounts 2020-21 (for period ended 31 March 2021) Accounts presented to the House of Commons pursuant to Section 6 (4) of the government Resources and Accounts Act 2000 Annual Report presented to the House of Commons by Command of Her Majesty Ordered by the House of Commons to be printed on 15 July 2021 HC 391 This is part of a series of departmental publications which, along with the Main Estimates 2021-22 and the document Public Expenditure: Statistical Analyses 2019, present the government’s outturn for 2020-21 and planned expenditure for 2021-22. © Crown copyright 2021 This publication is licensed under the terms of the Open Government Licence v3.0 except where otherwise stated. To view this licence, visit nationalarchives.gov.uk/doc/open-Government-licence/version/3 Where we have identified any third-party copyright information you will need to obtain permission from the copyright holders concerned. This publication is available at: www.gov.uk/official-documents Any enquiries regarding this publication should be sent to us at: [email protected] ISBN – 978-1-5286-2550-0 CCS – CCS0421468362 07/21 Printed on paper containing 75% recycled fibre content minimum. Printed in the UK by the APS Group on behalf of the Controller of Her Majesty’s Stationery Office. Contents Directors’ Report 7 Foreword 8 Ministers and Board Members 10 Permanent Secretary’s perspective on performance 14 Cabinet Office Lead Non-Executive’s Report 17 Performance Report 19 Cabinet Office Overview 20 Long Term Expenditure Trends 24 Supporting the Government response to COVID-19 27 Strategic Objectives 32 Governance Report 55 Statement of Accounting Officer’s responsibilities 56 Governance Statement 58 Accountability Report 75 Remuneration and staff report 76 1. -

THE 422 Mps WHO BACKED the MOTION Conservative 1. Bim

THE 422 MPs WHO BACKED THE MOTION Conservative 1. Bim Afolami 2. Peter Aldous 3. Edward Argar 4. Victoria Atkins 5. Harriett Baldwin 6. Steve Barclay 7. Henry Bellingham 8. Guto Bebb 9. Richard Benyon 10. Paul Beresford 11. Peter Bottomley 12. Andrew Bowie 13. Karen Bradley 14. Steve Brine 15. James Brokenshire 16. Robert Buckland 17. Alex Burghart 18. Alistair Burt 19. Alun Cairns 20. James Cartlidge 21. Alex Chalk 22. Jo Churchill 23. Greg Clark 24. Colin Clark 25. Ken Clarke 26. James Cleverly 27. Thérèse Coffey 28. Alberto Costa 29. Glyn Davies 30. Jonathan Djanogly 31. Leo Docherty 32. Oliver Dowden 33. David Duguid 34. Alan Duncan 35. Philip Dunne 36. Michael Ellis 37. Tobias Ellwood 38. Mark Field 39. Vicky Ford 40. Kevin Foster 41. Lucy Frazer 42. George Freeman 43. Mike Freer 44. Mark Garnier 45. David Gauke 46. Nick Gibb 47. John Glen 48. Robert Goodwill 49. Michael Gove 50. Luke Graham 51. Richard Graham 52. Bill Grant 53. Helen Grant 54. Damian Green 55. Justine Greening 56. Dominic Grieve 57. Sam Gyimah 58. Kirstene Hair 59. Luke Hall 60. Philip Hammond 61. Stephen Hammond 62. Matt Hancock 63. Richard Harrington 64. Simon Hart 65. Oliver Heald 66. Peter Heaton-Jones 67. Damian Hinds 68. Simon Hoare 69. George Hollingbery 70. Kevin Hollinrake 71. Nigel Huddleston 72. Jeremy Hunt 73. Nick Hurd 74. Alister Jack (Teller) 75. Margot James 76. Sajid Javid 77. Robert Jenrick 78. Jo Johnson 79. Andrew Jones 80. Gillian Keegan 81. Seema Kennedy 82. Stephen Kerr 83. Mark Lancaster 84. -

Lead Non-Executive Director – Department for Education

Lead Non-Executive Director – Department for Education Introduction The Department for Education’s (DfE) aim is to ensure world-class education and care that allows every child and young person to reach his or her potential, regardless of background. Over the next four years, the Department is leading an ambitious and wide-ranging programme of reform across early years, schools, 16-19, and children’s social care, building on and extending the changes of the last Parliament. We are expanding the academies and free school programme to empower professionals on the frontline, reforming the curriculum and qualifications so that they represent an international gold standard, and ensuring that young people leave school with the knowledge, skills and resilience to succeed in modern Britain. At the same time we are reforming adoption, fostering and children’s services so that they work quickly and effectively to transform the life chances of the most vulnerable and disadvantaged young people. These changes set a challenge for the organisation itself. We delivered significant organisational change in 2010-15 and halved administrative expenditure in real terms over this period. With substantial resources allocated to our priorities in the 2015 spending review, our focus for 2015-20 is on ensuring the Department has the capability and capacity it needs to implement the Government’s strategic priorities. Setting the right conditions for success in education and children’s services means becoming increasingly effective in how we deliver reform: transforming the way we go about our work in order to help leaders in the education and social care systems do likewise. -

THE WALES COMMISSIONER the Equality and Human Rights

THE WALES COMMISSIONER The Equality and Human Rights Commission CANDIDATE INFORMATION PACK 2021 Closing date for this post is: 3 September 2021 at 17:00 hrs Applications should be sent to: [email protected] If you require this information in an alternative format or in Welsh language please contact [email protected] Twitter - Follow us to keep up to date with public appointments vacancies http://publicappointments.cabinetoffice.gov.uk Page 1 of 16 Contents A Message from the Minister for Women and Equalities 3 Diversity and Equality of opportunity 4 Background to the Organisation 5 Role of the EHRC Wales Commissioner 6 Person specification and eligibility criteria 7 Conditions of appointment 8 Indicative timetable and how to apply 9 Privacy notice 11 How we will handle your application 14 Complaints Process 15 Standards in public life, political activity, disqualification from appointment 16 and conflicts of interests Page 2 of 16 A Message from the Minister for Women and Equalities Thank you for your interest in becoming the Wales Commissioner of the Equality and Human Rights Commission (EHRC). The EHRC is an independent body responsible for promoting and enforcing the laws that protect fairness, dignity and respect. It contributes to making and keeping Britain a fair society in which everyone, regardless of background, has an equal opportunity to fulfil their potential. The EHRC uses its unique powers to challenge discrimination, promote equality of opportunity and protect human rights. The Wales Commissioner chairs a statutory Wales Committee with important functions. The Committee’s main duties include advising the Commission about the exercise of its powers in so far as they affect Wales. -

Statement by Chief Minister Re Meeting with HM Treasury

STATEMENTS ON A MATTER OF OFFICIAL RESPONSIBILITY The Bailiff: Very well, we now come to statements. The first statement of which I have notice is a statement to be made by the Chief Minister regarding a meeting with Her Majesty’s Treasury on 27th November. 6. Statement by Chief Minister regarding a meeting with H.M. Treasury on 27th November 2008. 6.1 Senator F.H. Walker (The Chief Minister): Members will be aware that in his pre-budget report delivered last week the U.K. Chancellor of the Exchequer announced a review of the long term opportunities and challenges facing the Crown Dependencies and Overseas Territories as financial centres which have been brought into focus by recent financial and economic events. We in Jersey have, of course, been here before with the Edwards Review in 1998. However, to some extent this time it is different. We are now experienced in the review process. We have already been fully reviewed by the I.M.F. in 2003 and at that time were found to be almost fully compliant with the then international standards of regulation. More recently we have engaged with a review of the Treasury Select Committee in their work on offshore centres. Even more recently we have just concluded a further review by I.M.F. teams looking into our compliance firstly with international standards of anti-money laundering and countering the financing of terrorism; and secondly with prudential regulation under an I.M.F. review which includes matters of financial stability. We await their reports in due course. -

Michael Potter Committee for TEO Room 412 Parliament Buildings Ballymiscaw Stormont BELFAST BT4 3SR 26 January 2021

Stormont Castle BELFAST BT4 3TT Michael Potter Committee for TEO Room 412 Parliament Buildings Ballymiscaw Stormont BELFAST BT4 3SR 26 January 2021 Dear Michael Joint Ministerial Committee (European Negotiations) Meeting – Tuesday 29 December 2020 I wrote to you on Tuesday 29 December to advise you that the twenty eighth meeting of the Joint Ministerial Committee (EU Negotiations) (JMC (EN)) would be held on the same day at 16.30 and to provide you with a copy of the agreed agenda. I am now writing to report on the Executive’s actions at that meeting and provide you with a copy of the Joint Communiqué. The Executive was represented at the meeting by the First Minister and deputy First Minister. From the UK Government: The Chancellor of the Duchy of Lancaster, Rt Hon Michael Gove MP, The Secretary of State for Scotland, Rt Hon Alister Jack MP, The Secretary of State for Wales, Rt Hon Simon Hart MP, The Secretary of State for Northern Ireland, Rt Hon Brandon Lewis MP, and The Paymaster General, Rt Hon Penny Mordaunt MP. From the Scottish Government: The Cabinet Secretary for the Constitution, Europe and External Affairs, Michael Russell MSP and The Minister for Europe and International Development, Jenny Gilruth MSP. From the Welsh Government: The Counsel General and Minister for European Transition, Jeremy Miles MS. The Joint Communiqué is attached at Appendix A. On the UK-EU Trade and Cooperation Agreement (TCA), an update on the agreement was provided by David Frost, the Prime Minister’s Europe Adviser and Chief Negotiator of Task Force Europe. -

TRADE and COOPERATION AGREEMENT First Meeting of The

TRADE AND COOPERATION AGREEMENT First Meeting of the Partnership Council 9 June 2021, 08:00-09:30 BST, Admiralty House, London MINUTES SUMMARY The Partnership Council: ● Discussed SPS measures and customs controls in relation to trade in goods between the Parties. ● Welcomed the outcome of the annual fisheries consultations for the rest of 2021 and discussed some other issues related to the implementation of the fisheries heading of the TCA. ● Noted the Parties’ intention that the Specialised Committee on Fisheries should be convened as soon as possible, and operate as an effective cooperation platform. ● Recognised that arrangements on law enforcement are working well in practice. ● Noted the Parties’ intention that the Specialised Committee on Participation in Union Programmes should be convened as soon as possible. ● Discussed long-term visa fees for EU citizens in the UK. ● Noted that implementing the governance structures of the TCA is critical to the implementation of the Agreement. ● Agreed on an indicative timetable of TCA Specialised Committee meetings in 2021. ● Committed to encourage their respective Parliaments to establish the Parliamentary Partnership Assembly, and agreed to facilitate establishing the Civil Society Forum as quickly as possible by adopting operational guidelines. Item 1: Introduction Item 1.1: Welcome and opening remarks from the co-chairs 1. The UK co-chair, Rt Hon Lord Frost of Allenton, Minister at the Cabinet Office, welcomed everyone to the meeting and introduced the UK delegation. He noted that it was the first meeting of the Trade and Cooperation Agreement (TCA) Partnership Council (PC), and that this marked a new phase in the UK and EU relationship as sovereign equals.