Fichier Modele Des Documents Vierge

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Consolidated Results at September 30, 2019

PRESS RELEASE Rabat, October 21, 2019 CONSOLIDATED RESULTS AT SEPTEMBER 30, 2019 Improvements all round: » Group customer bases up to nearly 68 million customers; » Increase in Group revenues (up 0.9% on a like-for-like basis*) thanks to Mobile Data; » Steady increase in Consolidated EBITDA (up 4.9% on a like-for-like basis*) thanks to continued cost-optimization efforts; » Group share of adjusted Net Income up 1.3% on a like-for-like basis*; » Adjusted Consolidated Cash Flow From Operations up 18.0% (like-for-like basis*) with capital expenditure at 12.0% of consolidated revenues. Outlook for 2019 maintained, at constant scope and exchange rates and excluding IFRS16: ► Stable revenues; ► Stable EBITDA; ► CAPEX approximately 15% of revenues, excluding frequencies and licenses. To mark the publication of this press release, Abdeslam Ahizoune, Chairman of the Management Board, made the following comments: “Maroc Telecom group maintains its growth trend Reference player in all its markets, Maroc Telecom with increased revenues, from Data in particular, continues to support the changes brought by the and its margin improvement thanks to cost digital transformation through infrastructures optimization. These results strengthen the Group in deployment and enhanced offers to make achieving its annual objectives and confirm the technological innovation accessible to the largest profitability and the relevancy of its business number of users.” model. *Like-for-like basis refers to the consolidation of Tigo Chad, unchanged MAD/Ouguiya/ CFA Franc -

Consolidated Results for Q1 2020

PRESS RELEASE Rabat, April 20, 2020 CONSOLIDATED RESULTS FOR Q1 2020 Good operational performance: » Almost 69 million customers in the Group, up 11.3%; » +4.0% growth in consolidated revenue (+2.0% on a like-for-like basis*) thanks to the strong interest for Mobile Data in Morocco and the subsidiaries; » EBITDA improved by 2.2% on a like-for-like basis*, enabling margins to be kept at a high level of 51.5% (+0.1 pt on a like-for-like basis*); » Adjusted Net Income Group share increased by 1.4% on a like-for-like basis*. To mark the publication of the quarterly results, Mr. Abdeslam Ahizoune, Chairman of the Management Board, made the following comments: “The results of this first quarter are driven by the customers. The Group has managed to ensure positive momentum of customer base and Data the availability and continuity of its services under revenue across the countries in which the Group exceptional conditions imposed by the pandemic. operates. In the current context of health crisis It thus quickly mobilized technological resources and lockdown, the Group remains fully mobilized to increase the capacities of the networks in order for the protection of its employees and its to face the increase in Data usage.” *Like-for-like basis refers to the consolidation of Tigo Chad, unchanged MAD/Ouguiya/CFA Franc exchange rates and the neutralization of the application of IFRS16 impacts. 1 GROUP’S ADJUSTED* CONSOLIDATED RESULTS Change IFRS in MAD million Q1-2019 Q1-2020 Change on a like-for-like basis(1) Revenue 8,948 9,309 +4.0% +2.0% EBITDA -

Download Press Release

Press release Rabat, July 8, 2009 Maroc Telecom declared the winner of the international tender offer for the acquisition of a 51% stake in SOTELMA, the incumbent Malian telecoms operator, for €275 million. Under the presidency of his Excellency Mr. Amadou Toumani Touré, President of the Republic of Mali, Mr. Abdeslam Ahizoune, Chairman of the Management Board of Maroc Telecom, and Ms. Diarra Mariam Flanté Diallo, Minister of Communications and New Technologies with responsibility for the privatization process and Mr. Sanoussi Touré, Minister of the Economy and Finance, signed a definitive transaction agreement on July 7, 2009 in the presence of his Excellency Mr. Modibo Sidibé, Prime Minister and head of the government of the Republic of Mali, and the members of the Malian government. Commenting on the signing of the agreement, Mr. Ahizoune stated: “We are satisfied with the conclusion of this partnership between Maroc Telecom and the government of the Republic of Mali in connection with the privatization of SOTELMA. The company has a powerful brand image in Mali and offers considerable growth potential. Maroc Telecom will do everything necessary to make the company the preeminent telecoms operator in its region”. SOTELMA generated revenues of €112 million in 2007. At end-December 2008, it had over 500,000 active mobile subscribers and over 83,000 fixed-line subscribers (Source: ITU). Growth prospects for the Malian market are particularly promising, with an estimated mobile penetration rate of 26% and a fixed-line penetration rate of 0.6% at end-2008. For reference, Maroc Telecom owns majority stakes in the Mauritanian incumbent operator, Mauritel (since April 2001), in ONATEL of Burkina Faso (since December 2006) and in Gabon Telecom (since February 2007). -

H1 2020 Consolidated Results

PRESS RELEASE Rabat, July 20, 2020 H1 2020 CONSOLIDATED RESULTS Resilience of the Group's business amid an unprecedented health crisis: » 9% growth in the Group's overall customer base, which reached 68.4 million customers; » Stable consolidated revenues thanks to International activities and Mobile and Fixed line Data in Morocco; » Maintain of good profitability through optimized cost management: Consolidated EBITDA margin of 52.4%, up 0.7 pt on a like-for-like basis; » Rapid adaptation of network resources and capacity to respond to market developments facing the Covid-19 crisis. Revision of 2020 outlook on a like-for-like basis and at constant exchange rates: ► Slight decrease in revenues; ► Slight decrease in EBITDA; ► CAPEX of approximately 10% of revenues, excluding frequencies and licenses. Upon the publication of this press release, Mr. Abdeslam Ahizoune, Chairman of the Management Board, said: «In an unprecedented context of global health Maroc Telecom, a socially responsible company, crisis, the Maroc Telecom Group is mobilized to has also contributed to the collective effort through comply with the authorities' guidelines and meet numerous initiatives in Morocco and in the the expectations of its customers. countries of its subsidiaries, notably through contributions to COVID funds set up by the The Group's network capacities and authorities. infrastructures, which were very busy during the lockdown period, fully responded to the increase in This health context prompted the Group to adopt a demand and the expansion of new usages, without broad cost optimization plan, which made it any impact on the quality of service. The relevance possible to maintain good performance over the of the Group's strategy, focused on investment for half-year despite the first effects of the pandemic.» the strengthening of networks, infrastructures and digitalization, is thus reinforced. -

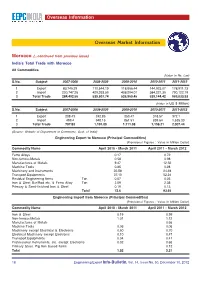

10Th December, 2012.Pmd

Overseas Information Overseas Market Information Morocco (...continued from previous issue) India’s Total Trade with Morocco All Commodities (Value in Rs. Lac) S.No. Subject 2007-2008 2008-2009 2009-2010 2010-2011 2011-2012 1 Export 83,745.29 110,544.19 118,656.44 144,923.07 178,911.73 2 Import 200,747.26 429,263.55 408,294.01 384,221.35 790,122.19 3 Total Trade 284,492.55 539,807.74 526,950.45 529,144.42 969,033.93 (Value in US $ Million) S.No. Subject 2007-2008 2008-2009 2009-2010 2010-2011 2011-2012 1 Export 208.43 242.85 250.47 318.57 372.1 2 Import 499.4 948.15 861.51 839.64 1,635.33 3 Total Trade 707.83 1,191.00 1,111.98 1,158.21 2,007.44 (Source: Website of Department of Commerce, Govt. of India) Engineering Export to Morocco (Principal Commodities) (Provisional Figures : Value in Million Dollar) Commodity Name April 2010 - March 2011 April 2011 - March 2012 Ferro Alloys 0.17 0.72 Non-ferrous Metals 0.58 0.98 Manufactures of Metals 9.47 12.32 Machine Tools 0.35 0.28 Machinery and Instruments 22.58 24.48 Transport Equipments 37.10 52.31 Residual Engineering Items Ton 0.07 0.05 Iron & Steel Bar/Rod etc. & Ferro Alloy Ton 2.09 2.38 Primary & Semi-finished Iron & Steel 0.19 0.13 Total 72.6 93.65 Engineering Import from Morocco (Principal Commodities) (Provisional Figures : Value in Million Dollar) Commodity Name April 2010 - March 2011 April 2011 - March 2012 Iron & Steel 0.19 0.99 Non-ferrous Metals 1.01 1.12 Manufactures of Metals 0.66 Machine Tools 0.06 0.06 Machinery except Electrical & Electronic 0.50 0.70 Electrical Machinery except Electronic 0.10 0.47 Transport Equipments 0.04 0.41 Professional Instruments, etc. -

Developement-Report2013 En.Pdf

MAROC Maroc Telecom MAURITANIE MALI Mauritel Sotelma BURKINA FASO Onatel GABON Gabon Télécom 2001 2004 2005 Strategic partner Vivendi IPO, with 14.9% of Vivendi increases its key acquires a 35% stake in the Company's share stake in Maroc Telecom, Maroc Telecom. capital floated on the from 35% to 51%. Acquisition of Casablanca and Paris dates 54% of Mauritel, stock exchanges. Mauritania's incumbent telecommunications operator. A major player in the socioeconomic development of five african countries More than 37 millions customers, + 13,3% year on year 34,7 millions 1,64 millions 3,3 millions customers customers customers mobile-telephony fixed-line active internet MAD 28,56 billion - 4,3 % * from 2012 in revenues MAD 16,2 billion MAD 5,54 billion in EBITDA in net income (Group share) - 3 % * from 2012 - 17,4 % * from 2012 *Like for like 2006 2007 2009 2013 Acquisition in December Acquisition in February of Acquisition in July Vivendi and Etisalat of 51% of Onatel, Burkina 51% of Gabon Télécom of 51% of Sotelma, enter into exclusive Faso's incumbent SA, Gabon's incumbent Mali's incumbent negotiations for the sale telecommunications telecommunications telecommunications of Vivendi's 53% stake in operator. operator. Vivendi operator. Maroc Telecom. increases its stake in Maroc Telecom, from 51% to 53%. 03 Business activity in Morocco MAD 21,3 billion MAD 12,3 billion in revenues in EBITA - 8,1 % from 2012 - 8,2 % from 2012 Mobile customer base Fixe-line customer base Internet customer base ADSL 99,95 % market share 42,85 % 88,01 % * market share market share Internet 3G *Excl. -

View Annual Report

2012 ANNUAL REPORT CONTENTS GROUP PROFILE – BUSINESSES – FINANCIAL REPORT – CONSOLIDATED LITIGATION – RISK FACTORS 2 FINANCIAL STATEMENTS – 1 4 STATUTORY AUDITORS’ REPORT 1. GROUP PROFILE 4 ON THE CONSOLIDATED FINANCIAL 2. BUSINESSES 16 STATEMENTS – STATUTORY 3. LITIGATION 45 AUDITORS’ REPORT ON THE FINANCIAL STATEMENTS – 4. RISK FACTORS 51 STATUTORY FINANCIAL STATEMENTS 168 SELECTED KEY CONSOLIDATED SOCIETAL, SOCIAL AND FINANCIAL DATA 170 ENVIRONMENTAL INFORMATION 54 I. 2012 FINANCIAL REPORT 171 2 II. APPENDICES TO THE FINANCIAL 1. CORPORATE SOCIAL RESPONSIBILITY (CSR) POLICY 56 REPORT : UNAUDITED SUPPLEMENTARY FINANCIAL DATA 207 2. SOCIETAL INFORMATION 60 III. CONSOLIDATED FINANCIAL 3. SOCIAL INFORMATION 71 STATEMENTS FOR THE YEAR 4. ENVIRONMENTAL INFORMATION 86 ENDED DECEMBER 31, 2012 212 5. VERIFICATION OF IV. VIVENDI SA 2012 STATUTORY NON-FINANCIAL DATA 95 FINANCIAL STATEMENTS 320 INFORMATION ABOUT RECENT EVENTS – OUTLOOK – THE COMPANY – CORPORATE 5 STATUTORY AUDITORS’ REPORT 364 GOVERNANCE 100 3 1. RECENT EVENTS 366 1. GENERAL INFORMATION 2. OUTLOOK 366 ABOUT THE COMPANY 102 3. STATUTORY AUDITORS’ REPORT 2. ADDITIONAL INFORMATION ON EBITA OR EBITDA FORECASTS ABOUT THE COMPANY 103 BY BUSINESS UNIT 367 3. CORPORATE GOVERNANCE 118 4. REPORT BY THE CHAIRMAN OF VIVENDI’S SUPERVISORY BOARD INDEPENDENT AUDITORS ON CORPORATE GOVERNANCE, 6 RESPONSIBLE FOR AUDITING – INTERNAL AUDITS AND RISK THE FINANCIAL STATEMENTS 368 MANAGEMENT – FISCAL YEAR ENDED DECEMBER 31, 2012 156 1. INDEPENDENT AUDITORS RESPONSIBLE 5. STATUTORY AUDITORS’ REPORT, FOR AUDITING THE FINANCIAL PREPARED IN ACCORDANCE WITH STATEMENTS 370 ARTICLE L.225-235 OF THE FRENCH COMMERCIAL CODE, ON THE REPORT PREPARED BY THE CHAIRMAN OF THE SUPERVISORY BOARD OF VIVENDI SA 166 2012 ANNUAL REPORT The Annual Report in English is a translation of the French “Document de référence” provided for information purposes. -

MAD 10 Billion Investment Agreement Signed by Moroccan Government and Maroc Telecom

Release Rabat, January 16, 2013 MAD 10 Billion Investment Agreement Signed by Moroccan Government and Maroc Telecom Infrastructure modernization and expansion to satisfy rapid growth of mobile traffic and broadband internet Rollout of fiber-optic network to meet rising demand for ultrafast broadband Under the chairmanship of the Moroccan prime minister Mr. Abdelilah Benkirane, Messrs. Nizar Baraka, Minister of Economy and Finance, and Abdelkader Amara, Minister of Industry, Trade, and New Technologies, both representing the government and Mr. Abdeslam Ahizoune, Chairman of the Management Board of Maroc Telecom, proceeded on January 16, 2013 with the signing of the fourth investment agreement between the government and Maroc Telecom. Pursuant to this agreement, Maroc Telecom commits to undertake an investment program of MAD 10.087 million over the period 2013–2015 leading to the creation of 500 direct jobs. The agreement aims at modernizing and expanding the infrastructures to meet the growing needs of mobile traffic and broadband internet, and the rollout of the fiber-optic access network for ultrafast broadband. The program will replace nearly all existing equipment with the latest technologies, in addition to directly creating 500 long-term jobs. On this occasion, Mr. Ahizoune stated that “this investment marks a turning point in the history of Maroc Telecom, which is now positioned to meet the challenge of technological generation change and the related services.” He added that “this program is the driving force for the democratization of NICT access, which is key in today’s digital world and vital for economic and social growth in Morocco.” In addition to the MAD 10 billion to be invested in Morocco over the period 2013–2015, MAD 4 billion will be invested in the Group’s foreign subsidiaries over the same period. -

REGISTRATION DOCUMENT Including the Annual Unancial Report Worldreginfo - 4E3f6317-7984-4435-8B2c-Cd58e13b8244 CONTENTS

2 0 1 7 REGISTRATION DOCUMENT including the annual Unancial report WorldReginfo - 4e3f6317-7984-4435-8b2c-cd58e13b8244 CONTENTS MESSAGE FROM THE MANAGEMENT 1 KEY FIGURES, GROUP STRATEGY BOARD’S CHAIRMAN 2 AND RISK FACTORS 11 CORPORATE 1.1b 2017 key Ɠ gures 12 GOVERNANCE 3 1.2b Group strategy 14 MAROC TELECOM IN BRIEF 4 1.3b Risk factors 16 HIGHLIGHTS 2017 6 2 GENERAL INFORMATION ABOUT THE COMPANY 23 2.1b Person responsible for the Registration Document and for the audit of the Ɠ nancial statements 24 2.2b Information about the Company andbcorporate governance 26 3 DESCRIPTION OF THE GROUP, BUSINESS ACTIVITIES, LEGAL AND ARBITRATION PROCEEDINGS 61 3.1b Description of the Group 62 3.2b Business activities 70 3.3b Legal and arbitration proceedings 103 4 FINANCIAL REPORT 105 4.1b Consolidated results of the past threebyears 106 4.2b Overview 109 4.3b Consolidated Ɠ nancial statements atb31bDecemberb2015, 2016 and 2017 120 4.4b Statutory Ɠ nancial statements 166 5 RECENT DEVELOPMENTS AND GROWTH OUTLOOK 197 5.1b Recent developments 198 5.2b Market outlook 198 5.3b Objectives 199 6 NOTES 203 Cross-reference table 204 Financial information reported in 2017 207 Statutory auditors’ fees 207 Ordinary Shareholders’ Meeting ofbAprilb24,b2018 208 Glossary 210 WorldReginfo - 4e3f6317-7984-4435-8b2c-cd58e13b8244 2017 REGISTRATION DOCUMENT Including the annual financial report This Registration Document was filed with the French Financial Markets Regulator (AMF) on April 09, 2018, in accordance with Article 2212-13 of its General Regulations. The Registration Document may be used in connection with a financial transaction if supplemented by an offering circular (note d’opération) approved by the AMF. -

FINANCIAL REPORT First Half of 2020

FINANCIAL REPORT First Half of 2020 1 Maroc 1 Telecom • Financial Report H1 2020 Preliminary remarks: This financial report and the condensed financial statements for the half year ended June 30th, 2020 were approved by the Management Board on July 16th, 2020, and reviewed by the Audit Committee at its meeting on July 17th, 2020. This report should be read in conjunction with the Management Board’s report for the year ended December 31, 2019 as published in Registration Document as filed with the Securities Regulator (AMF) on April 27, 2020 (“2019 universal registration document”). 2 Maroc 2 Telecom • Financial Report H1 2020 CONTENTS HIGHLIGHTS 1. CERTIFICATIONS 1.1 Person responsible for the interim report 7 1.2 Certification of the interim report 7 1.3 Persons responsible for the audit of the financial statements 7 2. H1 ACTIVITY REPORT 2.1 Description of activities 11 2.2 Related-party transactions 20 2.3 Growth outlook 23 3. FINANCIAL REPORT 3.1 Consolidated financial Data 25 3.2 Income statement and financial position 28 3.3 Consolidated financial statements and notes 32 3.4 Statutory financial statements 43 3 Maroc 3 Telecom • Financial Report H1 2020 Highlights January 2020 In Morocco, the ANRT decision on the referral from Wana on unbundling imposing financial penalty and injunctions. IAM complies with the terms of the decision within the deadlines. Maroc Telecom is launching the "All-in-One" *5 pass which adapts to customer use and habits and can be used to make domestic and international calls, send SMSs and connect to the Internet. -

CONSOLIDATED RESULTS for the 1St QUARTER 2021

PRESS RELEASE Rabat, 23 April 2021 CONSOLIDATED RESULTS FOR THE 1st QUARTER 2021 Results driven by solid performances in subsidiaries: » Increase in the Group's customer base by 6.8%, more than 73 million customers; » Profitability maintained with the Group's adjusted EBITDA margin at 51.2%; » Growth in Mobile Data (+15.8%*) and Mobile Money services (+21.9%*) in the Moov Africa subsidiaries; » Sustained growth in Fixed Data in Morocco of +11.9%. To mark the publication of the quarterly results, Mr Abdeslam Ahizoune, Chairman of the Management Board, stated: “In a context still marked by the health crisis its investments on strengthening networks, linked to Covid-19, the Maroc Telecom Group infrastructure and improving the quality of ends the first quarter with operating results driven service. by its international assets. Its diversification strategy is once again proving itself and While this crisis' duration and effect on the improving its resilience in this context of crisis. economy are still unknown, the Group will remain vigilant and fully mobilised in order to The Group is continuing its savings plan and is overcome it." managing to maintain its profitability and focuses * At constant exchange rates MAD/Ouguiya/CFA franc 1 THE GROUP’S ADJUSTED CONSOLIDATED RESULTS* (IFRS in MAD million) Change at constant Q1 2020 Q1 2021 Change exchange rates (1) Revenues 9,309 8,914 -4.2% -5.0% Adjusted EBITDA 4,794 4,561 -4.9% -5.5% Margin (%) 51.5% 51.2% -0.3 pt -0.3 pt Adjusted EBITA 2,913 2,746 -5.7% -6.2% Margin (%) 31.3% 30.8% -0.5 pt -0.4 -

FINANCIAL REPORT First Half of 2019

FINANCIAL REPORT First Half of 2019 1 Maroc 1 Telecom • Financial Report H1 2019 Preliminary remarks: This financial report and the condensed financial statements for the half year ended June 30th, 2019 were approved by the Management Board on July 16th, 2019. They were submitted to the Supervisory Board on July 19, 2019, after review by the Audit Committee at its meeting on July 19th, 2019. This report should be read in conjunction with the Management Board’s report for the year ended December 31, 2018 as published in Registration Document as filed with the Securities Regulator (AMF) on April 11, 2019 (“the 2018 Registration Document”). 2 Maroc 2 Telecom • Financial Report H1 2019 CONTENTS HIGHLIGHTS 1. CERTIFICATIONS 1.1 Person responsible for the interim report 7 1.2 Certification of the interim report 7 1.3 Persons responsible for the audit of the financial statements 7 2. ACTIVITY REPORT 2.1 Description of activities 10 2.2 Related-party transactions 18 2.3 Growth outlook 22 3. FINANCIAL REPORT 3.1 Consolidated financial Data 24 3.2 Income statement and financial position 27 3.3 Consolidated financial statements and notes 31 3.4 Statutory financial statements 42 3 Maroc 3 Telecom • Financial Report H1 2019 Highlights January 2019 Maroc Telecom launches the new "Switch" balance conversion service which offers Jawal customers the freedom and flexibility to convert their Voice credits to Data and vice versa according to their needs. In Ivory Coast and Mali, the domestic Mobile call termination rate falls to 7 CFA francs/min starting January 1, 2019.